2016 Postmortem

Related: About this forum''That's what they offered."

"Why did you accept $675,000 from Goldman Sachs to speak?"

Hillary Clinton is going to really regret saying these 4 words about Goldman Sachs

By Chris Cillizza

Washington Post, February 4

Hillary Clinton spent an hour talking to CNN's Anderson Cooper and a handful of New Hampshire voters in a town hall on Wednesday night. For 59 minutes of it, she was excellent — empathetic, engaged and decidedly human. But, then there was that other minute — really just four words — that Clinton is likely to be haunted by for some time to come.

"That’s what they offered," Clinton said in response to Cooper's question about her decision to accept $675,000 in speaking fees from Goldman Sachs in the period between serving as secretary of state and her decision to formally enter the 2016 presidential race.

The line is, well, bad. More on that soon. But, the line when combined with her body language when she said it makes it politically awful for her.

Clinton is both seemingly caught by surprise and annoyed by the question all at once. Neither of those is a good reaction to what Cooper is asking. Both together make for a uniquely bad response.

CONTINUED...

https://www.washingtonpost.com/news/the-fix/wp/2016/02/04/4-words-on-goldman-sachs-that-hillary-clinton-is-going-to-really-regret/?tid=hybrid_experimentrandom_3_na

Video etc. etc. etc. at link.

antigop

(12,778 posts)Most top GOP fundraisers and donors on Wall Street won’t say this kind of thing on the record for fear of heavy blowback from party officials, as well as supporters of Cruz and Rand Paul. Few want to acknowledge publicly that the Democratic front-runner fills them with less dread than some Republican 2016 hopefuls. And, to be sure, none of the Republican-leaning financial executives are so far suggesting they’d openly back her.

But the private consensus is similar to what Goldman Sachs CEO Lloyd Blankfein said to POLITICO late last year when he praised both Christie — before the bridge scandal — and Clinton. “I very much was supportive of Hillary Clinton the last go-round,” he said. “I held fundraisers for her.”

Octafish

(55,745 posts)Wall Street keeps what they win at the casino and when they lose it's Main Street what gets to pick up the tab.

The repeal of Glass-Steagall in 1999 spelled disaster in the 2008 Bankster Bailout. The Democratic president who signed it into law was working in a spirit of bi-partisanship with his Republican Senate colleague to encourage new areas of banking by deregulating the financial industry cough gutting the New Deal protections of the Wall Street casino from using taxpayer-backed bank deposits.

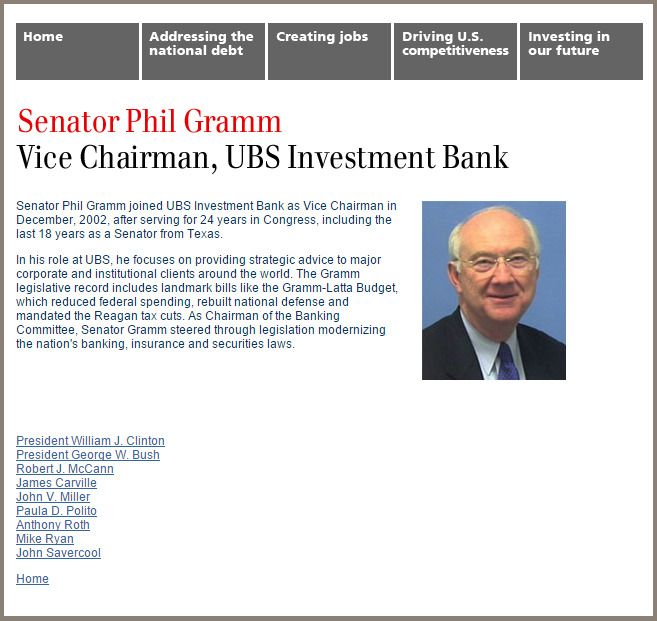

See if you can spot some familiar names on this list:

They now work together at UBS -- which received uncounted billions in bailout money -- to specialize in some kind of "Weath Management."

PS: Forensic economist and former Fed regulator William K. Black wrote it reminds him of what happened during the Savings and Loans Crisis of the late 80s and early 90s. At the time, that was the greatest bank heist in history.

antigop

(12,778 posts)Octafish

(55,745 posts)Ask the Waltons. Important history from 1992 campaign:

Bush Ventures to Clinton Turf, Honors Sam Walton

Republicans: The trip to Arkansas is billed as nonpolitical. The gravely ill Wal-Mart founder is given the Medal of Freedom.

by Douglas Jehl

Los Angeles Times, March 18, 1992

BENTONVILLE, Ark. — On the day Arkansas Gov. Bill Clinton emerged as the prohibitive favorite to win the Democratic presidential nomination, President Bush visited the governor's home state on a trip he insisted had nothing to do with politics.

Bush made the journey to present the Medal of Freedom, the nation's highest civilian honor, to one of its richest men, Sam Walton, the gravely ill 73-year-old founder of Wal-Mart Stores.

SNIP...

Walton, who built the Wal-Mart empire from one store to a $9-billion fortune, now is confined to a wheelchair, and Bush choked up during the ceremony at the company's headquarters in Bentonville as he praised the entrepreneur as an emblem of "America's success."

"I think it's important that all Americans understand that some things are going very, very well in the United States of America," Bush said. "And one of those things is Wal-Mart."

SNIP...

Wal-Mart has retained its Arkansas roots even as it has grown beyond the region. The chain also has links to the Clintons--the governor's wife, Hillary, has a substantial financial stake in the company and serves on its board of directors.

Walton's family has generously supported many of Clinton's past campaigns. This year, Walton has contributed the legal maximum of $1,000 to both Clinton and Bush.

CONTINUED...

http://articles.latimes.com/1992-03-18/news/mn-3841_1_sam-walton

Walmart continued to grow since then, making the heirs of Sam Walton very wealthy. Most everyone else in the USA has not done so well.

reformist2

(9,841 posts)Octafish

(55,745 posts)Big Leaguers.

Evidence of an American Plutocracy: The Larry Summers Story

By Matthew Skomarovsky

LilSis.org

Jan 10, 2011 at 19:31 EST

EXCERPT...

Another new business model Rubin and Summers made possible was Enron. Rubin had known Enron well through Goldman Sachs’s financing of the company, and recused himself from matters relating to Enron in his first year on the Clinton team. He and Summers went on to craft policies at Treasury that were essential to Enron’s lucrative energy trading business, and they were in touch with Enron executives and lobbyists all the while. Enron meanwhile won $2.4 billion in foreign development deals from Clinton’s Export-Import Bank, then run by Kenneth Brody, a former protege of Rubin’s at Goldman Sachs.

Soon after Rubin joined Citigroup, its investment banking division picked up Enron as a client, and Citigroup went on to become Enron’s largest creditor, loaning almost $1 billion to the company. As revelations of massive accounting fraud and market manipulation emerged over the next years and threatened to bring down the energy company, Rubin and Summers intervened. While Enron’s rigged electricity prices in California were causing unprecedented blackouts, Summers urged Governor Gray Davis to avoid criticizing Enron and recommended further deregulatory measures. Rubin was an official advisor to Gov. Davis on energy market issues at the time, while Citigroup was heavily invested in Enron’s fraudulent California business, and he too likely put pressure on the Governor to lay off Enron. Rubin also pulled strings at Bush’s Treasury Department in late 2001, calling a former employee to see if Treasury could ask the major rating agencies not to downgrade Enron, and Rubin also lobbied the rating agencies directly. (In all likelihood he made similar attempts in behalf of Citigroup during the recent financial crisis.) Their efforts ultimately failed, Enron went bust, thousands of jobs and pensions were destroyed, and its top executives went to jail. It’s hard to believe, but there was some white-collar justice back then.

SNIP...

Summers also starting showing up around the Hamilton Project, which Rubin had just founded with hedge fund manager Roger Altman. Altman was another Clinton official who had come from Wall Street, following billionaire Peter Peterson from Lehman Brothers to Blackstone Group, and he left Washington to found a major hedge fund in 1996. The Hamilton Project is housed in the Brookings Institution, a prestigious corporate-funded policy discussion center that serves as a sort of staging ground for Democratic elites in transition between government, academic, and business positions. The Hamilton Project would go on to host, more specifically, past and future Democratic Party officials friendly to the financial industry, and to produce a stream of similarly minded policy papers. Then-Senator Obama was the featured political speaker at Hamilton’s inaugural event in April 2006.

Summers joined major banking and political elites on Hamilton’s Advisory Council and appeared at many Hamilton events. During a discussion of the financial crisis in 2008, Summers was asked about his role in repealing Glass-Stegall, the law that forbade commercial and investment banking mergers like Citigroup. “I think it was the right thing to do,” he responded, noting that the repeal of Glass-Stegall made possible a wave of similar mergers during the recent financial crisis, such as Bank of America’s takeover of Merrill Lynch. He was arguing, in effect, that financial deregulation did not cause the financial crisis, it actually solved it. “We need a regulatory system as modern as the markets,” said Summers — quoting Rubin, who was in the room. “We need a hen house as modern as the food chain,” said the fox.

CONTINUED...

http://blog.littlesis.org/2011/01/10/evidence-of-an-american-plutocracy-the-larry-summers-story/

They're all doing great things moving their loot offshore. Ask for UBS Wealth Management.

Kip Humphrey

(4,753 posts)It doesn't mean I will reciprocate! (no to Glass-Steagall, no to breaking up too-big-to-fail financial institutions).

![]()

PoliticAverse

(26,366 posts)how much the speaker wants, and they agree to it or don't. If Hillary wants too much they can

always go with Chelsea: http://college.usatoday.com/2015/06/30/university-of-missouri-chelsea-clinton-speaker/

NurseJackie

(42,862 posts)She should have asked for 21% more! (And probably would have received it.)

Clearly, she's an in-demand speaker, there's no doubt about that.

Go, Hillary! ![]()

![]()

![]()

morningfog

(18,115 posts)PoliticAverse

(26,366 posts)a great deal more.

antigop

(12,778 posts)If she supports overturning CU, then she admits there's a problem with money in politics,

Oh...it's because it's only OTHER people who are influenced...not her.

stillwaiting

(3,795 posts)UglyGreed

(7,661 posts)if you can get it ![]()

Octafish

(55,745 posts)

Here are a few slices of life from those who'd get a friendly return phone call:

Warren Buffett: He made $12.7 billion this year or ~$37 million per day; ~$1.54 million per hour; or ~$25,694 per minute.

Bill Gates: He earned $11.5 billion this year which works out to be ~$33.3 million per day; $1.38 million per hour; or ~$23,148 per minute.

Sheldon Adelson: The casino mogul earned $11.4 billion this year which means he made ~$33 million per day; ~$1.38 million per hour; or $22,946 per minute.

Jeff Bezos: He made $11.3 billion this year or ~$32.7 million per day; $1.36 million per hour; or ~$22,745 per minute.

Mark Zuckerberg: The Facebook founder made $10.5 billion this year or ~$30.4 million per day; ~$1.27 million per hour; or ~$21,135 per minute.

Masayoshi Son: He made $10.3 billion this year or ~$29.86 billion per day; ~$1.24 million per hour; or $20,732 per minute.

Sergey Brin: He made $9.3 billion this year which works out to be ~$26.9 million per day, $1.12 million per hour; or $18,719 per minute.

Larry Page: He made $9.3 billion this year which works out to be ~$26.9 million per day, $1.12 million per hour; or $18,719 per minute.

Lu Chee Woo: He brought in $8.3 billion this year or ~$24 million per day; ~$1 million per hour; or ~$16,706 per minute.

Carl Icahn: The billionaire investor made $7.2 billion this year, which works out to be ~$20.87 million/day; ~$869,565/hour; or ~$14,492/minute.

SOURCE: http://www.businessinsider.com/what-warren-buffett-makes-per-hour-2013-12

So, a billionaire makes about as much as the average schmuck working three part-time, minimum wage jobs for a year, per minute. Then, they move it offshore. Ask the Waltons and DeVoses and Kochs: It's all legal.

UglyGreed

(7,661 posts)we are here to serve and we should just accept what crumbs which fall from their plates it seems.

Octafish

(55,745 posts)From what I can see: The plutocrats must believe that a healthy, educated, happy, and prosperous people are a danger to their positions of privilege. That's why they hate Democracy.

99Forever

(14,524 posts)Just Clinton business as usual.

Nuttin' ta seee here. Move along move along.................