US Records $71 Billion Budget Surplus in June

Source: ASSOCIATED PRESS

JOSH BOAK – JULY 11, 2014, 2:23 PM EDT

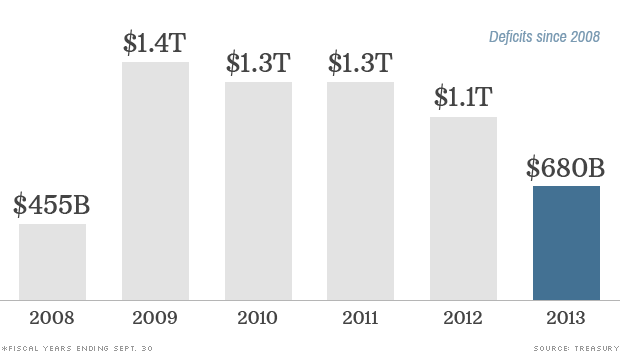

WASHINGTON (AP) — The U.S. government ran a monthly budget surplus in June, putting it on course to record the lowest annual deficit since 2008.

The Treasury Department says the June surplus totaled $71 billion, following a $130 billion deficit in May. The government also ran a surplus in June 2013, bolstered by dividends from Fannie Mae, the mortgage giant under federal conservatorship for the past six years.

For the first nine months of this budget year, the deficit totals $366 billion, down 28 percent from the same period in 2013. Tax receipts are up 8 percent compared to the prior year-to-date, while spending has increased 1 percent.

The Congressional Budget Office is forecasting a deficit of $492 billion for the full budget year ending Sept. 30.

###

Read more: http://talkingpointsmemo.com/news/us-records-71-billion-budget-surplus-in-june

cosmicone

(11,014 posts)yeoman6987

(14,449 posts)Put the rest towards the debt please.

Kingofalldems

(38,425 posts)Reads like something from Fox news.

EEO

(1,620 posts)Kingofalldems

(38,425 posts)That is a great point you made though.

yeoman6987

(14,449 posts)rtracey

(2,062 posts)Would be nice to hear something about this, except on here.... hmmm maybe on Fox.....hahahaha sorry, MSNBC, CNN or NBS, ABC, CBS, any mainstream media.....

Cosmocat

(14,559 posts)The entire "liberal press" is to busying being led around by its nose to greedily lap up the poutrage of the day for the republicans ...

Botany

(70,449 posts)

freshwest

(53,661 posts)NRaleighLiberal

(60,009 posts)...oh yeah...BENGHAZI!

![]()

![]() (just in case in these tense times!)

(just in case in these tense times!)

![]()

davidpdx

(22,000 posts)could you imagine what it would look like?

Yavin4

(35,423 posts)Running a surplus when there are needs here at home is absolute madness.

robbob

(3,522 posts)....and then start another war. Surplus problem solved.

Botany

(70,449 posts)crashing and burning the economy so we go into a recession. BTW it was two wars

that w had and he did those "off the books" too.

deurbano

(2,894 posts)jakeXT

(10,575 posts)

Psephos

(8,032 posts)Don't be fooled by the propaganda. And yes, in the true Orwellian sense of the word, this is propaganda, designed to fool you and enable the government to continue its unsound ways with no blowback.

I run a "surplus" myself every month until I sit down to pay my bills, too. However, I can't sit down at my laser printer and spit out extra $$$ when I need it. The US government thinks it can do exactly that. They back that fake money with IOUs that people of the future are obligated to pay. It's called generational theft. Fly now, pay later. Or actually, your kids pay later. Nice.

The US government has to borrow money to pay interest on what it owes, and is using the Fed to hold interest rates below historical and present-value levels to hide the problem. Think of what you would feel like if you had to get a cash advance on a credit card just to make your minimum credit card payments each month. You would rightly feel that this can't go on forever, and know that the farther it goes, the worse the end result. Now think what would happen if the credit card company decided you have become a worse credit risk, and raises your interest rates. That's coming for the US, too.

Meanwhile, the Fed snaps its fingers and "creates" >$3 billion of Monopoly money every day, and pushes into the banks. Wonder why stocks are trading at all-time highs? Because all that fake money has to go somewhere. 1%ers use it to inflate asset bubbles, while you and I become debt serfs. An asset bubble simply reaches into the future and extracts future value for use by market parasites in the present. No one is creating actual value the way we do when we work (services, machinery, farm goods, wind generators, whatever), they're just running up a tally sheet on a computer. They are, in short, "financializing" the sweat of your brow and the property you've amassed, and they use that to enrich themselves and push you into debt. While the bubble lives, your debt seems "reasonable." Besides, you have a 60" TV now, right? And you put it on your AMEX. So you are prosperous!

When the bubble pops, the true present value of the assets is revealed. Meanwhile, your "reasonable" debts become a millstone that can destroy you. The newspapers run shock headlines about how XXX trillions of dollars were wiped out. lol Wrong. Until converted into tangible assets, the fake money and its fake valuation were literally just paper promises. Nothing is actually destroyed except bits and bytes in a computer, and people's confidence - and that is the worst destruction of all, the hardest to overcome.

It all works like a charm until it doesn't. History is instructive.

Stallion

(6,473 posts)"The Congressional Budget Office is forecasting a deficit of $492 billion for the full budget year ending Sept. 30."

this is not propaganda-projected deficit for fiscal year ending Sept 2014 has now been lowered by about $100 Billion

Psephos

(8,032 posts)geek tragedy

(68,868 posts)Psephos

(8,032 posts)geek tragedy

(68,868 posts)points.

geek tragedy

(68,868 posts)points, my friend.

Seems to be a pattern:

http://election.democraticunderground.com/?com=view_post&forum=1014&pid=654373

http://www.democraticunderground.com/1251309659#post12

http://www.democraticunderground.com/?com=view_post&forum=1014&pid=728815

Too bad the candidate with your economic philosophy lost in 2012.

Psephos

(8,032 posts)"If everyone is thinking alike, then no one is thinking." - Benjamin Franklin

Your name comes to mind instantly as an archetype of "thinking alike." The content of your every post is fully predictable.

Like all hive-mind boys, your main tool of "discussion" is to excoriate and demean those who somehow failed to share your opinion, and worse, had the nerve to express it.

Go pound sand.

geek tragedy

(68,868 posts)get a hostile reception at Democratic underground. Shocking, no?

TOS says "don't be a wingnut."

Psephos

(8,032 posts)Somehow I think the irony is lost on you, "freethinker." ![]()

geek tragedy

(68,868 posts)tell the story. And your 'theories' are little more than a hodge podge of discredited rightwing myths.

In this case, you're spewing nonsense because the actual data backs up the Democratic way of doing things. You "cut spending" deficit scolds were proven wrong, yet again. Just like you and Mitt Romney were wrong when you advocated letting the big three automakers go belly up.

jeff47

(26,549 posts)Should probably not turn to him for how to run things.

Microeconomics (your financial situation) is radically different than macroeconomics (the country's financial situation). Things that are good in microeconomics, such as not running debt, are bad in macroeconomics, where the government is "the spender of last resort".

What we should be doing is running up massive deficits during bad economic times, and then pay those off during good economic times. We're in bad economic times, so it's actually bad that we're running a surplus at the moment. It would be better for the economy if we ran a large deficit now.

But then you have to pay down the debt during good economic times. Unfortunately, "starve the beast" conservatives don't want to do that. So they push massive tax cuts so we don't pay down the debt.

You utterly contradict yourself here.

If we're running large inflation, then we aren't debt serfs - our debt gets eroded by inflation.

We're still in a housing and debt crisis because we are not running enough inflation.

Psephos

(8,032 posts)You are taking a micro look at an annual revenue picture that is an ocean of red ink. Just like they hoped you would do.

Secondly, if you think the US is going to "pay down the debt" during the coming "good times" (should be here any day now, right?), you have not read how similar situations have played out in the past. I can tell you that in over 200 case histories of countries that ran debt to equity ratios similar to the US's, and that tried to print their way out of trouble, exactly zero avoided default and economic catastrophe.

As for your inflation observation, again, I can't help you if you haven't learned how inflation transfers wealth from savers to government to support out-of-control debt service. How much incentive do you have to save money right now, jeff? 1/2% interest, when inflation on what we "debt serfs" actually need to live (food, gasoline, electricity, housing, water, medical care, etc.) is running 8 - 10% based on the exact same basket of goods the US government used for inflation calculation in the 1990s.

You say inflation erodes debt. But it also erodes the purchasing (or debt-paying) power of wages. And the wages somehow never rise nearly as fast as the inflation. It also erodes the value of payments/benefits from the government to you, which is why they're doing it in the first place. Your SS check will still come for the full dollar amount promised, but it will only be enough to buy one breakfast at a cheap restaurant.

Worse still, inflation sucks the value from the life savings of older people, many or most of whom are on a defined, non-COLA'd pension. The immorality and evil of that is hard to overstate.

Sorry, can't go there with you.

jeff47

(26,549 posts)Yes, we aren't running an annual surplus, but we're running a surplus at the moment. We should not be. We should be spending enormous sums of money to get the economy moving.

That's largely because of the "print their way out of trouble", not the deficit.

We can borrow at incredibly cheap rates. We don't need to borrow in order to spend. However, the "natural" interest rate at the moment is negative, thanks to the shitty economy. Printing vast sums is intended to address that.

Reading. Try it!

Your claim: That there is massive inflation, and "regular people" are drowning in debt. Those are contradictory.

If there's massive inflation, the value of my debt is going way down - sure I borrowed $100k for a mortgage, but that's now worth $80k in fixed dollars. As a result, it becomes easier to pay off the debt.

If I'm getting buried in debt, then there can't be massive inflation - inflation would erode the debt.

Only if wages stay constant. Which isn't stable in a "massive inflation" scenario. You can hold wages constant for a little while, but employees will start demanding more money.

KinMd

(966 posts)and we had these same results, Fox would be trumpeting the ROMNEY MIRACLE

Stuart G

(38,414 posts)Jobs are increasing, people are paying more taxes. You will see. Where I live, within 5 miles there have to be at least 10 very large construction projects. The sites employ many hundreds perhaps more if all were counted. I think July's number will be much larger..You won't see any of this on Fox but some media outlets will mention this. Just in passing...but I believe that you will not hear anything at all about the so called "budget deficient" in the next Congressional Election in November...At least from the Repuks

ALBliberal

(2,334 posts)If so this is an amazing turn around