General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMy employer-based health insurance rates

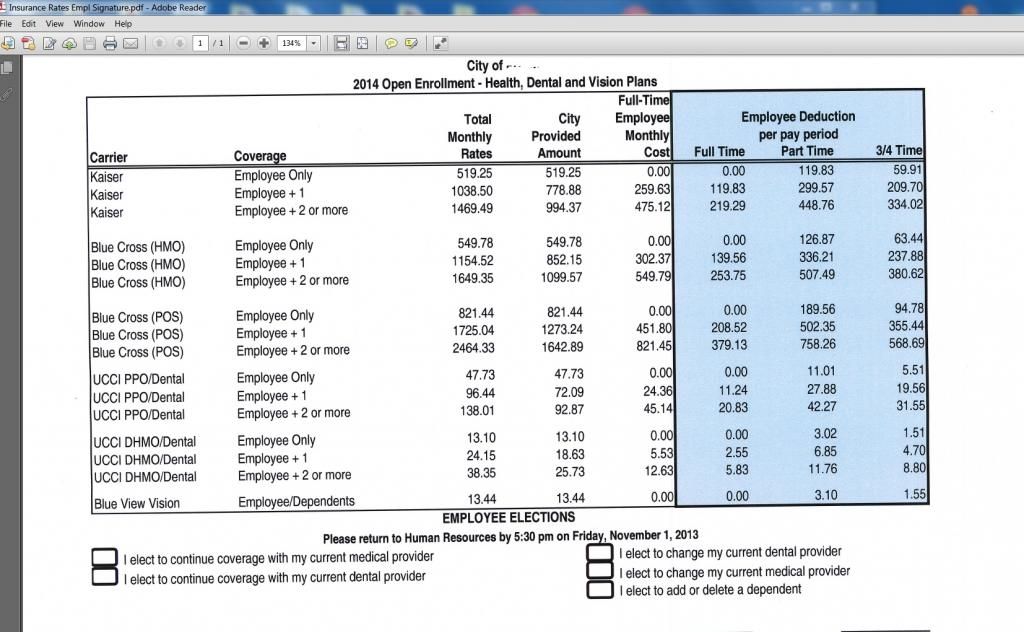

Anthem Blue Cross POS - Employee + 1 (wife)

Per Month Total - $1725.04

Employer - $1273.24

I pay - $451.80

These rates hurt both the employer and employee.

Employer-based insurance is hurting our economy big time.

ON EDIT: This premium is at approximately 37.5% of my gross pay. Outrageous. How much would single-payer cost?

And here is more:

Anthem Blue Cross POS - Employee + 2 or more

Per Month Total - $2464.33

Employer - $1642.89

Employee - $821.45

--

MANative

(4,112 posts)PPO model - Employee + spouse

Monthly total: 840.91

Employer Contribution: 583.08

Employee Contribution: 257.83

Roughly 25% of salary, for insurance that still leaves us with a $1500 deductible and 20% co-insurance on just about everything. Single payer is the only way to go.

SoCalDem

(103,856 posts)Not all that many years ago, BEFORE the HMO was "born" (and along with it, the rise of the mega-insurance companies & the hospital corporations) , some of all of that money would have been in the employee pay envelope.....not in an insurance CEO's Cayman bank account.

Stop and think about all the things that came along at roughly the same time:

HMO coverage at specified facilities instead of the family doctor

401-k

union busting

defined benefit pensions swapped for defined contribution, and then ended

credit cards instead of raises

All of these things started really ramping up from the 80's to the present , and the wages these things stole from employees have been flushed from the main street economies.

Had we removed employer-medical coverage back when we should have, I suspect that medical care would not be as expensive, and we would have had single payer/universal/nationalized health care ages ago...

cilla4progress

(24,723 posts)The Crash of 2016. Really lays all this out..and at the feet of "Saint Ronald."

Before he slashed top income tax rates, everything was balanced and far more equitable.

That single fact started this downhill trajectory.

I wonder if it can be stopped? At least we (the bottom 99%) still have the numbers. One would think in a democratic electoral system, we could vote in higher income tax rates? I think that's what we were all hoping for with Pres Obama. Damn Congress.

SoCalDem

(103,856 posts)is going to participate the the largest transfer of wealth in human history...

NOT to their heirs, but to the healthcare INDUSTRY.. ![]()

unless we "take responsibility" and refuse to play their game..

A dear friend of ours recently died and he got all the family together and flat-out told them he wanted NO FUNERAL..NO MEMORIAL (except for the immediate family) and showed them his paperwork demanding no "heroic" efforts.

He stopped chemo when it was obvious he would not "win" his war. He was medicated to prevent as mush pain as possible, and he participated in life as long as he could.. We saw them out socially 4 days before he died.

He wanted to die at home with his family..and he did ![]()

PeaceNikki

(27,985 posts)single payer.

Those numbers do not factor in all of the administrative work that employers have to pay for HR people to shop for and manage these plans.

I just don't get it.

Warren Stupidity

(48,181 posts)Of course the health insurance industry and big pharma are opposed, but every other corporate sector should be lobbying for single payer Medicare for all.

The answer is that they understand class loyalty, they always have.

PeaceNikki

(27,985 posts)when health insurance is tied to employment, it makes it that much harder for the employee to leave.

![]()

Lex

(34,108 posts)Imagine all the things employers could be doing if there weren't these criminally high costs to pay to insurance companies. Practically extortion.

mzteris

(16,232 posts)Or someone's getting a very nice kickback

SHRED

(28,136 posts)I work in the public sector for a city of 50,000.

We have approximately 85 employees in Anthem and 35 in Kaiser.

Last year at least 8 Anthem members had multi-thousand/million dollar care treatments as in cancer and other things.

mzteris

(16,232 posts)Between Anthem and Kaiser? Is there a reason? Generally speaking, one company with the whole loaf will give you a better price than two with part of a loaf.

And you can pit one against the other. Were their other companies involved in the bidding process? Are there any smaller local co-op type health care associations? Some hospitals/clinics have their own. But it is a smaller city (or large town) so maybe not.

Though it does sound like your group is very high risk. That's not the insurance companies' fault. There has to be a spreading of the risk. That's what groups are for.

It sounds like you would be better off with independent coverage, in fact probably most of you. Except those high risk people of course. That would pretty much leave them out in the cold even with ACA. Unless their medical bills were so high they qualify for subsidies. My suggestion? You all take a look at what ACA gets you.

And I still say you have a crappy agent.

SHRED

(28,136 posts)I think we are getting ripped off.

No worries for me though because I am getting the heck outta there soon. Retirement! Thanks ACA!!!!

mzteris

(16,232 posts)Again, one agency who has access to ALL of your employees business will give you a better deal than two companies who will have fewer participants.

Your agent may tell you it's a better price because the "competition" for the individual business, but you're way too small for that. The bidding war should come BEFORE the policy is in place.

Someone - besides the insurance company - is making out like a bandit. Maybe several someones.

SHRED

(28,136 posts)I doubt if there are any "kickbacks" going on but who knows.

Good point about the two groups. We have approximately 85 employees in Anthem and 35 in Kaiser. Would those 35 make a big difference if we had only Anthem?

mzteris

(16,232 posts)the better the deal, because there are more people to spread the risks around.

And if it's public sector, it's probably more likely there are kickbacks - of some sort (jobs, contracts, freebies - it doesn't HAVE to be $$) than in the private!

edhopper

(33,543 posts)is that if corporations were taxed as part of National Healthcare it would probably cost them half as much as they pay now in premiums. But they would fight such a tax tooth and nail because, you know, socialism, taxes, job creators, etc...

Yo_Mama

(8,303 posts)The premium exceeds 9.5% of your household income, right? If that's so, then you can go on the exchange and get a premium subsidy.

SHRED

(28,136 posts)My employer covers me 100%.

Dependent coverage expense is not counted in the "affordability" factoring.

--

You're right.

SHRED

(28,136 posts)He has a wife and two kids on his plan... Over 800 dollars per month. Criminal.

Sunlei

(22,651 posts)think employers get perks from insurance co like free insurance for them and a type of life insurance on all employees that employer/insurance co collect on if employee dies.

SHRED

(28,136 posts)Last edited Sun Nov 24, 2013, 02:14 PM - Edit history (1)

It's the tax payers who are getting ripped off.

ON EDIT: I just figured it... His total premium costs for him and his family come out to 65% of his pay. He pays 21% and the city pays the remaining 44%.

tavalon

(27,985 posts)I think my employer is proud of how much they contribute to my insurance. And yet, I paid $5000 out of an empty pocket this last year.

Single Payer. Single Payer. Single Payer.

INdemo

(6,994 posts)I question the validity $2664.00+? ..I jut don't believe this is accurate

SHRED

(28,136 posts)

INdemo

(6,994 posts)you found as part of the affordable care act. Still for group insurance this seems high when just for fairly low copays my wife get individual coverage through BC BS for 525.00 per month..

Rosa Luxemburg

(28,627 posts)Tax breakdown for £25,500 salary (approx. $40,000)

£2,080 Pensions and Benefits

(including £212 on Housing Benefit and £296 on Incapacity Benefits)

£1,094 on the NHS

£824 on Education

£339 on Defence

£160 on the Police

£44 on Prisons

£92 on Roads

£71 on Railways

just £1094 a year for health! (S1770 per year)

http://www.bbc.co.uk/news/uk-england-16744819

Tuesday Afternoon

(56,912 posts)I can not afford the Silver Plan. I have two Rx that I take daily. Ugh.

Loudly

(2,436 posts)Medicare for all Baby!

http://www.medicare.gov/your-medicare-costs/costs-at-a-glance/costs-at-glance.html