General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsInterest Rates (What we "know" is so Wrong!)

Last edited Wed Jan 30, 2013, 03:37 AM - Edit history (4)

The interest rates we (USA) have to pay on new debt just went up a little on speculation that S&P will NOT downgrade our credit again. (Up to 2%, which is still pretty close to the all-time low, but higher than last month.)

That is not a typo. Not being downgraded means higher rates.

On the other hand, after S&P DID downgrade our credit last year interest rates went down.

This is one of the most striking examples of how US fiscal policy is nothing like a household budget.

For the USA, in a depressed economy, interest rates are not based on our ability to repay the debt (which is 100%), or on competition for dollars to borrow (which is low in a down economy) but are rather a prediction of future inflation. In a depressed economy low inflation expectations are all about low future economic growth. The depressed economy is what is keeping inflation down. End the depressed economy and interest rates will go up.

Policies and events that will prolong the depressed economy (also know as "bad terrible things"![]() keep rates low.

keep rates low.

Low rates mean that we are fucking up. Low rates mean that the economy sucks and will continue to suck. And in a weaker economy (like today) any government policy that hurts the economy will reduce interest rates.

Republicans (and a shocking number of Democrats, including the president) have some sense that if the government borrows and spends more money it will cause interest rates to go up because irresponsible borrowers have to pay higher interest rates.

This is flat out, provably, demonstrably wrong in current economic conditions.

In current conditions, borrow and spend causes rates to go up only if it "threatens" to be stimulative enough to result in more economic growth. If we had a huge stimulus package it would cause rates to go up, but only because it would result in expectations of higher future growth.

NOTE: This applies to the US but not to Greece because the US makes its own money while Greece does not. Greece cannot print more Euros and thus might actually default. Anyone who ever cites the example of Greece in talking about US policy is a charlatan... either a fool or someone playing you for a fool.

If the whole world embraced the proposals in Paul Krugman's book "End this Depression Now!" interest rates would leap, and RW types would say, "See... Krugman's ideas are irresponsible." But interest rates would be leaping because bond traders would fear that the policies would, in fact, end the depression.

If S&P were to downgrade the US debt again that would put downward POLITICAL pressure on US spending. It would make austerity more likely.

And austerity means lower growth. And lower growth means lower interest rates. Again, in a down economy the interest on our debt is a prediction of the future world economy, not a judgment of our credit-worthiness.

So a story that S&P will NOT downgrade our debt means that there is LESS pressure for our politicians to cut spending (or raise taxes) and thus the prospects for future growth are HIGHER.

But most of our politicians refuse to believe this, no matter how often it is demonstrated.

Professor Krugman is on the case...

The interest rate on U.S. long term debt is up a bit, briefly breaking above 2 percent today. So, is this reflecting worries about US debt sustainability?

Of course not — and by now it seems that even financial reporters get it. The main cause of the slight uptick, according to news reports, was a better-than-expected durable goods number, which brings marginally closer the day when the Fed might finally start raising rates. In other words, it was economic optimism, not pessimism, behind the rate rise.

And according to the FT Alpha ville post linked above, a second reason may have been a statement by Fitch that a US downgrade is less likely. That’s right, reduced fears of a downgrade lead to higher, not lower, US borrowing costs.

Why? Because scare talk from the rating agencies feeds the deficit scolds, making destructive austerity more likely, and therefore pushing back the date when the Fed might raise rates. You might say that the only thing we have to fear from the rating agencies is fear itself — not market fear, because the bond markets don’t seem to care, but political fear, the instinctive tendency to overreact to talk of bond vigilantes...

http://krugman.blogs.nytimes.com/2013/01/28/ratings-and-rates/

http://ftalphaville.ft.com/2013/01/28/1357662/first-time-in-a-while-10-year-treasuries-pierce-2-per-cent/

cthulu2016

(10,960 posts)Recursion

(56,582 posts)Great post; I've tried to explain this to people but you did it much better than I've ever seemed to.

cthulu2016

(10,960 posts)A lot of the interest rate worriers include competition for debt ("crowding out"![]() in their thinking. It is possible, in extreme cases, for Treasury interest rates to decouple from inflation expectations due to government borrowing too much, and that would have a negative effect on growth.

in their thinking. It is possible, in extreme cases, for Treasury interest rates to decouple from inflation expectations due to government borrowing too much, and that would have a negative effect on growth.

The crowding out effect is always exaggerated by RW types, but it is an actual possibility in an extreme case.

But there is no great private competition for the debt! If there was great demand for private borrowing we wouldn't be in a down economy in the first place.

Recursion

(56,582 posts)Thank you. I've been trying to find the right way to say that for a while.

Now, the Federal Funds Rate is a different animal entirely.

librabear

(85 posts)I think what you say is true, up until we can find people to buy our debt.

Right now this is the case because there is easy credit out there, for our country and everyone else. Debt is cheap and we keep gobbling it up. The worse our economy looks the cheaper our debt gets. That's why the government stimulates the economy with their fiscal ploicies of the last 20 years.

I maintain that keynesian economics works within certian limits. Get outside those limits and it doesn't work anymore. Like Greece. If people stop buying the debt then the price goes up. The biggest problem is that we don't know where these limits are. The only to find them may be to bump up against them and the results could be catastrophic.

cthulu2016

(10,960 posts)Keynes says Greece is screwed.

There is nothing in Keynes that says that a segment of a large economic system can spend its way to prosperity while having no control over central bank interest rates, money supply, fiscal policy within the currency zone...

Greece is screwed because nobody wants their debt because they cannot pay it back.

They are not an example of Keynesian policy.

Lefty Thinker

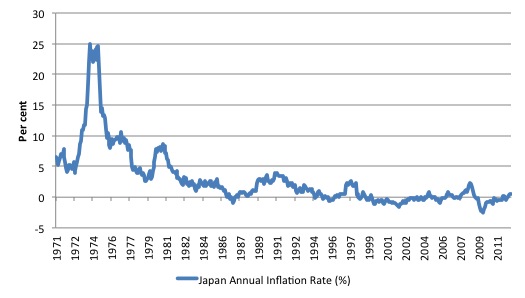

(96 posts)Please see what the OP said about Greece and their situation with the Euro. The situation you are saying is like Japan: they offerred debt and were only willing to pay so much in order to borrow. When their debt wasn't fully purchased they "printed". We also have that option; Greece doesn't. Japan is not fighting inflation -- in fact they are getting desperate to halt deflation.

cthulu2016

(10,960 posts)doubled her money supply while experiencing deflation in five of those years and inflation of about 1% the others. (IIRC)

It is difficult to create inflation in a down economy.

librabear

(85 posts)It's not inflation in a down period that is concerning, it's inflation that threatens the recovery.

cthulu2016

(10,960 posts)Japan continued to be a victim of unusually low inflation, as it has been for a generation.

As you can see, actual deflation (inflation below 0%) continues to crop up there.