General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsImmediately After Launching Effort To Scuttle Iran Deal-Sen Cotton Meets With Defense Contractors

In an open letter organized by freshman Sen. Tom Cotton, R-Ark., 47 Senate Republicans today warned the leaders of Iran that any nuclear deal reached with President Barack Obama could expire as soon as he leaves office.

Tomorrow, 24 hours later, Cotton will appear at an “Off the Record and strictly Non-Attribution” event with the National Defense Industrial Association, a lobbying and professional group for defense contractors.

The NDIA is composed of executives from major military businesses such as Northrop Grumman, L-3 Communications, ManTech International, Boeing, Oshkosh Defense and Booz Allen Hamilton, among other firms.

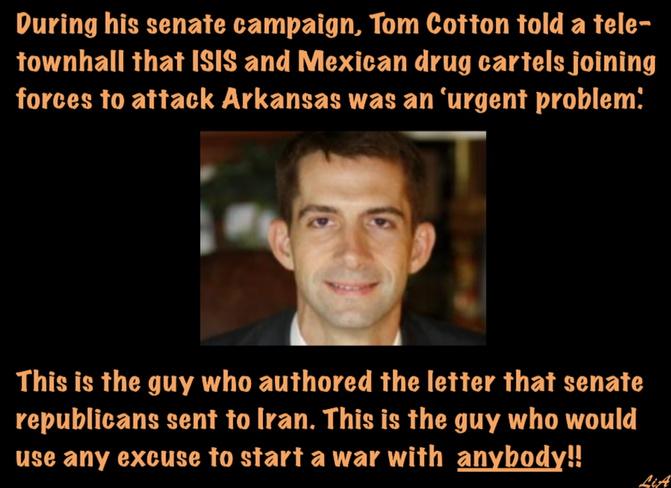

Cotton strongly advocates higher defense spending and a more aggressive foreign policy. As The New Republic’s David Ramsey noted, “Pick a topic — Syria, Iran, Russia, ISIS, drones, NSA snooping — and Cotton can be found at the hawkish outer edge of the debate…During his senate campaign, he told a tele-townhall that ISIS and Mexican drug cartels joining forces to attack Arkansas was an ‘urgent problem.'”

$$$$$$$$$$$$$$$$$$$$

MORE:

https://firstlook.org/theintercept/2015/03/09/upon-launching-effort-scuttle-iran-deal-senator-tom-cotton-meets-defense-contractors/

CincyDem

(6,351 posts)CincyDem

(6,351 posts)Thinkingabout

(30,058 posts)They are barking and foaming at the mouth about emails and are trying to divert attention from their dealings.

Cha

(297,154 posts)Fred Sanders

(23,946 posts)GoneFishin

(5,217 posts)Octafish

(55,745 posts)By William K. Black

Bloomington, MN: December 10, 2014

We know that insider trading is an activity in which cheaters prosper. We know that Wall Street and the City of London are dominated by a fraudulent culture and we know that firm culture is set by the officers that control the firm. We know that the Department of Justice (DOJ) has allowed that to occur by refusing to prosecute any of the thousands of senior bank officers who became wealthy by leading the three most destructive financial fraud epidemics (appraisals, “liar’s” loans, and fraudulent sales of these fraudulently originated mortgages to the secondary market) in history. No one is surprised that Wall Street’s elites have also engaged in widespread efforts to rig the stock markets so that they can shoot fish in the barrel through insider trading. Unlike the three fraud epidemics, one DOJ office, the Southern District of New York, has brought a series of criminal prosecutions against these officers.

Wall Street’s court of appeals (the Second Circuit) has just issued an opinion not simply overturning guilty verdicts but making it impossible to retry the elite Wall Street defendants that grew wealthy through trading on insider information. Indeed, the opinion reads like a roadmap (or a script) that every corrupt Wall Street elite can follow to create a cynical system of cutouts (ala SAC) that will allow the most senior elites to profit by trading on insider information as a matter of routine with total impunity. The Second Circuit decision makes any moderately sophisticated insider trading scheme that uses cutouts to protect the elite traders a perfect crime. It is a perfect crime because (1) it is guaranteed to make the elite traders who trades on the basis of what he knows is secret, insider information wealthy absent successful prosecutions and (2) using the Second Circuit’s decision as a fraud roadmap, an elite trader can arrange the scheme with total impunity from the criminal laws. The Second Circuit ruling appears to make the financial version of “don’t ask; don’t tell” a complete defense to insider trading prosecutions. The Second Circuit does not simply make it harder to prosecute – they make it impossible to prosecute sophisticated insider fraud schemes in which the elites use junior cutouts to create (totally implausible) deniability.

The New York Times article on the decision was entitled “Two Insider Trading Convictions Are Overturned in Blow to Prosecutors.” The title is partially correct. The real blows, however, were to investors, the already crippled integrity of Wall Street, and every honest trader on Wall Street who cannot possibly compete with his rivals who cheat through the “sure thing” of insider trading now that the Second Circuit has written an opinion explaining how to corrupt the entire system with impunity from the criminal laws.

Wall Street’s most recent effort to rig the markets through insider trading is far larger and more audacious than any prior effort, including those by Michael Milken and Boesky. Wall Street elites sought to institutionalize the corruption of officers of a wide range of publicly traded corporations. The goal was to gain a corrupt advantage over honest investors in trillions of dollars in securities trades.

The Second Circuit decision admits that the prosecutors presented evidence established a massive conspiracy designed to allow Wall Street elites to profit by engaging in insider trading, a conspiracy that greatly enriched the defendants that were convicted in the case under appeal.

“At trial, the Government presented evidence that a group of financial analysts exchanged information they obtained from company insiders, both directly and more often indirectly. Specifically, the Government alleged that these analysts received information from insiders at Dell and NVIDIA disclosing those companies’ earnings numbers before they were publicly released in Dell’s May 2008 and August 2008 earnings announcements and NVIDIA’s May 2008 earnings announcement. These analysts then passed the inside information to their portfolio managers, including Newman and Chiasson, who, in turn, executed trades in Dell and NVIDIA stock, earning approximately $4 million and $68 million, respectively, in profits for their respective funds.”

The Second Circuit was not distressed that senior Wall Street officials received information that was clearly insider information that they knew they should not have access to. The insider information they were provided was the crown jewels – two major corporations’ soon to be announced “numbers” – at least one of which was sure to be a major surprise to the markets. A senior trader that knows “the number” in advance, particularly when he knows that the number will be a surprise, can shoot fish in a small barrel with a large shotgun. The insider information allows the senior trader to reduce the risk of loss to trivial levels while increasing the probability of gain to near certainty. The trader makes a fortune by cheating, not through any unusual skill. The senior trader knows that no employee of any publicly traded corporation is permitted to release such secret and proprietary insider information to investors.

CONTINUED...

http://neweconomicperspectives.org/2014/12/second-circuit-makes-sophisticated-insider-trading-perfect-crime.html

Money trumps peace, baby!