A scandal over rate-fixing is about to hit the US

Source: MSNBC

7

hours

ago

By Roland Jones

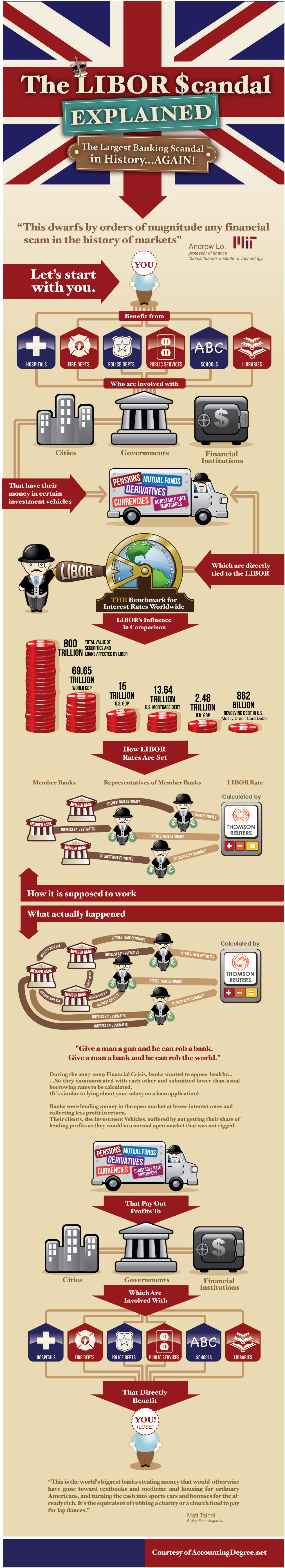

It may seem like just another obscure banking scandal at a 322-year-old British bank, but there are a number of good reasons why you should care about the LIBOR rate-rigging scandal now roiling the world’s biggest and most powerful banks, including that it probably cost you money if you own a mortgage.

In late June, Barclays paid $453 million to regulators in the U.K and the U.S. to settle accusations that it had tried to influence LIBOR, or the London interbank offered rate -- a benchmark interest rate that affects the price at which consumers and companies across the world borrow funds.

The rate, which is fixed via a poll of banks by the British Bankers’ Association, an industry group in London, is the benchmark for setting payments on some $360 trillion worth of financial instruments, ranging from credit cards to more complex derivatives, such as futures contracts.

-

“It depends on how pervasive it was at the other institutions,” Bair told CNBC. “It sounds like it was pretty widespread.”

Bart Naylor, an expert in financial regulation at the consumer advocacy group Public Citizen, said that a wave of investor lawsuits seems inevitable, especially here in the U.S.

-

Darrell Duffie, a professor of finance at Stanford University’s Graduate School of Business, said he expects any lawsuits arising from the LIBOR scandal to cost banks in the region of billions of dollars, or tens of billions of dollars. He cautioned that it’s difficult to say which, given that at this point we do not yet know the ultimate extent of the participation of other banks in the LIBOR distortions.

Read more: http://marketday.msnbc.msn.com/_news/2012/07/11/12684779-a-scandal-over-rate-fixing-is-about-to-hit-the-us?lite

bluesbassman

(19,370 posts)The greed of the bankers know no bounds. They already have a rigged system and yet the seek to game it too. Absolutely disgusting.

susanai

(1 post)The silence is deafening when it comes to the media in America. I am hearing that it is too complicated a subject for americans' to take in - tosh! ALL government wants this to be buried, and deep. Where is CNN on this? Should have been top headlines there a week ago. Where is Fox? The WSJ carried a small story about LIBOR years ago and like the jerks they are back slapping themselves. Idiots did not follow up on their story though. Wonder why. America has become an outrider of 'awfulness in journalism'. I have started reading anything but American.

Huey P. Long

(1,932 posts)

Response to Huey P. Long (Reply #4)

bupkus This message was self-deleted by its author.

Huey P. Long

(1,932 posts)http://www.americablog.com/2012/07/libor-for-laymenwhat-is-it-and-why.html

http://www.guardian.co.uk/business/2012/jun/28/barclays-libor-scandal-question-answer

http://money.cnn.com/2012/07/03/investing/libor-interest-rate-faq/index.htm

http://www.rollingstone.com/politics/news/the-scam-wall-street-learned-from-the-mafia-20120620

http://www.rollingstone.com/politics/blogs/taibblog/why-is-nobody-freaking-out-about-the-libor-banking-scandal-20120703

http://www.telegraph.co.uk/finance/personalfinance/consumertips/banking/9359744/Barclays-how-does-Libor-affect-my-mortgage.html

http://en.wikipedia.org/wiki/Libor

http://en.wikipedia.org/wiki/British_Bankers%27_Association

Use the social buttons to the right to share on popular social sites. If you have a blog or other website, copy the below code and paste it into your website.

=

http://www.accountingdegree.net/numbers/libor.php

bhikkhu

(10,715 posts)...and their clients suffered because the lower profits lowered the size of their dividend?

Perhaps I'm not especially outraged or surprised because I always assumed the interbank lending was heavily manipulated on the inside, and subject to political pressures - support or lack thereof - from the fed and the IMF and EU and so forth.

In any case, if they lowered rates to give the illusion of confidence, and if this had the effect of reducing the profits "normal market conditions" might have yielded, then how one thinks about that might also be conditioned by how one thinks about the profits of the banking industry. If they colluded to collectively reduce their profits, that sounds all good to me - even if those who rely on banking profits for income were affected. If they did the opposite, that would be a problem.

JDPriestly

(57,936 posts)doing something akin to insider trading with their knowledge of the fact that the LIBOR was rigged and of the extent to which it was rigged. That knowledge would give those inclined to do so the opportunity and ability to trade certain financial instruments to their advantage and to the disadvantage of others not in the know. That is what I reckon was going on.

You can be pretty sure it wasn't just a matter of making the markets look good or giving a glow of prosperity to a sick economy. These greedy pigs were making money off of this at the expense of depositors and others. That's the only reason they would have taken the risk of cheating like this.

snot

(10,520 posts)Huey P. Long

(1,932 posts)S&P 500 Futures On Brink As Banks Lead Losses on Libor Probe

The selling started as Europe opened last night and despite a few pull-backs to VWAP, has continued all morning. S&P 500 futures have crossed the chasm and are heading back to new cycle lows here as the major financials are being sold aggressively on the back of tomorrow's release of the NY Fed's Libor report (among other things we are sure) and have given up all their post EU-Summit gains. USD strength, commodity weakness (with Silver And Gold leading the charge lower this week now) and Treasury yields back to yesterday's post-auction spike lows. VIX up to 19.5% and correlation rising very systemically.

S&P 500 futures broke initial support and are teetering on the brink here...

http://www.zerohedge.com/news/sp-500-futures-brink-banks-lead-losses-libor-probe

==

In a survey of 500 senior executives in the United States and the UK, 26 percent of respondents said they had observed or had firsthand knowledge of wrongdoing in the workplace, while 24 percent said they believed financial services professionals may need to engage in unethical or illegal conduct to be successful.

Sixteen percent of respondents said they would commit insider trading if they could get away with it, according to Labaton Sucharow. And 30 percent said their compensation plans created pressure to compromise ethical standards or violate the law.

http://www.reuters.com/article/2012/07/10/us-wallstreet-survey-idUSBRE86906G20120710

Does anything else need to be said?

bhikkhu

(10,715 posts)...but in the same period in the US the TARP program was desperately trying to keep the faltering interbank lending market open to head off a full-scale economic meltdown. That was done by making zero-interest overnight loans available to banks, which effectively lowered the interest rates for interbank lending and injected confidence into the banking sector. I read in one place that they estimate about $100 million in "lost" interest income due to that activity, but that is a drop in the bucket compared to the cost of bank failures.

In any case, all that was done more or less openly and legally here - the ongoing details were noted daily in the financial news - and sounds like the same thing that was done in Europe, though the regs there may be different?

Huey P. Long

(1,932 posts)Hey, nothing will likely happen to them, at least not yet. Its coming though. Its coming.

RainDog

(28,784 posts)Igel

(35,300 posts)The banks typically collect money from one set of people and distribute it to another.

This shows the distribution. Unless they're just printing money, there's another set of participants that were affected.

I guess they were just the 1% that we don't care about, because surely things like lower mortgage,line of credit and lower credit card interest rates don't affect any of the people on that chart.

Unless, of course, we want to redefine "all the facts" as "half the facts." But that kind of redefinition should be noted somewhere.

go west young man

(4,856 posts)In bed with big banks.

dixiegrrrrl

(60,010 posts)instead of "manipulated the rate at least since 2010"

( and now more reports say for years before then).

Every story I read or heard from US or Brit news says "tried to manipulate the rates"

As if the banks failed to do it.

hedgehog

(36,286 posts)and have come to the conclusion that the actual manipulation of the LIBOR doesn't matter so much as that the damn thing exists at all! Why are credit card rates bench marked on what a bunch of bankers in London think they might have to pay for credit? Why not bench mark them on the number of Keebler elves in the Hollow Tree!

arcane1

(38,613 posts)and why should that affect the rest of us?

Igel

(35,300 posts)Overnight borrowing can be enormous.

But the actual cash reserves held by banks aren't always huge. You want your funds liquid, but not in cash.

Let's assume there's ArcaneI Local Bank, ALB. ALB has $25 billion in funds, but most of the cash is held at branches (for their use) and most of the rest of the funds are invested. You don't want to pay interest on money that you have, as cash, in the vault. Your money is lent out as mortgages, it's "lent" in the purchse of bonds and Federal securities.

But you also have a lot of corporate customers, include MegaCorp LLC. MC has sales of $500 million and a payroll of $120 million a year. It pays salaries twice a month, and that's $5 million. However, in April it pays it taxes and has $0.5 million in cash on hand when it needs to make payroll. It has receivables that'll cover payroll, and it has assets and a lot of money invested in bonds and CDs. But it needs 4.5 billion for 2-3 days.

In fact, not only is MegaCorp in this position, but so are BigBiz. HugeCorp, and SkruYu, Inc. You've given them lines of credit up to $10 million. At 4 pm you get a call from all of them asking for $5 mill for MegaCorp, $7 mill for BigBiz, $4 mill for HugeCorp, and $12 millio for SkruYu. You need $28 million in cash--and you need it for a total of 3 days. You can sell, at whatever the market rate is, your bonds. Maybe take a loss, maybe not. But the sales won't settle for a day. Yeah, your money manager might get in trouble.

Or you send out a message saying, "Hey, I need $28 million for 3 days." Claybar's Bank and MaseChorgan, who are bigger, respond. "Yeah, we have the cash. Now, you're a good customer, and you've loaned us money in the past. You're not likely to go belly up or default. So I give you a lower rate than other customers. How do we settle on that rate?"

You needed to borrow, even though you were nowhere near insolvency. You could have said "no" to your clients. You get your money to loan out to them so your clients can make payroll. LIBOR is how the rate is set (esp. if you're in Europe); in the US the Fed short-term borrowing rate is usually more important.

A HERETIC I AM

(24,366 posts)Actually, "Federal Securities" ie: Treasury bonds, notes and bills settle same day.

Your account would be credited with the cash within minutes of your bond desk receiving a buy order from a counterparty.

That's why US Treasuries are so attractive worldwide. The market for them is very deep and EXTREMELY liquid.

Otherwise, nice little analogy.

arcane1

(38,613 posts)Here's the link to Shapiro's blog on the topic, linked in the OP:

http://www.sonecon.com/blog/

![]()

Huey P. Long

(1,932 posts)from your link:

The LIBOR Mess Could Be the Biggest Financial Fraud in History

If our financial policies were based on recent experience, the debate over government regulation versus self-regulation by Wall Street would be settled. Yet, the refrain that “the big banks know best” remains the default position of most American conservatives and many policymakers. This childlike faith will be tested by the new scandal swirling around some of the most basic interest rates in the global economy, the LIBOR or “London Inter Bank Offered Rates.” This past week, Barclays Bank admitted that it secretly manipulated LIBOR rates for years, all to pad its own bottom line. And Barclays is not some lone, bad apple. Investigators here as well as in London, Brussels and Tokyo are hard at work looking into reports of similar manipulation by other big players, including Citigroup, Deutsche Bank and J.P. Morgan Chase. This could well turn into the largest consumer fraud ever seen.

-

arcane1

(38,613 posts)And the acronym "LIBOR" has come up several times in the past few months, by people asking how much data we can provide regarding it. None of us in my department had ever heard of it before, and since May the rest of the company is asking us about it ![]()

![]()

Huey P. Long

(1,932 posts)US Attorneys General Jump On The Lieborgate Bandwagon; 900,000+ Lawsuits To Follow, And What Happens Next?

Submitted by Tyler Durden on 07/11/2012 21:00

How many potential lawsuits are we talking about here? Quite a bit in fact as the FT explains:

There are at least 900,000 outstanding US home loans indexed to Libor that were originated from 2005 to 2009, the period the key lending gauge may have been rigged, investigators have said. Those mortgages carry an unpaid principal balance of $275bn, according to the Office of the Comptroller of the Currency, a bank regulator.

Also, as explained here before, not only is this a legal bonanza, but it will be a political feast for the Congressional circus to earn numerous C-SPAN brownie points.

“I think the US government should be just as aggressive in getting to the bottom of this scandal as the United Kingdom has been,” said Senator Sherrod Brown, chair of the bank regulatory subcommittee on the Senate banking committee.

“This was not isolated to London, but affected tens of millions of investors, borrowers and taxpayers in our country as well,” Mr Brown added.

What does the above mean?

=

http://www.zerohedge.com/news/us-attorneys-general-jump-lieborgate-bandwagon-900000-lawsuits-follow

Smilo

(1,944 posts)we all know that the banks are just too big to fail

![]()

toddwv

(2,830 posts)You'll have to get most of your information from the internet once the talking points make the rounds.

Huey P. Long

(1,932 posts)Why Libor matters to Main Street

JOANNA SLATER

NEW YORK — The Globe and Mail

Published Wednesday, Jul. 11 2012, 7:39 PM EDT

Last updated Wednesday, Jul. 11 2012, 7:42 PM EDT

The gritty streets of Baltimore are a long way from the City of London. But as reports emerged that a key global interest rate set in Britain might have been manipulated, local officials began to wonder: Did we get stiffed?

Across the United States, governments, investors and regulators are asking that same question. The rate-rigging scandal now gripping the U.K. is crossing over to the U.S., complete with investigations, hearings, and a flood of lawsuits.

“This could be gigantic,” said Peter Shapiro, managing director of Swap Financial Group LLC, which acts as an adviser to the city of Baltimore. “The numbers are awesome.”

Baltimore, like many other cities, struck financial contracts with banks based on the benchmark rate. Mr. Shapiro asserts Baltimore suffered when banks artificially low-balled that rate, reducing the city’s interest revenue.

=

http://www.theglobeandmail.com/report-on-business/international-business/european-business/why-libor-matters-to-main-street/article4409018/?cmpid=rss1

Igel

(35,300 posts)We like investors. We want those with money to make more money.

Granted, in this case it's a municipality, but when we look at investors in a negative light we act like there can't be any good investors. Financial transaction taxes, things that hurt investors in general, are usually good. Except when we decide, based on how we feel about an individual, that they're not.

We like borrowers, because they're paying absurdly high interest rates to vampire banks. Anything that lowers interest rates must be good.

In this case, the LIBOR scandal mostly helped those we like in ways we like: It reduced investor profits by lowering the interest rate that borrowers paid in really nasty economic times. It probably helped Barclay's, but not necessarily American banks because they weren't as involved in setting the LIBOR rates and so the rates didn't reflect their solvency. In fact, in late '08 and in '09 the LIBOR rate was actually big news (until then I'd never heard of it).

In other words: Let's be outraged that big investors were screwed out of the profits earned by lending to commoners through banks.

DeSwiss

(27,137 posts)...and that is as it should be.

''Chaos is required for the veils to fall down.''

K&R

Huey P. Long

(1,932 posts)Libor Scandal Could Turn 'Ugly' As U.S. Cities Begin To Sue

The Huffington Post | By Mark Gongloff

Posted: 07/11/2012 4:07 pm Updated: 07/11/2012 4:07 pm

The news on Wednesday that cities and states are suing some of the world's largest banks over Libor manipulation shows how this scandal could blow up into one of history's biggest bank frauds.

That's because interest-rate manipulation might well have kept your town or state from hiring firefighters or teachers, from paving roads or paying for indigent care or after-school programs for your kids -- adding to the human suffering of the economic collapse these same banks caused in the first place.

If it's any consolation, the lawsuits and fines over this manipulation could potentially cost the banks -- which include not only Barclays but Bank of America, JPMorgan Chase, Citigroup, and many more -- billions of dollars.

"This could get very ugly in a hurry for some banks," Peter Tchir of TF Market Advisors wrote in a note.

And this could finally be enough to make Americans stop reacting to the Libor scandal with "a shrug," as Joe Nocera recently put it, and push them closer to believing what Robert Shapiro, founder of economic advisory firm Sonecon, calls possibly "the biggest financial fraud in history."

=

http://www.huffingtonpost.com/2012/07/11/libor-scandal-lawsuits_n_1665708.html?utm_campaign=071112&utm_medium=email&utm_source=Alert-business&utm_content=FullStory

NBachers

(17,107 posts)"If you give a capitalist enough rope, eventually he will hang himself." Kark Marx

"These capitalists generally act harmoniously and in concert, to fleece the people." - Abraham Lincoln

"Fascism is capitalism plus murder." - Upton Sinclair

"The best way to destroy the capitalist system is to debauch the currency" - Vladimir Lenin

Citizen Worker

(1,785 posts)oil to swab the necks of these serial criminals. We'll have to do it because, you know, we must look forward not backward.

msongs

(67,395 posts)Sherman A1

(38,958 posts)into the dirt. They should not be able to take a coffee break or use a restroom without a heavily enforced regulation for it.

They are simply not to be trusted to do anything without someone looking over their shoulder.

Nihil

(13,508 posts)Assuming for a moment that by "regulate" you mean "create & enforce laws to regulate)

(rather than some of the more bloodthirsty suggestions upthread) then just *who* is

going to do it?

The politicians?

![]()

The politicians who are only where they are because of the banks and continue to

be totally owned by them? No, I don't think that those folks are going to do shag-all

about actually regulating their masters ...

Sherman A1

(38,958 posts)I said it needs to happen.

Big Difference ![]()

Nihil

(13,508 posts)... just at the stupidity & frustration of the situation.

Talk about proving that crime *does* pay ... still, I'm sure we'll be

roundly encouraged to "Look forwards not backwards" any time that

the subject of actually punishing people for their crimes raises its

ugly little head ...

blkmusclmachine

(16,149 posts)They do it because they know no one will come after them. The entire system is rigged from the get-go. Don't expect anything but bogus bullshit cover-up from the Politicians, for they are on the take as well. "Too Big To Fail."

The Wizard

(12,541 posts)and resources to steal with impunity. They'll stop when they see guillotines and head baskets on Wall Street. Paris, 1789, the sequel.

Huey P. Long

(1,932 posts)Posted on July 8, 2012 by WashingtonsBlog

Even Nouriel Roubini Says We Need to Jail or Hang Some Bankers

Nobel prize winning economist Joe Stiglitz – and many other experts – have said nothing will change unless dishonest bankers are jailed.

Former trader Max Keiser has been calling for years for crooked bankers to be hanged, to send a message that crime won’t be tolerated.

But Nouriel Roubini is a lot more mainstream than Keiser – or even Stiglitz – being very close to Treasury Secretary Tim Geithner. See this and this.

Roubini told Bloomberg that nothing has changed since the start of the financial crisis, and we might need to throw bankers in jail – or hang them in the streets – before they’ll change:

Nobody has gone to jail since the financial crisis. The banks, they do things that are illegal and at best they slap on them a fine. If some people end up in jail, maybe that will teach a lesson to somebody. Or somebody hanging in the streets.

-

I noted 7 years ago:

I am NOT calling for the overthrow of the government. In fact, I am calling for the reinstatement of our government. I am calling for an end to lawless dictatorship and a return to the rule of law. Rather than trying to subvert the constitution, I am calling for its enforcement.

***

The best way to avoid all types of revolution would be for the government to start following the rule of law. I passionately hope it will do so.

The fact that even mainstream economists like Roubini are talking about hanging bankers shows that this is the last chance for the justice system – the only thing which stands between criminals on Wall Street and pitchforks – to work.

-

http://www.washingtonsblog.com/2012/07/mainstream-economist-we-might-need-to-hang-some-bankers-to-stop-illegal-behavior.html

fredamae

(4,458 posts)explaining how Big and Widespread this is.

http://current.com/shows/viewpoint/videos/the-mob-learned-from-wall-street-eliot-spitzer-on-the-cartel-style-corruption-behind-libor-scam/

Huey P. Long

(1,932 posts)Just as we noted here, the analyst estimates for the potential impact of Libor (litigation and regulatory) liabilities have begun. Morgan Stanley sees up to a 17% hit to 2012 EPS (from $420 to $847 million per bank) in a worst case from just regulatory costs, and a further 6.8% potential hit to 2013 EPS if the top-down $400 million average per banks losses from litigation are taken on one year (considerably more if the bottom-up numbers of more than $1 billion are included). They see LIBOR risk in three parts: regulatory fines (we est median 7-12% hit to ‘12 EPS; litigation risk (7% EPS hit over 2 yrs); and less certainty on forward earnings. There are a plethora of assumptions - as one would expect - but the ranges of potential regulatory fine and litigation risk are very large though the MS analysts make the greater point that the LIBOR 'fixing' broadens investor support for more transparency in fixed income trading in addition to fixed income clearing leaving the threat of thinner margins as another investor concern.

We estimate LIBOR regulatory fines off of Barclays settlement. Our bull case: a 2-9% hit to 2012e EPS as banks settle with regulators for the same amount as Barclays. Our base case: a 4-13% hit to 2012e EPS as, apart from UBS, banks do not receive the discount that Barclays got for being early and cooperative. Our bear case, 5-17% hit to 2012e EPS: a 30% premium to base case fines to reflect the possibility that the UK Serious Fraud Office layers on new fines once its LIBOR investigation (started July 6) is completed.

LIBOR litigation risk is harder to quantify, but we take a stab. We assume every 1bp of LIBOR understatement every day for 4 years represents a $6 billion hit to the LIBOR panel of banks. If the 16 banks listed in the class action lawsuits shared equally, we estimate this would be a ~$400 million hit per bank.

Top-down:

-

http://www.zerohedge.com/news/here-come-libor-liability-estimates

just1voice

(1,362 posts)---The Scam Wall Street Learned From the Mafia

How America's biggest banks took part in a nationwide bid-rigging conspiracy - until they were caught on tape---

Huey P. Long

(1,932 posts)

Libor Lawsuits Are Piling Up And Could Cost Billions, Banks Brace For Another Big Legal Battle

Advisor Network |7/12/2012 @ 1:25PM

The Libor rate scandal could make banks’ mortgage and foreclosure troubles look like child’s play and that doesn’t bode well for an industry still in recovery mode.

The best case scenario is that banks were just lying about their own Libor rates independently which is what Barclays says it was doing when it paid up $450 million to settle charges last week. But there have been whispers by some (and apparently some evidence that has yet to surface) that say banks actually colluded to fix the daily interest rate. If proven true, it will mean major trouble for banks and the criminal aspect of the case gets even stronger.

How? The Libor rate affects about $800 trillion dollars of contracts and all sorts if financial instruments globally, according to experts. Investors of all sizes use the rate as a basis for a variety of financial products; homeowners mortgages, consumers’ credit cards and even city governments use derivatives contracts tied to Libor when issuing some bonds.

Some investors, specifically those who were receiving some form of payment from banks based on the Libor rate, allege that banks including Barclays, Bank of America, JPMorgan Chase, Citigroup and others have been manipulating Libor basing payments on false rates.

Who has a claim? “Anyone with a floating rate. The suits are building with some class actions forming already,” says bank analyst Glenn Schorr of Nomura. Earlier this year three plaintiff groups including Charles Schwab and the City of Baltimore filed suits against the 16 banks that submit Libor rates accusing them of collusion, or price fixing, under the Sherman Antitrust Act. It’s a damning allegation that has the potential to cost banks hundreds of billions of dollars.

-

http://www.forbes.com/sites/halahtouryalai/2012/07/12/libor-lawsuits-are-piling-up-and-could-cost-billions-banks-brace-for-another-big-legal-battle/

==================

US Banks Sweat Libor Scandal Spanking

By Dan Freed 07/12/12 - 03:05 PM EDT

NEW YORK (TheStreet) -- The Libor-fixing scandal has yet to significantly impact shares of Bank of America(BAC_), JPMorgan Chase(JPM_)or Citigroup(C_), though the threat is likely to hang over the companies for several months at the very least.

"We're not sure this potentially large problem is 'fully priced in' just because it's received a bunch of press so far," wrote analysts at Nomura in a 21-page research report published Thursday, which attempts to assess the potential impact of the scandal.

-

http://www.thestreet.com/story/11615215/1/us-banks-sweat-libor-scandal-spanking.html?cm_ven=GOOGLEN

=================

Assessing Libor's impact

State, prosecutors to examine if agencies lostmoney over ratemanipulation scandal

By Steven Syre

Globe Staff / July 12, 2012

Massachusetts prosecutors will meet with state finance officials next week to examine whether public agencies lost money when a key interest rate used to price loans and credit around the world was manipulated by bankers several years ago.

-

http://www.boston.com/business/articles/2012/07/12/mass_attorney_general_treasury_officials_examine_state_impact_of_libor_scandal/

=================

Huey P. Long

(1,932 posts)Warren Buffett: Libor Scandal Involves 'The Whole World'

The Huffington Post | By Bonnie Kavoussi Posted: 07/12/2012 3:35 pm Updated: 07/12/2012 3:59 pm

Everyone should be paying attention to the Libor scandal, at least according to Warren Buffett.

"It's a big deal," Buffett told CNBC "Squawk Box" host Becky Quick Thursday. "You get Libor, and you're talking about the whole world."

-

Rolling Stone's Matt Taibbi recently said it was likely that most or all of these banks were guilty of rigging Libor, since 16 banks help set the Libor rate every day. On CNBC, Buffett called Libor "the base rate for the whole world."

"Everything is tied in [to Libor]," Buffett said. "The idea that a bunch of traders can start e-mailing each other or phoning each other and play around with that rate is an important thing, and it is not good for the system." Buffett said that unwinding the collateral damage from the alleged Libor rate-rigging will not be easy because millions of contracts are based on Libor.

"It is a can of worms," he said.

-

VIDEO at link-

http://www.huffingtonpost.com/2012/07/12/warren-buffett-libor-scandal_n_1668649.html

Kaleko

(4,986 posts)I appreciate your efforts on our behalf very much.