Brent falls more, Saudi Arabian king issues speech

Source: Reuters

BY LIBBY GEORGE

Oil prices fell to fresh 5-1/2 year lows on Tuesday, extending losses after a 5 percent plunge in the previous session as worries over a global supply glut intensified.

Brent crude fell close to $51 a barrel, its lowest since 2009, with cuts to Saudi Arabia's official selling prices to Europe this week adding more pressure to the 55 percent price rout since June.

Saudi Arabia's King Abdullah said in a speech read for him on Tuesday the country would deal with the challenge posed by lower oil prices "with a firm will" but gave no sign the world's top exporter was considering changing its policy of maintaining production in the face of fast-growing U.S. shale supplies.

"We would need an indication that Saudi Arabia is considering output cuts," said Carsten Fritsch, a commodities analyst with Commerzbank.

FULL story at link.

Read more: http://www.reuters.com/article/2015/01/06/us-markets-oil-idUSKBN0KE06V20150106

Fred Sanders

(23,946 posts)GreatGazoo

(3,937 posts)Fred Sanders

(23,946 posts)We are not "in this together"... Was that sarcasm?

upaloopa

(11,417 posts)I don't think we are in this at all. The oil industry does not have our interests at heart.

Fred Sanders

(23,946 posts)GreatGazoo

(3,937 posts)We have a deal with Saudi Arabia:

...

“This sale will send a strong message to countries in the region that the United States is committed to stability in the Gulf and broader Middle East,” Andrew Shapiro, assistant secretary of state for political-military affairs, told reporters.

Saudi Arabia, which has a predominantly Sunni Muslim population, and Iran, mostly Shiite, have competed for regional influence for decades, and the Obama administration has sought to bolster its security relationship with Riyadh, despite their differences over the response to the Arab Spring.

http://www.washingtonpost.com/blogs/checkpoint-washington/post/us-saudi-arabia-strike-30-billion-arms-deal/2011/12/29/gIQAjZmhOP_blog.html

The Saudis are helping us overthrow Assad right now. Many other connections. Not saying it is good, just saying the US and SA are tied together economically until their oil runs out.

Fred Sanders

(23,946 posts)really need to brush up on your macroeconomics and geopolitics.

leftynyc

(26,060 posts)There are at least three major potential impacts on global economic instability that will likely follow in the wake of global oil price deflation, some of which have already begun to appear:

First, a more rapid appreciation of the US dollar, and the corresponding relative decline in the currencies of a number of emerging market economies (EMEs) — in particular those dependent on commodity exports and especially those for whom oil exports make up a significant percent of total exports. There is a long, historical and documented relationship between falling oil prices and a rising US dollar. So global oil deflation means a rising US dollar.

Fred Sanders

(23,946 posts)leftynyc

(26,060 posts)you're tying yourself into. I trust the people here to see what is - a person who is loathe to admit they were wrong and will go into sarah palin type gymnastics rather than admit it.

Kurska

(5,739 posts)The ruble is "tied" to oil, when oil drops the ruble drops. When oil drops hard, the ruble drops hard too.

The U.S dollar is influenced by oil, big difference. Oil can drop greatly and the U.S dollar will still be fine even if lower oil prices are exerting a downward pull on the value of the dollar.

It's the difference between a very strong and a very weak correlation.

leftynyc

(26,060 posts)value of the dollar is not tied to oil (absolutely nothing about the strength of the correlation). That is clearly wrong. If you also want to twist yourself into a pretzel and play word games, knock yourself out.

Kurska

(5,739 posts)I'm not twisting anything. I wasn't even involved in this at the start. Reading the exchange as an outsider observers it was clear what was meant and the reality of the situation.

When you're talking about currencies, tying something to it means the value of the currency is almost entirely determined by the value of the second item. A gold standard would be mean the dollar was tied to the value of gold. Russian essentially operates on an Oil Standard. This is not true of the united states. That is the difference, that is why different words should be used for describing these two situations.

joshcryer

(62,270 posts)It's shuttering fracking expansion.

It's all but killed Keystone.

It's literally put a kink into energy self-sufficiency.

The US is going to have to redo its numbers.

upaloopa

(11,417 posts)things. So is lower gasoline prices. We aren't giving our money to speculators as much, our water will remain safe a little longer too.

joshcryer

(62,270 posts)It's good that Keystone will probably not be built if this continues for too much longer. Every year its price goes up a billion or two. Fracking is a disaster, it not only damages water tables, it also causes earthquakes.

I'm just saying the US energy roadmap depends on fracking (and to an extent keystone) to get us to that 2050 energy independent trajectory. That's the market based strategy. Without the markets and high oil prices then it could take longer. You'd need a grand bargain to get you there.

I simply don't see the Republicans passing legislation to usher in green tech at a time when, in actuality, it'd be affordable to do so.

upaloopa

(11,417 posts)self sufficient as a goal.

We need to work toward not needing petroleum based energy.

Adrahil

(13,340 posts)There are foreign policy benefits in the immediate future of reducing our dependence on foreign oil.

But my fear is that cheap oil would destroy any resolve to actually continue the shift to renewable energy. Because in the end, people are very short sighted.

upaloopa

(11,417 posts)Adrahil

(13,340 posts)Personally, I'd prefer a massive investment of capital in research and technology maturation NOW. But I have no illusions that will happen, because CHEAP GAS!

upaloopa

(11,417 posts)what good are they. What is needed is cheap affordable transportation that does not rely on fossil fuels.

In my state you won't get people out of their cars. Give them alternative sources of power to run their cars that doesn't increase the price of the car and they will buy them.

wordpix

(18,652 posts)Around Palm Springs and Joshua Tree NP there are large wind and solar projects and there are a few homes here and there that use solar/wind but Southwest states need to ramp up. There's constant bright sun every day and the desert has plenty of wind or at least frequent and regular breezes blowing.

upaloopa

(11,417 posts)Take rt 58 from Tehachapi toward Edwards AFB and Mohave. Wind farms as far as you can see.

Fred Sanders

(23,946 posts)bad.

Ask an economist.

joshcryer

(62,270 posts)But to think it was part of some strategy is crazy. The Saudi's are doing this all on their own, in response to US oil buildout. We were supposed to be the worlds largest producer. They stopped that in its tracks.

Fred Sanders

(23,946 posts)I believe it more a function of supply and demand, there is a huge supply now, nothing to do with changes in Saudi oil production or export.

Cosmic Kitten

(3,498 posts)Ask an economist, eh?

How about someone who understands energy extraction?

Arthur Berman: We’ve read a lot of silly articles since oil prices started falling about how U.S. shale plays can break-even at whatever the latest, lowest price of oil happens to be. Doesn’t anyone realize that the investment banks that do the research behind these articles have a vested interest in making people believe that the companies they’ve put billions of dollars into won’t go broke because prices have fallen? This is total propaganda.

<snip>

Oil prices need to be around $90 to attract investment capital. So, are companies OK at current oil prices? Hell no! They are dying at these prices. That’s the truth based on real data. The crap that we read that companies are fine at $60/barrel is just that. They get to those prices by excluding important costs like everything except drilling and completion. Why does anyone believe this stuff?

<snip>

Continental Resources is the biggest player in the Bakken. Their free cash flow—cash from operating activities minus capital expenditures—was -$1.1 billion in the third- quarter of 2014. That means that they spent more than $1 billion more than they made. Their debt was 120% of equity. That means that if they sold everything they own, they couldn’t pay off all their debt. That was at $93 oil prices.

And they say that they will be fine at $60 oil prices? Are you kidding? People need to wake up and click on Google Finance to see that I am right. Capital costs, by the way, don’t begin to reflect all of their costs like overhead, debt service, taxes, or operating costs so the true situation is really a lot worse.

The Continental Resources example is just ONE of the many

companies that's going to lose big, unless they get a bailout.

The are plenty more smaller players with no ability to service debt

with oil at the current pricing.

Just saying, this is NOT a good thing.

When energy extractors can't service their debts

banks and investors are going to lose big.

This is another financial collapse in the making

Fred Sanders

(23,946 posts)saving?

And crazy RW billionaire owned Continental Resources can handle it.

Energy extraction is less than 2% of GDP.

Cosmic Kitten

(3,498 posts)So RW billionairs can afford it?

How about those who invested in energy and got junk bonds?

Should we ask an economist again?

While the overall high-yield market is down 2.3% since the end of August, oil and gas junk debt has dropped 4.6%. But as Bloomberg reports, it hides the bloodletting beneath the surface.

Samson Investment, an oil and gas explorer headquartered in Tulsa, OK, owned by private equity firm KKR, extracted $2.25 billion of new money from gullible investors in July. In early August, these junk bonds still traded at 103.5 cents on the dollar. Then reality sank in, and that formerly low-risk paper plunged to 77.5 cents on the dollar.

Not just in fracking la-la land. Paragon Offshore, an offshore driller, completed its spinoff from Noble in early August. Its stock started trading at $17.50 a share and immediately plunged and is now down a cool 68% in the first 10 weeks as an independently traded company. In July, it also sold $580 million in 10-year junk bonds to your bond fund at 100 cents on the dollar. Now they trade for 77.3 cents on the dollar.

Hercules Offshore, a Houston-based drilling company with the appropriate ticker HERO, saw its shares plunge 81% since July last year to $1.47. In March, it had the temerity to sell – or rather investors had the Fed-induced idiocy to buy – for 100 cents on the dollar $300 million in junk bonds that now trade at 66 cents.

Yep, some people can afford it.

Let the peons take the loss, right!

Fred Sanders

(23,946 posts)Energy extraction has doubled in the last 10 years in America and is almost, wait for it again...almost

2% of GDP.

Cosmic Kitten

(3,498 posts)How much of the energy sector is tied to

pension investments or 401k's?

You saying average investors, middle-class investors

don't stand to take a loss when the bubble bursts?

You keep ignoring the real world, everyday investor damage.

Do you work in finance perchance?

Fred Sanders

(23,946 posts)Cosmic Kitten

(3,498 posts)So that's your point?

An overly optimistic spin that lower fuel prices

are "just like a tax cut" bwahaha

Of course there will be household savings.

But HOW those savings are applied is the BIG question.

Your article starts out with the premise of CONSUMER SPENDING!

But what if that does not happen?

What if people apply that money to paying down debt?

Is paying down debt the same as consumer spending?

Isn't paying down debts a drag on the economy?

Fred Sanders

(23,946 posts)Cosmic Kitten

(3,498 posts)But it won't necessarily lead to increased consumer spending

as your linked article speculates.

Its pretty absurd to think saving $750 at the pump

will magically turn into people buying new cars.

Just saying, wishful thinking.

Your article is putting lipstick on a pig for the benefit

of market confidence... we've saw this play before.

Fred Sanders

(23,946 posts)"In a recent GasBuddy.com survey of 100,000 people, 45 percent said they will use the extra money to pay bills, while 38 percent said they put it in savings. Just 14 percent said they would spend it on holiday gifts."

So 59% say they will spend the savings, tens of billions of dollars pumped into the economy.

upaloopa

(11,417 posts)The rest does not impact the working man.

Cosmic Kitten

(3,498 posts)There's not much indication that lower gas price

saving ares going into consumer purchases.

People are servicing their own debt,

ie. paying off credit cards

Fred Sanders

(23,946 posts)are very good things..if gas prices stay the same a massive 120 billion dollar annual direct tax cut to the public.

http://blogs.wsj.com/economics/2014/12/10/lower-gas-prices-like-huge-tax-cut-for-middle-class/

Cosmic Kitten

(3,498 posts)Maybe you forgot what "economists" were saying in 2007???

But now they somehow are credible?

Alan Greenspan ADMITTED he was wrong after 2007.

The number 1!1 economist was WRONG about that market

But now economists got it right? ![]()

But on Thursday, almost three years after stepping down as chairman of the Federal Reserve, a humbled Mr. Greenspan admitted that he had put too much faith in the self-correcting power of free markets and had failed to anticipate the self-destructive power of wanton mortgage lending.

“Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief,” he told the House Committee on Oversight and Government Reform.

But the energy bubble is COMPLETELY different

upaloopa

(11,417 posts)was talking about in 2007 and oil

2007 was about the bursting of the housing bubble.

Using smilies to make your point is weak,

Cosmic Kitten

(3,498 posts)He was talking about the frenzied speculation

and collateralizeing of debt just like we are seeing

in the shale oil boom.

It's boom and bust redux... dot com, housing, fracking

Investors get hosed every time

upaloopa

(11,417 posts)buyers. The oil industry does not impact the middle class like the housing industry did.

upaloopa

(11,417 posts)They will pay less interest on debt and their financial future will be better.

Look at the individual not the investor class's wealth maximization.

FBaggins

(26,731 posts)He's a geologist... and his track record over the last few years has been less than stellar.

He's fervently hoping that a market-driven production collapse in US oil/gas will allow him to pretend that his peak oil predictions for that US production were actually correct (rather than laughably wrong).

GliderGuider

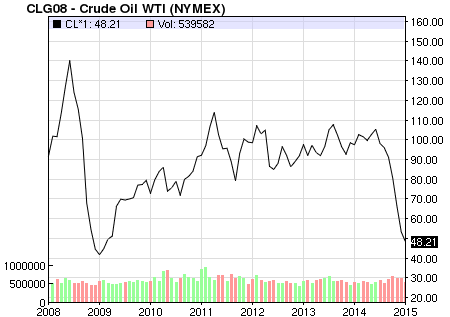

(21,088 posts)

Anything seem similar at the two ends of this chart? We had cheap gas prices in late 2008 as well...

Fred Sanders

(23,946 posts)GreatGazoo

(3,937 posts)(hurting Canada too but the target is Putin)

Russian crude, like Brent, is more expensive to refine than Texas light sweet crude or Saudi oil. Russia has not made their refineries more efficient which was okay when oil was at $90 but once it fell below their cost of production they were screwed:

http://www.orlandosentinel.com/opinion/os-ed-russia-oil-prices-20141212-story.html

joshcryer

(62,270 posts)That doesn't mean it's some grand strategy. If anything the US is getting lucky that the Saudi's have lost their mind and have no sane long term strategy.

Cosmic Kitten

(3,498 posts)In the LONG term the Saudi's are protecting their market share.

Cosmic Kitten

(3,498 posts)SkyDaddy7

(6,045 posts)They are looking at for themselves...Trying to derail the massive push to alternative energy & hurt shale oil & gas producers as well as tar sand producers...Get everyone in the West hooked back on low gas prices then raise the prices again when the time is right. This is all highly calculated!

Cosmic Kitten

(3,498 posts)dembotoz

(16,802 posts)sure it is a coincidence but he always was a slippery character.

jtuck004

(15,882 posts)Thank you Lewis Black.

bigworld

(1,807 posts)If you believe the Israeli press