Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 23 July 2012

[font size=3]STOCK MARKET WATCH, Monday, 23 July 2012[font color=black][/font]

SMW for 20 July 2012

AT THE CLOSING BELL ON 20 July 2012

[center][font color=red]

Dow Jones 12,822.57 -120.79 (-0.93%)

S&P 500 1,362.66 -13.85 (-1.01%)

Nasdaq 2,925.30 -40.60 (-1.37%)

[font color=red]10 Year 1.46% -0.02 (-1.35%)

30 Year 2.54% -0.02 (-0.78%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

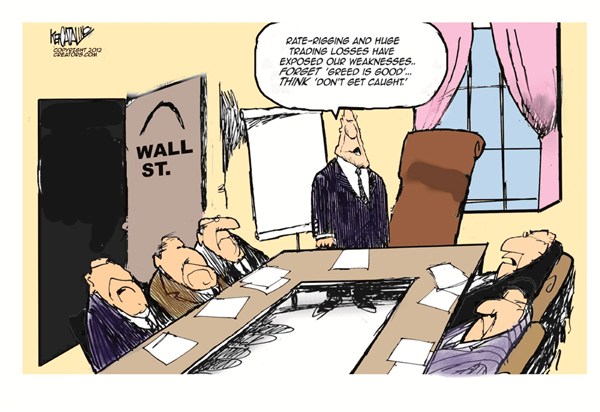

(85,373 posts)The same could be given to the political hacks they bought, and their agent-lobbyists.

But who is going to do the "catching"? Eric Holder, the Enabler-in-Chief? The FBI, who were given their severance from fraud several administrations ago? The Press, bought and paid for by Corporations, some of them from overseas?

It's torches and pitchforks. They can't drone us all.

Demeter

(85,373 posts)Pulitzer prize-winning journalist Ron Suskind quotes Treasury Secretary Timothy Geithner as saying

The confidence in the system is so fragile still… a disclosure of a fraud… could result in a run, just like Lehman.In other words, Geither said that the big bankers are “too big to jail”, because disclosing any portion of their massive fraud would cause bank runs.

Former IMF economist Simon Johnson notes:

***

The message to bank executives today is simple: build your bank to be as big as possible – and then keep growing. If you manage to become big enough, you and your employees are not just too big to fail, but also too big to jail.

Glenn Greenwald notes:

Indeed, the Obama administration has made it official policy not to prosecute fraud. Top economists, on the other hand, completely contradict Geithner and the rest of the administration … saying that fraud caused the Great Depression and the current financial crisis, and that the economy will never recover until fraud is prosecuted. Top economists and experts on fraud say that fraud is not only widespread, it is actually the business model adopted by the giant banks. MULTIPLE REFERENCES AT LINK Therefore, unless the big banks are broken up, financial fraud will grow exponentially like cancer, and the economy will be destroyed.

Their Size Allows Them to Rig the Market

...Nobel prize winning economist Joseph Stiglitz noted in September that giants like Goldman are using their size to manipulate the market:

Further, he says, “That raises the potential of conflicts of interest, problems of front-running, using that inside information for your proprietary desk. And that’s why the Volcker report came out and said that we need to restrict the kinds of activity that these large institutions have. If you’re going to trade on behalf of others, if you’re going to be a commercial bank, you can’t engage in certain kinds of risk-taking behavior.”

The giants (especially Goldman Sachs) have also used high-frequency program trading which not only distorted the markets – making up more than 70% of stock trades – but which also let the program trading giants take a sneak peak at what the real (aka “human”) traders are buying and selling, and then trade on the insider information. REFS AT LINK (This is frontrunning, which is illegal; but it is a lot bigger than garden variety frontrunning, because the program traders are not only trading based on inside knowledge of what their own clients are doing, they are also trading based on knowledge of what all other traders are doing). Goldman also admitted that its proprietary trading program can “manipulate the markets in unfair ways”. The giant banks have also allegedly used their Counterparty Risk Management Policy Group (CRMPG) to exchange secret information and formulate coordinated mutually beneficial actions, all with the government’s blessings. In other words, a handful of giants doing it, it can manipulate the entire economy in ways which are not good for the American citizen. And the political system. No wonder Nobel prize-winning economist Paul Krugman thinks that we have to break up the big banks to stop their domination of the political process

If We Break Up the Giants, Smaller Banks Will Thrive … And Loan More to Main Street

Do we need to keep the TBTFs to make sure that loans are made? Nope.

USA Today points out:

***

The amount of loans outstanding to businesses and individuals fell 9.1% for the 12 months ending Sept. 30, 2009, at banks that participated in TARP compared with a 6.2% drop at banks that didn’t.

Dennis Santiago – CEO and Managing Director of Institutional Risk Analytics (Chris Whalen’s company) – notes:

Fortune reports that smaller banks are stepping in to fill the lending void left by the giant banks’ current hesitancy to make loans. Indeed, the article points out that the only reason that smaller banks haven’t been able to expand and thrive is that the too-big-to-fails have decreased competition:

As big banks struggle to find a way forward and rising loan losses threaten to punish poorly run banks of all sizes, smaller but well capitalized institutions have a long-awaited chance to expand.

BusinessWeek notes:

At a congressional hearing on small business and the economic recovery earlier this month, economist Paul Merski, of the Independent Community Bankers of America, a Washington (D.C.) trade group, told lawmakers that community banks make 20% of all small-business loans, even though they represent only about 12% of all bank assets. Furthermore, he said that about 50% of all small-business loans under $100,000 are made by community banks…

Indeed, for the past two years, small-business lending among community banks has grown at a faster rate than from larger institutions, according to Aite Group, a Boston banking consultancy. “Community banks are quickly taking on more market share not only from the top five banks but from some of the regional banks,” says Christine Barry, Aite’s research director. “They are focusing more attention on small businesses than before. They are seeing revenue opportunities and deploying the right solutions in place to serve these customers.”

Fed Governor Daniel K. Tarullo said:

For example, while the number of credit unions has declined by 42 percent since 1989, credit union deposits have more than quadrupled, and credit unions have increased their share of national deposits from 4.7 percent to 8.5 percent. In addition, some credit unions have shifted from the traditional membership based on a common interest to membership that encompasses anyone who lives or works within one or more local banking markets. In the last few years, some credit unions have also moved beyond their traditional focus on consumer services to provide services to small businesses, increasing the extent to which they compete with community banks.

Thomas M. Hoenig pointed out in a speech at a U.S. Chamber of Commerce summit in Washington:

On the other hand, Hoenig pointed out:

45% is about 45% more than the amount of increased lending by the too big to fails. Indeed, some very smart people say that the big banks aren’t really focusing as much on the lending business as smaller banks. Specifically since Glass-Steagall was repealed in 1999, the giant banks have made much of their money in trading assets, securities, derivatives and other speculative bets, the banks’ own paper and securities, and in other money-making activities which have nothing to do with traditional depository functions.

Now that the economy has crashed, the big banks are making very few loans to consumers or small businesses because they still have trillions in bad derivatives gambling debts to pay off, and so they are only loaning to the biggest players and those who don’t really need credit in the first place. LINKS FOR REFERENCE So we don’t really need these giant gamblers. We don’t really need JP Morgan, Citi, Bank of America, Goldman Sachs or Morgan Stanley. What we need are dedicated lenders. The Fortune article discussed above points out that the banking giants are not necessarily more efficient than smaller banks:

“They actually experience diseconomies of scale,” Narter wrote of the biggest banks. “There are so many large autonomous divisions of the bank that the complexity of connecting them overwhelms the advantage of size.”

And Governor Tarullo points out some of the benefits of small community banks over the giant banks:

A small, but growing, body of research suggests that the financial services provided by large banks are less-than-perfect substitutes for those provided by community banks.

It is simply not true that we need the mega-banks. In fact, as many top economists and financial analysts have said, the “too big to fails” are actually stifling competition from smaller lenders and credit unions, and dragging the entire economy down into a black hole.

...............................

Do we need the Too Big to Fails to help the economy recover? No. The following top economists and financial experts believe that the economy cannot recover unless the big, insolvent banks are broken up in an orderly fashion:

Nobel prize-winning economist, Joseph Stiglitz

Nobel prize-winning economist, Ed Prescott

Former chairman of the Federal Reserve, Alan Greenspan

Former chairman of the Federal Reserve, Paul Volcker

Former Secretary of Labor Robert Reich

Dean and professor of finance and economics at Columbia Business School, and chairman of the Council of Economic Advisers under President George W. Bush, R. Glenn Hubbard

Simon Johnson (and see this)

Former 20-year President of the Federal Reserve Bank of Kansas City, who was today nominated to be FDIC Vice Chair Thomas Hoenig (and see this)

President of the Federal Reserve Bank of Dallas, Richard Fisher (and see this)

President of the Federal Reserve Bank of St. Louis, Thomas Bullard

Deputy Treasury Secretary, Neal S. Wolin

The President of the Independent Community Bankers of America, a Washington-based trade group with about 5,000 members, Camden R. Fine

The Congressional panel overseeing the bailout (and see this)

The head of the FDIC, Sheila Bair

The head of the Bank of England, Mervyn King

The leading monetary economist and co-author with Milton Friedman of the leading treatise on the Great Depression, Anna Schwartz

Economics professor and senior regulator during the S & L crisis, William K. Black

Leading British economist, John Kay

Economics professor, Nouriel Roubini

Economist, Marc Faber

Professor of entrepreneurship and finance at the Chicago Booth School of Business, Luigi Zingales

Economics professor, Thomas F. Cooley

Economist Dean Baker

Economist Arnold Kling

Former investment banker, Philip Augar

Chairman of the Commons Treasury, John McFall

In addition, many top economists and financial experts, including Bank of Israel Governor Stanley Fischer – who was Ben Bernanke’s thesis adviser at MIT – say that – at the very least – the size of the financial giants should be limited. Even the Bank of International Settlements – the “Central Banks’ Central Bank” – has slammed too big to fail. As summarized by the Financial Times:

This was dangerous because it reinforced the risks of moral hazard which might lead to an even bigger financial crisis in future.

And as I noted in December 2008, the big banks are the major reason why sovereign debt has become a crisis:

In other words, by assuming huge portions of the risk from banks trading in toxic derivatives, and by spending trillions that they don’t have, central banks have put their countries at risk from default.

Similarly, a study of 124 banking crises by the International Monetary Fund found that propping banks which are only pretending to be solvent hurts the economy:

Cross-country analysis to date also shows that accommodative policy measures (such as substantial liquidity support, explicit government guarantee on financial institutions’ liabilities and forbearance from prudential regulations) tend to be fiscally costly and that these particular policies do not necessarily accelerate the speed of economic recovery.

***

All too often, central banks privilege stability over cost in the heat of the containment phase: if so, they may too liberally extend loans to an illiquid bank which is almost certain to prove insolvent anyway. Also, closure of a nonviable bank is often delayed for too long, even when there are clear signs of insolvency (Lindgren, 2003). Since bank closures face many obstacles, there is a tendency to rely instead on blanket government guarantees which, if the government’s fiscal and political position makes them credible, can work albeit at the cost of placing the burden on the budget, typically squeezing future provision of needed public services.

The big banks have been bailed out to the tune of many trillions, dragging the economy down a bottomless pit from which we can’t escape. LINKS. Unless we break them up, we will never escape.

The Failure to Break Up the Big Banks Is Dooming Us to Depression

All independent experts agree that unless we rein in derivatives, will have another – bigger – financial crisis. But the big banks are preventing derivatives from being tamed. We have also pointed out that derivatives are still very dangerous for the economy, that the derivatives “reform” legislation previously passed has probably actually weakened existing regulations, and the legislation was “probably written by JP Morgan and Goldman Sachs“.

We’ve noted:

There is no incentive from the moneyed interests in either Washington or New York to change it…

I believe we are in a cabal. There are five or six players only who are engaged and dominant in this marketplace and apparently they own the regulatory apparatus. Everybody is afraid to regulate them.

That’s bad enough.

But Bob Litan of the Brookings Institute wrote a paper (here’s a summary) showing that – even if real derivatives legislation is ever passed – the 5 big derivatives players will still prevent any real change. James Kwak notes that Litan is no radical, but has previously written in defense in financial “innovation”.

Here’s a good summary from Rortybomb, showing that this is yet another reason to break up the too big to fails:

Here, of course, I refer to the major derivatives dealers – the top 5 dealer-banks that control virtually all of the dealer-to-dealer trades in CDS, together with a few others that participate with the top 5 in other institutions important to the derivatives market. Collectively, these institutions have the ability and incentive, if not counteracted by policy intervention, to delay, distort or impede clearing, exchange trading and transparency…

Market-makers make the most profit, however, as long as they can operate as much in the dark as is possible – so that customers don’t know the true going prices, only the dealers do. This opacity allows the dealers to keep spreads high…

In combination, these various market institutions – relating to standardization, clearing and pricing – have incentives not to rock the boat, and not to accelerate the kinds of changes that would make the derivatives market safer and more transparent. The common element among all of these institutions is strong participation, if not significant ownership, by the major dealers.

So Bob Litan is waving a giant red flag that the top dealer-banks that control the CDS market can more or less, through a variety of means he lays out convincingly in the paper, derail or significantly slow down CDS reform after the fact if it passes.

***

If you thought we’d at least get our arms around credit default swap reform from a financial reform bill, you should read this report from Litan as a giant warning flag. In case you weren’t sure if you’ve heard anyone directly lay out the case on how the market and political concentration in the United States banking sector hurts consumers and increases systemic risk through both political pressures and anticompetitive levels of control of the institutions of the market, now you have. It’s not Matt Taibbi, but it’s much further away from a “everything is actually fine and the Treasury is in control of reform” reassurance. Which should scare you, and give you yet another good reason for size caps for the major banks.

Failing to Break Up the Big Banks is Destroying America

Moreover, the big banks are still dumping huge amounts of their toxic derivatives on the taxpayer. REFERENCE And the extreme concentration of power and control over the entire global economy of a handful of large banks means that the entire system is extremely vulnerable.

Why Aren’t They Being Broken Up?

So what is the real reason that the TBTFs aren’t being broken up (and why are they 30% bigger now than before the financial “reform” law was was passed)?

Certainly, there is regulatory capture, cowardice and corruption:

Economic historian Niall Ferguson asks:

Manhattan Institute senior fellow Nicole Gelinas agrees:

Investment analyst and financial writer Yves Smith says:

William K. Black says:

The Obama administration and Fed Chairman Ben Bernanke have refused to investigate the nature and causes of the crisis. And the administration selected Timothy Geithner, who with then Treasury Secretary Paulson bungled the bailout of A.I.G. and other favored “too big to fail” institutions, to head up Treasury.

Now Lawrence Summers, head of the White House National Economic Council, and Mr. Geithner argue that no fundamental change in finance is needed. They want to recreate a secondary market in the subprime mortgages that caused trillions of dollars of losses.

Traditional neo-classical economic theory, particularly “modern finance theory,” has been proven false but economists have failed to replace it. No fundamental reform can be passed when the proponents are pretending that there really is no crisis or need for change.

Harvard professor of government Jeffry A. Frieden says:

Economic consultant Edward Harrison agrees:Regulating Wall Street has become difficult in large part because of regulatory capture.

But there is an even more interesting reason . . .

The number one reason the TBTF’s aren’t being broken up is [drumroll] . . . the ‘ole 80?s playbook is being used.

As the New York Times reports:

In other words, the nine biggest banks were all insolvent in the 1980s.

Indeed, Richard C. Koo – former economist at the Federal Reserve Bank of New York and doctoral fellow with the Fed’s Board of Governors, and now chief economist for Nomura – confirmed this fact last year in a speech to the Center for Strategic & International Studies. Specifically, Koo said that -after the Latin American crisis hit in 1982 – the New York Fed concluded that 7 out of 8 money center banks were actually “underwater” and “bankrupt”, but that the Fed hid that fact from the American people. So the government’s failure to break up the insolvent giants – even though virtually all independent experts say that is the only way to save the economy, and even though there is no good reason not to break them up – is nothing new. William K. Black’s statement that the government’s entire strategy now – as in the S&L crisis – is to cover up how bad things are (“the entire strategy is to keep people from getting the facts”) makes a lot more sense.

mother earth

(6,002 posts)been and just how intertwined these cons truly are, and to think they've been operating with little to no regulation. Every last wealthy 1%er got there on the backs of the poor and the middle class, their crimes are friggin legion, they have blood on their hands. How much money must a person acquire before he feels he has a comfortable and good life?

For Geithner to admit just how fragile the recovery is....no shit...yet their pillage and plundering still goes on.

I hope the banks become nationalized because we cannot rely on an honest free market, and the banking industry is worst than the mafia. At least the mafia acknowledged their criminality.

Fuddnik

(8,846 posts)He even admitted at his confirmation hearings that he didn't see himself as a regulator, when he was supposed to be the top, hands on regulator of Wall Street.

In Suskind's "Confidence Men", he reveals that one of Obama's first orders to Geithner was to come up with a plan to break up Citi. Geithner ignored him. At a Economic Advisors meeting several months later, which Geithner didn't attend, Obama asked how the plan was coming along. Christine Romer answered, "Mr. President, there is no plan". After the meeting Rahm chewed her a new asshole for throwing poor Timmeh to the wolves, when he wasn't there to defend himself.

Po_d Mainiac

(4,183 posts)meant "enabler" not "regulator"

Demeter

(85,373 posts)Something very interesting is happening.

There’s been so much corruption on Wall Street in recent years, and the federal government has appeared to be so deeply complicit in many of the problems, that many people have experienced something very like despair over the question of what to do about it all. But there’s something brewing that looks like it might be a blueprint to effectively take on the financial services industry: a plan to allow local governments to take on the problem of neighborhoods blighted by toxic home loans and foreclosures through the use of eminent domain. I can't speak for how well the program will work, but it's certainly been effective in scaring the hell out of Wall Street. Under the proposal, towns would essentially be seizing and condemning the man-made mess resulting from the housing bubble. Cooked up by a small group of businessmen and ex-venture capitalists, the audacious idea falls under the category of "That’s so crazy, it just might work!" One of the plan’s originators described it to me as a "four-bank pool shot."

Here’s how the New York Times described it in an article from earlier this week entitled, "California County Weighs Drastic Plan to Aid Homeowners":

Then, the idea goes, the county could cut the mortgages to the current value of the homes and resell the mortgages to a private investment firm, which would allow homeowners to lower their monthly payments and hang onto their property.

I’ve been following this story for months now – I was tipped off that this was coming earlier this past spring – and in the time since I’ve become more convinced the idea might actually work, thanks mainly to the extremely lucky accident that the plan doesn’t require the permission of anyone up in the political Olympus. Cities and towns won’t need to ask for an act of a bank-subsidized congress to do this, and they won’t need a federal judge to sign off on any settlement. They can just do it. In the Death Star of America’s financial oligarchy, the ability of local governments to use eminent domain to seize toxic debt might be the one structural flaw big enough for the rebel alliance to exploit. The plan only makes sense in the context of America’s overall economic paralysis. Right now the economy is stuck in a standstill, largely because of the housing bubble...Instead of letting everyone be slowly ground into dust under the weight of all of that debt, the idea behind the use of eminent domain is to pull the Band-Aid off all at once. The plan is being put forward by a company called Mortgage Resolution Partners, run by a venture capitalist named Steven Gluckstern. MRP absolutely has a profit motive in the plan, and much is likely to be made of that in the press as this story develops. But I doubt this ends up being entirely about money.

“What happened is, a bunch of us got together and asked ourselves what a fix of the housing/foreclosure problem would look like,” Gluckstern. “Then we asked, is there a way to fix it and make money, too. I mean, we're businessmen. Obviously, if there wasn’t a financial motive for anybody, it wouldn’t happen.”

Here’s how it works: MRP helps raise the capital a town or a county would need to essentially “buy” seized home loans from the banks and the bondholders (remember, to use eminent domain to seize property, governments must give the owners “reasonable compensation,” often interpreted as fair current market value). Once the town or county seizes the loan, it would then be owned by a legal entity set up by the local government – San Bernardino, for instance, has set up a JPA, or Joint Powers Authority, to manage the loans. At that point, the JPA is simply the new owner of the loan. It would then approach the homeowner with a choice. If, for some crazy reason, the homeowner likes the current situation, he can simply keep making his same inflated payments to the JPA. Not that this is likely, but the idea here is that nobody would force homeowners to do anything. On the other hand, the town can also offer to help the homeowner find new financing. In conjunction with companies like MRP (and the copycat firms like it that would inevitably spring up), the counties and towns would arrange for private lenders to enter the picture, and help homeowners essentially buy back his own house, only at a current market price. Just like that, the homeowner is no longer underwater and threatened with foreclosure...In order to make MRP work, Gluckstern and his partners needed to find local officials with enough stones to try the audacious plan. With so many regions in such desperate straits thanks to the housing mess, that turned out to be not as hard as perhaps might have been expected... MRP has been courting local officials in Nevada, Florida, and in parts of the Northeast. In New York, officials in Suffolk County on Long Island, where 10% of homes are underwater, are seriously considering the plan.

The role of MRP and the presence of businessmen like Gluckstern in this whole gambit is going to tempt some reporters to pitch this story as a purely financial story, and certainly it does have interest as a business headline. But MRP’s role aside, this is also a compelling political story with potentially revolutionary consequences. If this gambit actually goes forward, it will inevitably force a powerful response both from Wall Street and from its allies in federal government, setting up a cage-match showdown between lower Manhattan and, well, everywhere else in America. In fact, the first salvoes in that battle have already been fired. For instance, the Wall Street trade association, SIFMA, this past week issued a denunciation of the eminent domain plan that includes a promise of a legal challenge. “We believe the MRP proposal is unlikely to survive a judicial challenge,” one of SIFMA’s lawyers wrote. Other trade groups are lining up to describe the tactic as illegal or "unconstitutional." More insidiously, however, SIFMA pledged that its members will not allow future home loans originated in counties that use the eminent domain tactic to participate in something called the To-Be-Announced (TBA) markets for mortgage-backed securities. Explaining this would require a sharp detour into a muck of inside-baseball mortgage terminology, but the long and the short of it is that SIFMA is promising to make it difficult for any community that tries this tactic to obtain private mortgage financing in the future...Essentially, SIFMA is promising a kind of collusive financial lockout of uncooperative communities. The threat would appear to be a high-handed form of redlining that raises serious antitrust questions, but in a way, that kind of response is to be expected. Ultimately, the MRP tactic will be a fascinating test case to see exactly how much local self-determination will be allowed by the centralized financial oligarchy and its allies in the federal government. If through boycotts, collusion, federal pressure and other forms of encirclement, local governments can be stripped of their right to condemn blighted property, we’ll know that the guts have been cut out of the very idea of regional self-rule. It will be fascinating to watch. At the very least, this story has the potential to be the first true open, pitched battle between Wall Street and the homeowners and communities who have been the primary victims of financial corruption.

Tune in for more on this front soon.

Demeter

(85,373 posts)#10 is right up the road. I ate there the other night

# 9 is where I live. I didn't even know we were close to Detroit

Warpy

(111,169 posts)Real estate prices there are rock bottom, there's still no income tax, and a lot of laws there favor the elderly, especially the frail elderly.

Then again, I wasn't particularly interested in living there. It's too hot, buggy, steamy, and full of wingnuts.

Fuddnik

(8,846 posts)I'm paying $3,000 peer year for homeowners and flood (no contents coverage on the flood), and that's after I dropped sinkhole coverage, otherwise it would have been close to $6,000 per year. And that's for a $250k replacement cost.

And, they're talking about tripling it next year. If it happens, I'll be in that wave of foreclosures.

There was a state insurance back in Mass. for renter's insurance in Boston. Florida is going to have to do the same for homeowners at some point or watch everybody send in jingle mail and leave.

Fuddnik

(8,846 posts)State Farm dropped everyone in the state. Me included. Other companies too.

Citizens is the insurer of last resort. They're now the biggest in the state.

Demeter

(85,373 posts)I don't see much other option....it can't be too hard, if you've got some political pull.

Tansy_Gold

(17,847 posts)The reason the insurers got out of FL was the huge pay-outs from the hurricanes, and the potential pay-outs on the sink holes and all the other risks. The risks and potential losses would be hardly different with a co-op, only slightly less due to not having to show a profit. But one bad year would wipe them out.

Po_d Mainiac

(4,183 posts)Ain't enough co-op to cover Andrew #2

Demeter

(85,373 posts)LOTS OF OVERLAP IN THIS LIST AND THE PREVIOUS....

Demeter

(85,373 posts)...It's absolutely imperative that we begin to understand what unfettered, unregulated capitalism does, the violence of that system, which is portrayed in all of the places that we visited.

These are sacrifice zones, areas that have been destroyed for quarterly profit. And we're talking about environmentally destroyed, communities destroyed, human beings destroyed, families destroyed. And because there are no impediments left, these sacrifice zones are just going to spread outward....There's no way to control corporate power. The system has broken down, whether it's Democrat or Republican. And because of that, we've all become commodities. Just as the natural world has become a commodity that is being exploited until it is exhausted, or it collapses...The political system is bought off, the judicial system is bought off, the law enforcement system services the interests of power, they have been rendered powerless. You see that in the coal fields of Southern West Virginia. Now here, in terms of national resources is one of the richest areas of the United States. And yet these harbor the poorest pockets of community, the poorest communities in the United States. Because those resources are extracted. And that money is not funneled back into the communities that are sitting on top of, or next to those resources.

Not only that, but they're extracted in such a way that the communities themselves are destroyed quite literally because you have not only terrible problems with erosion, as they cause when they do the mountaintop removal, they'll use these gigantic bulldozers to push off all the trees and then burn them.

And when we flew over the Appalachians, and it's a terrifying experience, because you realize only then do you realize how vast the devastation is. Just as when we were both in the war in Bosnia, you couldn't grasp the destruction of ethnic cleansing until you actually flew over Bosnia, and village after village after village had been razed and destroyed. And the same was true in the Appalachian Mountains. And these people are poisoned. The water is poisoned, it smells, the soil is poisoned. And the people who are making tremendous profits from this don't even live in West Virginia--

amandabeech

(9,893 posts)were in such bad shape.

Is there anything special going on in those burbs, other than Ford being in D.H., that might make them worse than some of the other north or west burbs?

Demeter

(85,373 posts)not that it's better in the smaller ones

amandabeech

(9,893 posts)Are the Bloomfields and the Grosse Pointes having problems as well?

Foreclosures around my Mom, and there are quite a few, are generally second homes near Lake Michigan, inland lakes and in heavily forested areas. The locals, particularly the farmers, aren't having as many problems, maybe because the local banks are more conservative than the big banks that are more likely to have issued the mortgage and note on the vacation properties. We may see some problems later with smaller farmers who are dependent on fruit exclusively, like cherries, apples and sometimes peaches. The lucky ones are diversified into asparagus which was in good shape in May and early June before the worst of the drought descended. Summer veggies won't be very good unless the farmer owns or can rent irrigation equipment.

I imagine that Ann Arbor is still in pretty good shape, though. The Big U is still going although I know that the State of Michigan has drastically, drastically reduced its share of the money needed to run the place.

Demeter

(85,373 posts)and I know at least our paper was bought by Fundies for the express purpose of shutting it down as a news source.

amandabeech

(9,893 posts)and I remember your posts about the demise of the Ann Arbor News. Foreclosure listings are supposed to be published in the paper, or at least I thought. You'd probably have to call the courthouse to find out where they're listed. Maybe on the County Clerk's web page. I would think that foreclosures might be in the Free Press or Snooze one day a week unless laws have changed.

My Mom gets the Muskegon Chronicle, but it's down to 3 days a week, like the Flint Journal was. Both these areas have an older population less likely to get news from the internet. At least the paper has more pages each time it publishes, but still, it's not as good on time sensitive news. The Chronicle actually rakes muck unlike its sister paper, the Grand Rapids Press, which is all happy news. The GR TV stations are all happy news, too. My cousin who lives in GR doesn't bother to watch. He gets his sports and weather on the internet or cable. My Mom finds most of it useless, too.

I get info about my Mom's county from the weekly rural paper, which is the only one published in that county. All the real estate foreclosures for the week show up on about 3-4 pages, down from 8-11 pages during the worst of it. Many acres of farmland and woodland in my home county, as well as in neighboring counties, were carved up into lots, with the thought that everyone from Chicago, Detroit and Grand Rapids would be up in this rural county for all their vacations and for their summer residence after retirement. Obviously, that didn't happen. There are still farm fields with big signs indicating lots for sale. They'll probably revert to farmland again, after they are sold.

Demeter

(85,373 posts)...It was the first month California's foreclosure rate ranked number one since RealtyTrac began issuing its report in January of 2005.

Blomquist says the so-called "Homeowner Bill of Rights" signed into law by Governor Jerry Brown yesterday may help reduce foreclosure rates.

"I think this law will make it less likely that banks are going to repossess a property through foreclosure and more likely that they, as an alternative they'll agree to a short-sale."

Looking at mid-year data, Blomquist says California posted the nation's fourth highest state foreclosure rate in the first half of 2012 behind Nevada, Arizona and Georgia.

mother earth

(6,002 posts)Fuddnik

(8,846 posts)Truth tellers and good investigative reporters are increasingly scarce.

Years ago, who would have thought that Rolling Stone would be doing top notch reporting?

mother earth

(6,002 posts)Demeter

(85,373 posts)"Steal a little," wrote Bob Dylan, "they throw you in jail; steal a lot and they make you a king." These days, he might recraft the line to read: deal a little dope, they throw you in jail; launder the narco billions, they'll make you apologise to the US Senate. Two months ago in Washington DC, a poor black man called Edward Dorsey Sr was convicted of peddling 5.5 grams of crack cocaine. Because he was charged before a recent relative amelioration in sentencing, he was given a mandatory 10 years in jail....Last week, managers from Britain's biggest bank, HSBC, lined up before the Senate's permanent sub-committee on investigations – just across the Potomac river from the scene of Dorsey's crime – to be asked questions such as: "It took three or four years to close a suspicious account. Is there any way that should be allowed to happen?"

The "suspicious account" was that of a "casa de cambio", a currency exchange house operated in Mexico on behalf of the largest criminal syndicate in the world and one of the most savage, the Sinaloa drug-trafficking cartel. The dealings had been flagged up to HSBC bosses by an anti-money laundering officer, but to no avail – the dirty business continued. "No, senator," came the reply from a bespectacled Brit called Paul Thurston, chief executive, retail banking and wealth management, HSBC Holdings plc. The same casa de cambio, called Puebla, was known to be under investigation in another case involving the Wachovia bank during the time HSBC was entertaining its money. US authorities had seized $11m from Wachovia's Miami office, on the way to securing the biggest settlement in banking history with Wachovia in March 2010, detailed in this newspaper last year. Wachovia was fined $50m and made to surrender $110m in proven drug profits, but was shown to have inadequately monitored a staggering $376bn through the casa de cambio over four years, of which $10bn was in cash. The whistleblower in the case, an Englishman working as an anti-money laundering officer in the bank's London office, Martin Woods, was disciplined for trying to alert his superiors, and won a settlement after bringing a claim for unfair dismissal. No one from Wachovia went to jail – and, said Woods at the time of the settlement:

"These are the proceeds of murder and misery in Mexico, and of drugs sold around the world. But no one goes to jail. What does the settlement do to fight the cartels? Nothing. It encourages the cartels and anyone who wants to make money by laundering their blood dollars."

HSBC has been found to have handled $7bn in narco cash, "and this is the starter for 10", Woods now says. "We'll get the full picture over time. But what's the sanction on these banks? What's their risk? The cartels should renegotiate their charges with the banks. They're being priced for a risk element that isn't there." Wachovia was not the first, neither will HSBC be the last. Six years ago, a subsidiary of Barclays – Barclays Private Bank – was exposed as having been used to launder drug money from Colombia through five accounts linked to the infamous Medellín cartel. By an ironic twist, Barclays continued to entertain the funds after British police had become involved after a tip-off, from HSBC. And the issue is wider than drug-money. It is about where banks, law enforcement officers and the regulators – and politics and society generally – want to draw the line between the criminal and supposed "legal" economies, if there is one...

If there is a prosecution, it is always "deferred", as with Wachovia, and a Californian bank called Sigue used by HSBC to receive the Mexican drug money. Be good for a year, and we'll forget about it. Since when did the likes of Edward Dorsey of Washington enjoy that kind of leniency?....But in this newspaper – when we revealed the original "cease and desist" order against HSBC – the former head of the UN Office on Drugs and Crime, Antonio Maria Costa, posited that four pillars of the international banking system are: drug-money laundering, sanctions busting, tax evasion and arms trafficking.

.....................................................................................................................................

Herein, along with Dylan's dictum, lies the problem. We don't think of those banking barons as the financial services wing of the Sinaloa cartel. The stark truth is that the cartels' best friends are those people in pin-stripes who, after a rap on the knuckles, return to their golf in Connecticut and drinks parties in Holland Park. The notion of any dichotomy between the global criminal economy and the "legal" one is fantasy. Worse, it is a lie. They are seamless, mutually interdependent – one and the same.

Demeter

(85,373 posts)The Obama Justice Department is in theater mode, again, pretending to threaten the bankster class with criminal penalties – prison time! – for their manipulation of the global economy’s benchmark interest rates. The Justice Department claims to be building criminal and civil cases in the LIBOR scandal, which in sheer scope is the biggest fraud by international capital in history. But that’s all a front, a farce. Barack Obama has spent his entire presidency protecting Wall Street, starting with his rescue of George Bush’s bank bailout bill after it’s initial defeat in Congress, in the last days of Obama’s candidacy. He packed his administration with banksters, passed his own bailout and, in collaboration with the Federal Reserve, channeled at least $16 trillion dollars into the accounts of U.S. and even European banks – by far the greatest transfer of capital in the history of the world. Obama has reminded the banksters that it was he who saved them from the “pitchforks” of an outraged public. He pushed through Congress so-called financial reform legislation that left derivatives – the deadly instruments of mass financial destruction that were at the heart of the meltdown – untouched.

Wall Street may or may not remain loyal to Obama, but Obama has been loyal to Wall Street, the guys who gave him the campaign cash to become a viable candidate. His Attorney General, Eric Holder, a corporate lawyer to the core, is busily staging a pre-emptive LIBOR prosecution of bankers in order to shield them from legal action by a host of other government agencies and, ultimately, from the global universe of parties that have been harmed by the bankster’s schemes– a list that stretches to infinity. Holder’s job is to monopolize the LIBOR case, to the extent legally and humanly possible, grabbing jurisdiction and consolidating the cases against the banks with the aim of reaching a settlement that does not further destabilize the financial system.

Holder and his boss already pulled that trick earlier this year with settlement of the bank “robo-signing” scandal – a scheme that would have ranked as the “crime of the century” until LIBOR came along. A small group of state attorney generals were holding up an administration-brokered settlement that effectively gave the banksters immunity from prosecution, in return for a measly $25 billion payout. Obama used every power of his office to pressure the state law officers into line. The last one capitulated with a promise from Obama that a “special unit of prosecutors” would expand the investigation into abusive mortgages practices. You haven’t heard a peep about it, since.

Now Obama and Holder are playing the same diversionary game, making tough noises about criminal investigations of the LIBOR conspirators. But the Justice Department has already given immunity to Barclay’s Bank, of Britain, and to the Swiss banking giant UBS. More immunities will follow. The reason Eric Holder is staging criminal investigations is because that’s the only way he can protect the bankers, through immunities and by gradually narrowing the scope of the case. In the end, there will be settlements all around, and the banksters will move on to even more fantastic heights of criminality – thanks to the loyal, protective hands of President Obama.

Demeter

(85,373 posts)The article about the Libor scandal, coauthored with Nomi Prins, received much attention, with Internet repostings, foreign translation, and video interviews. To further clarify the situation, this article brings to the forefront implications that might not be obvious to those without insider experience and knowledge.

The price of Treasury bonds is supported by the Federal Reserve’s large purchases. The Federal Reserve’s purchases are often misread as demand arising from a “flight to quality” due to concern about the EU sovereign debt problem and possible failure of the euro. Another rationale used to explain the demand for Treasuries despite their negative yield is the “flight to safety.” A 2% yield on a Treasury bond is less of a negative interest rate than the yield of a few basis points on a bank CD, and the US government, unlike banks, can use its central bank to print the money to pay off its debts.

It is possible that some investors purchase Treasuries for these reasons. However, the “safety” and “flight to quality” explanations could not exist if interest rates were rising or were expected to rise. The Federal Reserve prevents the rise in interest rates and decline in bond prices, which normally result from continually issuing new debt in enormous quantities at negative interest rates, by announcing that it has a low interest rate policy and will purchase bonds to keep bond prices high. Without this Fed policy, there could be no flight to safety or quality. It is the prospect of ever lower interest rates that causes investors to purchase bonds that do not pay a real rate of interest. Bond purchasers make up for the negative interest rate by the rise in price in the bonds caused by the next round of low interest rates. As the Federal Reserve and the banks drive down the interest rate, the issued bonds rise in value, and their purchasers enjoy capital gains.

As the Federal Reserve and the Bank of England are themselves fixing interest rates at historic lows in order to mask the insolvency of their respective banking systems, they naturally do not object that the banks themselves contribute to the success of this policy by fixing the LIbor rate and by selling massive amounts of interest rate swaps, a way of shorting interest rates and driving them down or preventing them from rising. The lower is Libor, the higher is the price or evaluations of floating-rate debt instruments, such as CDOs, and thus the stronger the banks’ balance sheets appear. Does this mean that the US and UK financial systems can only be kept afloat by fraud that harms purchasers of interest rate swaps, which include municipalities advised by sellers of interest rate swaps, and those with saving accounts? The answer is yes, but the Libor scandal is only a small part of the interest rate rigging scandal. The Federal Reserve itself has been rigging interest rates. How else could debt issued in profusion be bearing negative interest rates?

BLANKET INDICTMENT OF RUBIN, GREENSPAN, AND THEIR ENABLERS FOLLOWS

...The ongoing crisis cannot be addressed without restoring the laws and regulations that were repealed and discarded. But putting Humpty-Dumpty back together again is an enormous task full of its own perils...

CONCLUSION: A HORRIFIC DETHRONING OF THE DOLLAR AND THE END OF THE WORLD (AS WE KNOW AND HATE IT) MUST READ

Demeter

(85,373 posts)The rate-manipulation scandal has demonstrated that banks will collude with one another for their own benefit. Banks didn't report the rate at which they were borrowing from other institutions. They could report a made-up rate that, not surprisingly, turned out to serve their economic interests at the time. So, it might come as a worry that there is another, multitrillion-dollar market - the credit-default swap market - that operates under a similar principle. Credit-default swaps are insurance-like derivatives, or side bets, that protect investors from bad events like a company going bankrupt or a country failing to pay its debts.

Whether a company has defaulted on its debt might seem unambiguous to some naïve souls out there. But that's hardly the case, especially when there are lawyers involved and billions of dollars at stake. Because credit-default swap contracts can be worthless when they expire, the timing of insolvencies can make the difference between making and losing a great deal of money. Decisions about when a swap pays out are made by a trade group called the determinations committee of the International Swaps and Derivatives Association. The mere fact that a determinations committee exists is evidence that "insolvency" is not simple to define. Sure, credit-default swaps are products for grown-ups. Sophisticated investors play in this market. Foster children and the infirm are not putting their life savings into this market directly.

But they matter to corporations and countries. When Europe tried to bail out Greece, an enormous debate sprang up about whether the restructuring of Greece's debt was technically considered a "default." Initially, the committee said it wasn't. Then, after some details shifted, the committee ruled it was. A proper market would want an organization that was impartial, regulated, transparent and open to appeal. No such luck. The determinations committee has 15 members, 10 of which are the major dealers in credit-default swaps, the giant banks that are effectively permanent members. One criterion for dealer members is that they trade a certain amount of derivatives. After the 2008 financial crisis, there are fewer such firms, and they have consolidated their influence and power over our capital markets. The committee operates as a quasi-Star Chamber. It makes decisions without having to publish its reasoning and almost never has. There isn't any appeal process. The committee itself says it isn't bound by precedent....The biggest concern is that there's no prohibition against committee members deciding cases in which they may well have an economic interest. There is no recusal process. Indeed, it is almost impossible for the major dealers to not have a stake in the outcomes, since they are the major dealers.

A spokesman for the association contended that "there are safeguards built into the process which work to support integrity of process." The voting, if not the reasoning behind it, is publicly disclosed. The committee requires a supermajority for decisions, 12 of the 15 votes, so the dealers can't gang up on the other members. And it's entirely possible that banks might be on different sides of a trade, with some banks having sold protection and some having bought it. The hope would be that the conflicts of interest cancel each other out.

To the market's credit, there is no evidence that the process has become corrupted by big banks. Given the evidence of collusion in the rate-manipulation case, however, trusting it to remain that way doesn't seem like a good plan...

I SAY GIVE IT A WEEK.

Demeter

(85,373 posts)U.S. prosecutors and European regulators are close to arresting individual traders and charging them with colluding to manipulate global benchmark interest rates, according to people familiar with a sweeping investigation into the rate-rigging scandal. Federal prosecutors in Washington, D.C., have recently contacted lawyers representing some of the individuals under suspicion to notify them that criminal charges and arrests could be imminent, said two of those sources who asked not to be identified because the investigation is ongoing.

Defense lawyers, some of whom represent individuals under suspicion, said prosecutors have indicated they plan to begin making arrests and filing criminal charges in the next few weeks. In long-running financial investigations it is not uncommon for prosecutors to contact defense lawyers for individuals before filing charges to offer them a chance to cooperate or take a plea, these lawyer said.

The prospect of charges and arrests of individuals means that prosecutors are getting a fuller picture of how traders at major banks allegedly sought to influence the London Interbank Offered Rate, or Libor, and other global rates that underpin hundreds of trillions of dollars in assets. The criminal charges would come alongside efforts by regulators to punish major banks with fines, and could show that the alleged activity was not rampant in the banks.

"The individual criminal charges have no impact on the regulatory moves against the banks," said a European source familiar with the matter. "But banks are hoping that at least regulators will see that the scandal was mainly due to individual misbehavior of a gang of traders."

In Europe, financial regulators are focusing on a ring of traders from several European banks who allegedly sought to rig benchmark interest rates such as Libor, said the European source familiar with the investigation in Europe...

"More than a handful of traders at different banks are involved," said the source familiar with the investigation by European regulators. There are also probes in Europe concerning Euribor, the Euro Interbank Offered Rate...In the United States, the regulatory investigation is being led by the Commodity Futures Trading Commission, which has made the Libor probe one of its top priorities.

MUCH MORE AT LINK

Demeter

(85,373 posts)Last edited Sun Jul 22, 2012, 08:53 PM - Edit history (1)

http://news.yahoo.com/former-stanford-exec-says-limbo-sec-case-drags-143243472--finance.htmlBernerd Young has waited more than two years for a final decision from U.S. securities regulators about whether he will be charged over his role as compliance officer at the brokerage owned by convicted Ponzi schemer Allen Stanford. In those two years, Young says his life has been put on hold as the cloud of the Securities and Exchange Commission probe has overshadowed his attempts to move on professionally. MGL Consulting, where he is currently chief executive officer, has lost 20 percent of its clients, filed for bankruptcy and had regulators kill the firm's expansion plans - all driven by the stigma of the probe, Young says. In his first media interview since the discovery of Allen Stanford's $7 billion Ponzi scheme in 2009, Young and his attorney told Reuters they believe the SEC's stalling has unfairly denied him his right to due process.

...Allen Stanford was sentenced in June to 110 years in prison for bilking investors with fraudulent certificates of deposit issued by his Stanford International Bank in Antigua. Since then, the SEC has continued to build cases against four executives and at least three lower-level financial advisers who worked for Allen Stanford's U.S. brokerage, Stanford Group Co, according to public records and people familiar with the matter. But legal disagreements among SEC officials and recusals by some of the commissioners have fueled delays that have left both the potential defendants and the victims of Stanford's Ponzi scheme in limbo. The SEC has postponed a vote on the cases multiple times, even though it has been 25 months since Young first received a "Wells notice", which indicates the SEC plans to recommend charges and gives the defendant the chance to rebut them. The 2010 Dodd-Frank law gave the SEC six months to make a final decision after sending a Wells notice, but SEC lawyers can seek extensions, which they have done in Young's case. Prior to Dodd-Frank, there were no specific time limits. The provision was included in the law to speed up SEC cases that could otherwise drag on for years...

Of the four executives, Young is perhaps the most well-known because he was previously a regulator with the Dallas office of the National Association of Securities Dealers (NASD), or what is now the Financial Industry Regulatory Authority (FINRA). At the time he worked there, SEC Chairman Mary Schapiro and Democratic Commissioner Elisse Walter were high-ranking officials at NASD. According to Young's attorney and documents reviewed by Reuters, the two were involved in a decision to remove Young from his position at NASD in 2003. Both have since recused themselves on Young's case, leaving only three commissioners to make a decision. Delays were later exacerbated after one commissioner departed in August 2011, and was not replaced until November. Agency lawyers have also disagreed over how much due diligence the potential defendants should have conducted before selling the CDs, and whether lower-level financial advisers could be liable if they relied on senior management. People familiar with the SEC's thinking say the agency is leaning toward dropping charges against the lower-level people, but still bringing cases against the four executives: Young; Jason Green, the former Louisiana branch manager who later oversaw parts of the private client group; former Stanford Group Co president Daniel Bogar; and former Houston branch executive director Jay Comeaux, these people said. Dan Hedges, an attorney for Comeaux, said his client hopes to reach a settlement with the SEC. John Kincade, a lawyer for Green, declined to comment. In testimony during Stanford's criminal trial, Green acknowledged being under investigation by the SEC, but said he was "hopeful" the SEC would not bring its case. Tom Taylor, a lawyer for Bogar, said his client is trying to be patient and recognizes that the case is complex...The SEC's latest 180-day extension on the case is set to expire in September. The SEC could take a vote soon, people familiar with the matter said.

YOUNG'S STORY

Young was on the 12th floor of Stanford's Houston office when he says he first learned the truth about Allen Stanford's fraudulent CDs. It was February 17, 2009. Bogar had just convened an emergency meeting with Young and other Stanford executives. Just a week prior, Young said Bogar had told him there was a "problem" with the CD disclosure documents, but Bogar had refused to provide any details. Young hoped the meeting would shed more light. He was unprepared, however, when Bogar told the group that the Stanford International Bank portfolio consisted of at least $1.6 billion in personal loans to Allen Stanford, Young said. "The reactions around the room were just as you can imagine. Oh-my-God," Young said. "People on the phone broke down crying." As the group of executives left the conference room to take a small break, the office was raided by federal agents. Helicopters flew overhead and TV cameras were already set up. He says everyone was told to go back to their desks, take their car keys and leave everything behind - even their morning coffee. It was not until roughly one year later, he says, that the SEC came knocking. Two SEC staffers met him in a Houston hotel conference room armed with binders they said contained evidence that Young's actions had led investors to think incorrectly that their deposits were insured...

MORE AT LINK

Demeter

(85,373 posts)THE COMPLETE AUDIO BOOK--AT LINK

http://www.informationclearinghouse.info/article22922.htm

Now I need a way to move them to my Nook or phone.

I've read the book a couple of times, and still use it for reference. But, the book is so important that it needs to be studied carefully/

Demeter

(85,373 posts)Motorists may have been paying too much for their petrol because banks and other traders are likely to have tried to manipulate oil prices in the same way they rigged interest rates, an official report has warned.

Concerns are growing about the reliability of oil prices, after a report for the G20 found the market is wide open to “manipulation or distortion”. Traders from banks, oil companies or hedge funds have an “incentive” to distort the market and are likely to try to report false prices, it said. (UK)Politicians and fuel campaigners last night urged the Government to expand its inquiry into the Libor scandal to see whether oil prices have also been falsely pushed up.

They warned any efforts to rig the oil price would affect how much drivers pay at the pump, which soared to a record high of 137p per litre of unleaded earlier this year. Robert Halfon, who led a group of 100 MPs calling for lower fuel prices, said the matter “needs to be looked at by the Bank of England urgently...We need to know whether the oil price has been manipulated in a similar way to Libor,” the MP for Harlow said. “This impacts on millions of people all round the country concerned about the price of petrol at the pumps.”

Petrol retailers use oil price “benchmarks” to decide how much to pay for future supplies. The rate is calculated by data companies based on submissions from firms which trade oil on a daily basis – such as banks, hedge funds and energy companies. However, like Libor – the interest rate measure that Barclays was earlier this month found to have rigged – the market is unregulated and relies on the honesty of the firms to submit accurate data about all their trades... there are four main differences between oil prices and Libor – the quality of its data, its independence, competition between reporting agencies and the transparency of its methodology.

MUCH MORE

Demeter

(85,373 posts)I would say they were entitled to be cranky, though, for at least a half-life....

Fuddnik

(8,846 posts)Demeter

(85,373 posts)Last edited Mon Jul 23, 2012, 08:14 AM - Edit history (1)

Well, I'm sure we will see stocks climb another 200 pts today....maybe not. Futures down 150 at 7:45.

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Euro ebbs below $1.21 before recovery; crude and gold futures sag...

Demeter

(85,373 posts)Demeter

(85,373 posts)Zoe Chace has an informative but tonally off piece about how the European Central Bank has decided to stop doing its job and start making decisions outside the scope of its formal authority instead.

The way this works is pretty simple. Central banks are supposed to stabilize demand. Stabilizing demand properly is crucially important to short-term economic growth. But in the long-term, other things matter much more than demand stabilization. Smart politicians don't want to have their country's short-term growth prospects crushed by inappropriate monetary policy. And smart economists know that long-term growth is the most important thing of all. So since central banks are staffed by smart economists, it's tempting to do what the European Central Bank is doing and simply forget about stabilizing aggregate demand correctly and instead use monetary policy as a weapon.

As Chace puts it:

Thanks to its unusual powers, the ECB has succeeded in forcing European governments to do things they otherwise might not have.

There are many problems with this approach, starting with the fact that it's illegal. For one thing, it completely blurs the lines of democratic accountability and will ultimately undermine the wellsprings of good governance. This is important, because even though the European Central Bank staff certainly seems to think it knows what the secrets are to long-term growth, the fact of the matter is that this is very controversial. We're used to hearing people of a "progressive" bent talking about stimulus while more conservative types talk about structural reform, but two can play at this game. Take Jeffrey Sachs, for example, who's basically doing the same thing from the left and insisting that it would somehow be wrong to solve America's demand shortfall unless we first embrace an ambitious eco-egalitarian economic reform agenda.

These are important questions; they're questions that national legislatures have to sort out. Central bankers have to stick to a relatively narrow set of goals and be held accountable when they fail to meet those goals.

Demeter

(85,373 posts)For however many minutes, I am grateful.

the wunderground site doesn't even know it. Ever since they sold out, I've been afraid of this...

It is, however, rapidly approaching 80F at 8 AM...high of 102 predicted. Goddess help me.

Demeter

(85,373 posts)maybe it will come back. The clouds are very dark still.

Roland99

(53,342 posts)rained pretty good for about 30 min. right after I thought about mowing the lawn.

oh well.

btw, where's the mega-caffeinated tea this morning? ![]()

Roland99

(53,342 posts)DOW -1.3%

NASDAQ -1.4% [/font]

Europe:

[font color="red"] FTSE 100 5,538 -114 -2.02%

DAX 6,490 -140 -2.11%

CAC 40 3,124 -70 -2.20%

FTSE MIB 12,636 -431 -3.30%

IBEX 35 6,034 -212 -3.40%

Stoxx 600 253 -5 -2.13% [/font]

Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)xchrom

(108,903 posts)

Demeter

(85,373 posts)How are you doing, X?

xchrom

(108,903 posts)i really want to start making home made pizzas again -- so i've got my cook books out.

how about you -- is the humidity still getting under your skin?

the humidity has been terrible here -- and for all that we get SOME rain but not enough.

Demeter

(85,373 posts)The weather may be the straw that breaks the camel's back. Or the Kid.

One or the other, but not both, I could cope with. Time for a new plan...

xchrom

(108,903 posts)sorry miss demeter...hang in there.![]()

Demeter

(85,373 posts)the minute I walk out in the sun. I don't recall feeling this way until recently. Either my skin is thinner, or the sun's rays are much hotter and damaging, or both.

After all, I'm wearing as little as possible to begin with, and sweating even so; the burning is injury to the insult.

xchrom

(108,903 posts)but if i stand outside -- just stand -- i'm wet with sweat like it was.

and yes -- that burns!

Tansy_Gold

(17,847 posts)Thin crust, so it bakes up crispy and light yet yeasty, not floury. Know what I mean?

Demeter

(85,373 posts)With the exception of my grandmother's holiday egg bread, which is very sensitive to water content, since it's so heavy with extra ingredients (raisins, butter, milk, eggs, orange and lemon peel) that too much water will make it not rise at all....

xchrom

(108,903 posts)The key to a really good pizza is, of course, the crust. We make pizza at our house at least once a week, so you can be sure this recipe comes to you after years of very meticulous and scientific kitchen testing! We think we've got it just about the way we like it.

Plus, the fact that it comes together in a few minutes and doesn't need time to rise means that we can throw it together any night of the week! Thoughts on pizza-making below, as well recipes for dough, sauce, and topping inspiration!

This crust has a bit of crunch, but it's pliable enough to fold in half if required. The mild wheat flavor is a nice backdrop to whatever toppings you want to layer on top.

Since we're keeping the crust on the thinner side, this dough doesn't actually require time to rise. You roll it out after kneading it briefly and let it rest on the counter while you prepare the toppings. When it goes in the oven, the heat gives the bread a quick burst of rising so it will still have some chew when you bite into it.

For extra depth of flavor or if you're planning ahead for meals, you can refrigerate the dough overnight or up to 48 hours. This gives the dough a slightly sweet flavor and a more crackling crust. Once you've finished kneading, divide the dough in two and store it in separate containers or zipper bags. When you're ready to make your pizza, take the dough out of the fridge and let it warm up a bit while you prepare the toppings--ten minutes or so should do it.

Home-made Thin Crust Pizza

Makes 2 pizzas

For the dough:

3/4 cups (6 ounces) of water

1/2 teaspoon of active-dry yeast (if using instant yeast, you don't need to dissolve it during the first step)

2 cups (10 ounces) unbleached all-purpose flour

1/2 tsp salt

Tansy_Gold

(17,847 posts)I think I'll try that one night this week. I am soooooooo hungry for a good pizza!!!!!

xchrom

(108,903 posts)once you're patient enough to churn out the dough -- it's just so much better than pizza you get out.

you wouldn't think so but it is.

Tansy_Gold

(17,847 posts)

Demeter

(85,373 posts)xchrom

(108,903 posts)

Tansy_Gold

(17,847 posts)As I wrote last week, my Great-aunt Minna gave the jewelry to me as a gift for my 16th birthday. She said she had bought them in Italy. A few weeks later, she and Great-uncle Leonard took me out to dinner to a "fancy" restaurant -- which then became a sort of tradition which they did with my girl cousins and sister when they reached 16 -- and I wore an emerald green satin dress, that being the fanciest thing I owned. It was EXACTLY that color!

xchrom

(108,903 posts)they really are just too wonderful.

isn't it amazing what they do with that stuff?

Demeter

(85,373 posts)The Consumer Financial Protection Bureau announced on last Monday that it would begin supervising the leading credit bureaus, the companies that collect financial details of everyone's life. The bureau will oversee and make rules covering about 30 credit reporting companies, representing 94 percent of the $4 billion credit reporting market. The rules will apply to the three big credit reporting firms - Equifax, Experian and TransUnion - and others with more than $7 million in annual revenue. The credit reporting companies already must abide by the Fair Credit Reporting Act and they have also been subject to Congressional oversight, but they lacked a single federal overseer, said the bureau's director, Richard Cordray.

"The fact that this industry has never before been subject to any federal supervision means there's a lot we don't know about it," Mr. Cordray said in an interview Monday morning.

Credit reports have increasing importance in consumers' lives because they are used in many kinds of lending, by landlords in renting a property and even as a way to screen job applicants. And various reports have found that up to 25 percent of credit reports contain errors that could hurt consumers' ability to borrow. Among the common mistakes in credit reports, according to the consumer agency, are loans and credit cards the person never opened, accounts inaccurately shown as late or with incorrect credit limits, delinquency dates and Social Security numbers....

The credit bureaus join mortgage brokers, payday lenders and credit card companies among the institutions beyond banks that the bureau regulates. The agency itself was a creation of the sweeping Dodd-Frank financial reform law in 2010. This move is the first in a series of rule-makings to define "larger participants" among consumer financial companies, the bureau said.

The supervision of credit reporting agencies will start Sept. 30, and the bureau will begin on-site examinations after that. The bureau already is supervising loan originators, mortgage servicing companies and payday lenders.

Roland99

(53,342 posts)Demeter

(85,373 posts)as in, there is none. Except commodities: land, oil, gold, etc.

Roland99

(53,342 posts)seems nothing is safe today.

Demeter

(85,373 posts)It would be interesting to see some statistics on volume. These are futures, anyway, and we know how little that means.

Demeter

(85,373 posts)...The deleveraging process at eurozone banks is reshaping the US banking landscape. Lawyers, bankers and analysts say that many of the spoils of eurozone turmoil have gone to US banks, their Canadian competitors or specialised private equity groups and hedge funds, with Chinese operators also ramping up US operations.

For example, Wells Fargo and JPMorgan Chase, two of the biggest US banks, last year bought a portion of a $9.5bn portfolio of commercial real estate loans sold by Anglo Irish, the nationalised Irish bank. Capital One, the US bank, bought the US online banking business of ING, the Dutch lender. France and Germany, led by BNP Paribas and Deutsche Bank, still have some of the biggest foreign operations in the US. But French financial groups including BNP, Crédit Agricole and Société Générale have announced plans to shrink their balance sheets. US assets owned by German banks have fallen from their $427bn peak in 2007, to $267bn as of March. Assets held in the US by French bank-owned offices have fallen from $420bn in December 2007 to $373bn, according to the latest Fed data. The pullback by banks from smaller eurozone countries is even more stark, as their banking systems come under severe pressure. US assets owned by Irish banks plunged from $130bn in September 2008 to $3.6bn as of March.

Wells has been one of the more active US banks in buying assets from European competitors. The company recently snapped up a $6bn loan portfolio from WestLB, the troubled German Landesbank, as well as the North American energy business of France’s BNP...

xchrom

(108,903 posts)

Markets around the world are getting crushed. Investors and traders seem to be freaking out again about the euro crisis. Greek and Spanish stock markets are getting slammed.

And it looks like things could be just as ugly in the U.S. markets when they trade today. Futures are currently signaling an ugly open.

Dow futures are down 150 points.

S&P 500 futures are down 15 points.

Nasdaq futures are down 33 points.

Energy and agricultural commodities are all down. Here's a roundup of the futures markets courtesy of FinViz.

Read more: http://www.businessinsider.com/us-futures-2012-7#ixzz21Ru3eKeC

Demeter

(85,373 posts)... "Money" in the real world is a piece of paper (or electronic version of the same) that is a promissory note - a promise to pay you - that legally must be accepted by anyone to whom it is given to settle a debt. Behind this promise is the federal government in two very big ways: First, the government itself stands behind the promise as the party that will pay what it says it will pay on the piece of paper. Second, the government ensures that everyone must accept this promise if the piece of paper is handed over when you buy something or settle a debt...Some "authority" must have the power to issue or authorize the issuing of "promises to pay that must be accepted" - i.e. to "create" money. In the United States that "authority" is called the Federal Reserve ("the Fed"