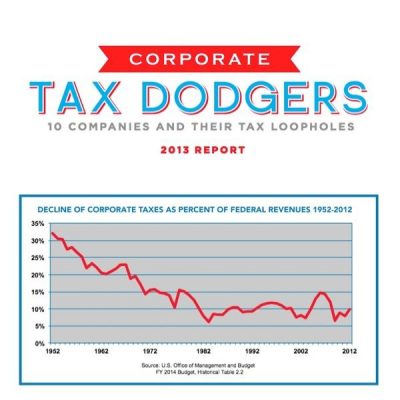

Corporate Tax Dodgers: 10 Companies and Their Tax Loopholes

Bank of America

Had $17.2 billion in profits offshore in 2012 on which it paid no U.S. taxes. Reported it would owe $4.3 billion in U.S. taxes if profits are brought home.

Citigroup

Had $42.6 billion in profits offshore in 2012 on which it paid no U.S. taxes. Reported it would owe $11.5 billion in U.S. taxes if profits are brought home.

ExxonMobil

Paid just a 15% federal income tax rate from 2010-2012, less than half the official 35% corporate tax rate – a tax subsidy of $6.2 billion. Had $43 billion in profits offshore in 2012 on which it paid no U.S. taxes.

Made $5.7 billion from 2010-2012 and didn’t pay a dime in federal income taxes. Got a tax subsidy of $2.1 billion. Received $10.3 billion in federal contracts from 2006-2012.

http://www.ips-dc.org/corporate_tax_dodgers/

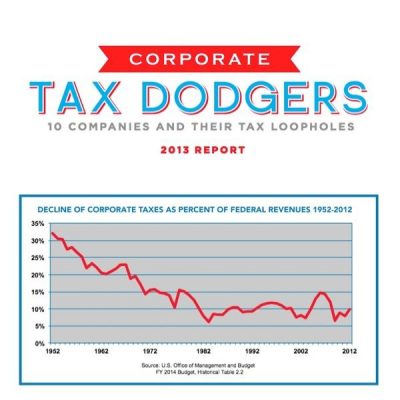

Tax exempt laws have changed so much in the last 15 years its bankrupting the country as they make more and give less they just buy more politicians to keep the money train running leaving less money for schools to infrastructure moving higher taxes for everyone else, screw the small guy is the game.