Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMitt Romney admits 'harvesting' companies

Mitt Romney admits 'harvesting' companies

by Scarce

This would be the literal definition of a "vulture capitalist", right?

via David Corn at Mother Jones:

http://www.dailykos.com/story/2012/09/27/1136986/-Mitt-Romney-admits-harvesting-companies

by Scarce

This would be the literal definition of a "vulture capitalist", right?

via David Corn at Mother Jones:

Mother Jones has obtained a video from 1985 in which Romney, describing Bain's formation, showed how he viewed the firm's mission. He explained that its goal was to identify potential and hidden value in companies, buy significant stakes in these businesses, and then "harvest them at a significant profit" within five to eight years.

TRANSCRIPT: Bain Capital is an investment partnership which was formed to invest in startup companies and ongoing companies, then to take an active hand in managing them and hopefully, five to eight years later, to harvest them at a significant profit…The fund was formed on September 30th of last year. It's been about 10 months then. It was formed with $37 million in invested cash. An additional $50 million or so of what I'll call a call pool, which is money that we can call upon if the deals are large enough that they require more than a $2 or $3 million dollar initial investment. Why in the world did Bain and Company get involved in this kind of a business? We're not particularly noted for having years and years of experience in financing. Three reasons. We recognized that we had the potential to develop a significant and proprietary flow of business opportunities. Secondly, we had concepts and experience which would allow us to identify potential value and hidden value in a particular investment candidate. And third, we had the consulting resources and management skills and management resources to become actively involved in the companies we invested in to help them realize their potential value.

http://www.dailykos.com/story/2012/09/27/1136986/-Mitt-Romney-admits-harvesting-companies

Mitt clearly has no experience in "financing." He does have experience as a corporate raider.

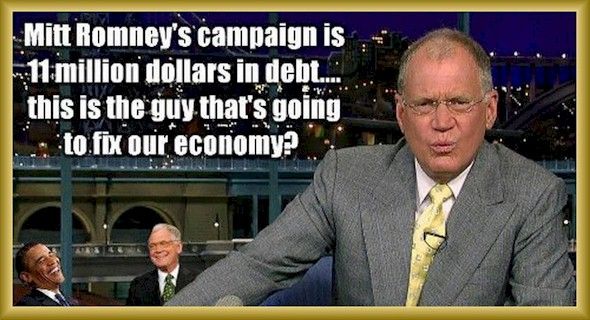

Romney Ended Primary $11 Million in Debt. Is This How He'd Manage the U.S. Economy?

http://www.dailykos.com/story/2012/09/27/1136979/-Romney-Ended-Primary-11-Million-in-Debt-Is-This-How-He-d-Manage-the-U-S-Economy

Romney Campaign spends same as Obama Campaign for HALF the staff.

http://www.democraticunderground.com/10021408243

Staples to close 30 U.S. stores, dealing another blow to Mitt Romney's job creation claims

http://www.democraticunderground.com/10021418679

He’s No Averell Harriman

Fred Kaplan has what I think is the best take so far on Romneyshambles:

I would only add that the bankers of yore operated by building relationships; Bain made its investors money in large part by breaking relationships, e.g. by walking away from implicit promises to workers. It’s not a style that makes for good diplomacy.

http://krugman.blogs.nytimes.com/2012/07/27/hes-no-averell-harriman/

Fred Kaplan has what I think is the best take so far on Romneyshambles:

The thing that Krauthammer doesn’t get is that Romney is not the sort of businessman—that his brand of capitalism is not the sort of enterprise—that requires even the most elementary understanding of diplomacy, courtesy, or sensitivity to other people’s values, lives, or perceptions.

The American capitalists-turned-statesmen of an earlier generation—Douglas Dillon, Averell Harriman, Robert Lovett, John McCloy, Dean Acheson, Paul Nitze—took risks, built institutions, helped rebuild postwar Europe, befriended their foreign counterparts: in short, they cultivated an internationalist sensibility at their core. Whatever you think of their politics or Cold War policies generally (and there is much to criticize), financiers formed an American political elite in that era because finance (through the Marshall Plan, the World Bank, the IMF, and so forth) was so often the vehicle of American expansionism.

By contrast, private-equity firms, such as Bain Capital, where Romney made his fortune, tend to view their client companies as cash cows, susceptible to cookie-cutter formulas from which the firms’ partners reap lavish fees, almost regardless of the outcome. Their ends and means breed an insularity, a sense of entitlement, a disposition to view all the world’s entities through a single prism and to appraise them along a single scale.

I would only add that the bankers of yore operated by building relationships; Bain made its investors money in large part by breaking relationships, e.g. by walking away from implicit promises to workers. It’s not a style that makes for good diplomacy.

http://krugman.blogs.nytimes.com/2012/07/27/hes-no-averell-harriman/

Business Is Not Economics

President Obama gets this exactly right:

A country is not a company — and it’s definitely not a private equity firm.

And here’s the thing: Romney is running for president entirely on the basis of his business success...Once the Bain record becomes a liability instead of a strength, there’s nothing there.

http://krugman.blogs.nytimes.com/2012/07/13/business-is-not-economics/

President Obama gets this exactly right:

When some people question why I would challenge his Bain record, the point I’ve made there in the past is, if you’re a head of a large private equity firm or hedge fund, your job is to make money. It’s not to create jobs. It’s not even to create a successful business – it’s to make sure that you’re maximizing returns for your investor. Now that’s appropriate. That’s part of the American way. That’s part of the system. But that doesn’t necessarily make you qualified to think about the economy as a whole, because as president, my job is to think about the workers. My job is to think about communities, where jobs have been outsourced.

A country is not a company — and it’s definitely not a private equity firm.

And here’s the thing: Romney is running for president entirely on the basis of his business success...Once the Bain record becomes a liability instead of a strength, there’s nothing there.

http://krugman.blogs.nytimes.com/2012/07/13/business-is-not-economics/

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

0 replies, 1217 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (2)

ReplyReply to this post