Economy

Related: About this forumRail Cargo Drop Accelerates, Pointing to U.S. Economy Weak Spots

Thomas Black

December 7, 2015 — 11:38 AM EST

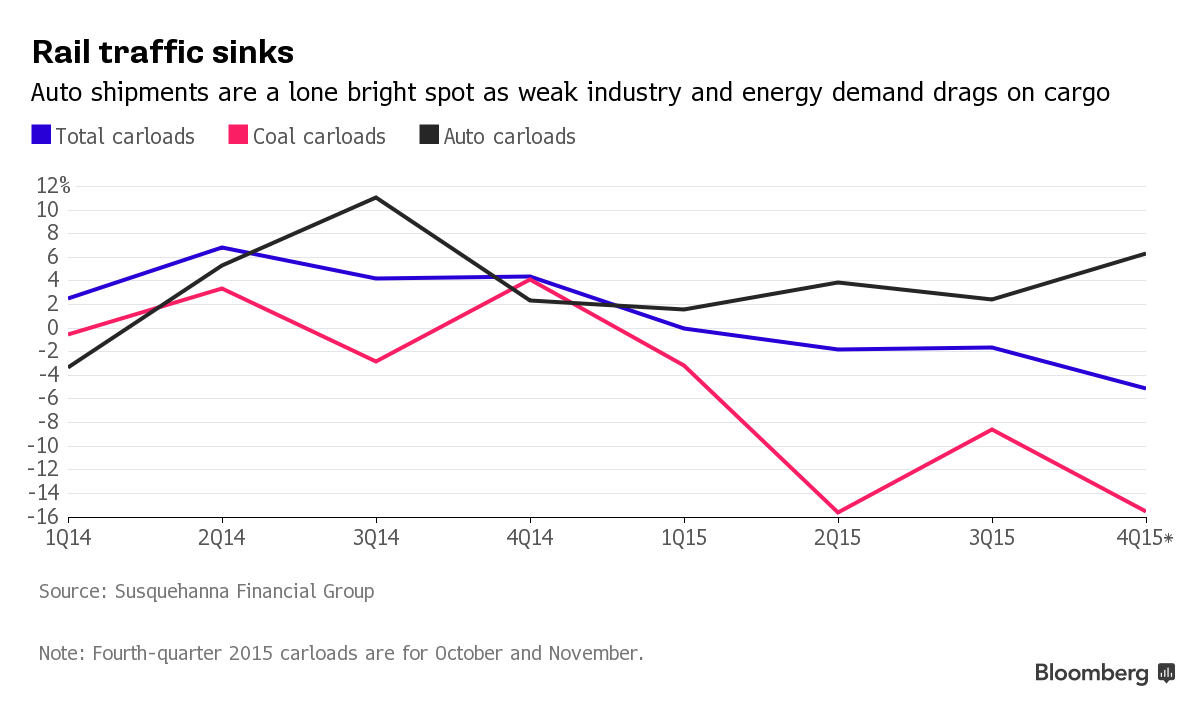

A sharper decline in U.S. railroad cargo this quarter points to weak spots in the U.S. economy as a strong dollar crimps exports, retailers whittle down excess inventory and energy investment stalls.

Union Pacific, Warren Buffett’s BNSF Railway Co. and other large U.S. railroads have posted a 5.1 percent drop in carloads since the beginning of October, topping decreases of 1.6 percent in the third quarter and 1.8 percent in the second. A decline in consumer-related cargo this quarter is adding to weakness in industrial and energy traffic.

While it’s too early to tell if something “drastic” is happening to the economy, “it does feel kind of like a soft, flat, sort of wait-and-see environment,” said Union Pacific Chief Financial Officer Rob Knight at a Credit Suisse Group AG conference last week. The rail industry provides detailed weekly carload reports with only a three-day lag, giving one of the most current looks at shipping demand.

The railroad weakness adds to U.S. economic indicators that have been sending mixed signals. The Institute for Supply Management’s index showed November manufacturing contracted at the fastest pace since 2009 while factory orders in October rose 1.5 percent. Consumers are buying autos at a record pace and November payrolls increased by 211,000, more than economists’ estimates.

Intermodal Traffic

Railroad intermodal traffic, which rose in the previous two quarters, has fallen 1.3 percent since the beginning of October. Intermodal consists mostly of consumer goods that are moved in containers that can be switched between ships, trains and trucks, and accounts for almost half of the industry’s carloads.

more...

http://www.bloomberg.com/news/articles/2015-12-07/rail-cargo-drop-accelerates-pointing-to-u-s-economy-weak-spots

elleng

(131,127 posts)Intermodal Traffic

Railroad intermodal traffic, which rose in the previous two quarters, has fallen 1.3 percent since the beginning of October. Intermodal consists mostly of consumer goods that are moved in containers that can be switched between ships, trains and trucks, and accounts for almost half of the industry’s carloads.

The excess inventory that’s dragging on intermodal carloads is also hurting U.S. growth, said Tim Quinlan, an economist at Wells Fargo & Co. The economy in the fourth quarter may expand about 1.5 percent at an annualized rate, he said. Growth was 2.2 percent in the third quarter from a year earlier.

Significant Drag

“That slowing is due mostly to a drag from net exports and a significant drag from inventories,” Quinlan said.

CoffeeCat

(24,411 posts)Last edited Mon Dec 7, 2015, 07:52 PM - Edit history (2)

Do you also follow the Baltic Dry Index?

The BDI measures/tracks the price to ship raw materials via large container ships. When the economy slows, demand for basic inputs (metals, lumber, etc) slows, and the price to ship goods decreases.

Conversely, as demand for raw materials increases, so does the demand and cost to ship goods.

The BDI is at 30 year lows. Lower than 2008, After the US economy crashed. Economists were alarmed in 2008, when the BDI plunged below 900.

It's at 580 today. Holy crap. Pre 2008 levels were around 12,000.

This is crazy! The demand for rail and shipping of consumer goods is a very solid measure of consumer demand.

What is going on?

Fuddnik

(8,846 posts)If he can't, there's always the Tooth Fairy.