General Discussion

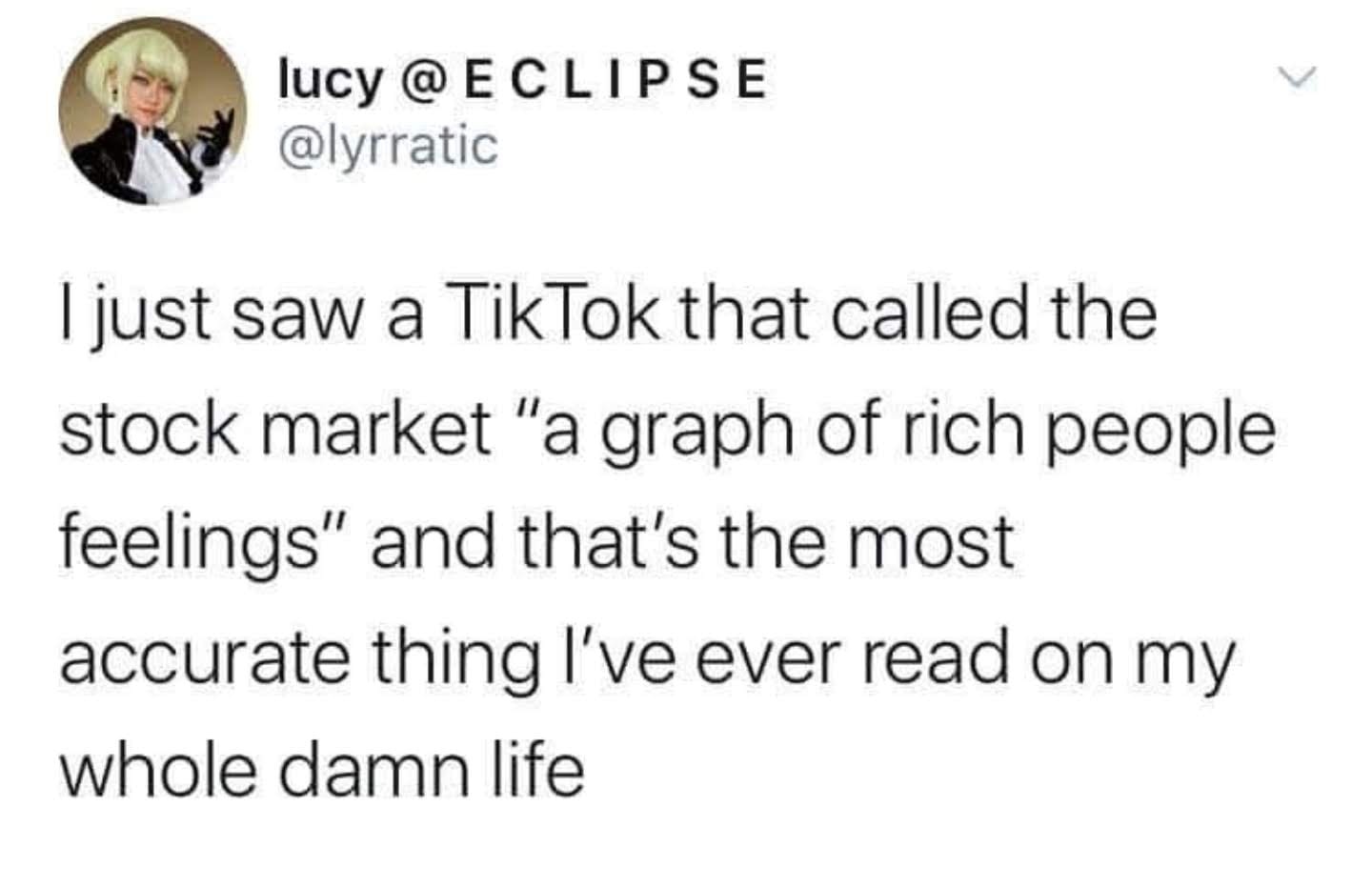

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Stock Market: "A graph of rich people feelings"

?w=600&h=336

?w=600&h=336

?1643155624

?1643155624SYFROYH

(34,154 posts)It really hurts the middle class who don't have pensions anymore and are relying on retired funds.

But the markets are up 15% in the last year, it's been a great bull run. A day or a week of losses shouldn't effect regular 401K holders. As they near retirement age (The only time losses really matter) they should be in less volatile investments anyways.

Here's the thing though, the average worker doesn't understand the markets or finance well enough to direct their own investments. Heck, I have a MBA with a focus on Finance and I don't know enough. So people look at their 401K options for investing and think they can tune them and beat the market and they lose big. Put your money in the target year for retirement fund and leave it alone completely, the risk of not doing so isn't worth it. Those retirement funds are blended in ways to protect you from risk ad still realize nice returns.

And of course people end up borrowing out their 401Ks or withdrawing early in tough times, and that's a disaster too. Pensions de-risked all of this, going away from them is something the middle class will suffer from for generations.

mahatmakanejeeves

(57,262 posts)Last edited Wed Jan 26, 2022, 01:17 PM - Edit history (2)

Now they tell me. Maybe about one out of ten times I've tried catching a falling knife, I ended up without blood on my hands.* That doesn't keep me from trying.

I'm still throwing money into this mess on a regular basis. That seems to work.

* {edited: not "with blood on my hands." I said the opposite of what I intended to say, that it's a risky strategy.}

Johnny2X2X

(18,955 posts)I know a guy, pretty smart software engineer who got out when Covid hit and went into bonds almost all of 2020. He didn't lose any money, but he missed out on a huge bull run in the markets. He should have sat tight in his blended target year for retirement funds, he missed out on $tens of thousands in gains by not doing so.

Yeah, I throw money every paycheck at it too. I'm maxing out now so an IRA is on the horizon.

Everybody is an amateur investment guru now though, just like Day Traders became a factor. And everyone feels pretty smart during bull runs, but very few know how or when to adjust in a bear market.

Midnight Writer

(21,674 posts)I've got a buddy who sells every time there is a downturn and buys when the market goes back up. It doesn't work out very well.

Oddly, he acknowledges his folly, but he is ruled by his emotions. Down market scares him, he pictures his money slipping away, so he sells. Up market encourages him, he thinks about how much he could be making, so he buys.

Scrivener7

(50,897 posts)Septua

(2,251 posts)..90% of all stocks are owned by 10% of the people.

https://www.cnbc.com/2021/10/18/the-wealthiest-10percent-of-americans-own-a-record-89percent-of-all-us-stocks.html

Scrivener7

(50,897 posts)feel that real estate is a bad thing.

Income inequality is the scourge of our time.

But the fact that they have more assets doesn't make my assets - that I earned by sweat, hustle, scrimping and working like a dog at multiple jobs at once for 45 years - less useful to me.

brooklynite

(94,278 posts)By why let facts get in the way of a good rant?

Scrivener7

(50,897 posts)a bit now. It seems to be creeping up.

doc03

(35,289 posts)a smaller IRA in Mutual Funds I managed myself. Instead of waiting until I reached 70 1/2 to start taking

out RMDs I started in 2013 at 65. When I retired in 2009 the market was in the crapper but I stuck with it

and now even after taking withdrawals out for 8 years the principle is double what it was in 2009. My funds are

currently about 40% equities and 60% fixed income.

ProfessorGAC

(64,801 posts)If this is the most accurate thing she's ever read, she must barely read.

Patton French

(742 posts)Many, many middle class people will be relying on their 401k for retirement. To gloat about a falling stock market because rich people also benefit from a rising market is cruel to many who aren’t rich.