General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Big Money Behind Netanyahu

Talk about symbolic: Mrs. Sheldon Adelson dropped her purse on Congress.

The Big Money Behind Netanyahu

Sheldon Adelson, the casino tycoon who has proposed nuking Iran, was in the gallery as Israeli Prime Minister Netanyahu delivered his “State of the Union” speech to a rapt and rapturous U.S. Congress. After all, Adelson funds both Netanyahu and the Republican Right, as Bill Moyers and Michael Winship note.

By Bill Moyers and Michael Winship

ConsortiumNews, March 5, 2015

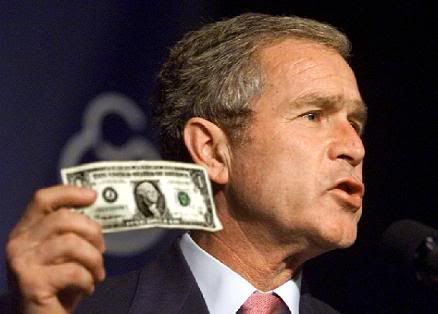

Everything you need to know about Israeli Prime Minister Benjamin Netanyahu’s address to Congress on Tuesday was the presence in the visitor’s gallery of one man – Sheldon Adelson.

The gambling tycoon is the Godfather of the Republican Right. The party’s presidential hopefuls line up to kiss his assets, scraping and bowing for his blessing, which when granted is bestowed with his signed checks.

Data from both the nonpartisan Center for Responsive Politics and the Center for Public Integrity show that in the 2012 election cycle, Adelson and his wife Miriam (whose purse achieved metaphoric glory Tuesday when it fell from the gallery and hit a Democratic congressman) contributed $150 million to the GOP and its friends, including $93 million to such plutocracy-friendly super PACs as Karl Rove’s American Crossroads, the Congressional Leadership Fund, the Republican Jewish Coalition Victory Fund, Winning Our Future (the pro-Newt Gingrich super PAC) and Restore Our Future (the pro-Mitt Romney super PAC).

Yet there’s no knowing for sure about all of the “dark money” contributed by the Adelsons – so called because it doesn’t have to be reported. Like those high-rise, multi-million dollar apartments in New York City purchased by oligarchs whose identity is hidden within perfectly legal shell organizations, dark money lets our politicians conveniently erase fingerprints left by their ink-stained (from signing all those checks) billionaire benefactors.

But Sheldon Adelson was not only sitting in the House gallery on Tuesday because of the strings he pulls here in the United States. He is also the Daddy Warbucks of Israel and Benjamin Netanyahu is yet another of his beneficiaries – not to mention an ideological soulmate.

Although campaign finance reform laws are much more strict in Israel than here in the United States, Adelson’s wealth has bought him what the historian and journalist Gershom Gorenberg calls “uniquely pernicious” influence.

Adelson owns the daily Israel Hayom, a leading newspaper, as well as Makor Roshon, the daily newspaper of Israel’s Zionist religious right and NRG, a news website. He gives Israel Hayom away for free in order to promote his hardline views – the headline in the paper the day after Obama’s re-election was “The US Voted (for) Socialism.”

More important, he uses the paper to bang the drum incessantly for Netanyahu and his right-wing Likud Party, under the reign of which Israel has edged closer and closer to theocracy. As Hebrew University economist Momi Dahan put it: “De facto, the existence of a newspaper like Israel Hayom egregiously violates the law, because [Adelson] actually is providing a candidate with nearly unlimited resources.”

Sheldon, meet Rupert.

In fact, as Israel’s March 17 election approaches, Adelson has increased the press run of Israel Hayom’s weekend edition by 70 percent. The paper says it’s to increase circulation and advertising, but rival newspaper Ha’aretz reports, “Political sources are convinced the extra copies are less part of a business plan and more one to help Netanyahu’s re-election bid.”

Just like the timing of Netanyahu’s “State of the Union” address to Congress this week was merely a coincidence, right? “I deeply regret that some perceive my being here as political,” Netanyahu told Congress. “That was never my intention.” Of course.

In Gershom Gorenberg’s words, the Prime Minister “enjoys the advantage of having a major newspaper in his camp that portrays the world as seen from his office: a world in which Israel is surrounded by enemies, including the president of the United States; in which peace negotiations are aimed at destroying Israel; in which Israel’s left is aligned with all the hostile forces, and even rightists who oppose Netanyahu want to carry out a coup through the instrument of elections.”

So Netanyahu gets the best of both of Adelson’s worlds – his powerful propaganda machine in Israel and his campaign cash here in the United States. Combined, they allow Netanyahu to usurp American foreign policy as he manipulates an obliging U.S. Congress enamored of Adelson’s millions, pushing it further to the right on Israel and the Middle East.

There you have it: Not only is this casino mogul the unofficial head of the Republican Party in America (“he with the gold rules”), he is the uncrowned King of Israel — David with a printing press and checkbook instead of a slingshot and a stone. All of this came to the fore in Netanyahu’s speech on Tuesday: the U.S. cannot determine its own policy in the Middle East and the majority in Congress are under the thumb of a foreign power.

Like a King Midas colossus, Sheldon Adelson bestrides the cause of war and peace in the most volatile region of the world. And this is the man who — at Yeshiva University in New York in 2013 — denounced President Obama’s diplomatic efforts with Iran and proposed instead that the United States drop an atomic bomb in the Iranian desert and then declare: “See! The next one is in the middle of Tehran. So, we mean business. You want to be wiped out? Go ahead and take a tough position and continue with your nuclear development.”

Everything you need to know about Benjamin Netanyahu’s address to Congress Tuesday was the presence in the visitor’s gallery of that man. We are hostage to his fortune.

Bill Moyers is the managing editor of Moyers & Company and BillMoyers.com.

Michael Winship is the Emmy Award-winning senior writer of Moyers & Company and BillMoyers.com, and a senior writing fellow at the policy and advocacy group Demos.

SOURCE w LINKS: http://consortiumnews.com/2015/03/05/the-big-money-behind-netanyahu/

spanone

(135,795 posts)Octafish

(55,745 posts)by Erich Zeuss

GlobalResearch.ca

On December 10th, Wall Street’s federal appeals court, the 2nd Circuit Court of Appeals, ruled that if inside information about what is going to happen to a corporation is taken advantage of by an investor, it’s okay, so long as the source of the inside-tip isn’t directly paid for passing it along.

In other words, if you have friends who have inside information that they received from their friends, they are free to pass it along to you, and you are free to pass inside information that you possess along to them to pass along to others, but neither of you is permitted to pay the other for any inside tip — the information can legally be acted on only if the tipper is not paid for the tip.

CONTINUED w/links...

http://www.globalresearch.ca/corruption-is-now-officially-legal-in-the-u-s-but-must-be-done-right/5419612

The money in politics, it transforms democracy into plutocracy.

Geronimoe

(1,539 posts)Almost all of Congress.

Scuba

(53,475 posts)Wellstone ruled

(34,661 posts)Octafish

(55,745 posts)Enthusiast

(50,983 posts)Octafish

(55,745 posts)Shoot. All the billions these guys and gals are holding makes me want to become a Republican. I can understand where the Godman Sachs wing is coming from, wanting to be their friend.

Thespian2

(2,741 posts)but with Adelson and the Koch-sucking brothers buying all the politicians available, they pretty much own the US Congress...and all the red states.

Octafish

(55,745 posts)Rick Snyder turned us into a "Right to Work State."

His benefactors in creating the Foundations for Feudalism for the 21st Century:

The Koch Brothers and Sheldon Adelson

http://www.mlive.com/lansing-news/index.ssf/2014/10/michigan_governors_race_2014_w.html

Their ad budget flooded Lions games in October, outspending the Democrat -- a real Dem from the Democratic Wing: Mark Schauer.

UTUSN

(70,652 posts)Octafish

(55,745 posts)I kid. The ones who were there Tuesday, someone owns 'em all.

Response to Octafish (Original post)

Joe Johns This message was self-deleted by its author.

Mc Mike

(9,111 posts)Octafish

(55,745 posts)by GARETH PORTER

CounterPunch, weekend edition March 6-8, 2015

Western news media has feasted on Prime Minister Netanyahu’s talk and the reactions to it as a rare political spectacle rich in personalities in conflict. But the real story of Netanyahu’s speech is that he is continuing a long tradition in Israeli politics of demonising Iran to advance domestic and foreign policy interests.

SNIP...

‘Existential danger’ Dismissed by Mossad

Tamir Pardo, the current chief of Mossad, has said that a nuclear Iran would not necessarily pose an existential threat to Israel even if it did acquire nuclear weapons. His predecessor Meir Dagan, who has made no secret of his disdain for Netanyahu’s handling of policy toward Iran as dangerously reckless, said flatly in 2012, that “Israel faces no existential threat,” and another previous Mossad chief, Ephraim Halevy, has also criticised Netanyahu for talking about an “existential threat” from Iran.

SNIP...

Israel’s Fear of US-Iran Rapprochement

What induced Netanyahu to start selling the snake oil of Iran as menace to Israel was not any new evidence of Iranian interest in nuclear weapons or hostility toward Israel. It was the fear of a rapprochement between the Clinton administration and the newly elected Khatami government and the hope of depriving Iran of what was assumed to be Russian assistance for building missiles that could reach Israel.

Netanyahu was alarmed by the signals from both Tehran and Washington in the summer of 1997 indicating interest in reducing tensions between the two countries. That would have represented a real threat to Israel’s political and strategic interests, and he was determined to cut it short. Netanyahu’s response was to start to begin sending messages to Iran through other governments that Israel would carry out pre-emptive strikes against Iranian missile development sites unless it stopped its ballistic missile programme.

It was a reckless tactic that would not cause Iran to stop working on missiles, but could well provoke a much tougher Iranian public posture toward Israel. That, in turn, would allow Netanyahu to put pressure on the Clinton administration to steer clear of any warming relations with Iran.

CONTINUED...

http://www.counterpunch.org/2015/03/06/israels-long-history-of-gaming-the-iranian-threat/

Hiya, Mc Mike! What a sight for sore eyes you are!

Mc Mike

(9,111 posts)I was sorry to see P.M. Rabin's involvement in pushing the same line in the '90's, though I think he had to be doing some good things that disagreed with the far-right zealots, or he wouldn't have been killed.

I had always assumed that Israel and Iran were in conflict since the '79 fundy Moslem takeover of Iran. The more I learn about the Middle East, the more I see how uninformed I am, how easy it is to make key assumptions that are truly off the mark.

I notice one typo in the on-line article. Under the para headed 'Rabin and the Nuclear Threat':

"The portrayal of Iran as a serious threat to Israel’s existence has been serving Israeli diplomatic interests ever since Rabin reversed more than a decade of low-key policy toward the Islamic Republic and suddenly began claiming that Iran would have nuclear weapons and missiles capable of hitting Iran within three to seven years and appealed to the United States to stop it.", it should be 'Israel', where the second 'Iran' is typed.

Despite the bi-partisan nature of the dishonesty about Iran, it would be good to see Labor kick Likud out of power in Israel, for the good of Israel and the entire region. The less influence Likud and the Repugs have over foreign policy, the better off the world is.

I always look for info from you when I come to the site, Octa. You know and compile key info about history, foreign policy, and covert ops that I try to study and keep up on. Thanks again.

libdem4life

(13,877 posts)Faithful? Or, pillorying Hillary for, at the present time, being likely the only one best connected.

This is about Israel, but it's the same story in US politics. The Daddy Warbucks of both parties don't fancy giving away portions of their fortunes to anyone likely to be a loser. Most are funding the Pick of the Litter of both parties, however, just to be on the safe side. But surely they watch the polling data. And it's why I think that Jeb is playing it safe letting the others cannibalize each other first.

Obama was an aberration in the system in many ways...he did get a lot of those small donations after his presence and speech at the Convention, but I'm sure big money had a part to play with his overtaking Hillary. Our closest equivalent is Julian Castro and how I wish, but my guess is that the donors aren't ready for a Hispanic Leftist just yet.

Octafish

(55,745 posts)Take Phil Gramm. Once a simple Texas congressman, today a wealthy banking executive. In between he went from being an ex-academic Democrat to becoming a wealthy Republican. He also used his transfiguration to develop a plan to loot both the banks and the Treasury and have the taxpayers pick up the tab. He even got his political enemies to sign off on it.

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

The Sting

In the best rip-off, the mark never knows that he or she was set up for fleecing.

In the case of the great financial meltdown of 2008, the victim is the U.S. taxpayer.

Going by the lack of analysis in Corporate McPravda, We the People are in for a royal fleecing.

Don’t just take my word about the current situation between giant criminality and the politically connected.

[font color="green"][font size="5"]You see, there is evidence of conspiracy. An honest FBI agent warned us in 2004 about the coming financial meltdown and the powers-that-be stiffed him, too.[/font size][/font color]

The story’s below. And it’s not fiction. It is true to life.

The Set-Up

You don’t have to be a fan of Paul Newman or Robert Redford to smell a BFEE rat. The oily critter’s name is Gramm. Phil Gramm. He helped Ronald Reagan push through his trickle-down fiscal policy and later helped de-regulate the nation's once-healthy Saving & Loan industry. We all know how well that worked out: Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit.

In 1999, then-super conservative Texas U.S. Senator Gramm helped pass the Gramm-Leach-Bliley Financial Services Modernization Act. This law allowed banks to act like investment houses. Using federally-guaranteed savings accounts, banks now could make risky commercial and real-estate loans.

The law should’ve been called the Gramm-Lansky Act. To those who gave a damn, it was obviously a potential disaster. During the bill’s debate, the specter of a “taxpayer bail-out” was raised by Sen. Byron Dorgan of North Dakota, warning about what had happened to the deregulated S&Ls.

Gramm wasn’t alone on the deregulation bandwagon. The law passed, IIRC, like 89-9. More than a few of my own Democratic faves went along with this deregulation, “get-government-off-the-back-of-business” law.

Today we have their love child, MOAB—for the Mother Of All Bailouts.

The Mark

In a sting, someone has to supply the money to be ripped off. Crooks call that person the mark or target or mope. In the present case, that’s the U.S. taxpayer.

Today’s financial crisis seems like a re-run of what happened to the Savings & Loans industry in the late 1980s. Well it is a lot like what happened to the S&Ls. Then, as now, it’s the U.S. taxpayer who gets to pick up the tab for someone else’s party.

Don’t worry, U.S. taxpayer. You’re getting something (among several things) for your $700 billion. You’re getting all the bad mortgage-based paper on almost all of Wall Street. I’d rather have penny stocks, because if there ever was something of negative value it’s the complicated notes and derivatives based on this mortgage debt.

When it comes to Bush economic policy, left holding the bag are We the People, er, Mopes. Don’t worry, it can’t get worse. As St. Ronnie would say, “Well. Yes.” You see, what the bag U.S. taxpayers hold is less than empty. It’s filled with bad debt.

The Mastermind

Chief economist amongst these merry band of thieves and traitors was one Phil Gramm (once a conservative Democrat and then an ultraconservative Republican-Taxus). An economist by training and reputation, Gramm was one of the guiding lights of Reaganomics, the cut taxes, domestic spending, and regulations while raising defense-spending to new heights. In sum, it was a fiscal policy to enrich friends – especially the kind connected to the BFEE.

Foreclosure Phil

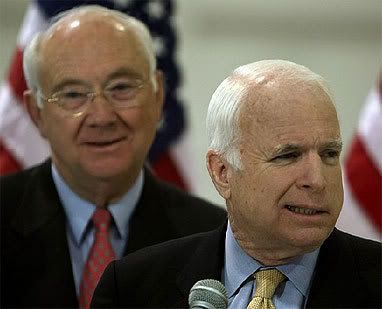

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for a Swiss bank at the center of the housing credit crisis, he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

David Corn

MotherJones.com

May 28, 2008

Who's to blame for the biggest financial catastrophe of our time? There are plenty of culprits, but one candidate for lead perp is former Sen. Phil Gramm. Eight years ago, as part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown. Yet has Gramm been banished from the corridors of power? Reviled as the villain who bankrupted Middle America? Hardly. Now a well-paid executive at a Swiss bank, Gramm cochairs Sen. John McCain's presidential campaign and advises the Republican candidate on economic matters. He's been mentioned as a possible Treasury secretary should McCain win. That's right: A guy who helped screw up the global financial system could end up in charge of US economic policy. Talk about a market failure.

Gramm's long been a handmaiden to Big Finance. In the 1990s, as chairman of the Senate banking committee, he routinely turned down Securities and Exchange Commission chairman Arthur Levitt's requests for more money to police Wall Street; during this period, the sec's workload shot up 80 percent, but its staff grew only 20 percent. Gramm also opposed an sec rule that would have prohibited accounting firms from getting too close to the companies they audited—at one point, according to Levitt's memoir, he warned the sec chairman that if the commission adopted the rule, its funding would be cut. And in 1999, Gramm pushed through a historic banking deregulation bill that decimated Depression-era firewalls between commercial banks, investment banks, insurance companies, and securities firms—setting off a wave of merger mania.

But Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act. Written with the help of financial industry lobbyists and cosponsored by Senator Richard Lugar (R-Ind.), the chairman of the agriculture committee, the measure had been considered dead—even by Gramm. Few lawmakers had either the opportunity or inclination to read the version of the bill Gramm inserted. "Nobody in either chamber had any knowledge of what was going on or what was in it," says a congressional aide familiar with the bill's history.

It's not exactly like Gramm hid his handiwork—far from it. The balding and bespectacled Texan strode onto the Senate floor to hail the act's inclusion into the must-pass budget package. But only an expert, or a lobbyist, could have followed what Gramm was saying. The act, he declared, would ensure that neither the sec nor the Commodity Futures Trading Commission (cftc) got into the business of regulating newfangled financial products called swaps—and would thus "protect financial institutions from overregulation" and "position our financial services industries to be world leaders into the new century."

Subprime 1-2-3

Don't understand credit default swaps? Don't worry—neither does Congress. Herewith, a step-by-step outline of the subprime risk betting game. —Casey Miner

CONTINUED…

http://www.motherjones.com/news/feature/2008/07/foreclo...

A fine mind for modern Bushonomics. Kill the middle class. Then, rob from the poor to give to the rich.

The Mentor

Anyone who’s ever heard him talk knows that Gramm must’ve learned all this stuff from somebody. He could never think it all up on his own. He had to have help. That’s where Meyer Lansky, the man who brought modern finance to the Mafia, comes in.

Money Laundering

Answers.com

EXCERPT...

History

Modern development

The act of "money laundering" was not invented during the Prohibition era in the United States, but many techniques were developed and refined then. Many methods were devised to disguise the origins of money generated by the sale of then-illegal alcoholic beverages. Following Al Capone's 1931 conviction for tax evasion, mobster Meyer Lansky transferred funds from Florida "carpet joints" (small casinos) to accounts overseas. After the 1934 Swiss Banking Act, which created the principle of bank secrecy, Meyer Lansky bought a Swiss bank to which he would transfer his illegal funds through a complex system of shell companies, holding companies, and offshore accounts.(1)

The term "money laundering" does not derive, as is often said, from Al Capone having used laundromats to hide ill-gotten gains. It was Meyer Lansky who perfected money laundering's older brother, "capital flight," transferring his funds to Switzerland and other offshore places. The first reference to the term "money laundering" itself actually appears during the Watergate scandal. US President Richard Nixon's "Committee to Re-elect the President" moved illegal campaign contributions to Mexico, then brought the money back through a company in Miami. It was Britain's Guardian newspaper that coined the term, referring to the process as "laundering."

Process

Money laundering is often described as occurring in three stages: placement, layering, and integration.(3)

Placement: refers to the initial point of entry for funds derived from criminal activities.

Layering: refers to the creation of complex networks of transactions which attempt to obscure the link between the initial entry point, and the end of the laundering cycle.

Integration: refers to the return of funds to the legitimate economy for later extraction.

However, The Anti Money Laundering Network recommends the terms

Hide: to reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly be part of the laundering scheme, and it is these which ultimately prove to be the interface between the criminal and the financial sector

Move: clearly explains that the money launderer uses transfers, sales and purchase of assets, and changes the shape and size of the lump of money so as to obfuscate the trail between money and crime or money and criminal.

Invest: the criminal spends the money: he/she may invest it in assets, or in his/her lifestyle.

CONTINUED...

http://www.answers.com/topic/money-laundering

The great journalist Lucy Komisar has shone a big light on the subject:

Offshore Banking

The U.S.A.’s Secret Threat

Lucy Komisar

The Blacklisted Journalist

June 1, 2003

EXCERPT…

In 1932, mobster Meyer Lansky took money from New Orleans slot machines and shifted it to accounts overseas. The Swiss secrecy law two years later assured him of G-man-proof banking. Later, he bought a Swiss bank and for years deposited his Havana casino take in Miami accounts, then wired the funds to Switzerland via a network of shell and holding companies and offshore accounts, some of them in banks whose officials knew very well they were working for criminals. By the 1950s, Lansky was using the system for cash from the heroin trade.

Today, offshore is where most of the world's drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20 percent. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

Lansky laundered money so he could pay taxes and legitimate his spoils. About half the users of offshore have opposite goals. As hotel owner and tax cheat Leona Helmsley said---according to her former housekeeper during Helmsley's trial for tax evasion---"Only the little people pay taxes." Rich individuals and corporations avoid taxes through complex, accountant-aided schemes that routinely use offshore accounts and companies to hide income and manufacture deductions.

The impact is massive. The IRS estimates that taxpayers fail to pay in excess of $100 billion in taxes annually due on income from legal sources. The General Accounting Office says that American wage-earners report 97 percent of their wages, while self-employed persons report just 11 percent of theirs. Each year between 1989 and 1995, a majority of corporations, both foreign- and U.S.-controlled, paid no U.S. income tax. European governments are fighting the same problem. The situation is even worse in developing countries.

The issue surfaces in the press when an accounting scam is so outrageous that it strains credulity. Take the case of Stanley Works, which announced a "move" of its headquarters-on paper-from New Britain, Connecticut, to Bermuda and of its imaginary management to Barbados. Though its building and staff would actually stay put, manufacturing hammers and wrenches, Stanley Works would no longer pay taxes on profits from international trade. The Securities and Exchange Commission, run by Harvey Pitt---an attorney who for more than twenty years represented the top accounting and Wall Street firms he was regulating---accepted the pretense as legal.

"The whole business is a sham," fumed New York District Attorney Robert Morgenthau, who more than any other U.S. law enforcer has attacked the offshore system. "The headquarters will be in a country where that company is not permitted to do business. They're saying a company is managed in Barbados when there's one meeting there a year. In the prospectus, they say legally controlled and managed in Barbados. If they took out the word legally, it would be a fraud. But Barbadian law says it's legal, so it's legal." The conceit apparently also persuaded the Securities and Exchange Commission.

CONTINUED…

http://www.bigmagic.com/pages/blackj/column92e.html

Socialize the risk for Wall Street. Privatize the loss to Uncle Sam’s nieces and nephews. Congratulations, Dear Reader! Now you know as much as Phil Gramm.

The Diversion

Still, a global financial meltdown sounds like something bad. Making things worse, we’re hearing that Uncle Sam is broke! Flat busted. Tapped out.

That’s odd, though. We the People see the Treasury being emptied with tax breaks for the wealthy and checks to the companies they own that make money off of war. Want to know how to make a buck these days? Invest in the likes of Halliburton and Northrup Grumman. Anything in the warmongering business connected to Bush and his cronies will weather the downturn or depression.

The Wall Street Journal -- a paper owned and operated by Fox News’ head, Rupert Murdoch – was very quick to promote the crisis, as DUer JustPlainKathy observed. The paper was even faster to pounce on a solution: What’s needed is a safety net for banks. And quick as a wink, they found the answer!

Only the U.S. taxpayer has the wherewithal to prevent the collapse of the global financial system -- a global economic meltdown that would freeze up credit and investment and expansion and prosperity and a return to the Great Depression. Who can be against that?

Oh. Kay. Sounds about right – Rupert the Alien agreeing with what Leona Helmsley said: “Only the little people pay taxes.”

Gramm and McCain also are in favor of privatization. How nice is that?

The Getaway

George Walker Bush and his right-wing pals feel they can get away with this, their latest rip-off the American taxpayers. Who can blame them? When compared to their clear record of incompetence, lies, fraud, theft, mass-murder, warmongering and treason, what’s a few trillion dollar rip-off?

Still, it's weird how they act.

They must really think they’ll be welcomed with open arms in Paraguay and Dubai and Switzerland.

Going by the welcome the world gave the Shah of Iran, they’re in for a big surprise.

The FBI Guy

Don’t say we weren’t warned. An intrepid FBI agent with something sorely lacking in the rest of the Bush administration, integrity, blew the whistle on the bank thing…

FBI saw threat of mortgage crisis

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

We were warned and nothing happened.

Repeat: And nothing happened.

They must think We the People are really stupid. Are we supposed to believe that all that $700 billion in bad debt just happened? Where did all that money go? Who got all the money?

Meyer Lansky moved the Mafia’s money from the Cuban casinos to Switzerland. He did so by buying a bank in Miami. Phil Gramm seems to have done the same thing as vice-chairman of UBS, except the amounts are in the billions.

Who cares? He’s almost gone? Nope. That money still exists somewhere. I have a pretty good idea of where it might be. And George Bush and his cronies are poised to get away with a whole lot of loot.

Who Should Pay for the Bailout

If you are fortunate enough to be one, good luck American taxpayer! You’re in for a royal fleecing. Once the interest is figured into the bailout, we’re looking at a couple of trill.

[font color="purple"]The people who should pay for the bailout aren’t the American people. That distinction should go to the crooks who stole it -- friends of Gramm like John McCain and George Bush and the rest of the Raygunomix crowd of snake-oil salesmen. For them, the Bush administration -- and a good chunk of time since Ronald Reagan -- has not been a disaster. It’s been a cash cow.[/font color]

The above was posted on DU on Sept. 21, 2008. (Check out the responses, lots of info from DUers.) What's changed since then? Nothing near what I'd hoped for, certainly: http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x4055207

Here's what we've learned since then: Phil Gramm invited some of his old political acquaintances to dip their beaks in at UBS. Since the repeal of Glass-Steagal, they've specialized in all kinds of Wealth Management there:

http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html