Dem proposal for a graduated income tax is precisely what they should be fighting for

In March of 2015, Michigan Democrat Jim Townshend introduced legislation in the House – House Bill 4341 – that would change Michigan’s regressive flat state income tax to a graduated tax. Not surprisingly, it never went anywhere in the Republican-controlled House. And that’s a shame because, if implemented, it would increase state tax revenues by as much as $700,000,000 $870,000,000 and still lower taxes for 95% of Michiganders.

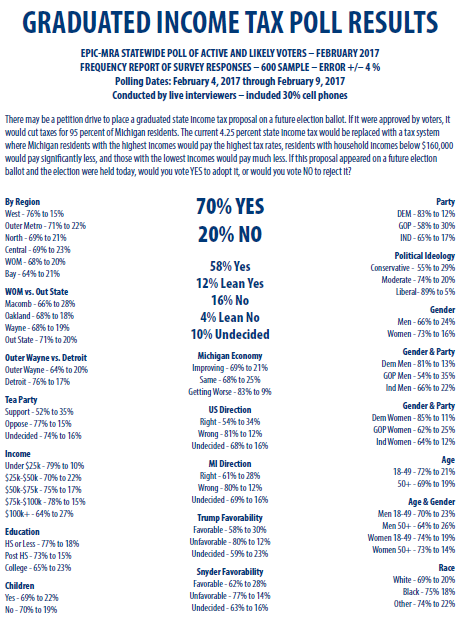

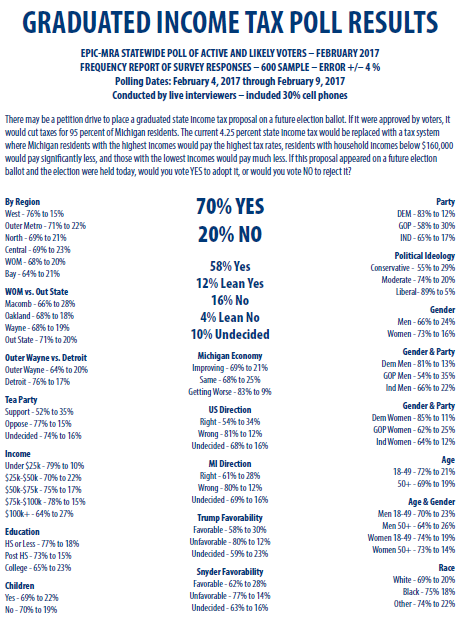

This is the sort of populist, across-the-board, tax policy that could appeal to even people who found themselves voting for Donald Trump in November of last year. Why do I say that? Have a look at these results from a recent EPIC-MRA poll on this topic:

A full 70% of Michiganders favor this tax proposal. It doesn’t matter how you slice the respondents demographically, a majority of people like this idea. A LOT. Even people with incomes over $100,000 a year support it 64% to 27%.

The breakdown on the tax rates looks like this:

3% tax rate on incomes up to $20,000

4% tax rate on incomes between $20,000 and $40,000

5% tax rate on incomes between $40,000 and $80,000

6% tax rate on incomes between $80,000 and $125,00

7% tax rate on incomes between $125,000 and $200,000

8% tax rate on incomes between $200,000 and $500,000

9% tax rate on incomes between $500,000 and $1,000,000

10% tax rate on incomes over $1,000,000

Read more: http://www.eclectablog.com/2017/04/turning-michigan-blue-again-dem-proposal-for-a-graduated-income-tax-is-precisely-what-they-should-be-fighting-for.html