General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhat percentage of seniors have Social Security payments as their only income?

They will soon starve to death if the payments stop!

Ohiogal

(31,901 posts)Trump supporters?

I just don’t get it.

blueinredohio

(6,797 posts)WhiteTara

(29,692 posts)it will hurt "the right people" not them.

blueinredohio

(6,797 posts)Then couldn't believe it when it happened to their so?

WhiteTara

(29,692 posts)Mariana

(14,854 posts)There's no way to convince them otherwise.

KentuckyWoman

(6,679 posts)It's pretty consistent around here. Whether low income or good income in this neck of the woods, the ones who tend to go Republican will indeed do so down ticket - but not for Trump. They've mostly all had it. Maybe 1 exception in this entire community of over 1000 seniors.

It doesn't mean they'll actively vote Biden, but I don't see many of them supporting Trump. Anectodal, non scientific.

I can't really say beyond that - the Covid "safer at home" for people like me means all the event at the local senior center are cancelled.

drray23

(7,615 posts)Using data from the Current Population Survey ( CPS ), SSA estimates that in 2014, about 84 percent of people aged 65 or older received Social Security benefits; and among those in the bottom 40 percent of the income distribution, benefits accounted for an average of around 84 percent of total income ( SSA 2016b).

Wellstone ruled

(34,661 posts)Newest Reality

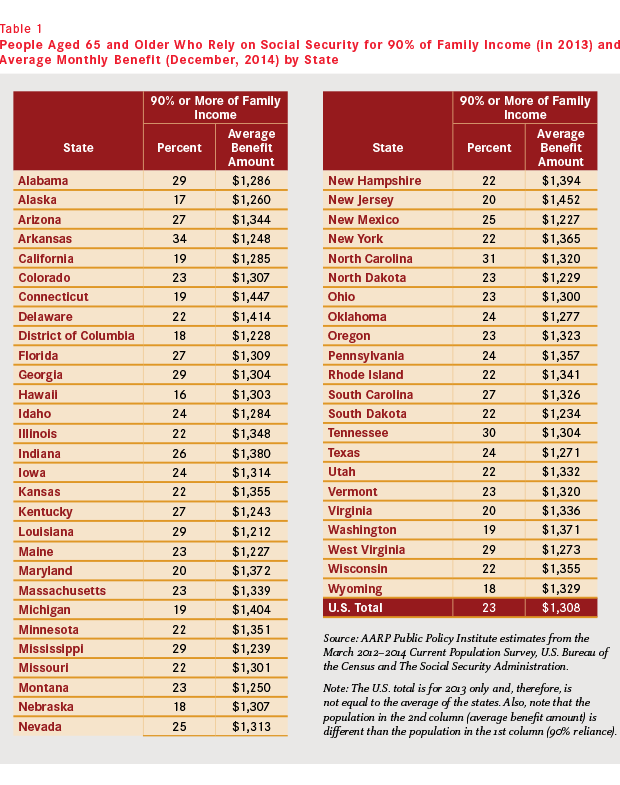

(12,712 posts)It is from several years ago, but there should be updated stats available.

https://www.aarp.org/ppi/info-2015/people-aged-65-and-older-who-rely-on-social-security-for-90-percent-of-family-income-and-average-monthly-benefit-by-state.html

drray23

(7,615 posts)so basically a full quarter of us senior households.

it would be devastating.

Newest Reality

(12,712 posts)Plus, it will also impact those who have other means, of course. It all depends on their net income and many who are not totally dependent on SS may be still be on a fixed income. It would be a cut.

That means harder times and more insecurity and uncertainty for some people are not in that that percentile, as well.

Another issue here is that the people who are collecting retirement benefits are ENTITLED to that as we all know. They paid into it and rightfully deserve a return. That's an important contention.

They shouldn't treat this like some form of handout.

In fact, the income cap should be raised immediately, IMHO. Let those doing well pay more into the system to support and strengthen it.

sinkingfeeling

(51,436 posts)Guess that's why they voted overwhelmingly for MF45.

redstatebluegirl

(12,265 posts)SharonClark

(10,014 posts)I honestly thought it would be higher in some states.

katmondoo

(6,454 posts)die.

lostnfound

(16,161 posts)Be sad for the country, sure. But don’t be scared of anything. You have a community to turn to.

![]()

redstatebluegirl

(12,265 posts)hopefully, we can help you live out your life fully. I'm 70ish and frightened of this clown PINO myself. But we as caring Americans will muddle through.

justhanginon

(3,289 posts)if some recipients depend on it for 84% of their income and they lose it ($1098) they are left with $210 per month to live on.

I think I figured that right but it is early and I am old so you math folks might want to check.

Gidney N Cloyd

(19,818 posts)The way I'd figure it is if the avg SS pmt is $1,308 and that's 84% of a person's total income then their total income is about $1,557, meaning they're drawing about $249 a month from some non-SS source.

justhanginon

(3,289 posts)$500.00 a month doesn't go far and even their non SS source could easily dry up in this economy.

ProfessorGAC

(64,827 posts)For 25% of seniors, SS is 90% or more of total income.

In addition, (Fact 6 at the link) 4 in 10 recipients would slip below the poverty line without those payments.

Social Security provides the majority of income to most elderly Americans. For about half of seniors, it provides at least 50 percent of their income, and for about 1 in 4 seniors, it provides at least 90 percent of income, across multiple surveys and the study that matches survey and administrative data.

https://www.cbpp.org/research/social-security/policy-basics-top-ten-facts-about-social-security

Hoyt

(54,770 posts)an automatic cut of 23%, or so, unless someone does something. Obama tried, and got crucified. We better win in November.

lostnfound

(16,161 posts)totodeinhere

(13,056 posts)something like that would be allowed to happen.

onethatcares

(16,161 posts)Even if you don't receive this benefit you know someone that does and you should be very aware that if Payroll Taxes are eliminated, so will Social Security and Medicare.

It's not funny, it's not right and it is down right cruel to take what we've worked with the past 70 years and give another tax cut to the wealthiest in the nation. Exactly how many billions of dollars does one need to be satisfied?? How many billions, or even millions of dollars do you have?

I don't write this because I hate "Wealth", I write this because there will be many who lose all they have worked for their entire lives in short order.

Stand up and Speak out. It is your life in the balance.

Critique is appreciated and I am not finished yet.

Zoonart

(11,830 posts)It makes everything that we worked for all of our lives and all of the trust we have given to our Government a total LIE.

If they will take everything we have worked and saved for away... what DO we need them for?

The Republican Party is destroying the Republic. The MSM finds it entertaining.

sarcasmo

(23,968 posts)SamKnause

(13,087 posts)Wellstone ruled

(34,661 posts)are receiving monthly stipends from their IRA's and 401's are a diminishing group. And with this Pandemic ruling daily lives,the new SS Recipients are going to be more dependent on it as their only source of income.

The Trump Recession is hurting our nation worse than the Great Depreciation of 1929. And the recovery will be a decade away.

totodeinhere

(13,056 posts)But I think it's fear mongering to suggest that payments might stop outright.

qwlauren35

(6,145 posts)

What's True

On Aug. 8, 2020, U.S. President Donald Trump said he intended to "terminate the tax," referring to Social Security and Medicare payroll taxes. It's a step that would — if taken in isolation — remove nearly 90% of funding for Social Security benefits, and thus likely pose a threat to the continued existence of those programs.

What's False

In the same remarks, Trump also articulated different and conflicting plans for payroll taxes, saying variously that he would forgive four months' worth of deferred payroll tax obligations, that he would extend the deferral of payroll tax obligations, and that he would permanently "cut" payroll taxes.

What's Undetermined

It's unknown whether Trump had a plan to replace the shortfall in Social Security funding in the event that he eliminated payroll taxes.

totodeinhere

(13,056 posts)n/t