Fed Chair Powell says interest rates are 'likely to be higher' than previously anticipated

Source: CNBC

Federal Reserve Chairman Jerome Powell on Tuesday cautioned that interest rates are likely to head higher than central bank policymakers had expected. Citing earlier data this year showing that inflation has reversed the deceleration it showed in late 2022, the central bank leader warned of tighter monetary policy ahead.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said in remarks prepared for two appearances this week on Capitol Hill. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Those remarks carry two implications: One, that the peak, or terminal, level of the federal funds rate is likely to be higher than the previous indication from the Fed officials, and, two, that the switch last month to a smaller quarter percentage point increase could be short-lived of inflation data continue to run hot.

In their December estimate, officials pegged the terminal rate at 5.1%. Current market pricing is a bit higher than that, in the 5.25%-5.5% areas, according to CME Group data. Powell did not specify how high he thinks rates ultimately will go.

Read more: https://www.cnbc.com/2023/03/07/fed-chair-powell-says-interest-rates-are-likely-to-be-higher-than-previously-anticipated.html

Scrivener7

(50,944 posts)Last edited Tue Mar 7, 2023, 01:02 PM - Edit history (2)

Every time the market inches up, he throws another wrench in the works.

This is intentional.

EDITED: I originally was mistaken and said there were no rate hikes in tfg's administration. BumRushDaShow showed that rates did indeed go from .75 to 2.5 during that time. But then, the rates were CUT again back down to 1.5. And then to zero during Covid.

During Biden's administration it has gone to 4.75 percent. In two and a half years.

While my original statement had an error, the gist of it - namely that the vast bulk of interest rate hikes are taking place in the Democratic administration, when the problem existed during the Republican administration too - remains correct.

sprinkleeninow

(20,235 posts)hamsterjill

(15,220 posts)Pisses me off. Looking at property and rates are a major factor.

FredGarvin

(471 posts)As a result of low rates for too long a time.

hamsterjill

(15,220 posts)But okay.

I’m just trying to buy a piece of property to house a cat rescue. Rates had come down a bit. I hate to see them go back up and keep people from being able to qualify.

BumRushDaShow

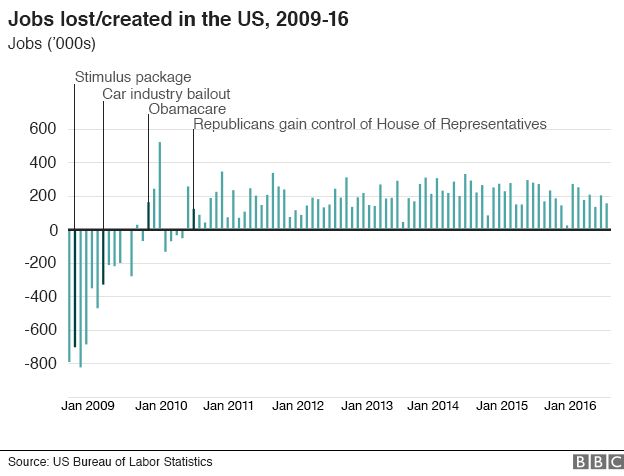

(128,815 posts)Actually 7 rate hikes during 45's administration and held it there until the pandemic hit and started cutting again. ![]()

(graph from here as of Mar. 3, 2023 - https://www.macrotrends.net/2015/fed-funds-rate-historical-chart)

(from here - https://www.forbes.com/advisor/investing/fed-funds-rate-history/)

FredGarvin

(471 posts)So many conspiracies, so little time.

Scrivener7

(50,944 posts)BumRushDaShow

(128,815 posts)but then the cuts didn't happen again until the economy collapsed with his poor handling of the pandemic! ![]()

ETA to note that Janet Yellen was Fed Chair from 2014 - 2018, so she was Chair for those earliest 3 rate hikes in 2017 and then Powell came in when Yellen's term was up in Feb. 2018 and he did the other 4 hikes.

Scrivener7

(50,944 posts)back down to 1.5, pre-Covid, though all the conditions that are given as reasons for these hikes today were existing at that time. Yet the response under the whiny republican president was to drop rates.

Then they went to zero at the end of his term because of COVID.

BumRushDaShow

(128,815 posts)Technically, that earlier "drop to near zero" originally happened when? It started the fall of 2007 when the Dow hit it's peak but then the housing market began to collapse and the junk bonds and worthless credit default swaps were rampant. The decreases continued in Shrub's final year, finally hitting the low of "near zero" (~0.25%) a month before Obama took office because of the "Great Recession". It stayed there the next 7 years until the end of 2015, when there were some small, once-a-year increases. When 45 came in, there were 3/4 times a year increases.

It had never really gone down that low before nor stayed that low for as long as it had during the modern period.

Scrivener7

(50,944 posts)They had a nominal excuse for the earlier zero and negative interest rates around the 2008 debacle.

But the stated objective of preventing inflation beginning during tfgs administration was treated one way during tfgs administration before Covid and another way during Bidens administration. Similar economic conditions are in place now as then, yet the rate hike is being handled very differently.

BumRushDaShow

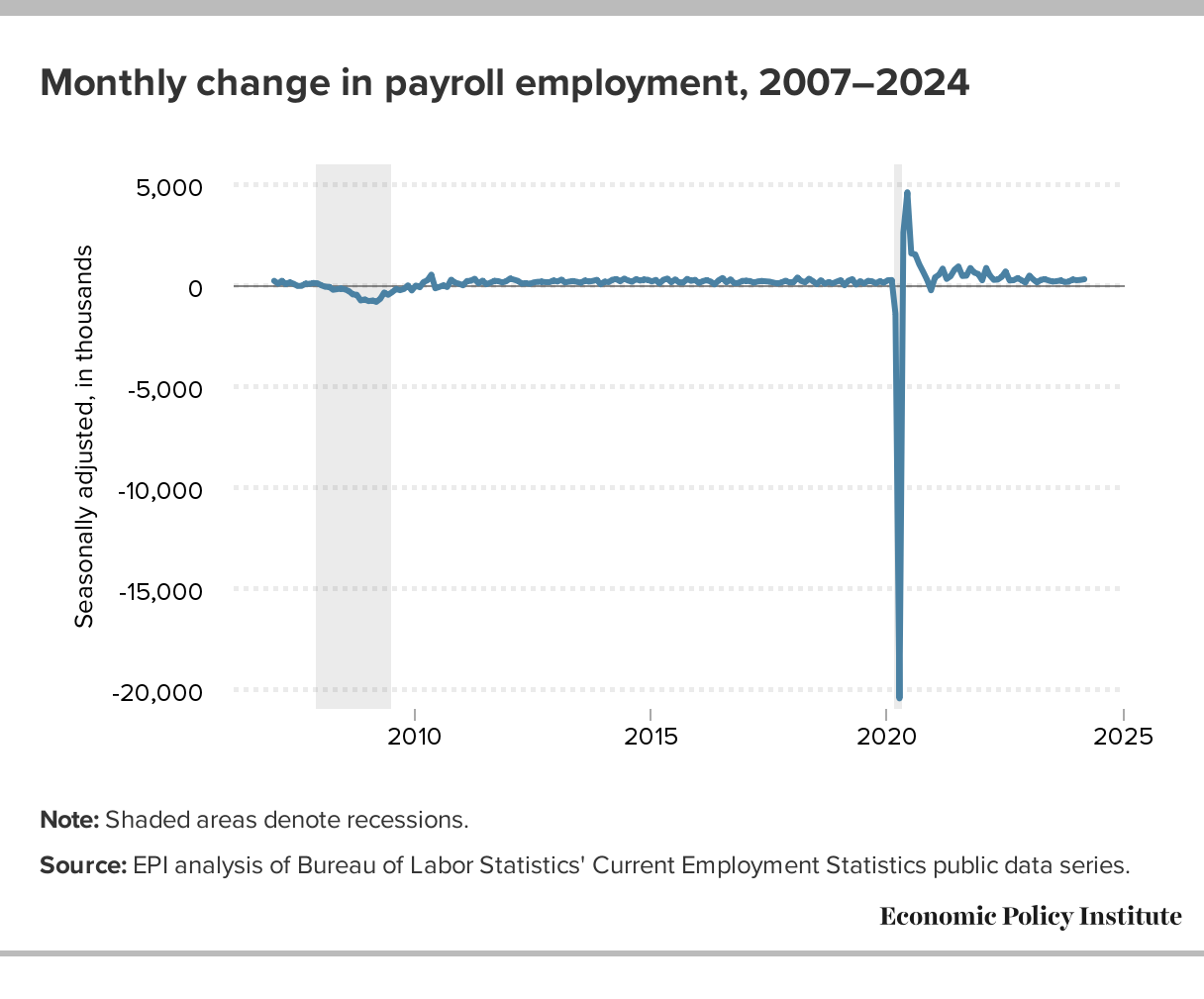

(128,815 posts)

(above from here - https://www.epi.org/indicators/unemployment/)

And that was literally akin to what happened at the end of Shrub's term in 2008 before Obama won, where the economy had even shed something like 750,000 jobs just in the month of January 2009 when he was inaugurated.

So having come out of that economic disaster period by 2015 with Obama's "booming economy" (that 45 inherited), the rate hikes began anew at that point and continued for the next 3 years into 45's term.

At that point, it wasn't quite yet done to prevent "inflation" but supposedly (according to some) to avoid "deflation".

BUT after the pandemic hit and because of something that was tried under Biden that hadn't been done since FDR - pouring money into the economy (not piddling amounts but good chunks), there was a different type of scenario going on because it was already on top of those years of near zero interest rates. And then couple that with a major war in Europe that impacted not only energy (one of the biggest drivers of inflation) but commodities - notably crops (due to Ukraine apparently being Europe's "bread basket" ), and that seems to have fueled the inflation angst (in addition to the outright price gouging that we know has nothing to do with supply and demand but to gain profits).

I have posted many times that the last time that we had this odd intersection of calamities was WW1 ~2017 - 2019 (World War, global pandemic, extreme weather that impacts goods and services).

I blame you guys for making me do this!!

Scrivener7

(50,944 posts)I don't think we are disagreeing on anything.

BumRushDaShow

(128,815 posts)Forgive me because I am like this at the moment -

![]()

Scrivener7

(50,944 posts)BumRushDaShow

(128,815 posts)(it's what MIRT does to ya! ![]() )

)

Scrivener7

(50,944 posts)JohnSJ

(92,122 posts)Powell.

Prior to that, because of the financial implosion, interest rates were kept at artificially low rates for too long. Those artificially low interest rates were kept there under Bernanke also. That along with the bush deregulation, followed by the trump trade wars and mishandling of the pandemic, led to shortages and inflation we are going through now.

Yes, this is intentional, just like when Volker was chairman. They are trying to increase interest rates to put a curb on inflation.

Unlike what Volker did, interest rates are NOT going to go to 20%.

The hyperbole going across the airwaves has no bearing on reality. Interest rates should be higher. They were kept too low for too long.

I expect before the end of 2023 inflation will be under control. The advantage we have now is that unemployment is at historically low levels.

KPN

(15,642 posts)and at a reasonable annual rate by the end of 2023. Wall Street has been feeding at the trough with the relatively low to non-existent interest rates since the latter end of Reagan's administration, albeit with a few speed bumps (the dot.com, housing and pandemic crashes) which were quickly remedied. My concern today is more about keeping labor and the job environment strong, while at the same time providing security for the pension funds that have been managed prudently; the hell with the big banks and wealthy private investors who live off Wall Street. But that's a complex act and pulling it off won't be easy. At this point, I'm not sure that Wall Street and/or DC are sufficiently committed to protecting and enhancing labor and worker wages as a higher priority.

Scrivener7

(50,944 posts)So we kept rates artificially low, then raised them a tiny amount during the republican adminstration, then dropped them again during the republican administration, all pre-Covid.

The response to those same conditions during a Democratic administration is to raise them to 4.75 with more increases planned.

I don't deny that the interest rates should not be kept artificially low. But the way they address the problem certainly does change given the party in power.

jimfields33

(15,767 posts)Scrivener7

(50,944 posts)1.5.

Than from 1.5, down to nil during Covid,

Under Biden, they have gone up to 4.75 with more hikes to come.

That's a lot of wrenches in the works in a two and a half year period.

And while I understand interest rates near zero are not good, it is interesting that the vast bulk of the increases are taking place in a Democratic administration, when the problem was there during the previous Republican one.

FredGarvin

(471 posts)Their only tool in the box is to raise rates.

Which are still historically low.

gab13by13

(21,299 posts)until it caused a recession.

IronLionZion

(45,421 posts)they want it really bad. You can see the disappointment on conservative media outlets any time there is good economic news.

JohnSJ

(92,122 posts)the pandemic along with the financial implosion that occurred under bush, brought us to where we are now.

There is plenty of ammunition for the Democrats to push back on the republicans on this. They just have to do it.

JohnSJ

(92,122 posts)Fiendish Thingy

(15,569 posts)So Powell is definitely targeting the historical sweet spot.

Folks who came of age in the post 2008 crisis era are used to unusually low rates; some of us remember 15-18% interest rates in the late 70’s/early 80’s…

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

Powell waited too long to start hiking, inflation overheated, and now he’s playing catch up.

Congress could have assisted with tax hikes on the rich, which would have helped cool inflation, but, you know, Manchin, Sinema, filibuster…

KPN

(15,642 posts)long. Most likely, they still are.

Response to Fiendish Thingy (Reply #10)

KPN This message was self-deleted by its author.

friend of a friend

(367 posts)Fiendish Thingy

(15,569 posts)friend of a friend

(367 posts)The loan, I call it that because, unlike CDs, it was not insured. Okay, I just looked it up, it is called an uninsured certificate of deposit.

Fiendish Thingy

(15,569 posts)If it was uninsured, they couldn’t guarantee that you would earn 18%.

friend of a friend

(367 posts)The only time a bank doesn't pay is if it goes insolvent. Anyway, I got my 18% at the end of 12 months.

bucolic_frolic

(43,123 posts)The Fed has no interest in fighting inflation, which breaks out about every 40 years plus or minus. They don't anticipate, they react. Then they drag out the pain for years because they deliver weak sauce.

FredGarvin

(471 posts)Trump tossed $6,000,000,000,000.00 into the lap of the system during the pandemic.

And people wonder why inflation is so high?

Powell cow-toed to Wall Street the entire time.

His "inflation is transitory" remark is one of the biggest fed gaffes in history.

Lonestarblue

(9,969 posts)Gas prices are up again for no real reason other than predatory pricing. Profits are off the wall for many corporations because of predatory pricing. These rate hikes are not easing inflation. The possibility should be considered that the earlier decrease in inflation was caused not by the rate hikes but by publicity on predatory gas prices and threats of taxes on windfall profits. The FED’s policies are hurting average people while doing nothing on inflation. Instead of raising rates higher and higher until they cause another recession, perhaps they should cease raising rates for a few more months to gauge whether inflation truly changes.

ImNotGod

(134 posts)CountAllVotes

(20,868 posts)I have a small IRA and 6% would be a great for me anyway. If I can get 6%, I'll go long on it! Seven years if it is an option! ![]()

![]()

BumRushDaShow

(128,815 posts)that mentioned the "CD" word. ![]()

I know I have interest-bearing savings accounts (including one at my credit union) and suddenly the interest payments have started to roll in "significantly" (in quotes because it is a comparison to next to nothing) for the first time in almost 10 years.

CountAllVotes

(20,868 posts)It is a fragment of the other one. The penalty on it is 4 years!

So, it is paying 2.1% until Sept. and after that it goes into the IRA share acct. which pays a whopping .025%! ![]()

The other one is paying 3.4% until January. It is a bit bigger than the $1,000.00 one that I cannot get into without forfeiting all of that interest (big deal, a whole $20.00 a year).

![]()

FredGarvin

(471 posts)Inflation is eating those 2% investments alive.

In 7 years you would have lost about 60% of that investment at current inflation rates.

It sucks

CountAllVotes

(20,868 posts)I had to put it somewhere. It won't be there much longer anyway so I really do not care.

That said, it is a loser of an investment but cashing it out was not an option as you can only rollover once a year.

It was the best I could find when TFG was around saying that the "fed is driving me crazy".

Yes, it was driving TFG crazy as he screwed over old people and savers as he pocketed their money. ![]()

BumRushDaShow

(128,815 posts)and I *think* it was around when the rates were 8% (past the peak), but that got cashed out fairly quickly after it was eligible (I think when I was getting $$$ together for a new car down payment).

CountAllVotes

(20,868 posts)I needed a new car badly at that time. It was 17% for a 5-year loan.

I couldn't afford that!

So, I kept driving my old VW bug.

Finally after another ten or so breakdowns, my late father convinced me to borrow the money to buy a new car from my late uncle at 7% interest.

I went for that "deal". However, it was not a deal at all. I would have been paying that uncle of mine for the rest of my life the way he had it rigged as the "payments" were simply paying him the interest on the loan!

Once I figured out that he was screwing me badly, I doubled up on those payments and paid the car off as fast as I could. It took me about two years to do it, but I did!

![]()

Still pissed at that greedy old uncle of mine after so many years.

Shame on him!

He could have given me the money to buy a new car I found out after he had died as money was left to me by my grandmother which I never saw but he sure saw it alright (and snapped it right up and kept it!). ![]() again ...

again ...

Lesson: DO NOT BORROW MONEY FROM A FAMILY MEMBER!

![]()

BumRushDaShow

(128,815 posts)I was driving a '78 Colt. Good run-around car (had gotten it used with low mileage from my mom's next door neighbor - it was his 90+ year old aunt's car and she had recently passed). But it was 4-cylinder, had no power- nor power-assisted steering (it was just plain "rack-and-pinion" ), no AC, and was AM radio only. I would say it was probably barely a step above a bug being a sedan and not a manual shift (although I have been in bugs and they were generous with the space in them due to the bench seats and domed roof).

IOW, it was time! ![]()

FredGarvin

(471 posts)All that money is in the hands of Wall Street.

Even at 6% that investment would result at net zero gain under current inflation conditions.

The best you can get is about 2% in guaranteed treasuries in an IRA.

Its a real bad situation for IRA/401K "investors"

JohnSJ

(92,122 posts)FredGarvin

(471 posts)Thanks for the info.

Never looked into buying CD's in an IRA account.

I used to buy jumbo 1 year CD's in the late 2000's at 8%. When inflation was about 3%.

Still, the CD rate seems wayyyy low.

Scrivener7

(50,944 posts)CountAllVotes

(20,868 posts)That is where it has been from day #1. It was in the stock market for awhile but I got out of it as it was going down very fast.

It goes from a matured CD to an IRA savings acct., the thing that pays .025%. It is a holding tank for it until I can combine it with the other one. Its only a couple of months and the amount in it is the bare minimum so I'm not worried about it.

I was getting 6.5% for a long time but that was back in the days when interest rates were not at zero.

I had to hit it a lot last year to pay my late husband's medical expenses. At $500 a day, I had to make a lot of withdrawals to pay his hospice bills. ![]()

![]()

FredGarvin

(471 posts)Medical costs end up eating a persons long fought-for earnings.

Both of my parents ended up in medical facilities that drained all of their net worth.

Everything people in the USA work for their entire lives eventually ends up in medical corporation's pockets.

CountAllVotes

(20,868 posts)I was not expecting this to occur believe me.

I was going to sell the house and move to Ireland as that is where he was from.

That did not happen, he died instead.

That hospice thing was ok for a few days but had it gone on for a month or longer, I don't know what I would have done as 30 days @ $500 a day would have been $15K. ![]()

It is a sad way to spend your IRA up real quick, hence the rollover to the 2.1% CD for the time being.

![]()

![]() !!!

!!!

![]()

Scrivener7

(50,944 posts)I think one was 4.8 and one 4.85. Thirteen month term, which was weird.

CountAllVotes

(20,868 posts)TERM

APY*

4.70%

18 month

Not bad, not bad at all.

![]()

Scrivener7

(50,944 posts)had already begun to fall

FredGarvin

(471 posts)Inflation made that +5% into -1%.

It's criminal how low bank rates are.

Scrivener7

(50,944 posts)madville

(7,408 posts)You can only put $10,000 annually in those though and you have to hold them at least a year before you can cash in (5 years to avoid the 3 month interest penalty).

They’re not a bad place to stick cash you otherwise don’t need if you think inflation will remain high.

LudwigPastorius

(9,135 posts)Inflation runs a little high for a year or so...

Or, the Fed sends the economy into the toilet before the election, getting Trump or DeSantis elected, plunging the country into an irreversible slide into an authoritarian fascist state...

Tough choice! /s

roamer65

(36,745 posts)We won’t see lower inflation until prices are about 50-75 pct higher than pre-pandemic levels. All higher interest rates do is slow inflation. They don’t kill it.

A new equilibrium has to be reached and we simply aren’t there yet.

There is still too much “hot money” in the system, even though the Fed has been draining some of it off over the past few months.

https://www.statista.com/statistics/1121016/monthly-m1-money-stock-usa/