Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Video & Multimedia

Related: About this forumMax Keiser: Reform = Crime To Favor Wall St. Crooks

In this episode, Max Keiser and co-host, Stacy Herbert, discuss the 99% knocking on Timmy Geithner's door looking for 'reform' of criminal behavior. In the second half of the show Max talks to independent video journalist, Luke Rudkowski, about livestreaming to the world from a smartphone and his recent work covering the NATO summit in Chicago.

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

4 replies, 1540 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (5)

ReplyReply to this post

4 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Max Keiser: Reform = Crime To Favor Wall St. Crooks (Original Post)

marmar

May 2012

OP

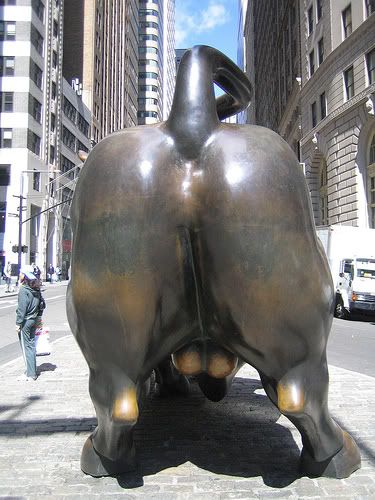

[center]Birthplace of Wall Street's ideas:

[/center]

[/center]

Frances

(8,545 posts)2. Waste of time watching this

If you think you've got it bad under Obama, wait till Mitt takes ove

marmar

(77,080 posts)4. That wasn't the point of it, but whatever.

DeSwiss

(27,137 posts)3. Oh BTW, remember that derivatives market we don't regulate?, We're now backstopping it.

Entirely. Globally. Even the foreign derivatives market if they're deemed ''systemically important'' by the Treasury Secretary. So the idea that our government ''runs'' anything besides their mouths and us and the country into the ground, is almost funny. Oh, and that global market we're now backing?, it now stands at over [font color=red]$1.2 quadrillion[/font]. Yes, that's quadrillion with a Q.

- They slipped that one right past us in the Dodd bill that was supposed to be saving us. Ha-ha.

- They slipped that one right past us in the Dodd bill that was supposed to be saving us. Ha-ha.

As An Encore to Bailing Out the Big Banks, Government to Backstop Derivativees Clearinghouses … In the U.S. and Abroad

*snip*

Little noticed is that on Tuesday Team Obama took its first formal steps toward putting taxpayers behind Wall Street derivatives trading — not behind banks that might make mistakes in derivatives markets, but behind the trading itself. Yes, the same crew that rails against the dangers of derivatives is quietly positioning these financial instruments directly above the taxpayer safety net.

The authority for this regulatory achievement was inserted into Congress’s pending financial reform bill by then-Senator Chris Dodd. Specifically, the law authorizes the Federal Reserve to provide “discount and borrowing privileges” to clearinghouses in emergencies.

To get help, they only needed to be deemed “systemically important” by the new Financial Stability Oversight Council chaired by the Treasury Secretary. Last year regulators finalized rules for how they would use this new power. On Tuesday, they began using it. The Financial Stability Oversight Council secretly voted to proceed toward inducting several derivatives clearinghouses into the too-big-to-fail club. After further review, regulators will make final designations, probably later this year, and will announce publicly the names of institutions deemed systemically important.

link: http://www.zerohedge.com/contributed/2012-05-26/encore-bailing-out-big-banks-government-backstop-derivativees-clearinghouses-

*snip*

Little noticed is that on Tuesday Team Obama took its first formal steps toward putting taxpayers behind Wall Street derivatives trading — not behind banks that might make mistakes in derivatives markets, but behind the trading itself. Yes, the same crew that rails against the dangers of derivatives is quietly positioning these financial instruments directly above the taxpayer safety net.

The authority for this regulatory achievement was inserted into Congress’s pending financial reform bill by then-Senator Chris Dodd. Specifically, the law authorizes the Federal Reserve to provide “discount and borrowing privileges” to clearinghouses in emergencies.

To get help, they only needed to be deemed “systemically important” by the new Financial Stability Oversight Council chaired by the Treasury Secretary. Last year regulators finalized rules for how they would use this new power. On Tuesday, they began using it. The Financial Stability Oversight Council secretly voted to proceed toward inducting several derivatives clearinghouses into the too-big-to-fail club. After further review, regulators will make final designations, probably later this year, and will announce publicly the names of institutions deemed systemically important.

link: http://www.zerohedge.com/contributed/2012-05-26/encore-bailing-out-big-banks-government-backstop-derivativees-clearinghouses-

- See also:

A Mess the 45th President Will Inherit - Taxpayers now stand behind derivatives clearinghouses

link: http://online.wsj.com/article/SB10001424052702304840904577422393164106270.html

Top Derivatives Expert Estimates Size of the Global Derivatives Market at $1,200 Trillion Dollars … 20 Times Larger than the Global Economy

link: http://www.washingtonsblog.com/2012/05/top-derivatives-expert-finally-gives-a-credible-estimate-of-the-size-of-the-global-derivatives-market.html