Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 2 July 2012

[font size=3]STOCK MARKET WATCH, Monday, 2 July 2012[font color=black][/font]

SMW for 29 June 2012

AT THE CLOSING BELL ON 29 June 2012

[center][font color=green]

Dow Jones 12,880.09 +277.83 (2.20%)

S&P 500 1,362.16 +33.12 (2.49%)

Nasdaq 2,935.05 +85.56 (3.00%)

[font color=green]10 Year 1.64% -0.03 (-1.80%)

30 Year 2.75% -0.02 (-0.72%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,862 posts)STAY RIGHT HERE BECAUSE THE SO-CALLED OBAMACARE IS NOT. . . .

On, never mind. I just remembered where I am. . . .

![]()

Demeter

(85,373 posts)and, with our luck, it will get even worse in November.![]()

![]()

Well, the ice cream block party went well, for all that it was stifling and the first time we ever did anything like this. I just knocked on doors in the neighborhood, bribed people to come out and talk and fill out our first survey, etc.

I am, of course, exhausted, and contemplating my third shower of the day...and that committee meeting I didn't go to? It was scheduled for LAST Sunday. Oh, well....

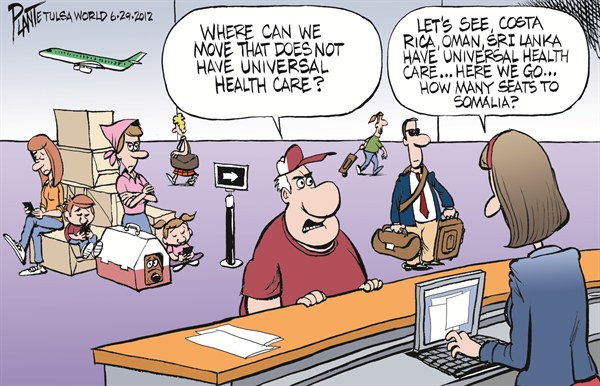

tclambert

(11,087 posts)where people with guns FIGHT for their food. Sure, occasionally a pirate gets shot in the head by a Navy Seal. Not really very often. I say ship all the Tea Party supporters and Libertarians over there.

Po_d Mainiac

(4,183 posts)by opting to pay the tax instead of insuring CONgress?

Demeter

(85,373 posts)How high will they jack it on Monday morning? Stay tuned for a full report. It was $3.30 Sunday...at selected locations.

Demeter

(85,373 posts)The sanctions noose around Iran is set to tighten Sunday as the European Union imposes a total embargo on all purchases of Iranian oil.

The new sanctions are aimed at putting pressure on the Islamic Republic to make concessions on its nuclear program. Iran insists the program is limited to peaceful, civilian purposes, but many Western nations believe Iran has nuclear weapons ambitions.

The move against Iran comes at a time when oil prices have been dropping for the past couple of months.

The EU action could potentially reverse that trend and push world oil prices higher over the next few months. Analysts surveyed by Bloomberg News forecast that the price for premium crude will rebound to more than $114 for the third quarter of this year....

WISHFUL THINKING, I THINK. MAYBE IF ISRAEL GETS ITS SHOOTING WAR...OTHERWISE, I DON'T THINK ANY FEAR-GENERATED PRICE INCREASE CAN BE SUSTAINED IN THIS DEPRESSION.

Hugin

(33,164 posts)Mmm-doggies! ![]()

It's unprecedented! Nothing like it anywhere else on the charts! That's gonna leave a mark!

![]()

Po_d Mainiac

(4,183 posts)wordpix

(18,652 posts)I really doubt Israel wants a war, surrounded as it is by enemies who have proclaimed desire for its total destruction.

Some people do not want to recall why Israel was created in the first place (due to the Nazi genocide of Jews with 6 million exterminated during WWII) and could not care less if the entire nation is wiped out. Is that you?

What does this issue have to do with the price of oil, really?

Demeter

(85,373 posts)I have nothing against any race or class, and most likely have Ashkenazi in my own bloodline. But there are two things I do not put up with. One is stupid, when it's avoidable (not developmental) and the other is crazy. I don't care who you are, you say or do something stupid when you know better and everybody knows you do, I'm gonna call you on it. And when you are just plain crazy, like the current bunch of Israeli leadership, going around to all the other nations, trying to foment a war on Iran, double ditto.

Roland99

(53,342 posts)Fuddnik

(8,846 posts)Demeter

(85,373 posts)Sigh.

Demeter

(85,373 posts)Glad I got in early....

Demeter

(85,373 posts)Maria Verdugo, a 20-year-old graduate of the University of California, Santa Cruz, barely remembers the presidential election of 2008 — the one that spawned a youth movement that was singular in its scope and political effectiveness — except for “something about Obama saying we needed a change.” These days, Ms. Verdugo is so busy working to pay off her student loans that she has not decided whether to register “as a Democrat, a Republican or what,” she said....Chad Tevlin, 19, a student trying to pay for college by cleaning portable toilets in South Bend, Ind., cannot recall if he registered to vote at all. “Pointless” is how he describes politics...And Kristen Klenke, a music student in central Michigan, has decided to skip this election altogether. “I know it sounds horrible,” said Ms. Klenke, 20. “But there’s a lot of discouragement going around.”

In the four years since President Obama swept into office in large part with the support of a vast army of young people, a new corps of men and women have come of voting age with views shaped largely by the recession. And unlike their counterparts in the millennial generation who showed high levels of enthusiasm for Mr. Obama at this point in 2008, the nation’s first-time voters are less enthusiastic about him, are significantly more likely to identify as conservative and cite a growing lack of faith in government in general, according to interviews, experts and recent polls. Polls show that Americans under 30 are still inclined to support Mr. Obama by a wide margin. But the president may face a particular challenge among voters ages 18 to 24. In that group, his lead over Mitt Romney — 12 points — is about half of what it is among 25- to 29-year-olds, according to an online survey this spring by the Harvard Institute of Politics. And among whites in the younger group, Mr. Obama’s lead vanishes altogether. Among all 18- to 29-year-olds, the poll found a high level of undecided voters; 30 percent indicated that they had not yet made up their mind. And turnout among this group is expected to be significantly lower than for older voters.

“The concern for Obama, and the opportunity for Romney, is in the 18- to 24-year-olds who don’t have the historical or direct connection to the campaign or the movement of four years ago,” said John Della Volpe, director of polling at the Harvard Institute of Politics. “We’re also seeing that these younger members of this generation are beginning to show some more conservative traits. It doesn’t mean they are Republican. It means Republicans have an opportunity.”

Experts say the impact of the recession and the slow recovery should not be underestimated. The newest potential voters — some 17 million people — have been shaped more by harsh economic times in their formative years than by anything else, and that force does not tend to be galvanizing in a positive way. For 18- and 19-year-olds, the unemployment rate as of May was 23.5 percent, according to the Bureau of Labor Statistics. For those ages 20 to 24, the rate falls to 12.9 percent, compared with the national unemployment rate of 8.2 percent for all ages. The impact of the recession on the young has created a disillusionment about politics in general, several experts suggested.

“I think the lack of excitement right now is palpable enough to be a challenge to the re-election campaign” of Mr. Obama, said Peter Levine, director of the Center for Information and Research on Civic Learning and Engagement at Tufts University.

The Romney campaign intends to seize the moment, with new online and campus-based initiatives rolling out in the next few weeks, said Joshua Baca, the campaign’s national coalition director. He said the message would be simple: Mr. Obama’s economic policies are not working for young people. The strategy? “Dorm room to dorm room” or “parent’s basement to parent’s basement, wherever they are because of the economy, that’s where we’ll be going,” Mr. Baca said. “The key to this is having a very strong volunteer base to knock on doors.”...For its part, the Obama campaign has already started outreach efforts focusing on teenagers in high school. It has organized youth rallies in swing states over the last few months and plans to be a force on college campuses in the fall. Campaign officials expressed confidence.

“Young people know what’s at stake,” said Clo Ewing, an Obama campaign spokeswoman. “So just as they came out in huge numbers to organize and lead a movement in 2008, their energy and commitment will help build this campaign again in 2012.”

MORE VIGNETTES

Demeter

(85,373 posts)The chairman of Barclays PLC could resign as soon as Sunday following a huge fine levied on the bank for its manipulation of interest rates, according to multiple reports in the British media.

Marcus Agius will step down as he prepares to be questioned this week by members of the British Parliament over actions that led to the imposition of a $456 million fine, the reports said. It was levied last week to settle a probe into attempted manipulation and false reporting relating to two benchmark interest rates that form the basis for hundreds of trillions of dollars of transactions.

Chief Executive Bob Diamond and trio of other executives have agreed to give up bonuses this year due to their “collective responsibility as leaders.” Diamond also noted that the activities by the bank’s traders “fell well short” of its standards. The Guardian newspaper reported that Michael Rake, a former top accountant and senior independent director on the board of the bank, is seen as a likely candidate for temporary chairman of Barclays...There are reports that as many as 15 people have been disciplined or fired due the scandal but Diamond has so far resisted growing political and public pressure to step down.

Demeter

(85,373 posts)To the long, dismal list of fatally broken institutions — GDP, governments, schools, corporations — we can add the mysterious Libor, and its conveniently comfortable calculation. It's difficult to overstate what a pillar of the global economy Libor is — it's used in setting interest rates that affect the daily lives of pretty much every citizen of every advanced economy across the globe. And it's difficult to overstate how troubling it is that this, too, is an institution rigged by the few, for the few; that this institution too, is, corrupted.

This scandal isn't about price-fixing. It's not about a bank. It's not even about power and privilege, corruption and compromise. It's about life, tragedy, and human potential. It's about the capacity to create a worthwhile future. It is, in short, about you and I, and the places we seek for ourselves in the world...

BUT OTHER THAN THAT, HOW DID YOU LIKE THE PLAY, MRS.LINCOLN?

Demeter

(85,373 posts)I can't put a number on it, but I don't think it's hyperbole to describe the LIBOR manipulation as theft at an almost unimaginable scale. One issue with too big banks, a too big banking system, and generally asleep regulators, is that the amount of money to be made by shifting any key rates by even a tiny unnoticeable amount is huge. A teensy percentage of a trillion dollars is still big money.

Free money for the Great Casino, government backstopping of losses, and legal means to take a chunk of every transaction aren't enough for them. They want to steal some more.

But they're extraordinary people, so what's to be done?

Demeter

(85,373 posts)Business secretary backs demand for police inquiry into bank fined £290m for role in manipulating City interest rates...The business secretary said the public would not understand why people were jailed for petty theft while bankers were getting off, "having perpetrated what looks like conspiracy".

And he said he agreed with Lord Blair, the former Metropolitan police commissioner, who said there appeared to be evidence that Barclays employees were engaged in conspiracy to defraud...

Sushi_lover

(1,430 posts)How is PwC not getting any grief? They are the auditor which missed the fraud at MF Global and they are Barclay's auditor too.

Demeter

(85,373 posts)Demeter

(85,373 posts)TELL ME, DO COLONIES RISE?

http://www.nytimes.com/2012/07/01/opinion/sunday/africa-on-the-rise.html

GENERATIONS of Americans have learned to pity Africa. It’s mainly seen as a quagmire of famine and genocide, a destination only for a sybaritic safari or a masochistic aid mission. So here’s another way to think of Africa: an economic dynamo. Is it time to prepare for the African tiger economy? Six of the world’s 10 fastest-growing economies between 2001 and 2010 were in Africa, according to The Economist. The International Monetary Fund says that between 2011 and 2015, African countries will account for 7 of the top 10 spots.

Africa isn’t just a place for safaris or humanitarian aid. It’s also a place to make money. Global companies are expanding in Africa; vast deposits of oil, gas and minerals are being discovered; and Goldman Sachs recently issued a report, “Africa’s Turn,” comparing business opportunities in Africa with those in China in the early 1990s.

I’m writing this column in Lesotho, a mountainous kingdom (it was snowing the day I arrived!) in southern Africa, on my annual win-a-trip journey. The winner this year, Jordan Schermerhorn, an engineering student at Rice University, and I visited garment factories that make clothing for American stores. This country is Africa’s biggest apparel exporter to America. One set of factories we visited, belonging to the Nien Hsing Textile Company, a giant Taiwanese corporation, employs 10,000 people in Lesotho, making this its biggest operation in the world. Workers turn out bluejeans for Levi’s and other American companies, and Alan Han, a senior company official, said quality is comparable to that of factories in Asia. While America may largely misperceive Africa as a disaster zone, China does get the promise on the continent. Everywhere you turn in Africa these days there are Chinese businesspeople seeking to invest in raw materials and agriculture. But American businesses seem to be only beginning to wake up to the economic potential here.

Why does that matter? Because trade often benefits a country more than aid. I’m a strong supporter of foreign aid, but economic growth and jobs are ultimately the most sustainable way to raise living standards...

KRISTOFF ISN'T SMART ENOUGH TO BE A DORK, I SWEAR

Demeter

(85,373 posts)If I survive that long...

Demeter

(85,373 posts)Just no rain and no coolth.

Demeter

(85,373 posts)http://news.yahoo.com/fact-check-keeping-current-health-plan-071940391.html

In promoting the health care law, President Barack Obama is repeating his persistent and unsubstantiated assurance that Americans who like their health insurance can simply keep it. Republican rival Mitt Romney says quite the opposite, but his doomsday scenario is a stretch...

___

OBAMA: "If you're one of the more than 250 million Americans who already have health insurance, you will keep your health insurance. This law will only make it more secure and more affordable."

ROMNEY: "Obamacare also means that for up to 20 million Americans, they will lose the insurance they currently have, the insurance that they like and they want to keep."

THE FACTS: Nothing in the law ensures that people happy with their policies now can keep them. Employers will continue to have the right to modify coverage or even drop it, and some are expected to do so as more insurance alternatives become available to the population under the law. Nor is there any guarantee that coverage will become cheaper, despite the subsidies that many people will get. Americans may well end up feeling more secure about their ability to obtain and keep coverage once insurance companies can no longer deny, terminate or charge more for coverage for those in poor health. But particular health insurance plans will have no guarantee of ironclad security. Much can change, including the cost. The non-partisan Congressional Budget Office has estimated that the number of workers getting employer-based coverage could drop by several million, as some workers choose new plans in the marketplace or as employers drop coverage altogether. Companies with more than 50 workers would have to pay a fine for terminating insurance, but in some cases that would be cost-effective for them. MORE FACTS AT LINK

Demeter

(85,373 posts)I GOT NEWS FOR YOU, GOV, NOBODY IS GOING TO COMPLY...THE LAW IS TOO FRICKING IMPOSSIBLE TO COMPLY WITH.

Demeter

(85,373 posts)I THINK I CAN, I THINK I CAN...

http://ecx.images-amazon.com/images/I/61pXn1FwJ9L._BO2,204,203,200_PIsitb-sticker-arrow-click,TopRight,35,-76_AA300_SH20_OU01_.jpg

http://www.democracynow.org/2012/6/29/as_supreme_court_affirms_patchwork_us

VIDEO AND TRANSCRIPT AT LINK

Demeter

(85,373 posts)SO HE'S AN EVIL GENIUS, I GET IT. HE COULDN'T POSSIBLY HAVE MADE ACA WORSE, AND YET HE DID! DITTO ON ARIZONA'S IMMIGRATION FASCISM.

http://news.yahoo.com/more-nuanced-view-roberts-health-care-law-084842342.html

Chief Justice John Roberts could have taken down the entire, massive health care law that his fellow Republicans deride as "Obamacare." He could have prevented the Supreme Court decision that largely disabled the most disputed aspects of Arizona's crackdown on illegal immigrants. He didn't do either, and in the process surprised (or dismayed) longtime court observers of every political stripe. Those two outcomes in the finals days of his seventh year on the court offer some clues for reassessing what kind of chief justice Roberts is and intends to be. Is he no longer the rock-ribbed conservative loved by supporters and jeered by opponents? Has he become a pragmatic leader mindful of the court's place in history? Is he more canny, but still solidly conservative?

The measure of a justice is best taken after decades of service, rather than a few years. At age 57, Roberts could lead the court for another quarter-century. But at the very least, the end of the Roberts Court's most consequential term already is leading to revised, and in some cases more nuanced, appraisals of his leadership. Erwin Chemerinsky, a liberal scholar who is dean of the law school at the University of California at Irvine, announced that the era of the Roberts Court had begun. "He authored the opinion in the most important case in his seven years on the court, and did so against what was expected," Chemerinsky said.

In truth, Roberts' vote to uphold President Barack Obama's health care law was not so much a surprise. He long had been counted among the possible votes to uphold the law. But it was widely assumed that if Roberts ultimately voted for it, so too would Anthony Kennedy, most often the decisive vote in closely fought cases. It was only the second time in his tenure that Roberts provided the deciding vote for the side favored by the court's liberals. Up until now, it had been the Kennedy Court, Chemerinsky said, "This year, it was the Roberts Court."

MORE FAWNING AT LINK

Demeter

(85,373 posts)THE Arizona law requiring police to check the immigration status of anyone they suspect of being in the country illegally — a statute tentatively blessed last week by the Supreme Court — is an invitation to abuse. It is all too likely to be used, as the court itself seemed to fear, to intimidate and demean people with the wrong accent or skin tone, thus delivering a get-out-the-humiliated-Hispanic-vote bonus to President Obama. The less likely alternative is that it will be applied more like the random T.S.A. searches at airports, thus infuriating Arizonans across the board.

While we wait for this to play out, let’s turn our attention to another aspect of the so-called “show me your papers” law: Show me WHAT papers? What documents are you supposed to have always on hand to convince police that you are legit? Welcome to an American paradox. This country, unlike many other developed democracies, does not require a national identification card, because the same electorate that is so afraid America is being overrun by illegal aliens also fears that we are one short step away from becoming a police state. I’ve suggested before that, as part of any comprehensive reform of our senseless immigration laws, Americans should master their anxieties about a national identification card. The Arizona controversy reinforces my conviction.

This is not a peripheral issue. The reason Arizona and other states have deputized police as amateur immigration agents — and contemplated making enforcers out of school principals, emergency-room nurses and other civil servants — is that we have failed so utterly to fortify the most obvious line of defense. No, not the Mexican border. Employers. Jobs are, after all, the main magnet for illegal immigration. If we had a reliable way for employers to check the legal status of prospective workers, and held them strictly accountable for doing so, we would not feel the need for all these secondary checkpoints. What we have now is a laughably ineffective program called E-Verify, in which employers send information supplied by job applicants to be matched against databases in the Social Security Administration or the Department of Homeland Security. The most extensive study of this program, published in 2009, found it to be so easy to fool the system with stolen or fraudulent documents that more than half of the unauthorized job applicants got a green light. In the absence of a credible federal system, frustrated states are improvising their own controls. For example, in many states you now have to prove U.S. citizenship or legal residency to get a driver’s license. This is presumably what most Arizonans will show police if they are challenged under the “show me” law. But by transforming a driver’s license into a kind of internal passport, Arizona and states with similar laws have created a different problem. Illegal immigrants don’t stop driving; they just drive unlicensed, untested and uninsured.

I understand that the idea of a national ID comes with some chilling history, which is why it has been opposed by activists on the right and left — by the libertarian Cato Institute and the A.C.L.U., by People for the American Way and the American Conservative Union. Opponents associate national identification cards with the Nazi roundups, the racial sorting of apartheid South Africa, the evils of the Soviet empire. Civil rights groups see in a national ID — especially one that might be required for admission to the voting booth — a shadow of the poll taxes and literacy tests used to deter black voters in the Jim Crow South. More recently, accounts of flawed watch-list databases and rampant identity theft feed fears for our privacy. The most potent argument against an ID is that the government — or some hacker — might access your information and use it to mess with your life.

“The one thing we know with certainty about databases is that they grow,” said Marc Rotenberg, executive director of the Electronic Privacy Information Center, which includes national ID cards on its list of threats. The official urge to amass and use information, he told me, “takes on a life of its own.”

...You might start with the Social Security card. You would issue a plastic version, and in it you would embed a chip containing biometric information: a fingerprint, an eye scan or a digital photo. The employer would swipe the card and match it to the real you. Unlike your present Social Security card, the new version would be useless to a thief because it would contain your unique identifier. The information would not need to go into a database...

Demeter

(85,373 posts)New York’s biggest investment houses are shifting jobs out of the area and expanding in cheaper locales in the United States, threatening the vast middle tier of positions that form the backbone of employment on Wall Street. The shift comes even as banks consider deeper staff cuts here (NYC), which could undermine the state and city tax base long term.

“Places like New York or London will remain financial centers, but most of the players are taking a much harder look and asking whether they can move large numbers of jobs,” said James Malick, a partner at the Boston Consulting Group who advises banks on relocation. In addition to higher taxes in the New York region, employers face real estate and labor costs significantly above the national average.

Consultants say they have seen a sharp pickup in this trend, known as near-shoring, as opposed to offshoring overseas. Goldman Sachs, during a presentation to investors in late May, even boasted of the cost savings that relocating jobs can bring.

“Some functions need to stay in the United States, but they don’t need to be in New York City or near the client,” Mr. Malick said. And with most investment giants facing anemic revenue and more stringent regulation that cuts into trading revenues, relocation is more tempting than it was before the financial crisis.

Low-level jobs have already migrated to call centers and back offices overseas, while top-end traders and bankers are secure in the New York area, experts say. Instead, services like accounting, trading and legal support, and human resources and compliance are being shifted to places like Salt Lake City, North Carolina and Jacksonville, Fla. Garry Douyon enjoyed his job helping process trades and working with clients and traders at RBS in Stamford, Conn., earning nearly $100,000 a year, but when the firm decided last fall to move his team to Salt Lake City with a salary of $60,000, he said he really didn’t have much of a choice...The potential shift has profound implications for New York’s tax base and economy because of Wall Street’s outsize financial profile. Last year, the industry contributed 14 percent of New York State’s tax revenue. After peaking at 213,000 in August 2007, securities industry jobs in the state fell more than 15 percent in the wake of the financial crisis, according to the Bureau of Labor Statistics. Since then they have risen nearly 12,000, but at 191,200, employment is well below pre-crisis levels. By contrast, over the same period, Delaware gained 1,300 securities jobs while Arizona picked up 2,600. The federal government does not specifically track securities jobs in Utah, North Carolina or Florida, popular locations for near-shoring. But data from firms illustrates the trend.

Since the end of 2009, Deutsche Bank’s work force in the New York area has fallen to 6,900 from 7,400 even as its staff in Jacksonville rose to 1,000 from 600. Credit Suisse’s staff in the New York region has dropped by 500 in the past four years, but the firm has added 450 positions in North Carolina’s Research Triangle, in the area of Raleigh, Cary, Durham and Chapel Hill. And last year, Bank of New York Mellon cut 350 jobs in New York City while hiring 150 people in Lake Mary, Fla. New York’s status as a financial capital is not likely to fade, and the state’s share of securities jobs in the United States has held steady at about 24 percent in recent years. “Even as the securities industry goes through a difficult time, New York remains the financial capital of the world and I don’t see that changing anytime soon,” said Thomas P. DiNapoli, the New York State comptroller. But regional offices perform more and more of the sophisticated work usually associated with Wall Street and nearby trading hubs like Jersey City and Stamford. This parallels a shift in some technology jobs away from Silicon Valley to Portland, Ore., and cities in Texas, said Michael Shires, a professor at the School of Public Policy at Pepperdine, who prepares an annual ranking of the best cities for employment.

J. Keith Crisco, the North Carolina secretary of commerce, visits New York three to five times a year, meeting with executives from firms already in North Carolina, like Credit Suisse, while reaching out to prospects. Another trip is planned this month. North Carolina provided Credit Suisse with roughly $14 million in incentives to bring it to the state. Delaware, which announced in April it had lured up to 1,200 JPMorgan Chase jobs to the state, is set to pay the giant bank $10.1 million in cash incentives. Alan Levin, director of the Delaware Economic Development Office, estimates the typical salary for those jobs at $78,000 a year.

SPECIAL DETAIL ON GOLDMAN SACHS ROUNDS IT OUT

Demeter

(85,373 posts)JP Morgan’s credit rating would be much lower without government backing.

As Bloomberg noted last week:

And as the editors of Bloomberg pointed out a couple of weeks ago:

***

With each new banking crisis, the value of the implicit subsidy grows. In a recent paper, two economists — Kenichi Ueda of the IMF and Beatrice Weder Di Mauro of the University of Mainz — estimated that as of 2009 the expectation of government support was shaving about 0.8 percentage point off large banks’ borrowing costs. That’s up from 0.6 percentage point in 2007, before the financial crisis prompted a global round of bank bailouts.

To estimate the dollar value of the subsidy in the U.S., we multiplied it by the debt and deposits of 18 of the country’s largest banks, including JPMorgan, Bank of America Corp. and Citigroup Inc. The result: about $76 billion a year. The number is roughly equivalent to the banks’ total profits over the past 12 months, or more than the federal government spends every year on education.

JPMorgan’s share of the subsidy is $14 billion a year, or about 77 percent of its net income for the past four quarters. In other words, U.S. taxpayers helped foot the bill for the multibillion-dollar trading loss that is the focus of today’s hearing. They’ve also provided more direct support: Dimon noted in a recent conference call that the Home Affordable Refinancing Program, which allows banks to generate income by modifying government-guaranteed mortgages, made a significant contribution to JPMorgan’s earnings in the first three months of 2012.

Way to suck at the government teat, Mr. self-proclaimed free market champion.

Demeter

(85,373 posts)...The largest interest rate derivatives sellers include Barclays, Deutsche Bank, Goldman and JP Morgan … many of which are being exposed for manipulating Libor.

They have been manipulating Libor on a daily basis since 2005.

They are still part of the group of banks which sets Libor every day, and none have been criminally prosecuted.

They have received a light slap on the wrist from regulators, which – as nobel economist Joe Stiglitz points out – is just the cost of doing business when fraud is the business model.

Indeed – as Bloomberg notes – they’re probably still manipulating the rate...

DETAILS AT LINK

Demeter

(85,373 posts)... Back in 1910 Angell published a famous book titled “The Great Illusion,” arguing that war had become obsolete. Trade and industry, he pointed out, not the exploitation of subject peoples, were the keys to national wealth, so there was nothing to be gained from the vast costs of military conquest. Moreover, he argued that mankind was beginning to appreciate this reality, that the “passions of patriotism” were rapidly declining. He didn’t actually say that there would be no more major wars, but he did give that impression.

We all know what came next.

The point is that the prospect of disaster, no matter how obvious, is no guarantee that nations will do what it takes to avoid that disaster. And this is especially true when pride and prejudice make leaders unwilling to see what should be obvious. Which brings me back to Europe’s still extremely dire economic situation. It comes as something of a shock, even for those of us who have been following the story all along, to realize that more than two years have passed since European leaders committed themselves to their current economic strategy — a strategy based on the notion that fiscal austerity and “internal devaluation” (basically, wage cuts) would solve the problems of debtor nations. In all that time the strategy has produced no success stories; the best the defenders of orthodoxy can do is point to a couple of small Baltic nations that have seen partial recoveries from Depression-level slumps, but are still far poorer than they were before the crisis.

Meanwhile the euro’s crisis has metastasized, spreading from Greece to the far larger economies of Spain and Italy, and Europe as a whole is clearly sliding back into recession. Yet the policy prescriptions coming out of Berlin and Frankfurt have hardly changed at all. But wait, you say — didn’t last week’s summit meeting produce some movement? Yes, it did. Germany gave a little ground, agreeing both to easier lending conditions for Italy and Spain (but not bond purchases by the European Central Bank) and to a rescue plan for private banks that might actually make some sense (although it’s hard to tell given the lack of detail). But these concessions remain tiny compared with the scale of the problems. What would it really take to save Europe’s single currency? The answer, almost surely, would have to involve both large purchases of government bonds by the central bank, and a declared willingness by that central bank to accept a somewhat higher rate of inflation. Even with these policies, much of Europe would face the prospect of years of very high unemployment. But at least there would be a visible route to recovery.

Yet it’s really, really hard to see how such a policy shift could come about.

Part of the problem is the fact that German politicians have spent the past two years telling voters something that isn’t true — namely, that the crisis is all the fault of irresponsible governments in Southern Europe. Here in Spain — which is now the epicenter of the crisis — the government actually had low debt and budget surpluses on the eve of crisis; if the country is now in crisis, that’s the result of a vast housing bubble that banks all across Europe, very much including the Germans, helped to inflate. But now the false narrative stands in the way of any workable solution. Yet misinformed voters aren’t the only problem; even elite European opinion has yet to face up to reality. To read the latest reports from European-based “expert” institutions, like the one released last week by the Bank for International Settlements, is to feel that you’ve entered an alternative universe, one in which neither the lessons of history nor the laws of arithmetic apply — a universe in which austerity would still work if only everyone had faith, and in which everyone can cut spending at the same time without producing a depression.

So will Europe save itself? The stakes are very high, and Europe’s leaders are, by and large, neither evil nor stupid. But the same could be said, believe it or not, about Europe’s leaders in 1914. We can only hope that this time is different.

Demeter

(85,373 posts)Israel unsuccessfully sought a $1 billion loan from the International Monetary Fund (IMF) for transfer to the Palestinian Authority to prevent its financial collapse, Israeli and Palestinian officials said on Monday.

The IMF turned down the request, according to Israel's Haaretz newspaper, because it did not want to set a precedent of one state getting a loan on behalf of a none-state body.

The aid-dependent Palestinian economy in the West Bank is facing a deepening financial crisis due to a drop in aid from Western backers and wealthy Gulf states as well as Israeli restrictions on trade...

THIS IS AKIN TO THE CLASSIC DEFINITION OF CHUTZPAH...KILLING ONES PARENTS, THEN ASKING THE COURT FOR LENIENCY, SINCE ONE IS RECENTLY BECOME AN ORPHAN...

Demeter

(85,373 posts)GIVING NEW MEANING AND ENERGY TO THE IDEA OF "CURRENCY SPECULATION"...INTERESTING READ

xchrom

(108,903 posts)

Tansy_Gold

(17,862 posts):yawn:

xchrom

(108,903 posts)UPDATE: We've just wrapped up the bulk of global PMI numbers, and the gist of these surveys of the manufacturing economy is: Ugly, but in line with expectations.

So the market reaction is fairly ho hum, with many markets shading slightly negative, but not dramatically so.

Markets are now totally digesting the news, and rallying anyway.

Italy, for example, is up 0.99%.

Germany is up 0.3%

France is up 0.5%.

US futures are basically flat.

Remember, this is going to be a strange week, with lots going on, but quiet due to the mid-week holiday breakup.

Read more: http://www.businessinsider.com/morning-markets-july-2-2012-7#ixzz1zSicQfUp

xchrom

(108,903 posts)For a sober take on last week's EU summit, check out Wolfgang Münchau at the FT, who argues that it was really Merkel who won the summit last week, and that nothing has changed.

Here's the gist of his argument:

The ESM (Europe's main bailout fund) has no more money than it did before.

It's not big enough, especially if it's going to bail out Spain's banks and reduce Italy's borrowing costs.

Germany gave up no new euros.

Italy still has to face a troika program to get its budget under control.

The ECB isn't any more involved than it was.

The Spanish banking bailout will still require outside supervision.

It's not clear that the ESM really has the power to recap banks under the current treaty. That may require votes.

Munchau concludes:

The most important event last week was probably not the agreement at the summit anyway, but the statement by Ms Merkel that there will be no eurozone bonds “for as long as I live”. My belief is that this statement reveals she is not serious about political union, to which she has been paying lip-service over the past few weeks. Her tactics remind me of the “coronation theory” of the 1980s: the Bundesbank used to say that monetary union was acceptable but only after full political union was completed. It was another way of saying never. I always suspected all this talk about long-term solutions might be a ruse. Now, it seems, we know.

Read more: http://www.businessinsider.com/wolfgang-mnchau-nothing-has-changed-in-europe-2012-7#ixzz1zSn63MeL

Demeter

(85,373 posts)States don't fail overnight. The seeds of of their destruction are sown deep within their political institutions...I'M SURE SOME DO, THEY JUST DON'T LAST LONG ENOUGH TO COUNT...Some countries fail spectacularly, with a total collapse of all state institutions, as in Afghanistan after the Soviet withdrawal and the hanging of President Mohammad Najibullah from a lamppost, or during the decade-long civil war in Sierra Leone, where the government ceased to exist altogether. Most countries that fall apart, however, do so not with a bang but with a whimper. They fail not in an explosion of war and violence but by being utterly unable to take advantage of their society's huge potential for growth, condemning their citizens to a lifetime of poverty. This type of slow, grinding failure leaves many countries in sub-Saharan Africa, Asia, and Latin America with living standards far, far below those in the West....AND THEN, THERE ARE COUNTRIES LIKE OURS, RAPIDLY APPROACHING THOSE SAME CONDITIONS...

What's tragic is that this failure is by design. These states collapse because they are ruled by what we call "extractive" economic institutions, which destroy incentives, discourage innovation, and sap the talent of their citizens by creating a tilted playing field and robbing them of opportunities. These institutions are not in place by mistake but on purpose. They're there for the benefit of elites who gain much from the extraction -- whether in the form of valuable minerals, forced labor, or protected monopolies -- at the expense of society. Of course, such elites benefit from rigged political institutions too, wielding their power to tilt the system for their benefit. But states built on exploitation inevitably fail, taking an entire corrupt system down with them and often leading to immense suffering. Each year the Failed States Index charts the tragic stats of state failure. Here's our guide to 10 ways it happens:

1. North Korea: Lack of property rights

2. Uzbekistan: Forced labor

3. South Africa: A tilted playing field

4. Egypt: The big men get greedy

5. Austria and Russia: Elites block new technologies

6. Somalia: No law and order

7. Colombia: A weak central government

8. Peru: Bad public services

9. Bolivia: Political exploitation

10. Sierra Leone: Fighting over the spoils

11. USA: ALL OF THE ABOVE, PLUS A SLEEPING CITIZENRY

Demeter

(85,373 posts)EVENTUALLY....WE HOPE....

Demeter

(85,373 posts)By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that several major indicators are still significantly below the pre-recession peaks.

GDP Percent Previous Peak

This graph is for real GDP through Q1 2012. Real GDP returned to the pre-recession peak in Q3 2011, and has been at new post-recession highs for three consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 5.1% from the 2007 peak.

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through the May report released Friday.

This measure was off 10.7% at the trough in October 2009.

Real personal income less transfer payments is still 3.7% below the previous peak.

The third graph is for industrial production through May.

Industrial production was off over 17% at the trough in June 2009, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 3.4% below the pre-recession peak.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 3.6% below the pre-recession peak.

All of these indicators collapsed in 2008 and early 2009, and only real GDP is back to the pre-recession peak. At the current pace of improvement, industrial production will be back to the pre-recession peak in early 2013, personal income less transfer payments in 2014, and employment in 2015.

xchrom

(108,903 posts)Just out!

Eurozone unemployment hit 11.1% in May, a brand new high.

That's up from the previous high of 11.0%.

Youth unemployment has risen to 22.6%, according to Markit.

Read more: http://www.businessinsider.com/eurozone-unemployment-rises-to-111-2012-7#ixzz1zStAhyxm

Roland99

(53,342 posts)economy." This metric is only going to get worse, only in the future it will be coupled with increasingly more direct and contingent debt all around.

At 45.1 in June, unchanged from the previous month, the final Markit Eurozone Manufacturing PMI® was up slightly from its earlier flash estimate of 44.8. However, the rate of decline signalled was identical to May, when operating conditions deteriorated at the fastest pace for almost three years. Over the second quarter as a whole, the PMI registered its lowest average reading (45.4) since the second quarter of 2009.

Demeter

(85,373 posts)and whatever such a novelty triggers...

Roland99

(53,342 posts)nothing like a chocolate pop tart to start the day.

BTW, the calories listed on the side? Those are only for *1* pastry! A serving size is *1* pastry!

But there are *2* in a wrapper!!

DemReadingDU

(16,000 posts)Roland99

(53,342 posts)Demeter

(85,373 posts)I'll go water the peach tree, it will only take 5 minutes....

after an hour of wrestling with the hoses, replacing various broken connectors, and getting thoroughly wet, breakfast time was over.

On the other hand, look at all the calories I save! And in my soaking wet clothes, I have natural cooling! And the hoses are at least halfway fixed, and maybe tomorrow it will only take 5 minutes to water the peach tree....

and the tree is still alive, in spite of everything. That's got to count to the good.

xchrom

(108,903 posts)China's manufacturing activity grew at its slowest pace in seven months in June, adding to fears about a slowdown in its economy.

Its official purchasing managers' index (PMI) fell to 50.2 from 50.4 in May, data released on Sunday showed.

There have been fears that a slowdown in markets such as the US and Europe may hurt demand for China's exports.

The PMI is a key indicator of manufacturing activity. Any reading above 50 indicates growth.

xchrom

(108,903 posts)Unemployment in the eurozone hit 11.1% in May while the downturn in its manufacturing sector continued, according to official statistics.

A total of 17.56m people are now out of work marking the highest level since records began in 1995, according to EU statistics body Eurostat.

Meanwhile, the manufacturing Purchasing Managers' Index (PMI), compiled by Markit, was stuck at 45.1 in June.

Any reading below 50 indicates contraction.

xchrom

(108,903 posts)Mexico's old ruling party, the PRI, is set to return to power as early official results indicate its candidate Enrique Pena Nieto has won the presidential election.

Mr Pena Nieto, 45, is on about 37%, several points ahead of Andres Manuel Lopez Obrador, who has not conceded.

Thousands of police were on duty for the vote, amid fears of intimidation from drug gangs.

Mexicans were also electing a new congress and some state governors.

Roland99

(53,342 posts)But don't let that dampen the markets' mood!

Demeter

(85,373 posts)

There's a famous ballet, called the Green Table, the masterpiece of German choreographer Kurt Jooss, and his most popular work, depicting the futility of peace negotiations of the 1930s...FROM WIKIPEDIA:

The Green Table was created for the "Concours international de chorégraphie" in Paris, in which Jooss had been invited to participate. The originality of the piece won him the first prize and marked an important step in his career. Choreographed in 1932, between two great conflicts, The Green Table is a sort of generic war, a set of circumstances that produce the same result no matter where or when they are played out...

In 1932, looking out through the thickening hedges of Nazism, Jooss takes a less visionary path. The Green Table is concerned neither with the individual's struggles and redemption, nor with working out a nobler fate for mankind. Jooss dramatizes the way destructive impulses are released, and shows us the consequences. His moral position is unimpeachable, and he drives home his lesson in a series of stark images. Each scene works a variation on the same theme, like the 41 woodcuts in Hans Holbein's The Dance of Death. The idea is that Death becomes everyone's partner, effectively seducing them into his dance on the same terms by which they lived their lives. No decisive action, change, or resolution is suggested, and in framing the Dance of Death with the stalemated parentheses of a diplomatic conference, Jooss seems to say none can be expected. The expressionists found the Dance of Death.

Through archetypal characters Jooss revisualizes human life as a function of a larger cosmology, an enduring and spiritual sphere where perhaps even war and death can be seen in a more comprehensible scale. Undiluted essences of natural behavior, these characters are stripped of temporality and individual preference. Today, even as we feel detached from their obvious artificiality, we recognize ourselves in them, in some epic form. People will still be able to understand them in a hundred years.

THE PLOT

Lasting about 30 minutes and subtitled "A dance of death in eight scenes", it opens with a group of diplomats (the Gentlemen in Black)(portrayed by the other characters in the piece, with the exception of Death) having a discussion around a rectangular table covered with a green cloth. They end up pulling guns from their pockets and shooting in the air, thus symbolizing the declaration of war.

The next six scenes portray different aspects of wartime: the separation from loved ones in The Farewells, war itself in The Battle and The Partisan, loneliness and misery in The Refugees, the emotional void and the atmosphere of forced entertainment in The Brothel, and, finally, the psychologically beaten and wounded survivors in The Aftermath. The ballet then ends as it began, with the "Gentlemen in Black" around the green table.

Throughout these episodes the figure of Death is triumphant, portrayed as a skeleton moving in a forceful and robot-like way, relentlessly claiming its victims.

The dance ends with a repeat of the opening scene, a device the choreographer uses to show his mistrust in the talks of the diplomats; completely indifferent to the ravages of war, they continue their hypocritical negotiations.

Analysis

The Green Table reflects a concern for social issues and the problems of that era (shared by many artists contemporary with Jooss) such as political corruption and militaristic policies. Its style, with its cutting irony, caricature, and boldness of language, has much in common with Expressionism, which flourished in the first decade of the 20th century. The cynical structure of the dance, for example, is a formal expression of this dry humour: the diplomats repeat their routine with total indifference to the real consequences of their decisions. The seriousness of their discussion is negated by the music that Jooss chose to accompany this scene: a playful tango. He also dressed the characters in masks, which gave them a grotesque look, and created movements that are exaggerations of naturalistic movement, such as gesticulating while talking, or nervously pacing up and down while thinking.

The costumes and props were chosen for their symbolic qualities: a flag for the hopeful soldier, a red dress coupled with a white scarf for the partisan, or the skeleton-like costume of Death.

Jooss mastered the visual outlook of his compositions with great skill; again the scene of The Gentlemen in Black provides an example of how the choreographer directed the audience to focus on a particular point of interest, which may be a dancer located on a higher plane than the rest of the group, or someone keeping still while everybody else is moving (or vice versa), or simply a convergence of the compositional lines.

The Green Table uses elements of classical ballet, such as turn-out, demi-pointe, extensions, turns, arabesques, and other ballet steps. However, there is no pointe work or any other feature that could suggest virtuoso display. The gracefulness, elegance, ethereal quality, and other affectations of classical ballet are eliminated.

WHEN I FIRST SAW THIS BALLET, I THOUGHT THE GENTLEMEN IN BLACK WERE CEOS....NOT DIPLOMATS!, AND THE GREEN TABLE, WHICH SUGGESTED THE GREEN EYESHADES OF ACCOUNTANTS, WHERE THEY CAST UP THEIR PROFITS AND LOSSES...

TODAY, WE ALL KNOW THEY ARE, THEY WERE EVEN THEN...KRUPPS, FORD, IBM, THE LIFE INSURANCE COMPANIES...THE DIPLOMATS WERE JUST THEIR ERRAND BOYS AND LACKEYS. ALL IT TAKES IS A HITLER TO PUT ALL THEIR PLANS IN ACTION....OR A CHAMBERLAIN, TO LET THEIR PLANS GO UNHINDERED....

&feature=results_main&playnext=1&list=PL09392D62A80DB7F3

xchrom

(108,903 posts)AN EU oil embargo on Iran came into full force yesterday after exemptions on some contracts and insurance ended, boosting crude prices and putting pressure on the Persian Gulf nation to halt its nuclear-enrichment program.

The reduction in Iranian exports may become the biggest supply disruption from a member of the Organisation of Petroleum Exporting Countries (Opec) since an armed rebellion all but halted pumping in Libya last year, according to the International Energy Agency.

It also comes as a strike by Norwegian workers is curbing flows from North Sea fields.

“We expect Brent oil prices to be supported by Iranian oil sanctions and potential loss of supplies from the North Sea,” Gordon Kwan, head of regional energy research at Mirae Asset Securities based in Hong Kong, said.

xchrom

(108,903 posts)France's new Socialist government must cut public sector jobs and force through eye-watering austerity measures next year to meet a key European deficit target, the national audit office said today in an in-depth report on public finances.

Economists have warned for months that faltering economic growth was gnawing a hole in state revenue, but president Francois Hollande kept the issue largely under wraps until he won presidential and parliamentary elections in May and June.

Having promised to steer clear of Greek-style austerity to rally voters, Mr Hollande risks angering the public, leftist allies and trade unions as he seeks what the audit office said should be €33 billion in savings next year.

That is equivalent to 3.3 per cent of government spending."2013 is a crucial year. The budgetary equation is going to be very hard, much harder than expected due to the worsening of the economic picture," Didier Migaud, head of the Court of Auditors, told a news conference. "It will require unprecedented cuts to public spending as well as increases in taxation."

Roland99

(53,342 posts)Summarizing results from the report, the North American Disney parks all saw very small gains of 0-1% in 2011. Below is a table of attendance for North America in 2011.

Top Theme Parks in North America

Park 2011 2010 Change

Millions Millions %

1. Magic Kingdom 17.1 17.0 1.0

2. Disneyland 16.1 16.0 1.0

3. Epcot 10.8 10.8 0.0

4. Disney’s Animal Kingdom 9.8 9.7 1.0

5. Disney’s Hollywood Studios 9.7 9.6 1.0

6. Islands Of Adventure 7.7 5.9 29.0

7. Disney’s California Adventure 6.3 6.3 1.0

8. Universal Studios Orlando 6.0 5.9 2.0

9. Seaworld Orlando 5.2 5.1 2.0

10. Universal Studios Hollywood 5.1 5.0 2.0

11. Seaworld San Diego 4.3 3.8 13.0

12. Busch Gardens Tampa Bay 4.3 4.2 2.0

13. Knott’s Berry Farm 3.7 3.6 1.5

14. Canada’s Wonderland 3.5 3.4 3.0

15. Kings Island 3.1 3.1 1.0

16. Cedar Point 3.1 3.1 3.0

17. Hershey Park 2.9 2.9 2.0

18. Busch Gardens Europe 2.7 2.8 -2.0

19. Six Flags Magic Mountain 2.7 2.6 3.8

20. Seaworld Texas 2.6 2.6 0.0

Disney retains the top five spots and six of the top seven in North America. The Magic Kingdom park at Walt Disney World in Florida remains the top theme park not only in North America but in the world with attendance of 17.1 million. Close behind it is Disneyland Park at Disneyland Resort in California with attendance of 16.1 million. The other three Disney parks in Florida round out spots 3-5 with gains of 0-1%.

In 2011 Universal Orlando’s Islands of Adventure leapt ahead of Disney’s California Adventure (DCA) into the sixth spot, with DCA falling to spot seven. The biggest gain of 29% was at Islands of Adventure attributable to the new Wizarding World of Harry Potter. Sea World San Diego also achieved large gains.

DemReadingDU

(16,000 posts)It's probably been at least 20 years since I have been, and our family only went because of discount tickets from where I was working.

But my daughter-in-law seems to think that it is a must to have season passes and go every month with the kids.

Roland99

(53,342 posts)Took my youngest a few times. The water park there is really good.

Demeter

(85,373 posts)(I'm holding out for the real thing, not some cheap concrete and plastic imitation).

mother earth

(6,002 posts)K & R for yet another illuminating thread on our daily dose of "democracy" and "capitalism" in action. ![]()

Roland99

(53,342 posts)* May construction outlays above 0.2% expected

* April building outlays up revised 0.6% vs. 0.3%

* U.S. May construction spending up 0.9%

Roland99

(53,342 posts)Viva_La_Revolution

(28,791 posts)Manufacturing in the U.S. unexpectedly contracted in June for the first time in almost three years, indicating a mainstay of the U.S. expansion may be faltering.

The Institute for Supply Management’s manufacturing index fell to 49.7, worse than the most-pessimistic forecast in a Bloomberg News survey, from 53.5 in May, the Tempe, Arizona- based group’s report showed today. Figures less than 50 signal contraction. The median forecast in the Bloomberg survey called for a decline to 52.

http://www.bloomberg.com/news/2012-07-02/manufacturing-in-u-s-unexpectedly-contracted-in-june-ism-says.html

Ruh roh is right ![]()

wordpix

(18,652 posts)Demeter

(85,373 posts)This brief segment from a recent speech by Joe Stiglitz sums up very neatly the nature of our current economic predicament (emphasis added):

I think this is a very useful way to think about the potential effectiveness under current conditions of various policy proposals, including conventional fiscal and monetary stabilization policies.

Part of the reason for our anemic and fitful recovery is that contested claims, especially in the housing market, continue to be settled in a chaotic and extremely wasteful manner. Recovery from subprime foreclosures is typically a small fraction of outstanding principal, and properly calibrated principal write-downs can often benefit both borrowers and lenders. Modifications that would occur routinely under the traditional bilateral model of lending are much harder to implement when lenders are holders of complex structured claims on the revenues generated by mortgage payments. Direct contact between lenders and borrowers is neither legal nor practicable in this case, and the power to make modifications lies instead with servicers. But servicer incentives are not properly aligned with those of the lenders on whose behalf they collect and process payments. The result is foreclosure even when modification would be much less destructive of resources. Despite some indications that home values are starting to rise again, the steady flow of defaults and foreclosures shows no sign of abating. Any policy that stands a chance of getting us back to pre-recession levels of resource utilization has to result in the quick and orderly settlement of these claims, with or without modification of the original contractual terms. And it's not clear to me that the blunt instruments of conventional stabilization policy can accomplish this.

Consider monetary policy for instance. The clamor for more aggressive action by the Fed has recently become deafening, with a long and distinguished line of advocates (see, for instance, recent posts by Miles Kimball, Joseph Gagnon, Ryan Avent, Scott Sumner, Paul Krugman, and Tim Duy). While the various proposals differ with respect to details the idea seems to be the following: (i) the Fed has the capacity to increase inflation and nominal GDP should it choose to do so, (ii) this can be accomplished by asset purchases on a large enough scale, and (iii) doing this would increase not only inflation and nominal GDP but also output and employment.

It's the third part of this argument with which I have some difficulty, because I don't see how it would help resolve the fight over claims that is crippling our recovery. Higher inflation can certainly reduce the real value of outstanding debt in an accounting sense, but this doesn't mean that distressed borrowers will be able to meet their obligations at the originally contracted terms. In order for them to do so, it is necessary that their nominal income rises, not just nominal income in the aggregate. And monetary policy via asset purchases would seem to put money disproportionately in the pockets of existing asset holders, who are more likely to be creditors than debtors. Put differently, while the Fed has the capacity to raise nominal income, it does not have much control over the manner in which this increment is distributed across the population. And the distribution matters.

Similar issues arise with inflation. Inflation is just the growth rate of an index number, a weighted average of prices for a broad range of goods and services. The Fed can certainly raise the growth rate of this average, but has virtually no control over its individual components. That is, it cannot increase the inflation rate without simultaneously affecting relative prices. For instance, purchases of assets that drive down long term interest rates will lead to portfolio shifts and an increase in the price of commodities, which are now an actively traded asset class. This in turn will raise input costs for some firms more than others, and these cost increases will affect wages and prices to varying degrees depending on competitive conditions. As Dan Alpert has argued, expansionary monetary policy under these conditions could even "collapse economic activity, as limited per capita wages are shunted to oil and food, rather than to more expansionary forms of consumption."

I don't mean to suggest that more aggressive action by the Fed is unwarranted or would necessarily be counterproductive, just that it needs to be supplemented by policies designed to secure the rapid and efficient settlement of conflicting claims.

AND HE HAS A SOLUTION TO SUGGEST!