Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 17 December 2012

[font size=3]STOCK MARKET WATCH, Monday, 17 December 2012[font color=black][/font]

SMW for 14 December 2012

AT THE CLOSING BELL ON 14 December 2012

[center][font color=red]

Dow Jones 13,135.01 -35.71 (-0.27%)

S&P 500 1,413.58 -5.87 (-0.41%)

[font color=black]Nasdaq 2,971.33 0.00 (0.00%)

[font color=green]10 Year 1.70% -0.01 (-0.58%)

30 Year 2.86% -0.02 (-0.69%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Sunday's concert went very well....I attribute at least part of the good feeling generated to the fact that this year, I wasn't recovering from influenza.

Although why the entire region isn't suffering from pneumonia, given the incredibly awful weather (cold, gray, drizzle and wind), is anybody's guess.

This last week before the big event, try to keep a little Christmas in your heart, and I will, too. If that means not driving in traffic, so be it.

Demeter

(85,373 posts)REMEMBER, THE GERMANS INVENTED SCHAUDENFREUDE...

http://www.spiegel.de/international/world/pain-continues-after-war-for-american-drone-pilot-a-872726.html

A soldier sets out to graduate at the top of his class. He succeeds, and he becomes a drone pilot working with a special unit of the United States Air Force in New Mexico. He kills dozens of people. But then, one day, he realizes that he can't do it anymore...For more than five years, Brandon Bryant worked in an oblong, windowless container about the size of a trailer, where the air-conditioning was kept at 17 degrees Celsius (63 degrees Fahrenheit) and, for security reasons, the door couldn't be opened. Bryant and his coworkers sat in front of 14 computer monitors and four keyboards. When Bryant pressed a button in New Mexico, someone died on the other side of the world.

The container is filled with the humming of computers. It's the brain of a drone, known as a cockpit in Air Force parlance. But the pilots in the container aren't flying through the air. They're just sitting at the controls.

Bryant was one of them, and he remembers one incident very clearly when a Predator drone was circling in a figure-eight pattern in the sky above Afghanistan, more than 10,000 kilometers (6,250 miles) away. There was a flat-roofed house made of mud, with a shed used to hold goats in the crosshairs, as Bryant recalls. When he received the order to fire, he pressed a button with his left hand and marked the roof with a laser. The pilot sitting next to him pressed the trigger on a joystick, causing the drone to launch a Hellfire missile. There were 16 seconds left until impact..."These moments are like in slow motion," he says today. Images taken with an infrared camera attached to the drone appeared on his monitor, transmitted by satellite, with a two-to-five-second time delay.

With seven seconds left to go, there was no one to be seen on the ground. Bryant could still have diverted the missile at that point. Then it was down to three seconds. Bryant felt as if he had to count each individual pixel on the monitor. Suddenly a child walked around the corner, he says.

Second zero was the moment in which Bryant's digital world collided with the real one in a village between Baghlan and Mazar-e-Sharif.

Bryant saw a flash on the screen: the explosion. Parts of the building collapsed. The child had disappeared. Bryant had a sick feeling in his stomach.

"Did we just kill a kid?" he asked the man sitting next to him.

"Yeah, I guess that was a kid," the pilot replied.

"Was that a kid?" they wrote into a chat window on the monitor.

Then, someone they didn't know answered, someone sitting in a military command center somewhere in the world who had observed their attack. "No. That was a dog," the person wrote.

They reviewed the scene on video. A dog on two legs?

Demeter

(85,373 posts)AND MOST WILL FIND THEY CAN'T AFFORD TO USE IT, EITHER...

http://www.washingtonpost.com/blogs/wonkblog/wp/2012/11/21/millions-will-qualify-for-new-options-under-the-health-care-law-the-vast-majority-have-no-idea/

After surviving a Supreme Court decision and a presidential election, the Obama administration’s health-care law faces another challenge: a public largely unaware of major changes that will roll out in the coming months. States are rushing to decide whether to build their own health exchanges and the administration is readying final regulations, but a growing body of research suggests that most low-income Americans who will become eligible for subsidized insurance have no idea what’s coming...Part of the problem, experts say, is that people who will be affected don’t realize the urgency because the subsidies won’t begin for another year. But policy decisions are being made now that will affect tens of millions of Americans, and the lack of public awareness could jeopardize a system that depends on having many people involved. Low enrollment could lead to higher premiums, health policy experts say. Hospitals worry that, without widespread participation, they will continue getting stuck with patients’ unpaid medical bills. And advocates say the major purpose of the Affordable Care Act – extending health insurance to more Americans – will go unmet if large numbers of vulnerable people don’t take advantage of it.

But because “Obamacare” has been so controversial, and its fate caught up in the presidential campaign, there has been little public discussion about the specifics of putting it into action. States such as Texas and Florida, where opposition to the legislation was strong, have been slow to embrace the law and critics have been loath to promote it. Initial White House efforts at outreach caused congressional Republicans to accuse the administration of using taxpayer money for political gain. In mid-November, Ways and Means Committee Chairman Dave Camp (R-Mich.) subpoenaed Health and Human Services Secretary Kathleen Sebelius, demanding information about how her agency has used federal money to promote the Affordable Care Act. The administration is preparing a final budget for an outreach program focused on the opening of the exchanges in October.

“People hear it’s going to come in 2014, which makes it not very relevant to their lives,” said Tevi Troy, a top Health and Human Services official under President George W. Bush. “If you don’t have an understanding of the law, that’s when you’re going to have real take-up problems.”

Seventy-eight percent of the uninsured Americans who are likely to qualify for subsidies were unfamiliar with the new coverage options in a survey by Democratic polling firm Lake Research Partners. That survey, sponsored by the nonprofit Enroll America, also found that 83 percent of those likely to qualify for the expansion of Medicaid, which is expected to cover 12 million Americans, were unaware of the option. In separate October polling data from the Kaiser Family Foundation, 41 percent of voters described themselves as “confused” about the health-care law. Even in Maryland, one of the states that has most aggressively implemented the Affordable Care Act, awareness is low. A survey released Monday found that 30 percent of likely Maryland voters describe themselves as knowing “a lot” about the coming changes.

“Most Maryland voters don’t fully understand the law,” said Nikki Highsmith Vernick, president of the Horizon Foundation, the nonprofit based in Howard County that sponsored the study. “The people who stand to benefit the most know the least about it.”

SO IT GOES, ON AND ON AND ON...

Demeter

(85,373 posts)The nation’s health care overhaul took another step forward Tuesday NOVEMBER 20 when the Obama administration proposed new rules that clarify insurers’ duties and legal responsibilities under key provisions of the Affordable Care Act. The law, which critics have long referred to as “Obamacare,” makes it illegal for insurance companies to deny coverage to people with pre-existing conditions, beginning in 2014. The first proposed rule is a series of five market revisions that will help implement that part of the law.

The proposal first requires private insurers to sell policies to all consumers regardless of their health status or history, while also banning these insurers from charging more for coverage based on a person’s health, gender or where he or she works. The proposal allows insurers to adjust premiums based only on a person’s age, history of tobacco use, family size and geographic location.

The new rule also reinforces current federal guidelines that forbid insurance companies from canceling or refusing to renew coverage just because a person becomes sick.

To avoid charging different premiums for different groups of people, the proposed rule requires insurers to maintain separate statewide customer pools for the individual and small group markets. These pools will be used to determine risk and premium costs.

"This insures that the cost of coverage will be spread among all the insurers’ customers in the market," said Gary Cohen, the director of the Center for Consumer Information and Insurance Oversight at the Department of Health and Human Services.The rule’s final provision insures that young adults and people who can’t afford insurance will have access to catastrophic health coverage in the individual insurance market.

Many of today’s proposed rules will help “ensure that consumers are protected from some of the worst insurance-industry practices,” Cohen said.

WHY DON'T I BELIEVE THIS?

Tansy_Gold

(17,860 posts)Truth is, I stumbled upon the Max Weber quote by accident some months ago and grabbed it for my sig line. Because it's true: sometimes we don't even know that it's impossible, but we try anyway.

I know this is the Economy group and it's the SMW thread, and maybe I should take this to the :shudder: gungeon, but I refuse to set cyberfoot in there.

Besides, don't we all agree that virtually everything nowadays comes down to the bottom line? And if it affects the bottom line, doesn't that make it -- whatever it is -- economy-related?

I don't do guns. I think I have a shotgun around here somewhere that belonged to my husband, but I'm not even sure where it is. I certainly don't know how to use it, and I probably ought to get rid of it.

The BF has a shotgun, and it did come in handy when we had a 5-foot rattler on the back patio. No, he didn't beat the snake with the gun.

But if -- IF -- we agree that the general population really doesn't need assault weapons, and IF we agree that there's a need to get a handle on the proliferation of guns, would it be so wrong to look at it in terms of the bottom line?

BF and I were talking about this at supper when it occurred to me that maybe there's one avenue that hasn't been explored. Maybe it has and I just haven't seen it. But maybe it's just another route to consider.

I think we're going to see a renewal of the assault weapon ban -- a ban on manufacture and importation. That takes care of the new ones. If that happens, then I think there will be renewed calls for existing weapons to be surrendered for cash. No, of course not everyone is going to give up their fire power, but every AW off the streets is one less to worry about.

The gun show and other loopholes need to be closed. Background checks need to be enforced better.

And for the love of life, we need to improve mental health care.

But if we're really serious about changing the conversation about guns, and particularly about assault weapons, maybe one way to go about it is through the way it impacts people's bottom lines.

If the insurance industry could be persuaded to go along with this -- and I have no idea how that would be accomplished -- one tactic might be to require all homeowner's insurance policies to include a gun clause. If anyone in the household has guns, they must be registered. An insurance company can refuse to write policies for households where there are any assault weapons; the homeowner has a choice between the assault weapons or coverage. If there's a claim made for any casualty loss and there are unregistered weapons found, coverage is void. I'm sure there will be companies to step in and write policies at outrageous premiums to cover those assault weapons, and that's fine. There will still be a lot of people who will simply not be able to afford to keep their AK-47s or whatever they are.

More important, however, is the possibility that this kind of action will raise the level of the debate, because it's not legislation; it's "just doing business."

And I fully realize that this isn't going to deal with all the handguns and all the conceal carry legislation and all that, but it's a step. And if the insurance companies decided to raise the liability premiums on bars that don't/can't ban guns -- pre-emptively avoiding huge loss settlements when patrons are shot -- that's not legislation. It's just free enterprise.

Legislation can change the way we behave, and our behavior can affect legislation. The two are not mutually exclusive.

But if we don't take the first step, how will we ever get. . . . . anywhere?

Demeter

(85,373 posts)On the one hand, I don't own firearms, don't know how to use them, don't particularly want to learn.

On the other hand, if there's going to be civil war, or revolution, or fascism, I may have to. And that possibility is not zero.

If the population is disarmed, then the population is at risk from police and army abuses. Posse comitatus is gone...

The statute only addresses the US Army and, since 1956, the US Air Force. It does not refer to, and thus does not restrict or apply to, the National Guard under state authority from acting in a law enforcement capacity within its home state or in an adjacent state if invited by that state's governor (in its federal capacity, the National Guard forms part of the Army or Air Force of the United States). The Navy and Marine Corps are prohibited by a Department of Defense directive (self-regulation), but not by the Act itself. Although it is a military force, the U.S. Coast Guard, which now operates under the Department of Homeland Security, is also not covered by the Posse Comitatus Act, primarily because the Coast Guard has both a maritime law enforcement mission and a federal regulatory agency mission...wikipedia

I submit that these are not irrational fears, and that not only the paranoid Teabaggers hold them.

To disarm the nation, we would have to disarm the government. If they lay down their warrantless surveillance and their drones, their entrapments, their black sites and torture and restore habeas corpus, then we can deal.

If ordinary citizens have as much right to the life, liberty and pursuit of happiness as the banksters, then we can talk.

What we really need, and it's been building for some time, is a Constitutional Convention that expressly prohibits Big Corporations, Big Money, and Big Mouths getting into the discussion.

Tansy_Gold

(17,860 posts)your suddenly acquiring firearms on the eve of civil war would do any good? Seriously -- if you believe it's going to come to that, why aren't you stockpiling now? Personally, I believe it's because you don't think that's going to really happen.

And I'm not advocating getting rid of all the guns, taking them away from everyone.

I'm looking at two different but related issues.

1. Start getting rid of the assault weapons. No one needs those. Period.

2. Start raising the level of discourse and awareness. Get beyond the blind allegiance to The Second Amendment and start having that meaningful discussion.

If we can't at least do the second one, if we refuse to even so much as TRY, then we have to just accustom ourselves to more Columbines, more Newtowns, more Auroras, more Kileens, more San Ysidros, more Virginia Techs, more Fort Hoods. Because if we don't change the culture, we can't even begin to change the behavior. And right now, the behavior is deadly.

Hugin

(33,148 posts)It was our Founding Fathers' reaction to the Acts of Proscription and the Dress Act passed in Britain in 1746 during the Highland Clearances. Specifically, the Disarming Act.

"An act for the more effectual securing the peace of the highlands in Scotland" was passed by the Parliament of Great Britain, coming into effect on November 1, 1716 which outlawed anyone in defined parts of Scotland from having "in his or their custody, use, or bear, broad sword or target, poignard, whinger, or durk, side pistol, gun, or other warlike weapon" unless authorised.

This act proved ineffectual and in 1725 An act for the more effectual disarming the highlands in that part of Great Britain called Scotland; and for the better securing the peace and quiet of that part of the kingdom was passed and more effectively enforced by Major-General George Wade. Wade succeeded in confiscating a significant number of useful weapons, though the Highlanders still managed to hide many weapons for future use."

Dress Act

Disarming Act

Make of it what you will... But, as all things in the Constitution the Revolution was the root of it.

Tansy_Gold

(17,860 posts)And the whole "slippery slope" argument is too much like RW propaganda that sanctifies the gun culture. If anything, there is a "slippery slope" already engaged in the other direction, one that permits killing on a "Stand Your Ground" defense. With guns now allowed virtually everywhere, where will that defense lead?

But again, my contention is that if we do nothing to try to change this, then we have no other choice but to accept, without grief or outrage, the continuation. And further, we have to accept the responsibility for it. Because what you are saying is THERE IS NOTHING WE CAN DO. If there's nothing we can do about gun control, and we end up doing nothing at all, then there's nothing we can do about the mounting death toll. No place will be safe, ever. And then there's no way to deny our own responsibility for not even trying.

It's not a matter of "I could learn to use weapons" in a few weeks. Does anyone really believe they'd have a.) that much warning and b.) arms readily available to buy at that point? If the big bad government decides to do a big ol' take-over, they aren't gonna give you time to prepare to resist it. That's why the "preppers" are stockpiling their guns and ammo now. At least they're that much in touch with their own distorted reality.

IMHO, there won't be a sudden take-over that results in confiscation of the guns because the elements of the government that would even consider doing that are on the side of the gun nuts.

Hugin

(33,148 posts)But, instead to point out that this issue has been a political football used as a wedge for at least the last 200+ years or more.

There's a reason the Second Amendment is in the Constitution, but, it has nothing to do with preserving the common man's rights.

The founders of the U.S. were facing going to war with Britain to become free at the point the Constitution was written. So, they were trying to garner political allies wherever they could. Since, that was a fresh wound with the British, of course they rubbed it throughly with salt. They accomplished this in many ways. So, bottom-line the Second Amendment has a lot of political overtones. Another example is that in the U.S. we have Secretaries instead of Ministers.

Personally, I don't see a need for having a gun around. They aren't a very useful tool. Classic uni-taskers, if you ask me. But, I know a lot of Gun Fetishists who scare the crap out of me sometimes. So, yes I agree. It's time to do something.

Demeter

(85,373 posts)1. Yes. I can learn to use weapons. They teach babies of 16 in the army...it isn't that difficult. And I'd have plenty of motivation.

2. I'm not stockpiling because I have an autistic person, no space to properly secure weapons and no extra money in the house.

3. I'd put the odds at 20-30% presently that the government does something beyond the repressions already implemented, and they aren't going to stop with pepper spraying protesters, in spite of the fact that protest is legally acceptable speech, as Michigan did last week at the capital.

What is the point in calling ourselves a democracy and a free nation, if they can do that, and get away with it, in the absence of any justification?

Public trust is broken down. There's more than just the gun culture at work here.

snot

(10,529 posts)I'm not saying we shouldn't make changes in the law; but I believe in balances of power.

Power can take all kinds of forms, but a few major ones are weapons, wealth, and information. So I feel that weaponry, wealth, and info in some amounts need to remain in the hands of the people.

I'm not sure what the critical amounts are; but I'm pretty sure that when we let those balances get too far out of whack, some of those holding the larger amounts will succumb to the temptation to exploit their advantage.

Demeter

(85,373 posts)and they WILL take the continent. We have daily proof of their trying.

This is a clear case of "people fearing government" vs "government fearing its people"....too much of the former, no where near enough of the latter.

Demeter

(85,373 posts)Tansy_Gold

(17,860 posts)Demeter

(85,373 posts)Three days before 20 year-old Adam Lanza killed his mother, then opened fire on a classroom full of Connecticut kindergartners, my 13-year old son Michael (name changed) missed his bus because he was wearing the wrong color pants.

“I can wear these pants,” he said, his tone increasingly belligerent, the black-hole pupils of his eyes swallowing the blue irises.

“They are navy blue,” I told him. “Your school’s dress code says black or khaki pants only.”

“They told me I could wear these,” he insisted. “You’re a stupid bitch. I can wear whatever pants I want to. This is America. I have rights!”

“You can’t wear whatever pants you want to,” I said, my tone affable, reasonable. “And you definitely cannot call me a stupid bitch. You’re grounded from electronics for the rest of the day. Now get in the car, and I will take you to school.”

I live with a son who is mentally ill. I love my son. But he terrifies me.

A few weeks ago, Michael pulled a knife and threatened to kill me and then himself after I asked him to return his overdue library books. His 7 and 9 year old siblings knew the safety plan—they ran to the car and locked the doors before I even asked them to. I managed to get the knife from Michael, then methodically collected all the sharp objects in the house into a single Tupperware container that now travels with me. Through it all, he continued to scream insults at me and threaten to kill or hurt me.

That conflict ended with three burly police officers and a paramedic wrestling my son onto a gurney for an expensive ambulance ride to the local emergency room. The mental hospital didn’t have any beds that day, and Michael calmed down nicely in the ER, so they sent us home with a prescription for Zyprexa and a follow-up visit with a local pediatric psychiatrist.

We still don’t know what’s wrong with Michael. Autism spectrum, ADHD, Oppositional Defiant or Intermittent Explosive Disorder have all been tossed around at various meetings with probation officers and social workers and counselors and teachers and school administrators. He’s been on a slew of antipsychotic and mood altering pharmaceuticals, a Russian novel of behavioral plans. Nothing seems to work...

ZYPREXA WILL ONLY MAKE YOUR SON EAT UNCONTROLLABLY. CITALOPRAM AND/OR RISPERADONE ARE BETTER BETS...AND NO DECONGESTANTS, BECAUSE SEROTONIN SYNDROME WILL MAKE THINGS SO MUCH WORSE....

I AM ALSO ADAM LANZA'S MOTHER...WITH CERTAIN DIFFERENCES. MY KID ISN'T AS INTELLECTUALLY ORGANIZED. AND HER CO-ORDINATION IS MINIMAL. HER BRAIN AND NERVOUS SYSTEM DON'T WORK IN THE TYPICAL FASHION. BUT I'VE BEEN THERE, DONE ALL THAT.

AND WHILE I DON'T EXPECT MIRACLES, I DID EXPECT A LOT MORE THAN I GOT FROM THE SCHOOL SYSTEM....

Demeter

(85,373 posts)In the wake of another horrific national tragedy, it’s easy to talk about guns. But it’s time to talk about mental illness.

Po_d Mainiac

(4,183 posts)But also the environmental impacts of toxins on the brain coupled with the level of violence in entertainment.

NPR did a story this morning on the possible ban of mercury as a preservative in the 3rd world for childhood vaccines. Childhood exposure to particular forms of mercury are known to cause autism.

Asperger Syndrome is a form of autism.

A new study published in the Journal of Environmental Monitoring has found that mercury in the atmosphere is an oft-ignored form of air pollution, especially in urban areas where concentrations can reach dangerously high levels. The U.S. Environmental Protection Agency (EPA) has been lax in its enforcement of mercury-pollution standards over the past decade, exempting major polluters. Mercury is a neurotoxin that can harm the developing brains of children and infants;

http://www.rodale.com/mercury-pollution-and-exposure?page=0,1

Coal fired power plants, cement kilns, production of chlorine bleach & PVC and trash incinerators are the top four contributors of Hg pollution in the US

Tansy_Gold

(17,860 posts)and over and over and over and over and over.

Start here, from 2005.

http://fredericksburg.com/News/FLS/2005/092005/09252005/131521

Po_d Mainiac

(4,183 posts)The problem is legislation that bans mercury.

Methylmercury is toxic and bioaccumulative and neurotoxin, but if you swallowed a gob of mercury you would simply shit it out.

Tansy_Gold

(17,860 posts)The world is full of poisons, so we should allow everyone to have as many guns of as many types as they want. We can't do anything about anything so we might as well not even fucking try to do anything.

JUST FUCKING GIVE UP RIGHT FUCKING NOW.

Po_d Mainiac

(4,183 posts)Fuddnik

(8,846 posts)They should require a full psych exam for anyone wanting to own a gun.

He got a little ticked when I told him Reagan turned them all loose, now they're running around Congress.

Po_d Mainiac

(4,183 posts)would be armed and someone like self would be defenseless?

Can I expect a response to a 911 call within a half hour? No.

Have I been robbed? Yes.

Have I discharged a firearm in the defense of my property? Yes.

Tansy_Gold

(17,860 posts)Last edited Mon Dec 17, 2012, 01:19 PM - Edit history (1)

and don't read what you think I meant but didn't write.

There would be no ban on owning guns. So calm down and don't have a heart attack over it. ![]()

Under this proposal of mine, which has absolutely no effect of law, the insurance companies would require gun registration as a requirement of coverage. So duh, if you don't have insurance, you don't even have to register your guns. (edited to add: If you DO have insurance, your insurance company would require registration and could add requirements for security, but getting rid of all guns would not be required. IF the goal is to get rid of assault weapons, then removing coverage for those would be ONE way. But if you want to go the slippery slope, 2A is untouchable, you've silenced any hope of dialogue.)

Obviously, even if such a proposal went into effect, it wouldn't apply to people who don't have homeowner's insurance, which includes a lot of poor people, renters, etc. The point I was trying to make, and which may have been lost on some of the paranoiacs among us, is that if the insurance companies started something like this it might start a dialogue that has been monstrously lacking.

If we don't do something, ANYTHING, then nothing will change. If we sit around and weep and wring our hands and mourn, but do absolutely nothing, we can't very well be outraged and horrified when the same thing happens again. And again. And again.

edited for clarity.

Po_d Mainiac

(4,183 posts)Quote:An insurance company can refuse to write policies for households where there are any assault weapons; the homeowner has a choice between the assault weapons or coverage.

Define assault weapon. Therein is the problem.

A Remington 742 is an auto loader. There are 20 round magazines available. Under most definitions it would qualify as an 'assault rifle' The ballistics for the most common 742 calibers in the field today make what most people identify as an assault weapon look pretty wimpy by comparison.

What most people quantify as a 'high powered assault rifle' in actuality are either high velocity in the case of an 5.56mm (.223 cal) and the most common AK bore is neither high velocity nor high powered when compared to the the more common versions of the Remington 'hunting' rifle model 742.

Tansy_Gold

(17,860 posts)If your only objective, however, is to stifle discussion and leave the status quo untouched, that's not dialogue.

AnneD

(15,774 posts)As regulars know, I have worked in a middle school for the last 4 years. I have worked the bulk of my time as a School Nurse in an elementary school. In fact, the last elementary school that I worked in was the site of a deranged parent wearing a bomb blew himself up in 1954 taking the principal, a teacher, the custodian, and several students.

I can't even tell you what I have been through already this year at school this year: angry parents threatening me, angry students threatening me, trying to restrain kids out of their minds on drugs while waiting for 911 to arrive.

I grew up in a household when there were guns. At an early age were were taught hunting and gun safety. Guns not in use were locked in the gun cabinet. Now my brothers both have guns and hunt. It puts meat on the table and protects valuable farm animals from predators. I am currently gun shopping for 2 guns: a small caliber like a 38 for personal protection and a decent hunting rifle.

I go out to a shooting range on occasion to keep up my skills. I hope to God I never have to take a life in the protection of my life or property. I meet folks of all stripe out on a gun range. The only difference is that the liberals are card carrying members of the American Civil Liberties Union and the conservatives are card carrying members of the NRA.

After much reflection, I can honestly say I am for a ban on assault rifles. I think they have no place in a hunters arsenal. They are good for only one thing, killing people. That being said, I am opposed to any attempts to have a ban on other weapons.

I have a long familial history of distrust of the government, for good documented reasons. I do strongly believe in the second amendment and believe it was placed there as a safeguard against government. Remember the reasons why many of our forefathers came to this country in the first place. I don't think that makes me paranoid or crazy, just cautious.

With this privilege come responsibility. I have never been one to shy away from that responsibility. That being said, I realize that guns can attract certain personality types. I have gone to enough gun and knife shows to recognize the the signs. But not everyone that owns a gun is a raving lunatic and I hope you can keep that in mind. I have never brought a gun to school. I did carry a gun with me when I worked late night at the hospital-kept in the car of course because of the hours and the rough neighborhoods I had to travel through.

One thing missing in all this anti gun talks is a discourse on mental health care. What we desperately need are more and better mental health care, esp for adults. That has been a common thread running through these incidences. I know some may disagree, especially with the events of late. I reflected long and hard this weekend. We need a reasonable and ration dialogue on guns, particularly assault rifles. We also need to talk about mental health.

As always, wishing you happy hunting and watch out for the bears.

Demeter

(85,373 posts)But if we had mental health care to the degree we need, what would happen to the GOP? And Congress....they'd have to run real people.

![]() of course.

of course.

AnneD

(15,774 posts)care for everyone....not only would the GOP have to run real people, they would have to run on real issues.![]()

As I said, I have lurked on some of these anti gun threads but I don't take the bait. It is hard to have a rational discussion, which is something that we really need at this time. I work in education and health so I have a unique vantage point.

Tansy_Gold

(17,860 posts)There has been a HUGE amount of talk here on DU this past week-end about mental health care. I included that in my post. Not everything that's been stated in that discussion has been good or accurate or helpful, but there is a dialogue.

And talking about one aspect does not preclude talking about others.

AnneD

(15,774 posts)at DU did not mention Mental Illness, although they had started on Sunday. Outside of DU there is some talk starting now.

A comprehensive dialog and action is needed. And the way both sides are posturing now, it doesn't look so good. The last time we had a discussion was with the Brady Bill and the assault weapons ban. I remember notifying my congressman during that vote in favor of the ban.

Hotler

(11,425 posts)if you have a pit bull, rottweiler or other such breeds you can't get coverage or you pay extra. I was shopping for home insurance and Progressive wanted to know if I owned a dog. Not one mention if I had guns.

Demeter

(85,373 posts)“I’m wondering how much this society can endure before it explodes,” said Georg Pieper, a German psychotherapist who specializes in treating post-traumatic stress disorders following catastrophes, large accidents (including the deadliest train wreck ever in Germany), acts of violence, freed hostages…. But now he was talking about Greece.

He’d spent several days in Athens to give continuing education courses in trauma therapy for psychologist, psychiatrists, and doctors—for free, this being a country in crisis. He was accompanied by Melanie Mühl, an editor at the daily paper Frankfurter Allgemeine. And in her report, she decries how “news consumers” in Germany were fed the crisis in Greece.

It was “no more than a distant threat somewhere on the horizon,” defined by barely understood terms, such as bank bailout, haircut, billion-euro holes, mismanagement, Troika, debt buyback…. “Instead of understanding the global context, we see a serious-faced Angela Merkel getting out of dark limos in Berlin, Brussels or elsewhere, on the way to the next summit where the bailout of Greece, and thus of Europe, is to be moved forward another step” [also read... The Curse Of The “Irreversible” Euro].

But what is really happening in Greece is silenced to death in the media. Pieper calls this phenomenon a “giant feat of repression.”

And so they report their findings that cannot be dressed up in the by now normal euro bailout jargon and acronyms. There were pregnant women rushing from hospital to hospital, begging to be admitted to give birth. They had no health insurance and no money, and no one wanted to help them. People who used to be middle class were picking through discarded fruit and vegetables off the street as the stands from a farmers’ market were being taken down...

Read more at http://www.nakedcapitalism.com/2012/12/favorite-reads-econ-business-finance-advisor-perspectives-doug-short-against-crony-capitalism-blacklisted-news-business-insider-before-its-news-george-dorgan-snbchf-com-fibs-and-wave.html#uqDsIpQ039w1Wt1s.99

Demeter

(85,373 posts)Apparently seeking post-Sandy advice, New York Mayor Bloomberg’s deputies recently paid a visit to New Orleans. According to The New York Times, Deputy Mayors Howard Wolfson, Linda I. Gibbs and Robert K. Steel met with New Orleans officials to discuss recovery and rebuilding. If New York’s development-minded mayor is consulting his equivalents in Louisiana, one can only hope that housing justice activists and especially public housing residents in this city are consulting theirs. When it comes to next steps after Hurricane Sandy, there are lessons to be learned from New Orleans after Katrina. The question is, Which ones will New York learn?

Seven years ago, as Hurricane Katrina was hitting the Gulf Coast, developers and their political allies were already seeing to it that minimum wage laws would be suspended in the name of urgency; they were. In the weeks following, thousands of public school teachers found themselves out of a job. The city’s free hospital was closed and every public housing development was either partially or totally torn down. Next, came a flood of eyes-on-the prize entrepreneurs with all manner of experiments for new models for housing, healthcare and schools. The results have been mixed, but by all available measures, the Big Easy’s more divided and, all these years on, longtime residents (especially African-Americans), feel more disenfranchised than ever.

Saket Soni, director of the New Orleans Workers Center and a community activist who has worked in that city since the storm, says it’s never too early for residents to start pushing for a place at the decision-making table. Change is going to come for sure, but there’s no guarantee that those who have been directly affected will have any say in shaping that change.

“If we wait for the lights to turn on, then what will happen is, by the time the lights turn on, what will be illuminated is the way public housing was stolen from right under the feet of residents, safety net was taken away," Soni told me...

Demeter

(85,373 posts)I note that we still haven’t heard from the Euro group meeting about what the exact plan is for Greece. As I said, my expectations are that a ‘deal’ will be stitched together at the last minute to ‘kick the can’ further down the road because I can’t see northern creditors having the political will to admit to their own taxpayers that real losses are inevitable at this time. The big question is whether the IMF is going to accept whatever the ‘deal’ ends up being. But if they are going to stick to their policy that the program needs to credibly deliver a government debt to GDP of 120% by 2020 it hard to see how they can...As you maybe aware, my overall assessment of the current Troika programs is that the policy implementation is far too one-sided and simultaneously forcing large fiscal adjustments on euro-bound nations that are already highly indebted and possess structural current account deficits is likely to be counterproductive without significant debt write-downs.

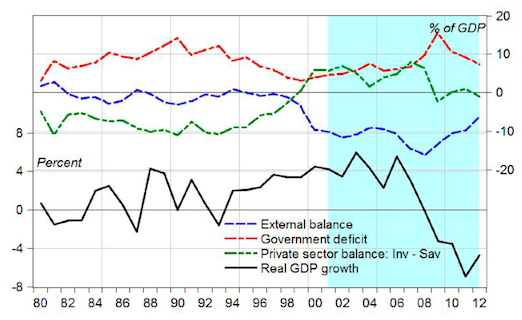

The premise for the Troika programs is that internal devaluation will make supported nations more competitive and therefore lead to an export driven recovery. This however, ignores two points. Firstly, without investment in the tradeable sectors to support the structural transformation and increased productivity the only point of adjustment is wages and employment which means that servicing existed debts held by the private sector becomes impossible (I discuss this point here). Secondly, if large sections of each countries export sectors are all attempting the same thing there will be significantly lower external demand to support this adjustment. The likely outcome therefore, as I’ve covered previously in terms of sector flows, is:

It may appear logical to you that this must occur, and I don’t totally disagree, but that doesn’t change the fact that under these circumstances there is simply no way that the private sector will be able to continue to make payments on the debts it has accumulated during the period of significantly higher income. This is a major unaddressed issue.

If we look at the data in the case of Greece this is exactly what we see.

As you may notice we are now seeing a reversal in the external balance which means the current account is starting to move out of deficit. In fact over recent months the Greek government has been reporting a current account surplus:

“The trade deficit fell by 700 million euro, as a result of a 512 million euros decrease in the trade deficit excluding oil and ships, as well as declines of 68 million euros and 120 million euros in the net import bill for oil and ships, respectively,” said the Bank of Greece in a statement on Monday.

“The trade deficit excluding oil and ships shrank due to the considerably reduced import bill (down by 726 million euros or 30.3 percent), despite the fact that export receipts fell by 213 million euros or 15.9 percent in September 2012.

Read more at http://www.nakedcapitalism.com/2012/11/why-greece-is-a-model-of-economic-mismanagement.html#wydEpxWLcR5xKzrL.99

Demeter

(85,373 posts)BECAUSE THERE ISN'T A SINGLE JOB INVOLVED...EXCEPT MAYBE THE CHAIRMAN'S? AND BECAUSE WITHOUT INTEREST, THERE'S NO POINT IN SAVING, AND IT WILL NOT GROW THE ECONOMY?

http://www.nationofchange.org/why-fed-s-jobs-program-will-fail-1355675390

For the first time, the Federal Reserve has explicitly linked interest rates to unemployment. Rates will remain near zero “at least as long” as unemployment remains above 6.5 percent and if inflation is projected to be no more than 2.5 percent, said the Federal Open Market Committee in a statement Wednesday.

Put to one side the question now obsessing stock and bond traders — whether the new standard means higher interest rates will kick in sooner than the middle of 2015, which had been the Fed’s previous position. By linking interest rates directly to the rate of unemployment, Bernanke is explicitly acknowledging that the Federal Reserve Board has two mandates — not just price but also employment. “The conditions now prevailing in the job market represent an enormous waste of human and economic potential,” said Fed Chairman Ben S. Bernanke. These are refreshing words at a time when Congress and the White House seem more concerned about reducing the federal budget deficit than generating more jobs.

But the sad fact is near-zero interest rates won’t do much for jobs because banks aren’t allowing many people to take advantage of them. If you’ve tried lately to refinance your home or get a home equity loan you know what I mean. Banks don’t need to lend to homeowners. They can get a higher return on the almost-free money they borrow from the Fed by betting on derivatives in the vast casino called the global capital market. Besides, they’ve still got a lot of junk mortgage loans on their books and don’t want to risk adding more.

Low interest rates also lower the cost of capital, which in theory should encourage companies to borrow for expansion and more hiring. But companies won’t expand or hire until they have more customers. And they won’t have more customers as long as most people don’t have additional money to spend. And here we come to the crux of the problem. Consumers don’t have additional money. The median wage keeps dropping, adjusted for inflation. Most of the new jobs in the economy pay less than the jobs they replaced. Corporate profits are taking a higher share of the total economy than they have since World War II, but wages are taking the smallest share since then (see graph).

PROFITS

?resize=600%2C450

?resize=600%2C450

2012-12-13-1.corporateprofitmargins.jpg

(Business Insider, St. Louis Federal Reserve Board)

WAGES

?resize=600%2C450

?resize=600%2C450

2012-12-13-2.wagestogdp.jpg

(Business Insider, St. Louis Federal Reserve Board)

Globalization and technological changes continue to eat away at the American middle class. Yet we’ve done nothing to stop the erosion. To the contrary, as in Michigan, we continue to undercut labor unions — which for three decades after World War II had been the principal bargaining agents for the working middle class. Moreover, instead of creating easy paths for people to gain the skills they need for higher wages, we’re doing the opposite. We’re firing teachers and squeezing 30 kids into K-12 classrooms, defunding job training programs and reducing support for public higher education.

Instead of encouraging profit-sharing, we’re facilitating the Walmartization of America — the lowest possible wages along with the fattest possible corporate profits. (Walmart, which directly employs almost one percent of the entire workforce at near-poverty wages, made $27 billion in operating profits last year.) Republicans want to make corporations and the wealthy even richer — demanding tax cuts and roll-backs of regulations on the pretense that companies and the wealthy are the “job creators.” But the real job creators are America’s middle class and all those aspiring to join it, whose purchases propel the economy forward. And whose declining earnings are holding the economy back.

So two cheers for Ben Bernanke and the Fed. They’re doing what they can. The failure is in the rest of the government — at both the federal and state levels — still dominated by deficit hawks, supply-siders, and witting and unwitting lackeys of big corporations and the wealthy.

Demeter

(85,373 posts)Last edited Mon Dec 17, 2012, 04:32 PM - Edit history (1)

http://www.alternet.org/belief/12-cool-holiday-traditions-arent-about-god-or-shopping?akid=9813.227380.2dFq7a&rd=1&src=newsletter762100&t=71. Celebrating the End of December.

All across the Northern Hemisphere our ancestors marked the winter solstice with festivals that acknowledge the cycle of life: death and birth, darkness and light. For cold, lean people it may have seemed like the sun might never reappear. Yet, a few days after solstice the days began to visibly lengthen, promising another spring. Persephone would return from Hades; King Winter would be beaten! Pagan Scandinavia celebrated Yule, the great turning of the wheel of life. The Roman Pope Julius 1 chose December 25 to honor the birthday of Jesus because it already hosted two related festivals of birth: natalis solis invicti (“birth of the unconquered sun”), and the birthday of Mithras, the “Sun of Righteousness.” Today, mid-winter celebrations in the month of December include the Buddhist Bodhi Day (December 8); Hannukah (December 8); Solstice itself, which has many names ; Hindu Pancha Ganapati (December 21-25); Festivus (December 23), Kwanzaa (December 26-January 1), New Years Eve, and of course, Hogmanay.

2. Candles & Lights

Since ancient times, man-made lights have symbolized the light of the sun and the promise of brighter days to come. We are toldthat pagan Romans decorated living trees with fragments of metal and images of the fertility god Bacchus. Twelve candles on a tree honored the sun god. The writings of one early Church father, Tertullian, discuss early Christians who imitated their neighbors by decorating their homes with candles and laurel at the turn of the year. In the North of Europe, Germanic people honored Woden by tying candles to evergreen branches, along with fruit. The Jewish festival of Hanukkah, a time of remembering, is centered on the menorah and is also called the Festival of Lights.

3. Trees

For many Pagan peoples of Europe, evergreen trees were symbols of enduring life. Their branches had the power to fend off evil spirits. Druids held ceremonies while gathered around sacred trees. Cutting entire trees and bringing them indoors may have been too destructive, but we know that Pagans brought in evergreen boughs. Because trees are so strongly associated with Pagan celebrations some Christians have opposed them being a part of Christmas festivities. The first record of a decorated Christmas tree dates to 1521, in Germany. At the time, a prominent Lutheran minister protested: "Better that they should look to the true tree of life, Christ." But the appeal of evergreen branches indoors is so universal that it has since been adopted through much of Christianity and into some homes for the celebration of the Jewish Hanukkah.

4. Wreaths

In Scandinavia, the traditional Yule wreath symbolized the “Wheel of the Year,” which was also honored around the calendar with festivals marking winter and summer solstice and each equinoxes. Some ancient groups believed that the great wheel stopped turning at the point of the winter solstice and so it was taboo to turn a butter churn or wheel on the shortest day of the year. For Germanic people , wreaths decorated with small candles encouraged the return of spring: the circle of the wreath representing the seasons, and the candles representing warmth from the sun. When made of holly and ivy, a wreath was thought to provide protection to any household where it hung on the door.

5. Santa

6. Mistletoe

7. Holly

8. Feasting!

9. Mulled Wine & Cider

10. Gift Giving

11. Hearth Fires

12. Last But Not Least, The Number Twelve!

FUNNY. ASIDE FROM THE NUMBER 12, THIS IS MY CELEBRATION MODE...

I'D ADD ONE MORE ITEM: PERFORMANCE! MUSIC, DANCE, THEATRE, PUPPET SHOWS, ALL FORMS OF ENTERTAINMENT...EVEN READING.

Demeter

(85,373 posts)...two journalists, David Wise and Thomas B. Ross, shined a bright light into those shadows, called you part of an “invisible government,” and outed you in ways that you found deeply discomforting.

Their book with that startling title, The Invisible Government , was published in 1964 and it was groundbreaking, shadow-removing, illuminating. It caused a fuss from its very first paragraph , which was then a shockeroo: “There are two governments in the United States today. One is visible. The other is invisible.”

I mean, what did Americans know at the time about an invisible government even the president didn't control that was lodged deep inside the government they had elected?

READ ON

Demeter

(85,373 posts)The night of the shootings at Sandy Hook Elementary School in Newtown, Conn., I was in the car with my wife and children, working out details for our eldest son’s 12th birthday the following Sunday — convening a group of friends at a showing of the film “The Hobbit.” The memory of the Aurora movie theatre massacre was fresh in his mind, so he was concerned that it not be a late night showing. At that moment, like so many families, my wife and I were weighing whether to turn on the radio and expose our children to coverage of the school shootings in Connecticut. We did. The car was silent in the face of the flood of gory details. When the story was over, there was a long thoughtful pause in the back of the car. Then my eldest son asked if he could be homeschooled...

Demeter

(85,373 posts)If there was going to be major action to reduce the $1 trillion in student debt—or at least the rate at which it’s increasing—it probably should have happened by now.

The conventional wisdom going into the election was that President Obama and the Democrats would have to galvanize the youth vote if they wanted a repeat of 2008. With nearly 20 percent of families, and 40 percent of young families, owing a slice of the education debt, the issue affects a large and growing constituency. And because existing student loan policy is so anti-student and pro-bank, Democrats could have proposed a number of commonsense, deficit-neutral reforms, even reforms that would have saved the government money. The stars were aligned for a major push.

Remarkably, it didn’t happen. Instead we saw dithering, half-measures, and compromises meant to reassure voters that politicians were aware of their suffering and that something was going to be done. The moves that were implemented did not address the core problem: the amount of money debtors will have to pay. For example, President Obama claimed credit for delaying a doubling of interest rates on federal loans from 3.4 to 6.8 percent, while, at the same time, ending interest grace periods for graduate and undergraduate students. The first measure is temporary and is expected to cost the government $6 billion; the second is permanent and will cost debtors an estimated $20 billion in the next decade alone. Despite his campaign rhetoric, President Obama has overseen an unparalleled growth of student debt, with around a third of the outstanding total accruing under his watch.

Neither major party offered a credible plan to reduce the student-debt burden. While Obama assured voters (“Let me be perfectly clear . . .”) that he understood the importance of supporting students who wanted to go to college, the Romney campaign spouted free-market platitudes. The real difference between the two sides was ultimately more about who debtors would owe—the Treasury or private lenders—than about how much. Not a single policy proposal on the proper scale was offered, and so the true size of the problem fell out of the national debate. Obama won reelection with a smaller majority than in his first election—the first time that has happened to an incumbent president since 1944—and the Republicans retained control of the House of Representatives.

There’s nothing accidental about a student debt discussion that veers between insubstantial and nonexistent...

Demeter

(85,373 posts)Many civil libertarians refused to vote for President Barack Obama given his dismal record in the expansion of the security state, surveillance law, and assertions of unchecked executive power. The Administration went into radio silence on such issues during the campaign in an effort to win back liberals (as they did on medical marijuana) only to announce after the election that they would resume the same policies. The Democratic leadership has shown the same duplicity on civil liberties for years — including hiding knowledge of the Bush torture program and surveillance programs as well as blocking any meaningful investigations into those alleged crimes. Now, some Democrats have reportedly put that hypocrisy on public display again. Senator Patrick Leahy introduced the bill which, as originally written, required warrants for the reading of emails and was heralded by Democrats during the campaign as their showing of fealty to privacy and civil liberties. The Justice Department then took the bill and flipped it to serve as a sweeping denial of privacy rights . . . and some Senators are pushing on passage now that the election is over. The bill includes warrantless access to university email systems.

The re-written bill now authorizes warrantless access to Americans’ e-mail for over 22 federal agencies with only a subpoena and no probable cause. State and local agencies will have access to email system, including university emails. Internet providers will have to give notice if they are thinking of informing customers of access given to such agencies. Such notification can be postponed by up to 360 days. While not speaking for his Democratic colleagues, Leahy says that he does not support some of the exceptions. Leahy was once an ally for civil libertarians but is now viewed with great suspicion given his authorship of the 1994 Communications Assistance for Law Enforcement Act as well as the Protect IP Act. An article in The New Republic concluded Leahy’s work on the Patriot Act “appears to have made the bill less protective of civil liberties.” He also inserted controversial portions of the Patriot Act. Leahy however insists that he will oppose rollbacks. Yet, the Justice Department has objected to protections in the bill according to reports and some Senators are pushing for the restrictive version of the bill. Leahy’s staff says that he will push a draft closer to the original in committee. [Update: CNET is standing by its story and says that Leahy only backed down after criticism following its story and that Leahy is abandoning amendments of his own making].

There is no denial of the opposition to the privacy protections by the Administration.

However, the Obama Administration is quoted as objecting that privacy protections would have an “adverse impact” on national security investigations. Democratic members doing the bidding of the Administration will find likely allies in the GOP, including Senator Chuck Grassley who has warned about the dangers of too much privacy.

The control of the security establishment over both White House and Congress appears now completely unchecked and unabashed. After securing reelection, President Obama wasted no time in returning to his prior record of disregarding privacy and civil liberties concerns. Once again, both the media and liberals are muted in any response when the same re-writing of the bill would have produced outcries under the Bush Administration. Of course, Obama can certainly point out that liberals should have had no illusions. On torture, military tribunals, surveillance, undeclared wars, and other issues, Obama made himself painfully clear. His campaign was one of personality over principle and only the personality remains....

Demeter

(85,373 posts)Former UBS banker Kweku Adoboli has been jailed for seven years and dubbed a trader who was "out of control", having been found guilty of the biggest fraud in British history. Jailing him on Tuesday, Mr Justice Keith told Adoboli: "There is a strong streak of the gambler in you. You were arrogant to think the bank's rules for traders did not apply to you."

Adoboli will serve half his sentence minus a year already spent in custody - a total of two and a half years.

City of London Police, which investigated his activities after he confessed his losses in an email to colleagues, said Adoboli was one of the most sophisticated fraudsters the force had come across. Detective chief inspector Perry Stokes, from the City of London police, said:

"To all those around him, Kweku Adoboli appeared to be a man on the make whose career prospects and future earnings were taking off.

"He worked hard, looked the part and seemingly had an answer for everything. But behind this facade lay a trader who was running completely out of control and exposing UBS to huge financial risks on a daily basis.

Demeter

(85,373 posts)The Department of Justice and the state of Missouri have each announced criminal plea bargains with one Lorraine Brown, former chief executive of DocX, the Lender Processing subsidiary best known for its price sheet for fabricating the mortgage documents a servicer, or frankly, anyone would need to claim they had standing to foreclose on your home. Funny how that particular DocX product was mentioned no where in the plea deals...This admission of guilt by Brown for wire and mail fraud on the federal level and fraudulent and forged document filings in Missouri now allows the Obama Administration to claim it has sent another “executive” to jail. And the bizarre progress of this case was that the Missouri attorney general had sued both Brown and LPS, and you’d expect them to cut a deal with Brown to go after the bigger target, LPS. But it’s likely Brown was not very sophisticated; she apparently went to an interview with the FBI without the advice of counsel. Rule number one is don’t lie to the FBI, and the document release Tuesday show that Brown did. And her attorneys let LPS get in front of her. The firm paid $2 million in fines to Missouri and “cooperated” in going after small fry Brown (rather than the bigger fry of LPS’ clients). Nicely played.

Brown admitted guilt to perpetrating a six-year scheme, from 2003 to 2009 to forge and falsify over a million signatures, including now-infamous practices such as “surrogate signing”, in which other employees, typically temps, would forge the signatures of robosigners. The federal penalties are up to five years in prison plus $250,000 in fines; the Missouri penalties re two to three years in prison.

Several things are striking about this deal. First is that it appears that the Missouri suit against Brown goaded the Feds to join. It’s hardly unheard of for state regulators to embarrass their Federal counterparts into action, and the DoJ probably could not afford to sit out a successful prosecution on its beat, particularly after all the noise the Obama Administration has made about its new, improved anti mortgage fraud efforts. But that makes the second item more striking: how the “statement of facts” presents Brown as deceiving Lender Processing Services about her illegal actions. Brown is thus a rogue executive whose misdeeds presumably don’t have bigger implications for LPS or the industry. It’s nauseating to see the filings take that position and contain statements like this:

The reference to “notarized” is the big tell that the supposedly proper procedures that Brown was violating were also abuses. A notarized document requires that the signer have personal knowledge of the matters attested to, such as the principal amount of the mortgage or the amount the borrower owes. You can’t simply go though some legal hoops and give a third party at a completely different organization “signing authority.” They ALSO have to have the requisite personal knowledge. The knowledge requirement makes it impossible in most cases to have someone outside the organization act as a proxy for the party in charge. This whole procedure is a sham, yet the bland language of the plea bargain documents treats it as perfectly legitimate. [Update/correction: the issue here is that servicers outsourced BOTH the signing of affidavits and the related notarization to firms like DocX. I incorrectly bundled both under "notarization" but these are distinct activities. The famed robosigners and surrogate signers were typically signing affidavits; the notaries were simply an additional component of this bogus process. Apologies for the sloppiness]. Indeed, we’ve had explicit “see no evil” statements. From the Palm Beach Post writeup of the plea deal:

Huh? At a minimum, the DocX client was being defrauded of the service he was contracting for, that of having his authorized agent, and only his authorized agent, sign documents. All fees paid when surrogate signers were used were part of a scheme to provide client less service than they thought they were getting (and that’s before we get to the resulting frauds on end parties, like courts, borrowers, county recorders’ offices). This simply shows that there is no will to clean up this problem; they’d rather put band-aids on gunshot wounds than be required to operate. In fact, what Brown is guilty of is simply taking the bad practices in the industry to their logical conclusion. After the robosiging scandal broke, banks kept claiming it was mere paperwork “errors” or “sloppiness” when in fact what they were doing was quite deliberately vitiating procedures that go back to the 1677 Statute of Frauds to make sure that documents are signed by legitimate parties. The notion that you can have someone removed from your organization who is paid a mere $15 an hour merrily sign on your behalf is a travesty. None of these managers would ever delegate authority like that over their checkbook, yet they were doing that cavalierly with the single most important asset of most families. Brown’s crime was that she was sloppy about the form of this exercise in form over substance. Having obviously different versions of the same person’s signature floating about raised the question of who was really executing these documents...

MORE

Demeter

(85,373 posts)JPMorgan Chase lost a bundle on the trades placed by the "London whale," but few people know how the bank eventually unwound the trade. JPMorgan turned to hedge fund BlueMountain Capital Management, which was co-founded by Andrew Feldstein, a former JPMorgan banker and credit derivatives expert. BlueMountain unwound the trade over several weeks by buying protection on CDX IG 9, the index at the center of the bank's precarious position, thus offsetting JPMorgan's existing bets and then selling them on to the bank.

http://r.smartbrief.com/resp/ecsvBYvBbTCflmkxCicOlvCicNUGhs?format=standard

Demeter

(85,373 posts)JPMorgan Chase & Co. (JPM) was pressed by U.S. regulators to strengthen investor disclosures on proprietary trading almost a year before a wrong-way bet on credit derivatives cost the bank at least $6.2 billion.

The Securities and Exchange Commission asked Chief Financial Officer Douglas Braunstein to provide information about the bank’s so-called principal transactions revenue and proprietary trading, according to letters between the agency and the company from June 15 of last year through Feb. 17 that were made public yesterday. Proprietary trading, in which banks make bets with their own money, would be restricted under a Dodd- Frank Act provision known as the Volcker rule.

“It is not clear how much of this revenue was generated from your proprietary-trading business, hedge-fund activity and private-equity funds that would be affected by the Volcker rule,” Suzanne Hayes, assistant director of corporation finance at the SEC, wrote in the initial letter. JPMorgan disclosed in a previous filing that it liquidated proprietary holdings within the equities unit and “it is not clear if this was the extent of your proprietary-trading business,” she wrote.

The letters preceded JPMorgan’s assertion in May that a portfolio of credit derivatives, which bet against the creditworthiness of U.S. companies such as Wal-Mart Stores Inc. (WMT), was a hedge against a weakening economy rather than a proprietary bet. The position was amassed by trader Bruno Iksil, who came to be known as the London Whale because his wager was big enough to move the market....The U.S. Senate Permanent Subcommittee on Investigations is probing the loss, and the panel’s chairman, Michigan Democrat Carl Levin, called it a “textbook” example of why regulators need to tighten the Volcker rule. The Ohio Public Employees Retirement System and other pension funds are suing JPMorgan for turning the CIO into a “secret hedge fund” while claiming it was supposed to mitigate risk...MORE

Demeter

(85,373 posts)Private-equity firms are using almost as much debt to fund acquisitions as they did before the financial crisis, as return-hungry investors rush to buy bonds and loans backing those takeovers.

The rise in borrowed money, or leverage, heralds the possibility of juicy returns for buyout groups. Ominously, the surge also brings back memories of the last credit binge around six years ago, which saddled dozens of companies with huge levels of debt. Some companies laden with debt by private-equity firms in the mid 2000s foundered during the recession.

"Leverage is a double-edged sword," said Mark Goldstein, an investment banker to private-equity firms for RBC Capital Markets. "The gain is greater if the investment works out, but the consequence is also greater if things don't go as planned."

MORE

Demeter

(85,373 posts)China scrapped a ceiling on investments by overseas sovereign wealth funds and central banks in its capital markets, part of government efforts to encourage long-term foreign ownership and shore up slumping equities.

Sovereign funds, central banks and monetary authorities can now exceed the $1 billion limit that still applies to other qualified foreign institutional investors, according to revised regulations posted Dec. 14 on the State Administration of Foreign Exchange’s website. The statement did not mention a new ceiling or an increase in the total investment quota allowed under the program also known as QFII.

The removal of the investment limit on sovereign investors “marks another step in the direction to gradually open up China’s capital account,” Wang Aochao, head of research at UOB Kay Hian Investment Consulting (Shanghai) Co., said by telephone today. “It’s part of a gradual process. QFII money still accounts for a very small fraction of China’s capital markets.”

China would “definitely” expand the foreign-currency quota provided under the QFII program once the current allotments of $80 billion are filled, Guo Shuqing, chairman of the China Securities Regulatory Commission, said last month. Regulators have since 2003 approved a combined QFII quota of $36.04 billion as of Nov. 30 under the program which allows foreign investors to buy yuan-denominated securities, the SAFE said on Dec. 11.

MORE

Demeter

(85,373 posts)The first real movement in the "fiscal cliff" talks began on Sunday, with Republican House Speaker John Boehner edging slightly closer to President Barack Obama's key demands as they try to avert the steep tax hikes and spending cuts set to take effect unless Congress intervenes by December 31. But Boehner's new positions, on tax rates and the total amount of new revenue to be included in a deficit-reduction deal, were still far from those held by Obama.

And the two sides have yet to make headway on tough issues such as entitlements, with the Republicans wanting far more than Democrats are likely to tolerate in cuts to Medicaid and Medicare, the government healthcare programs for the poor and seniors.

Sources familiar with the Obama-Boehner talks confirmed that Boehner proposed extending low tax rates for everyone who has earned less than $1 million, and rates would rise for wages above that. Obama wants that threshold set at $250,000...Under current law, the 35 percent top tax rate is scheduled to expire on January 1, and would automatically go to 39.6 percent - where it was during the Clinton administration. Boehner also has increased to $1 trillion his figure for total revenue, compared to Obama's figure of $1.4 trillion. The balance of a 10-year deficit-reduction plan would come from spending cuts.

The White House has not accepted the Boehner proposals...

Demeter

(85,373 posts)House Speaker John Boehner offered to raise income tax rates on households earning more than $1 million a year in exchange for containing the cost of federal entitlement programs, as part of a deal with President Barack Obama to cut the federal deficit, according to two people familiar with the talks.

The offer, made in a Dec. 14 phone call between the two leaders, marks the first time Boehner has entertained an increase in income tax rates in his talks with Obama to avoid more than $600 billion in automatic spending cuts and across- the-board tax increases set to start next month...

IT STILL SUCKS, BUT BOEHNER BLINKED

Demeter

(85,373 posts)If it takes too long to head off the "fiscal cliff," the Internal Revenue Service may be forced to push tax refunds into the second quarter as taxpayers hold off filing their returns, potentially taking more than $200 million out of the pockets of consumers in the second quarter. If even $100 million of refunds are delayed, that could cut retail spending and send the U.S. economy into recession...

Demeter

(85,373 posts)MULLIGANS FOR THE 1%?

http://www.bloomberg.com/news/2012-12-13/nasdaq-cancels-some-trades-in-nine-u-s-stocks-over-one-minute.html

Nasdaq Stock Market canceled some trades in nine U.S. stocks, such as Goldman Sachs Group Inc., Hewlett-Packard Co. (HPQ) and Sprint Nextel Corp. (S), that occurred more than 10 percent away from yesterday’s close. The errors took place in the minute before the regular opening of trading, the Nasdaq OMX Group Inc. unit said on its website. Goldman Sachs fell as much as 20 percent to $94.01 and Hewlett-Packard plunged 79 percent to $3.06 before the trades were broken. Sprint touched $2.82, a 50 percent decline, prior to the Nasdaq’s decision to reverse those transactions.

“When I first saw they were canceling trades, my first reaction was: here we go again,” Larry Peruzzi, senior equity trader at Cabrera Capital Markets LLC in Boston, wrote in an e- mail. “I would not be happy if these erroneous trades triggered a stop-loss order if I had one on the books. My concern here is the frequency these errors are happening.”

Concern about mistakes in electronic trading has grown this year after a software error on Aug. 1 caused Knight Capital Group Inc. (KCG) to lose $457 million, almost bankrupting one of the largest U.S. market makers. Nasdaq accidentally halted the start of trading in Whitehorse Finance Inc. (WHF) last week and flubbed Facebook Inc.’s initial public offering in May when its auction to set the first traded price for the shares failed....The trades were canceled under Nasdaq’s “clearly erroneous transaction” rule, which covers prints that are “substantially inconsistent with the market price at the time of execution,” according to its statement. For Goldman Sachs (GS), there were 12 trades totaling 1,200 shares at $94.01 as well as one trade for 100 shares at $94.31 and a 100-share trade at $97.36, according to data compiled by Bloomberg. All occurred in the second before the 9:30 a.m. open of exchanges in New York and were broken. Trades occurring during the same second as low as $109.87, 7 percent below yesterday’s close, were not canceled. Transactions in Citigroup Inc. (C) at or below $33.77, Hewlett- Packard from $13.07, AT&T Inc. (T) from $31.04, Western Union Co. from $11.90, Wells Fargo & Co. (WFC) from $30.15, Kroger Co. (KR) from $23.93, Goldman Sachs from $106.28 and Sprint from $5.09 and in Ventas Inc. (VTR) at or above $71.58, were voided, the Nasdaq OMX unit said on its website.

“When something like this happens, it can be a big deal for traders in that if they were on the other side of these trades and traded out of those positions, they would be exposed to risk they had not foreseen,” Mark Turner, head of U.S. sales trading at New York-based Instinet Inc., wrote in an e-mail. “In these challenging times, consistency in regulation and governance is paramount.”

Demeter

(85,373 posts)Top central banks around the world on Thursday renewed a series of currency swap lines set up during the 2007-2009 financial crisis, providing a precaution against future market strains. The U.S. Federal Reserve said it had extended for another year the dollar swaps with the European Central Bank, Bank of Canada, Bank of England and Swiss National Bank. The announcement was released at the same time by the other central banks.

These provisions were an important part of the powerful response launched by monetary authorities during the crisis to keep global financial markets open, curbing lofty dollar funding costs which had spiraled due to fear over counter-party risk. Swap arrangements were revised and extended in November, 2011 as the euro zone debt crisis intensified, to ease the dollar funding pressure being experienced by some European banks.