General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe four-letter word supporters of free trade never utter: DEBT

Last edited Wed Jun 29, 2016, 05:04 PM - Edit history (3)

(repost of an earlier thread of mine)Have you been told by some "expert" on TV or in a print article that Americans save money by purchasing cheap foreign goods at places such as Wal-Mart or Target? That Americans' real incomes, despite stagnating wages, magically "rise" because of access to cheap foreign goods? And have you believed them? Then ask yourself the following:

Are you saddled with credit card debt? A home mortgage that seems to be growing more ominous? A student loan that you will not be able to retire even if you were to live to age 200?

If you are, or if your neighbors are (indeed, much of the rest of the nation is), then the reason can ultimately be traced to a factory in Ohio being relocated to Mexico. And to a textile mill in South Carolina moving to Indonesia. And to an auto plant in Detroit going to China. Or simply thousands of other factories ceasing to exist at all due to cheap imports.

That is because stagnant wages brought about by trade liberalization have decreased consumer purchasing power, while government policy has encouraged borrowing to make up the difference: credit cards, auto loans, home equity loans, student loans, all kinds of loans. Furthermore, the US government's simultaneous near-sponsorship of Wall Street has resulted in creating a sophisticated new industry: the financial industry. We've traded making material things for Americans to sell to themselves and the world market for making new instruments for banks to sell to cash-strapped American consumers. And whatever little money consumers might save by purchasing slightly less expensive foreign-made retail goods is greatly outweighed by their monthly debt payments -- debt payments unthinkable a generation ago.

Backdrop:

Before the era of trade liberalization (allowing cheap imports to enter the US market, an era commencing roughly in the early 1970's and continuing to the present time), household debt was virtually unknown. Homeowners did carry mortgages, but strong wages and strong job security easily retired these mortgages in timely fashion. Credit card debt was almost non-existent; wages were that strong.

Similarly, with the sole exception of wartime periods, government debt was also unknown.

But something happened when cheap imports began to flood the US market. People began to use credit cards much more often than they did in the past. They also took on larger auto loans, larger mortgages, larger student loans.

And, crucially, they also had much more trouble retiring these debts -- forever.

Trade agreements have also ballooned the nation's federal debt:

Free trade agreements have also ballooned the trade deficit, which, in turn, results in a huge increase in government (national) debt, as noted by economist Ian Fletcher:

Over the past 35 years or so that we have been running trade deficits, we have mostly paid for this by assuming debt, and especially in recent years, a huge part of that debt has been public debt. One consequence has been that in order to manipulate the dollar price of its currency downward and boost exports, China has been buying huge amounts of U.S. Treasury securities. Thus the same mechanism that caused our trade deficits also increased our governmental debt.

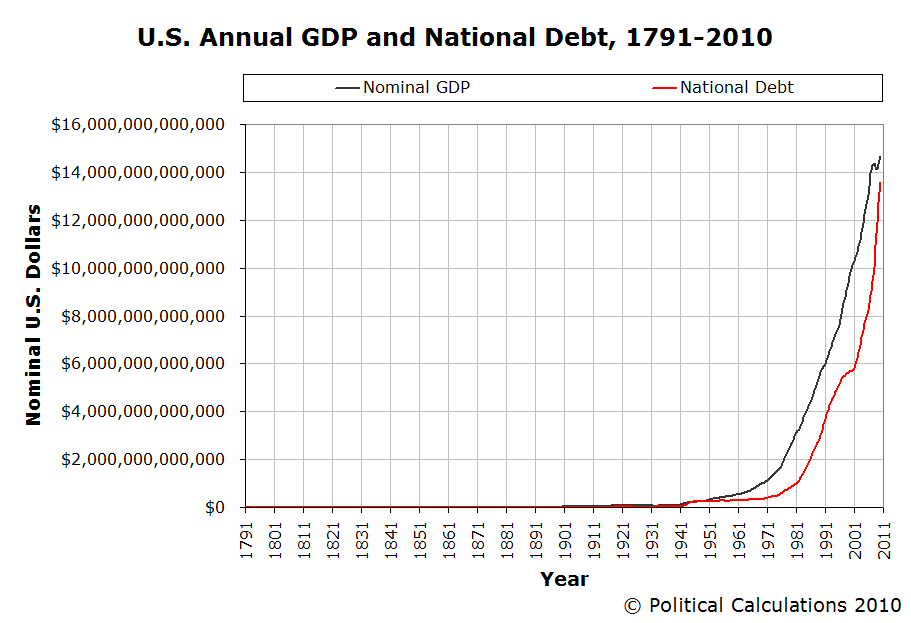

Note the upward trajectory of both household and national debt in the era of "trade liberalization":

The United States is now experiencing the same syndrome that all the great empires of the past did when they traded away their economies' golden gooses: unsustainable, runaway debt -- at all levels.

Ohioblue22

(1,430 posts)Hoyt

(54,770 posts)goods. Many companies failed. Sorry, such protection merely got us gas guzzling, crummy cars.

I really don't think debt will decline by joining Trump in supporting Nationalism and America First.

orwell

(7,771 posts)...pretty charts aside, high levels of consumer debt has nothing to do with cheap imports. The debt levels are so high because most refuse to live within their means. Savings has been devalued due to low rates of return on savings (central bank intervention to boost demand) and we have been trained by years of inflation to buy now and pay later.

To add to the debtor class mistakes, excess income is frequently converted to consumption rather than to income producing assets. People would rather buy a $3 coffee than put that money away and buy Starbucks stock.

In the end debt itself becomes meaningless in the age of Central Bank money creation. It will take decades before economists catch up to this fact. They are still fighting the "monetary wars" of the last century or wrapping themselves in gold and silver from the Middle Ages.

For all our modernity we are economically clueless.

brentspeak

(18,290 posts)As I stated before, in this day of "trade"-depressed wages, underemployment, and diminishing employment prospects (all the result of trade deals), people are forced to borrow to make ends meet. And even in cases when they are not, they are encouraged by the government to borrow. Remember Bush's "Shop til' you drop!"? His administration's egging on the housing market (read: mortgages)? Bill Clinton's celebration of the bond market? For the past 30 years, after it has abandoned the manufacturing industry, our own government has essentially sponsored and promoted the financial industry -- it is a directly state-sponsored and supported industry (multiple bailouts; bankers who serve as economic, trade, and labor advisers; financial corporations who are candidates' main sources of funding, etc.)

Promoting cheap imports, Washington has encouraged wanton consumption. It has coddled banks and peddled debt on their behalf. And, by means of employee-hostile trade deals, it has worked hand-in-hand with Wall Street to correspondingly depress wages and benefits so that workers are often required to borrow.

orwell

(7,771 posts)I am a low income voter who has lived in the United States since birth. I have no debt and a very comfortable lifestyle. I never inherited anything from anyone.

I never incurred debt in the first place. I saved and bought what I needed without incurring debt.

I was raised by a single mother in one of the most expensive states in the union to live.

How am I able to accomplish this miracle?

I practiced what I am preaching.

brentspeak

(18,290 posts)And everyone else forced into debt due to calamity? Those strong benefits which would have existed with good jobs have disappeared once the trade deals were signed into law. That is how the trade deals were constructed: to depress wages, to reduce benefits, and to promote debt.

You do understand this, right?

closeupready

(29,503 posts)in terms of making generalizations.

DanTex

(20,709 posts)Do you think people would have less credit card debt if goods were more expensive?

Yavin4

(35,438 posts)First, most American debt is related to health care costs, and that's due to the American voting public's refusal to vote for a more cost-effective health care system. Second, high levels of student debt is due to tuition rates rising higher than the rate of inflation for decades even though the delivery of quality education could be made cheaper with technology. Third, credit card and mortgage debt is tied to poor understanding of how these financial instruments work. That can be, and is currently, corrected with better disclosure.

Finally, the "strong wages and strong job security" era was not due to factory jobs, but government intervention into the labor markets which forced companies to bargain with labor. Those same factory jobs from a different era did not deliver the benefits which you cite. Even more, if we did bring back ALL factory jobs from overseas, they would not pay the same wages nor offer the same benefits from that era long ago. They would have to pay a global wage for that job or the company would not be able to compete globally. Globalization is happening whether there are trade agreements or not.

brentspeak

(18,290 posts)without even knowing it.

It has been the trade deals which took the knees out from underneath private unions in the first place. One of the primary goals behind all post-1975 "trade" deals has been to destroy the power of the private union sector and its collective bargaining power. The "government intervention in the labor markets" you think you're referring to was actually the trade deals, designed to cut labor off at the knees.

Everything else you say is basically Davos globalist apologetics.

uponit7771

(90,335 posts)... and other countries.

Our manufacturing output is still high, it's not because tons more people got hired it's because automation got more and more robust... primarily.

Unfair trade didn't help.... unfair trade.

I think absorbing worker by the way of infrastructure is a good deal vs red state welfare programs in defense

brentspeak

(18,290 posts)To take advantage of Chinese and Mexican robots?

"Trade" (what should more accurately be called "job offshoring") is paramount on the list.

uponit7771

(90,335 posts)... or 5th actually why our job sectors aren't like it was during the 50s and 60s cause that's what people want to get back to.

But again, its easier to demogauge the others including other nations

Yavin4

(35,438 posts)government policies and actions in the present. Bringing back factory jobs does nothing to change that. You would still need massive govt. intervention to re-create those middle class jobs, and if the people already don't vote for health care, child care, education, etc., what makes you think that these same people will vote for a government that makes these factories pay middle class wages and benefits?