General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMy sis found this on FB: "Now that the Dow is at an all time high ...

"Now that the Dow is at an all time high I put out a bucket for all the trickle down. Unfortunately I checked it a little while ago and it was only filled with bullshit."

graham4anything

(11,464 posts)Everyone's pension funds are directly related to the market.

When it goes up, people's funds go up.

NutmegYankee

(16,199 posts)Pensions. ![]()

graham4anything

(11,464 posts)and people that liked Ronald Reagan should also have voted for Jimmy Carter in 1980

(like Elizabeth Warren who voted for Reagan).

NutmegYankee

(16,199 posts)Squinch

(50,955 posts)Javaman

(62,530 posts)treestar

(82,383 posts)And how do the poor benefit from a low Dow? There are fewer tax revenues and even less chance for them.

Socialism itself would be terrible with an inactive economy.

I swear I used to think people on the left were smarter, but now I see how they can also be deranged.

JDPriestly

(57,936 posts)experience.

The problem is that the Dow goes up and down, and most people get caught in the downs. That is because they lose their jobs in the downs and then have to cash in or borrow against their 401(K)s and right when they can get the least for the stocks or funds or whatever they own.

People need to watch out that they don't get snagged by the mania of the boom/up stage.

The stock market is extremely bi-polar, and anyone involved in it needs to understand that. Do not think for one moment that the economy is good because the stock market is up.

The stock market rises when the rich feel so rich that they decide they can afford to gamble with their money. The rich are doing well.

That does not necessarily mean that the rest of us are doing well.

In California we have a tax surplus, a huge increase in taxes coming in this year. That is because in 2012, we passed a referendum measure that increased taxes, especially those of the rich. It is also because we elected a fairly liberal Democratic governor and have Democratic majorities big enough to pass good legislation in both our state houses. Wisconsin, Indiana, Ohio, the entire South, and other states, TAKE NOTICE. Democrats at every level of state government is a recipe for a balanced budget and increasing employment.

The problem with the stock market rising is that it probably will not mean increased federal tax revenues as long as we have a Republican House and Blue Dogs in the Senate. That is because a lot of the income the stock market will produce will be taken by investors in ways that are not taxed. The money probably won't be spent on Main Street USA.

And the rise in the stock market is unlikely to mean more jobs in the USA. In fact, it may mean that some businesses are showing higher profits at the moment because they have laid people off.

The rising suicide rate is a more useful measure of the health of our economy than the rising stock market.

NutmegYankee

(16,199 posts)Decades of class warfare have left most without any retirement security.

mountain grammy

(26,623 posts)mimi85

(1,805 posts)We'd be up shit creek without ours, not that they're very large, but it's way more than our mortgage payment.

HiPointDem

(20,729 posts)Digby catches some of the talking heads saying that we’re all dependent on the stock market for our retirement. Which leads to the question, what do you mean “we”, rich man?

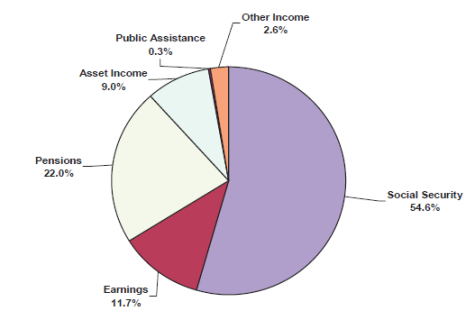

From here, sources of income among the second quartile of older Americans, that is, from the 50th to the 75th percentile:

Even in this group — which is above median, although not at the top — Social Security accounts for more than half of income. (It’s the great bulk of income among poorer retirees). Asset income is, by comparison, trivial.

OK, a couple of caveats. Pensions will presumably be a smaller share of income in future, because defined-benefit plans have given way to defined-contribution. Also, this only tracks income; to the extent that seniors live by drawing down assets, that isn’t shown.

Still, the idea that the typical American’s retirement basically depends on the stock market is utterly wrong; that’s only true for a small elite.

http://krugman.blogs.nytimes.com/2009/10/23/how-the-other-75-percent-lives/

graham4anything

(11,464 posts)everyone in their life who worked for a company who gave them health insurance from day one of their working life

never were taxed on that freebee they received(and probably most didn't even know or care they had it)

and over the years, that would be equal to 100s of thousands of dollars a self-employed had to pay out of their own pocket, on money that was 100% taxed.

and yet, those same people are whining their health insurance bills may go up $100 bucks, after years of getting it free and reaping the benefits from something they never called a benefit but used to benefit themselves.

which is why I don't partake in the whine.

Did people expect to be given freebees their entire life, AND then whine about it too?

That is greedy IMHO.

I know from the last 21 years going from company paid to my own family plan, how many people don't even realize what they got for free and still get for relatively cheap, but they still whine anyhow.

(and granted there are others who don't work and have been left out, but those people always existed in all time periods, and this is not about them.)

Instead of going to the car wash once a month, banking those dollars for retirement and taking the hose and washing it oneself could have left a nice nestegg for harder times.

(proverbially speaking of course).

HiPointDem

(20,729 posts)graham4anything

(11,464 posts)if a person has never had anything in it, then they are irrelevant to the conversation in the first place.

FDR NEVER EVER inteded SS to be a one all for a person's (then much shorter) retirement period.

SS was like a bonus on top of savings and pensions. Never was it meant to be a sole source of support.

And if one never had a job, then worrying about the market rising/falling is irrelevant to those people.

Too many baby boomers think they were entitled to free living their whole life

first from their parents

then from their parents leaving inheritance money which they greedily hoped were millions

but oops, the parents had other ideas and spent it on themselves and not left it for later times

that is not the governments fault.

Excess and 48 ounce sodas instead of saving the $2 and buying a cheaper soda which would save $100s of thousands in doctors bills.

then comes a baby boomers retirement (and this about baby boomers, not their parents who already are assured of all the SS money they are entitled for), but this is all about the baby boomers and their toys.

Their had to have every single tv toy ever made.

Isn't it?

And aren't we all baby boomers or parents of one?

(and if not, if someone is so young, then they are not affected by any of this talk for another 40 years or so).

and FDR never had a constant number anyhow.

Did he? If we are being honest here.

BTW-when the times were good(say in Clinton's era), how many people sold in their stocks/bonds at the top?

And their houses which skyrocketed to prices they weren't worth?

Did people take advantage then, or did they greedily hope their $100 home would be $600 instead of $400?

Smart person took the $400 and banked the rest in bonds and dollars and not items

that are unstable.

Fuddnik

(8,846 posts)Roosevelt DID intend for SS to be a retirement fund. This was started in the middle of the fucking depression for Christ's sake. Nobody had any money saved. People were starving.

Now after re-reading your post, I think I kno where you get your facts. Heritage Foundation comic books, and airplane glue.

Honeycombe8

(37,648 posts)to help prevent what was happening at the time....a net to prevent our seniors from falling through the floor and becoming homeless. It was NEVER intended as a "retirement plan" on which seniors could live well in their senior years. It was a MINIMUM type of program. It was very successful, too!

Fuddnik

(8,846 posts)Roosevelt intended it to be a minimal, livable retirement program.

Back then, the only working class people who had pensions were railroaders, who were covered by the Railroad Retirement System, which Social Security was modeled on. It still survives today, is very healthy, and pays much better benefits than Social Security.

If every President since Eisenhower didn't tweak COLA, unemployment, and GDP figures to make themselves look better, Social Security benefits would be almost double what they're paying out now.

Here's an excerpt from "Bad Money", by Kevin Phillips. Excerpt originally published in Harpers.

http://www.tampabay.com/news/hard-numbers-the-economy-is-worse-than-you-know/473596

Ever since the 1960s, Washington has gulled its citizens and creditors by debasing official statistics, the vital instruments with which the vigor and muscle of the American economy are measured.

The effect has been to create a false sense of economic achievement and rectitude, allowing us to maintain artificially low interest rates, massive government borrowing, and a dangerous reliance on mortgage and financial debt even as real economic growth has been slower than claimed.

The corruption has tainted the very measures that most shape public perception of the economy:

• The monthly Consumer Price Index (CPI), which serves as the chief bellwether of inflation;

• The quarterly Gross Domestic Product (GDP), which tracks the U.S. economy's overall growth;

• The monthly unemployment figure, which for the general public is perhaps the most vivid indicator of economic health or infirmity.

Not only do governments, businesses and individuals use these yardsticks in their decisionmaking, but minor revisions in the data can mean major changes in household circumstances — inflation measurements help determine interest rates, federal interest payments on the national debt, and cost-of-living increases for wages, pensions and Social Security benefits.

And, of course, our statistics have political consequences too. An administration is helped when it can mouth banalities about price levels being "anchored" as food and energy costs begin to soar.

The truth, though it would not exactly set Americans free, would at least open a window to wider economic and political understanding. Readers should ask themselves how much angrier the electorate might be if the media, over the past five years, had been citing 8 percent unemployment (instead of 5 percent), 5 percent inflation (instead of 2 percent), and average annual growth in the 1 percent range (instead of the 3-4 percent range).

(snip) more

Honeycombe8

(37,648 posts)It just SUPPLEMENTS it. My basic expenses, for example...Social Security will not pay for them. I would delve into poverty, had I not saved some $ on my own. But SS will enable me to live hopefully a decent life, with careful budgeting. I am middle class.

Of course millions don't have expendable income to save, so SS becomes their only source of income in their senior years. It was this way for one of my grandmas. Thank goodness she had sons to contribute to her income and make sure she was taken care of. SS paid her almost nothing. She had been a waitress and cheap motel maid most of her life. Had never even owned a car or nice clothes or anything to speak of.

JDPriestly

(57,936 posts)conservative investments (which is what seniors are told to do when they are no longer working and receiving paychecks) are earning only maybe 1% on their savings. That is per year.

That means that if you have $100 save, you get $1 per year. If you have $1,000 saved, you get $10 per year. If you have $10,000 saved, you get $100 per year. If you have $100,000 saved, you get $1,000 per year. If you have $1,000,000 saved, you get $10,000 per year.

If you are getting 2% per year, which is not that common on the kind of investments that brokers encourage seniors to make, you will receive $2 on every $100 you save. If you have $500 saved, you will get $5 per year.

You can figure out how much your own savings would supplement Social Security at this time. If the economy improves, maybe banks and conservative investments will pay more, but right now looking to savings or investments on the amounts you save on an income of $40,000 per year is pretty much a joke.

Remember, you cannot always save when you are working, not every year. People have setbacks. There are health emergencies, times of unemployment, bad investments. Businesses go bust. All kinds of things happen. So most people do not manage to save millions of dollars for retirement. That is especially true of people in their 50s right now, people who are unemployed or on the edge, people who have lost their homes or businesses.

People who have children to educate may be faring worse than those who are single.

Another group that faces great difficulty in retirement is widows and widowers. Two really do live cheaper than one once you retire.

And yes, the alternative to Social Security is relying on your children for hand-outs. That's what Social Security is supposed to help prevent.

Ask yourself, based on your current income, how much would you have to save for it to add up to a couple of million at age 65? Remember that while your savings increase in value some years, they lose value in others. Most people overestimate how much money they will earn on their savings or investments.

bahrbearian

(13,466 posts)JDPriestly

(57,936 posts)Prior to Social Security, impoverished old people went to some equivalent of the poorhouse. My grandmother and mother lived through the depression and could tell horrifying stories about people who ended up in the poorhouse.

Social Security was originally created to provide some independence and dignity for seniors.

The program was originally limited to include only certain groups of working people. It was so successful and so popular that it was expanded to allow others to pay into it and gradually came to include mandatory taxation even for the self-employed.

The Republicans and certain anti-Social-Security folks have created myths about Social Security to confuse the public.

My father chose to put money into Social Security early on although in his line of work he was not required to do it.

It is a minimum plan. The average Social Security beneficiary receives between !200 and 1300 per month. That means that about half receive less than that. Even with Social Security, a shocking number of seniors are living below the poverty line. I have read that the maximum Social Security benefit is around $2500 per month, but I could be wrong about that. Social Security is not a good living, but a senior can survive on it. Hard to get your teeth taken care of. Hard to pay for a hearing aid. Hard to take good care of your eyes if your income is just Social Security. In some parts of the country, you really can't hardly pay your own rent if you are living just on Social Security. You need subsidized housing to have a place to live in some areas of the US. Lots of seniors need subsidized meals and housing in addition to Medicare and Social Security.

CrispyQ

(36,478 posts)Now graham finally makes sense!

HiPointDem

(20,729 posts)AllyCat

(16,189 posts)Being told we had pensions, then finding out they were unfunded was not planning for the future? Putting money in a 401k to save for our golden years so only to watch it never earn as well as wall street seems to pull it in is "relying on SS"? Clearly if this has worked for you, you must be an investment banker, ready to help everyone with our finances.

graham4anything

(11,464 posts)why would one think it was worth $650 when in reality it was worth $160 plus repairs and addons and adjust for inflation.

I won't whine if I get $400 that I could have gotten $650 or $800 or whatever.

Something is worth on day bought and day sold.

Whining what could have been is irrelevant.

Could have been but I bet one wanted more, therefore one can also get less

Gotta know when to fold and walk away

I bought my house not as investment but to live andnot move up up up or down

Therefore, it is only worth what it is on day I sell it. Don't expect a penny more. That is just dreaming.

BTW-one can break a 401K at any time, and just pay the penalty and taxes as one signs on for.

One was happy for a 401k that the compnay gave free of charge with no strings attached, no?

The other man's grass is always greener has been there since day one.

I only worry about my grass. The other man is entitled to his grass too.

Only busybodies care about how much the other makes.

That is why most companies forbid workers from discussing ones salary since day one

(or try too). It only breeds contempt. No one knows what the other guy gets

UNLESS we live in pure socialism, and well, blame Tom and Ben and George that we live in a capitalistic society, not our current President.

AllyCat

(16,189 posts)A penny more? How about thousands of dollars LESS on a modest home despite up and coming neighborhood and reasonable improvements? Somehow, we are to blame for thinking that decades of Americans investing in their neighborhoods and communities by buying and improving their residences were completely delusional? Take the 401K early? Yeah, I tried that when I lost my job the first time...and it ends up costing BIG TIME.

You can tell everyone who is having trouble it is their own fault for not investing more wisely...but I suspect few here will believe you.

I don't care what others make. Wait a minute, yeah, I do. I DO CARE that all those people out there who are busting their butts and not making ends meet make less money than corporate CEOs who make a gazillion dollars a year. Who adds value to the economy? Not the latter. I have not one problem with a bus driver making 6 figures. I have a huge problem with some nasty little tyrant making 8 for making other people's lives a living hell.

graham4anything

(11,464 posts)which came first?

Walmart getting rid of all the mom and pops?

or the people greedily buying the cheap priced stuff they sold causing the mom and pops with higher prices out

Now the moms and pops have no jobs and they could blame walmart, or they could blame the people who abandoned them to go to walmart

Walmart is not in business to care about anyone but themselves

This looking for purity that doesn't exist achieves nothing.

The people that greedily wanted to save a few bucks on drugs and cheap stuff, are to blame for Walmart getting a foothold. They could have been stopped.

One little city has kept them out time and again. There are NO Walmart's in Manhattan, and alot of stores are mom and pops still. (Of course the far left hates the guy who has kept Walmart out, but that's a different thread).

Squinch

(50,955 posts)You know that's a ridiculous position, right?

Honeycombe8

(37,648 posts)Part of the problem with 401ks is that the owners (the employees) really have to know a bit about investments (for some 401k plans), in order to make wise choices. Some plans offer "models" so that the employees don't have to have knowledge. You invest in either a conservative, moderate, or aggressive model, and the investment company does the mixing of funds for you.

But the investment company won't tell you some things (like when a recession hits...get your money out of those funds!), so it's best for people to read at least a basic investment book and have SOME knowledge. But most people don't.

Basic investment and mutual fund info is free on the internet.

I didn't know what the word "securities" meant until I bought some investment books years ago. IMO, kids should be taught this in high school. It's more helpful than algebra.

AllyCat

(16,189 posts)... but I didn't expect that I needed to be an investor to save for retirement. I'm in health care, not banking. I should not have to read a book on investments (that could still lead me astray and I wouldn't know the difference) in order to save my money. The 401K thing was sold as the greatest thing to make us all able to live comfortably in retirement, yet Wall Street knew they would take all that money and no one would know it until it was too late.

Honeycombe8

(37,648 posts)Sorry 'bout that. I just meant it as an intro, since I know that most people haven't read investment info, and yet the success of retirement plans is dependent on it.

If you are saving for retirement, you are an investor, whether you recognize that or not.

That's why I think it should be taught in school, as part of a financial course. Reading a bit about it may not mean someone gets rich, but it helps avoid being taken advantage of and making absolutely wrong decisions, in some cases.

If anyone has a 401k, it has mutual funds. If an employee doesn't know what a fund is, or how to invest in one, that's a clue to read up on it. His/her retirement depends on it.

But I do that about anything and everything. If I had sudden nausea for no apparent reason, I Google that to see what it could be. Knowledge is a good thing.

Kids should also learn about budgeting, looking at wages and salaries when determining what to do for a living, how to know what price house you can afford, amortization tables, basic investments, how savings will grow over decades, etc. Necessary things to know, much more so than algebra, which I have not used even once, that I recall.

annabanana

(52,791 posts)(quaint saying from olden times)

AnnieK401

(541 posts)I am surprised that the that the percentage of people with pensions shown above was even as high as is it is. More and more corporations are doing away with them, along with any kind of collective bargaining for better salaries which would allow people to save more - if we can even trust banks at this point (think Cypress.) Health care through employers is slipping away also. Many, of not most, employers look at someone over 50 as damaged goods, and if you are over 50 and have been out of work for 6 months, forget it. The fact is there is just not a job available for everyone. What would you suggest for people who corporate America no longer has any use for? We can't all start a successful small business and be entrepreneurs, the fact is that about 9 out of 10 business fail within a few yrs. It's very sad to see the number of people who spend their life savings trying to make a business work. It's even sadder to see people prey on anyone they can in order to try and hustle a few bucks. One other thing, we are spending billions on unnecessary military equipment, etc. just so more people can have jobs. It would probably be much cheaper in the long run just to cut them a check. I believe your view might have had some merit 30 yrs. ago, but it no longer fits the current reality of most people.

graham4anything

(11,464 posts)one of the people on a different thread is discarding the quote in the OP I made becaue that person is 53 and so is the one discarding it.

And its not just corporate America going younger.

It is small companies too.

But, it works both ways

People no longer have loyalty to a company, and in reverse they have no loyalty.

btw=if everyone got rid of everyone from jobs they themselves don't like (aka the ones that don't like the military-where would those people work?

Remember, people volunteer for the troops, people like the benefits of the military offers,

but then can't get a job outside, so they need to continue.

And that applies to all the industry that is directly associated with

including the food places in the area of the places that make that.

Where would all those people work?

and how would tearing down the current people in power in the democratic party to get republican people, make it better?

AnnieK401

(541 posts)AllyCat

(16,189 posts)I think misunderstanding may be the norm...word-salad indeed.

Honeycombe8

(37,648 posts)To disregard those because others have even less isn't right.

I don't know much about pensions, except they are going by the wayside, but as a worker iwth a 401k I can say that it has been crucial in planning and saving to have enough to live on in my senior years. Social Security won't provide enough for me to get by, I think (I've done the numbers and a budget already - yikes!).

I wish I had a pension, in a way, but I don't. So I've had to scrimp and save to contribute to my 401k. Thank God I've had that.

So the stock market being good...that's a great thing. Millions lost a lot of their retirement savings during the recession.

AnnieK401

(541 posts)especially if you are looking to a 401K for extra retirement income, as you are. And I truly understand what you are saying. The problem is what is making it go to an all time high. If workers are having to suffer so that corporations can enjoy record profits, and therefore send their stock prices through the roof, that can be a problem - at least for those (most Americans) who don't have 401K's and depend on a paycheck for a living.

Honeycombe8

(37,648 posts)Including me. I've read that it goes up and down depending on a variety of factors, and not necessarily having anything to do with the economy, though it does at times.

But if it's gone up because of greed of the companies, I agree with you...and that would hurt us all, even those of us who have 401ks and pensions (if you take both of those together, that is actually MOST of the workers in the U.S., since close to half of the workers have 401ks).

Stocks don't go up, though, because a company has a stash of cash, though it helps. It's the financial outlook of the company, or what "experts" THINK is the financial outlook of a company, or insider information, that drives the price of the stock, I think.

So when the unemployment rate goes down, the stock market goes up often because people think the outlook of the companies is good. And that's good for everyone, if it's true.

But if there's one thing I've noticed about the stock market, it's that it will go down again, and it will go up again. We just don't know when.

Hissyspit

(45,788 posts)Jeez...

Bluenorthwest

(45,319 posts)Very right wing Republican views you got there, disgusting to see on DU.

The Wizard

(12,545 posts)who was permanently injured in Vietnam. I worked my ass off at hard labor until my body said it's time to quit. I take exception at your broad brush attack on my generation.

I've lived past the life expectancy for Vietnam veterans and collect Social Security too. Sorry to be a burden to you.

HughBeaumont

(24,461 posts)If you don't stand for something, you'll Graham4Anything.

Fumesucker

(45,851 posts)This was not one of those times.

trumad

(41,692 posts)I swear the dude is on mushrooms half the time.

Word Salad indeed.

Shades of Carlos...

Fumesucker

(45,851 posts)Squinch

(50,955 posts)And seriously? You're saying that a foregone monthly car wash could have provided a retirement?

And in saying that you are suggesting that it's just profligacy and irresponsibility that is going to make majorities of our elderly destitute? You seriously want to say that?

Fuddnik

(8,846 posts)They were part of a deferred wage package. I took less pay, for future retirement and healthcare business.

Then, after working for 30 years, the company stole all of it. Turned the pensions over to the PBGC, which pays about 1/3 what the pension should have paid. Health insurance? Bye Bye.

And to think of all the money I could have saved over the last 30 years by doing things like eating, or recreation that pumped money back into the economy.

graham4anything

(11,464 posts)If you took the job you wanted,the above is NOT true.

the benefits were historically over the decades, never considered part of the salary.

AND if what you are saying is true, why rail about people who get big bonus when in fact they get little salary?

you can't have it both ways.

If one worked at the same job without the benefits, then they would have had tens or hundreds of thousands of MORE bills, not less in doctor bills ON TOP of health care.

and I personally know this.

Company paid was less than $100 a month.

20 years of self-employed out of pocket went from the $100 they took out of paycheck to over $3000 for the same exact plan MONTHLY

til this year, when thanks to the Presidents plan I pay 1/2 that amount, still alot more than most people who are whining that their $100-$500 is going up 20% (which at most would make it $600.)

BTW-blame the doctors too, instead of everyone but the doctors. They start the ball rolling and they now only work 9 to 5 three or four days a week and don't leave a number or replacement

(not mine, he is on call 24/7/365 or leaves a trusty other doctor the 6 weeks a year he vacations).(and most don't get 6 weeks a year off either.

Why no blame for doctors?

Doctors are only as good as the teacher that teaches them and gets payed 1/10th what a doctor makes.

Fuddnik

(8,846 posts)When we negotiate a contract, we come up with a framework on how much will be in the wage and benefits package. The company was supposed to fund a defined benefit pension plan, and retiree health benefits out of what would normally be paid in hourly wages.

When management decided to run the company into the ground, they made sure that their pensions were in a trust fund that were untouchable by the bankruptcy courts. The PBGC took over the pensions, and paid approximately 35% of what was supposed to be paid. Health insurance for employees and retirees stopped that day.

Where did the pension fund go? The company used the pension fund in a leveraged buyout to buy the company. Mitt Romney style. All perfectly legal. It's even worse today with more private equity sharks in the game.

You really don't have a clue as to how the world works, do you?

graham4anything

(11,464 posts)you are talking about something entirely different.

Please decide which you are takling about.

People get a job that pays for their doctor bills today, not after retirement,

and those are freebees. No one who gets a job they want looks at that as money

(now, some may get a lowpaying job solely for benefits, but that too is on purpose.

And the benefits only apply while working.Anyone knows that

you are talking about retirement, which only affects those about to retire(in their late 50s 60s).

People in retirement already have their grandfathered in.

So stop with the Ron Paul soundbytes.

Fuddnik

(8,846 posts)That was the deal when I started working there. A good wage. A decent pension. And health Insurance after retirement.

Repeat. That was the deal when I started working there in 1971. And it all fell apart in 2001. Everyone who worked all those years for those deferred benefits got fucked. Period.

And no, noby was grandfathered in. The prior retirees got fucked too.

And no, it's not Rand Paul. It's FDR.

So stop with the Alfred E. Neuman soundbytes, and Glen Beck history lessons.

You really don't have a clue what you're talking about.

graham4anything

(11,464 posts)and jees, on 9-11, 3000 people died because of one personOBL, and the 19 he commanded,

and commerce stopped dead.The man Bush said he would smoke out, and ignored, and finally, thank God and Obama, he was caught and America breathed again.

Health insurance NOT after retirement, no one is talking after retirement benefits.

Talking about this week, one works, one gets sick, their freebee health insurance or very cheap monthly health insurance kicks in, you get well, you go back to work and still have the cheapie health insurance, and never are you taxed on it, nor is that part of the salary.

lastlib

(23,244 posts)This sounds an awful lot like the "free stuff" meme with a side order of "47 percent". Seriously, dude?

Hissyspit

(45,788 posts)And calling people whiners.

DJ13

(23,671 posts)JDPriestly

(57,936 posts)When your employer pays for your healthcare, he isn't giving it to you for free.

Your healthcare is one part of your compensation package. If you didn't have the healthcare, you would presumably get the money your employer pays for the healthcare and buy your own healthcare.

That you don't pay taxes on your "free" healthcare is due to a quirk in the tax code, possibly a concession to unions but not something that individuals bargain for in their pay package. The tax break is not due to some clever trick on the part of the working person.

People who own their small businesses get all kinds of tax breaks that working people don't get. If you were to break down the tax advantages and disadvantages of selling your labor to a boss or setting up your own business, the list of advantages for the self-employed would be far longer than the list for the hired labor.

reACTIONary

(5,770 posts)...22% of this groups income is from pensions. Which means pensions ARE a significant source of income for this group. The chart also shows asset income at 9%. Again, a significant chunk of change and probably directly tied to economic (stock-market) performance.

My father in law fell into the lower half of the income range, and a significant portion of his income, though not as much as social security, came from his retirement pension. That didn't mean that it increased as stocks went up... it was a defined benefit, so he got what he got regardless. That doesn't mean the stock-market isn't important for retirement pensions, however. They do have to be solvent. And, of course, it is much more important for those who are on defined contribution, rather than defined benefit, plans.

Stock market performance is not insignificant for retired Americans, and actually, for all Americans, regardless of their over-all economic status.

treestar

(82,383 posts)don't have the money to spend.

Honeycombe8

(37,648 posts)The AMOUNT of money they draw from them in retirement is a different matter than whether they had them or contributed to them, if they had the option to do so.

In 2011, 51 million American workers were active 401(k) participants. http://www.ici.org/policy/retirement/plan/401k/faqs_401k

Since not everyone participates in their employer's 401k, then more than 51M workers had the option to participate. Also, of those who participated, many didn't contribute very much to them. I didn't, until I got older and my salary increased.

That's not the majority of workers, but that's a heck of a lot of workers. So yes, the stock market is very important for our economy, and of course, we care that these workers' retirement savings increased rather than took a dive, as they did a few years ago. It's important.

(And don't forget...this is just 401k. Add to that those that have pensions, and you have even more millions of workers participating in retirement plans by employers.)

Cal Carpenter

(4,959 posts)Most Americans do NOT have a pension. Fact.

Thor_MN

(11,843 posts)People are paid a defined amount from a pension fund, the market's swings do not change that defined amount.

I know two people that are retired and collecting on pensions.

I know exactly one person that has a job with a defined benefit pension plan.

"The market" affects only those with investments. Many people I know have so little invested that "the market" affects them very little.

It's totally naive to think that everyone has any investments at all, much less a pension.

graham4anything

(11,464 posts)but as for the rest and the OP quote, it makes for good sound bytes of an echo chamber rah rah rah tear it down without thinking it could be so much worse the day after

Cal Carpenter

(4,959 posts)"humble" or not, and measurable FACTS.

You seem uninterested in such things as measurable FACTS, which is but one contributing factor to the disruptive nonsense you repeatedly spew.

graham4anything

(11,464 posts)depending on the goal?

Converse or mob echo?

I don't mind being alone. Doesn't mean no one doesn't agree with me. Just that they block the OPs and others who disagree with me views out, so they don't see it.

(an example, nothing to do with this topic, I was against guns and arguing loudly by myself in the pro-gun area when gun talk wasn't allowed in the GD. Most people did not bother to argue there as it does fall on deaf ears of that echo chamber. Doesn't mean I didn't do it though.)

Conversation only hurts those that want to shut down conversation.

Which is why the 5/20% extreme keep shouting and the 95/80 for the most part are silent.

Doesn't mean that anymore than the 5/20 actually agree, just that they are vocal about it.

FDR and Lincoln and perhaps even LBJ would never have been elected President in 2008 and 2012.

And in another sense, it is why Josh Gibson or Satchel Paige or any of the 100s of other as qualified were not Jackie Robison.

It is why Al Sharpton and Jesse Jackson did not become President (both of whom I voted for in the primaries) and why Barack Obama did become President.

In all 3 of the above paragraphs/examples, all were just as good as the others, but there is a reason and they all are as liberal as each other.

(and LBJ was the most liberal who ever became President, and if JFK did not compromise and pick LBJ, he never would have become president either.)

Thor_MN

(11,843 posts)Corporations ditched those a long time ago, forcing people into 401Ks.

And as I pointed out, the market has very little effect on the payouts to individuals from pension plans.

Supply side, trickle down, Reagonomics, call it what you will, is pure bullshit. It does not work, except to concentrate wealth to richest. The people that believe in supply side and are not in the upper percentages, are fools.

leftyohiolib

(5,917 posts)Thor_MN

(11,843 posts)The GOP and those that support supply side are actively working to get rid of unions, BTW.

The person I was replying to said "Everyone's pension funds are directly related to the market." I was pointing out that it was quite naive to think that everyone has a pension. Not to mention that other than mandated adjustments, the swings of the market do not affect pension payouts to individuals

leftyohiolib

(5,917 posts)Corporations ditched those a long time ago, forcing people into 401Ks. just as a reminder that not all corps have ditched them and they can be had again but people need to organize, fight and not be afraid to lose their jobs.

Thor_MN

(11,843 posts)Hope that makes your afternoon better.

Go Vols

(5,902 posts)dkf

(37,305 posts)The market enables full payment of a pension.

Here:

Many others are invoking the nuclear option, declaring bankruptcy as a way to unload their pension plans on the taxpayers. Unfortunately, the Pension Benefit Guaranty Corporation (PBGC), established in 1975 to backstop private sector pensions, is already reeling from a decade of high-profile and expensive pension defaults at companies like United Airlines and steelmaker LTV.

Nine of the 10 largest pension defaults in history occurred since 2000, leaving the PBGC with a deficit of $11 billion at the end of 2008. That gap could swell to more than $100 billion over the next few years, amounting to a backdoor bailout for big corporations, and a bitter pill for abandoned retirees.

Workers at Republic Steel saw first hand how it works when they had their pensions cut by $1,000 a month in 2002 by the PBGC and then cut again in 2004. Five workers from the Lorain, Ohio, plant committed suicide after the first time their pension was diminished. In the second round of cuts, retirees like Bruce Bostick, former grievance chair for USW Local 1104, saw their retirements fall from $1,047 a month to $125.

The situation for public sector workers isn’t much better. Although 80 percent of public employees have traditional pensions, those benefits are now in the cross-hairs of conservative and liberal politicians. Two-thirds of public sector pension plans are underfunded—to the tune of $430 billion—and state and local budget crises are pitting taxpayers against public employees from California to Maine.

http://www.labornotes.org/2009/09/pensions-next-casualty-wall-street

Thor_MN

(11,843 posts)The poster I replied to said that the market increases a person's funds in the pension. People do not have funds in a pension, they have a defined payment out of a pension plan. The person I was addressing stated that the OP was naive, while demonstrating an amazing lack of knowledge.

Your post shows that a pension can fail, which really isn't what we were discussing (an up market), but is a valid point, which I touched on when I mentioned mandated adjustments.

dkf

(37,305 posts)Believe me pension trustees are the first ones cheering on the market.

The market enables retirement. Cash can't do it.

Thor_MN

(11,843 posts)Pensions, which were brought up by the poster I was talking to, are endangered and increasingly rare. That person said that everyone's pension funds go up with the market which is incredibly naive, and totally ironic since they labeled the OP as naive.

dkf

(37,305 posts)Many rules are dependent on the funding, like caps for the top earners and rollover options.

The goal of 80% funding is more than an arbitrary number.

Thor_MN

(11,843 posts)One could also go the route the GOP imposed on the Postal Service and mandate 100% funding for 75 years, paid into the fund in 10 years time. Makes for a very healthy pension fund...

dkf

(37,305 posts)Thor_MN

(11,843 posts)Here, I give you something irrelevant to challenge if you wish.

My favorite color is blue.

dkf

(37,305 posts)Lately I've heard of some pensions buying annuity policies to fulfill their obligations. Depending on how those are structured people could conceivably see higher payouts.

Thor_MN

(11,843 posts)As "some" of the increasingly rare pensioners doesn't really come anywhere near the "everybody" that the person I replied to stated, that's essentially insignificant.

Fuddnik

(8,846 posts)I worked in the Republic Steel-LTV railroad division for 31 years. My company pension got cut from $1500 per month to $500 per month, and the PBGC takes 10% of that back every month for overpayments.

They cut off the Steelworkers health insurance the next day. Luckily for me, there are different federal laws on how a railroad can shut down, and they had to establish a trust fund that paid for our (just the railroads) health insurance for 3 years.

LTV used the USW pension fund to buy Republic Steel. They completely mismanaged the company. They went from having over $700 million cash on hand to bankrupt in a little over a year.

I was a union officer, and I got a phone call at 2:00am from a yardmaster in Cleveland, and he said, "They're trying to destroy the blast furnaces. They're empty, and they're not banking them with coke to keep them warm, and preserve them". There was no logical reason for them to do that. They had thousands of tons of coke sitting right there.

I gave him Dennis Kucinich's phone number, and tell him what they're trying to do. Kucinich called the CEO and Plant Manager and told them there would be hell to pay if that happened, and He went down there at 3:00 am. Obviously he convinced them to bank the furnaces, and Wilbur Ross came in and bought the place for a song.

At least now they still employ a couple of thousand people, plus thousands of peripheral jobs.

But, LTV Mismanagement managed to have all the executives pensions socked away in a trust fund that couldn't be touched by a bankruptcy judge.

pangaia

(24,324 posts)toddaa

(2,518 posts)And the 401k has been a wonderful education in how absolutely worthless the DJI average is. At least 2% of my 401K is house money, but the house always wins.

Honeycombe8

(37,648 posts)Pension funds are usually invested very conservatively, and are in the hands of others, with the future recipient having no say-so on how they're invested. That's because the future recipient doesn't actually own the benefits until he receives them. They're owned by someone else (which is why pensions are easier to steal or lose than 401ks or other things).

You mean 401ks I think. The employees actually own the 401k and direct how they are invested.

And you're right. I have a 401k and IRA. If it weren't for the stock market, I'd never be able to retire. As it is, I'll be lucky if I'm able to go to part-time and then finally, when older, retire fully (because of Social Security & Medicare).

I am pretty happy when the stock market is up!!!!! A lot of people lost their retirement savings in 401ks during the recession.

Marr

(20,317 posts)Jesus-- pull it back, hoss.

rhett o rick

(55,981 posts)SalviaBlue

(2,917 posts)What is this thing of which you speak? And how can this 58 year old get one? I fear I may need one soon.![]()

abelenkpe

(9,933 posts)And why should my generation and the one after care since we don't have one and never will?

GeoWilliam750

(2,522 posts)Pension funds typically contain mostly bonds rather than equities, and will have missed the vast majority of this rise.

JDPriestly

(57,936 posts)of all the fools out by systematically defunding the market.

Live a long time, and you will see the pattern. It's boom and bust, and the smart guys watch the signals while the naive "investors" fall for the same scam over and over and over.

Read up on some of the books about the Wall Street Crash of 1929. It was just one of a long, long series of busts in the repeated cycle of our stock market.

Every time we get into a boom, we hear that now things are different. This time the good times will not end, or at least they won't go bust because now we are . . . . fill in the blanks. There is always some talk about how the economy now is different than it used to be.

Fools walk in . . . . Save your money, but be very careful.

Listen to Parenti's talk in the video posted on DU right now.

pnwmom

(108,980 posts)You do realize that most people don't have pension funds, right?

Skittles

(153,169 posts)Nanjing to Seoul

(2,088 posts)quaker bill

(8,224 posts)which means my benefits stay the same regardless of the market. This is the whole point of having a defined benefit plan. My pension is worth just a little more today than it was at market bottom, because I have added 4 years of service. If the market were to correct tomorrow, my benefit would remain the same.

I have some personal, non-tax deferred money in the market. it is doing just fine.

treestar

(82,383 posts)that trickle down doesn't exist. It may not be enough for many people and should be regulated and some of the wealth redistributed.

But complaining about a high Dow is silly. If it crashed, we have a bad economy and guess who gets affected the worst? It's not as if it would be good for the lowest income people if the Dow crashed.

Honeycombe8

(37,648 posts)That no doubt lead to some suicides and homelessness.

Of course you don't really "lose" a mutual fund. It just decreases in value for the time being, so the $ isn't there maybe when you need it. But it will go up again.....if you can wait.

treestar

(82,383 posts)stimulating the economy. A good dow is better than a crash, which makes things worse for everyone.

I can sympathize that it should not be the 1% benefitting most, though they naturally would, since they had the most to begin with.

jeff47

(26,549 posts)The theory of trickle-down is as the income of the wealthy goes up, the income of everyone else will also go up.

We've been trying it for the past 30 years. The result has been a massive increase in income for the wealthy, and a loss of income for everyone else. Quite literally, the rich got richer and everyone else got poorer. That pretty conclusively demonstrates that trickle-down doesn't exist.

Trickle down is a pile of bullshit created to justify massive tax cuts.

rhett o rick

(55,981 posts)The Dow is an all time high and the 99% are in a depression.

The Dow is a measure of financial speculation and nothing more.

Let's look at unemployment, home foreclosures, number of homeless, number of clients at food banks and soup kitchens. Those are indicators of the economy of the 99%.

mountain grammy

(26,623 posts)It doesn't advocate bringing the whole system down or the dire consequences of a market crash. It's merely stating the obvious: the rich get richer, the working class gets the teeny, tiny trickle.

southernyankeebelle

(11,304 posts)reformist2

(9,841 posts)They are a pathetic replacement to "defined benefit" pensions - which are the only real kind of pensions, anyway.

Historic NY

(37,451 posts)Last edited Sat May 4, 2013, 08:58 PM - Edit history (1)

most of that money you pay in premiums is tied to the market, depending on policies.

heaven05

(18,124 posts)and insightful. David Stockman's/Reaguns trickle down bullshit right?

Initech

(100,080 posts)And what's pissing me off is that no one in Congress is calling out how much Reagonomics has failed. ![]()

rhett o rick

(55,981 posts)And it's about time.

ErikJ

(6,335 posts)He is finishing this bok due in bookstores in Oct. He says that nothing has changed, the bubble is being re-inflated. Crash due in 2015.

NBachers

(17,120 posts)

My Occupy protest sign

ForgoTheConsequence

(4,868 posts)Don't give him the attention he's looking for, he's done this on multiple message boards.

Someone referred to him as a "disrupter" and they were dead on.

Fuddnik

(8,846 posts)bhikkhu

(10,718 posts)The stock market has no direct affect on me (deliberately so), but I would still rather see it doing well - meaning people with investments and retirements and so forth secure.