General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsStop it, stop saying Social Security needs reform, you are a Democrat, right?

#HandsOffMySocialSecurity Well a crap load of you Kossacks and Democrats in Washington DC are talking about SS as if there is something wrong with it, and it needs to be fixed. If you advocate for leaving SS alone, cool. IF not its time to come to terms with what Democrats are saying that enables the GOP long term plan to destroy Social Security.

The only thing wrong with Social Security is the economy. In fact the Social Security Trustees tells us that. Of course for those of you who have never read any actual Trustees report, and continue to repeat this falsehood that the Social Security Trust Fund will be depleted in 20 or so years, and just buying a load of GOP crap.

Stop it. Take your hands off my Social Security. You're not being responsible, I don't trust you, go home, lock the door and turn off the internet. Just stop it.

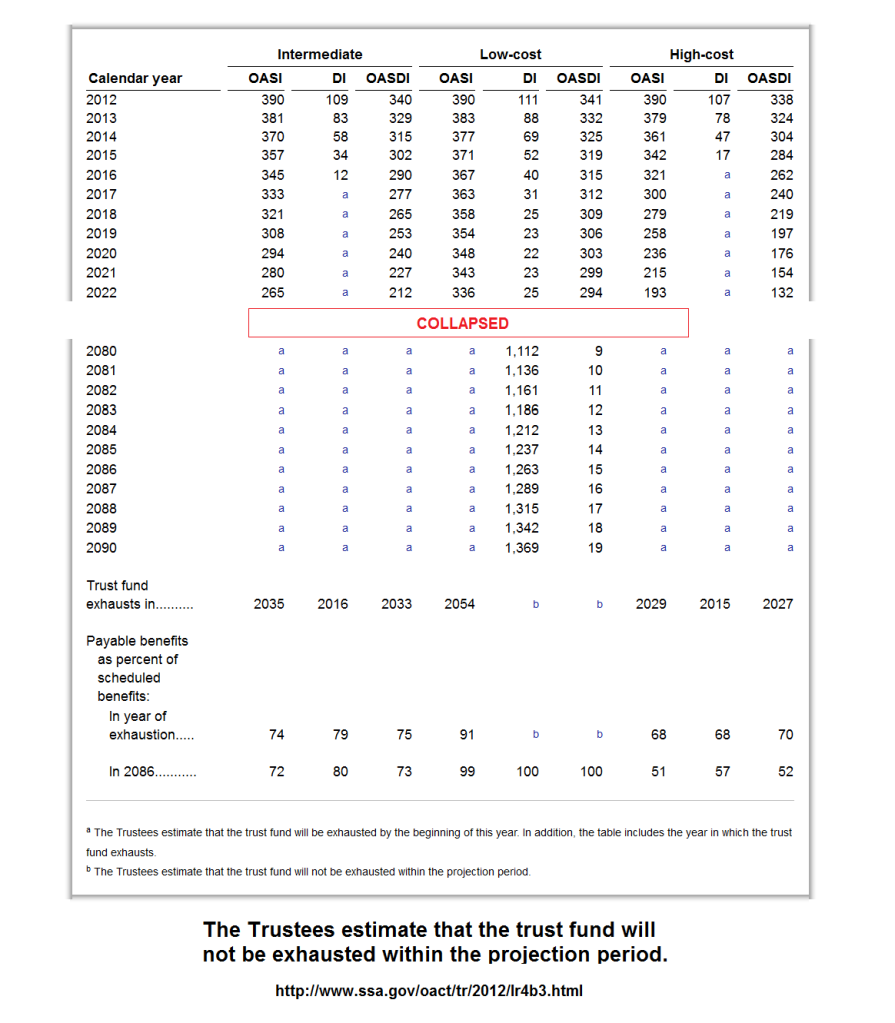

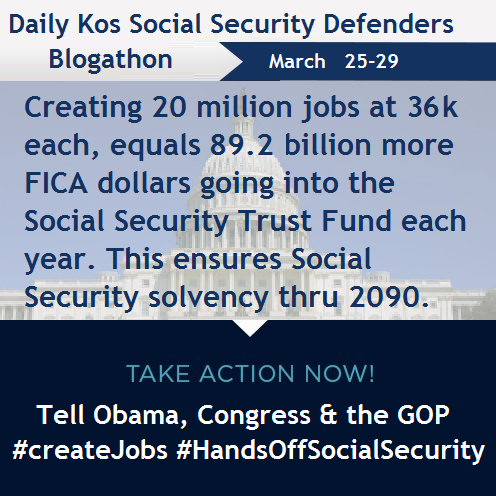

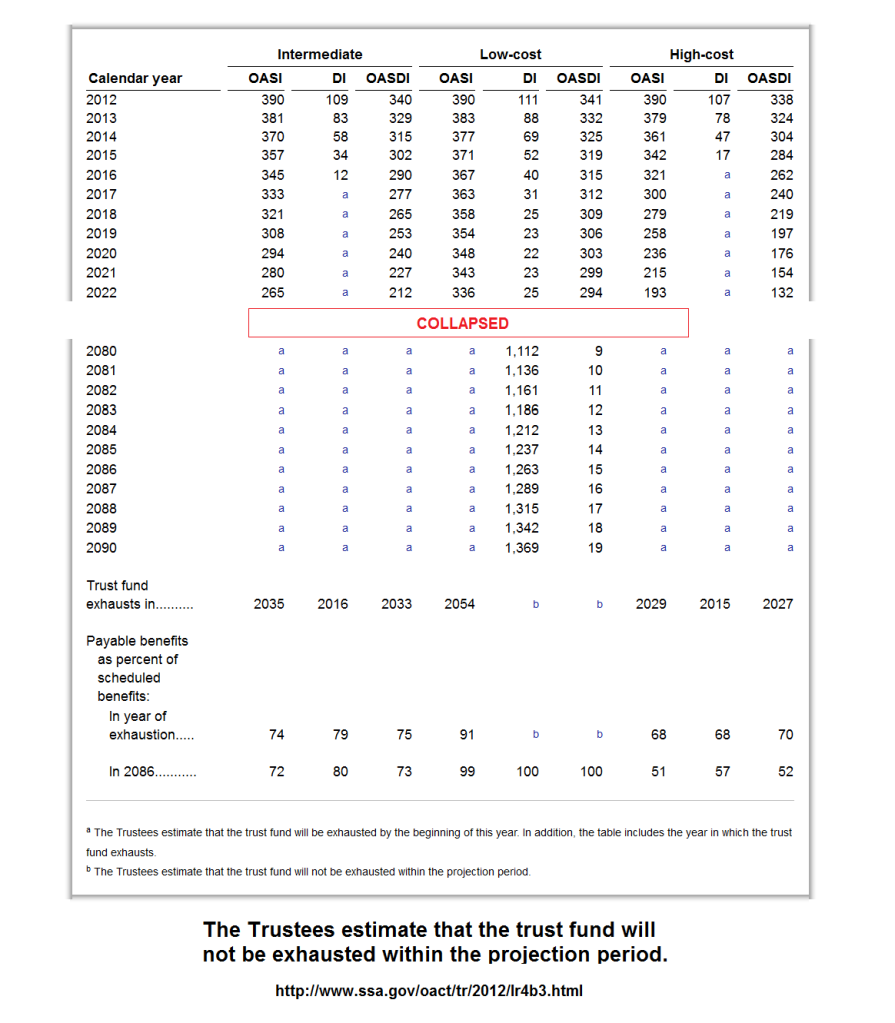

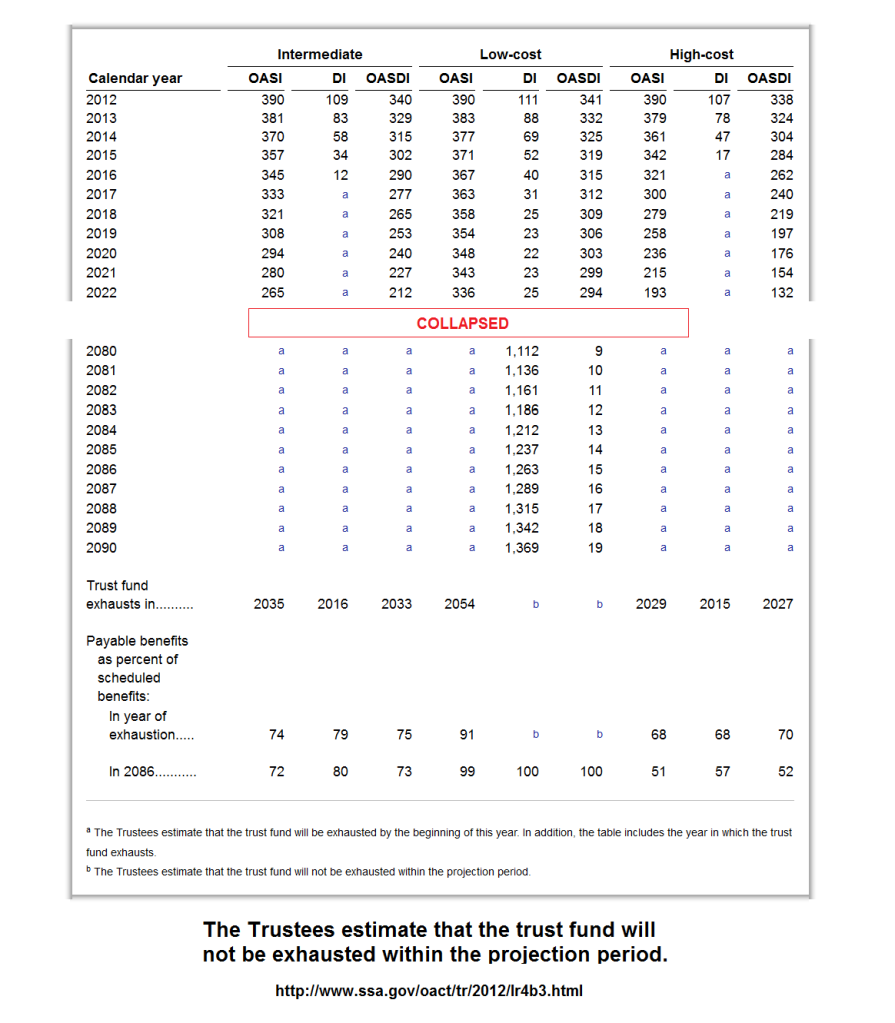

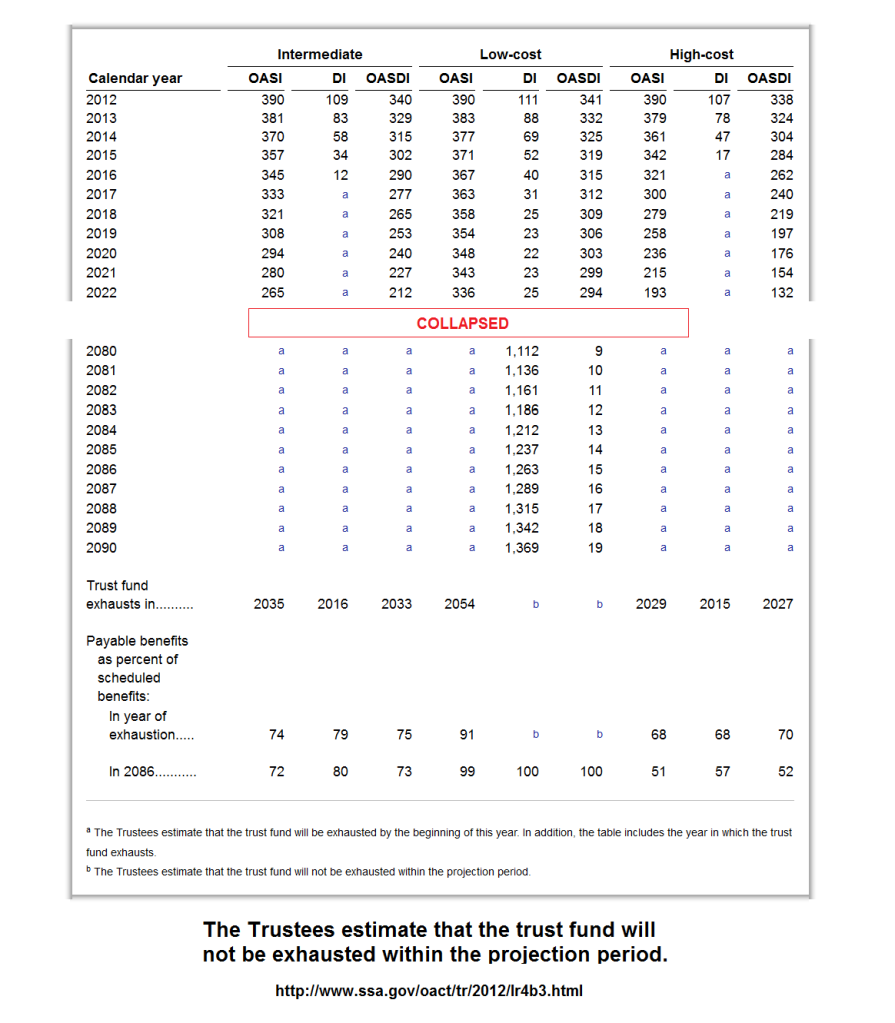

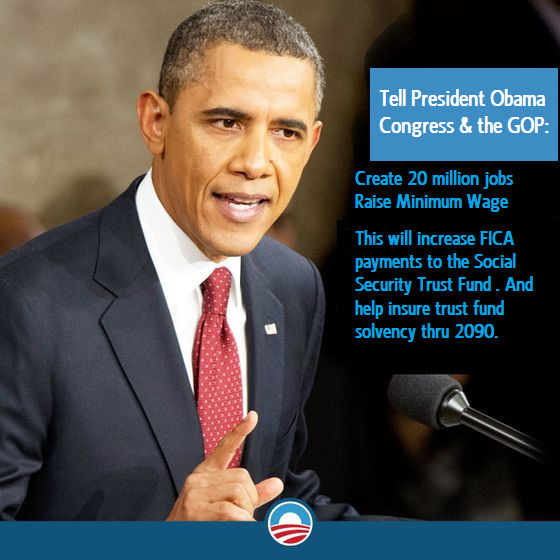

Lets create jobs, raise the minimum wage, and watch the FICA roll in. Heres a screen cap of the Trustees 2012 report, look very carefully for the footnotes.....

Look at the OASDI column.

Have you never heard this information before? than I excuse you. IF you have heard this information before, and you choose to ignore it, and you still predict 20 more years of recession, well friends, in light of the Sequester and the debt limit talks that could happen this month and things horribly worse....

This diary and its lack of respect is for you.

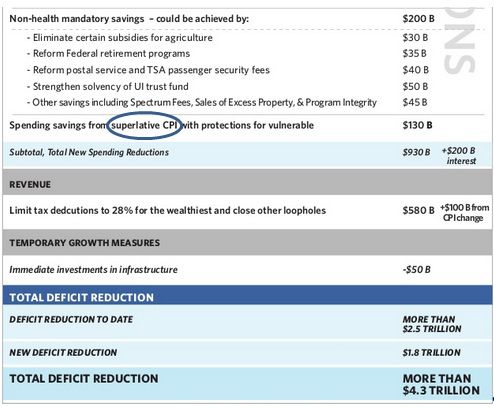

Chained CPI and Superlative CPI both mean 130 billion in cuts:

Job creation and raising the min wage go a long way to making Social Security solvent thru 2090. Don't comment here, call up DC and give them an earful. Tell them:

Remember there are Democrats who seem to settle for no real jobs programs and Chained CPI, I know, thats some crazy shit, but its true. 25 million Americans would take a full time year round job if offered, do you have our unemployed backs, or is chained CPI or Superlative CPI ok with you?

If it comes to this trade off, Raise the SS cap, or 25 million jobs and the GOP is only letting you pick one..... which is it going to be?

If it comes to this trade off, SS benefit cuts, or raising the minimum wage and the GOP is only letting you pick one..... which is it going to be?

Make the call, call Congress and tell you representative this:

Roger Fox told me the Social Security Trustees said if we create lots of jobs and keep raising the minimum wage over 20 years, then my Social Security is good thru 2090.

Dont wait for the grand bargain to hit you, draw a line in the sand right now, get on the phone, email your friends and relatives and make sure they know whats at risk, whats going on this week & the rest of this month and make sure they know what to do & say about it.

Join me and the Social Security Defenders Twitter team #HandsOffMySocialSecurity I'm at https://twitter.com/RDanaFox

EDIT: 57 recs in under 2 hours, thanks for your support.

CaliforniaPeggy

(149,499 posts)Goddamn it.

Keep your dirty mitts off our Social Security!

![]()

FogerRox

(13,211 posts)We're gearing up the Social Security Defenders Twitter team for March 25-29.

https://twitter.com/RDanaFox thats me.

CaliforniaPeggy

(149,499 posts)FogerRox

(13,211 posts)CaliforniaPeggy

(149,499 posts)I can post your pictures, graphs etc over there.

FogerRox

(13,211 posts)Cant wait.

And thanks, heres my photobucket Social Security Defenders album

http://s38.photobucket.com/albums/e101/FogerRox/Social%20Security%20Defenders/

CaliforniaPeggy

(149,499 posts)In any particular order?

![]()

I'm going to be offline now, to make dinner. I'll check back later.

![]()

FogerRox

(13,211 posts)I get crazy on my FB, I dont expect most people to go to the extremes I do.

CaliforniaPeggy

(149,499 posts)I'll PM you my "real" name, and we can be friends, if you like...

![]()

sabrina 1

(62,325 posts)from going any further than it has already.

No DEMOCRAT should be falling for this fraud. We know the facts about SS yet even here I see attempts to defend the outright fraud that is perpetrated on the people who own this fund.

Thank you for this and I hope everyone will get into this fight to stop the corrupt thieves who are behind the lies we are being told from achieving their goal.

FogerRox

(13,211 posts)I asked the Administrator a question.

Heres the graphics so far, I expect some more - donated by a friend.

http://s38.photobucket.com/albums/e101/FogerRox/Social%20Security%20Defenders/

Flatulo

(5,005 posts)step passed.

jerseyjack

(1,361 posts)FogerRox

(13,211 posts)FogerRox

(13,211 posts)Love it. {{{{{ Hugs }}}}}} for that.

still_one

(92,055 posts)FogerRox

(13,211 posts)Guy Whitey Corngood

(26,493 posts)Warpy

(111,106 posts)First, remove it from the General Fund and restore it to its original form, a self supporting pay as you go old age insurance plan.

Second, remove the earnings cap temporarily until the whole trust fund has been restored.

Third, lower the age for half benefits to 55. At 65, people should be eligible for full benefits. The restoration of the trust fund will accomplish this.

Fourth, index benefits to a market basket of goods and services whose contents can't be changed by another Greenspan the next time the conservatives take over.

Begin to lower the Medicare eligibility age for a full price buy in for people who are still working but getting shafted by the big insurance companies.

FogerRox

(13,211 posts)The SS Trust Fund is not part of the General fund, the trust fund consists of "Special US Treasuries" and is off budget.

And then explain:

Second, remove the earnings cap temporarily until the whole trust fund has been restored.

thanks in advance.

Warpy

(111,106 posts)It is a free standing insurance program and was only put there so Johnson could rob overpayments for the Vietnam War and Reagan turned it into a real racket, using overpayments after he raised the tax six times to try to disguise what giving all his rich friends a free ride on taxes had done to the treasury.

Get it OUT of the General Fund. It doesn't belong there, never did.

FogerRox

(13,211 posts)The Social Security Trust Fund, or at least the OAS (Old Age Survivors) Trust Fund, is almost as old as Social Security itself being established on Jan 1, 1940 pursuant to the Social Security Amendments of 1939.

Warpy

(111,106 posts)If you want to learn the difference between the Social Security program and the semi fictional trust fund, try Wikipedia. Then maybe my post will make sense to you.

FogerRox

(13,211 posts)http://www.ssa.gov/history/InternetMyths2.html

From its inception, the Trust Fund has always worked the same way. The Social Security Trust Fund has never been "put into the general fund of the government."

Otherwise known as an internet myth.

magellan

(13,257 posts)Isn't this where the IOUs come into play? The surplus money is converted into T-bonds, and the government borrows against those to fund its whims. Right now there's nearly $3 Trillion in surplus SocSec payments, converted into T-bonds, that the government has borrowed against, and at some point it'll have to start paying that back, with interest, in order for SSA to cover the baby boomers retiring (which is ostensibly why the payroll tax was increased by Reagan in the first place).

The problem is, they don't want to have to pay back what they've borrowed. Hence the "crisis" with SocSec. It's completely manufactured, just a convenient way to shift the blame for reckless spending by the Repubs on wars and tax cuts to SocSec by claiming it's costing the government too much. Which is a lie. That's OUR money they borrowed and spent as if it were general revenue.

At least that's my understanding of it.

FogerRox

(13,211 posts)But that would cause a collapse of the global economic system.

2.6 trillion in the Trust fund.

And again the trust fund is off budget, not in the general fund, and to claim that it is is a demonstration of being a CT nut, or ignorant, or confused, or not having done any research.

I posted a link to SS.gov upthread that makes it quite clear, the Trust Fund is not in the general fund. If someone is confused by that, well stay out of the deep end of the pool. Or just keep making shit up.

magellan

(13,257 posts)I say the money borrowed against the surplus is used as general revenue. Or perhaps to offset general spending, to make it look less than is really being spent.

And I don't say the government won't pay the money back when they need to...but I do think they're using this scare tactic to undermine SocSec so it can be at least partially privatized.

FogerRox

(13,211 posts)I wrote 2 OPs on DU and one at DK, answering question at all 3. Least you can do is to stay with the topic.

magellan

(13,257 posts)What wasn't clear was who or what you were snarking at in your first reply to me. And now you give me more attitude?

Now I'm out. Have fun.

HiPointDem

(20,729 posts)government (iow, borrowed into the general fund) in exchange for government securities ("IOUs). That's in the initial law.

The TF serves a purpose. Ideally it serves as a cushion for overdraft, like keeping extra money in your checking account. It works the same way. The bank has actually borrowed that extra money in your checking account, but it will return it to you on demand.

SS is prohibited by law from using general revenues, but when SS revenues are borrowed by the government, they can be returned as needed in the same way. That's protection for unforseen shortfalls, such as in a recession year where SS collections are down and more people opt for retirement when they lose jobs.

The only thing that changed was that Reagan *increased* SS taxes beyond what was needed to maintain a simple cushion, to generate an ever-increasing surplus over 30 years.

That's how the TF got so big -- because the taxes circa 1983-2000 were significantly more than needed to fund then-current retirees.

But the TF has always been there, and it always represented money borrowed by the feds from excess SS taxes.

You have the general picture right, but the focus wrong. Congress cannot do anything other than spend excess SS collections. The problem is not that it spent them, but that so much excess was collected in the first place.

And, as you say, that some would prefer not to have to pay it back.

magellan

(13,257 posts)I knew the law was originally written that way, but I'd forgotten about this part - "Congress cannot do anything other than spend excess SS collections."

That's why I said Reagan increased the payroll tax, ostensibly to cover baby boomers. I don't know if others feel the same, but I've suspected that he really did it to bring in more money to borrow and spend.

HiPointDem

(20,729 posts)set up the 'crisis' of the future.

magellan

(13,257 posts)If ALEC was behind this all the time, from way back when, it wouldn't surprise me.

HiPointDem

(20,729 posts)up rates that high; the results were easily predictable.

and it was bipartisan.

don't know if you've seen this CATO institute paper, but it basically lays out the game plan the privatizers have followed ever since.

Achieving a Leninist Strategy (1983)

Stuart Butler and Peter Germanis

http://www.cato.org/sites/cato.org/files/serials/files/cato-journal/1983/11/cj3n2-11.pdf

Setting up IRAs as an alternative model for retirement, talking up problems with SS, dividing the various SS constituencies (e.g. old v. young, upper-class v. middle-class v. poor, developing a constituency for change (finance sector, insurance companies, etc.), laying the ground so that you're ready for the next 'crisis' when your plans can be put into action...

"The next Social Security crisis may be further away than many people believe. ... it could be many years before the conditions are such that a radical reform of Social Security is possible. But then, as Lenin well knew, to be a successful revolutionary, one must also be patient and consistently plan for real reform."

I read this a number of years ago & a light bulb went on in my head. I realized that the ruling class plans things *way* ahead; by the time the people get wind of what's going on, they're way behind the game.

Another light bulb came on when I saw the vote tallies on the 1983 SS amendments that jacked up SS taxes, started taxing SS, etc.

It was a bipartisan vote, with a majority of democrats voting yes -- and some of our staunch 'progressives,' notably Gore & Kennedy, didn't vote.

Even I, as a non-math person, after doing some research could see that 'pre-financing' SS did nothing to improve its financing and was actually harmful, but our democratic reps couldn't see it? I don't believe it.

And taxing SS amounted to a benefits cut, pure and simple.

magellan

(13,257 posts)I had to read the paper myself to be sure that wasn't meant sardonically. Because as we know, the Cato Institute is Koch Bros, free market bs central, 2nd only to the Heritage Foundation in catapulting the propaganda. But no, they outright admit to taking a lesson from Lenin. How the right wingnuts would howl to learn the plan to privatize SocSec was drawn from Leninist strategy!

This should be shared. WIDELY.

Beyond that glaring oddity: holy crap, this is proof that they've been hellbent on destroying public opinion about SocSec so they could eventually privatize it for at least three decades. PURE MANUFACTURED CRISIS.

Again, it should be shared everywhere. And especially shoved in the faces of Rand Paul and Paul Ryan acolytes who've bought into the propaganda that SocSec is an unsustainable ponzi scheme, the obedient little asshats.

I've wondered about the move to tax SocSec but never checked the votes. Afraid to say it doesn't surprise me to learn it was a bipartisan effort. When Durbin came forward in 2007 and said he knew before the invasion of Iraq that the public was being misled, but didn't say anything because he was sworn to secrecy, I began to lose faith in the Dems...and my opinion of them as a functional opposition party has only eroded since then. The term 'kabuki theater' gets used here a lot, and that's my general impression of things nowadays.

Thanks for sharing that, HiPoint. I've bookmarked the page and will definitely be using the info.

HiPointDem

(20,729 posts)Please do use it widely, I think more people should know.

here's a link to the op, kick it & comment if you want to see it stick around.

some people skip stuff that looks wonky.

http://www.democraticunderground.com/10022053689

magellan

(13,257 posts)I'll repost the thing myself if it doesn't turn up.

HiPointDem

(20,729 posts)happened to & it's a recent one, not an old one like this.

hmm.

repost it, i'd like to see what happens!

magellan

(13,257 posts)I hope you don't mind but I moved links around in your OP so they matched up to what site was being quoted.

Let's hope more DUers read it this time!

HiPointDem

(20,729 posts)FogerRox

(13,211 posts)There were down to less than a years worth of benefits in assets, summer of 1983. And since IIRC the increases were phased in, so there was no large increase in funds.

HiPointDem

(20,729 posts)what happened was a matter of paper accounting only -- whether the accounting of SS was placed 'off-budget' or 'on-budget'.

In early 1968 President Lyndon Johnson made a change in the budget presentation by including Social Security and all other trust funds in a "unified budget." This is likewise sometimes described by saying that Social Security was placed "on-budget."

SS accounting was taken 'off-budget' again by Reagan:

So, to sum up:

1- Social Security was off-budget from 1935-1968;

2- On-budget from 1969-1985;

3- Off-budget from 1986-1990, for all purposes except computing the deficit;

4- Off-budget for all purposes since 1990.

http://www.ssa.gov/history/BudgetTreatment.html

SS isn't "in the general budget" in any way different from how it was when it began. Initially SS went into a special account; the TF was established in 1939, before payments started being made.

In the 1939 Amendments, a formal trust fund was established and a requirement was put in place for annual reports on the actuarial status of the fund..."

http://www.ssa.gov/history/BudgetTreatment.html

HomeboyHombre

(46 posts)You can't have too many of them these days, heh.

JDPriestly

(57,936 posts)42 USC § 401 - Trust Funds

Current through Pub. L. 112-238. (See Public Laws for the current Congress.)

(a) Federal Old-Age and Survivors Insurance Trust Fund

There is hereby created on the books of the Treasury of the United States a trust fund to be known as the “Federal Old-Age and Survivors Insurance Trust Fund”. The Federal Old-Age and Survivors Insurance Trust Fund shall consist of the securities held by the Secretary of the Treasury for the Old-Age Reserve Account and the amount standing to the credit of the Old-Age Reserve Account on the books of the Treasury on January 1, 1940, which securities and amount the Secretary of the Treasury is authorized and directed to transfer to the Federal Old-Age and Survivors Insurance Trust Fund, and, in addition, such gifts and bequests as may be made as provided in subsection (i)(1) of this section, and such amounts as may be appropriated to, or deposited in, the Federal Old-Age and Survivors Insurance Trust Fund as hereinafter provided. There is hereby appropriated to the Federal Old-Age and Survivors Insurance Trust Fund for the fiscal year ending June 30, 1941, and for each fiscal year thereafter, out of any moneys in the Treasury not otherwise appropriated, amounts equivalent to 100 per centum of—

(1) the taxes (including interest, penalties, and additions to the taxes) received under subchapter A of chapter 9 of the Internal Revenue Code of 1939 (and covered into the Treasury) which are deposited into the Treasury by collectors of internal revenue before January 1, 1951; and

(2) the taxes certified each month by the Commissioner of Internal Revenue as taxes received under subchapter A of chapter 9 of such Code which are deposited into the Treasury by collectors of internal revenue after December 31, 1950, and before January 1, 1953, with respect to assessments of such taxes made before January 1, 1951; and

(3) the taxes imposed by subchapter A of chapter 9 of such Code with respect to wages (as defined in section 1426 of such Code), and by chapter 21 (other than sections 3101(b) and 3111(b)) of the Internal Revenue Code of 1954 with respect to wages (as defined in section 3121 of such Code) reported to the Commissioner of Internal Revenue pursuant to section 1420(c) of the Internal Revenue Code of 1939 after December 31, 1950, or to the Secretary of the Treasury or his delegates pursuant to subtitle F of the Internal Revenue Code of 1954 after December 31, 1954, as determined by the Secretary of the Treasury by applying the applicable rates of tax under such subchapter or chapter 21 (other than sections 3101 (b) and 3111(b)) to such wages, which wages shall be certified by the Commissioner of Social Security on the basis of the records of wages established and maintained by such Commissioner in accordance with such reports, less the amounts specified in clause (1) of subsection (b) of this section; and

(4) the taxes imposed by subchapter E of chapter 1 of the Internal Revenue Code of 1939, with respect to self-employment income (as defined in section 481 of such Code), and by chapter 2 (other than section 1401(b)) of the Internal Revenue Code of 1954 with respect to self-employment income (as defined in section 1402 of such Code) reported to the Commissioner of Internal Revenue on tax returns under such subchapter or to the Secretary of the Treasury or his delegate on tax returns under subtitle F of such Code, as determined by the Secretary of the Treasury by applying the applicable rate of tax under such subchapter or chapter (other than section 1401 (b)) to such self-employment income, which self-employment income shall be certified by the Commissioner of Social Security on the basis of the records of self-employment income established and maintained by the Commissioner of Social Security in accordance with such returns, less the amounts specified in clause (2) of subsection (b) of this section.

The amounts appropriated by clauses (3) and (4) of this subsection shall be transferred from time to time from the general fund in the Treasury to the Federal Old-Age and Survivors Insurance Trust Fund, and the amounts appropriated by clauses (1) and (2) of subsection (b) of this section shall be transferred from time to time from the general fund in the Treasury to the Federal Disability Insurance Trust Fund, such amounts to be determined on the basis of estimates by the Secretary of the Treasury of the taxes, specified in clauses (3) and (4) of this subsection, paid to or deposited into the Treasury; and proper adjustments shall be made in amounts subsequently transferred to the extent prior estimates were in excess of or were less than the taxes specified in such clauses (3) and (4) of this subsection. All amounts transferred to either Trust Fund under the preceding sentence shall be invested by the Managing Trustee in the same manner and to the same extent as the other assets of such Trust Fund. Notwithstanding the preceding sentence, in any case in which the Secretary of the Treasury determines that the assets of either such Trust Fund would otherwise be inadequate to meet such Fund’s obligations for any month, the Secretary of the Treasury shall transfer to such Trust Fund on the first day of such month the amount which would have been transferred to such Fund under this section as in effect on October 1, 1990; and such Trust Fund shall pay interest to the general fund on the amount so transferred on the first day of any month at a rate (calculated on a daily basis, and applied against the difference between the amount so transferred on such first day and the amount which would have been transferred to the Trust Fund up to that day under the procedures in effect on January 1, 1983) equal to the rate earned by the investments of such Fund in the same month under subsection (d) of this section.

. . . .

More

http://www.law.cornell.edu/uscode/text/42/401

» Analysis & Opinion Home

Opinion

David Cay Johnston

Follow David Cay Johnston

[View David Cay Johnston RSS feed]

Social Security is not going broke

By David Cay Johnston

May 4, 2012

social security | taxes

Which federal program took in more than it spent last year, added $95 billion to its surplus and lifted 20 million Americans of all ages out of poverty?

Why, Social Security, of course, which ended 2011 with a $2.7 trillion surplus.

That surplus is almost twice the $1.4 trillion collected in personal and corporate income taxes last year. And it is projected to go on growing until 2021, the year the youngest Baby Boomers turn 67 and qualify for full old-age benefits.

. . . .

Now let’s look at how that $2.7 trillion Social Security surplus arose. In 1983, President Ronald Reagan sponsored an increase in Social Security taxes, changing the program from pay-as-you-go to collecting much more taxes than it paid in benefits. The idea was to have the Boomers prepay part of their old age benefits. The extra tax was supposed to pay off the federal debt and then be invested in federal bonds. Instead, Reagan ran huge deficits, violating his 1980 promise to balance the federal budget within three years of taking office.

http://blogs.reuters.com/david-cay-johnston/2012/05/04/social-security-is-not-going-broke/

Find out how much money we wasted in Iraq and Afghanistan -- two lost wars.

http://costofwar.com/

msongs

(67,336 posts)FogerRox

(13,211 posts)liberal N proud

(60,331 posts)WillyT

(72,631 posts)FogerRox

(13,211 posts)rurallib

(62,371 posts)that really must go.

HiPointDem

(20,729 posts)it's what keeps SS from being turned into something that can be styled as 'welfare,' where the top 20% or so of wage earners wind up funding most of the program.

it's why SS is supported by a majority of the population, including high earners.

you want to raise taxes on someone, raise income taxes on the top 1-5%, the prime beneficiaries of the bush tax cuts that were premised on the 'surplus' created by excess SS taxation.

Generic Brad

(14,272 posts)The wealthy should pay the same tax on every last penny of income they earn like the rest of us do.

FogerRox

(13,211 posts)ANd removing the cap automatically creates a $14,ooo monthly check for some uber rich person.

I think its much smarter to go back to the income tax rates we had pre Reagan era.

Generic Brad

(14,272 posts)Their payout should be capped and their contributions should be increased.

FogerRox

(13,211 posts)The GOP would love that.

JDPriestly

(57,936 posts)The highest benefit is not that high. Don't worry about it. That some people get benefits that are too high is not the problem, not at all.

FogerRox

(13,211 posts)IF we remove the cap we automatically create a 14k monthly per the SS AIME formula.

How do you think Seniors got the COLA this year, the cap went from 110k in 2012, to 113k in 2013, that was a IIRC 1.7% COLA for benefits.

customerserviceguy

(25,183 posts)Remove the cap, and you shove the maximum benefit through the roof. Even with 85% of that benefit taxable to higher earners, if you apply the top tax rate to it, they still keep about two-thirds of it.

How about raising the cap modestly, index it for inflation, and make the sky the limit on the employer's portion of FICA?

David__77

(23,311 posts)There should be no maximum payout or contribution. But the marginal payout should progressively get smaller as income goes above different thresholds. We need to maintain a clear link between contribution and payout for most recipients.

HiPointDem

(20,729 posts)that the highest wage earners wind up funding the majority of the program -- over half. And that makes the program ripe to be demagogued as welfare. it also means a lot of resentment on the part of some of those high wage earners, also ripe for demagoguery.

And remember -- SS taxes LABOR, it doesn't tax CAPITAL.

The funding structure has worked just fine for 73 years. The only reason you're calling for a change now is because you've been set up to do so.

Think about it: there's nearly $3 trillion in the Trust Fund currently. What would the purpose be in raising even *more* money in SS taxes at this moment, when SS is owed $3 trillion?

ErikJ

(6,335 posts)The SS trust fund currently has a $2.6 trillion SURPLUS which will last till 2037, then it will go to a pre-1985 pay as you go fund like it was since 1937.

FogerRox

(13,211 posts)based on 20 more years of recession and no wage growth. Eric, Please reread the OP, specifically the chart that says SS is good thru 2090.

ErikJ

(6,335 posts)He said the SURPLUS in the trust fund will last til 2037 at which time, at current rates, will be able to pay out 90% benefits. He has advocated that we raise the cap from $110,000 a year or even unlimited cap which would make it solvent forever.

FogerRox

(13,211 posts)and leaves a donut hole IIRC between 113k and 250k in FICA.

http://thinkprogress.org/economy/2011/08/25/304387/bernie-sanders-introduces-bill-to-lift-the-payroll-tax-cap-ensuring-full-social-security-funding-for-nearly-75-years/?mobile=nc

TexasBushwhacker

(20,116 posts)The CBO will only project out 75 years, so to say it will keep SS solvent for 75 years is essentially saying it's solvent in perpetuity.

Another thing they need to do is have an Alternative Minimum Social Security Tax. It's bad enough that the investment class only has to pay capital gains rate on ALL their investment income. Make them contribute to SS and Medicare too. I don't care that they're rich and won't need it. Taking care of the disabled, survivors and the elderly should be the cost of living in a civilized society.

FogerRox

(13,211 posts)I do know the CBO scored the gap at .6% of GDP over 75 years, and removing the cap equals .6%.

Since Sanders bill doesnt collect FICA between 133k and 250k, it cant equal .6%. 113k is the 83rd percentile, 250k is the 97.5th. About 15% get a huge break, I wont bother doing the math, so I'm keeping my guess.

Just my guess.

But job creation can close the same gap

Without large scale job creation there is no recovery, with no recovery, we wont be addressing income disparity.

TexasBushwhacker

(20,116 posts)is that a disproportionate amount of increased income has gone to the 1%. By having the untaxed gap between $113K and $250K, it gives those in the upper middle a bit of a break. That demographic hasn't seen much of an increase income over the last several years either.

I agree about job creation though. Considering that other countries are willing to loan the US money at essentially 0% interest when you subtract inflation. Go ahead and repair those thousands of crumbling bridges. Fund education and job training so we can fill those millions of jobs that go unfilled for lack of training.

Just an example. We have 2 earthen dams constructed over 50 years ago on the west side of Houston. They are in desperate need of repair. They are 2 of the top 6 dams in need of repair in the country and when they fail, it could be Katrina levels of damage OR GREATER. So why aren't we spending millions now to prevent billions in damage later. The work needs to be done. People need jobs. Borrow the money from China or whoever and GET IT DONE.

http://www.houstonpress.com/2012-07-19/news/addicks-barker-dams/

FogerRox

(13,211 posts)The traditional decades old metric of what is the middle class, being in the middle 3 quintiles might apply here, or not.

I'll have to draw the line at 85%.

I hate on all the remove the cap ideas, but..... if we're going to play with the cap, lets do it right, thats the Begich bill.

http://www.dailykos.com/story/2013/03/04/1191509/-AK-Sen-The-Daily-Kos-Should-Endorse-The-Protecting-Preserving-Social-Security-Act-of-2013

Response to FogerRox (Reply #42)

ProSense This message was self-deleted by its author.

HiPointDem

(20,729 posts)I've done that, as has Roger Fox, and it's enlightening.

The SS Trustees make 3 forecasts; a low-cost, high-cost, and middle of the road forecast. Sanders is quoting the middle-of-the-road forecast, and that's the one that's always quoted in the media too.

But the fact is: the low-cost forecast has been more accurate on average than either of the other two.

The second fact is: the middle-of-the-road forecast is based on dubious assumptions about growth, employment, productivity etc -- essentially based on the idea that we're going to be in recession for the next 75 years.

A third fact: when Reagan jacked up SS taxes in 1983 he *also* said it would 'save' SS forever. But it didn't. When politicians say things like that, they're bullshitting you, and Sanders is no exception.

A question: There's nearly $3 trillion dollars in the Trust Fund. That represents a debt owed to SS. Why is Sanders promoting *increasing* SS taxes at this time? What is the point in collecting even more SS taxes before that debt is paid down? The Trust Fund is still *growing,* getting bigger. Why does sanders want to collect even more money to make it even bigger????

The people who designed SS knew what they were doing; they created the most successful and longest-lived retirement security program in history. Every step away from their design is a step toward destruction of the program, and that's the aim of all these phoney 'solutions'.

Raising the cap is promoted as the 'left' solution as v. the 'right' solution of private accounts. But they're both bad.

First and foremost, because the 'crisis' is not as advertised.

JDPriestly

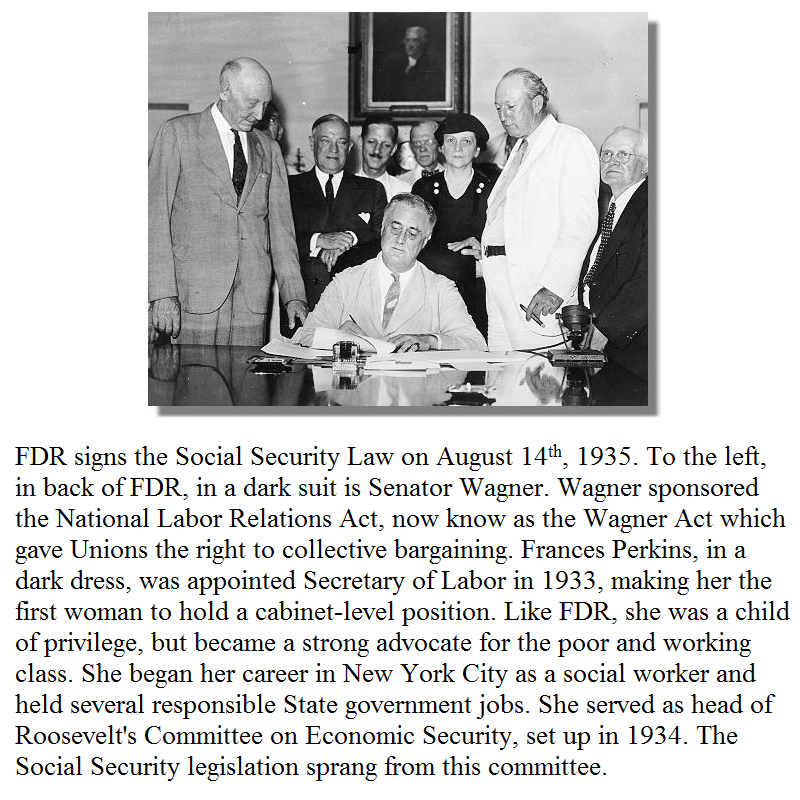

(57,936 posts)On August 14, 1935 President Roosevelt signed the bill into law at a ceremony in the White House Cabinet Room.

http://www.ssa.gov/history/tally.html

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874 on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont where one of her classmates was Calvin Coolidge. In 1905, after working as a school teacher, she became a legal secretary. One of the partners in the firm, John G. Sargent, would later become Attorney General in the Coolidge Administration.

Ida May never married and had no children. She lived alone most of her life, but spent eight years near the end of her life living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand she dropped by the Rutland Social Security office to ask about possible benefits. She would later observe: "It wasn't that I expected anything, mind you, but I knew I'd been paying for something called Social Security and I wanted to ask the people in Rutland about it."

http://www.ssa.gov/history/imf.html

FogerRox

(13,211 posts)Up until Jan 1 1940, the Trust fund did not exist.

grahamhgreen

(15,741 posts)HiPointDem

(20,729 posts)JDPriestly

(57,936 posts)in the Trust Fund for the baby boomers.

The "surplus" in the Trust Fund is intended to provide for the baby boomers' retirement. It will not be needed when the baby boomers are mostly dead because after the demise of the baby boomers, the money-in, money-out Trust-Fund-primarily-to-separate-Social-Security-revenues-from-the-General-Fund operations will resume.

All this worry about depleting the surplus in the Trust Fund is foolish because the surplus in the Trust Fund was specifically set up to pay for the Baby Boomers' senior years.

This is a big hoax.

The real problem is jobs. Social Security is just a red herring. Republicans want to keep wages and therefore tax revenues low. That's their goal. That's what they campaign on. They don't want to have more jobs. This lousy job market is great for the GOP and the corporate masters.

HiPointDem

(20,729 posts)Miss Fuller's claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.

FogerRox

(13,211 posts)HiPointDem

(20,729 posts)from labor?

Raise income taxes on capital and let them PAY BACK THE MONEY THEY BORROWED FIRST.

Your proposal is illogical.

reteachinwi

(579 posts)This idea should be an OP.

HiPointDem

(20,729 posts)madinmaryland

(64,931 posts)RAISE THE CAP.

rhett o rick

(55,981 posts)HiPointDem

(20,729 posts)Honeycombe8

(37,648 posts)But there seems to be agreement that for now, SS is solvent. It will start paying in the red in 10 - 20 years, according to some. Not bankrupt. Just not having the full amounts that are owed to beneficiaries each year. But you say that's not so, and I follow the reasoning. When the economy improves, SS income will go up. Makes sense.

But I do know that for now, there is NO NEED to fool with Social Security. That should be off the table and discussed separately, later, if at all.

That's not to say that the Dems shouldn't entice Republicans with it, such as the last offer which was for certain the Republicans wouldn't take. At least that's my opinion of what that last offer was about But who knows.

I wish someone would take a stand and just say NO. You know...like the Republicans do.

GoneFishin

(5,217 posts)I have never heard anything close to 10 years.

It is pure bullshit for any politician to suggest that this should be on the table for cuts.

Any suggestion that it needs to be "fixed" is propaganda.

FogerRox

(13,211 posts)

Honeycombe8

(37,648 posts)They send you a paper that tells you your estimated benefits for some future year, etc. In that paper is a blip about SS's solvency. At one time, it said it would be solvent for 10 years, at which time it would start having to pay out more than incoming or in its fund or whatever.

However, I'm old enough to remember that this doomsday prophecy pops up every decade.

For instance, that blip about 10 years I mentioned....well, if it's true that it's now 20 years...I guess it was wrong about the 10 years, since Social Security hasn't been tweaked in the last few years.

FogerRox

(13,211 posts)Low cost, Intermediate cost, High cost and a Stochastic model. The Intermediate cost scenario says SS will be broke in 2033, thats probably the date your familiar with. But the Intermediate and high cost scenarios are very conservative estimates based on unrealistic assumptions, like GDP growth staying at 2.1%, like 20 more years of recession. and unemployment staying put.

The low cost scenario relies on 2.8% GDP growth, lots of job creation and some wage growth. Nothing too improbable, and all in line with historical trends.

This chart I took from the 2012 Social Security Trustees report, the link is on the bottom. It shows the different scenarios and the dates that trust fund depletion is predicted, except where I collapsed the chart to fit on a page.

GoneFishin

(5,217 posts)But, I am still uncertain how to interpret the data. If there is any scenario under which the fund exhausts in 2015 then I don't understand why the SS privatization pirates aren't screaming about the sky falling in 2015.

PoliticAverse

(26,366 posts)(see http://www.ssa.gov/oact/progdata/fundFAQ.html#n1 )

The Old-Age and Survivors Insurance (OASI) trust fund

and

The Disability Insurance (DI) trust fund.

The DI trust fund is currently projected to be depleted in a few years (~ 2017)

What happens to the DI trust fund depends a great deal on how many people apply and are approved for

disability payments in the next few years.

FogerRox

(13,211 posts)Which is why its probably more prudent to consider the OASDI column.

Honeycombe8

(37,648 posts)when they say SS will be exhausted in a few years?

I thought the DI might be a problem. These are people who might become disabled at young ages, before they've paid much in, and they will naturally get a lot of benefits, since they will have more years on SS than the norm. I think.

Thanks!

HiPointDem

(20,729 posts)most recent official forecast, and it's the one used in the media.

That forecast changes every year though, depending on economic conditions and the assumptions they plug into the model. That's why you hear different numbers.

But basically, 20 years until the Trust Fund is used up, officially. However, SS would still be able to pay out 75-80% of benefits on SS tax revenues alone after that, without any "fix" at all. (And because of scheduled benefit increases, the value represented by that 75-80% would actually be above the current 75-80% value).

Date for exhaustion of the TF isn't set in stone though; lots of things can alter the situation. More jobs and higher wages, for one.

And remember: it's a forecast, not a certainty. In fact, the Trustees make 3 forecasts every year, and the low-cost forecast has been most accurate in the short-term. And it shows the TF not being exhausted at all.

So I guess my point is, when people tell you X will *definitely* happen, they're lying. And quite possibly they're trying to stampede you into supporting something that will be bad for you.

Honeycombe8

(37,648 posts)The forecast can't possibly forecast when the effects of the recession will end, or to what extent. If I were doing the forecast, I'd be VERY conservative about incoming money, to be safe.

Thanks!

reteachinwi

(579 posts)Brief and understandable.

http://www.latimes.com/business/la-fi-hiltzik-20130310,0,966731.column

Honeycombe8

(37,648 posts)dkf

(37,305 posts)http://www.ssa.gov/oact/TRSUM/index.html

You may dispute the numbers but this is put out by the trustees of the SS fund.

Here are your trustees:

Timothy F. Geithner,

Secretary of the Treasury,

and Managing Trustee

Kathleen Sebelius,

Secretary of Health

and Human Services,

and Trustee

Charles P. Blahous III,

Trustee

Hilda L. Solis,

Secretary of Labor,

and Trustee

Michael J. Astrue,

Commissioner of

Social Security,

and Trustee

Robert D. Reischauer,

Trustee

According to you these trustees are crap GOPers? Do you truly believe that?

GoneFishin

(5,217 posts)Timothy F. Geithner

Managing Trustee

HiPointDem

(20,729 posts)all attempts to stampede you into a 'solution' to their 'problem'.

FogerRox

(13,211 posts)Low cost, Intermediate cost, High cost and a stochastic model.

Low cost says 2090

Intermediate cost says 2033

High Cost says 2029

You are quoting from the Summary. I'm quoting from the tables included from within the 2012 report on trust fund ratios. Below is a screen capture from the 2012 SS TRustees report, Trust Fund Ratios:

Here is the direct link

http://www.ssa.gov/oact/tr/2012/lr4b3.html

If I can be of any other assistance let me know.

dkf

(37,305 posts)Why would you assume the best case scenario? Is that really how you would give advice? You would think the intermediate had a higher probability than either the high or low case.

Your advice seems a bit irresponsible to me. People need more reality, less moon and stars and happy talk.

FogerRox

(13,211 posts)dkf

(37,305 posts)Thinking it will all turn out okay, housing prices always go up, you can refinance or flip the house, etc.

Frankly if you wanted me to choose any of those models I would pick the stochastic model, and certainly not the best case scenario. Any salesperson who uses best case scenarios is someone I have problems with.

In fact I would probably use the high and the low to see the range of possibilities. But to plan for the future based on either high or low is not smart.

FogerRox

(13,211 posts)Guess, whats will be the average GDP growth over the next 20 years?

I'm guessing 3% to 3.5%. 3.5% is the best case scenario. The days of 4-6-8% GDP growth are long gone.

Whats your guess?

Less than 2%?

Less than 3%

Make your guess then look up the Intermediate and High cost scenarios, see Real GDP

http://www.ssa.gov/oact/tr/2012/lr5b2.html

dkf

(37,305 posts)I'd put it at 6%.

GDP I'd put between the low and intermediate scenarios.

I would be loathe to predict interest rates and inflation...it depends how they intend to deal with the debt.

I'm not sure where that leaves me but its probably closer to intermediate than the low.

FogerRox

(13,211 posts)Good point-Unemployment of 4.5% is a stretch, but that is why we should stress large scale job creation, 20 million jobs would ball park leave us at 4-5% U3. And the 2011 CBO scoring of the shortfall is .6% of GDP, so 20 million jobs at 36k is just about .6% of GDP, 15 trillion in 2012.

And if we do have good job creation the GDP will be up above 3% most likely.

Its interesting that the low cost scenario assumes more inflation

Int 2.9

low 3.4

high 2.4

http://www.ssa.gov/oact/tr/2012/II_C_assump.html#97250

Possibly because of the assumption of more job creation and wage growth. But the high cost scenario has more Average annual percentage change in average wages.

GDP I'd put between the low and intermediate scenarios.

That would be between- roughly- 2.1% and 2.8%, so 2.45%..? If that 2.45% is mostly because of job creation thats bumping the 2033 date possibly half way to 2062 when the Boomers are statistically Dead. If 2.45% is because the top .1% and the corporations are doing swell, not so much.

I think no one expects GDP higher than 3.5% in a rolling 3 year average, I think if we create 20 million jobs and raise the min wage every 4-5 years, then GDP will be 3.0% to 3.3%.

Thanks for the good conversation.

HiPointDem

(20,729 posts)Last edited Wed Mar 13, 2013, 02:39 AM - Edit history (1)

even *if* the TF will be exhausted in 21 years based on current conditions, there's no reason to do anything about it right this minute; there's at least 10 years before anything needs to be done -- in which time, conditions may quite easily change.

And if the economy improves, so will the forecast.

dkf

(37,305 posts)HiPointDem

(20,729 posts)2086 is full of shit.

Ergo, the long-term projection is mostly bullshit and the main reason it exists is to set up strictures that will allow the privatizers to pressure the public and herd people into their desired solutions.

Current retirees are always supported by current production. (As is everyone). If SS can't support retirees, then nothing can, because if it can't support them that can only mean one of two things:

1. The US is not producing enough goods and services to feed shelter and clothe all its people, or

2. Some fractions of the US population are taking too much.

I do know, however, that the average UE rate during the period from 1970 to the present has been about 6% and we produced $3 billion in Social Security surpluses.

And finally I'll say that we have a reasonable amount of control over what they unemployment rate actually is. For example:

Greenspan, who is not an orthodox economist, decided to let the unemployment rate fall below the 6.0 percent target because he saw no evidence of inflation. He had to argue with the Clinton appointees to the Fed who wanted to raise interest rates to head off inflation. It was really due to Greenspan's policies that the unemployment rate was allowed to fall to 5.0 percent and eventually to 4.0 percent as a year-round average in 2000. This allowed millions of people to work who would not have otherwise had a job. The tight labor market also allowed for large gains in real wages for workers at the middle and bottom of the wage distribution for the first time in a quarter century. Oh, and for the DC policy wonks, it also gave us a budget surplus.

http://www.cepr.net/index.php/beat-the-press/Page-2

dkf

(37,305 posts)That is why I don't think we will see sub 5% UE in the future. Moreover look at where technology is taking us...robots and 3d printing will be significant. So we see manufacturing is growing in the US but jobs in manufacturing are not.

Rogoff and Reinhart's research show that historically when debt to GDP goes over 90% and above there is a 1% drag on GDP that lasts on average 26 years.

Then you have financial repression:

Financial repression is growing in prevalence throughout the world. Both developed and emerging economies use its tactics: developed sovereigns that struggle with explosive increases in their outstanding debt, and emerging market countries that face increasingly scarce external demand. Investors need to be especially alert to increasing financial repression, because it transfers value from savers, investors and creditors to government debtors. We are likely on the cusp of a new era of global financial repression, with important and far-reaching investment ramifications.

Costs and Risks of Financial Repression

Beyond the pain of low real returns imposed on savers and investors, there are other costs and risks associated with financial repression. It can inhibit growth over the medium to longer term because it tends to promote very inefficient capital allocation and to crowd out more productive investment. In addition, repression can potentially lead the economy toward significant (unintended) market distortions: asset booms/busts, uncontrollable bouts of inflation, sudden stops in economic activity from loss of confidence, or capital flight.

http://www.pimco.com/EN/Insights/Pages/A-New-Era-of-Global-Financial-Repression.aspx

FogerRox

(13,211 posts)to illustrate the point.

Maybe we only create 14 million jobs, but have good wage growth, well then it evens out in the GDP numbers , and all we need is GDP averaging about 2.8%.

Wasnt it the CBO who forecasted 12 million new jobs over the next 4 years? And that severely fooks up the Intermediate scenario, and nearly matches the low cost U3 numbers.

http://www.ssa.gov/oact/tr/2012/lr5b2.html

Meanwhile workforce growth in the Int scenario needs to drop from 1.2% to .4% within 10 years. Which is not going to happen, the BLS says .7% by 2050, and if we have immigration reform by 2015 that includes amnesty, the Int scenario is blown to shit with 18 years left to the 2033 date.

Lets keep the conversation going. Its worth it to me cause you are not making shit up and you understand the underlining data. We just disagree on some of the assumptions.

dkf

(37,305 posts)The intermediate assumptions reflect the Trustees' best estimate for the future behavior of each variable

http://www.ssa.gov/policy/docs/ssb/v65n1/v65n1p26.html

duffyduff

(3,251 posts)You have to be reminded of this all the time, because this comes right out of the far right, Koch-founded Cato Institute, which twisted the projections for reasons of ideology.

Obama and Geithner and the Catfood Commission also believe in this bullshit, and they know better.

I don't trust "Democrats" any better on this issue than Republicans since most of them have been infected with the neoliberal cancer.

JDPriestly

(57,936 posts)Social Security’s expenditures exceeded non-interest income in 2010 and 2011, the first such occurrences since 1983, and the Trustees estimate that these expenditures will remain greater than non-interest income throughout the 75-year projection period. The deficit of non-interest income relative to expenditures was about $49 billion in 2010 and $45 billion in 2011, and the Trustees project that it will average about $66 billion between 2012 and 2018 before rising steeply as the economy slows after the recovery is complete and the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers.

Unless we improve wages and increase the number of jobs, no part of our economy will do well in the future.

Social Security is a red herring. It is a small part of the bigger picture in our economy. We have to raise the minimum wage and the cap on income subject to Social Security taxes.

We are enjoying greatly increased productivity. The benefits of the increase in productivity should be shared across all segments of our society and not just hoarded by those at the top. That would solve many of the economic problems that we have. We will still have to deal with a decline in the amount of natural resources and more expensive energy.

FogerRox

(13,211 posts)A pleasure JD.

Except lets down play what was going on in 1983, there less than 1 years worth of assets at that point.

ProSense

(116,464 posts)You'd be surprised at who opposes raising the cap. Evidently, some believe that the rich should have some of their income protected from payroll taxes.

HiPointDem

(20,729 posts)CAPITAL INCOME (which makes up most of the income of 'the rich,' and is not subject to Social Security taxes).

"The rich," the truly rich, live mostly off capital income.

SS taxes labor.

The cap exists for a good reason; so that high-earners wouldn't be paying for most of SS, and beneficiaries could say with justification: "I paid for my benefits".

It's the reason that SS is strongly supported by a majority of the population.

Take away that and you take away a lot of support. Which is just what the privatizers want, and why it's their preferred 'solution' for a non-existent 'problem'.

ProSense

(116,464 posts)"I'm actually not surprised at your attempt to blur the distinction between LABOR INCOME & CAPITAL INCOME"

...I did all that by quoting another poster and offering a brief comment?

I'm not surprised at your defensiveness: http://www.democraticunderground.com/10022475178#post30

HiPointDem

(20,729 posts)HiPointDem

(20,729 posts)placement of the cap that's perhaps problematic.

It's CAPITAL that's enjoying most of the value of productivity increases, and raising the cap doesn't touch capital. SS taxes are assessed on labor only.

ProSense

(116,464 posts)"It's CAPITAL that's enjoying most of the value of productivity increases, and raising the cap doesn't touch capital. SS taxes are assessed on labor only."

...If income below $110,000 is subjected to Social Security payroll taxes, why would arguing against taxing "labor" income be used to protect income above that limit?

I mean, this sounds like an argument to protect the rich.

HiPointDem

(20,729 posts)Wage income is taxed twice actually; you pay income taxes even on the money taken off the top of your check for SS.

If I am a doctor working as an employee who makes $250K, i will pay $7049 in SS taxes.

Without a cap, I'll pay $15,500. In addition to paying income taxes of roughly $60,000. Making my effective total tax rate over 30%, which is way higher than Bill Gates' effective rate, I'm sure.

If I'm a doctor who *owns* a practice, I won't pay any SS taxes (unless I pay myself a salary, in which case I can set it as low or high as I like).

ProSense

(116,464 posts)If I am a doctor working as an employee who makes $250K, i will pay $7049 in SS taxes.

Without a cap, I'll pay $15,500. In addition to paying income taxes of roughly $60,000. Making my effective total tax rate over 30%, which is way higher than Bill Gates' effective rate, I'm sure.

If I'm a doctor who *owns* a practice, I won't pay any SS taxes (unless I pay myself a salary, in which case I can set it as low or high as I like).

...you believe the person who earns $113,000 or less deserves to have their entire income subjected to SS taxes, but some of yours should be exempted?

The person earning $113,000 also pays income taxes.

HiPointDem

(20,729 posts)reason was actually stated explicitly in the discussions during the creation of social security.

Given that wage income is structured unequally, with a small minority making a lot of income and most people making not so much, a flat tax on all wage income means that a small fraction of earners will be funding a majority percent of the cost of the program.

If you give them benefits in rough proportion to their contribution, there's not much left for the rest of beneficiaries, and the program doesn't succeed as a safety net.

If you don't give them benefits in proportion to their contribution, the program can be demagogued as 'welfare.' Lower-income people can't say "I paid for my benefits,' because in fact, they didn't pay for most of them.

This point, about keeping the program safe from this kind of attack, was discussed explicitly.

The solution was to cap contributions to cover roughly 90% of wage income and disburse benefits in rough proportion to what everyone pays in, with low earners getting a little bump and high earners getting a little haircut.

And this is the main reason that SS is the most successful and longest-lived retirement security program in history, and the most popular social program in america, supported by people at every level of income.

You are not wiser than the people who created social security.

Every deviation from their funding formula has weakened the program, not strengthened it.

You want to hit high earners, you can hit them through the income tax, which hits both labor and capital. Then they can PAY BACK THE $3 TRILLION THEY OWE TO SOCIAL SECURITY.

Which is something folks like you are loathe to talk about.

Social security is not a welfare program.

The person making $113K pays income taxes at a lower rate on his $113K than the person making $250K does the proportion of his income over that $113K.

The person making $250K receives the same SS benefits as the person making $113K.

ProSense

(116,464 posts)"it's stupid legislation and it doesn't strengthen anything."

..."stupid" to those trying to confuse the issue.

"I believe the people who set up SS were wiser than you."

...agree with this statement: "raising the cap to its original/traditional 90% is fine by me."

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=1839646

They were wiser, approximately 97 percent of all income was subjected to the tax. With more income concentrated at the top, it only makes sense to raise the cap.

There is no reason that some people should have their entire income taxed and others do not.

http://www.epi.org/blog/social-security-trustees-report/

HiPointDem

(20,729 posts)of where it actually is right now, but supposedly covering about 87% of total wage income.

It can be determined from income tax data if you want to calculate it.

but that's not what the sanders bill does.

FogerRox

(13,211 posts)HiPointDem

(20,729 posts)FogerRox

(13,211 posts)HiPointDem

(20,729 posts)FogerRox

(13,211 posts)FogerRox

(13,211 posts)HiPointDem

(20,729 posts)ProSense

(116,464 posts)Without a cap, I'll pay $15,500. In addition to paying income taxes of roughly $60,000. Making my effective total tax rate over 30%, which is way higher than Bill Gates' effective rate, I'm sure.

...not only did you receive a tax cut in the December deal, but you're wrong about the impact the legislation would have on someone earning $250K. It applies the tax to income above $250,000. That person is in the loophole.

http://www.democraticunderground.com/10022475178

That is my only disagreement with this bill, the cap should be removed on all income.

HiPointDem

(20,729 posts)people like yourself want to increase social security taxes, but only on WAGE LABOR, eh?

ProSense

(116,464 posts)"The question is, *why* did my hypothetical high earner receive an income tax cut, while people like yourself want to increase social security taxes, but only on WAGE LABOR, eh?"

...are you conflating the "income tax" with the SS security payroll tax?

I mean, if you were against the tax cut and want to conflate the two, here's an opportunity to raise taxes on the rich.

HiPointDem

(20,729 posts)JDPriestly

(57,936 posts)bonuses. But if that happens, it could be imposed at a lower rate -- on everyone. That would be fair to all.

JDPriestly

(57,936 posts)I would include income that is referred to as a "bonus." And then, I would lower the rate of the Social Security tax.

One problem that our politicians seem to be ignoring is the fact that people of the much older generation -- say people 75+ are far more likely to have work-related pensions than are the baby boomers, especially the younger baby boomers.

The presidents and Congresses since Nixon have pretty much followed policies that discouraged work-related pensions. Many employers liquidated pension funds when they sold the businesses in which their employees had worked for many years.

Baby boomers will thus be increasingly dependent on Social Security and Medicare.

Right now, if you recently retired and have a small amount of savings, your interest income is not keeping up with inflation.

This chart shows the inflation rate in 2011 at 3% and in 2012 at 1.7%. I believe it is higher than that for food and pharmaceuticals which are what seniors buy.

http://www.usinflationcalculator.com/inflation/current-inflation-rates/

Interest rates on CDs and bank accounts are generally less than 1%. If you can get 1%, you are really doing well. During the Reagan era, it was possible to get 15% interest on savings. The inflation rate was higher than it is now especially in 1979, 1980 and the early months of 1981, but it did not reach 15%.

For retirees that means that even if you saved, you have no income from your savings at this time. Retirees are not advised to invest in stocks unless they otherwise have a very safe financial situation.

So, retirees are really hurting right now. And while I think that if Congress would just focus on increasing jobs and raising wages, maybe by cutting back on imports, instead of on cutting Social Security and Medicare, things could get much better for younger people of working age, they will get much worse for seniors if Social Security and Medicare are cut. The chained CPI is a terrible idea. It will push many seniors onto food stamps and subsidized housing.

And when those now in their 50s who have been jobless for some years now -- and they are numerous -- have spent all their savings and take Social Security and Medicare, the situation will get worse.

Beef is way beyond the means of many on Social Security as it is.

All this talk about balancing the budget on the backs of seniors and baby boomers is foolish. It will not work.

duffyduff

(3,251 posts)I have read this shit for 30 years.

I don't care if these neolibs tell me something I know to be bullshit.

Phlem

(6,323 posts)and I hope the last.

-p

DirkGently

(12,151 posts)The Wizard

(12,527 posts)has nothing to with operating the government. It's an insurance policy funded by rate payers. It's time to deduct money from teabagger paychecks to pay for the medical care of gun violence victims. Military waste has to be identified and reversed. No one wastes resources like the military.

DonCoquixote

(13,616 posts)I need to ask, how can anyone just MAKE 20 million jobs?

FogerRox

(13,211 posts)LAst year we had a 15 trillion dollar economy, and we spent 195 billion on infrastructure, about 1.2%. An Additional 6% would be 900 billion, which would create about 22 million additional jobs.

The multilpier for infrastructure is the best bang for the buck , 2 to 2.5, so for every 100 billion spent expect 2 to 2.5 million jobs.

This link explains multipliers in the Sanfransico Federal Reserve report and the CBO report on the ARA stim bill in 2009.

http://www.washingtonpost.com/blogs/wonkblog/post/did-the-stimulus-work-a-review-of-the-nine-best-studies-on-the-subject/2011/08/16/gIQAThbibJ_blog.html

JDPriestly

(57,936 posts)Impose a tax on imports that helps pay for social programs here -- especially long-term unemployment benefits, education costs, all the costs that have risen but gone unfunded because we have lost the revenue we used to earn from high-wage industrial and support jobs. A Value-Added-Tax is how Germany and Austria have done it. And they are two countries with thriving economies compared to the rest of the world.

They also have laws and traditions that are more favorable to labor. That makes a big difference. Remember, Germany started toward a program of universal health insurance for all working people back in the 1870s. We still don't have anything of that kind. Obama's ACA is nothing compared to the German and Austrian programs.

DonCoquixote

(13,616 posts)Is'nt that the same tax that applies directly to groceries? I can see adding tax to higher end items (like financial transactions) but how would you keep Jane and John Q parent from getting screwed when they buy bread and milk?

JDPriestly

(57,936 posts)They have managed to maintain healthy economies in spite of the economic crisis. I credit the VAT. It's really high there. It shifts some of the social burden of importing so much from the third world onto the imported items.

We are losing a lot of income and payroll tax revenue due to stagnant, maybe even declining, wages. We have to make that up or lose our quality of life. A VAT tax is regressive -- true. But job losses due to cheap imports are even more regressive. Which hurts the working people most? VAT taxes or lost jobs? I would say lost jobs.

Melon_Lord

(105 posts)We should always be on the lookout for smarter and more efficient ways to spend money.

Shouting out that everything is better the way it is is usually a characteristic associated with conservatives.

FogerRox

(13,211 posts)

brentspeak

(18,290 posts)what other people said/didn't say.

The OP never claimed that "everything is better the way it is.".

AnotherMcIntosh

(11,064 posts)Melon_Lord

(105 posts)Everything is fine and there is nothing wrong with how things operate. The system is as good as it can be apparently...

FogerRox

(13,211 posts)lonestarnot

(77,097 posts)you think they are cash hoarding about now? They want to steal everything in order to claim a false ownership over everything that does or does not move.

FogerRox

(13,211 posts)lonestarnot

(77,097 posts)Mnemosyne

(21,363 posts)FogerRox

(13,211 posts)That will be a great step forward here at DU.

HiPointDem

(20,729 posts)FogerRox

(13,211 posts)a SS/Medicare group. I'm waiting for ELad to code it, and post.

You going to be around for this

Need folks to x post from DK to DU if the DU SS groups not up and running.

HiPointDem

(20,729 posts)& of course the usual missives to legislators.

ProSense

(116,464 posts)http://www.democraticunderground.com/10022475178

http://strengthensocialsecurity.org/

Raise the cap.

HiPointDem

(20,729 posts)ProSense

(116,464 posts)"it's stupid legislation and it doesn't strengthen anything."

..."stupid" to those trying to confuse the issue.

Do you still agree with this statement: "raising the cap to its original/traditional 90% is fine by me."

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=1839646

There is no reason that some people should have their entire income taxed and others do not.

http://www.epi.org/blog/social-security-trustees-report/

HiPointDem

(20,729 posts)A doctor who owns a practice and takes his income as a cut of profits rather than as salary doesn't pay SS tax.

"There is no reason that some people should have their entire income taxed and others do not."

but apparently there is.

the cap in 2013 is $113.7. it's raised every year.

ProSense

(116,464 posts)"the cap in 2013 is $113.7."

...be no cap. In fact, tax capital gains as income, but if those earning $113,000 or less have their entire income subjected to the tax, then so should everyone else.

On edit: You pointed out that a hypothetical about someone earning $250,000 (http://www.democraticunderground.com/?com=view_post&forum=1002&pid=2498296). That person just got a tax cut.

HiPointDem

(20,729 posts)specifically, you're ignoring the point about the distinction between wage and capital income, and the fact that the real 'rich' don't pay social security taxes.

and ignoring the fact that it's *these* folks who've been the prime beneficiaries of income tax cuts.

ProSense

(116,464 posts)HiPointDem

(20,729 posts)Romulox

(25,960 posts)Progressive taxation isn't "welfare". ![]()

Romulox

(25,960 posts)FogerRox

(13,211 posts)ProSense

(116,464 posts)"Sanders bill leaves a donut hole between 113k and 250k"

I agree it shouldn't: http://www.democraticunderground.com/?com=view_post&forum=1002&pid=2498315

Raise the cap.

FogerRox

(13,211 posts)You and I disagree on whether to remove the cap or not. But you are knowledgeable and you dont make shit up.

From that perspective its a pleasure to have you commenting in my OP.

ProSense

(116,464 posts)http://www.democraticunderground.com/10021871773

FogerRox

(13,211 posts)Egalitarian Thug

(12,448 posts)We have one gang of cut-throat thieves running both political parties, and they will have that SS money.

ladjf

(17,320 posts)FogerRox

(13,211 posts)graham4anything

(11,464 posts)Last edited Thu Mar 14, 2013, 05:41 AM - Edit history (1)

20 and 30 year olds NOT IN MILITARY SERVICE have not sacrificed for their country like all age groups prior to 1975. There could be a national service draft (not military unless those that want to want that).

Is it fair to say that 20 and 30 year olds (and those younger) should think the #s should all stay the same 30 to 40 to 50 years from now?

If everyone 45 or 50 and older could be grandfathered in (so that those people don't have a personal stake in wanting nothing cut from anything) changing a rate on those younger, so????

Who promised them a rose garden for 50 years?

Rates were different 50 years ago, why should the same rates stay in place 50 years later,especially as everyone is living longer anyhow.

And should health care costs drop drastically, the money needed for retirement will be so many times less than is needed now.

I don't think FDR or LBJ envisioned SS being the sole source of income available when in retirement. I think both envisioned people saving on their own too.

I think the intent they had is not saying all kids today should get the same #s later on.

Grandfather in at a certain age, and I see no reason that kids should sacrifice for the good of the country.

After all, didn't all those of a certain age sacrifice back when they were kids?

(and especially those born before 1960 all sacrificed and gave for the country.)

Again, this is about the kids and 50 years in the future. They could grandfather in those older.

DonCoquixote

(13,616 posts)I dare you to say that to a room full of Iraqi war vets!

Gen X and Y had to fight both of the Iraq wars, and we did not have the media catering to us the way they did the boomers!

"20 and 30 year olds have NEVER sacrificed for their country. "

I dare you to say that to the kids who went to college, got into student loan debt, only to find that they were doomed to have no job, because their Boomer parents voted with people that loved outsourcing..

like this rich center-left creep who LOVES outsourcing to India, the nation that took our high tech jobs, which was the bread and buttter for the 20 to 30 year olds.

http://www.ndtv.com/article/india/ndtv-exclusive-hillary-clinton-on-fdi-mamata-outsourcing-and-hafiz-saeed-full-transcript-207593

http://tootruthy.blogspot.com/2007/10/india-and-gap-exlpoit-child-slave-labor.html

Gen X and Y have gotten the least from America, yet they have sacrificed a lot for it, and yet we have a bunch of Clinton Boomers that still want us to kowtow at their altar!

I will say much, there is one bit of satsifaction I will have when Hillary wins the office in 2016. She will govern fully to the right of Obama, she will cut social security and medicare, just like her hubby tried to do before he got caught smoking cigars with his intern! I really look forward to seeing the "we should vioted for Hillary in 2008 cus she is a leader" type people get screwed, too bad they will be on their way out, while we will still be shoveling oursleves out of the mess, sans the New deal programs our grandparents worked to make sure were there for us..our grandparents, aka the REAL FDR Democrats, as opposed to their children that pissed it all away.

graham4anything

(11,464 posts)wihtout Ralph Nader's rightwing shenaningans, there was no Iraq as there would not have been a 9-11.

Place the blame on Iraq where it belongs on 3rd party protest votes

however, I note you ignored the entire post to have an anti-Hillary rant.

Hillary/Napolitano 2016.

But what you said, I see is very Ron Paul saying, the anti-India rant you gave.

Isn't that the Paul wanting to isolate the US and lock all the borders both in and out?

Like living in 1855. Pat Buchanan also liked isolationism. So does the Paul's BFF.

Al Gore kicked Ross Perot's ass in their NAFTA debate. Thank God Perot never became President, he had no idea one word he was saying in that debate. Perot just kept babbling on

and pointing to some meaningless graphs.

Sure did Ralph Nader and the environment well to seat W instead of Gore.

BTW, like liberals? Then why did people toss LBJ over for Nixon?

Because in 1968 there was two choices.

Keep LBJ or Nixon would win. LBJ with the heart retired because he felt the country sold him out.

Nixon won. HHH was a vastly inferior politician(but what a nice guy!) and could not compete with Nixon.

LBJ would have creamed him.

Eisenhower started Vietnam, a vicious man he was. NOT a nice guy. He was the originator of the Ronald Reagan school of Presidents.

One could go back and place the blame on anyone who backed Eisenhower, and not the great Adlai Stevenson.

But a guess some medals on Ike's shirt looked better than the brains in Adlai's head.

Who needs smart when you have Ike and Reagan.(two of the biggest war mongers ever).

Funny, the only time anyone mentions Ike though is to idolize one deranged line IKE said near the end of his life. One line 100% out of context with his entire life.

DonCoquixote

(13,616 posts)Indeed, I want her and Kathleen Sibelius in the 2016 hunt, as both of them are governors, and could do at least as good, if not better than, Hillary.

As far as Ron Paul, fat chance, you have never read me cricfuy libertarians here, have you? Go back and read my journal.

Nader, again, go back and read. Nothing was more Burgeosie than a bunch of rich yuppies and former hippies indulging in a "protest vote" because they taight they would punish Al Gore, because they thought W. was the same.

However, I notice you stayed clear away from the outsourcing, and the Gulf Wars, and never once addrressed the statement YOU MADE that 20 and 30 something have never sacrificed for this country.

graham4anything

(11,464 posts)My post asked why a 20 or 30 year old (IF they could grandfather anyone say 45 and older) should expect a lifetime later that all numbers stay the same

When FDR did not mandate all the numbers being the same, nor the retirement age.

People live longer.

A 20 year old in 2013 will live longer than a 20 year old in 1950.

Why should a 20 or 30(or younger) think they should ride a wave from decades ago.

People over 60 would all be grandfathered in, so no one would be able to say any of these reported numbers would affect them.

And I will edit the post I made to say Those not in the armed forces, though all of them volunteered to be there for whatever reason including some of the best benefits.

There is NO draft and 99% of the country does not volunteer. It is those I was referring to.

I shall edit to indicate NON-volunteers to the US armed forces.

DonCoquixote

(13,616 posts)nice dodge by the way, can't bear to see Hillary courting polcies that hurt us? But I will say this, your policy would in effect screw over the younger, making sure they pay fpor the "grandfathered in", when frankly, there is NO guarantee of how long anyone can live. Also, the idea of the generation "riding a wave" from decades ago is the idea of prgress this country used to have.

The Depression era parents did not enjoy the world the Boomers did, but they wanted them to, and gave them everything they wanted, a level of affluence and comfort that, if the environmentalist are great, may NEVER be achievable again. They suffered through the second world war, and knew that their children would never sacrifice the way they had to. Is it ethical for one generation to eat off of the WW2 generation efforts, then cut out on their own, as if they were eager to roll up whatever was left and eat it? Let me be real blunt, compare what turning sixty meant for the World War II types, and the modern generation. How many of your parents were healthy in their 70's, as healthy as the boomers are? Hell, the Rolling Stones are still on tour, and I say this as a Rolling Stones fan! There are many Boomers that still live active, healthy lives, thanks to the fact their parents voted FDR in. For any Boomer to hint of screwing over the young, when they got the benefits of the FDR generation, is a crime that neither FDR, nor for that matter, JFK, would have tolerated.

Meanwhile, my generation voted for Bill Clinton. It was the best we could do. Too bad the Boomers could not have kept Ron Ray Gun out.

and this quote is precious:

"Those not in the armed forces, though all of them volunteered to be there for whatever reason including some of the best benefits. "

Now, did it ever occur to you that many of these folks had much less options? Ever wonder why so many people in uniform are brown and black? I say this as a brown someone who has many in his family that had no other option. But no, we should praise someone that could afford the trip to Canada, and the lawyers to protect them, right?

And again, like I said, I realize that sometimes, you have hard choices. Nothing would please me more than to see a president Hillary fully rebuke what she helped create, for her to say "hey, sorry about killing Glass Steagall, passing Nafta, and the Telecommuncations Act, it was a mistake, just like don't ask don't tell was (thank god Obama ditched that mess), help me ditch these three bad ideas so Bill and I could leave a better legacy." I will tell you, if she promised to fix either of the three great mistake I mentioned, I would crawl through barbed wire to vote for her. I say this knowing that DU will call you on a promise you make.