Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 4 January 2016

[font size=3]STOCK MARKET WATCH, Monday, 4 January 2016[font color=black][/font]

SMW for 31 December 2015

AT THE CLOSING BELL ON 31 December 2015

[center][font color=red]

Dow Jones 17,425.03 -178.84 (-1.02%)

S&P 500 2,043.94 -19.42 (-0.94%)

Nasdaq 5,007.41 -58.44 (-1.15%)

[font color=green]10 Year 2.27% -0.01 (-0.44%)

30 Year 3.02% -0.01 (-0.33%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)On Nov. 24, TheStreet.com’s Jim Cramer appeared on The Today Show...On the air, Cramer told host Matt Lauer that despite the $700 billion bailout of Wall Street over the past year, lavish Wall Street bonuses would continue just the same — a brash thumb in the eye to struggling Americans who would neither get a bonus nor a bailout of their own anytime soon.

"What happened to these people? Nothing," Cramer said. "They got the money, they left. ... They got away with it, so why shouldn't the next guy try?"

And try they have. According to a 2009 study on executive compensation by the New York State Attorney General’s Office, a “who’s who” of Wall Street banks that grabbed federal bailout cash actually paid out bonuses to top-tier execs in excess of the actual profits earned by the financial institutions. According to the New York State report:

A separate study, this one from Harvard Law School, says that the chief executive officers of two failed investment banks, Bear Stearns and Lehman Brothers, earned “hundreds of millions of dollars” in bonuses and compensation — even as the banks’ shareholders lost everything. Still another study, from Johnson Associates, says that Wall Street bankers can expect up to a 40% increase in year-end bonuses when compared to 2008.

Consumers are up in arms over the issue, as surveys record the voices coming from Main Street to be loud and angry over bank executives stuffing their pockets with taxpayer-funded bailout money. According to The Wall Street Journal, two-thirds of Americans viewed bank executives as "unfavorable." And 75% of Americans surveyed said that any bank that received TARP funds shouldn’t pay any bonuses in 2009.

So it’s refreshing to hear that at least one Wall Street CEO — John Mack — has gone public with his intent to forego his year-end bonus. Mack, who is leaving Morgan Stanley at the end of 2009, wrote in a memo to employees this month that “given this unprecedented environment and the extraordinary financial support governments provided to our industry” he would accept no bonus this year. Morgan Stanley has since paid off its TARP debts, but Mack told his staffers that he wouldn’t accept any extra compensation in a year where the bank didn’t make a profit. So, despite paying out all those extravagant bonuses, maybe Mack is on to something. If enough bank CEOs stand up and say “no” to bonuses funded by taxpayer money, then banks will go a long way in restoring their credibility with the American people.

lest we forget

Proserpina

(2,352 posts)By studying the immune systems of plants, they've developed a technique that eliminates the need for chemicals...“In the Second World War,” Samuel Zook began, “my ancestors were conscientious objectors because we don’t believe in combat.” The Amish farmer paused a moment to inspect a mottled leaf on one of his tomato plants before continuing. “If you really stop and think about it, though, when we go out spraying our crops with pesticides, that’s really what we’re doing. It’s chemical warfare, bottom line.”

Eight years ago, it was a war that Zook appeared to be losing. The crops on his 66-acre farm were riddled with funguses and pests that chemical treatments did little to reduce. The now-39-year-old talked haltingly about the despair he felt at the prospect of losing a homestead passed down through five generations of his family. Disillusioned by standard agriculture methods, Zook searched fervently for an alternative. He found what he was looking for in the writings of an 18-year-old Amish farmer from Ohio, a man named John Kempf.

Kempf is the unlikely founder of Advancing Eco Agriculture, a consulting firm established in 2006 to promote science-intensive organic agriculture. The entrepreneur’s story is almost identical to Zook’s. A series of crop failures on his own farm drove the 8th grade-educated Kempf to school himself in the sciences. For two years, he pored over research in biology, chemistry, and agronomy in pursuit of a way to save his fields. The breakthrough came from the study of plant immune systems which, in healthy plants, produce an array of compounds that are toxic to intruders. “The immune response in plants is dependent on well-balanced nutrition,” Kempf concluded, “in much the same way as our own immune system.” Modern agriculture uses fertilizer specifically to increase yields, he added, with little awareness of the nutritional needs of other organic functions. Through plant sap analysis, Kempf has been able to discover deficiencies in important trace minerals which he can then introduce into the soil. With plants able to defend themselves, pesticides can be avoided, allowing the natural predators of pests to flourish.

According to Kempf, the methods he developed through experimentation on his Ohio farm are now being used across North and South America, Hawaii, Europe, and Africa. The entrepreneur promises clients higher-quality crops, bigger yields, better taste, and produce that carries a lucrative “organic” label. Kempf, however, considers his process as an important improvement upon standard organic farming methods. “Organic certification is a negative-process certification,” he explained, “You can do nothing to your field and become certified. In contrast, we focus on actively restoring the balance found in natural systems.”..

Proserpina

(2,352 posts)Some time ago, in the pages of USA Today, Duncan Black, better known to some as Atrios voiced the immediate need for increased Social Security benefits of 20% or more even if it means raising taxes on high incomes, or removing the payroll tax cap on salaries. Black is right about the need for increased benefits; but legislating that increase doesn’t require increasing taxes. In fact, Congress should both increase benefits and remove the payroll tax entirely.

But how is that possible without greatly increasing “the national debt”? The answer to that one is easy. Don’t tax or borrow to pay for it. Just mint a single one oz. platinum coin at the beginning of each fiscal year with a face value large enough to cover expected the cost of SS payments. Doing it that way will both take care of retirement needs and also provide a huge shot in the arm for employment, since the increase in Social Security benefit payments and the ending of the payroll tax won’t be offset by tax increases elsewhere that will depress aggregate demand.

How many times have you heard that the Government can only spend money after it raises revenue by either taxing or borrowing? Nearly every time someone talks or writes about the US’s public deficit/debt problem? Why is it that nobody asks why, since Congress has unlimited authority to create coins and currency, it doesn’t just create money when it deficit spends? The short answer is that Congress in 1913, constrained both itself and the Executive Branch from creating currency or bank reserves, delegating its power to do that to the Federal Reserve System.

But coins, it turns out are different. They’re the province of the Executive Branch, and the Treasury. And Congress provided the authority, in legislation passed in 1996, for the US Mint to create one oz. platinum bullion or proof platinum coins with face values to be specified at the discretion of the Secretary of the Treasury, having no relationship to the market value of the platinum used in the coins. These coins are legal tender. That is, they are tax credits, which the Treasury is obligated to accept in payment of taxes, if they ever fell into private hands. And when the Mint deposits them in its Public Enterprise Fund (PEF) account, the Fed must credit it with the face value of these coins, because the asset value of the coin is, legally, its face value. The difference between the Mint’s costs in producing the coins, and the reserves provided by the Fed in return for a deposit of such coins is the US Mint’s “coin seigniorage” or profit from the transaction.

The US code also provides for the Treasury to periodically “sweep” the Mint’s account at the Fed for profits. These then go into the Treasury General Account (TGA), the primary spending account of the Treasury, narrowing or eliminating the revenue gap between spending and tax revenues. So, platinum coins with multi-trillion face values, can produce profits closing the revenue gap, while still retaining the deficit between tax revenues and spending that can add to aggregate demand in the private sector and produce full employment. Platinum Coin Seigniorage (PCS) is also a way for the Executive to end debt ceiling crises, since seigniorage revenues can be used to repay debt instruments when they fall due, without needing to issue any more debt.

If all debt instruments are re-paid by using seigniorage, eventually the US would have no debt subject to the limit, or presence in the bond market, and would pay no interest to bond holders. No one would worry about the public debt, or use its size to justify blocking legislation...

Maybe Bernie can look into it, after he settles in at the White House...

Proserpina

(2,352 posts)http://consumerist.com/2014/10/10/a-brief-history-of-car-colors-and-why-are-we-so-boring-now/

• Everyone remembers their favorite car’s unique color, so when did we fade to black?

• Yellow, green and teal cars may fetch you a higher resale value due to relatively few of them

• Cars were first painted like carriages, color was expensive, didn’t last

• Henry Ford offered cars in black asphalt enamels because that color dried the fastest and was more durable than oil-based paints

• General Motors and Dupont partnered up for Duco, a new paint that made it easier to apply colorful paints that dried even faster than before

• Car manufacturers stared color advisory boards to suss out trends in popular culture and report back

•Everyone got wacky on colors for a while, including in the ‘60s and ‘70s

• We’re boring these days, choosing mostly black, white and gray/silver

• The recession scared people into a neutral colors phase, giving rise to the popularity of black, white and silver/gray

• The future is bright once again, however, as experts see colorful paint jobs coming back

...when you look around on the road and in your neighbors’ driveways, not everyone is driving in the technicolor lane. It feels more like the Model T days, of which Henry Ford wrote in his autobiography: “Any customer can have a car painted any color that he wants so long as it is black”. In fact, if it feels like we’ve returned to our grayscale roots, we have: Last year for example, the most popular car color in North America was white, reports Forbes, followed by black, gray and silver. And yet in that same article, Forbes discusses how popular a color is doesn’t mean it’s necessarily the best value, noting how a yellow car bought new will have a higher resale value down the road — pun completetly intended — than your more everyday tones.

As it turns out, during the recent recession, consumers were a bit shy of flashy things and tended to play it safe when and if they took the big step of buying a new car, and that trend has persisted over the years. Meaning the likelihood of a flood of yellow cars on the market is not great, hence, the rarer it is, the higher price tag it can command. This effect also works for green cars (Polynesian Green!) and orange (Tangerine Scream!) as well as teal (Just Teal [not a real color but should be]).

So now that we know the reason for popular car colors now, we wanted to figure out why, if perhaps trends are always or often tied to current events like a recession or depression.

Back to Henry Ford and his “any color as long as it’s black” statement: To quote Jerry Seinfeld, “What was the deal?” Was it because everyone was just in a a really cranky mood and just didn’t feel like happy colors? Not really — and as it turns out, there were some pretty spectacular car colors around the turn of the century, explains Gundula Tutt, an automotive color historian, conservationist and restorer living in Vörstetten, Germany. Her doctoral thesis is titled “History, development, materials and application of automobile coatings in the first half of the 20th century,” and she’s a member of the Society of Automotive Historians. So she knows her stuff, it’s safe to say...Back around 1900, Tutt says, cars were basically motorized carriages and thus, painting methods were derived from the oil-based coating formulations used for traditional horse drawn carriages. It was a complicated, expensive procedure to to apply the paint, and the drying time took several weeks. The color was luxurious, providing for brilliant paint jobs, but the paints couldn’t stand up to time and would end up turning yellow. There was no binding medium, Tutt says, so every time a color would fade or yellow, it’d have to be repainted. It gets expensive.

That long, expensive process is what prompted Ford to develop asphalt-based baked enamels for his cars — dark colors lasted longer, it fit in with the assembly line process and didn’t take as long to dry....

The early 1920s saw brilliant shades — the colors of the time were exotic, Tutt explains, with two, three and even four colors ont he same car, as well as painted birds and butterflies on some Lincoln models. Fast forward to the 1920s, when General Motors worked with the Dupont chemical company to create something known as pyroxylin, a substance that could be mixed with pigments to come up with new automobile coatings in a rainbow of colors, was more durable than previous pigments, and even better — could dry in minutes instead of hours. In 1923, the new Duco paint (as it was called) pyroxylin colors debuted at the New York Auto Show on GM’s Oakland Motor Car Company’s cars, known as the “True Blue Oakland Sixes.”

“Alfred P. Sloan, who had become GM president in May 1923, believed that consumers buying lower-priced cars would appreciate a range of color choices, particularly if the paints lasted,” notes the Chemical Heritage Foundation.

“Blue is a complicated color,” adds Tutt,” because it yellowed easily before. Now there was much less yellowing and upkeep, it was a cheaper, garageless car,” which was nice for consumers, as you could have a car without the bothersome expensive of having a garage.

more than anyone can possibly know about painting cars at link

October 10, 2014 By Mary Beth Quirk

Proserpina

(2,352 posts)I don’t believe I’ve successfully communicated to our readers the extraordinary nature of our times. We too often focus on the details, but ignore this essential aspect of our situation. Since the crash (perhaps starting even before) we’ve sailed beyond the edges of the known economic “space”. We can no longer even see the edges of the map.

Normal science, the activity in which most scientists inevitably spend almost all their time, is predicated on the assumption that the scientific community knows what the world is like. Much of the success of the enterprise derives from the community’s willingness to defend that assumption, if necessary at considerable cost. Normal science, for example, often suppresses fundamental novelties because they are necessarily subversive of its basic commitments.

— Thomas Kuhn’s Structure of Scientific Revolutions (1962)

Look at the US economy. Marvel at the oddness.

That the economy needs such large stimulus in the sixth year (NOW 7TH YEAR) of an expansion is unprecedented. Usually by now the economy has overheated from too-fast growth (inflation!), and economists are speculating about the next recession.

How we got here is equally strange. Like the Harry Potter books, since 2007 life has been a series of random plot twists. It will make a great novel; the film adaptation might be even better.

Plus we saw a series of equally astounding events in Europe starting with the Greece bust starting in March 2010. And the July 2012 announcement that the ECB would “do whatever it takes to preserve the euro”. And the December 2012 “hail Mary” pass of Abenomics in Japan, attempting to end their quarter-century slump before the government goes bust.

No economists (and probably nobody else) predicted most of this, despite their confident forecasts (economists often write as if they’re the voice of God). But the persistent failure of their forecasts since 2007 does not mean they should abandon their theories. Kuhn explains why:

Our reactions to these astounding events

The cumulative effect on me of these years has been disorienting, like Dorothy’s visit to Oz. We’ve enjoyed talking with the Lion, Tin Man, and Scarecrow. The yellow brick road is fun. We survived the flying monkeys and the Wicked Witch. When do we go home?

Most people have reacted differently to this series of events. They pretend that we’re still in Kansas, and this is just a New Normal. It’s a consensual hallucination, allowing these people to retain a feeling of stability and comfort. How long can they maintain this illusion, assuming we don’t return to Kansas?

There is a more important group struggling to understand these events. How have economists, as a profession, reacted? At what point do they decide their theories need radical revision? The re-thinking has already begun. It’s a slow process, a form of scientific revolution, as Kuhn tells us:

it's Waiting for Godot, all over again

Proserpina

(2,352 posts)Book Review:

Does Capitalism Have a Future?, Immanuel Wallerstein, Randall Collins, Michael Mann, Georgi Derluguian, and Craig Calhoun, Oxford University Press, 208 pages

Judging by the mainstream media, the most pressing problems facing capitalism are 1) income inequality, the subject of Thomas Piketty’s bestseller Capital in the Twenty-First Century, and 2) the failure of free markets to regulate their excesses, a common critique encapsulated by Paul Craig Roberts’ recent book The Failure of Laissez Faire Capitalism. These and many similar diagnoses reach a widely shared conclusion: capitalism must be reformed to save it from itself. Exactly how this economic reformation should be implemented is a question that sparks debates across the ideological spectrum, but the idea that capitalism can be reformed is accepted by the left, right, and libertarians alike. But socio-economist Immanuel Wallerstein asks a larger question: is the current iteration of global capitalism poised to be replaced by some other arrangement? Wallerstein and four colleagues explore the answer in Does Capitalism Have a Future?

Wallerstein is known as a proponent of world systems, the notion that each dominant economic-political arrangement eventually reaches its limits and is replaced by a new globally hegemonic system. Wallerstein draws his basic definition of the current dominant system—let’s call it Global Capitalism 1.0—from his mentor, historian Fernand Braudel, who meticulously traced modern capitalism back to its developmental roots in the 15th century in an influential three-volume history, Civilization & Capitalism, 15th to 18th Centuries. From this perspective, there is a teleological path to global capitalism’s expansion, beneath the market’s ceaseless cycle of boom-and-bust.

It is today’s latest and most expansive iteration of capitalism—one dominated by the mobility of global capital, state enforcement of private rentier/cartel arrangements, and the primacy of financial capital over industrial capital—that Wallerstein and his collaborators view as endangered. Amidst the conventional chatter of social spending countering markets gone wild—as if the only thing restraining rampant capitalism is the state—Wallerstein clearly identifies the state’s role as enforcer of private cartels. This is not just a function of regulatory capture by monied elites: if the state fails to maintain monopolistic cartels, profit margins plummet and capital is unable to maintain its spending on investment and labor. Simply put, the economy tanks as profits, investment, and growth all stagnate.

Wallerstein characterizes this iteration of capitalism as “a particular historical configuration of markets and state structures where private economic gain by almost any means is the paramount goal and measure of success.”

more

Proserpina

(2,352 posts)It wasn't all that bad a year to be a Motown resident, or a software publisher, or even a job seeker without a high school degree. Homeowners in West Virginia have less reason to be upbeat, and women are more likely to see the cloudy side of the street. Here's how Americans fared in a handful of demographic groups across the economy in 2015:

Unemployment

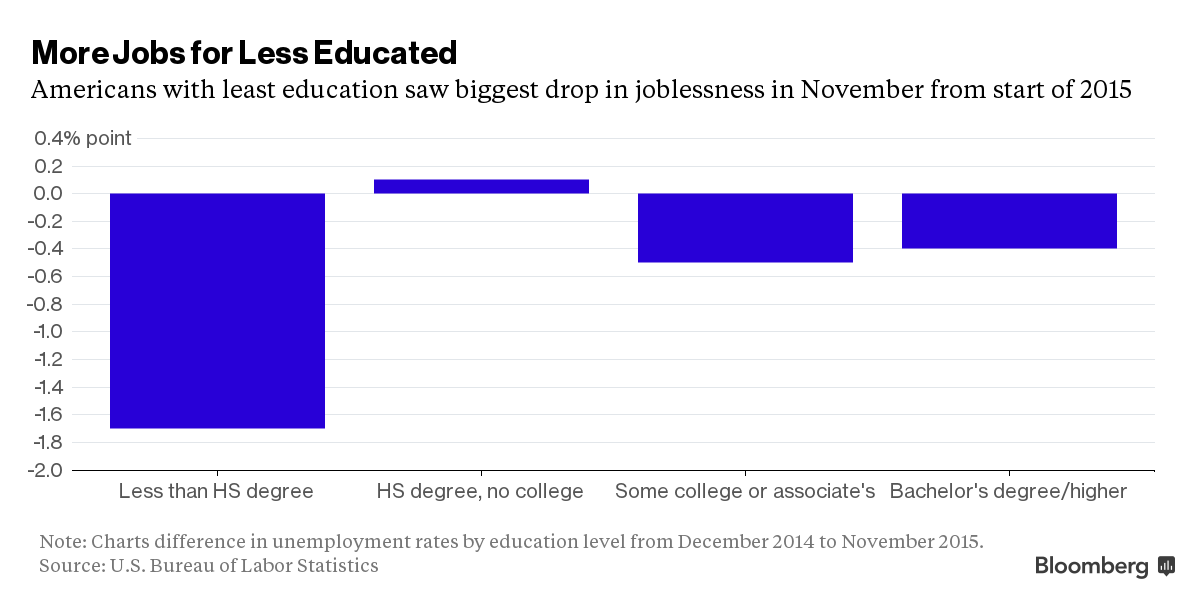

The labor market this year demonstrated how less can be more. Americans with the least amount of education — less than a high school degree — saw the biggest reduction in joblessness from December 2014, with that unemployment rate dropping 1.7 percentage points. The two higher categories, composed of those with some college or an associate's degree and those with a bachelor's degree or higher, each experienced about a half-point decline in jobless rates. Meanwhile, those with a high school education but no college made no progress, seeing a 0.1 percentage point increase in their unemployment rate.

The caveat for those most-improved: Job seekers with the least education still have the highest rate of unemployment, at 6.9 percent in November. That compares with 2.5 percent among the most educated Americans, and a 5 percent overall unemployment rate that's at its lowest since April 2008.

Wages

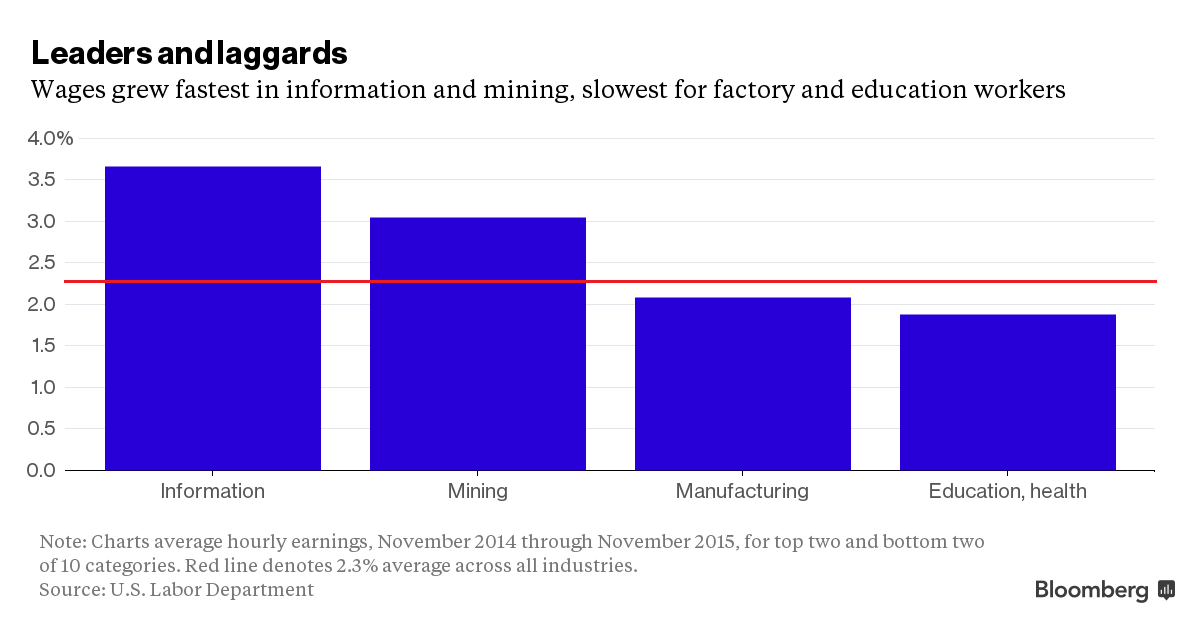

Average hourly earnings were sluggish in 2015, climbing 2.3 percent in November from a year earlier across 10 industry groups. A 3.7 percent jump put information workers at the top of the ladder, followed by mining and logging, which is very surprising given the slump in commodity prices. Not counting the miscellaneous "other services" group, wage gains in education and health, at 1.9 percent, and in manufacturing fared the worst.

more

Video discussion features stunned and incredulous exclamations

Proserpina

(2,352 posts)This year will herald a changing of the guard among some central banks in Asia, right at a time when the region's economy is facing significant headwinds.

New chiefs are scheduled to be appointed at the Australian and Malaysian monetary authorities, while the Indian central bank governor's term is also up.

The changes will come as China's slowdown continues to reverberate, the commodities slump is expected to linger and Asia's policy makers are tipped to cut interest rates further even as the U.S. Federal reserve is tightening.

Changing of the guard:

Australia:

After a decade at the helm, Glenn Stevens will relinquish the post of Governor at the Reserve Bank of Australia in September. Stevens time at the helm included a period when Australia's economy turned white hot on the back of a once in a century mining boom, before cooling sharply. A collapse in iron ore prices has dominated the narrative during Stevens last years of his term, forcing the bank to cut interest rates to record lows.

India:

Since taking over the Reserve Bank of India in 2013, Raghuram Rajan has made waves. Along with catching the market off guard with surprise rate cuts, Rajan has bolstered the nation's foreign exchange reserves and agreed a new inflation mandate with the government. Rajan also secured a deal on a new monetary policy committee. His term finishes this year and the former International Monetary Fund chief economist hasn't said if he will seek a reappointment or look further afield. The role is appointed by the government. Some analysts have tipped Rajan for a role on the global stage.

Malaysia:

Central bank Governor Zeti Akhtar Aziz is expected to step down in April after 16 years at the top. Zeti is credited with bolstering the bank's autonomy during her time in office and more recently was an outspoken critic about a funding scandal involving the premier and alleged financial irregularities at a state investment company, saying the issues hurt confidence in the country. Zeti has said she thinks there is an internal candidate who would be able to succeed her, though the government will ultimately choose the successor.

The Bank of Korea will also see a shake up. While Lee Ju Yeol, a 35-year BOK veteran, will remain in charge, a majority of the central bank's seven-member policy board will be replaced in April.

Still, even amid the departures, some of the region's most experienced policy makers remain in office. Asia's longest serving central bank governor is Perng Fai-nan, who has served as governor of the Central Bank of the Republic of China (Taiwan) since 1998. He was last reappointed in 2013 for a five year term.

The People's Bank of China Governor, Zhou Xiaochuan, is the longest-serving Group of 20 central bank chief. Zhou has championed reforms to China's financial markets, such as the successful bid for the yuan to gain reserve currency status and the freeing up of domestic interest rates. Reappointed by President Xi Jingping in 2013, there is periodic speculation that Zhou, who turns 68 this year, is due to be replaced.

Proserpina

(2,352 posts)everyone is excited by events in the Middle East. perhaps there will be fresh reports in the morning. Goodnight, all!

Proserpina

(2,352 posts)antigop

(12,778 posts)The trading halt was China's first-ever use of circuit breakers -- a kind of emergency brake -- on main exchanges.

Investors were reacting to disappointing manufacturing data, which suggested the country's all-important factory sector is in for more pain. After improving for two months, Caixin's manufacturing PMI fell to 48.2 in December. Any number below 50 represents a deceleration.

nitpicker

(7,153 posts)The FTSE especially is being hit not only due to slowing resource demand from China, but also by other factors as well.

Proserpina

(2,352 posts)Russia’s crude output set another post-Soviet record in December, according to Energy Ministry data, as the nation’s producers seek to withstand the slump in oil prices.

The country’s crude and gas condensate production increased to 10.825 million barrels a day last month, beating the previous record set in November by 0.4 percent, Bloomberg calculations based on the data show. Output for the year increased 1.4 percent compared with 2014, exceeding 534 million metric tons, or almost 10.726 million barrels a day, according to the preliminary information e-mailed from Energy Ministry’s CDU-TEK unit.

Russian crude producers have been setting post-Soviet records even amid plunging prices and U.S. and European Union sanctions that cut access to foreign financing and technology. The companies have managed to squeeze more crude out of some aging fields in West Siberia and brought a few mid-sized new projects on line...

I have a bad feeling about this...Indiana Jones

Proserpina

(2,352 posts)Financial markets are starting 2016 on a bleak note and China is at the center of it.

Stocks crumbled around the world, with emerging markets falling the most since August and European equities heading for the worst first day of trading ever, as slowing manufacturing triggered a selloff that halted equity trading in Shanghai. Asian currencies weakened with metals and credit markets, while bonds jumped and the yen rallied on demand for haven assets. Adding to the turmoil, Saudi Arabia and Bahrain cut ties with Iran, sending Gulf stocks lower and pushing Brent crude up as much as 3.3 percent.

“It’s a nasty start for the year,” said Peter Kinsella, a senior currency strategist at Commerzbank AG in London. “It might be the New Year, but old problems remain. Chinese growth concerns have not gone away.”

The slump in developing nations harks back to financial turmoil in August that was fueled by China’s devaluation of the yuan. It shows the pace of growth in the world’s second-largest economy will remain key for markets in 2016 after a slowdown last year dragged emerging markets lower and sparked a slump in commodities prices. The Caixin factory index for China came in at 48.2 in December, missing the median analyst estimate of 48.9 in a Bloomberg survey, after the nation’s first official economic report of 2016 on Jan. 1 signaled manufacturing weakened for a fifth month, the longest such streak since 2009.

The MSCI All-Country World Index fell 1 percent by 8:24 a.m. in New York, its biggest drop since Dec. 18. China’s CSI 300 Index of large-capitalization companies listed in Shanghai and Shenzhen fell 7 percent, setting off a circuit-breaker that suspended trading for the rest of the day. The Stoxx Europe 600 Index fell 2.6 percent, heading for its worst start of the year ever as more than 580 of its companies fell...

more

Proserpina

(2,352 posts)The amount of debt that the governments of the world’s leading economies will need to refinance in 2016 will be little changed from last year as nations make strides in cutting budget deficits to a third of the highs seen during the financial crisis.

The value of bills, notes and bonds coming due for the Group-of-Seven nations plus Brazil, China, India and Russia will total $7.1 trillion, compared with $7 trillion in 2015 and down from $7.6 trillion in 2012. Japan, Germany, Italy and Canada will all see redemptions fall, while the U.S., China and the U.K. face increases, data compiled by Bloomberg show.

The amount of maturing debt has gradually fallen since Bloomberg began collating the data in 2012. The decline may bring some support to the bond market as the U.S. Federal Reserve gradually raises interest rates, pushing yields up from record lows. Budget deficits are forecast by economists to narrow for a seventh straight year in 2016 as governments extend the maturity of their outstanding debt and continue to cut back on the extra spending put in place to combat the global financial meltdown.

“Most of these countries are moving toward fiscal discipline,” said Mohit Kumar, head of rates strategy at Credit Agricole SA’s corporate and investment-banking unit in London. “There was fiscal expansion during the crisis for various reasons: to support growth and to shift liabilities from the private sector into the public sector. Those effects are going away.”

more

Proserpina

(2,352 posts)A free-trade accord giving Ukraine tariff-free access to EU markets has come into effect under an association deal between Brussels and Kyiv. Meanwhile, Russia has banned food imports from its southwestern neighbor.

The long-awaited introduction of the EU's free-trade deal with Ukraine on Friday coincided with the imposition of Moscow's food embargo on the country.

The implementation of the accord was delayed by a year, as the EU and Ukraine sought to address Russian concern about a broader EU Association Agreement that was at the heart of a breakdown in relations between Kyiv and Moscow.

However, no agreement was reached despite more than 20 three-way meetings between the parties.

Ukraine, a traditional satellite of Russia, looks poised to increasingly gear its economy towards the 28-member bloc. Kyiv will be expected to adapt to EU standards in areas such as public procurement, intellectual property rights and, crucially, competition...

antigop

(12,778 posts)Proserpina

(2,352 posts)In other news, the ponds froze for the first time this winter, and it's snowing and sticking, to boot. Instant winter, just add January. Snow wasn't in the forecast, mind you. Looks like it's lake-effect snow, because there's no water vapor drifting in from anywhere.

Fuddnik

(8,846 posts)Lucky you're not in Buffalo.

We're down to a bone-chilling 65 today, but winter will be over by Thursday, with highs near 80 again.

Tansy_Gold

(17,868 posts)(Not a very long article. All emphasis added by TG)

For VW, the fallout has been long and damning. The company's share price fell off a cliff immediately after the first allegations, and has only recovered a little bit in the months since. The CEO has been replaced. The episode prompted EPA to overhaul its emissions testing procedures to better catch similar evasion tactics in the future. And the company now faces lawsuits from pissed-off drivers and car dealers.

The suit today represents the Obama administration's first steps to follow up on the EPA's allegations. The suit says that VW could be liable for up to $6,500 in fines per vehicle—totaling to more than $3 billion—and adds that recalls or other possible remedies are still being considered. It also says that criminal charges haven't yet been ruled out. Volkswagen didn't immediately respond to a request for comment about the new suit.

Fuddnik

(8,846 posts)It wasn't that long ago we were at or near parity.

I saw some Canadian tourists on the local news the other night talking about how expensive their winter vacations were this year.

Proserpina

(2,352 posts)Pulled the sheets right off the Canadian bed, so to speak.

PassingFair

(22,434 posts)You can bet I've been pulling some overnight get-aways lately!