General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsPicking Our Pockets and Lining Theirs - Banksters Take Us to the Brink (Moyers and Winship)

Conspiratorial Wink (detail) by Michael Samuels

The Truth in Plain English:

Picking Our Pockets and Lining Theirs

Banksters Take Us to the Brink

by BILL MOYERS and MICHAEL WINSHIP

CounterPunch

Weekend Edition July 13-15, 2012

EXCERPT...

And what a business! You’ve most likely been hearing about the newest scandal in banking, centering on Barclays Bank in Great Britain and something called Libor. That stands for London Interbank Offered Rate and involves a group of bankers who set a daily interest rate affecting trillions of dollars of transactions around the world. Your home mortgage, your college debt, your credit card fees; all of these could have been affected by Libor.

Now you would think the rates would be set by market forces, right? Aren’t they what makes the world go ‘round? But it turns out some of those insiders were manipulating the index for their own gain, to make their banks look better off during the financial crisis, lower their borrowing costs, and raise their profits – by cheating. Picking our pockets and lining theirs.

SNIP...

“In testimony last week before the British Parliament, former Barclays chief executive Robert E. Diamond said the bank had repeatedly brought to the attention of U.S. regulators — as well as U.K. regulators — the problems that the bank was experiencing in the Libor market.

“He said the bank’s warnings to regulators that Libor was artificially low did not lead to action. Barclays’ regulator in the United States is the Federal Reserve Bank of New York, which was run at the time by current Treasury Secretary Timothy F. Geithner.”

CONTINUED...

http://www.counterpunch.org/2012/07/13/banksters-take-us-to-the-brink/

Gosh. I'm so old that I can remember when America had more than a few leaders who put the People ahead of profits.

malaise

(268,939 posts)Octafish

(55,745 posts)“In testimony last week before the British Parliament, former Barclays chief executive Robert E. Diamond said the bank had repeatedly brought to the attention of U.S. regulators — as well as U.K. regulators — the problems that the bank was experiencing in the Libor market.

One man's "Problems" are another man's "Profits."

Trillo

(9,154 posts)Octafish

(55,745 posts)woo me with science

(32,139 posts)Octafish

(55,745 posts)We'd never know it, either, were not for Bernie Sanders.

PDF of The FED audit. See page 131 (144 on my puter's PDF readerthing).

What bugs me most is the fact The Fed can materialze money out of thin air to help their rich cousins in ANOTHER FREAKING COUNTRY but can't raise a finger to help the City of Detroit, say, where 2,000 public school students are HOMELESS.

msongs

(67,395 posts)Octafish

(55,745 posts)He does it for the uncommon bad:

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

And he had sooooooooooooooooooooooooooooooooooooooooooooooo much buy-partisan support in passing the welfare for the wealthy legislation and then getting it signed, it still sickens.

Overseas

(12,121 posts)Wisdom of the Free Market.

Before Enron.

And the Bush Crash.

Democrats were supposed to get behind Voluntary Self-Regulation even after decades of proof that it fails to protect the people, well, 99% of the people that is.

Octafish

(55,745 posts)Remember how fast Bushler distanced himself from Kenny Boy? That was when all that HARKEN SEC brouhaha was bubbling up, again. Then, just before sentencing, Kenny left this mortal toil? Too sad.

Federal Reserve Directors' Banks and Businesses Took $4 Trillion in Bailouts -- Sanders FED Audit

http://www.democraticunderground.com/1002807254

PS: Here's the Buy-partisan ENRON angle:

Lieberman in ENRON Land

PS: I know it's old news to you, Overseas. Must think of future generations...

Overseas

(12,121 posts)I sometimes forget how vast.

sabrina 1

(62,325 posts)and did nothing to stop it. Are there no decent people left anywhere, who even tried to stop this massive crime against the people? So far, I have not seen a single report of anyone who seriously tried to stop this. Maybe there were such people, but like Brooksley Born who warned about all of this so long ago, they were silenced. That's always possible.

So there were warnings, but nothing came of them. Just like Madoff about whom there had been many complaints to the SEC, but all of which were ignored, and as mentioned above, Brooksley Born and who knows how many others.

If this does not demonstrate that what we need to put an end to this corrupt system is some entity, other than those already in place who were either colluding with the scam or ignoring it because they didn't want to take on those powers, that is made up of ordinary people and/or well-known people in the field of economics like Dean Baker eg, to do a proper and thorough investigation and who will not be influenced to hide anything that the people need to know.

Octafish

(55,745 posts)There are good people, unfortunately the dreary greed industries cough rich mentality cough must not have much appeal for them.

Libor scandal exposes banks’ rigging of global rates

Barry Grey

WSWS.org 6 July 2012

Rotting in its own criminality, the capitalist financial system produces ever more powerful arguments for its expropriation and reconstitution under public ownership and democratic control.

The latest banking scandal, thus far focused on UK-based Barclays bank, goes to the heart of the global financial system. It provides a glimpse into the mechanisms by which a handful of giant banks rig the so-called “free market” to boost their profits and the fortunes of their executives and big investors. It is a process of economic plunder whose result is mass unemployment, poverty and ever increasing social inequality.

SNIP...

As one Financial Times commentator put it, rigging Libor is “the financial equivalent of contaminating the water supply.”

SNIP...

This type of gaming of the Libor and Euribor rates (as well as the Tokyo-based Tibor) was being carried out by virtually all of the major international banks. A dozen regulators around the world are investigating somewhere between 12 and 20 other banks, including HSBC, the largely state-owned Royal Bank of Scotland, Deutsche Bank, Credit Suisse, UBS, JPMorgan Chase, Citigroup, Bank of America, Bank of Tokyo-Mitsubishi and Sumitomo Mitsui. More settlements along the lines of the Barclays deal are expected in the coming weeks.

This bankers’ conspiracy has a very real and vast impact on the lives of ordinary people. Countless billions were effectively stolen from new homeowners or those with variable-rate mortgages, credit card holders, students with college loans, small business borrowers and other consumers when the banks priced the Libor rate artificially high. The Wall Street Journal noted Thursday that an extra 0.3 percentage point would add $100 to the monthly payment on a $500,000 adjustable-rate mortgage.

CONTINUED...

http://www.wsws.org/articles/2012/jul2012/pers-j06.shtml

I'm with you, Sabrina1. I nominate the People's representatives appoint William K. Black to lead the investigation and regulatory re-build PDQ. Otherwise, America is heading for it's own Bastille Day. Big Time.

suffragette

(12,232 posts)and one that hasn't been getting nearly enough attention.

Posted in

http://www.democraticunderground.com/1002917004

from

http://www.propublica.org/article/beyond-barclays-laying-out-the-libor-investigations

In his testimony, Diamond stuck by the line that everybody was doing it. And indeed, the revelation that banks might have tried to keep their rates artificially low during the crisis isn’t altogether new—in 2008, the Wall Street Journal reported that banks were submitting much lower rate estimates than other market measures would have suggested. In 2008, the British Bankers’ Association said it had received suggestions that banks were exhibiting “herd” behavior in setting low rates.

The Washington Post notes that a manipulated Libor doesn’t just have repercussions for investors and borrowers, but also for regulatory efforts; by keeping rates low during the financial crisis, the banks were trying to quell concerns about the health of the banking system and “stave off calls for additional regulation.”

So, "herd behavior" in conducting an action designed at least in part to “stave off calls for additional regulation.”

And that at the time they - all the 'too big to fail' - banks were causing a global financial crisis that led to public money being poured into their 'private' businesses and massive cuts to public social services.

And at a time many of them were also manipulating energy prices a la Enron (but sneakier) and engaged in other shady ventures:

http://www.democraticunderground.com/1002901524

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=161453

Instead of prosecuting them and regulating the whole industry, we keep funneling more money to them, out of which they pay a small portion as fines, then proceed to continue the scam.

It's time to stop this corrupt cycle.

woo me with science

(32,139 posts)Octafish

(55,745 posts)Elites say that we need inequality to encourage the rich to invest and the creative to invent. That's working out well -- for 1% pooches.

By Gerald Friedman, AlterNet

Posted on July 8, 2012, Printed on July 15, 2012

Summer 2009. Unemployment is soaring. Across America, millions of terrified people are facing foreclosure and getting kicked to the curb. Meanwhile in sunny California, the hotel-heiress Paris Hilton is investing $350,000 of her $100 million fortune in a two-story house for her dogs. A Pepto Bismol-colored replica of Paris’ own Beverly Hills home, the backyard doghouse provides her precious pooches with two floors of luxury living, complete with abundant closet space and central air.

SNIP...

The slowdown in growth since the abandonment of egalitarian New Deal policies has cost Americans about 30 percent of their income. And the massive redistribution of income away from average Americans and toward the rich has destroyed the sense that America is a land of opportunity for all. Quality of life has plunged because the shredding of social protections has exposed average Americans to much higher levels of risk. The substitution of defined contribution pensions, such as Individual Retirement Accounts or 401K plans, for defined benefit pensions has reduced retirement security for individuals while reducing the risk borne by employers or other social institutions. Just as important as declining income for many Americans, the stress and anxiety associated with the risk shift has contributed to rising levels of depression and morbidity and a decline in life expectancy for Americans compared with residents of other countries.

Workers’ security has been abandoned. But the government has let financial markets run wild. In 1982, Congress deregulated the thrift industry, freeing thrifts to engage in reckless and fraudulent behavior. In 1994, it removed restrictions on interstate banking. In 1998 it allowed Citigroup to merge with Travelers’ Insurance to create the world’s largest financial services company. And in the Gramm-Leach-Bliley Act of 1999, it repealed the remaining Glass-Steagall barriers between commercial and investment banking. Acting with the virtual consent of Congress and the president, in 2004, the Securities and Exchange Commission established a system of voluntary regulation that in essence allowed investment banks to set their own capital and leverage standards.

By then our financial regulatory system had largely returned to the pre-New Deal situation in which we trusted financial institutions to self-police. Advocates of deregulation, like Federal Reserve chair Alan Greenspan, were unconcerned because they expected banks and other financial firms to limit their risk for fear of failure. Either they misunderstood the incentives facing company managers, or they did not care. In practice, financiers are playing with other people’s money (ours). When they do well, their compensation is tied to profits and they can earn huge sums. But when their investments fail, they are protected because monetary authorities and the United States Treasury cannot allow "too big to fail" financial companies to go bust. So long as risky investments would have periods of high returns, the managers of deregulated financial firms have an incentive to increase their risk, profiting from success while passing the costs of failure to the public. We have all been suffering from the consequences of their failures since the financial crisis of 2007-'08.

The share of income going to the top 1 percent has doubled since the 1970s, returning to the levels of the 1920s. The greatest gains have gone to the very wealthiest and to executives and managers, especially of financial firms. From 1973 to 2008, the average income of the bottom 90 percent of American households fell even while the rich gained. The wealthiest 1 percent gained 144 percent or over $600,000 per household; and the richest 1 percent of the 1 percent, barely 30,000 people, gained over 455 percent or over $19,000,000.

CONTINUED...

http://www.alternet.org/story/156143/

What Les McCann said about that stinking mutt.

Overseas

(12,121 posts)Octafish

(55,745 posts)

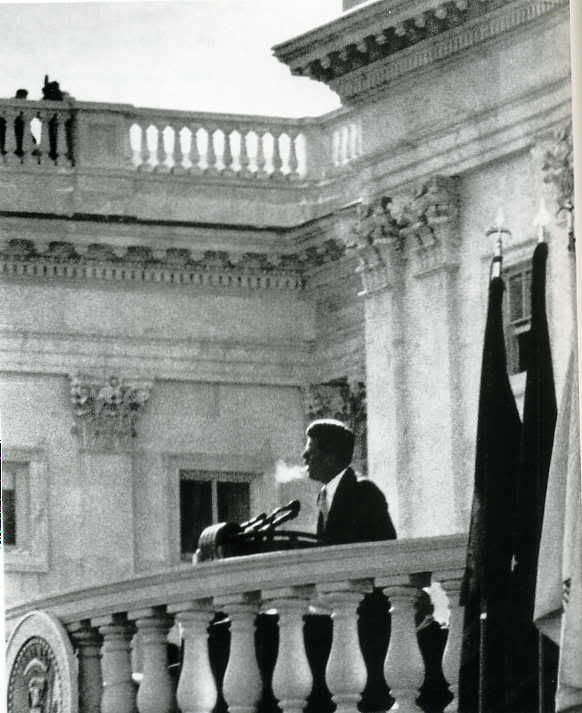

President John F. Kennedy, Friday, January 20, 1961, in his Inaugural Address

More for those new to the subject:

JFK battled Wall Street and Big Business

So, in the short time he had, President Kennedy did what he could to balance the interests of concentrated wealth with the interests of the average American -- necessary for the good of the country.

Professor Donald Gibson detailed the issues in his 1994 book, Battling Wall Street: The Kennedy Presidency.

From the book:

"What (J.F.K. tried) to do with everything from global investment patterns to tax breaks for individuals was to re-shape laws and policies so that the power of property and the search for profit would not end up destroying rather than creating economic prosperity for the country."

-- Donald Gibson, Battling Wall Street. The Kennedy Presidency

More on the book, by two great Americans:

"Gibson captures what I believe to be the most essential and enduring aspect of the Kennedy presidency. He not only sets the historical record straight, but his work speaks volumes against today's burgeoning cynicism and in support of the vision, ideal, and practical reality embodied in the presidency of John F. Kennedy - that every one of us can make a difference." -- Rep. Henry B. Gonzalez, Chair, House Committee on Banking, Finance, and Urban Affairs

"Professor Gibson has written a unique and important book. It is undoubtedly the most complete and profound analysis of the economic policies of President Kennedy. From here on in, anyone who states that Kennedy was timid or status quo or traditional in that field will immediately reveal himself ignorant of Battling Wall Street. It is that convincing." -- James DiEugenio, author, Destiny Betrayed. JFK, Cuba, and the Garrison Case --This text refers to an out of print or unavailable edition of this title.

Had he lived to serve a second term, I'd bet on JFK putting people ahead of The Fed. Bet also there'd be a heckuva lot more leaders, er, politicians who'd do the same.

sabrina 1

(62,325 posts)It seems that when anyone threatens the Banking system, they either end up dead, or persecuted, like Julian Assange. No one seemed all that concerned about Wikileaks, even after the War Logs (America doesn't seem to get too excited about war and torture so they really had nothing much to worry about). But when he revealed in a July 2010 interview that most of the leaks Wikileaks had were 'from the Private Sector' and confirmed in response to questions in the interview, that some of what they were about to reveal 'could take down some big banks', all hell broke loose for him.

He did not verify which banks they had info on, but we know now that BOA hired 'contractors' to go after him and anyone, Glenn Greenwald eg, who were supporting the work Wikileaks was doing. About one month after that interview, he was accused of sexual assault, never charged, but has been a political prisoner ever since. Additionally a successful effort was made to cut off Wikileaks' funding.

I guess it's dangerous to reveal anything about the Big Banks.

Overseas

(12,121 posts)has been clear for so long. I thought my Democrats would finally band together, and not be so buy-partisan.

And we weren't even granted the freedom from medical terror with Medicare for All after the Bush Torture and the Bush Crash.

And major reinstatement of anti-trust regulations and breaking up Big Finance and the sovereignty of the quarterly profit statement.

But hoping felt so much better than facing brutal realities.

bobthedrummer

(26,083 posts)that used to surround ALEC and the BANKSTERS.

Below are links to some of what's known here in Wisconsin from The Center for Media and Democracy.

Bankster USA

http://www.banksterusa.org

ALEC Exposed

http://www.alecexposed.org