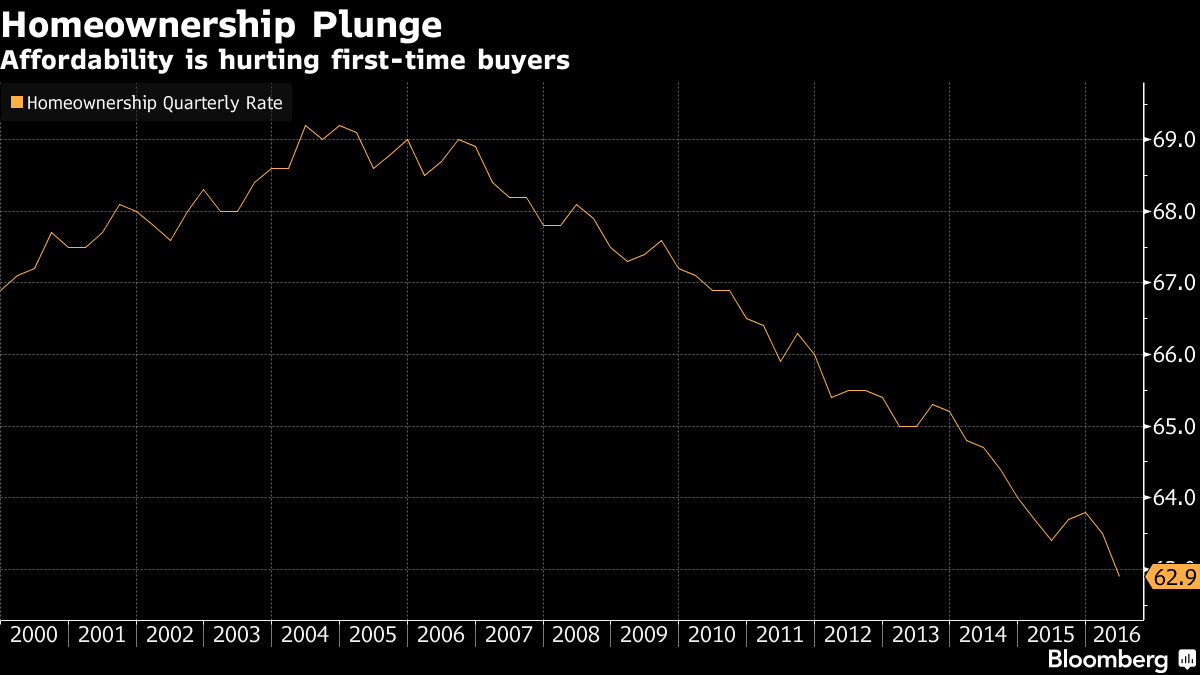

Homeownership Rate in the U.S. Drops to Lowest Since 1965

Source: Bloomberg

The U.S. homeownership rate fell to the lowest in more than 50 years as rising prices put buying out of reach for many renters.

The share of Americans who own their homes was 62.9 percent in the second quarter, the lowest since 1965, according to a Census Bureau report Thursday. It was the second straight quarterly decrease, down from 63.5 percent in the previous three months.

The drop extends a years-long decline from the last housing boom, in part because of tight credit and a shift toward renting in the aftermath of the crash. First-time buyers have been struggling to find affordable properties as low mortgage rates and an improving job market spur competition for a tight supply of listings. Home prices rose 5.2 percent in May from a year earlier, according to the S&P CoreLogic Case-Shiller index of values in 20 cities released this week.

“One of the biggest hurdles now is affordability,” Mark Vitner, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina, said before the Census Bureau report was released. “Home prices are rising so much faster than incomes, so it’s hard for buyers to save for a down payment.”

The homeownership rate reached a peak of 69.2 percent in June 2004.

<snip>

Read more: http://www.bloomberg.com/news/articles/2016-07-28/homeownership-rate-in-the-u-s-tumbles-to-the-lowest-since-1965

IronLionZion

(45,433 posts)and people move for jobs more often now than they used to. It's a very daunting prospect to put down a significant amount of one's life savings without knowing if your job/income is going to continue for even a few months, let alone a few years.

snooper2

(30,151 posts)Igel

(35,300 posts)You don't read the labels, you shouldn't look at the curve on the graph.

It at least used to be traditional to put a zig-zag to show that there's a break from 0, but that's just an added crutch.

It would start being misleading if they put multiple curves with multiple scales, or had similar descriptions for one graph with widely spaced 1% intervals and then a similar graph with a different scale. Still, reading the labels gets past that.

Midnight Writer

(21,751 posts)I am not seeing the invisible free market hand. If products are priced beyond customers ability to buy, shouldn't a competitor come along with an innovative product that meets the buyer's needs at a cheaper price? Isn't the new home industry strangling itself by making products that most folk can't afford?

Any economists out there that can explain this to me? Surely home builders are not simply foolish. Is there something I am not understanding?

TwilightZone

(25,467 posts)It's not always the house or the materials; the location is a huge part of the market value in a lot of areas.

There's a builder here that builds very similar plans in different neighborhoods. Similar floor plans, similar materials, etc. In some neighborhoods, they're building in the low $200s. In others, they're $600k.

haele

(12,649 posts)Now, bringing manufactured homes on lots are cheaper, but people still have to be able to purchase at least 1/8 acre of land, grade and develop the utility infrastructure for it.

Apartment buildings are far more expensive to build and develop if you don't have immediate buyers waiting to move in. Code restrictions and additional safety/habitability costs are greater because of the density of people that will be living in that building.

If someone making poverty wages with a regular job is only able to get a loan for (realistically) a $40K house or apartment, and the cost to the builder is $75K a unit, it doesn't work without some form of subsidy.

Now if you're talking retro-fitting existing housing and selling for an affordable cost, depending on the state of the building it can be less expensive or more expensive. There's a lot of housing out there that still requires expensive abatement work and repairs.

For example, three years ago, we came into a small windfall and bought a manufactured home (okay, a 1560 sq. ft. double-wide) fixer-upper from the 1970's "as is" for $25K "cash", and we've already spent twice the purchase price just bringing it up to a livable state - for the most part in sweat equity and bargain hunting. I've done demolition plumbing, dry-wall, paint, kitchen and bathroom cabinets and counters, minor electrical, and flooringmyself over that time. With a disabled spouse and young grandchildren living with us, there were a lot of changes that needed to be made so the house would be efficient, sturdy, and safe for everyone. We've only spent $12K in outside labor.

The average cost is $80K for an equivalent in age and sq.ft - which, honestly, is what we're going to end up paying for this one we're living in now. At least, we were able to use the money to build it as we needed it to be in the first place, rather than buying already worked on, and then having to spend another $40K or so to retro-fits and repairs to fit our needs.

Remember those "flipper" shows - where someone buys a fixer upper, does the basic repair work, and sells it? The typical flipper would take the type of house that was affordable to a working family, spend 20% of the purchase price on "repairs" and cosmetics, then turn around and sell it for double what they paid - putting that house past the range of the average working person, who if they could purchase it, could usually have afforded that additional $10 - $30K the flipper spent to bring the house up to code.

It would take a very, very charitable builder to do this - and then sell the house for cost as an affordable, low-income property. And then, after a year, that very same charitable builder would be out of business - no one would want to work for him/her, and no business would want to provide him/her credit for the projects.

Unless the government (federal, state, or local), subsidized the renovation costs and acceptable profit margin so he/she would be able to continue purchasing the "fixers" and auctioned foreclosures, and making them available to the general market as renovated homes.

Haele

Angel Martin

(942 posts)in some high cost jurisdictions such as Oakland, the development fees alone for a single family house is $71K. Even the smallest multi unit is $55K.

http://www.bizjournals.com/sanfrancisco/blog/real-estate/2015/11/new-oakland-housing-fees-housing-development.html

those are out of pocket costs even before a builder puts a shovel in the ground. And if it is a new development, or a redevelopment, the developer pays for road, sidewalk, sewers, parks etc on top of that.

Statistical

(19,264 posts)So someone owns the home. The builder doesn't really care if the occupant is the owner as long as someone buy it.

The problem is that as low end housing becomes scarce those with deeper pockets buying investment properties to rent have more resources and will snag the homes. So people end up living in them they just don't own them, their landlord does.

X_Digger

(18,585 posts)My father just retired after 40+ years in the home building industry.

The big reason he finally packed it in? He couldn't keep competent help. He way paying $20/hour for minimally-skilled carpenter help in rural Southwest Virginia (an awesome salary for the area and job) and he STILL couldn't get folks who could a) show up on time, b) show up five days a week, c) not show up drunk, d) not show up stoned to shit, and e) could tell their ass from a hole in the ground.

PSPS

(13,593 posts)First, those peak years of ownership were way too high due to lax lending rules (i.e., no-doc liar's loans.)

Second, it's hard for first-time buyers to compete in a market full of foreign all-cash buyers awash in billions of stolen or otherwise nefarious dollars to launder.

Igel

(35,300 posts)The previous post about the housing bubble is certainly relevant.

Another point is that this isn't the # of owner-occupied units per 100k population (i.e., per capita, in some way) but the # of owner-occupied units / total # of units. That can certainly be because it's harder to make a down payment. It can also be due to a splitting in that middle-income level, because of lower wages or split families (both translate to "lower household income"![]() . If there's a push to delay marriage so that there are more single-occupancy apartments, that's also "lower household income."

. If there's a push to delay marriage so that there are more single-occupancy apartments, that's also "lower household income."

progree

(10,903 posts)levels

ozone_man

(4,825 posts)For many it is debt slavery, paying usury rates to the banks. The banks are the "House" and they always win.

Eventually, there will be an adjustment to the price escalation in houses and stocks. It might occur after the FED stops issuing free money. Just guessing.

StevieM

(10,500 posts)ozone_man

(4,825 posts)Other incremental investments would be better. For example a 401k, hopefully when the bubble market has popped.

TexasBushwhacker

(20,183 posts)Many are more mobile than we used to be. Back when you worked for one company for decades it made sense. But now, with traffic and the cost of gas, I prefer to live near where I work and the longest I've worked anywhere in the last 2 years is 8 months. If I had a family I would certainly buy a house rather than rent one if I could but as a single person, I'll stick to renting.

Buckeye_Democrat

(14,853 posts)There's also property taxes, maintenance, insurance and other costs that renters can often avoid.

The "American Dream" of owning a home didn't start taking off until the post-WW2 boom, when the USA had a major advantage compared to other industrialized countries reeling from infrastructure damage.

http://realtormag.realtor.org/news-and-commentary/feature/article/2008/05/homeownership-america

By 1900, nearly 40 percent of Americans were living in urban areas, double the percentage from 40 years earlier. But 75 percent of those urban dwellers were renters.

Ace Rothstein

(3,161 posts)We bought our house 4 years ago and have had to replace the roof, repair the furnace a few times, repair the water heater and electrical work.