General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Takeover of our Democracy and our Economy by Wall Street

It is no coincidence that as the influence of money in politics has exploded to levels not seen in our country since prior to the Great Depression of the 1930s, wealth inequality has also reached record high levels – with the giant financial institutions of Wall Street leading the way.

The roots of economic catastrophe

Nobel Prize-winning economist Paul Krugman sums up the anti-regulatory craze that led to our current crisis in his book, “The Return of Depression Economics and the Crisis of 2008” – in which he discusses the “shadow banking system”, which refers to the extreme deregulation of our banking system:

But this warning was ignored, and there was no move to extend regulation. On the contrary, the spirit of the times – and the ideology of the George W. Bush administration – was deeply anti-regulation. This attitude was symbolized by a photo-op… in which representatives of various agencies… used pruning shears and a chainsaw to cut up stacks of regulations. More concretely, the Bush administration used federal power… to block state-level efforts to impose some oversight on subprime lending…

So the growing risks of a crisis for the financial system and the economy as a whole were ignored or dismissed. And the crisis came.

This should not have been surprising. Why should we expect that the results of deregulating financial institutions – or any corporate sector of our economy – should be any different than deregulating organized crime (i.e. doing away with all laws used to control it), for example? Both organized crime and corporate America are focused primarily on a ruthless pursuit of profits and power, and neither is particularly concerned about who gets run over in the process. So when the barriers are purposely removed we should not be too surprised to see lots of people get run over.

It should not be surprising that when the wealthy few are given huge advantages over vast masses of people that they will use their powers to their own advantage. What we have seen in this country since the Reagan presidency is vast expansion of the income and wealth gap in our country, and consequently the accumulation into the hands of the wealthy few vast powers to shape national legislation to their advantage.

Privatizing benefits while socializing the responsibility for the consequences of risks should strike us as the most obvious of frauds. Yet those in power have managed to bamboozle millions of Americans into thinking of it as “throwing off the restraints on free enterprise”.

Behind the deregulation of our financial system – the corruption of democracy by money

Bill Moyers explains in his book, "Moyers on Democracy", that the root of the problem is that our elected representatives in Congress need huge sums of money to finance their campaigns and remain in office. As a result of this:

The Gilded ages – then and now – have one thing in common: audacious and shameless people for whom the very idea of the public trust is a cynical joke…Having cast our ballots in the sanctity of the voting booth, we go about our daily lives expecting the people we put in office to weight the competing interests and decide to the best of their ability what is right…

Twenty-five years ago Grover Norquist had said that “What Republicans need is 50 Jack Abramoffs in Washington…” Well, they got it, and the arc of the conservative takeover of government was completed… Money, politics, and ideology became one and the same in a juggernaut of power that crushed everything in sight…

This crowd in charge has a vision sharply at odds with the American People. They would arrange Washington and the world for the convenience of themselves and the transnational corporations that pay for their elections… The people who control the U.S. government today want “a society run by the powerful, oblivious to the weak, free of any oversight, enjoying a cozy relationship government, and thriving on crony capitalism

If Republicans are the cheerleaders for the 1%, Democrats are collaborationists

Goron Lafer makes it clear in an article titled "Why Occupy Wall Street Has Left Washington Behind" that, though the Republicans are worse, both parties are to blame:

Gifts by our government to Wall Street

Bush administration – the Bush-Paulson bailout

Robert Scheer explains, in “The Great American Stickup”, how the financial industry bailout began under President Bush’s Secretary of the Treasury, Henry Paulson, and worked for the benefit of Wall Street, especially for Goldman Sachs:

What we have here is a rare glimpse into the workings of the billionaires’ cub, that elite gang of perfectly legal loan sharks who in only the most egregious cases will be judged as criminals… These amoral sharks, who confiscated billions from shareholders and the 401(k) accounts of innocent victims, were rewarded handsomely, rarely needing to break the laws their lobbyists had purchased…

In September 2008 came {Paulson’s} infamous three-page, take-it-or-leave-it proposal to Congress that the government fork over $700 billion in bailout funds, and he was successful in insisting that no strings be attached in the form of punishment for CEOs, oversight or control on bonuses… Basically they gave Congress a ransom note: “We’ve got your 401(k) and if you want to see your 401(k) alive again, give us $700 billion in unmarked bills”. The threat worked, and the bailout intrusion into the ostensibly free market of a scope unprecedented in U.S. history passed by a wide margin in Congress, with few questions asked…

Obama administration

Continuation of the Bush bailout by the Obama administration

The bailout continued under the Obama administration. As the Obama administration was considering putting Treasury Secretary Tim Geithner’s plan into effect – which was largely a continuation of the Bush administration plan – several eminent non-corporate economists warned them and us of the consequences. They used different words, but their basic description of the Geithner plan was the same: a reverse Robin Hood scheme, conducted behind closed doors:

Paul Krugman wrote:

In other words, this is a gift from the American taxpayers to the banks. Krugman added:

What Joseph Stiglitz had to say about the Geithner bailout plan was very similar to what Krugman said:

Long after these warnings were ignored by the Obama administration, and the continued bailout of Wall Street was widely recognized as a dismal failure in which Wall Street used their taxpayer funded gift almost solely to enrich themselves, Robert Reich put the issue in perspective:

Homeowners can’t use bankruptcy to reorganize their mortgage loans because the banks have engineered laws to prohibit this. Banks have also made it extremely difficult for young people to use bankruptcy to reorganize their student loans. Yet corporations routinely use bankruptcy to renege on contracts.

Little help for homeowners

Given that home foreclosures were at the heart of our economic crisis, one would hope that government interventions would be targeted towards helping homeowners rather than relying on a trickle down sort of solution in which primarily banks were targeted for relief. But it didn’t work out like that. Help for homeowners would cut into Wall Street’s profits. As William Greider noted:

William Kuttner in his book, "A Presidency in Peril – The Inside Story of Obama’s Promise, Wall Street’s Power, and the Struggle to Control our Economic Future", describes how this crisis was handled by both the Bush and Obama administrations:

Obama’s solution was a program called "Making Home Affordable". Kuttner explains that this program had several fatal flaws. Perhaps the most fundamental flaw was that it was voluntary for the banks. Instead of mandating actions on the part of banks, they were given various “incentives”. But the incentives weren’t enough to make it worth the bank’s while to provide much help to homeowners. In fact, in many cases they had an incentive to foreclose rather than help the homeowner stay in the home. Consequently, the banks offered very little help for most homeowners.

There was one provision of Obama’s bill that had some teeth. That was the proposed authority of bankruptcy judges to compel banks to modify loans to prevent foreclosures. This provision was fiercely resisted by the financial industry, and therefore given very little support by the Obama administration. Kuttner explains:

The only provision of the bill that was opposed by the financial industry therefore died in the Senate. Kuttner commented on the difference in government solicitude for banks, compared with the rest of us – the bottom 99%:

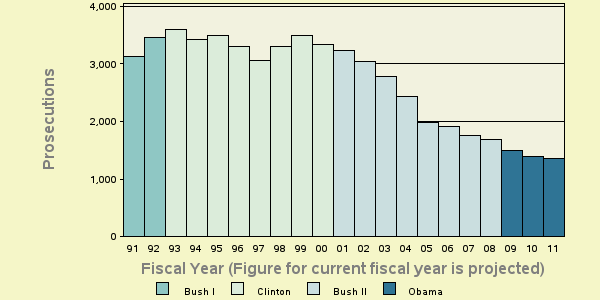

Declining prosecutions for financial institution fraud

One would hope that, with the wild excesses and evidence of fraud committed by our large financial institutions during the Bush and Obama administrations, that our federal government would have been especially active in prosecuting those responsible. But to the contrary, a simple chart that requires no comment tells the story:

[font color="red"]Criminal Financial Institution Fraud Prosecutions over the Last 20 Years[/font]

The money behind the gifts to Wall Street

Much was made about the large amounts of money that the Obama campaign amassed from small donors in 2008. It is true that the Obama campaign raised a great deal of money from small donors. In 2008, 30% of his record-breaking $745 million campaign donations came from small donors (defined as $200 or less). But what about the other 70 percent? Ari Berman puts the issue into perspective:

Of the $89 million raised in 2011 by the Obama Joint Victory Fund, a collaboration of the Democratic National Committee (DNC) and the Obama campaign, 74 percent came from donations of $20,000 or more and 99 percent from donations of $1,000 or more.

The campaign has 445 "bundlers" (dubbed “volunteer fundraisers” by the campaign), who gather money from their wealthy friends and package it for Obama. They have raised at least $74.4 million for Obama and the DNC in 2011. Sixty-one of those bundlers raised $500,000 or more. Obama held seventy-three fundraisers in 2011 and thirteen last month alone, where the price of admission was almost always $35,800 a head.

Three of Obama’s top seven contributors in 2008 were financial industry giants:

Goldman Sachs: $1,013 thousand

JP Morgan Chase: $809 thousand

Citigroup: $737 thousand

Morgan Stanley wasn’t far behind, at $512 thousand. By contrast, John McCain received less than a million dollars combined from those three institutions. Those contributions were not made with altruistic purposes in mind. As noted above, the financial giants were very well compensated by the Obama administration during his first presidential term.

Wall Street now loves Romney even more than Obama

Yet despite the Obama administration’s very generous treatment of Wall Street, the 2012 election cycle is turning out to be a very different matter. Five of Romney’s top six contributors so far have been financial industry giants:

Goldman Sachs: $636 thousand

JP Morgan Chase: $503 thousand

Morgan Stanley: $476 thousand

Bank of America: $466 thousand

Citigroup: $345 thousand

And this campaign is far from over. Undoubtedly, by the time it’s over, financial industry contributions to Romney’s campaign will dwarf even their huge contributions to the 2008 Obama campaign. And by contrast, the five institutions noted above aren’t even among Obama’s top 20 contributors in 2012, which ends at $127 thousand.

Why the desertion by Wall Street of Obama for Romney, after the Obama administration treated them so well? Obama did sign legislation requiring some regulation of the financial industry, and he did engage in some populist rhetoric against the excesses of Wall Street. Even that was too much for them. It’s hard to imagine, but a Romney administration is likely to dole out even more welfare to the financial industry that the Obama administration did.

The power of the 1% in American politics

Ari Berman summarizes the issue in "Occupy Wall Street Hits K Street":

The problem continues to worsen, accelerating with every election cycle. In 2008, Barack Obama became the first major party nominee to decline federal matching funds – in order to avoid limits on campaign spending. 2012 will mark the first Presidential election where both major party candidates refused federal matching funds for that reason.

In 2010, 1 percent of the 1 percent accounted for 25 percent of all campaign-related donations ($774 million) and 80% of all donations to the two major parties. Despite the severe unpopularity of the giant financial institutions in the United States today, the money they supply to political campaigns remains a major force in American politics. Stephen Colbert noted that half of the money raised by Super PACs in 2011 came from

just twenty-two people. That’s seven one-millionths of 1 percent of Americans.

Robert Reich’s suggestions on what needs to be done

In "'Big Government' Isn't the Problem, Big Money Is", Robert Reich, who resigned as Bill Clinton’s Secretary of Labor because of insufficient support for his recommendations, suggests what needs to be done:

Don’t focus solely on Washington or entirely on elections. Corporate campaigns – consumer boycotts of companies behind the largest political contributions, media attention to those that award top executives the fattest compensation packages while laying off the most workers – can play an important role. And when candidates are the targets, don’t wait for them to emerge with agendas and policy positions. Take an active role in creating those agendas – and get candidates to run on them.

We should demand, for example, that the marginal income tax on the top 1 percent return to what it was before 1981 – at least 70 percent; that a transactions tax be imposed on all Wall Street deals; that distressed homeowners be allowed to reorganize their mortgages under bankruptcy; that Medicare be available to all; that the basic military budget be cut by at least 25 percent over the next decade; that the Glass-Steagall Act be resurrected and Wall Street’s biggest banks be broken up; and that all political contributions be disclosed, public financing be made available to candidates in general elections and a constitutional amendment be enacted to reverse Citizens United.

Tell incumbents you’ll work your heart out to get them re-elected on condition they campaign on such an agenda… Newly elected officials must know that we will continue to mobilize support for a progressive agenda, reward them for pushing it and hold them accountable in the next election cycle if they don’t. We will even go so far as to run candidates against them in their next primary – candidates who will run on that agenda.

Progressives must take back our economy and our democracy from a regressive right backed by a plutocracy that has taken over both.

Junkdrawer

(27,993 posts)given to the most sociopathic managers by owners with the souls of Paris Hilton and judged by one metric:

Return On Investment

They've sucked up as much as the can from the lower classes. Now they set their sights on Social Security and Medicare.

Soon the only place they can get the money will be from each other. And when the elephants dance, the mice tremble.

Time for change

(13,714 posts)Like the plantation owner slavemasters of the Old South, there is a limit to how badly they can treat those whose labors they depend upon for their own well-being.

The key is for the rest of us to recognize what is happening and to unite in our efforts against those who currently control our lives, our futures, and the future of our planet.

HiPointDem

(20,729 posts)fleeing from the french revolution.

onethatcares

(16,166 posts)the entire banking fuck of us but I really hate the $3.00 begging emails.

Although I'm a Democrat and a supporter of President Obama, when he's raking in millions from the same

companies that are screwing the little guy over, I wonder, "What's the use?" "Is my voice heard and is the

same attention paid to it as to JCMorgan?"

Time for change

(13,714 posts)elected officials.

Is the same attention paid to your voice as that of JP Morgan Chase and other giant financial institutions? I think the record speaks for itself, and the answer is NO. The Citizens United decision and other USSC decisions have shifted the discourse in this country way to the right. When money is considered a form of speech, then the wealthy have much more access to speech than we have, and result is that both parties try to please the wealthy much more than is healthy for a democracy.

Zorra

(27,670 posts)Most progressives are either too comfortable or too afraid to take any effective action to remedy the situation. Many believe that voting will somehow magically solve this problem, and this is the most unrealistic expression of delusional woo of this century so far. Purple pigs will be flying over Peoria before voting will ever affect the 1% plutarchy in any way except make it stronger.

The only possibility of toppling the 1% is through citizen mass non-compliance with the system - boycotts, strikes, and civil disobedience.

The 1% are living in gated communities consisting of ivory towers.

The only way we can get them out of power is to get enough concerned people to surround them, and starve them out.

And as we can see with Occupy, there are only a very, very few people in this country who are courageous enough risk their well being in any sort of serious attempt to take back our democracy and our economy. It's really sad; sad, but true.

Time for change

(13,714 posts)except that I believe that there is a tipping point at which enough people will get mad enough or uncomfortable enough that they will engage in corrective action that will change things for the better. The main question is where is that tipping point?

I hope they get mad enough before they get uncomfortable enough. But I'm afraid that by the time that happens it may be too late to save us from disaster -- that is, a planet made much more uninhabitable than it is today, due to the cumulative effects of climate change and/or widespread war.

Zorra

(27,670 posts)I could have written your post (#5) word for word.

sabrina 1

(62,325 posts)If the entire Democratic half of the country understood that you have to do more than just 'shut up and vote', there would be some hope of changing things.

But once the Dem half of the equation was infiltrated by the Third Way, in a way, that is OUR Tea Party, a lot more subtle, but very effective in changing the face AND philosophy of the Dem Party, the advantage for the 1% was enormous. Now they own One and Half of the political parties.

People have tried to compare Occupy with the Tea Party when there is zero comparison to be made. The Tea Party, like the Third Way, are well funded organizations designed to not only keep the Status Quo going but to keep on moving the money up the scale.

Occupy is a grassroots Social Justice Movement and in no way compares to the Tea Party. And it has not funding, and an awful lot of Dems, influenced by the Third Way rhetoric, who fear it just as much as the supporters of the 1% fear.

DemReadingDU

(16,000 posts)Truly shocking the gazillions of money that is being used to buy our politicians.

I wonder that people think this has been going on for so long, they think it is now normal? It is not normal, the money has to get out of politics. I don't know how to deter politicians from accepting so much in donations, but the people need to get so upset that there is a tipping point. Unfortunately, I don't think that will come until people get so downtrodden that there is no other way except to revolt in some manner. I doubt this will come in my lifetime (mid-60s), but more likely my children and grandchildren.

Time for change

(13,714 posts)it's been going on so long.

Additionally, our national news media rarely questions the propriety of buying our elected officials, and many people seem to believe that if it's not criticized by our national news media then it must be ok.

DemReadingDU

(16,000 posts)So many don't see the propaganda that is constantly fed to them every day via TV and that they are being brainwashed. Whatever happened to people's thinking skills?

I am so thankful for the Internets that I can seek out a truer picture of what is going on.

Thanks for all your essays!

Overseas

(12,121 posts)Then I hoped the Bush Crash would be a tipping point and give Democratic legislators the courage to push to strengthen the New Deal with Medicare for All in consideration of the hundreds of thousands losing their homes... and strong financial re-regulation, even with the people he had in charge... The jig was supposed to be up at that point, or so I thought.

I'd love to see a tiny transaction tax on Wall Street. Those millions of robo-trades scare me. And commodity futures trading's global effects. And so much more.

woo me with science

(32,139 posts)Octafish

(55,745 posts)Government has gone from the role of referee making sure the game is fair and square to active player for the rich team, ensuring a game where the field is tilted downhill for permanent one-way trickle-down. Of course they stay in ref's stripes to make certain the Plutos get every break and call.

Thank you for a remarkable and outstanding OP, Time for Change.

Time for change

(13,714 posts)Especially Scalia. Bush v. Gore, Citizens United. These people damage our democracy as much as anyone. I would love to see Scalia and Thomas impeached -- and prosecuted too, assuming the someone uncovers the deals behind some of their more outrageous decisions. But even in the absence of a smoking gun, they should be impeached.

Overseas

(12,121 posts)hay rick

(7,607 posts)Last edited Sun Aug 12, 2012, 09:01 PM - Edit history (1)

Parts I particularly appreciated in your description of our tattered democracy:

Quoting Lafer:

The Krugman and Stiglitz commentary on Geithner's plan is all painfully on point.

You provide this astonishing, nightmarish statistic:

And Robert Reich provides a one paragraph summary of what the Democratic Party platform should be but won't:

Time for change

(13,714 posts)They should make all Americans wonder about the state of our democracy -- not to mention an economy that facilitates such gross inequalities in wealth.