Two things it is vital to take away from this piece:

1) The American economy is not going deeper into debt. The

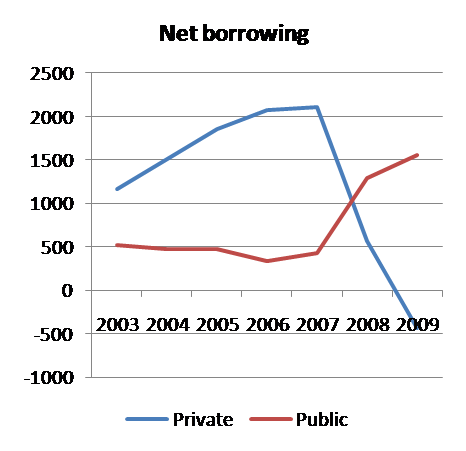

Federal Government is going deeper into debt because the entire rest of the country is NOT going deeper into debt. Borrowing in the American economy is DOWN. Let the chart sink in and notice that it goes below zero. (Borrowing below zero is paying off existing debt and I think is counted as part of 'the savings rate') Net American borrowing went from 2500 billion in 2007 to 1000 billion in 2009... a staggering drop. And because people are not borrowing much to build things and such there is MORE American investment capital out there looking for safe places to park money... like US Treasuries. Our burgeoning federal debt is LESS financed by foreign nations than it was three years ago.

2) Dire concerns about China holding so much of our debt or not buying more of our debt are, no matter how widely held, baseless xenophobic wing-nuttery.

March 15, 2010, 9:00 am

China�s Water Pistol

"China is the biggest buyer of Treasury bonds at a time when the United States has record budget deficits and needs China to keep buying those bonds to finance American debt."...it�s considered obligatory to say this in any article about US-China relations. As it happens, however, while it�s part of what everyone knows, it�s also

completely false. Why don�t people get this? Part of the answer is that it�s really hard for non-economists � and many economists, too! � to wrap their minds around the Alice-through-the-looking-glass nature of economics when you�re in a liquidity trap. Even if they�ve heard of the paradox of thrift, they don�t get the extent to which we�re living in a world where more savings � including savings supplied to your economy from outside � are a bad thing.

Also, and I think harder to forgive, is the way many commentators seem oblivious to how we got here. Yes, we have large budget deficits � but those deficits have arisen mainly as the flip side of a collapse in private spending and borrowing. Here�s what net borrowing by the US private and public sectors looks like in the Fed�s flow of funds report:

The US private sector has gone from being a huge net borrower to being a net lender; meanwhile, government borrowing has surged, but not enough to offset the private plunge.

As a nation, our dependence on foreign loans is way down; the surging deficit is, in effect, being domestically financed.The bottom line in all this is that we don�t need the Chinese to keep interest rates down. If they decide to pull back, what they�re basically doing is selling dollars and buying other currencies � and that�s actually an expansionary policy for the United States, just as selling shekels and buying other currencies was an expansionary policy for Israel (it doesn�t matter who does it!).

http://krugman.blogs.nytimes.com/2010/03/15/chinas-water-pistol/