Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 6 November 2015

[font size=3]STOCK MARKET WATCH, Friday, 6 November 2015[font color=black][/font]

SMW for 5 November 2015

AT THE CLOSING BELL ON 5 November 2015

[center][font color=red]

Dow Jones 17,863.43 -4.15 (-0.02%)

S&P 500 2,099.93 -2.38 (-0.11%)

Nasdaq 5,127.74 -14.74 (-0.29%)

[font color=black]10 Year 2.23% 0.00 (0.00%)

30 Year 3.00% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I hope you all can join in at some point.

The one tree rose opened another bloom for Election Day. That makes 4....and the leaves are getting so abundant, I am having doubts about where I am supposed to fit in this room! I think I see a new bud on the second tree, which already had its first 2 blooms indoors last month! Fortunately, the rose trees were espaliered, and so are more 2 dimensional than three. If worse comes to worse, I can find a different bedroom...and have a real honest-to-goodness Medieval solar for my sewing. That's next on the To-Do list: mending. Grr. If some people would learn how to wear instead of tear their clothes, I could do something more interesting.

In honor of the last day of Indian Summer (we've had a lovely week in the 70's with sun and not too much wind) I've finally planted the last blueberry bushes of the season (the cherry tree is only heeled in...I'm still trying to figure out where to put it for best sun exposure; fortunately, it's still a sapling. In the Spring, before it breaks bud, I hope to permanently plant it). Rain is coming this weekend...just in time!

And I raked, and weeded and had a healing time of it all, feeling mellow and looking forward to the weekend. There are at least half a dozen new films that are Kid-suitable opening all in one weekend...stupid planning in my eyes, but maybe everyone is trying to be in place for the Thanksgiving holiday. Can it really be nearly here, already?

Demeter

(85,373 posts)I DIDN'T THINK SHE WOULD GO IN FOR FLASHY BUT IMPOSSIBLE BILLS

http://www.occupydemocrats.com/warren-files-bill-to-make-ceos-pay-for-seniors-stolen-cost-of-living-increase/

Senator Elizabeth Warren (D-MASS) has embraced her role as a champion of the middle class, and wants to give the American people the bonus they deserve. In response to a recent study which showed that the CEOs of the 350 biggest corporations received a 3.9% raise last year, Warren has filed a bill to give all Social Security beneficiaries and veterans the same raise – and paying for it by taxing those same CEOs.

Social Security beneficiaries, for only the third time since 1975, will not receive a cost-of-living adjustment in the 2016 budget. Warren is very displeased with this news, and has filed the Seniors and Veterans Emergency Benefits Act to rectify the situation. “Social Security benefits are supposed to be indexed to inflation so that benefits rise when prices go up. But Congress’s formula is volatile and does a poor job of reflecting what older Americans actually spend” she announced in a press release.

This one-time gift of $580 will be paid for by removing a tax code provision that allows corporations to deduct a portion of executive salary from their taxes for “performance-based” bonuses. Her bill is a direct transfer of wealth from the ultra-rich to every day Americans and a warning shot at Republican austerity hawks like Paul Ryan, who are determined to privatize Social Security and turn it into another tool for Wall Street to profit off the American people. The Social Security program is one of the most sacred covenants made between the American people and their government, and we cannot allow the right-wing to break it. Social Security is not “entitlements;” it is our reward for a lifetime of taxes and our years of toil as productive members of American society.

MORE POWER TO HER--BUT SHE WILL NEED BERNIE, TOO.

wordpix

(18,652 posts)if she's pres. I'm for Bernie but right now he's a long shot according to the polls.

Demeter

(85,373 posts)Bernie Sanders has accomplished a lot in the first few months of his campaign. At first, he was considered a long-shot, someone incapable of challenging Hillary Clinton. While Sanders remains behind the former Secretary of State in national polls, Clinton’s lead has steadily shortened over time as the Vermont Senator’s popularity has risen. According to polling data, what Sanders lacks in support versus Clinton, he makes up for in his ability to stand up to Republicans. Against Donald Trump, Sanders outperforms Clinton by a full percentage point. against Ben Carson, Trump’s perhaps more stupid opponent for the GOP nomination, Clinton holds a clear advantage of three percentage points. In any case, they remain within the margin of error of each other against either Republican hopeful.

What’s remarkable about the Sanders campaign is that people love giving money to it — not billionaires, lobbyists, or the like; just regular people. In an interview with NPR, Sanders announced that his campaign had accomplished something amazing: The 2016 Democratic hopeful has accumulated more individual donations than any candidate in history.

“When we began this campaign six months ago, I’d say that 80 percent of the American people did not know who Bernie Sanders was, what I stood for. First polls that I saw had us at three percent or five percent,” Sanders said. “We have come a very, very long way. We have hundreds of thousands of volunteers in fifty states in this country. We have received more individual contributions, 750,000, than any candidate in American history at this point in the campaign.”

Sanders also addressed his lack of support in the African-American community, and how he intends to fix it. “If the elections were held today, just among the African-American vote, we would lose. But I think we have a real path to winning the support of the African-American community for two reasons,” Sanders said. “Number one, I’m just not well known in the African-American community…Number two, the African-American community and the Latino community are struggling in a nation in which our middle class is struggling…the issues that we are focusing on, rebuilding the economy and in the process creating UP TO 13 million decent paying jobs, many of those jobs will be for minority communities. Making public colleges and universities tuition free will benefit everyone in America, but even more so, the African-American community.”

“We have to a lot better job in discussing my record which in the United States Congress is the strongest records of any member in terms of civil rights,” Sanders said.

Win or lose, Sanders is shaping up to be a historic candidate, one who will emerge from this election a force to be reckoned with — whether or not he is our next President.

Listen to the interview AT LINK

Demeter

(85,373 posts)As if we don’t have enough problems with our health care system, burning coal for over third of our electricity makes it even worse.

Studies show coal kills ten times more people than any other energy source per kWh produced, and ten times more people in the developing world than in America, because of our Clean Air Act. These deaths are mainly from fine toxic particulates emitted from coal plants.

In fact, the Clean Air Act is the single piece of legislation that has saved the most American lives in history, and is why coal kills about 500,000 people in China each year, but only about 15,000 Americans per year.

However, there are a lot more health effects beyond actual death, and several studies have attempted to quantify those costs – costs that include lost work days, hospital visits, disability, prescription drugs and all the costs associated with illness in addition to death. A study by EPA’s Ben Machol and Sarah Rizk found that the use of coal in America costs us anywhere from $350 billion to $880 billion per year. That’s up to 6% of our GDP, and well over 10% of our total health care costs. Total health care costs in this country are about $3 trillion per year ...

MORE

Demeter

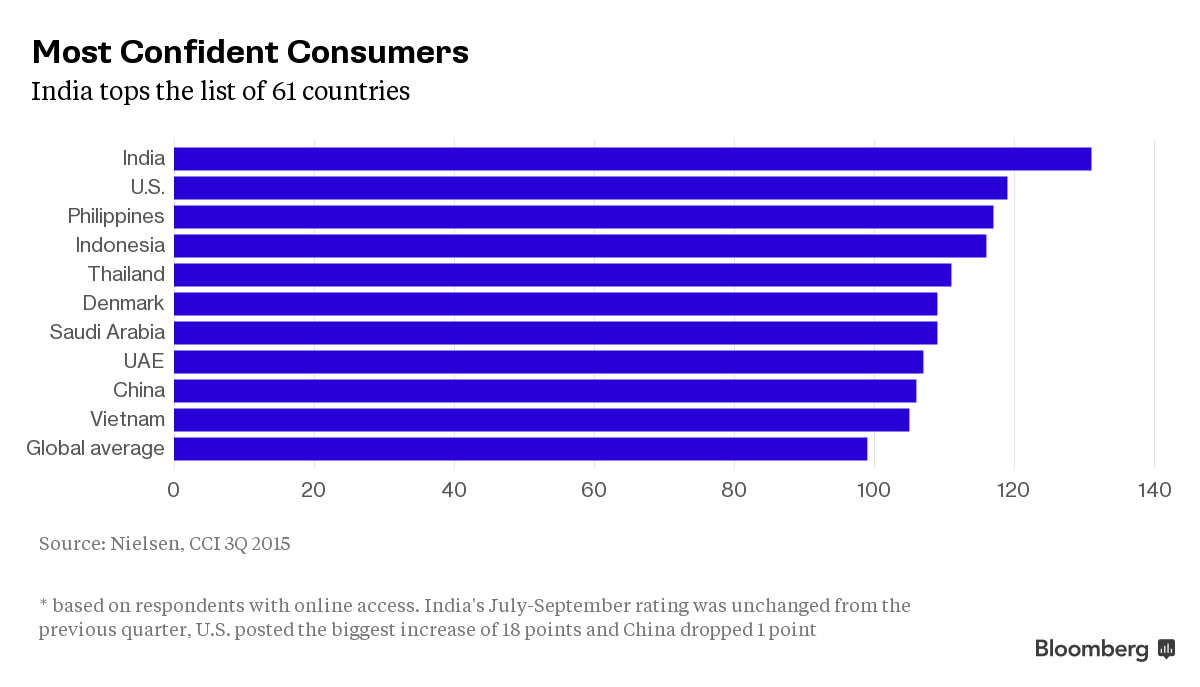

(85,373 posts)As China champions a transformation in its economy toward domestic demand, it could do with the type of sentiment burst that its biggest neighbor is now enjoying.

Consumers in India -- now the fastest-growing big economy -- are the world’s most confident, according to Nielsen. Surging personal wealth is pushing an unprecedented number of Indians to tour the globe, and companies are offering ever more exclusive attractions such as homes sold "by invitation only." Indians are also taking on more credit, helping to bolster spending power as the festival season approaches.

Higher consumption in a retail sector that accounts for about half the economy will help Prime Minister Narendra Modi get companies to invest more and create jobs for a burgeoning population. Spending could rise further following four interest rate cuts and a scheduled pay hike for state employees.

“Consumption will provide a kick-start," said Devendra Kumar Pant, chief economist at New Delhi-based India Ratings and Research, the local unit of Fitch Ratings. “This will lead to higher demand that will boost capacity utilization," and eventually push companies to expand, he said.

MAYBE EVEN GET SOME REFRIGERATION FOR FOOD? BAH-HUMBUG!

Demeter

(85,373 posts)DO TELL! WHAT DID SHE DO TO YOU, William Lee, CITIGROUP?

http://www.bloomberg.com/news/articles/2015-11-05/citi-janet-yellen-has-violated-one-of-the-cardinal-rules-of-economists

On Wednesday, the Federal Reserve's triumvirate reiterated that liftoff in December was still a possibility.

That possibility is contingent on economic data continuing to show improvements in the labor market that give monetary policy makers more confidence that inflation will trend back to 2 percent over the medium-term.

But Janet Yellen, Stanley Fischer, and William Dudley aren't really data-dependent, according to Citigroup Head of North America Economics William Lee. They're market-dependent.

During an interview on Bloomberg TV, Lee said the Fed seems to react much more to financial market conditions than the evolution of economic data...

MORE AND VIDEO INTERVIEW AT LINK

Demeter

(85,373 posts)THE ONES FULL OF BUBBLES, IN OTHER WORDS

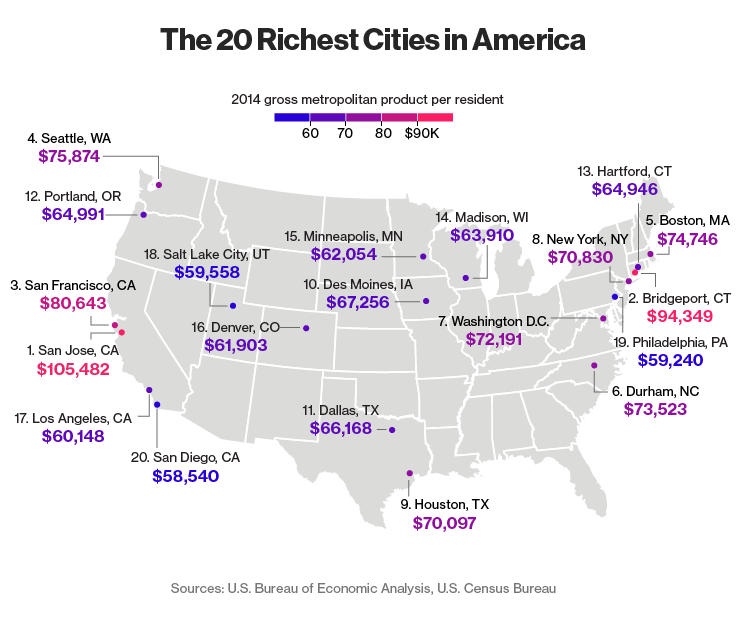

http://www.bloomberg.com/news/articles/2015-11-05/these-are-the-20-richest-cities-in-america

San Jose, San Francisco, Seattle: These cities house more than the headquarters of the world's largest technology companies. They are also some of the most productive hubs in the U.S. economy.

The San Jose, California metro area had the highest output per resident for 2014, according to a Bloomberg analysis of U.S. Bureau of Economic Analysis data for the 100 largest metropolitan areas. Gross metropolitan product (GMP) per capita in the Silicon Valley epicenter was $105,482, more than double the national average. Bridgeport, Connecticut ranked second at $94,349. San Francisco, Seattle and Boston followed...

Demeter

(85,373 posts)Republic Airways, one of the largest players in the regional airline business, escaped a bankruptcy filing recently when its 2,100 pilots accepted a new three-year contract. Republic executives call that agreement a cornerstone of their effort to rebuild an airline decimated by pilot shortages.

With that deal in hand, Republic is now telling its biggest customers: You need to step up. But can it get American, Delta, and United to lighten its flying load and help fund the $40-an-hour starting salary it now pays new pilot hires—the new top in the regional industry?

“Republic has serious challenges that we must still address and several quarters of recovery and rebuilding ahead of us," Chief Executive Officer Bryan Bedford said today on a call with analysts, outlining a quarter in which pretax income plunged 73 percent to $8 million from a year earlier, aggravated by less flying. The company, which has 240 jets and about 1,250 daily flights, is working to remove 50-seat Embraer jets and Bombardier Q400 turboprops from its fleet as airlines shift to larger, more efficient regional jets. Its shares were down 10 percent late in the trading session, part of a 64 percent decline this year.

The new compensation course at Republic shows one of the critical issues regional carriers are now facing as they try to maneuver the tough mandate Congress imposed in 2013 requiring more flying hours before commercial pilots can take the yoke. Lawmakers were driven to the new flight-hour rules mostly by the 2009 crash of a Colgan Air regional flight near Buffalo. That case revealed lapses in the pilots’ training and rest before the flight, and shocked many with the low pay endemic in the regional industry...MORE

Demeter

(85,373 posts)WHAT ABOUT WEEKENDS OFF, AND TWO WEEKS OF VACATION?

http://www.bloomberg.com/news/articles/2015-11-05/goldman-to-speed-promotions-to-improve-lives-of-junior-bankers

Goldman Sachs Group Inc. said faster promotions, third-year rotations and more automation of grunt work are among the latest changes it’s making to improve life for young investment bankers and head off defections.

The world’s top merger adviser will promote all analysts to associates after two years, and let them switch to different teams in their third year to broaden skills, said David Solomon, co-head of the firm’s investment bank. Top workers will be able to advance from associate to vice president in 3 1/2 years, cutting the previous timetable by 12 months, he said.

The moves mean higher pay for many junior bankers and earlier conversations with managers about future roles at the firm. Once Wall Street banks hire young employees, the biggest threats to retaining them typically come from their buy-side clients, such as investment funds, that start recruitment efforts within months to pick up talent fresh from two-year training programs.

“We’re really trying to develop people for a longer period of time than two years because, candidly, it takes more than two years to figure out" whether banking is the right career, Solomon said in an interview at the firm’s Manhattan headquarters. “By getting people on the track of becoming an associate, we’re basically just matching what’s going on in the world with other opportunities that are out there.”

IN THAT CASE, MAYBE IT ISN'T, FOR ANYONE

Demeter

(85,373 posts)WHAT? IT SHOULD BE THE OTHER WAY AROUND?

http://www.bloomberg.com/news/articles/2015-11-05/rich-americans-are-outstripping-the-poor-in-borrowing

Wealthy Americans aren't just pulling away from their poorer counterparts in income and wealth: They're also leading in borrowing for all categories except student loans, magnifying their advantage in purchasing power.

As earnings diverged and lending standards tightened in the wake of the financial crisis, Americans in top-earning zip codes have held increasingly more than lower-income individuals in mortgage, credit-card, and auto-loan balances, Federal Reserve Bank of New York research shows. That means the rich have gained greater ability to leverage their incomes to buy homes, cars, and merchandise.

"The income gap overall has been widening during this period, and mortgage and credit-card balances tend to be positively correlated with income," the authors wrote. "So, the declining share of mortgage debt and credit card debt in the lower-income zip codes over the last decade is broadly consistent with the widening income gap over the same period."

The researchers looked at data from the New York Fed Consumer Credit Panel, Internal Revenue Service, and Census Bureau to obtain income per adult for zip codes, which they then divided into five groups for the analysis. The chart below shows what has happened with the mortgage divide: The ratio of balances for those in the bottom fifth, compared to those in the top fifth, has resumed a longer-run downward trend after rising during the easy-lending subprime mortgage era. ,,,MORE

Demeter

(85,373 posts)Ex-American Apparel Inc. Chief Executive Officer Dov Charney lives in a Los Angeles mansion with eight bedrooms, but says he can’t scrape together enough cash to keep paying a lawyer. Charney is now representing himself in a lawsuit filed against him by the hedge fund Standard General, a backer of American Apparel. The 46-year-old told a Delaware judge that if he can’t raise money to hire a new lawyer, he’ll continue doing his own legal work.

Since American Apparel’s board ousted him in 2014, Charney has waged a costly legal campaign to regain control of the company he founded. When American Apparel filed for bankruptcy last month, it crushed the value of his remaining stock, which represented much of his net worth. He still has his house, which spans more than 11,000 square feet in the Silver Lake neighborhood of Los Angeles.

“As you may know, I was fired by American Apparel, the company I founded in Montreal over three decades ago, with no severance or otherwise,” Charney said in a letter dated Wednesday to the judge presiding over the case. “All of my shareholder interests have been wiped out, and I have depleted my savings on defending my life’s work and legal rights.”

...The American Apparel board first suspended Charney in June 2014 for allegations of misconduct, including misusing funds and violating the sexual-harassment policy. After more investigating, it fired him in December and named a new CEO. A lawyer for Charney has denied the allegations. Charney’s current predicament represents a sharp decline from his previous post, said Robin Lewis, CEO of the Robin Report, a retail strategy publication. But don’t count him out because he has “been able to wiggle out of more problems than anyone I’ve ever known,” Lewis said. Charney has said in a lawsuit that he was fired because other American Apparel executives wanted to sell the company and knew he wouldn’t approve. He also alleged that Standard General promised to reinstate him, and was then “betrayed” by the firm. Both American Apparel and Standard General have denied Charney’s allegations...

Demeter

(85,373 posts)SIGNS OF A DISTURBANCE IN THE FORCE....

http://www.nytimes.com/2015/11/05/business/dealbook/value-of-bitcoin-surges-emerging-from-a-lull-in-interest.html

After a long period of quiet, the price of the virtual currency Bitcoin is surging again as signs of interest from China and Wall Street have helped kick off a new speculative frenzy.

The price of a single Bitcoin has been steadily rising in recent weeks. On Wednesday, it spiked particularly sharply, rising above $500 on some exchanges, and bringing the value of a single coin up over 100 percent from a month ago. By the end of Wednesday, the price had fallen back closer to $400.

The recent rally has been the biggest since the online currency entered a sustained decline after the collapse of what was once the biggest Bitcoin exchange, Mt. Gox, in early 2014. That incident — and the use of Bitcoin for drug sales — led many people to write off the virtual money as a passing fad.

Nonetheless, many banks and financial firms continued to study the technology behind the scenes and have recently been expressing their interest — and announcing new investments — in the technology underlying Bitcoin, which is being heralded as a new way to conduct a broad array of financial transactions...MORE

Demeter

(85,373 posts)Almost no aspect of the financial world went unscathed as JPMorgan Chase Chairman and CEO Jamie Dimon offered his two cents on everything from bank regulation to bitcoin on Wednesday.

Dimon joined a growing chorus of business and political leaders calling on the U.S. government to allow big banks to fail.

"Banks should be allowed to fail," Dimon told those attending the final day of the Fortune Global Forum at the Fairmont Hotel in San Francisco, which drew 300 CEOs and senior executives. But he clarified: "We're not going to fail."

Dimon suggested a label for the government's efforts to resolve how to handle big banks when they run into trouble: "For the American public, it should be called 'bankruptcy for big, dumb banks.'"

MORE

Demeter

(85,373 posts)...In few places are the wounds of Greece's economic depression more evident than in the mouths of the nation's children. By most indicators of dental health, Greece is one of the unhealthiest places in Europe. The number of Greeks 16 years or older reporting unmet dental care needs was 10.6 percent in 2013, according to Europe's statistical agency Eurostat. That compares to a European Union average of 7.9 percent.

Dental problems are particularly acute among children, according to a recent survey by the Hellenic Dental Federation, a supervisory body. And the financial crisis has made things worse. In the decade up to 2014, 60 percent of all dental problems in 15-year-olds were left untreated for at least a year, up from 44 percent in the previous decade. Almost all the five-year-olds surveyed – 86.8 percent – suffered dental problems that had not been treated, the survey found.

"Teeth are unfortunately considered a luxury," said Niki Diamanti, a dentist who works at Hatzikosta Hospital, one of two public hospitals in the northwestern town of Ioannina. "If, five years ago, people went to the dentist once a year, now they go every five years."

In Greece's case, the situation is remarkable because the dental problems are not primarily caused by changes in daily oral hygiene, experts say. Rather, children are developing tooth diseases for reasons related to the country's six-year economic depression...

fasttense

(17,301 posts)Even young children have horribe teeth. One child died a couple of years ago from an abscess tooth. Yea, good teeth are a luxury in the US too.

antigop

(12,778 posts)You know the "toothbrush" was invented in West Virginia for a reason.

Demeter

(85,373 posts)The average female worker makes the most money she’ll ever earn a full 25 years before she’s likely to retire.

Between the ages of 20 and 40, the median pay for women ticks up slightly every five years until topping off at $49,000, where it stays through age 65, according to data released by salary comparison site PayScale on Thursday. But men see their salaries grow all the way until they’re at least 50, when their median earnings hit $75,000.

SEE GRAPHIC AT LINK

Demeter

(85,373 posts)A former Federal Reserve Bank of New York examiner on Wednesday admitted leaking confidential information to a Goldman Sachs employee that led to a $50 million penalty against the investment bank.

Jason Gross entered a guilty plea in Manhattan federal court to a misdemeanor theft of information charge, admitting giving information in August 2014 to former supervisor Rohit Bansal, who prosecutors say was trying to make a good impression after moving to his new job at Goldman Sachs.

Bansal, who had worked with Gross at the Federal Reserve until April 2014, is scheduled to enter a plea Thursday in Manhattan. His attorney, E. Scott Morvillo, declined to comment on Wednesday.

Prosecutors said the documents Gross shared with Goldman Sachs were used to assist it with client banks....Sentencing for Gross, 37, was scheduled for March 2, when he could face up to a year behind bars.

MORE AT LINK

Demeter

(85,373 posts)Deutsche Bank AG will pay $258 million and fire six employees to resolve a probe into sanctions violations from 1999 to 2006 after a string of e-mails showed employees discussed the “tricks” used to move money in and out of Iran, Libya, Syria, Burma and Sudan.

The settlement was announced Wednesday by the Federal Reserve and New York’s Department of Financial Services. The deal shows how authorities combed through the bank’s internal messages and singled out bad actors to broker a deal. They also show how the bank’s European arm kept U.S. staff in the dark, and some employees even told customers they were skirting U.S. law, according to a statement by Anthony Albanese, the acting superintendent of the DFS.

“We are pleased that Deutsche Bank worked with us to resolve this matter and take action against individual employees who engaged in misconduct,” Albanese said. “To truly deter future wrongdoing, it is important to focus not just on corporate accountability, but also individual accountability.”

Renee Calabro, a Deutsche Bank spokeswoman in New York, said the conduct ceased “several years ago” and the bank has since ended all business with the countries involved...

MORE

Demeter

(85,373 posts)A New York jury convicted two ex-Rabobank Groep traders of rigging a key financial benchmark in the first such trial since the government pledged in September to hold bankers accountable for wrongdoing.

The verdict in Manhattan federal court against Anthony Allen and Anthony Conti is certain to embolden prosecutors investigating possible corruption in the currency, precious metals and U.S. Treasury markets. And after a London judge handed Tom Hayes, a former trader at UBS Group AG and Citigroup Inc., a 14-year prison sentence for rigging Libor, it indicates that conduct some bankers once defended as routine could now land them behind bars.

Prevailing in a case against individuals was the next challenge for the U.S. Justice Department, which won $2 billion in criminal settlements with firms including Rabobank for gaming Libor -- the London interbank offered rate -- a measure tied to more than $350 trillion in loans and securities.

Robertson Park, a former federal prosecutor who worked on the Libor investigation, predicted there will be more criminal cases tied to possible collusion over rates in other markets...MORE

Demeter

(85,373 posts)That election took a lot out of me, even with the end of DST giving an extra hour of sleep and a return to natural circadian rhythms.

G'night, all!

Fuddnik

(8,846 posts)Still in ICU at Cleveland Clinic. They're having trouble with liquid secretions in his lungs, so he still has feeding and extracting and breathing tubes crammed down his throat.

The wife flew back down here tonight. She's worn out. Hopefully, they'll remove some of the tubes tomorrow. But, they've been saying that for 3 days. He seems alert, but he can't talk because of all the tubes. His sister from Detroit is staying with him for now. But, she's a worn out mess too.

According to the doctors, it should all work out well, but how long?

Demeter

(85,373 posts)At least the doctors have hopes of recovery...it could be so much worse.

Take good care of your wife, Doc. She's going to need some cozening extra care and comfort...

Edit...cozening doesn't mean what I thought it did. So, what is the word I want? Hmmm....

Demeter

(85,373 posts)Similar sounding, but such different meanings....

DemReadingDU

(16,000 posts)and he is young, which contributes to speedier recovery. Stressful for the family though, especially living in a different state. Perhaps some of his friends or co-workers could come visit so that his sister can take a break. With the tubes hampering talking, can he write with pencil/paper, or even use an electronic tablet. Prayers that he soon gets out of ICU.

Fuddnik

(8,846 posts)They're all there to see him everyday.

antigop

(12,778 posts)Demeter

(85,373 posts)Last edited Fri Nov 6, 2015, 09:03 AM - Edit history (1)

For autumnal rains, they are actually a month late. But I'm glad the planting is done, so I don't have to water.

All that exercise seems to have exacerbated the muscles injured by violent coughing from my never-ending illness of August....maybe I did crack a rib? I've never broken a bone, what does it feel like?

Another rose bloomed this morning. I can savor it all weekend!

Demeter

(85,373 posts)U.S. stock futures showed little change early Friday, as investors held off from big bets ahead of a much-anticipated jobs report.

S&P 500 futures ESZ5, +0.02% edged lower by 0.50 point, or less than 0.1%, to 2,093.50, while Dow Jones Industrial Average futures YMZ5, -0.06% fell by 12 points, or 0.1%, to 17,790. Nasdaq 100 futures NQZ5, +0.12% inched up by 5.50 points, or 0.1%, to 4,700.75.

The Labor Department is expected to report that the U.S. economy added 177,000 jobs in October, according to economists polled by MarketWatch. The unemployment rate is forecast to hold at 5.1%, with average hourly earnings up 0.2%.

The nonfarm-payrolls report is due at 8:30 a.m. Eastern Time. A strong jobs report is likely to boost bets that the Federal Reserve will raise interest rates next month. But William Adams, head of research at FastMarkets, said a weak report could spark a more dramatic reaction by financial markets....

Demeter

(85,373 posts)When economic crisis struck in 2008, policy makers by and large did the right thing. The Federal Reserve and other central banks realized that supporting the financial system took priority over conventional notions of monetary prudence. The Obama administration and its counterparts realized that in a slumping economy budget deficits were helpful, not harmful. And the money-printing and borrowing worked: A repeat of the Great Depression, which seemed all too possible at the time, was avoided.

Then it all went wrong. And the consequences of the wrong turn we took look worse now than the harshest critics of conventional wisdom ever imagined.

For those who don’t remember (it’s hard to believe how long this has gone on): In 2010, more or less suddenly, the policy elite on both sides of the Atlantic decided to stop worrying about unemployment and start worrying about budget deficits instead.

This shift wasn’t driven by evidence or careful analysis. In fact, it was very much at odds with basic economics. Yet ominous talk about the dangers of deficits became something everyone said because everyone else was saying it, and dissenters were no longer considered respectable — which is why I began describing those parroting the orthodoxy of the moment as Very Serious People...Some of us tried in vain to point out that deficit fetishism was both wrongheaded and destructive, that there was no good evidence that government debt was a problem for major economies, while there was plenty of evidence that cutting spending in a depressed economy would deepen the depression.

And we were vindicated by events.

WHAT COMES NEXT? SEE LINK!