Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Financial Industry Is Having Its Napster Moment

http://www.bloomberg.com/news/articles/2016-04-07/the-financial-industry-is-having-its-napster-momentJust as record companies in the early 2000s had to deal painfully with the digitization of music courtesy of Napster and Apple Inc.'s iTunes, many asset managers are now facing a similar situation as more investors make the switch from high-priced, actively managed mutual funds to passive, low-cost, exchange-traded funds (ETFs) and index funds. When the dust settles in this sea change, the financial industry may be half of what it once was, simply because its revenues will be half of what they once were.

This trend may be accelerated because of proposed new “fiduciary rules” issued by the Department of Labor, which will require brokers to (gasp) put clients' interest ahead of their own when it comes to customers' retirement investments. In other words, no more putting grandma in a pricey active mutual fund just because you get a commission, or "load" in industry jargon.

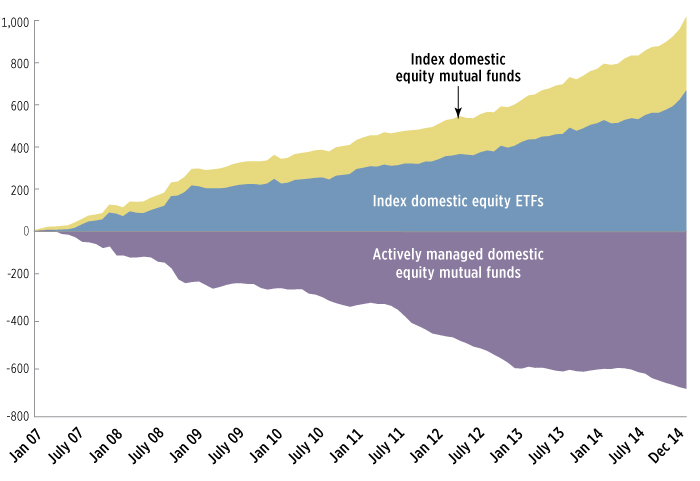

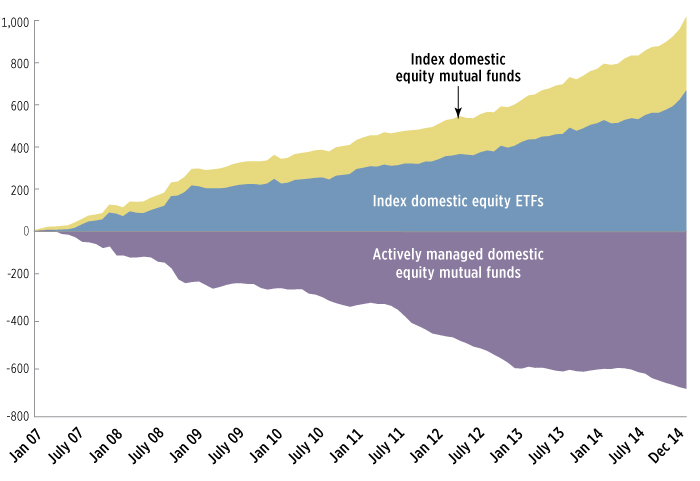

The rule, which is set for a vote in 60 days and would be phased in over the next two years, is predicted to be a boon for ETFs and index funds, the vast majority of which already pass the fiduciary rules and are the vehicles of choice for advisers currently abiding by this standard. Rule or no rule, however, the trend toward passively managed investing has been slowly blooming for more than a decade, as seen in the chart below from the Investment Company Institute, which looks at this trend within equity funds.

Since the beginning of 2015 alone, about $250 billion has moved out of actively managed mutual funds and into passively managed index funds and ETFs. For investors, this has been a way to save costs and increase returns, but to asset managers—and many of their stakeholders—this represents a direct hit to revenue and a frustrating new reality.

This trend may be accelerated because of proposed new “fiduciary rules” issued by the Department of Labor, which will require brokers to (gasp) put clients' interest ahead of their own when it comes to customers' retirement investments. In other words, no more putting grandma in a pricey active mutual fund just because you get a commission, or "load" in industry jargon.

The rule, which is set for a vote in 60 days and would be phased in over the next two years, is predicted to be a boon for ETFs and index funds, the vast majority of which already pass the fiduciary rules and are the vehicles of choice for advisers currently abiding by this standard. Rule or no rule, however, the trend toward passively managed investing has been slowly blooming for more than a decade, as seen in the chart below from the Investment Company Institute, which looks at this trend within equity funds.

Since the beginning of 2015 alone, about $250 billion has moved out of actively managed mutual funds and into passively managed index funds and ETFs. For investors, this has been a way to save costs and increase returns, but to asset managers—and many of their stakeholders—this represents a direct hit to revenue and a frustrating new reality.

I'm pretty sure my entire IRA (as small as it is) is in ETFs now; even the fixed-income stuff is in passive bond funds.

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

3 replies, 830 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (9)

ReplyReply to this post

3 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

The Financial Industry Is Having Its Napster Moment (Original Post)

Recursion

Apr 2016

OP

dembotoz

(16,811 posts)1. this is beyond me but looks important so kick

Recursion

(56,582 posts)2. Basically nobody is willing to pay fund managers anymore

So more money is going into automatically-managed funds that both cost less and historically perform better.

bemildred

(90,061 posts)3. +1.

It's like with mainstream news, the one thing they have going for them is they are more reliable than the web. So what happens when you start to use that credibility to propagandize the citizenry outside the commercial sphere? They stop paying attention because they notice you are bullshitting them.

Same thing with finance, customers can tell they are being manipulated, and they don't like it, and they have other choices now.