U.S. stocks come close, but fall short of record high

Source: Washington Post

The S&P 500?s resurgence defies reality: an entrenched recession, double-digit unemployment and a pandemic with no end in sight

By Hamza Shaban

U.S. stocks came close to making financial history Thursday, soaring toward record highs before slipping in late day-trading.

The Standard & Poor’s 500 index has been on a remarkable turnaround since late March, when equities markets got hammered by the economic calamity of the coronavirus.

The benchmark index — which offers a broader measure of the stock market than the Dow Jones industrial average — has been flirting with its February record of 3,386.15 for several trading days. It briefly topped that level Thursday before falling back.

The ferocity of the rebound has been underpinned by massive financial support from the federal government, said Nicole Tanenbaum of Chequers Financial Management, allowing investors to look towards an eventual recovery. “Economic data, while still at dire levels, is starting to show signs of stabilization, which, combined with a better than expected earnings season, is further fueling investor optimism despite an incredibly uncertain backdrop,” she said.

The Charging Bull statue stands near the New York Stock Exchange (NYSE) in New York, U.S., on Wednesday, June 17, 2020. U.S. stocks fluctuated as the recent rally begins to show signs of losing momentum amid a worrying increase in coronavirus cases. Photographer: Michael Nagle/Bloomberg (Michael Nagle/Bloomberg)

Read more: https://www.washingtonpost.com/business/2020/08/13/stocks-record-bear-market/

Thomas Hurt

(13,903 posts)Frustratedlady

(16,254 posts)Some other entity? I don't understand how the market stays up with a situation like we presently have.

SunSeeker

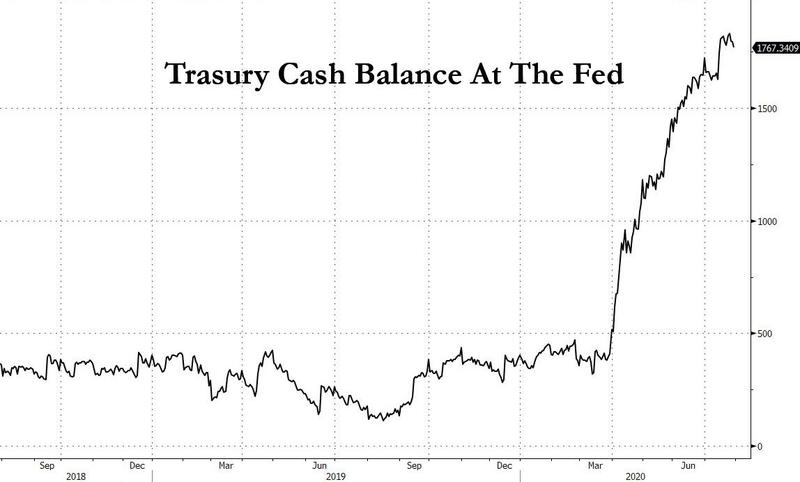

(51,550 posts)With plans to inject up to a total of $5 Trillion.

https://markets.businessinsider.com/news/stocks/why-stock-market-soaring-amid-recession-signals-fed-coronavirus-stimulus-2020-4-1029104715

But $20 billion to keep to our post office running? "No way!" says the GOP.

PatSeg

(47,399 posts)to help average people, schools, state and local governments. Trillions of dollars to help the wealthy, no problem.

Frustratedlady

(16,254 posts)back into circulation?

What is the going return on putting money into circulation? I seem to remember it used to be 1.7 return.

SunSeeker

(51,550 posts)Every SNAP dollar spent generates $1.73 in real GDP increase. "Expanding food stamps," the study read, "is the most effective way to prime the economy's pump." https://www.theatlantic.com/health/archive/2012/07/the-economic-case-for-food-stamps/260015/

Frustratedlady

(16,254 posts)I always thought food stamps helped the farmers, as well as the grocery stores and kept the poor fed. Yeah, I know about Cadillacs and fur coats.

This whole thing doesn't make any sense. Do Republicans even understand the return at least has some value?

I'm afraid they are going to mess around long enough that we get into a real depression/evictions and the dollar bill will only have value as fuel, like my mother told me they did with corn during the Depression since it was only worth 5 cents/bushel.

not fooled

(5,801 posts)who want no assistance for anyone except the rich want to kill off food stamps. Purely to suit their twisted ideology. Unfortunately, they are running the government now courtesy of their puppet red don.

Bengus81

(6,931 posts)"The Fed announced a $2.3 trillion package on April 9 to bolster lending and begin buying corporate debt across a range of credit ratings."

$600 per week for those effected by CV19? HELL NO!!!!

Born Free

(1,612 posts)You will see drastic changes, FED will say they need to cut back need to conserve yada.yada,yada

progree

(10,901 posts)Last edited Thu Aug 13, 2020, 08:04 PM - Edit history (1)

far in excess of inflation and population growth. A very substantial real increase.

Details of the graph's and numbers' sources are in post#9 in another Econ Group thread

Plus interest rate cut to zero (makes bonds even less competitive with stocks), virtually unlimited lending to corporations, M2 money supply up 25%, asset purchases by the Fed, Q3, deficit-tripling spending.

Result: market back up.

Despite a nose-dive in earnings:

Q1 S&P 500 Earnings per share:

2017 Q1: 27.46,

2018 Q1: 33.02,

2019 Q1: 35.02,

2020 Q1: 11.88 👀 😲

https://ycharts.com/indicators/sp_500_eps

We don't have the full Q2 earnings yet. But likely to be a lot worse, given that Q1 GDP declined by 5%, and Q2 GDP declined by 32.9% (both on an annualized rate basis. The actual GDP drops were Q1: 1.3%, Q2: 9.5%). So it would be pretty much impossible for Q2 earnings to be anything but a lot worse than Q1 earnings.

Frustratedlady

(16,254 posts)I'll try to figure it all out.

progree

(10,901 posts)has been propping up the stock market. (Before the stimulus began, the market dropped 34%).

The problem is that it can't be kept up forever, and when the inevitable unwinding of the stimulus begins, the market will react like this:

Picture Wiley E. Coyote running off the edge of the cliff, noticing that suddenly there's no feeling under his left foot, likewise his right foot, then he looks down, and then:

M a g a a a a a a a a a a a a a a a a

EarthFirst

(2,900 posts)Wellstone ruled

(34,661 posts)this market is like a balloon,hollow on the inside and supported by the ten FANGE stocks.

Bernardo de La Paz

(48,988 posts)The market has already priced in a Biden victory.

Mr.Bill

(24,280 posts)gab13by13

(21,304 posts)where he said that central banks were ready to pump more money into Wall Street if needed.

I use this example for why the market is up. Take a homeless person living under a bridge and give him 2 million dollars and then ask him how he is doing economically?

It looks to me like the demand side of economics is not consequential any more. When farmers lost their markets Trump simply gave them billions of dollars.

bucolic_frolic

(43,128 posts)Twice the money chasing 1/2 the economy. I'm guessing we may have already made a top, or will by mid-October. The tech economy and 7 FAANGs plus Tesla are fine. Find the income streams for the rest of the economy to support them long term.

Cash flows. It's all about what they produce over the decades.

jayfish

(10,039 posts)the entire US is a "bubble" and we're going to pop any minute. It's all BS!

Bengus81

(6,931 posts)Yep...they couldn't lose.

tclambert

(11,085 posts)Steinmart, JCPenney, Lord and Taylor, Men's Wearhouse, Chuck E. Cheese, Gold's Gym, 24 Hour Fitness, Intelsat, Ultra Petroleum, Whiting Petroleum, Chesapeake Energy, Virgin Australia, Aeromexico, Hertz, Advantage Rent A Car, Art Van Furniture, Borden Dairy, Briggs & Stratton, Cirque du Soleil, and more.

Steelrolled

(2,022 posts)and they are doing just fine.

The stock market looks out to the future, and once the initial panic of COVID-19 ended, it headed towards its previous path. The market believes that in a reasonably short time (< year) COVID-19 will not be a major factor in the economy. And you can't wait for that to happen to get back in. The other factor is that bond yields are near 0.