General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHere We Go Again? Tax Cuts For The Wealthy? Two Figures To Look At.

Are we really going to go through this AGAIN?

We've been cutting taxes for the wealthy for 36 years, and the EMPLOYMENT rate has NEVER gone up. The only thing that's gone up as a result of this is the National Debt. Reagan cut taxes in 1981, and by the time he left Office the National Debt had nearly TRIPLED.

How about a little experiment:

1. BUSH cut taxes in 2001 and 2003....and nothing happened. No jobs were created. The economy didn't explode. The only thing that exploded were the bank accounts of a few billionaires, and almost all of it was transferred to Tax Havens in the Bahamas and Switzerland.

2. Obama finally let the Bush tax cuts EXPIRE in 2012, and unemployment continued to DROP.

Conclusion: Employment goes up or down, REGARDLESS of the tax rate on the top 1%. If you cut the tax rate for the top 0.1%, they DO NOT invest it in job creation. The only thing you create is a whole mess of DEBT for everyone else.

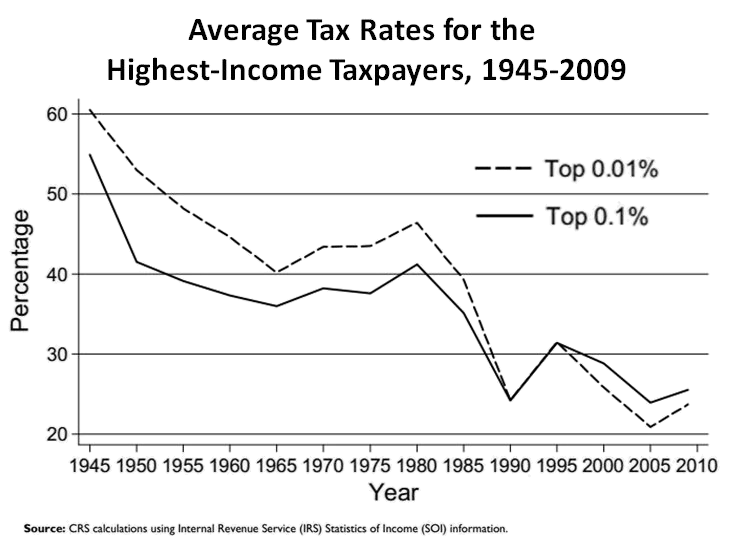

Take a look at this graph of top tax rates for the top 0.1% crowd, and tell me when we had the greatest periods of job growth, vs. the slowest job creation rates. I think most people would agree that we had the most robust economy between 1950 and 1970, when the top rates were around 60%; and the most sluggish economy when the top rates are below 20%.

JHan

(10,173 posts)

B Stieg

(2,410 posts)Not very funny, actually.

jmowreader

(50,553 posts)One of them is totally hypothetical, and the other was a perfect storm.

The hypothetical is the Laffer Curve. According to this monstrosity - for which Jude Wanniski's moldering corpse should be dug up and desecrated, as a warning to the others - there is one "perfect" tax rate that maximizes tax revenues. Below that rate you are leaving money on the table. Above it, the effect depends on who you're talking to. One version says a too-high tax rate disincentivizes work; the other says it incentivizes tax evasion. Naturally, this can be debunked:

1) Because every person has a different set of deductions, credits, legal tax dodges etc, every person's effective rate is different. Hence, you can't just pull a number out of the air and say, "eureka! The perfect tax rate!"

2) If someone is actually prone to either tax evasion or work evasion, they're going to do it no matter how low the tax rate gets.

The perfect storm was JFK's tax cut, which won't happen again for two reasons: the tax rate now isn't high enough (cutting the top marginal tax rate by 20 percentage points in 2017 would mean we'd have to pay Paris Hilton for being rich; in the 1960s, the rate AFTER the cut was seventy percent) and the cut did two things - gave the taxpayer enough of a savings he could invest it in large capital equipment like those crazy new "computer" things everyone was talking about, and left the government with enough money to bolt Neil Armstrong into a rocket and fire him at the moon.

pansypoo53219

(20,969 posts)KEEP CLAPPING OR TINKLEBELL WILL DIE!