General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHow Apple Takes A Bite Out Of All Of Us

It is difficult to name a company with a better popular image than Apple.

Stockholders love the strength of the company; it annually tops lists for best-run and most profitable, customers line up days or more ahead of time for product releases and distributors, code writers and feeder industries all heap praise on the technical giant. Steve Jobs, long dead, is still revered as a Silicon Valley pioneer.

And yet.

Apple stows a quarter of a trillion dollars a year offshore on the United Kingdom’s Isle of Jersey, where Apple pays no taxes.

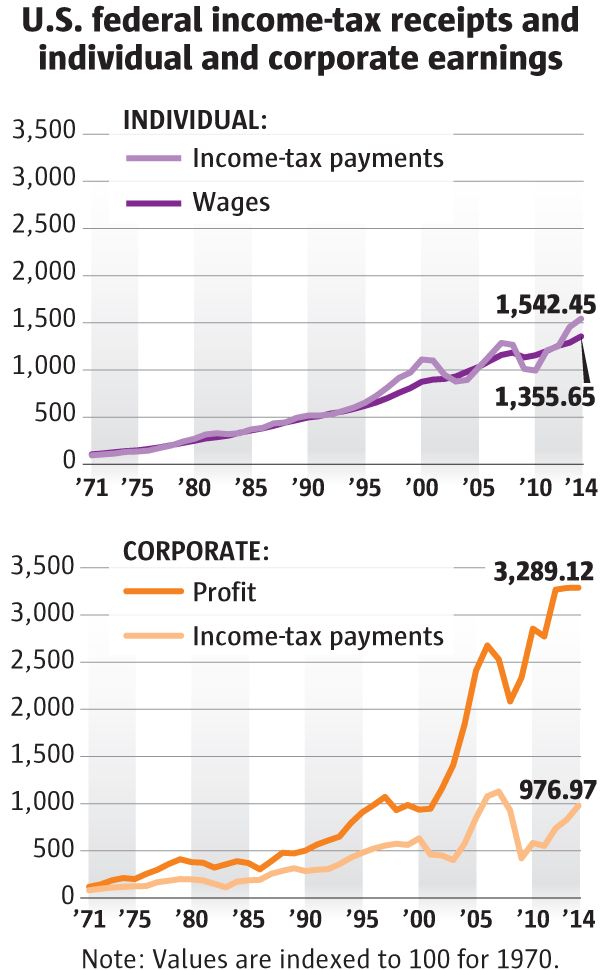

That little factoid makes me wonder about corporate behavior, the attack on government-paid social services and those Congressional talks about tax “reform,” a phrase known to the rest of us as tax cuts for corporations and giveaways for the wealthy. It’s a program that a new analysis from the nonpartisan Tax Policy Center will cost $7 trillion over the next 20 years, with individual taxpayers called on to provide much of the difference. The entire package is expected to cost an estimated $5.6 trillion over the next 20 years—an amount that economists say would be hard to offset through economic growth alone.

https://www.dcreport.org/2017/11/17/how-apple-takes-a-bite-out-of-all-of-us/

Even if the reporter wrote it on his Macintosh............

![]()

![]()

brooklynite

(94,501 posts)...nobody and no company pays MORE than they should.

pangaia

(24,324 posts)GeorgeGist

(25,319 posts)Hoyt

(54,770 posts)not added per year. Still a lot and assuming it all represents profits is subject to $80 Billion in taxes. That would pay less than 2 months of our bloated defense budget.

I also take issue with forecasting the impact of the awful tax plan over 20 years. Assuming the dang thing passes, we can reverse it in a few years electing Democrats.

Still, the overall point is valid.

msongs

(67,394 posts)customerserviceguy

(25,183 posts)Followers of the Apple religion will do whatever it takes to get the latest iCrap, no matter what the price.

lindysalsagal

(20,666 posts)I don't, but knowing DU, someone here will.

turbinetree

(24,695 posts)

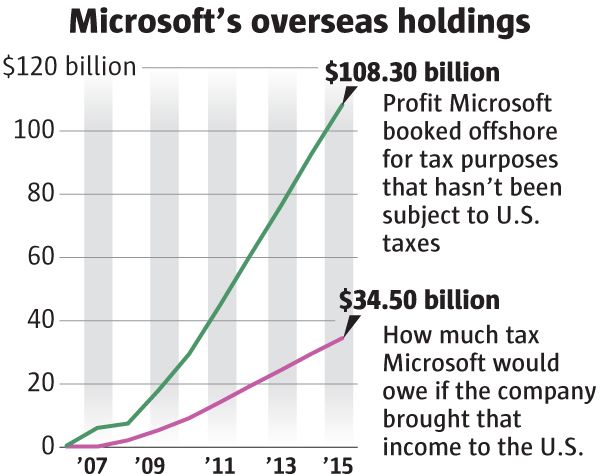

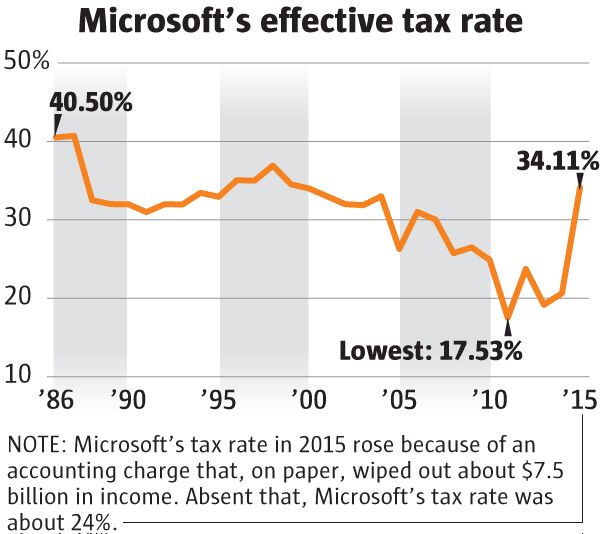

https://static.seattletimes.com/wp-content/uploads/2015/12/WEB-Updated-microsoft-tax-chart3-

c.jpg

How Microsoft moves profits offshore to cut its tax bill

Originally published

Microsoft has been at the center of the debate about corporate tax avoidance over the years.

The Wall Street Journal in 2005 investigated Microsoft’s use of Irish subsidiaries, highlighting the growing number of American technology companies establishing outposts there to take advantage of generous tax breaks.

A U.S. Senate hearing in 2012 outlined maneuvers that helped Microsoft save $6.5 billion in taxes over three years.

In December 2014, the IRS sued Microsoft, seeking testimony and documents as part of a long-running audit. Ultimately, a court ordered Microsoft to cooperate with the latest IRS requests. The audit continues.

The company isn’t alone in drawing scrutiny for its tax practices. Boeing has paid federal income tax in just three of the past 12 years, in part because of tax deductions the company took to account for development programs like the 787 Dreamliner. Amazon’s tax maneuvers have been criticized by the U.K. and European Union.

EU regulators have also targeted a tax deal Starbucks struck with the Netherlands. After a public outcry over low tax payments to the U.K., in 2013 Starbucks said it would not claim some tax deductions.

Reports have also focused on use of tax haven by other U.S. corporate stalwarts, from Wal-Mart to Google, Apple and General Electric.

https://www.seattletimes.com/business/microsoft/how-microsoft-parks-profits-offshore-to-pare-its-tax-bill/

Denzil_DC

(7,232 posts)And a little-discussed aspect of Brexit is the fact that on 1 January 2019, the EU's Anti Tax Avoidance Directive comes into force.

Which may make the more suspicious among us wonder why Brexit is so popular among offshore billionaires] (including those that own some of our media), why they're so keen on there being "no deal", and why they're against the idea of a long transitional period during which the UK would still be subject to EU regulations.

FarCenter

(19,429 posts)They are Crown Dependencies with their own governments, which is why they are so useful to the ultra-rich.

https://en.wikipedia.org/wiki/External_relations_of_the_Isle_of_Man#European_Union

Denzil_DC

(7,232 posts)...

In a paper published in January, the commission said: “This would make it much less attractive for companies to invest or do business in these jurisdictions.”

Several countries apply such defensive measures to protect their tax base from tax havens. But Brussels hopes that the prospect of a coordinated move by EU member states would send a strong signal of Europe’s determination to address tax avoidance and evasion.

Of the 10 jurisdictions flagged on the scorecard for their low tax rate, eight are British overseas territories or crown dependencies: Anguilla, Bermuda, the British Virgin Islands, Cayman Islands, Guernsey, Isle of Man, Jersey and the Turks and Caicos Islands.

https://www.theguardian.com/world/2016/sep/15/uk-overseas-territories-eu-tax-crackdown-economic-sanctions

FarCenter

(19,429 posts)As such, the sell where the prices are highest, manufacture where the costs are lowest, and store the profits where the taxes are least.