Rate Scandal Stirs Scramble for Damages

Source: NY Times

JULY 10, 2012, 9:28 PM

Rate Scandal Stirs Scramble for Damages

BY NATHANIEL POPPER

-

Baltimore has been leading a battle in Manhattan federal court against the banks that determine the interest rate, the London interbank offered rate, or Libor, which serves as a benchmark for global borrowing and stands at the center of the latest banking scandal. Now cities, states and municipal agencies nationwide, including Massachusetts, Nassau County on Long Island, and California’s public pension system, are looking at whether they suffered similar losses and are weighing legal action.

Dozens of lawsuits filed by municipalities, pension funds and hedge funds have been consolidated into a few related cases against more than a dozen banks that are involved in setting Libor each day, including Bank of America, JPMorgan Chase, Deutsche Bank and Barclays. Last month, Barclays admitted to regulators that it tried to manipulate Libor before and during the financial crisis in 2008, and paid $450 million to settle the charges. It said other banks were doing the same, but none of them have been accused of wrongdoing.

Libor, a measure of how much banks must pay to borrow money from one another in the short term, is set through a daily poll of the banks. The rate influences what consumers, businesses and investors pay on a wide range of financial contracts, as varied as mortgages and interest rate swaps. Barclays has said it and other banks understated the rate during the financial crisis to make themselves look healthier to the public, rather than to make more money from clients.

As regulators and lawmakers in Washington and Europe assess the depth of the Libor abuse and the failure to address it, economists and analysts are already predicting it could be one of the most expensive scandals to hit Wall Street since the financial crisis.

-

Read more: http://dealbook.nytimes.com/2012/07/10/libor-rate-rigging-scandal-sets-off-legal-fights-for-restitution/?smid=tw-share

leftyohiolib

(5,917 posts)dipsydoodle

(42,239 posts)"As unemployment climbed and tax revenue fell, the city of Baltimore laid off employees and cut services in the midst of the financial crisis. Its leaders now say the city’s troubles were aggravated by bankers’ manipulation of a key interest rate linked to hundreds of millions of dollars the city had borrowed."

The banks had artificially reduced Libor : not increased it. They had done so to support their balance sheets at the expense of reducing their profits. That meant Baltimore borrowed at a lower rate. Where's the loss ?

![]()

Huey P. Long

(1,932 posts)-If the banks submitted artificially low Libor rates during the financial crisis in 2008, as Barclays has admitted, it would have led cities and states to receive smaller payments from financial contracts they had entered with their banks, Mr. Shapiro said.

“Unambiguously, state and local government agencies lost money because of the manipulation of Libor,” said Mr. Shapiro, who is managing director of the Swap Financial Group and is not involved in any of the lawsuits. “The number is likely to be very, very big.”-

dipsydoodle

(42,239 posts)that they gained on one hand and lost on the other.

The only real , albeit maybe impractical , solution here would be for all trades since 2008 to be retroactively unwound. That would take less time than bringing this lot to trial which would probably take years.

This is an example of what can happen with a fraud trial :

Jury protest forces fraud trial collapse after 2 years . http://www.guardian.co.uk/uk/2005/mar/23/transport.constitution

Huey P. Long

(1,932 posts)If you wish to whitewash it, that is up to you.

dipsydoodle

(42,239 posts)key interest rate linked to hundreds of millions of dollars the city had borrowed : NOT LENT.

Huey P. Long

(1,932 posts)Now you attempt something else. As I say, up to you.

naaman fletcher

(7,362 posts)The cities paid less in interest, but also received less in interest. Whether or not a city gained or lost would depend on the amount of borrowing versus the amount of investing.

So, whether or not a city gained or lost from this depends on the types and amounts of borrowings and or investments.

Huey P. Long

(1,932 posts)naaman fletcher

(7,362 posts)It's illegal and they should be jailed. It doesn't say much for your critical thinking skills, however, if you prefer to be ignorant about the things that outrage you.

Huey P. Long

(1,932 posts)I'm afraid it is you who is 'ignorant', and needs a little critical thinking lesson. You chime in with more deflection. Well at least the thread is kicked.

The question never was if the investors profited. Illegal. You talk and defend the irrelavent. Get it?

naaman fletcher

(7,362 posts)You are lying.

You were not debating whether or not it was illegal. Nobody disagreed with you that it was illegal. I simply provided correct information to help enlighten those of us who like to understand issues.

JDPriestly

(57,936 posts)This is one of the worst things to happen in years. The repercussions of this are going to be felt for a long time.

rfranklin

(13,200 posts)Author’s Note: My book The Invisible Handcuffs of Capitalism (Monthly Review Press, 2011), from which this article is adapted, tells the story of how orthodox economists have systematically excluded all consideration of work, workers, and working conditions from mainstream economic theory, as well as the damage created as a result of that distortion. Neoclassical economists are concerned about the workers’ transactions with capital, but they care little about the workers themselves or their working conditions. Workers merely accept a wage bargain, go to work, and finally collect a wage. What happens at the workplace is irrelevant. The wage bargain is presumed to be voluntary, agreeable to both workers and their employers. In fact, the relationship between labor and capital is anything but voluntary. Capitalism uses a variety of weapons to make labor conform to its needs. The book compares this control to a Procrustean bed. According to Greek legend, Procrustes was an innkeeper who made his guests fit into an iron bed. He stretched the short ones and amputated the tall ones until they were the proper dimensions. Monetary policy is a Procrustean weapon. What follows is adapted from the book. It tells the story of how the Federal Reserve System sadistically wields monetary policy to keep wages low.

Economist Edwin Dickens has written a series of significant articles analyzing the minutes of the meetings, dating back to the 1950s, of the Open Market Committee of the Federal Reserve Board. (The Committee is the main policy-making body of the Board.) Dickens’s research shows convincingly that the Federal Reserve’s partisan behavior is designed to tilt the economy in the direction of the wealthy by making workers more compliant.

more at

http://www.democraticunderground.com/101634985

msedano

(731 posts)because you'll soon be on a Federal jury awash in technical crap a defense attorney will pile on like a tsunami. An informed jury is a danger to the banks. At the foot of that NYT article is a link to "understanding LIBOR". Jurors, do your thing.

mvs

Ikonoklast

(23,973 posts)Big Banks trying to screw over *other* Big Banks....

THIS IS AN OUTRAGE!!!!!111!!

Huey P. Long

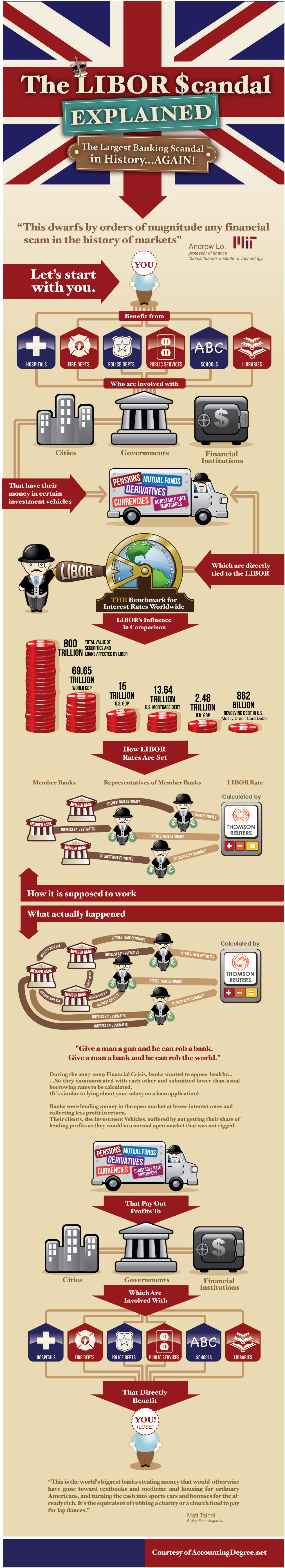

(1,932 posts)Infographic | The Libor $candal Explained – The Largest Banking Scandal in History