Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 14 February 2013

[font size=3]STOCK MARKET WATCH, Thursday, 14 February 2013[font color=black][/font]

SMW for 13 February 2013

AT THE CLOSING BELL ON 13 February 2013

[center][font color=red]

Dow Jones 13,982.91 -35.79 (-0.26%)

[font color=green]S&P 500 1,520.33 +0.90 (0.06%)

Nasdaq 3,196.88 +10.39 (0.33%)

[font color=red]10 Year 2.03% +0.02 (1.00%)

30 Year 3.23% +0.05 (1.57%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Not only can't fix stupid or evil, can't explain it, either.

Tansy_Gold

(17,862 posts)Is where VAWA was originally justified. I haven't kept up on the current battle, but because it was tied to commerce and the economy -- domestic violence is very, very costly -- I figured it was at least marginally appropriate. Beats the hell (pun intended) out of Dorner and SOTUS.

siligut

(12,272 posts)I am fine with it being here, your commerce clause explanation isn't even needed, but it is so good, everyone should see it.

tclambert

(11,087 posts)that it was, in fact, a comment.

Many good rants start with "No comment."

Demeter

(85,373 posts)As Congress struggles through one budget crisis after another, it is becoming increasingly evident that austerity doesn't work. We cannot possibly pay off a $16 trillion debt by tightening our belts, slashing public services, and raising taxes. Historically, when the deficit has been reduced, the money supply has been reduced along with it, throwing the economy into recession. After a thorough analysis of statistics from dozens of countries forced to apply austerity plans by the World Bank and IMF, former World Bank chief economist Joseph Stiglitz called austerity plans a "suicide pact."

Congress already has in its hands the power to solve the nation's budget challenges - today and permanently. But it has been artificially constrained from using that power by misguided economic dogma, dogma generated by the interests it serves. We have bought into the idea that there is not enough money to feed and house our population, rebuild our roads and bridges, or fund our most important programs - that there is no alternative but to slash budgets and deficits if we are to survive. We have a mountain of critical work to do: improving our schools, rebuilding our infrastructure, pursuing our research goals and so forth. And with millions of unemployed and underemployed, the people are there to do it. What we don't have, we are told, is just the money to bring workers and resources together.

But we do have it - or we could.

Money today is simply a legal agreement between parties. Nothing backs it but "the full faith and credit of the United States." The United States could issue its credit directly to fund its own budget, just as our forebears did in the American colonies and as Abraham Lincoln did in the Civil War.

Any serious discussion of this alternative has long been taboo among economists and politicians. But in a landmark speech on February 6, 2013, Adair Turner, chairman of Britain's Financial Services Authority, broke the taboo with a historic speech recommending that approach. According to a February 7 article in Reuters, Adair is one of the most influential financial policymakers in the world. His recommendation was supported by a 75-page paper explaining why handing out newly created money to citizens and governments could solve economic woes globally and would not lead to hyperinflation....MORE

Demeter

(85,373 posts)Jed Graham calls this “the deficit chart that should embarrass deficit hawks”:

“Here’s a pretty important fact that virtually everyone in Washington seems oblivious to: The federal deficit has never fallen as fast as it’s falling now without a coincident recession,” he writes for Investor’s Business Daily.

This is true whether or not the sequester goes into effect.

And we may well have a coincident recession this time, too. According to the initial GDP numbers, the economy shrank slightly in the fourth quarter of 2012, largely because government spending fell. As federal spending continues to fall and the effects are compounded by new tax increases (the payroll tax cut expired in January, for instance), it wouldn’t be a huge surprise to see more quarters of negative growth. So, given that the typical definition of a recession is two consecutive quarters in which the economy shrinks, this drop in deficits might yet be accompanied by another recession....MORE

Demeter

(85,373 posts)Back during the early days of the Iraq debacle, I learned that the military has a term for how highly dubious ideas become not just accepted, but viewed as certainties.

"Incestuous amplification" happens when a closed group of people repeat the same things to each other — and when accepting the group's preconceptions itself becomes a necessary ticket to being in the in-group. A fundamentally flawed notion — say, that the Germans can't possibly attack though the Ardennes — becomes part of what everyone knows, where "everyone" means by definition only people who accept the flawed notion.

We saw that in the run-up to the Iraq War, where perfectly obvious propositions — the case for invading was very weak, the occupation could well be a nightmare — weren't so much rejected as ruled out of the discussion altogether; if you even considered those possibilities, you weren't a serious person, no matter what your credentials.

Which brings me to the fiscal debate, which is characterized by the particular form of incestuous amplification that Greg Sargent, a commentator at The Washington Post, calls the Beltway Deficit Feedback Loop....MORE...And at this point, of course, all the Very Serious People have committed their reputations so thoroughly to the official doctrine that they almost literally can't hear any contrary evidence.

Ghost Dog

(16,881 posts)Government-issued money would work because it addresses the problem at its source. Today, we have no permanent money supply. People and governments are drowning in debt because our money comes into existence only as a debt to banks at interest...

... The threat of price inflation is the excuse invariably used for discouraging this sort of "irresponsible" monetary policy today, based on the Milton Friedman dictum that "inflation is everywhere and always a monetary phenomenon." When the quantity of money goes up, says the theory, more money will be chasing fewer goods, driving prices up.

What that theory overlooks is the supply side of the equation. As long as workers are sitting idle and materials are available, increased demand will put workers to work creating more supply. Supply will rise along with demand, and prices will remain stable.

True, today these additional workers might be in China, or they might be robots. But the principle still holds: if we want the increased supply necessary to satisfy the needs of the people and the economy, more money must first be injected into the economy. Demand drives supply. People must have money in their pockets before they can shop, stimulating increased production. Production doesn't need as many human workers as it once did. To get enough money in the economy to drive the needed supply, it might be time to issue a national dividend divided equally among the people...

/... http://www.truth-out.org/news/item/14513-how-congress-could-fix-its-budget-woes-permanently

... With the proviso that not just any kind of supply will do to meet the pent-up demand. New supply must come from economic activity healthy for the environment as well as for humanity.

Ghost Dog

(16,881 posts)Wednesday night may have marked the “emperor’s new clothes” moment of the Great Recession, in which the world suddenly realizes its rulers are suffering from a delusion that doesn’t have to be humored. That delusion today is economic fatalism: the idea that nothing can be done to break the paralysis in the global economy and therefore that a “new normal” of mass unemployment and declining living standards is inevitable for years or decades to come.

That such economic fatalism is nonsensical is the key message of a truly historic speech delivered on Wednesday by Adair Turner, chairman of Britain’s Financial Services Authority and one of the most influential financial policymakers in the world. Turner argues that a virtually surefire method of stimulating economic activity exists today and that politicians and central bankers can no longer treat it as taboo: Newly created money should be handed out to the citizens or governments of countries that are mired in stagnation and such monetary financing of tax cuts or government spending should continue until economic activity revives...

/... http://blogs.reuters.com/anatole-kaletsky/2013/02/07/a-breakthrough-speech-on-monetary-policy/

The Adair Turner lecture:

<cut>... Even to mention the possibility of overt monetary finance is however close to breaking a taboo. When some comments of mine last autumn were interpreted as suggesting that OMF should be considered, some press articles argued that this would inevitably lead to hyper inflation. And in the Eurozone, the need utterly to eschew monetary finance of public debt is the absolute core of inherited Bundesbank philosophy.

To print money to finance deficits indeed has the status of a moral sin – a work of the devil – as much as a technical error. In a speech last September, Jens Weidmann, President of the Bundesbank, cited the story of Part 2 of Goethe’s Faust, in which Mephistopheles, agent of the devil, tempts the Emperor to distribute paper money, increasing spending power, writing off state debts, and fuelling an upswing which however “degenerates into inflation, destroying the monetary system” (Weidmann 2012).

And there are certainly good reasons for being very fearful of the potential to create paper or (in modern terms) electronic money. In a post-gold standard world, money is what is accepted as money: it is simply the “fiat”, the creation of the public authority. It can therefore be created in limitless nominal amounts2. But if created in excessive amounts it creates harmful inflation. And it was John Maynard Keynes who rightly argued that “there is no subtler, no surer means of overturning the existing basis of society than to debauch the currency”.

The ability of governments to create money is a potential poison and we rightly seek to limit it within tight disciplines, with independent central banks, self-denying ordinances and clear inflation rate targets. Where these devices are not in place or are not effective, the temptation that Mephistopheles presents can indeed lead to hyper-inflation – the experience of Germany in 1923 or Zimbabwe in recent years. But before you decide from that that we should always exclude the use of money financed deficits, consider the following paradox from the history of economic thought. Milton Friedman is rightly seen as a central figure in the development of free market economics and in the definition of policies required to guard against the dangers of inflation. But Friedman argued in an article in 1948 not only that government deficits should sometimes be financed with fiat money but that they should always be financed in that fashion with, he argued, no useful role for debt finance. Under his proposal, “government expenditures would be financed entirely by tax revenues or the creation of money, that is, the use of non-interest bearing securities” (EXHIBIT 1) (Friedman, 1948). And he believed that such a system of money financed deficits could provide a surer foundation for a low inflation regime than the complex procedures of debt finance and central bank open market operations which had by that time developed.

Friedman was not alone. Henry Simons, one of the founding fathers of the Chicago school of free market economics, argued in his seminal article “Rules and Authorities in Monetary Policy” that the price level should be controlled by “expanding and contracting issues of actual money” and that therefore “the monetary rules should be implemented entirely by and in turn should largely determine fiscal policy” (Simons 1936). Irving Fisher argued exactly the same (Fisher, 1936). And the idea that pure money finance is the ultimate answer to extreme deflationary dangers is a convergence point of economic thought at which there is total agreement between Friedman and Keynes. Friedman described the potential role of “helicopter money” picked up gratis from the ground (Friedman, 1969): Keynes, surprisingly, since he was not usually a puritan, wanted people to at least have to dig up the “old bottles [filled] with bank notes” (Keynes, 1936) (EXHIBIT 2). But the prescription was the same. And Ben Bernanke, current Chairman of the Federal Reserve, argued quite explicitly in 2003 that Japan should consider “a tax cut … in effect financed by money creation” (Bernanke, 2003).

When economists of the calibre of Simons, Fisher, Friedman, Keynes and Bernanke have all explicitly argued for a potential role for overt money financed deficits, and done so while believing that the effective control of inflation is central to a well run market economy – we would be unwise to dismiss this policy option out of hand. Rather, we should consider whether there are specific circumstances in which it could play a role and/or needs to play a role, and even if not, whether exploration of the theory of money and of debt helps us better understand the problems we face, problems that may be addressed by other policy tools.

In this lecture I will therefore address both appropriate targets and appropriate tools, and will consider the full range of possible tools. But I will also stress the need for us to integrate issues of financial stability and of macroeconomic policy far more effectively than mainstream economics did ahead of the crisis... <cut>

/(.pdf 48pp)... http://www.fsa.gov.uk/static/pubs/speeches/0206-at.pdf

Ghost Dog

(16,881 posts)As the world’s advanced economies grow at half the speed of the pre-crisis years amid persistently high unemployment, governments are turning to a new set of monetary-policy makers who in word -- and they hope deed -- are more aggressive than their predecessors.

A revolution that began with the arrival in November 2011 of Mario Draghi at the European Central Bank now is gathering speed as Canada’s Mark Carney joins the Bank of England and the Bank of Japan awaits a new governor. The shift could culminate a year from now if Federal Reserve Chairman Ben S. Bernanke is succeeded by someone even bolder. The changing of the guard reflects both a need for central banks to offset fiscal paralysis and a bet that monetary policy remains a potent force. At the same time, investors are increasingly weighing the costs and benefits of quantitative easing, while suggesting too much is expected of central banks.

The appointments of activists “reflect the case that economies are still struggling to sustain solid recoveries and there’s pressure from political quarters to be more stimulative,” said Nathan Sheets, a former adviser to Bernanke and now global head of international economics at Citigroup Inc. in New York. “Central banks have stuff in the bag, but it’s largely untried and may generate unwelcome side effects.” ...

... “Central bankers have begun to redefine what their role is, moving away from inflation targeting toward sustaining the health of the financial system, indeed the wider economy,” said Milligan. “New policy makers may bring in new tools, ones which global investors will need to understand quickly.” ... “What we have now is a monetary problem, so it’s time for a monetary solution,” said Gabay, a former Bank of England official. “It’s tough to make monetary policy effective, but it’s the only way.”

The appeal for governments of appointing activists is that they have run out of room to ease fiscal policy and would prefer that central banks go for growth, even if it means a pickup in prices, said Rob Carnell, chief international economist at ING Group NV in London. Central bankers in some countries already are indicating a willingness to tolerate above-target inflation despite their mandates... “Governments think they don’t need to worry about inflation and wouldn’t even mind if some came along, so they’re putting people in who share that cause,” Carnell said. “It’s all about growth.” ...

/... http://www.bloomberg.com/news/2013-02-14/draghi-carney-show-ascent-of-whatever-it-takes-central-bankers.html

Demeter

(85,373 posts)President Obama delivered an uplifting State of the Union address to the Nation last evening, promising “to reignite the true engine of America’s economic growth – a rising, thriving middle class.” He said it was the country’s “unfinished task to restore the basic bargain that built this country – the idea that if you work hard and meet your responsibilities, you can get ahead.” He said it was his job “to make sure that this government works on behalf of the many, and not just the few.”

Unfortunately, the President’s speechwriter is not in charge of nominating candidates who could turn those lofty goals into realities. One must wonder exactly who is in charge of nominating candidates. When it comes to the most important posts that oversee Wall Street, the one industry in America that does more than any other to prevent hardworking Americans from getting ahead, it feels like Wall Street is in charge and not the man elected by the people to run the country.

Later this morning, Jack Lew’s confirmation hearing to serve as U.S. Treasury Secretary, one of the highest offices in the land, will take place in the Senate Finance Committee.

There are 99 percent of Americans who never received millions of dollars in compensation and bonuses from a company bailed out by the taxpayer, despite its years of corrupt dealings. There are 99 percent of Americans who never invested in an offshore account in the Cayman Islands. There are 99 percent of Americans who did not hold an executive post in a division that hid $39 billion of subprime debt off its books. The President could have picked from any one of those 99 percent of Americans to serve as his Treasury Secretary but instead he picked Jack Lew, a former executive of Citigroup who worked in the very division that collapsed the company at the very time it collapsed and received close to $1 million in bonuses when he departed in the midst of its collapse....

OTHER APPOINTMENTS ARE SIMILARLY SHREDDED...SEE LINK

TANSY, THIS WEBSITE IS RICH IN PUNGENT OPINION...ANOTHER GO-TO SITE...

Demeter

(85,373 posts)A Federal Reserve governor is joining those warning that junk-debt investors are poised for losses, while his institution’s policies spur them to keep buying the debt.

Yields on a record 38 percent of the $1.1 trillion of notes sold by the neediest U.S. borrowers were trading below the 10- year average rate for investment-grade debentures last month, Barclays Plc data show. Investors poured a record $1.3 billion into U.S. leveraged loan funds last week as covenants on the debt weaken the most ever.

The central bank’s policy of keeping benchmark borrowing costs at about zero for a fifth year is pushing investors into riskier debt, even as Fed Governor Jeremy Stein warns that the market for speculative-grade debt may be overheating. While U.S. prosecutors are suing Standard & Poor’s for deliberately failing to provide warnings against losses on collateralized debt obligations before the credit crisis, the government’s stimulus is fueling demand for similar products now...MORE

Demeter

(85,373 posts)Royal Bank of Scotland Group Plc executives told lawmakers they believed it was impossible to rig Libor, less than a week after regulators found traders at the lender manipulated the benchmark for more than four years.

“None of us thought of this as a risk that needed this level of attention,” said John Hourican, who resigned as investment-banking head after the fine, told a hearing of the Parliamentary Commission on Banking Standards in London today...

NEED THEY SAY MORE? WELL, THEY DO GO ON AT LENGTH FROM THERE AT LINK....

Demeter

(85,373 posts)but that's just my guess.

jtuck004

(15,882 posts)Here.

"Who is some guy in Normandy, but I just won $75,000!"

Leonard Cooper, eStem charter school, Little Rock, Arkansas.

He put himself in the money by taking a big wager on a previous answer. (And had one of his opponents gotten that last one correct he would have looked silly. But instead he's on youtube). I wonder what he will be doing in 10 years...

Hugin

(33,164 posts)After deep introspection, I'm putting my name in for Pope yet again.

Of course, if accepted, there would be changes... For instance, Mass would be served with a box of red wine and a large mallet in a most Gallagheresque manner.

However, those comfortable looking Pope Slippers are staying.

Demeter

(85,373 posts)although why you would want the job is beyond me.

Hugin

(33,164 posts)Happy V-day to you. ![]()

Tansy_Gold

(17,862 posts)Hugin

(33,164 posts)Thanks for all your SMW of the last year, Tansy. A very special Valentine's to you!

kickysnana

(3,908 posts)rebutted the speaker on no contraception, no abortion ![]() outed herself yesterday as having gone back to the church

outed herself yesterday as having gone back to the church ![]() by declaring she is giving up FB

by declaring she is giving up FB ![]() for lent. She continued on in public school

for lent. She continued on in public school ![]()

She has two little kids 1 and 3 and her 19 year old, ![]() on childcare sabbatical from a corporate job in HR, has almost got her teaching degree and is married to a great guy.

on childcare sabbatical from a corporate job in HR, has almost got her teaching degree and is married to a great guy.![]()

You just never know. ![]()

Hugin

(33,164 posts)Nice touch. ![]()

Your story reminds me of a story told to me by a former GF of mine; She said that once as a very young child she stood up on a pew and yelled, "Hey! Down in front! I can't see the show!" in the middle of High Mass. Not to age myself, but, in those days it was still in Latin.

Happy Valentine's kickysnana.

When my kids were small in the 70s, I occasionally would take them to Mass. They never would pay attention, rather would amuse themselves with books, etc. However, there was one time we went to church where my mom lives. And there, at the consecration, someone would ring bells. Did that bell ringing ever get my kids attention!

Ghost Dog

(16,881 posts)And in Greek...

Happy day all.

Roland99

(53,342 posts)Had a couples massage this morning with the Mrs...about to head out to lunch now.

Hugin

(33,164 posts)Demeter

(85,373 posts)The euro zone slipped deeper into recession in the last three months of 2012 after its largest economies, Germany and France, shrank markedly at the end of the year. It marked the currency bloc's first full year in which no quarter produced growth, extending back to 1995. Economic output in the 17-country region fell by 0.6 percent in the fourth quarter, the EU's statistics office Eurostat said on Thursday, following a 0.1 percent drop in output in the third quarter. The drop was the steepest since the first quarter of 2009 and more severe than the average forecast of a 0.4 percent drop in a Reuters poll of 61 economists. For the year as a whole, gross domestic product (GDP) fell by 0.5 percent. Within the zone, only Estonia and Slovakia grew in the last quarter of the year, although there are no figures available yet for Ireland, Greece, Luxembourg, Malta and Slovenia...

The euro hit a session low against the dollar after the weaker than forecast German reading and dropped again after the release of full euro zone figures...While the European Central Bank's pledge to do whatever it takes to save the euro has taken the heat out of the bloc's debt crisis, even its stronger members are gripped by an economic malaise that could push debt-cutting drives off track...Economists say the euro zone may also shrink in the first quarter of 2013 although more resilient Germany is expected to rebound...There are signs that countries like Spain are starting to benefit from harsh internal devaluations - marked by wage falls and job losses aimed at making companies leaner and more productive. The ECB predicts the euro zone will pick up later in the year although its currency, if it keeps strengthening, could quickly snuff out any of those hard-won competitive advantages for its high debt members.

More recent data for January have already suggested some upturn in the first months of 2013, in the bloc's stronger members at least, and if improvement comes it is likely to be seen in Germany first.

"The debt crisis has ebbed significantly and the global economy has turned up," said Joerg Kraemer at Commerzbank. "Therefore all the important early indicators for Germany are pointing upwards. I expect noticeable economic growth again in the first quarter."

Demeter

(85,373 posts)Euro zone countries can have extra time to meet deficit-cutting goals if the growth outlook deteriorates, the EU's top economic official has told finance ministers, as data signaled the bloc is mired in recession. Olli Rehn's comments, in a letter to European Union finance ministers dated Wednesday and posted on the Commission website, came just as France admitted it was likely to miss this year's deficit goal of 3 percent of GDP as its economy flounders. It has been suggested the Commission may give countries such as France and Spain an extra year - until 2014 - to meet their deficit targets. Data on Thursday showed both German and French GDP shrank more than expected in the last quarter of 2012, putting the euro zone economy on a shaky footing going into 20123.

The bloc as a whole slipped further into recession over the same period, contracting 0.6 percent in the fourth quarter after a 0.1 percent fall in GDP Q3, although economists expect growth to pick up towards the second half of this year. The fourth-quarter figure was worse than the -0.4 percent forecast by economists in a Reuters poll.

With many euro zone countries struggling to meet their nominal deficit targets, Rehn said it was more important to focus on structural deficits, which reflect the underlying shortfall not affected by the swings in the business cycle...The European Commission is due to publish its latest economic forecasts on February 22, figures that member states will take into account when they send their deficit-reduction plans to Brussels.

Rehn, the EU's Economic and Monetary Affairs Commissioner, said the economic weakness was largely due to deleveraging after the build-up of private and public debt during the credit boom of the previous decade. But he stressed that EU public debt had risen to 90 percent of GDP from 60 percent and that it was vital to bring this level down for sustainable growth. "When public debt levels rise above 90 percent they tend to have a negative impact on economic dynamism which translates into low growth for many years," he said.

Demeter

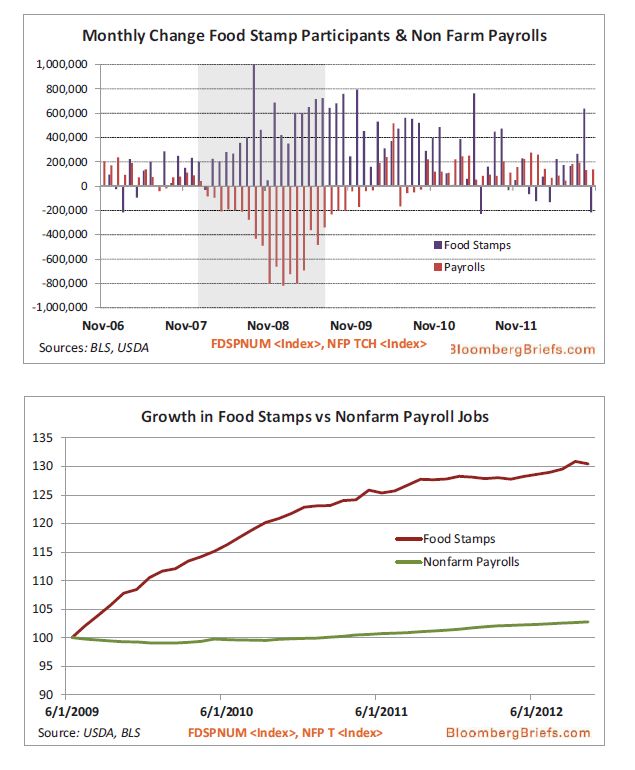

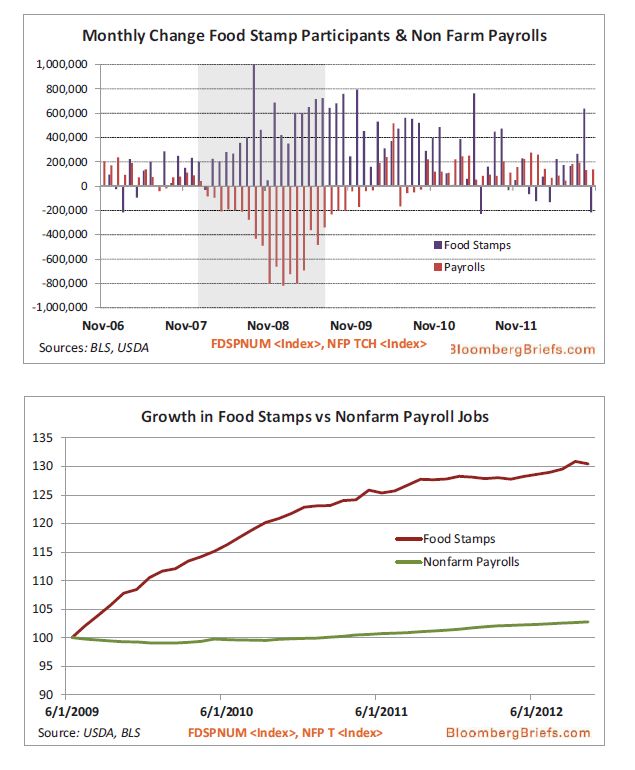

(85,373 posts)Below we see the US recovery in one graphic, from the February 4 issue of Bloomberg Briefs. It shows the weakness of the recovery, but has another and deeper lesson for us. The pressure of the Great Recession on business accelerated existing political and economic trends. As a result the New America has an increasing fraction of jobs that are some combination of minimum-wage, temporary, part-time, and with no benefits (Wal-Mart and Amazon have perfected these tactics; see the links below).

Free competition, open borders to immigration, and the destruction of private sector unions all contributed to this situation. Despite what we’re told, this was not inevitable or immutable by public policy. The nations of Northern Europe have shown this by the successful protection of their middle classes.

?w=600&h=727

?w=600&h=727

?w=600&h=727

?w=600&h=727

...The next few decades will be interesting. Will we allow these trends to help the 1% reshape America, or will we follow the Founders’ example and take command of events — and make our own destiny? Can we work together to form powerful political alliances, and then make wise decisions?

Demeter

(85,373 posts)

xchrom

(108,903 posts)

Hugin

(33,164 posts)Sorry to hear that. ![]()

Glad to see you here today, tho! ![]()

Demeter

(85,373 posts)

European penicillin. Get well soonest!

siligut

(12,272 posts)Sick is no good at all.

Stay warm, hot ginger tea with lemon and honey, warm saltwater gargle, extra Zinc and Vitamin C.

All that if it is the cruddy achy, snotty, sneezy thing going around.

DemReadingDU

(16,000 posts)Fuddnik

(8,846 posts)Hope you're feeling well soon.

xchrom

(108,903 posts)Europe's two largest economies, Germany and France, both shrunk markedly in the last three months of 2012, suggesting the euro zone has slipped deeper into recession and throwing a first quarter recovery for the region into doubt.

The German economy contracted by 0.6 per cent on the quarter, official data showed today, marking its worst performance since the global financial crisis was raging in 2009.

France's 0.3 per cent fall was also a touch worse than expectations.

Worryingly for Berlin, it was export performance - the motor of its economy - that did most of the damage.

Response to Tansy_Gold (Original post)

xchrom This message was self-deleted by its author.

Ghost Dog

(16,881 posts)xchrom

(108,903 posts)xchrom

(108,903 posts)US billionaire Warren Buffett is to buy food giant Heinz in a deal worth $28bn (£18bn).

Mr Buffett's Berkshire Hathaway company is part of a consortium of investors who will take over the food company, famous for its ketchup and baked beans.

In a statement, Heinz called the deal "historic", and the largest ever in the food industry.

The takeover has been approved by the company's board, but still needs to be voted on by shareholders.

xchrom

(108,903 posts)Japan's economy contracted for the third straight quarter in the three months to end of December, underlining the challenges the new government faces in reviving growth.

The economy shrank 0.1% compared with the previous three months. Most analysts had forecast growth of 0.1%.

That is equivalent to an annualised dip of 0.4% in gross domestic product.

Japan's growth has been hurt by a drop in exports to key markets as well as subdued domestic consumption.

xchrom

(108,903 posts)India's inflation rate has dipped to a three-year low, giving more room to policymakers to take steps to revive its sluggish economy.

The Wholesale Price Index, India's main gauge of inflation, eased to 6.62% in January, down from 7.18% in December.

India's growth rate has dipped recently amid slowing exports, a decline in investment and subdued domestic demand.

India's central bank cut interest rates last month and a slowdown in inflation may see it ease its policies further.

xchrom

(108,903 posts)India's prime minister has said talks on a $12bn (£7.7bn) deal to buy 126 Rafael fighter jets from France have been "progressing well".

Manmohan Singh's comments followed a meeting with French President Francois Hollande, who is on a visit to India.

The deal has been delayed since India began talks with Rafael's manufacturer Dassault Aviation last year.

On Thursday, Mr Hollande made a fresh push to sell the aircraft during his talks with Indian leaders.

bread_and_roses

(6,335 posts)... all the SMW & WEE crew for keeping on keeping on ... for Valentine's Day, bread and roses to all of you

[IMG] [/IMG]

[/IMG]

jtuck004

(15,882 posts)The GOP has plans for a comeback. But it may cost you a lot. The idea is to capitalize on recent Republican state takeovers to conduct an austerity experiment known as the new “red-state model” and prove that faulty policies can be turned into gold.

There will be smoke. There will be mirrors. And there will be a lot of ordinary people suffering needlessly in the wake of this ideological train wreck.

We already have a red-state model, and it’s called Mississippi. Or Texas. Or any number of states characterized by low public investment, worker abuse, environmental degradation, educational backwardness, high rates of unwanted pregnancy, poor health, and so on.

Read more at http://www.nakedcapitalism.com/2013/02/lynn-parramore-the-gop-plan-to-flush-your-states-economy-down-the-toilet.html#plklxZyc3jGiqTxJ.99

...

Here.

North Carolina is about to cut unemployment from 535 to 350, and throw tens of thousands off the rolls by removing extended benefits, leaving many with no way to pay their bills. That's the kind of plan these people are bringing to their citizens. There will be more states following their example as we try to move forward with a nation of people now employed as health care aides and retail coffee servers.

All anyone has to do to see what the result will be is to look back at the period from 1865 to about 1935, with islands of wealthy surrounded by miserable living and working conditions for many. That will be horribly damaging to many, and the effects will be felt by those who live better lives around them, whether in that state or no.