General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Case For Economic Optimism, From A Leading Pessimist (Dean Baker)

The economists who predicted the housing crisis tend to be a gloomy bunch, as Adam Davidson notes in his latest Times Magazine column. Dean Baker is the rare exception. In the following guest post, he explains why he has parted ways with the economic pessimists.

For more than five years before the recession began in December of 2007, I was one of the leading economic pessimists, warning of the housing bubble and the damage that its collapse would do to the economy. I based this pessimism on my analysis of the housing market, not a genetic disposition to pessimism. Given the economy's current situation, I find the warnings of the pessimists – the double-dip gang – to be wrongheaded and seriously counterproductive.

First to the economy's near-term prospects: the economy is growing and will in all probability continue to grow. Economies do generally grow. We see new investment, leading to more employment and higher productivity, which leads to higher profits and higher wages.

In the past when the economy has fallen into a recession it has been the result of plunges in house sales and car sales. Neither possibility seems plausible at the moment, primarily because both remain at extraordinarily low levels that leave little room for them to fall further. Even if they did fall, it would have only a limited impact since current demand is already so depressed.

<....>

In short, there seems little prospect that the U.S. economy will crater on its own. And the foreign events that could lead to a recession in the United States seem highly unlikely.

http://www.npr.org/blogs/money/2012/02/06/146462230/the-case-for-economic-optimism-from-a-leading-pessimist

Owlet

(1,248 posts)The price of oil.

I think he's just flat out wrong in this: And the foreign events that could lead to a recession in the United States seem highly unlikely.

I hope he's right, but...

Oil and Recoveries

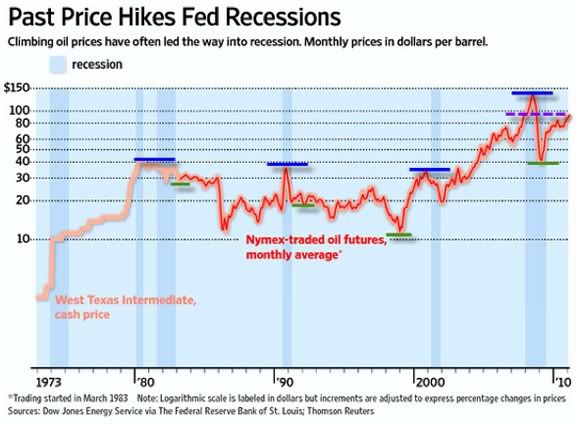

"There is a clear relationship between high oil prices and recessions, confirming the idea that the price of oil has the same impact on the economy as higher interest rates (perhaps even more so nowadays). Both are a source of friction. With higher interest rates, less lending and less consuming happens. With a higher price of oil, more money gets spent on energy, much of it sent to foreign producers of oil, and thus less money is available for other consumption.

Both higher oil prices and higher interest rates cause people to think a bit more before pulling the trigger on either ordinary spending or a big capital project.

Note that all of the six prior recessions were preceded by a spike in oil prices. In the case of the double-dip 1980's twin recessions, oil remained elevated after the first recession was (allegedly) over. Don't be fooled by the logarithmic nature of the chart below -- note that the typical decline in oil prices between the recession-inducing peak (blue lines) and the recovery-enabling trough (green lines) was a substantial 30%-50%:"

http://www.chrismartenson.com/blog/why-currency-fail/70928

I think he's just flat out wrong in this: And the foreign events that could lead to a recession in the United States seem highly unlikely.

I hope he's right, but...

...I don't think oil prices are going to hamper the recovery unless there is a surge, and the administration is cutting dependency on foreign oil. Next, Krugman made a similar case about European events.

It’s now conventional wisdom that the fate of the U.S. economy over the next three quarters — and hence, also, Obama’s reelection chances — depend on events in Europe. So maybe this is a good time to express some skepticism.

The map above — taken from here — tells us that overall, exports to Europe are just 2 percent of GDP. Some states, notably South Carolina, are more exposed (presumably because of those European-owned auto plants). But Obama isn’t going to win South Carolina in any case. And more broadly, even a sharp fall in exports to Europe would be only a small direct hit to demand.

OK, caveats: this only measures goods exports, and we should mark the numbers up maybe 25 percent to take account of services. Also, exports aren’t the only channel: if European events cause a Lehman-type event, disrupting financial markets world-wide, all bets are off.

And I should say that there is a long-standing puzzle concerning world business cycles: economies move in synch more than can easily be explained via concrete linkages in the form of exports.

- more -

http://krugman.blogs.nytimes.com/2012/02/06/americas-european-exposure/

Enrique

(27,461 posts)I agree, I always saw the double-dip as a red herring. The real problem has been the jobless recovery. The double-dip talk had people talking about a fantasy and ignoring the reality.

Here's Baker's conclusion:

In order for the economy to get back near its potential and to return to something resembling full employment in a reasonable period of time, we need much more than 2 to 3 percent growth. This sort of weak growth will needlessly condemn tens of millions of workers to unemployment or underemployment.

But if people think there's a high risk of a double-dip recession, then the public will end up being grateful for any growth whatsoever. And that would be the pessimists' fault.

he's referring to the 1.8 percent and 2.8 percent in last two quarters of 2011, respectively. There were a few nearly 4 percent quarters in 2010. So it's not about the few times GDP surges, but about the sustained trends.

Still, when you're coming out of a recession that saw GDP drop to nearly -9 percent, climb back into positive territory and then dip (causing fears), the trend upward will be seen as good news. The trend and recent economic reports are the reasons for Baker's new found optimism.

The "double-dip recession" fears fueled skepticism even in the face of a sustained trend. So it good to see Baker disavowing it.