General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsJacob Lew: Another Brick in the Wall Street on the Potomac (William K. Black)

Dr. Black explains how Dr. Wall Street will continue bleeding the patient dry.

President Obama and Jacob L. "Jack" Lew walk near Marine One.

Jacob Lew: Another Brick in the Wall Street on the Potomac

William K. Black

Assoc. Professor, Univ. of Missouri, Kansas City; Sr. regulator during S&L debacle

EXCERPT...

The unobvious aspects of the pattern compound these problems. First, Obama likes to surround himself with failures. Geithner set the pattern. He was supposed to be the principal regulator of most of the largest U.S. bank holding companies. He was an abject failure. His speeches and his statements at the Federal Reserve System's FOMC meetings during the crisis demonstrate that he remained clueless to the end. For reasons of brevity, I discuss only three of his failures as Treasury Secretary below.

Lew has gone from failure to failure. He was one of the architects of both of the Clinton administration's disastrous statutory deregulatory actions that helped produce the epidemic of accounting control fraud that drove the Great Recession.

Emanuel and Daley were failures as directors of Fannie and Freddie. Lew was a failure at Citicorp's proprietary derivatives trading arm. That failure is particularly dangerous because the purpose of the Volcker rule was to ensure that federally insured banks did not take proprietary positions in derivatives. Obama has put failed anti-regulators in positions where they can best undermine the reregulatory effort that is essential to reduce the risk and harm of future crises.

Obama's senior financial advisors have also failed ethically. Lew's great moral challenge was whether he would be honest about his errors. Honesty is essential to preventing future harm. Lew failed this second, less obvious, test as well. The CBS special notes:

CONTINUED w/Links...

http://www.huffingtonpost.com/william-k-black/jacob-lew-another-brick-i_b_2446848.html

Gee. I had thought I wouldn't miss old Timmy G.

Octafish

(55,745 posts)The obvious aspects of this pattern include: (1) Obama prefers to have Wall Street guys run finance (despite coming to power because Wall Street blew up the world), (2) the revolving door under Obama that connects Wall Street and the White House has been super-charged, and (3) even very short stints in Wall Street have made Obama's finance advisers wealthy. The obvious is vitally important, and it is largely ignored by the most prominent media. The obvious aspects help explain why Obama's economic policies have been incoherent, ineptly explained, inequitable, and often slavishly pro-Wall Street at the expense of our integrity and citizens.

Dr. Black blasts the Banksters

rhett o rick

(55,981 posts)them with someone better.

This cant end well. In 2008 some of us hoped that a Democratic president would undo the damage Bush did. And some of us thought that if President Obama got a second term, he could really let loose and undo the damage Bush did. The joke is on some of us.

Octafish

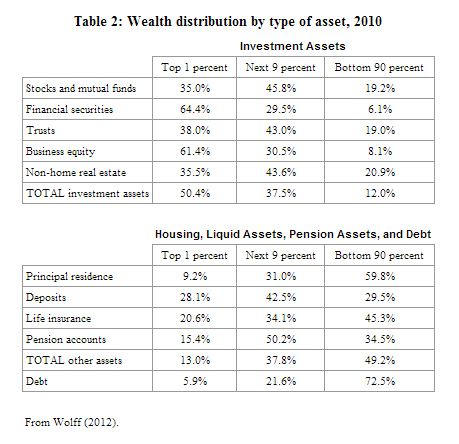

(55,745 posts)Most of the wealth ever created -- seven-eights by the estimation of David Stockman -- has been created since 1980. Stockman also said that war, fiscal and tax policies have financially benefited the rich over that time, leading to the greatest concentration of wealth in human history. Like secret government, that is most un-democratic.

The top five percent have gained more wealth than the whole human race had created prior to 1980

What gets me, rhett o rick, is I can still remember how the visible hand of government -- REGULATION -- worked to balance the playing field. Now it serves to hold up the side of the rich and it's easier than ever to move the ball downhill.

rhett o rick

(55,981 posts)I am just getting started but it looks like the Elite Theory says that the elite rule and if they understand that the masses should have some success or the whole system fails, good. But if they get tooo fucking greedy, they kiss the whole system goodbye. It isnt clear to me, but I think the Elite Theory suggests that we are just fucked. Totally at the mercy of the elite. Rebellion will just cause repression. Now I dont believe that.

On another note, you talked about the creation of wealth. I would like to learn more about that subject. As of now, it appears to me that not much wealth has been created in the last decade. Why bother to work to create wealth when it is soooooooo easy to steal wealth? For example, Bains Capital has made billions w/o creating any wealth.

Someone figured out in about 1980 that the middle class in the USofA had a great deal of total wealth and they started to loot it. Sharing, of course with our so-called Congressional representatives.

Seems to me that this will continue despite the "Democrat" in the WH, until the masses revolt and the elite figure out they need to give us some "cake".

Octafish

(55,745 posts)That's what William K. Black wrote.

I borrowed the phrase -- Know your BFEE: Goldmine Sacked or The Best Way to Rob a Bank Is to Own One

Thank you for the heads-up on Dye. His bio shows expertise in the concentrated power in elite institutions from education to business to politics. The Elite Theory reminds me of all the nice people around Leo Strauss, the father of neo-conservatism and idol of the PNAC crowd.

Regarding the protectors of great wealth, an expert:

Wealth, Income, and Power

by G. William Domhoff

University of California at Santa Cruz

This document presents details on the wealth and income distributions in the United States, and explains how we use these two distributions as power indicators.

Some of the information may come as a surprise to many people. In fact, I know it will be a surprise and then some, because of a recent study (Norton & Ariely, 2010) showing that most Americans (high income or low income, female or male, young or old, Republican or Democrat) have no idea just how concentrated the wealth distribution actually is. More on that a bit later.

As far as the income distribution, the most striking numbers on income inequality will come last, showing the dramatic change in the ratio of the average CEO's paycheck to that of the average factory worker over the past 40 years.

First, though, some definitions. Generally speaking, wealth is the value of everything a person or family owns, minus any debts. However, for purposes of studying the wealth distribution, economists define wealth in terms of marketable assets, such as real estate, stocks, and bonds, leaving aside consumer durables like cars and household items because they are not as readily converted into cash and are more valuable to their owners for use purposes than they are for resale (see Wolff, 2004, p. 4, for a full discussion of these issues). Once the value of all marketable assets is determined, then all debts, such as home mortgages and credit card debts, are subtracted, which yields a person's net worth. In addition, economists use the concept of financial wealth -- also referred to in this document as "non-home wealth" -- which is defined as net worth minus net equity in owner-occupied housing. As Wolff (2004, p. 5) explains, "Financial wealth is a more 'liquid' concept than marketable wealth, since one's home is difficult to convert into cash in the short term. It thus reflects the resources that may be immediately available for consumption or various forms of investments."

We also need to distinguish wealth from income. Income is what people earn from work, but also from dividends, interest, and any rents or royalties that are paid to them on properties they own. In theory, those who own a great deal of wealth may or may not have high incomes, depending on the returns they receive from their wealth, but in reality those at the very top of the wealth distribution usually have the most income. (But it's important to note that for the rich, most of that income does not come from "working": in 2008, only 19% of the income reported by the 13,480 individuals or families making over $10 million came from wages and salaries. See Norris, 2010, for more details.)

This document focuses on the "Top 1%" as a whole because that's been the traditional cut-off point for "the top" in academic studies, and because it's easy for us to keep in mind that we are talking about one in a hundred. But it is also important to realize that the lower half of that top 1% has far less than those in the top half; in fact, both wealth and income are super-concentrated in the top 0.1%, which is just one in a thousand. (To get an idea of the differences, take a look at an insider account by a long-time investment manager who works for the well-to-do and very rich. It nicely explains what the different levels have -- and how they got it. Also, David Cay Johnston (2011) has written a column about the differences among the top 1%, based on 2009 IRS information.)

CONTINUED w/Links...

http://www2.ucsc.edu/whorulesamerica/power/wealth.html

People pay attention to economics when it's put into the numbers that impact them. People also respect honesty, especially if they can check the books.

Obama's Biggest Mistake: Selling Out to the Bankers

The original sin of Obama's presidency was to trust bank-friendly economists and Bush carryovers, whose primary goal was to protect their own past decisions and futures.

New Deal 2.0 / By James K. Galbraith

November 7, 2010

EXCERPT...

But one cannot defend the actions of Team Obama on taking office. Law, policy and politics all pointed in one direction: turn the systemically dangerous banks over to Sheila Bair and the Federal Deposit Insurance Corporation. Insure the depositors, replace the management, fire the lobbyists, audit the books, prosecute the frauds, and restructure and downsize the institutions. The financial system would have been cleaned up. And the big bankers would have been beaten as a political force.

Team Obama did none of these things. Instead they announced “stress tests,” plainly designed so as to obscure the banks’ true condition. They pressured the Federal Accounting Standards Board to permit the banks to ignore the market value of their toxic assets. Management stayed in place. They prosecuted no one. The Fed cut the cost of funds to zero. The President justified all this by repeating, many times, that the goal of policy was “to get credit flowing again.”

SNIP...

These facts were obvious to everybody, fueling rage at “bailouts.” They also underlie the economy’s failure to create jobs. What usually happens (and did, for example, in 1994 - 2000) is that credit growth takes over from Keynesian fiscal expansion. Armed with credit, businesses expand, and with higher incomes, public deficits decline. This cannot happen if the financial sector isn’t working.

Geithner, Summers and Bernanke should have known this. One can be fairly sure that they did know it. But Geithner and Bernanke had cast their lots, with continuity and coverup. And Summers, with his own record of deregulation, could hardly have complained.

CONTINUED...

http://www.alternet.org/story/148770/obama%27s_biggest_mistake%3A_selling_out_to_the_bankers

Politically speaking, one would be amazed at what an economy based on justice, not just-us, would do for the nation.

Heck, if we taxed the rich who've gained most of what's been there to grab over the past 32 years at a fair rate, we'd solve the world's problems.

banned from Kos

(4,017 posts)I bumped this thread for you.

whatchamacallit

(15,558 posts)Last edited Thu Jan 10, 2013, 10:54 PM - Edit history (1)

Note: The quality of your argument will prove someone is an idiot.

banned from Kos

(4,017 posts)That is beyond dispute.

William Black has a cottage industry blog that feeds bait to bank griefers. In other words if Black did not rail on banks he would not exist.

whatchamacallit

(15,558 posts)Whatever shall we to do about these scoundrels besmirching such fine and noble institutions? ![]()

Octafish

(55,745 posts)Why that'd be, Dr. Black explains:

Lew helped establish finance policy under President Clinton.

Lew's predecessor as chief of staff was William Daley. Daley is a lawyer. Daley was on the executive board of J.P. Morgan-Chase during the crisis and before that he was on Fannie Mae's board of directors. Daley is a member of "Third Way's" controlling board. Third Way is a Pete Peterson ally that lobbies in favor of austerity and cuts to the safety net. It pushes Wall Street's, and Pete Peterson's, greatest dream -- privatizing Social Security. Privatization would allow Wall Street to increase its profits by hundreds of billions of dollars in fees for managing our retirement savings.

CONTINUED...

http://www.huffingtonpost.com/william-k-black/jacob-lew-another-brick-i_b_2446848.html

Dr. Black's got links for all the points he makes.

Almost forgot: Like the great DUer Trumad wrote, I'd rather be a Bank Griefer than a Bank Licker.

Kingwithnothrone

(51 posts)The fact that Lew supported raising the retirement age of Social Security and is open to raising the Medicare age as well.Staunch supporter to whom?

Dr.Austerity - the celebrated surgeon

says the patient has too much blood.

So, he makes a series of little incisions

until the patient collapses,with a thud...

hay rick

(7,607 posts)As an aide to Tip O'Neill, Lew was involved with the Greenspan Commission. The recommendations of that commission led to increasing the normal retirement for Social Security to 67. Recently, Lew has been characterized as a defender of "entitlements." One could argue that the increase in retirement age made in 1983 was prompted by, and actually lagged, the increase in life expectancy.

As for raising the Medicare age, the only reference to Lew's position I have seen is in this article: http://www.nytimes.com/2012/12/02/us/politics/obamas-aide-jacob-lew-is-a-low-key-power-broker.html?pagewanted=all&_r=2&

From the article:

The challenge now for Mr. Lew — and for Mr. Obama — is to forge an agreement that does not cut too deeply into the entitlement programs that Democrats cherish. Like Mr. Obama, Mr. Lew is a pragmatist; one person familiar with his thinking said he had previously expressed willingness to raise the Medicare eligibility age from 65 to 67, a move that many liberals oppose.

"One person familiar" is pretty weak tea for passing judgment. Do you have any other sources on Mr. Lew and Medicare? My current attitude toward Mr. Lew is open-minded with a dose of skepticism based on the track record of the man appointing him.

Kingwithnothrone

(51 posts)Thanks for the welcome,although it seems like a call out for some reason.I would hope that is not the case.

In any event let me help you with your journey.

Whatever the indigestion on the right, though, there’s no remotely coherent reason for the Senate to block Lew, and I suspect he’ll be confirmed by a wide margin. The longer-term threat to his tour as Treasury secretary could be grumbling on the left. This may be counterintuitive given his progressive credentials. But there’s a special sense of contempt people reserve for fellow travelers they feel may betray them, and it turns out Lew simply isn’t someone who believes Medicare and Social Security are untouchable. To the contrary, he was very much a proponent of pruning Medicare during the 2011 back-and-forth, at least if the GOP reciprocated with equally painful concessions. Among other things, Lew argued internally for ideas like raising the program’s eligibility age, something that makes the hair stand up on the backs of liberals’ necks, and which prompted much hand-wringing among some of Obama’s advisers. (I have details on the debate in my book.) Some liberal budget activists even whispered conspiratorially that Lew’s two years at Citigroup had changed him, though this seems a stretch given that Lew spent his days there keeping an eye on the books, not consorting with masters of the universe. (Which is not to say a liberal wonk didn’t have better things to do in 2007 than toil for a bank trying its damnedest to blow up the world.)

http://www.tnr.com/blog/plank/111780/when-it-comes-worldview-jack-lew-obama-in-coke-bottle-glasses

Have a quick glance at these also.

http://www.economicpopulist.org/content/who-knew-jack-lew

http://thehill.com/blogs/on-the-money/personnel-notes/276571-bernie-sanders-to-oppose-lew-nomination-at-treasury

Now with that in mind,let me say this.My ideas and thinking are far to the left.I am not a Liberal.I consider most of my views Leftist when it comes to what needs to be done to change the political situation in this country.That was not always the case,but it is now,and i don't see that changing.If you somehow think i am a Right Winger here to disrupt DU with my views,then you are in a world of confusion.As far as i can tell,there are still some posters here who are much to the left of the Democratic mainstream view and manage to coexist here without much hassle.I would think that views that staunchly defend the working class,the poor,and labor are still welcome at DU.

There will be no tolerance,no acceptance, no pragmatism, and no compromise in my views when it comes to Austerity and the destruction of the safety net(which is the last lifeline for millions of the least among us) regardless of which party is doing it.The election is over,but for millions the fight is just beginning.It won't be won by electing the lesser of two evils and being held hostage by the voice of centrism and conservative elements within the Democratic party.

That being said.The politics of personal perspectives will not be the answer,but one can still try to lend a voice for the poor and working class against Austerity.Cheers hay rick and excuse the grammar.It is not a strong suit.

hay rick

(7,607 posts)My post was not a call out. I am familiarizing myself with Mr. Lew and was looking for links (which you kindly provided) to more sources on Mr. Lew's position on Medicare.

A cluster of more folks generally hostile to austerity can be found here: http://www.democraticunderground.com/?com=forum&id=1116

Kingwithnothrone

(51 posts)Octafish

(55,745 posts)Look at this guy, making a case to sweep LIBOR under the rug:

The LIBOR Scandal: Not that Big a Deal?

Paul Solman

The Business Desk, PBS.org

One of the biggest business scandals of 2012 was the the manipulation of LIBOR, the London Interbank Offering Rate, on which so many other interest rates depend. LIBOR is determined by the banks themselves and, it turns out, was rigged -- for years. Traders were in cahoots with "submitters" from the banks responsible for "reporting" the rates banks were offering to charge one another in the London market -- the "interbank offering rate." But the submitters were incentivized -- and only too happy, it seems -- to accommodate the traders by customizing their submissions for the profit of all.

The Economist published some particularly juicy emails from the ongoing investigation:

"One banker at UBS, in asking a broker to help manipulate submissions, promised ample recompense:'I will f*ing do one humongous deal with you ... Like a 50,000 buck deal, whatever. I need you to keep it as low as possible ... if you do that ... I'll pay you, you know, 50,000 dollars, 100,000 dollars ... whatever you want ... I'm a man of my word.'

SNIP...

But Doug Dachille, our man in the pits (figuratively speaking), thinks it's easy to make something of the LIBOR scandal that it is not: a conspiracy that screwed the global economy. Doug was the head of proprietary trading at JP Morgan until the merger with Chase, and then co-head thereafter. He's been featured on this page before: here, here and here.

Here is his take on LIBOR:

"While everyone focuses on the market manipulation of LIBOR, for which it is unclear there was any material impact on the rate setting itself, or whether any institution was able to specifically profit, no one is focusing on the real market manipulation that is done knowingly to boost profits and enhance compensation -- mis-marking of trading and accrual positions...."

Doug went on to explain the issue of mis-marking -- a little wonky for this page, though if there's an upswell of requests, we'll be happy to publish the rest, with Doug's permission.

CONTINUED (A must read for those who want to document the problem with thinking one class is immune from criminality)...

http://www.pbs.org/newshour/businessdesk/2013/01/the-libor-scandal-not-that-big.html

You're the best, banned from Kos.

marmar

(77,077 posts)nt

Octafish

(55,745 posts)From Glenn Greenwald, upon Jack Lew's appointment as WH Chief of Staff a year ago:

The new WH Chief of Staff and Citigroup

Another banker who profited from the 2008 financial crisis is empowered in the Obama administration

BY GLENN GREENWALD

TUESDAY, JAN 10, 2012 04:58 AM EST

When President Obama last January announced the departure of Rahm Emanuel as White House Chief of Staff, many liberals were furious that his replacement was the Midwest Chairman of JP Morgan and Boeing Director William Daley, who was also an opponent of the Consumer Financial Protection Bureau and a critic of Obama’s health care bill as too leftist. As but one example, Rachel Maddow harshly condemned the choice, noting Daley was a hedge fund manager and “business lobbyist” and “is known for pushing Democrats toward business interests”; said “liberals are banging their heads against the wall as they try to comprehend this choice”; and then sardonically observed: “mmm – a banker and a lobbyist: smells like change.”

Yesterday, the White House announced Daley’s departure — he will now co-chair Obama’s re-election campaign, which basically means raising huge amounts of money from his Wall Street friends — and unveiled his replacement as Chief of Staff: Jacob Lew. In 2010, Lew became head of the Office of Management and Budget when Peter Orszag left and then, a couple months later, accepted a multi-million dollar position as a high-level Citigroup official. Lew has spent many years in various government positions, but he has his own substantial ties to Citigroup. Here is what Lew was doing in 2008 at the time the financial crisis exploded, as detailed by an excellent Huffington Post report from last year:

(Lew) oversaw a Citigroup unit that profited off the housing collapse and financial crisis by investing in a hedge fund king who correctly predicted the eventual subprime meltdown and now finds himself involved in the center of the U.S. government’s fraud case against Goldman Sachs. . . .

(I)t is his few years at Citi — in particular the one year he spent at its then-$54 billion proprietary trading, hedge fund and private equity unit — that’s likely to raise the most eyebrows in the coming weeks as Lew faces a Senate confirmation hearing.

Especially his unit’s investments in a hedge fund that bet on the housing market to collapse — a reality suffered by millions of American homeowners.

In particular, the Citigroup fund run by Lew, Citi’s Alternative Investments, invested heavily in the hedge fund of John Paulson, “who made billions off the deterioration of the housing industry by making bearish bets on securities tied to home mortgages — particularly subprime home mortgages.” One of Paulson’s largest bets at the time involved Goldman Sachs, which the SEC has now charged with “defrauding investors by creating and selling exotic securities tied to subprime home mortgages in 2007 without disclosing that they were handpicked by a hedge fund [Paulson] that was betting on them to fail.”

CONTINUED...

http://www.salon.com/2012/01/10/the_new_wh_chief_of_staff_and_citigroup/

Fully EMO effect: I hope I didn't hurt any GG Haters' feelings with this.

WillyT

(72,631 posts)Octafish

(55,745 posts)What Robert Scheer wrote:

The Inconvenient Truth About Jack Lew

By Robert Scheer

TruthDig.org, Jan 11, 2013

I suppose that he can’t be much worse than Timothy Geithner, but that should be scant cause for cheer over the news that the president has nominated Jack Lew as Treasury secretary. Both championed the financial deregulation craze of the Clinton administration, and both are acolytes of Robert Rubin, the former Clinton Treasury secretary who unfettered Wall Street greed and then took his own considerable cut of the action.

SNIP...

Really? That is a statement of such deliberate ignorance that one must marvel at Lew’s audacity in uttering it. He was one of the top economic officials in the Clinton administration when the president signed the Commodity Futures Modernization Act into law that declared all of those “derivative products” exempt from the reach of any existing government regulation or regulatory agency. It was aimed at silencing the warning of Brooksley Born, who, as head of the Commodity Futures Trading Commission, attempted to control the burgeoning market in the toxic assets that have carried such a huge human price in foreclosed homes and lost jobs.

Not only did Lew go along with the Clinton administration’s policy, he continued to endorse a radical deregulatory approach to financial markets as a board member of the Hamilton Project, funded by Rubin at the Brookings Institution. Lew’s myopic view of the origins of the economic meltdown, at odds even with Greenspan’s own admission of culpability, hardly qualifies him for the top economic position in the Obama administration. As Sanders told the Post this week, “In my view, we need a Treasury secretary who is prepared to stand up to corporate America and their powerful lobbyists and fight for policies that protect the working families in our country. I do not believe Mr. Lew is that person.”

But if we need that quality in a Treasury secretary, we certainly need it even more in the president, and given Obama’s appointments—from Lawrence Summers through Geithner and now Lew—it is clear that he is not that person. In announcing Lew’s nomination, the president only once referenced his chief of staff’s Wall Street experience, noting, “He helped oversee ... one of our largest investment banks.” That he also helped destroy it was buried as an inconvenient truth.

CONTINUED...

http://www.truthdig.com/report/item/the_inconvenient_truth_about_jack_lew_20130111/

Thanks, WillyT!

FarCenter

(19,429 posts)When the Bank One merger with JP Morgan Chase occurred, Dimon hired Daley, the Mayor's brother, as a was to placate the political powers in Chicago who were losing the Bank One headquarters.

Daley was an executive in charge of Government Relations. He was not a banker and Dimon would have never let him close to real money.

I doubt that Lew had any real responsibility at Citicorp, although with the incompetent management there, who knows? However, the title of "Managing Director" is well down the food chain.

Octafish

(55,745 posts)What Robert Scheer wrote:

Really? That is a statement of such deliberate ignorance that one must marvel at Lew’s audacity in uttering it. He was one of the top economic officials in the Clinton administration when the president signed the Commodity Futures Modernization Act into law that declared all of those “derivative products” exempt from the reach of any existing government regulation or regulatory agency. It was aimed at silencing the warning of Brooksley Born, who, as head of the Commodity Futures Trading Commission, attempted to control the burgeoning market in the toxic assets that have carried such a huge human price in foreclosed homes and lost jobs.

SOURCE: http://www.truthdig.com/report/print/the_inconvenient_truth_about_jack_lew_20130111/

After helping gut Glass-Steagall, the guy got a job running the Citi division charged with derivatives -- ground zero for the taxpayer bailout. Seems to me like Lew was one of the architects of the largest transference of wealth in human history.

FarCenter

(19,429 posts)I just doubt that Citi actually gave him financial decision making responsibilities or that he actually ran the organizations that he might have nominally been in charge of.

More likely, Rubin arranged for him to get a job at Citi, and Citi thought it would be a good idea to develop a relationship with a up and coming Washington bureaucrat who might be returning to DC. So they parked him in a couple of places in the organization, gave him a few million, etc. An MD in asset management might work on building relationships with rich politicians, rich donors, etc. but not actually do any investment decision-making for the clients.

His time at Citi doesn't mean that he knows squat about finance, investment, banking, or managing an organization.

Nor does it mean that he was ever in a position to make decisions that would increase or decrease the magnitude of the Citi debacle.

Oilwellian

(12,647 posts)Octafish

(55,745 posts)Deregulator of the New Deal Regulations for President Clinton

Union Buster at NYU

Bailout Bonus Beneficiary at Citigroup

Helped change WH Chief of Staff corporate affiliation from JP Morgan Chase

------

Seeing Mr. Lew st-st-state that de-regulation wasn't the proximate cause of financial crisis is most telling: Our party, the Democratic Party, is DBA as a subsidiary of the GOP, the party the financial community already owns.

Oilwellian

(12,647 posts)Next stop, European style austerity. I wonder what national treasure they'll sell first.

They have really been pushing the meme, Lew is a liberal, and a strong advocate for SS, Medicare & Medicaid.

JULIANNA GOLDMAN: Yes, that's right. It was sort of the 11th hour of negotiations.

And Lew was one of the -- he came up with the idea of the sequester and at the last minute Republicans came back and said they wanted to attach Medicaid cuts to the automatic spending cuts that would be in place if they weren't able to come up with a long-term fiscal solution that we now know is the sequester.

And Lew, he hadn't slept in days. He was on speakerphone and he sort of yelled, no, we're not doing that. And he hung up the phone on the Republicans, and ultimately those Medicaid cuts weren't included. But also telling about Jack Lew, he was pretty embarrassed by the incident because for him that kind of rare outburst was something that you don't often see from him.

(snip)

JUDY WOODRUFF: Jared Bernstein, what's he like to work with?

JARED BERNSTEIN, Former Chief Economist to Vice President Joe Biden: Very insightful, deep knowledge of fiscal matters.

He's been working, as you heard, on budgetary issues for about three decades. And these are issues that get more and more complicated. But Jack keeps that all in his head. Extremely good listener, a very reasonable person, but one of the things you always hear -- it reminded me in listening to Julianna -- one of the -- a constant in my work with Jack and his career has been a recognition that one of the important roles of government is to protect economically vulnerable people.

You heard it there in that Medicaid story, but you could say the same thing about protecting the social safety net, about Medicare. Now, this is not a guy who won't put spending cuts on the table, who won't even entertain -- he's a guy who would entertain cuts to entitlements, but they have got to be structured in such a way that protect economically vulnerable retirees, people who have been hurt by recession, folks who need the safety net, people who have been hurt by income inequality, deep values held by Jack Lew.

Video at link:

http://www.pbs.org/newshour/bb/politics/jan-june13/lew_01-10.html

This is such a classic case of the word games they're now playing, and I'm sure we'll hear them over and over for the next few months. He'll be quickly approved by the Senate, all the while showcasing him as a champion for entitlements. Then, once the sequester and debt ceiling negotiations begin, he'll "advise" that we compromise on entitlements.

Wall Street will be so elated. Their major fantasy, accomplished.

great white snark

(2,646 posts)Now I remember W. Black. What a $%&@. There are many, many more balanced reviews of Lew's history and more importantly how he's championed SS & Medicare.

MrSlayer

(22,143 posts)The game is rigged for the Wall Streeters to win every time. Obama doesn't give a fuck about us any more than Bush did. Or maybe he does but he's helpless to help us. No one is ever going to stop this bullshit. This is who the government works for. These are their bosses. Watch as Merrill Lynch asshole CEO Don Regan bullies President Reagan in this clip from Michael Moore's Capitalism documentary.

http://m.

This is who really runs the government. Nothing at all has changed since. Unless there is some kind of major revolution, and there won't be, this game is over.

Agony

(2,605 posts)From the transcript

"""

WILLIAM BLACK: Well, on financial matters, Jack Lew has been a failure of pretty epic proportions, and he gets promoted precisely because he is willing to be a failure and is so useful to Wall Street interests. So, you’ve mentioned two of the things in terms of the most important and most destructive deregulation under President Clinton by statute. But he was also there for much of the deregulation by rule, and a strong proponent of it, and he was there for much of the cutting of staff. For example, the FDIC, the Federal Deposit Insurance Corporation, lost three-quarters of its staff, and that huge loss began under Clinton. And the whole reinventing government, Lew was a strong supporter of that. And, for example, we were taught—instructed by Washington that we were to refer to banks as our "clients" in our role as regulators and to think of them as clients.

He goes from there to Wall Street, where he was a complete failure. You noted that part of what Citicorp did was bet that housing would fall. That was actually one of their winning bets. But they actually made a bunch of losing bets, as well. And the unit that he was heading would have not been permissible but for the deregulation of getting rid of Glass-Steagall under President Clinton. And you saw, as an example of Citicorp, why we shouldn’t be doing this. Why would we create a federal subsidy where all of us, through the U.S. government, are on the hook for Citicorp’s gambling on financial derivatives for its own account, you know, running a casino operation? That makes absolutely no public policy sense.

Then he comes into the Obama administration, and he was disastrously wrong. He tried very hard to impose austerity on the United States back in 2011, which is—he wanted, you know, the European strategy, which has pushed the eurozone back into recession, and Spain, Greece and Italy into Great Depression levels of unemployment.

And this is the guy, after all of these failures, who also is intellectually dishonest. He will not own up to his role and deregulation’s role and de-supervision’s role in producing this crisis—and not just this crisis, but the Enron-era crisis and the savings-and-loan debacle.

"""

Same old shit

Purveyor

(29,876 posts)won the election as his 'nominees' could only be better than the Presidents selections.

Spit.

hay rick

(7,607 posts)Now that the election is over we should be holding the President to a high standard.

MrSlayer

(22,143 posts)People hate this crappy pick, therefore we want an even worse pick?

I don't understand this logic.

The pick sucks, period. Just because Obama made it doesn't mean it's good. We're supposed to support shit just because "our" team serves it up?

It ain't that kind of party.

Purveyor

(29,876 posts)if his judgement was just but, we elected him and it is his call.

Indeed you can object and disagree...that is what makes it 'all good'.

![]()

TrogL

(32,822 posts)hay rick

(7,607 posts)From the article:

As for whether liberals will warm to Lew, my reporting suggests it could cut either way. On the one hand, Lew has a well-deserved reputation for defending programs that serve the poor, particularly Medicaid. On the other hand, as I elaborate on in my book, Lew and Treasury Secretary Tim Geithner were the administration’s chief proponents of accepting cuts to Medicare during last year's ceaseless deficit-bargaining with Republicans. Lew's enthusiasm for making a deal on Medicare was such that it prompted considerable grumbling in progressive circles.

There’s also the question of whether accommodating the GOP’s demands for large-looking cuts, even while minimizing them in practice, was as successful strategically as it was tactically. One could argue, after all, that the approach shifted the conversation entirely in the direction of cuts for much of the year, which wasn’t exactly a smashing success. I litigate this at some length in the book. (In fairness, the top political operatives, like David Plouffe and Daley, deserve much more credit/blame for the strategic portion of this calculus than Lew, who was operating on a more tactical level.)

For what it’s worth, one thing I don’t think liberals should get too exercised about, though they probably will, is Lew’s tenure at Citigroup, where he worked between 2006 and 2008. Lew was basically the chief administrator at Citi Alternative Investments, which runs the company’s portfolio of hedge funds and private-equity funds. That is, he was the guy who kept watch over the books and the paperwork, not a guy going out and placing multimillion-dollar bets or making hundred-million dollar deals. “He was not commercial,” one former Citi colleague told me for my book, using the Wall Street term of art for “business-minded.” “You’d trust him with your life, but he was not commercial.”