General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhat we knew in 2008

It is good to recall that terrorism existed before 9/11, and good to recall how screwed we were well before Lehman Brothers blew-up. (And before any evening news show ever used the phrase "mortgage-backed derivative."![]()

In winter of 2007-2008 there was a lot of pre-primary arguing that focused on Obama versus Hillary on Iraq, and how Iraq would play in November. (By picking war-hero McCain the Republicans were doing the same thing.) My take was that by November 2008 no voter would care about terrorism or international affairs or even remember Iraq because the economy would be in a bad recession on election day.

That was not psychic. It was vanilla. It was a known thing that the housing bubble had been rolling over for years and very likely that it would continue to do so and take down the economy, and that the resulting downturn was going to be very bad, and particularly damaging to jobs and would be unusually slow to recover. (Because of the particular nature of a housing bubble collapse.) That's what everyone knew, or should have known.

What was not widely known yet in early 2008 was the degree to which the global economy had been wired to a bomb through mortgage-based derivatives that would magnify the effect of the collapse of the housing bubble. The banks and hedge funds seem to have not even understood their own exposure.

Anyway... even without the derivative orgy fundamentally threatening the international banking system, the housing bubble burst was going to be a serious economic event. Even if one didn't know that the Fed would have to take rates down to zero.

A housing bubble is always unusually serious.

1) Housing usually leads the way out of business cycle recessions, both in economic activity and in employment. But if the cause of the recession is that housing prices are unsustainable then housing cannot sensibly bounce back and the economy is left without its usual interest-rate sensitive high-employment driver.

2) Of all types of asset bubble, housing speculation is the most played with "real" money. People borrow against real estate valuation routinely because banks think/thought housing was a stable sort of thing. If you bought pets.com cheap and saw it zoom up in price and then drop to zero you feel less rich, but hey... easy come easy go. If, however, you had borrowed a lot of money against that pets.com stock when it was up then when pets.com goes bust you still owe the money. In a housing bubble the buyers typically finance their investments with huge leverage. It as if everyone bought pets.com for way more money than they had in the world with only 10% down. Essentially, an asset bubble that is 90% "on margin." The last fool in on pets.com lost investment money that they were probably not going to spend this year anyway. The typical person who bought into housing at the top, however, quickly found themselves in real and immediate trouble and that has profound and immediate effects on demand. The typical pets.com loser has made it so that he will have less consumer buying power when he retires. Someone who has a big mortgage on a house they assumed they could flip or borrow against if they got laid off suddenly finds themselves unable to borrow, unable to sell and choosing between the mortgage and groceries today.

3) Few people are hired directly because pet.com hits some crazy valuation. It is just numbers in a computer. There will be more stock traders hired and such, but it is not labor intensive. On the other hand, similar jumps in housing valuation lead to many jobs building more houses. And when a housing bubble bursts those people are all laid off at once.

Anyway, I stared reading CalculatedRisk blog in 2007. It's a wonderful resource. Economic news and analysis with no agenda. (Having no agenda means it is a liberal site, don't you know, since the absence of a RW agenda is considered evidence of a LW agenda.)

Here is how he (and most other informed commentators who didn't have a direct financial interest in happy-talk) were talking about things in February of 2008:

So, for those expecting a 2nd half recovery in the economy, I believe they need to look elsewhere for growth – and they need to argue this time is different, i.e. that the economy will recover before housing this time.

More likely the economy will remain sluggish well into 2009 and the effects of the recession will linger. It is possible that fiscal and monetary stimulus will provide some 2nd half boost to GDP, but if that does take the economy out of an official recession, then I believe a double dip recession (or something that feels like one) is very probable.

Housing is still the key to the economy. And the housing outlook remains grim.

http://www.calculatedriskblog.com/2008/02/housing-as-engine-of-recovery.html

That was before anyone was hep to the derivative suicide-switch. Just normal analysis of what a correction in an inflated housing market portended.

Always good to revisit what was being said in real time.

__________

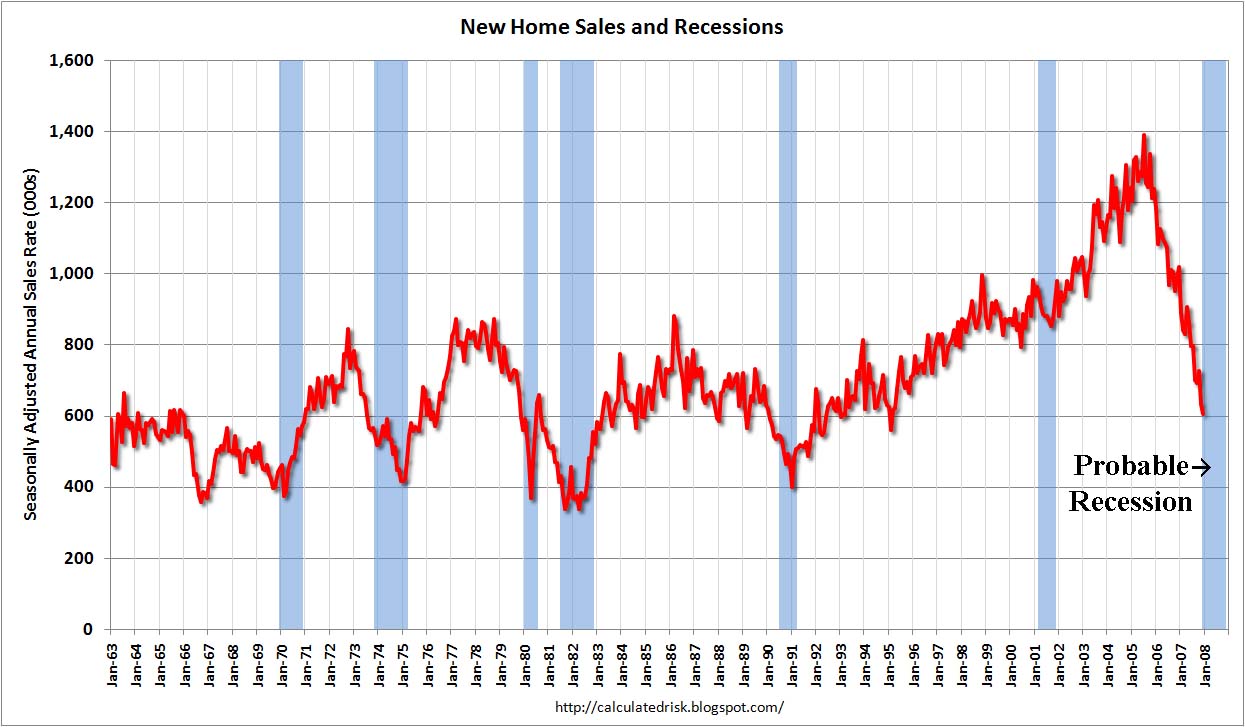

I am also adding this chart from the same day as the above blog entry, both as a reminder of how much housing had already collapsed a year before Lehman went belly-up, and because it's striking to recall that responsible commentators were publishing charts with a label like "probable recession."

cthulu2016

(10,960 posts)My pet eccentric economic theory is that the internet bubble did not burst. It simply moved out of high-beta stocks into real-estate.

The collapse of the internet bubble should have demolished our economy. It's effects were way too muted. But if a stock bubble deflates without a real CRASH then a lot of bubble profits can be taken out partially intact on the way down.

I was thinking of this looking at the chart... I hadn't appreciated how soon the rocket-leg of the housing bubble began. New home sales were already at near-record highs when the stock market was supposedly purged of excess and then new homes took off from that already record-high.

And that's an impressive housing move from 1991-2006. The deflection upward circa 2001 that we identify as the bubble part of housing isn't all that much steeper than the 1991-2000 line. It reminds me of the 1999 deflection in the NASDAQ as an already-big bubble entered the crazy blow-off top phase.

I suspect a chart combining the stock market and new home sales would show a huge all-asset bubble 1991-2006, getting a scare in 2000, pausing a little, and then continuing inflating... but in a different asset.

After housing rolled over we saw wild speculation in commodities. Gold, of course, and oil in 2007-2008, and even farm futures.

The funny money thrashing around seeking bubble-level returns in any asset class that seemed hot.