General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhat Jobs?

Some GOP ass-wipe, Kasich?, said laid-off workers can be retrained.

Roger Ailes' girlfriend moderator failed to follow-up other than with a crooked smile.

Questions a journalist might ask:

Retrained for what?

Who and what industries are hiring?

The conservative retraining scam for nonexistent and disappearing jobs is something we've been trying to do since Reaganomics was new -- unsuccessfully. Why would it work now? What's changed, besides these being the wealthiest times in human history?

Smarmie Doofus

(14,498 posts)Octafish

(55,745 posts)The guy buys up all the rancid grease and hoards it for what only he knows.

However, the donkey knows what he's doing.

whatthehey

(3,660 posts)As for industries it seems professional services, healthcare, and trade, transport and utilities are leading the pack.

Octafish

(55,745 posts)SOURCE: Josh Varlin, World Socialist Web Site

https://www.wsws.org/en/articles/2015/11/07/econ-n07.html

whatthehey

(3,660 posts)What exactly do stories of a few thousand of the latter tell us about the state of the economy?

Nobody ever tell you anecdotes can't refute data yet? They should have.

Octafish

(55,745 posts)We've been waiting for the recovery since 1967.

Here's some fact-based reporting on the jobs situation:

Professor Hugh Durrant-Whyte estimates that around “40 per cent of current [Australian] jobs have a high probability (greater than 0.7) of being computerised or automated in the next 10 to 15 years”. Comparative US research estimates that up to 47% of occupations in the US are highly susceptible to automation. Nearly 140 million full-time knowledge workers could be substituted by algorithms (agriculture used to comprise 40% of the US workforce, it now accounts for only 2%).

-- Labor Science Network, http://www.laborsciencenetwork.com/future_of_work_are_we_training_for_non_existent_jobs

Thanks for the kind reminder of data and anecdotes.

whatthehey

(3,660 posts)The labor market is a national one, and data show an admittedly sluggish but relatively steady improving trend. Detroit's woes no more reflect the nation than, say, Lincoln's near-full employment. Even Detroit has functioning roads which eventually lead to places like Ames or Fargo or Lincoln.

Octafish

(55,745 posts)All the statistics in the federal Department of Labor can show you how well the economy is doing. The reality is very different.

Here's what stands out for me:

An Interview with Tim Anderson on Obama's Commerce Nominee, Penny Pritzker, the Sub-Prime Queen

The Privilege of the Pritzkers

by DENNIS BERNSTEIN

CounterPunch, May 3-5, 2013

EXCERPT...

TA: $38 billion. One publication listed eight casinos, another listed 13, with each license worth a half a million dollars. There is another $5-7 billion in casinos. When you own 13 casinos for 5-7 billion, you are a player in the casino business. That’s just the hotels and casinos. There are many other companies they own such as the second largest chewing tobacco company, which they sold for 3.5 billion dollars. They actually owned the second and third largest chewing tobacco company, but have since off-loaded those for billions of dollars. Many of their assets are not what society considers clean assets, but hey don’t care. As far as money goes, they want it. When it comes to casinos or chewing tobacco companies, they don’t care. Their wealth is almost incalculable, because according to Forbes magazine, they are the only family in America to have off shore tax-free trusts because they were grandfathered in. Their off shore trust can ship money back to their family tax-free. It was grandfathered in because their grandfather got it through Congress – he was smart to see the future and got it done. Congress closed the loophole and grandfathered him in. Forbesmagazine wrote about the Pritzker’s off shore trust, they emphasized that there are over 1000 separate trusts. Many families have two or three different savings accounts to keep track of what money belongs to who, but when you have over 1000 different trusts to handle the family estate it’s very hard to comprehend how much wealth there is and how many businesses they control. A few years ago, Penny sold TransUnion, the largest credit reporting agency in America, but there’s a question about whether she sold it to herself by selling it to various hedge funds which her family has a large interest in. Until she sold it, you could say that Penny Pritzker had more files on every citizen in America than the CIA and FBI combined, because everybody has a credit score and credit report. Penny Pritzker had the credit scores and report on every single citizen in America.

SNIP...

TA: She had TransUnion while she had Superior Bank, so she controlled the credit scores of everybody who was getting a subprime loan. You pay a higher interest on your subprime loan based on your credit score. Whether or not it was ever brokered between the credit bureau and the bank, we don’t know, but we know the same people control both entities.

SNIP...

TA: Superior Bank was acquired back in 1989 as part of the original savings and loan giveaway by M, D and E Wall. As I wrote a in a paper for an economic conference in Denver, Superior Bank was sold to the Pritzkers for 42.5 million dollars. They changed the name from Lion Savings and Loan to Superior Bank after they acquired it. Lion Savings and Loan was sold to the Pritzkers just to put up money for the capital. But as government reports show, they only put up a million dollars cash and pledged their assets as the difference, the capital. That’s not supposed to be done, but they are privileged people so they get privileged deals. After they acquired this for $1 million they also got $640 million in tax credits.

SNIP...

TA: The tax credits were designed so they could use it in any entity they wanted. They didn’t have to use it on what they bought. It could be sold on the open market for value, the credits could be used to file back taxes or warehouse them for future taxes. So for a million dollars, they got 640 million dollars for agreeing to take over Superior Bank, which they then looted for years then gave it back to the government with an enormous loss to the uninsured depositors and the whole subprime industry.

CONTINUED...

http://www.counterpunch.org/2013/05/03/the-privilege-of-the-pritzkers/

PS: I don't have anything against rich people, per se. I'd just like to see the offices and powers of the government go toward helping somebody other than the rich. For a change.

whatthehey

(3,660 posts)I'm the reverse. Which is why I go on data, collected in a standardized manner by career professionals of all political stripes and consistently reported whether they show the alarming fast collapse of 2007-8 or the steady slow improvements since.

I'm really not sure what one person's investment portfolio has to do with the number of job openings, which I thought was the topic of the thread.

Octafish

(55,745 posts)In her work, she has done a stand-up job representing Capital over the interests of the worker, or in the case of her family's bank, community. Lots of people got tossed from their homes, depositors lost their savings (some replaced by the US taxpayer). At her family's other business, the Hyatt hotel chain, unions are not welcome. Odd person for Secretary of Labor, with that background.

Creating jobs, I understand from her statements and the president's, is not the government's responsibility. Job creation happens as a result of the economic conditions government creates.

Which is the point of the thread: What Jobs?

dairydog91

(951 posts)Here's something from a generally progressive think tank. Skip to "Stronger employment growth in low-wage industries contributes to overall slow wage growth." Having a "job", however loosely defined, is good for boosting the employment rate. But we aren't going to have a First World Society if a huge portion of the population gets stuck in permanent low-end employment.

whatthehey

(3,660 posts)Which so far it is not.

dairydog91

(951 posts)I think that data shows some pain.

Octafish

(55,745 posts)

The Shocking Redistribution of Wealth in the Past Five Years

by Paul Buchheit

Published on Monday, December 30, 2013 by Common Dreams

Anyone reviewing the data is likely to conclude that there must be some mistake. It doesn't seem possible that one out of twenty American families could each have made a million dollars since Obama became President, while the average American family's net worth has barely recovered. But the evidence comes from numerous reputable sources.

Some conservatives continue to claim that President Obama is unfriendly to business, but the facts show that the richest Americans and the biggest businesses have been the main - perhaps only - beneficiaries of the massive wealth gain over the past five years.

1. $5 Million to Each of the 1%, and $1 Million to Each of the Next 4%

From the end of 2008 to the middle of 2013 total U.S. wealth increased from $47 trillion to $72 trillion. About $16 trillion of that is financial gain (stocks and other financial instruments).

The richest 1% own about 38 percent of stocks, and half of non-stock financial assets. So they've gained at least $6.1 trillion (38 percent of $16 trillion). That's over $5 million for each of 1.2 million households.

The next richest 4%, based on similar calculations, gained about $5.1 trillion. That's over a million dollars for each of their 4.8 million households.

The least wealthy 90% in our country own only 11 percent of all stocks excluding pensions (which are fast disappearing). The frantic recent surge in the stock market has largely bypassed these families.

2. Evidence of Our Growing Wealth Inequality

This first fact is nearly ungraspable: In 2009 the average wealth for almost half of American families was ZERO (their debt exceeded their assets).

In 1983 the families in America's poorer half owned an average of about $15,000. But from 1983 to 1989 median wealth fell from over $70,000 to about $60,000. From 1998 to 2009, fully 80% of American families LOST wealth. They had to borrow to stay afloat.

It seems the disparity couldn't get much worse, but after the recession it did. According to a Pew Research Center study, in the first two years of recovery the mean net worth of households in the upper 7% of the wealth distribution rose by an estimated 28%, while the mean net worth of households in the lower 93% dropped by 4%. And then, from 2011 to 2013, the stock market grew by almost 50 percent, with again the great majority of that gain going to the richest 5%.

Today our wealth gap is worse than that of the third world. Out of all developed and undeveloped countries with at least a quarter-million adults, the U.S. has the 4th-highest degree of wealth inequality in the world, trailing only Russia, Ukraine, and Lebanon.

3. Congress' Solution: Take from the Poor

Congress has responded by cutting unemployment benefits and food stamps, along with other 'sequester' targets like Meals on Wheels for seniors and Head Start for preschoolers. The more the super-rich make, the more they seem to believe in the cruel fantasy that the poor are to blame for their own struggles.

President Obama recently proclaimed that inequality "drives everything I do in this office." Indeed it may, but in the wrong direction.

FORUM HOSTS, PLEASE NOTE: This work is licensed under a Creative Commons Attribution-Share Alike 3.0 License.

Paul Buchheit is a college teacher, an active member of US Uncut Chicago, founder and developer of social justice and educational websites (UsAgainstGreed.org, PayUpNow.org, RappingHistory.org), and the editor and main author of "American Wars: Illusions and Realities" (Clarity Press). He can be reached at paul@UsAgainstGreed.org.

Original Article: http://www.commondreams.org/view/2013/12/30-0

I'm searching for the latest figures. Don't want to be anecdotal.

dairydog91

(951 posts)The industries that claim to know which businesses will be hiring in the future and which promise to train you for good-paying jobs in those businesses! That will be a Ferrari's-worth of tuition, please. Don't complain if our employment statistics are faker than Donald Trump's hair.

Octafish

(55,745 posts)Who cares about jobs? Trade will help bring the profits of the future to those who earned them: The Capitalist.

The Trans-Pacific Partnership (TPP) includes special protections for corporations that offshore American jobs to low-wage countries. The TPP would not only replicate, but actually expand, the North American Free Trade Agreement's (NAFTA) extraordinary privileges for firms that relocate abroad, and eliminate many of the usual risks that make firms think twice about moving to low-wage countries. The TPP's offshoring incentives include a guaranteed minimum standard of treatment in the offshore venue and compensation for regulatory costs.

The NAFTA-style offshoring incentives that the TPP would expand have contributed to the net loss of more than 57,000 American manufacturing facilities and nearly 5 million U.S. manufacturing jobs – one out of every four – since NAFTA took effect. The U.S. Department of Labor lists millions of workers as specifically losing their jobs to offshoring and import competition since the Fast-Tracking of NAFTA, the World Trade Organization (WTO) and NAFTA expansion deals – and that is under just one narrow program that excludes many whose job loss is trade-related. Studies estimate that the U.S. economy could have supported 7 million more manufacturing jobs if not for the massive trade deficits that have accrued under current U.S. trade policy.

By expanding NAFTA's legacy of middle-class job erosion, the TPP would also exacerbate U.S. income inequality. A litany of studies has produced an academic consensus that trade flows during the era of TPP-like deals have contributed to the historic increase in U.S. income inequality – the only debate is the degree to which trade is to blame. NAFTA-style deals have exacerbated inequality by displacing well-paid manufacturing workers who must then compete for lower-paid non-offshoreable service sector jobs, which in turn depresses wages in those sectors, spurring broad-based middle-class wage stagnation.

A recent study finds that even with a conservative estimate of trade's contribution to inequality, the losses from a projected TPP-produced increase in inequality would wipe out tiny projected gains from the deal for most U.S. workers. The net result would be wage losses for all but the richest 10 percent of U.S. That is, for anyone making less than $88,000 per year, the TPP would mean a pay cut.

CONTINUED w/links...

http://www.citizen.org/Page.aspx?pid=6475

PS: Wouldn't you like to be a "Capitalist," too, dairydog91? We might, if we win Powerball.

PPS: I know, "Public Citizen." What's Ralph Nader know about justice, protecting consumers and democratic principles?

randome

(34,845 posts)The wholesale movement of manufacturing into the IT sector accounts for much of the turmoil. I don't even have a degree yet I'm making $92K a year.

[hr][font color="blue"][center]"If you're bored then you're boring." -Harvey Danger[/center][/font][hr]

Octafish

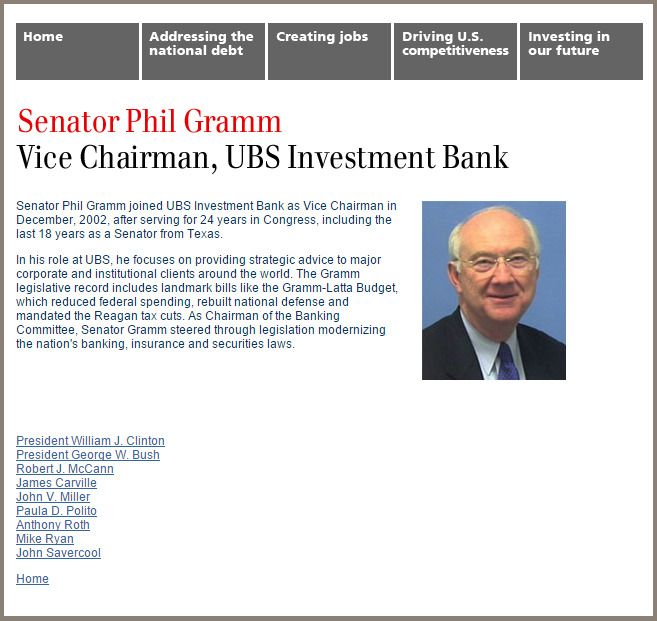

(55,745 posts)Take Wealth Management at UBS, they're hiring.

See if you can spot some familiar names on this list:

Small world. Phil Gramm, the Republican who spearheaded bank deregulation in the Senate, now works as vice chairman at Swiss bank UBS. He hired Bill Clinton, the Democrat, who signed bank deregulation that benefited Swiss bank UBS and other financial institutions.

They now work together at UBS -- which received uncounted billions in bailout money by the way -- to specialize in some kind of "Weath Management."

PS: Forensic economist and former Fed regulator William K. Black wrote it reminds him of what happened during the Savings and Loans Crisis of the late 80s and early 90s. At the time, that was the greatest bank heist in history. How were we to know it was a dry run for the really big money in 2008?

Rather than going to the rich banksters, do you know how many jobs $16 trillion could create? I bet it's a lot.

Atman

(31,464 posts)Or maybe a lettuce picker.

Octafish

(55,745 posts)From Forbes:

Today’s guest on The Future of Work Podcast is Micha Kaufmann, the CEO of Fiverr, which started off as a website where you could get any digital (and some physical) task done for $5. Now it has become a true freelance marketplace that has expanded well beyond that original concept. Today many organizations and individuals are using the site to both find top talent and find gigs. With the popularity of websites like Fiverr, Micha and I discuss why the gig economy is the future of work.

Micha describes Fiverr as the “Amazon for digital services.” It is a full digital marketplace with ‘sellers’ who are the freelancers and ‘buyers’ who are mostly small and medium sized businesses. Although the exact size of the gig or “freelancer” economy is not known, trends are showing this group will only increase. According to Micha, the changing generational workforce is a major factor of the growing gig economy. Through technology, other types of work in the gig economy, such as driving for Uber, or listing a rental on Airbnb, has brought offline activity to online. As the old concepts of work are being challenged, the gig and freelance economy is being viewed as a legitimate option to participate in, and build a career. We talk about that and much more so make sure to tune in!

What you will learn in this episode:

Trends Shaping the Future of Work

How Big is the Gig Economy?

The Impact of Robots and Automation

http://www.forbes.com/sites/jacobmorgan/2015/11/30/why-the-ceo-of-fiverr-thinks-the-future-of-work-is-about-the-gig-economy/#2715e4857a0b212d7c0272ea

I can't wait for the success to kick in.

bahrbearian

(13,466 posts)Octafish

(55,745 posts)I could teach journalism to people interested in spreading the truth -- very important job in a democracy.

Unfortunately, seeing how newspapers swirl down the drain and the local tee vee stations pipe in most of their "content" from NYC, there are few journalism jobs to speak of these days in the crossover states.

It's like what happened to democracy after money and speech were given over to the ownership class: rapidly disappeared.

Thank goodness the CIA still pays journalists!

LA Times Reporter Caught Falsifying Articles with CIA

One investigative reporter repeatedly broke ethical guidelines and “collaborated” with the CIA before publishing his stories. What an atrocity?!

ANDREW EMETT

NATIONOFCHANGE / NEWS INVESTIGATION

Published: Monday 8 September 2014

In violation of journalistic ethics and the Smith-Mundt Act of 1948, former Los Angeles Times reporter Ken Dilanian allowed CIA handlers to edit his articles prior to publication and reported false information to manipulate his audience. Responding to Freedom of Information Act (FOIA) requests, the CIA released hundreds of pages documenting the agency’s dubious relationship with national security reporters. Operating under a glaring lack of oversight, the CIA has been exploiting establishment journalists since its inception.

The newly released documents cover Dilanian’s correspondence with the CIA from March to July 2012. In his emails, Dilanian repeatedly broke ethical guidelines by submitting his articles to the CIA allowing them to alter facts in order to portray the agency in a more favorable light. Receiving false intelligence from the CIA, Dilanian reported a drone strike had successfully killed Al Qaeda leader Abu Yahya al-Libi without causing any collateral damage. According to Amnesty International and the Bureau of Investigative Journalism, at least 20 people were killed in the attack and several more wounded. Although some of the casualties had probably been Al Qaeda members, the other victims were rescue workers slaughtered in a follow-up drone strike.

While collaborating on an article with L.A. Times reporter David Cloud, Dilanian submitted a draft asking his CIA handlers to approve the version before it went to print. Dissatisfied with the earlier draft, the CIA later approved a softened version of the article that Dilanian and Cloud published on May 16. While collaborating with L.A. Times reporter Rebecca Keegan, Dilanian downplayed the CIA’s participation in leaking classified information to director Kathryn Bigelow and screenwriter Mark Boal for their factually inaccurate propaganda film, Zero Dark Thirty.

After leaving the L.A. Times last May, Dilanian has become an intelligence reporter for the Associated Press. He claims the AP does not allow him to submit articles to the CIA prior to publication and admits, “I shouldn’t have done it, and I wouldn’t do it now.”

Other national security reporters who corresponded with the CIA during this timeframe include Brian Bennett of the L.A. Times, David Ignatius of The Washington Post, Matt Apuzzo of The New York Times, Siobhan Gorman of The Wall Street Journal, Adam Goldman of The Washington Post, and Scott Shane of The New York Times.

Following the suspicious death of Buzzfeed reporter Michael Hastings, Robin Abcarian of the L.A. Times reported Hastings had been investigating CIA Director John Brennan at the time of his demise. Within hours, her colleague Brian Bennett contradicted her story claiming Hastings had been researching Florida socialite Jill Kelley instead. A few days later, L.A. Times reporter Andrew Blankstein debunked Bennett’s article and confirmed Hastings had been investigating CIA Director John Brennan when he died in a fiery explosion. Although Bennett’s article is full of false information, the editorial staff has refused to make any corrections.

CONTINUED...

http://www.nationofchange.org/la-times-reporter-caught-falsifying-articles-cia-1410186373

Capitalism's Invisible Army, all right.

PasadenaTrudy

(3,998 posts)My brother does HVAC and is a plumber. A friend of his is trying to hire people and can't find any. Starting pay is $38 an hour.