Economy

Related: About this forumWeekend Economists Examine (E)sc(h)atology January 24-26, 2014

WEE are What?

...Karl Quilter spent much of his life carefully and painstakingly sculpting out of clay the mold for what would eventually be cast into the golden angel perched atop The Church of Jesus Christ of Latter-day Saints temples. All but an estimated 10 or so Angel Moroni sculptures on temples worldwide are Quilter’s work, said his daughter, Elizabeth Quilter Finlinson...

http://www.huffingtonpost.com/2013/12/03/karl-a-quilter-dead_n_4378019.html

This beautiful grieving angel, draped over the grave of Emelyn Story, was the last work of her husband, the American sculptor, William W. Story, created in 1895 in her memory in the same year of her death.

The word arises from the Greek ἔ??????/ἐ??ά??/ἔ??????, eschatos/eschatē/eschaton meaning "last" and -logy meaning "the study of", first used in English around 1550. The Oxford English Dictionary defines eschatology as "The department of theological science concerned with ‘the four last things: death, judgment, heaven and hell’."

In the context of mysticism, the phrase refers metaphorically to the end of ordinary reality and reunion with the Divine. In many religions it is taught as an existing future event prophesied in sacred texts or folklore. More broadly, eschatology may encompass related concepts such as the Messiah or Messianic Age, the end time, and the end of days.

History is often divided into "ages" (Gk. aeons), which are time periods each with certain commonalities. One age comes to an end and a new age, where different realities are present, begins. When such transitions from one age to another are the subject of eschatological discussion, the phrase, "end of the world", is replaced by "end of the age", "end of an era", or "end of life as we know it". Much apocalyptic fiction does not deal with the "end of time" but rather with the end of a certain period of time, the end of life as it is now, and the beginning of a new period of time. It is usually a crisis that brings an end to current reality and ushers in a new way of living, thinking, or being. This crisis may take the form of the intervention of a deity in history, a war, a change in the environment, or the reaching of a new level of consciousness.

Most modern eschatology and apocalypticism, both religious and secular, involve the violent disruption or destruction of the world; whereas Christian and Jewish eschatologies view the end times as the consummation or perfection of God's creation of the world. For example, according to ancient Hebrew belief, life takes a linear (and not cyclical) path; the world began with God and is constantly headed toward God’s final goal for creation, which is the world to come.

Eschatologies vary as to their degree of optimism or pessimism about the future. In some eschatologies, conditions are better for some and worse for others, e.g. "heaven and hell"...

Not to be confused with Scatology....

http://en.wikipedia.org/wiki/Eschatology

To spare you the need to Google it:

Scatology

In medicine and biology, scatology or coprology is the study of feces.

Scatological studies allow one to determine a wide range of biological information about a creature, including its diet (and thus where it has been), healthiness, and diseases such as tapeworms. The word derives from the Greek ??ώ? (genitive ????ό?, modern ????ό, pl. ????ά

http://en.wikipedia.org/wiki/Scatology

We'll explore on both sides of this pair....for what else is Economics, but a combination of the two?

This astonishing sculpture forms part of Barcelona’s Poblenou Cemetery. The Kiss of Death (El Petó de la Mort in Catalan and El beso de la muerte in Spanish) dates back to 1930. A winged skeleton bestows a kiss on the forehead of a handsome young man: is it ecstasy on his face or resignation? Little wonder the sculpture elicits strong and varying responses from whoever gazes upon it....

http://www.kuriositas.com/2012/03/kiss-of-death.html

Demeter

(85,373 posts)Panic at how good a recovery the global economy is making sent markets across the world plunging this week. Investors are piling into Treasuries, it is said, and yields dropping.

The end of QE4ever has brought an end to the party with a bang. I'm sure there will be a whimper following at some point.

As soon as somebody posts a summary, I will bring to your attention.

Meanwhile, back at the FDIC...WE HAVE ANOTHER BANK FAILURE! Imagine that!

The Bank of Union, El Reno, Oklahoma, was closed today by the Oklahoma State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with BancFirst, Oklahoma City, Oklahoma, to assume all of the deposits of The Bank of Union. The two branches of The Bank of Union will reopen as branches of BancFirst during their normal business hours...

As of September 30, 2013, The Bank of Union had approximately $331.4 million in total assets and $328.8 million in total deposits. In addition to assuming all of the deposits of the failed bank, BancFirst agreed to purchase approximately $225.5 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $70.0 million. Compared to other alternatives, BancFirst's acquisition was the least costly resolution for the FDIC's DIF. The Bank of Union is the second FDIC-insured institution to fail in the nation this year, and the first in Oklahoma. The last FDIC-insured institution closed in the state was First Capital Bank, Kingfisher, on June 8, 2012.

Demeter

(85,373 posts)Demeter

(85,373 posts)A DAY LATE AND A DOLLAR SHORT, METHINKS.

http://www.reuters.com/article/2014/01/23/us-imf-banks-warning-idUSBREA0M1KF20140123

Big banks still pose a threat to the world financial system because there is a general assumption that governments will come to their rescue in case of trouble, an International Monetary Fund executive said on Thursday.

"It is astonishing that officials in countries are still largely ill-equipped to deal with a Lehman Brothers-style bankruptcy, where assets and liabilities are scattered across multiple jurisdictions and entities," Jose Vinals, tasked with financial oversight at the IMF, said in a blog post.

The 2008 bankruptcy of investment bank Lehman Brothers marked the height of the global credit crisis, and many of the reforms that have since been implemented were aimed at preventing a repeat of such a collapse. During the financial crisis, a number of the world's big banks were bailed out by governments with billions of dollars in taxpayer money.

"The not-so-good news is that, despite these efforts, implicit subsidies to these systemically important financial institutions remain too large," Vinals said, who said a related IMF study was due in April.

The problem of so-called too-big-to-fail banks is a priority for regulators in the Group of 20, which is due to convene in November and expected to discuss a global financial reform agenda, Vinals said.

The G20 includes Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, the Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the UK, the United States and the European Union. The Basel III bank capital rules require banks to borrow less to fund their business, so they are better able to deal with problems. Governments have also told banks to draw up plans that would enable them to systematically unwind their businesses if the necessity arose. The United States and Europe are putting into place so-called resolution authorities that would protect the wider financial system without the use of taxpayer funds in the event a bank needed to be bailed out.

Vinals said the G20 had "yet to do much of the heavy lifting" to sort out what would happen if a bank with major operations abroad were to go under.

Demeter

(85,373 posts)ERIC HOLDER GOT RELIGION! WHAT AREN'T THEY TELLING US? SOMEBODY CALL EDWARD SNOWDEN...

http://news.yahoo.com/no-bank-too-big-indict-u-attorney-general-144841971--sector.html

No American financial institution is too large to indict and no bank executive immune from criminal prosecution, Attorney General Eric Holder said in a television interview. In an interview with MSNBC scheduled to be broadcast on Friday, Holder cited the case against JPMorgan Chase & Co, which in November agreed to a civil settlement under which it would pay $13 billion to end a series of government investigations into its marketing and sale of mortgage-backed securities. The settlement with JPMorgan, the largest U.S. bank, allowed prosecutors to pursue criminal charges if warranted, and that investigation is ongoing.

"There are no institutions that are too big to indict," Holder said, according to an MSNBC transcript released before the interview.

"There are no individuals who are in such high level positions that they cannot be indicted, criminally investigated," he said.

The Justice Department is investigating "significant financial institutions," Holder said without elaborating.

"And the focus of those investigations is not only on the institutions but on individuals as well," he told MSNBC.

Holder told Reuters in December the Justice Department plans to bring civil mortgage fraud cases against several financial institutions early in 2014, using the JPMorgan case as a template.

TRULY, THE END TIME APPROACHETH

Hotler

(11,420 posts)For us not the bankers.

Dear Mr. Holder,

Civil suit, really? Jamie Dimon and his fellow bankers need to be rotting in prison. Wall ST. bankers need to be treated like drug dealers. Speaking of drugs. It is well known that pot and cocaine flows freely through the halls of Wall St. I you can't send them to jail for fraud send them to jail for drugs. It should be real easy for you since you go after pot smokers all the time.

Sincerely,

Hotler

Demeter

(85,373 posts)to suffer like a normal person, would you? In fact, I was called some AWFUL names here on DU for saying just that....see this, and the whole thread...

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=4382437

Hotler

(11,420 posts)And some wonder why we in SMW refer to GD as Jones Town. Any more when I venture in to GD I ask myself, Who are these people?????![]()

Demeter

(85,373 posts)Panache and all.

Demeter

(85,373 posts)SAY WHAT?

http://news.yahoo.com/senators-urge-fannie-freddie-aid-lower-income-households-191527352--sector.html

More than 30 Democrats in the U.S. Senate called on Friday for the regulator of government-controlled Fannie Mae and Freddie Mac to direct the companies to resume contributions for affordable housing initiatives. The senators focused on two unused funds that Congress established in 2008 to finance low-income housing with a portion of Fannie Mae and Freddie Mac's revenue. The Federal Housing Finance Agency, the companies' regulator, suspended payments into the funds in November of that year, after the government seized the companies as mortgage losses mounted.

After suffering huge losses, the companies have turned the corner and are now seeing record profits. The 33 lawmakers, led by Democrats Jack Reed of Rhode Island and Elizabeth Warren of Massachusetts and independent Bernie Sanders of Vermont, want the agency to resume contributing to the fund to help ameliorate a shortage of affordable housing for low-income Americans.

"The time is long overdue to lift the current suspension of contributions, and we ask your full and fair consideration of our request," the letter to newly installed FHFA Director Mel Watt said.

Fannie Mae and Freddie Mac have taken $187.5 billion in U.S. aid since they became state wards in September 2008. They have since paid about $185.2 billion in dividends to the government thanks to a surge in the U.S. housing market...Congress created the two housing trust funds to build a revenue source for low-income housing. The trust funds provide funds to finance new rental housing or rehabilitate existing units for families with very low incomes....President Barack Obama and lawmakers from both parties have said they want to wind down the two mortgage finance giants, which own or guarantee 60 percent of all U.S. home loans, but an overhaul process is years off.

In the meantime, their return to profitability has led to competing demands. Nonprofit housing groups have sued the FHFA, challenging the decision to suspend payments to the trust funds, while a large hedge fund that owns preferred shares of the companies is challenging the terms of their taxpayer bailout, which requires them to sweep most of the profits into the U.S. Treasury.

Demeter

(85,373 posts)

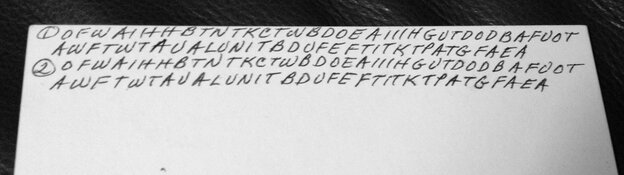

"Eighteen years later, the puzzle has been solved after one of Holm's granddaughters posted images of a card online. In just 13 minutes, a MetaFilter.com user figured out that as Dorothy Holm was dying, she was writing out prayers."

The first code to be broken:

"OFWAIHHBTNTKCTWBDOEAIIIHFUTDODBAFUOT

AWFTWTAUALUNITBDUFEFTITKTPATGFAEA"

The code crackers' conclusion: — "Our Father, who art in heaven ..."

Janna Holm, the granddaughter who posted about Dorothy Holm's index cards Monday at 4:13 p.m. CT, to see that solution pop up on the MetaFilter thread at 4:26 p.m. the same day. "Holy cow!" That fast an answer to something "that has been bugging my family for 20 years ... is amazing!"

...One big mystery still remains, though. Why did Dorothy Holm spend time during the final weeks of her life in 1996 filling 20 index cards with capital letters?

Janna Holm emailed MPR with this theory:

"My dad thinks that Dorothy Holm was so worried about losing her memory that she was just copying down the first letter of words to remind herself of common prayers. I think everyone has just been a little curious about the mysteries that she left behind, and even just knowing that it was a prayer (whether or not we can decipher it) is kind of comforting."

DemReadingDU

(16,000 posts)Appears this lady was raised Catholic, then Lutheran when she got married in the 1940s.

http://ask.metafilter.com/255675/Decoding-cancer-addled-ramblings

I'm wondering if some of her code was praying the rosary?

Demeter

(85,373 posts)Well, that's not good ... The blog took some time this week to look at the broader implications of the massive security breach at Target, Neiman Marcus and, potentially, other merchants. Elise Hu reports that this might finally force the U.S. to start using cards with encrypted chips because industry leaders know that current cards with magnetic stripes are outdated and easily exploitable. And Laura Sydell writes that the breach brought to light the inconsistent laws around the country concerning how quickly companies are required to alert customers that sensitive data were stolen.

You don't look a day over 29. The original Macintosh is celebrating an important birthday Friday: It's now old enough for run for U.S. senator. Steve Henn has a retrospective on its plucky beginnings. On the other side of the PC vs. Mac aisle, the once-acclaimed Windows XP just turned 12, and Microsoft wants the stragglers to switch over to an operating system that wasn't developed in the previous millennium. I found that it's proving harder than it seems — partly because mobile computing is getting so powerful. Alan Yu reports that your smartphone might soon be able to detect gamma radiation...

The Big Conversation

Even without a major revelation this week, the NSA has still been the subject of many in-depth analyses. An independent review board in the executive branch determined that the phone data collection system is illegal and called for it to end. WNYC's Brian Lehrer collected a list of the mass intelligence-gathering capabilities we know the NSA currently has. Columbia Journalism Review's Lauren Kirchner documented the FOIA fight over NSA-related documents...

...China's Web traffic mysteriously failed for several hours on Wednesday. Ever weirder, some of its traffic redirected to a website based in a Wyoming building that some think normally helps people get around the Chinese firewall. Weirder still, that building is home to several thousand companies. Odd all around.

SEE LINK FOR SOURCE MATERIAL AND MORE

Demeter

(85,373 posts)Germany’s plan to order banks to separate some of their riskiest businesses from deposits to protect clients could serve as a model for Europe, Finance Minister Wolfgang Schaeuble said.

Starting in 2017, German banks must supply capital and funding for proprietary and high-frequency trading operations as well as some business with hedge funds. The law stops short of ordering banks to split off trading on behalf of clients, as suggested by a panel led by Bank of Finland Governor Erkki Liikanen which advised the European Commission on its proposals.

The commission set a provisional date of Jan. 29 to publish a draft law on bank structure, Chantal Hughes, a spokeswoman for Michel Barnier, the EU’s financial services chief, wrote in an e-mail to Bloomberg News today.

“I assume that, as with our German bank split law, the European rule won’t threaten the financing of the real economy through the proven universal banking model,” Schaeuble said at an event near Frankfurt hosted by Deutsche Boerse AG, the operator of the city’s stock exchange...

YEAH, SURE

Demeter

(85,373 posts)Demeter

(85,373 posts)AND THIS EXPLAINS A LOT

http://www.swissinfo.ch/eng/business/Business_chiefs_fear_ticking_jobless_time_bomb.html?cid=37801578

The nascent global economic recovery is failing to trickle down to the man or woman on the street in the shape of new jobs or improved incomes, the World Economic Forum’s (WEF) Davos meeting has heard.

Another five million people were added to the unemployed ranks last year to reach a total of 202 million job seekers worldwide. At the same time, prosperity is concentrated in the hands of the few, with NGO Oxfam calculating that the 85 richest people have the same wealth as half the world’s population.

The growing divide between the haves and have-nots had already been identified by the WEF Global Risks report. But while the well-heeled delegates in Davos have recognised the problem, they are less enthusiastic about doing something about it, according to UNI Global Union Secretary-General Philip Jennings.

“The benefits of economic recovery are not widespread; they are gravitating towards the elite,” the head of the Geneva-based international trade union movement told swissinfo.ch. “Business people are not going to open their wallets voluntarily.”

THEIR LOSS

Demeter

(85,373 posts)Demeter

(85,373 posts)IS THAT SO? WELL, WE WILL JUST HAVE TO WAIT AND SEE. PERSONALLY, I THINK IT UNLIKELY

http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100026456/wests-30-year-vendetta-with-iran-is-finally-buried-in-davos/

Demeter

(85,373 posts)Demeter

(85,373 posts)If, as an effort at satire, I had written the story that the New York Times’ “DealBook” has just written about what JPMorgan’s board of directors has just actually done, people would have dismissed my piece as absurdly over the top. The board has decided to increase Jamie Dimon’s compensation substantially. The reason the board gives (in leaks to DealBook) must have resonated with Deal Book because it is the theme song that Deal Book has been singing for months, another “‘somebody done Dimon wrong’ song.”

Recall that the title of Andrew Ross Sorkin’s country-western lament was that Dimon was the victim of “bloodlust” because Dennis Kelleher, the head of the NGO “Better Markets,” believed that Dimon should be fired for poor performance.

As a slight reality check, which DealBook religiously avoids, Dimon led JPMorgan while it committed what government investigators have identified as over 15 frauds, most of them massive. As I’ve explained, Deal Book’s graphic laying out (very tersely) these frauds goes on for pages. These frauds represent the greatest financial crime spree the government has ever identified. I am not counting the frauds of Bear Stearns and Washington Mutual (WaMu)....

AND IT JUST GETS BETTER!

Demeter

(85,373 posts)This month marks the fiftieth anniversary of Stanley Kubrick’s black comedy about nuclear weapons, “Dr. Strangelove or: How I Learned to Stop Worrying and Love the Bomb.” Released on January 29, 1964, the film caused a good deal of controversy. Its plot suggested that a mentally deranged American general could order a nuclear attack on the Soviet Union, without consulting the President. One reviewer described the film as “dangerous … an evil thing about an evil thing.” Another compared it to Soviet propaganda. Although “Strangelove” was clearly a farce, with the comedian Peter Sellers playing three roles, it was criticized for being implausible. An expert at the Institute for Strategic Studies called the events in the film “impossible on a dozen counts.” A former Deputy Secretary of Defense dismissed the idea that someone could authorize the use of a nuclear weapon without the President’s approval: “Nothing, in fact, could be further from the truth.” (See a compendium of clips from the film.) When “Fail-Safe”—a Hollywood thriller with a similar plot, directed by Sidney Lumet—opened, later that year, it was criticized in much the same way. “The incidents in ‘Fail-Safe’ are deliberate lies!” General Curtis LeMay, the Air Force chief of staff, said. “Nothing like that could happen.” The first casualty of every war is the truth—and the Cold War was no exception to that dictum. Half a century after Kubrick’s mad general, Jack D. Ripper, launched a nuclear strike on the Soviets to defend the purity of “our precious bodily fluids” from Communist subversion, we now know that American officers did indeed have the ability to start a Third World War on their own. And despite the introduction of rigorous safeguards in the years since then, the risk of an accidental or unauthorized nuclear detonation hasn’t been completely eliminated.

The command and control of nuclear weapons has long been plagued by an “always/never” dilemma. The administrative and technological systems that are necessary to insure that nuclear weapons are always available for use in wartime may be quite different from those necessary to guarantee that such weapons can never be used, without proper authorization, in peacetime. During the nineteen-fifties and sixties, the “always” in American war planning was given far greater precedence than the “never.” Through two terms in office, beginning in 1953, President Dwight D. Eisenhower struggled with this dilemma. He wanted to retain Presidential control of nuclear weapons while defending America and its allies from attack. But, in a crisis, those two goals might prove contradictory, raising all sorts of difficult questions. What if Soviet bombers were en route to the United States but the President somehow couldn’t be reached? What if Soviet tanks were rolling into West Germany but a communications breakdown prevented NATO officers from contacting the White House? What if the President were killed during a surprise attack on Washington, D.C., along with the rest of the nation’s civilian leadership? Who would order a nuclear retaliation then?

With great reluctance, Eisenhower agreed to let American officers use their nuclear weapons, in an emergency, if there were no time or no means to contact the President. Air Force pilots were allowed to fire their nuclear anti-aircraft rockets to shoot down Soviet bombers heading toward the United States. And about half a dozen high-level American commanders were allowed to use far more powerful nuclear weapons, without contacting the White House first, when their forces were under attack and “the urgency of time and circumstances clearly does not permit a specific decision by the President, or other person empowered to act in his stead.” Eisenhower worried that providing that sort of authorization in advance could make it possible for someone to do “something foolish down the chain of command” and start an all-out nuclear war. But the alternative—allowing an attack on the United States to go unanswered or NATO forces to be overrun—seemed a lot worse. Aware that his decision might create public unease about who really controlled America’s nuclear arsenal, Eisenhower insisted that his delegation of Presidential authority be kept secret. At a meeting with the Joint Chiefs of Staff, he confessed to being “very fearful of having written papers on this matter.”

President John F. Kennedy was surprised to learn, just a few weeks after taking office, about this secret delegation of power. “A subordinate commander faced with a substantial military action,” Kennedy was told in a top-secret memo, “could start the thermonuclear holocaust on his own initiative if he could not reach you.” Kennedy and his national-security advisers were shocked not only by the wide latitude given to American officers but also by the loose custody of the roughly three thousand American nuclear weapons stored in Europe. Few of the weapons had locks on them. Anyone who got hold of them could detonate them. And there was little to prevent NATO officers from Turkey, Holland, Italy, Great Britain, and Germany from using them without the approval of the United States.

In December, 1960, fifteen members of Congress serving on the Joint Committee on Atomic Energy had toured NATO bases to investigate how American nuclear weapons were being deployed. They found that the weapons—some of them about a hundred times more powerful than the bomb that destroyed Hiroshima—were routinely guarded, transported, and handled by foreign military personnel. American control of the weapons was practically nonexistent. Harold Agnew, a Los Alamos physicist who accompanied the group, was especially concerned to see German pilots sitting in German planes that were decorated with Iron Crosses—and carrying American atomic bombs. Agnew, in his own words, “nearly wet his pants” when he realized that a lone American sentry with a rifle was all that prevented someone from taking off in one of those planes and bombing the Soviet Union.

* * *

As Dr. Leonard McCoy noted, in Star Trek IV: "It's a miracle these people ever got out of the 20th century."

* * *

You can read Eric Schlosser’s guide to the long-secret documents that help explain the risks America took with its nuclear arsenal, and watch and read his deconstruction of clips from “Dr. Strangelove” and from a little-seen film about permissive action links.

Eric Schlosser is the author of “Command and Control.”

Demeter

(85,373 posts)THE LAST TRUMP IS BLOWING

http://www.washingtonsblog.com/2014/01/54-republicans-say-weve-got-much-inequality.html

6 Conservative Reasons – Based Upon Conservative Values – For Making Sure Inequality Doesn’t Spiral Out of Control Even More

We’ve noted for years that it’s a myth that conservatives accept runaway inequality. Conservatives are very concerned about the stunning collapse of upward mobility. A poll from Gallup shows that a majority of Republicans think we’ve got too much inequality:

And the conservative website Townhall.com ran a story last month entitled, “Inequality is a Conservative Issue“. In fact, there are at least 6 solid conservative reasons – based upon conservative values – for reducing runaway inequality:

(1) It has now finally become widely accepted by economists that inequality drags down the economy. Conservatives like prosperity and economic growth, not things which pull down the economy;

(2) Inequality increases the nation’s debt. Conservatives don’t like debt;

(3) Runaway inequality leads to social unrest and violence. Conservatives like stability and order;

(4) Much of the cause of our soaring inequality is bailouts for the big banks and socialism for the buddies of the high-and-mighty at the Federal Reserve, Treasury, and White House. The government has consistently picked Wall Street over Main Street, and virtually all of the the big banks’ profits come from taxpayer bailouts. The Fed is still throwing many tens of billions a month at the big banks in “the greatest backdoor Wall Street bailout of all time”, which sucks the wealth away from the rest of the economy. Conservatives don’t like bailouts (a 2012 Harris poll showed that 87% of Republicans are against bank bailouts) or socialism; and

(5) One of the biggest causes of runaway inequality is that the big banks are manipulating every market, and committing massive crimes. Fraud disproportionally benefits the big banks, makes boom-bust cycles more severe, and otherwise harms the economy … all of which increase inequality and warp the market. These actions artificially redistribute wealth from honest, hard-working people to a handful of crooks. Conservatives hate redistribution … as well as crooks.

(6) Religious leaders have slammed the criminality of the heads of the big banks; and the Bible teaches - and top economists agree – that their crimes must be punished, or else things will get worse. A 2011 Gallup poll showed that 91% of U.S. conservatives believe that the Bible is either literally true or is the inspired word of God. If the crimes of the bankers are punished, inequality will start to decline, because a more lawful, orderly and even playing field will be reestablished.

We’re not calling for redistributing wealth from the rich. But we do support clawing back ill-gotten gains from criminals under well-established fraud principles:

We’re mainly talking about stopping further redistribution from Main Street to Wall Street. As Robert Shiller said in 2009:

For example, if we stop bailing out the Wall Street welfare queens, the big banks would focus more on traditional lending and less on speculative casino gambling. Indeed, if we break up the big banks, it will increase the ability of smaller banks to make loans to Main Street, which will level the playing field. We don’t even have to use government power to break up the banks … if the government just stops propping them up, they’ll collapse on their own. Indeed, many Republicans have pointed out that the big banks would fail on their own if the government stopped bailing them out. And using current fraud laws would do the trick in prosecuting Wall Street criminality.

Postscript: If you want to know the stunning truth of how bad inequality has gotten, read

http://www.washingtonsblog.com/2013/09/the-stunning-truth-about-inequality-in-america.html

If you want to hear what top economists say inequality does to our economy:

http://www.washingtonsblog.com/2013/12/mainstream-economists-finally-admit-runaway-inequality-hurting-economy.html

And if you want to find out whether government policy is making things better or worse, here’s your answer: http://www.washingtonsblog.com/2013/09/bad-government-policy-has-created-the-worst-inequality-in-world-history-and-it-is-destroying-our-economy.html

Demeter

(85,373 posts)TRANSCRIPT AT LINK

http://www.freesnowden.is/asksnowden/

Demeter

(85,373 posts)http://www.ianwelsh.net/bitcoin-is-not-optimized-for-privacy/

Just another quick note: Bitcoins keep track of every single transaction. That information is filed into the bitcoin itself.

Do not think that this is anonymous money, it is anything but. You’re still best off using cash for anonymous transactions or buying one use cards, etc… for online anonymous transactions.

China got bitcoin right. It is a virtual good. You could just as easily use any other virtual good to transfer money out of a country, so long as there is a liquid market you trust.

Follow The Bitcoins: How We Got Busted Buying Drugs On Silk Road's Black Market

http://www.forbes.com/sites/andygreenberg/2013/09/05/follow-the-bitcoins-how-we-got-busted-buying-drugs-on-silk-roads-black-market/

The crypto-currency Bitcoin has become the preferred payment method for much of the online underground, hailed by none other than the administrator of the booming Silk Road black market as the key to making his illicit business possible. But spending Bitcoins to anonymously score drugs online isn’t as simple as it’s often made out to be.

We at Forbes should know: We tried, and we got caught.

To be clear, we weren’t caught by law enforcement–so far at least, our experiment last month in ordering small amounts of marijuana from three different Bitcoin-based online black markets hasn’t resulted in anyone getting arrested. But a few weeks after those purchases, I asked Sarah Meiklejohn, a Bitcoin-focused computer science researcher at the University of California at San Diego, to put the privacy of our black market transactions to the test by tracing the digital breadcrumbs that Bitcoin leaves behind. The result of her analysis: On Silk Road, and possibly on smaller competitor markets, our online drug buys were visible to practically anyone who took the time to look. “There are ways of using Bitcoin privately,” says Meiklejohn. “But if you’re a casual Bitcoin user, you’re probably not hiding your activity very well.”

Bitcoin’s privacy properties are a kind of paradox: Every Bitcoin transaction that occurs in the entire payment network is recorded in the “blockchain,” Bitcoin’s decentralized mechanism for tracking who has what coins when, and preventing fraud and counterfeiting. But the transactions are recorded only as addresses, which aren’t necessarily tied to anyone’s identity–hence Bitcoin’s use for anonymous and often illegal applications...

Jack Lew and Jamie Dimon warn of Bitcoin dangers

THE QUESTION ARISES: DANGER TO WHOM? TO JACK LEW AND JAMIE DIMON?

http://www.ft.com/intl/cms/s/0/a00df0fc-8496-11e3-b72e-00144feab7de.html??siteedition=uk

Bitcoin has been tossed into the virtual gutter at the World Economic Forum in Davos this week, as top US financial leaders warned the vitrual currency could be used to fund terrorism and predicted that regulation would put it out of business.

Jack Lew, US Treasury secretary, said: “From the government’s point of view, we have to make sure it does not become an avenue to funding illegal activities or to funding activities that have malign purposes like terrorist activities...“It is an anonymous form of transaction and it offers places for people to hide,” Mr Lew said in an interview with CNBC at Davos.

Jamie Dimon, JPMorgan chairman and chief executive, told the same channel: “The question isn’t whether we accept it. The question is do we even participate with people who facilitate Bitcoin?” Ultimately, Mr Dimon said, Bitcoin would be subjected to the same regulatory standards as other payment systems and “that will probably be the end of them”. Regulatory uncertainty has deterred banks from offering services to virtual currency start-ups. But Mr Dimon’s cautious approach contrasts with rival Wells Fargo, which recently launched a group to examine how it might safely offer Bitcoin-related services or banking arrangements to virtual currency entrepreneurs.

The JPMorgan boss said: “Governments put a huge amount of pressure on banks, and so, to know who your client is, anti-money laundering, did you do real reviews of that? Obviously it’s almost impossible with something like that.” He added that Bitcoin was “a terrible store of value” that “can be replicated over and over”, and that according to reports, “a lot of it is being used for illicit purposes”.

Demeter

(85,373 posts)U.S. stocks finished the week with deep losses as investors fled equities and emerging-markets currencies on concerns about a contagion effect from China’s manufacturing slowdown. The S&P 500 and the Dow Jones Industrial Average recorded their worst weekly losses in more than a year while volumes on Wall Street on Thursday and Friday were significantly higher than their 30-day averages.

Investors began selling stocks and emerging-markets currencies heavily on Thursday following weak Chinese economic data. The sharp selloffs on Wall Street prompted some analysts to call it the beginning of a long-awaited correction.

Demeter

(85,373 posts)“Excesses in one direction will lead to an opposite excess in the other direction.”

So says rule No. 2 from retired and respected market technician Bob Farrell, whose 10 “Market Rules to Remember” offer investors a reality check on stocks, bonds and their money. Farrell’s advice is especially timely after the disappointing week stock investors have had, with the S&P 500 SPX -2.09% suffering its worst one-week percentage decline since June 2012, and the Dow Jones Industrials DJIA -1.97% taking its worst beating since November 2011. So far this year the S&P 500 has lost 3.1% and the Dow is down 4.2%. Where she stops, nobody knows. But the conviction that stocks are due for a correction – meaning at least a 10% slide – is the worst-kept secret on Wall Street. Pundits have been opining for months about how stocks are overbought and investors are too optimistic.

It’s about time stock prices turned south. Even a year without a meaningful correction is too long a stretch. Investors get comfortable; the market’s proverbial wall of worry breaks down. A correction gives investors who want to get out of the market an excuse to exit, and sets the stage for buyers to come off the sidelines. A selloff early in the year is even more welcome, since it gives the market a chance to form a new base from which to move higher.

Lower stock prices remind us that Mr. Market is mortal. “There are no new eras – excesses are never permanent,” Farrell noted in another of his famous rules. Indeed, if your investment portfolio is diversified to your specifications, market stumbles can be opportunities.

The dust from this market storm will settle, as it always does. Meantime, give your portfolio a checkup and figure out how to move forward. What’s different about the longer-term prospects for the global economy and the market that we didn’t see two weeks ago, when buyers were still lined up? Likely, not much.

westerebus

(2,976 posts)Poor china less and less low cost dollars, so they print more and more Yuan.

Has anyone noticed Mr Soros has been quiet re the unbalancing of the Turkish Lira.

May be I haven't been paying attention.

Then there's the POTUS and the TPP.

I was looking at the map and thought, if I wanted to ensure certain choke points or ports of call were on friendly terms with our consumer base in a quid pro quo, it makes sense in one sense. Not that we would ever deny a Asian power access to the right of way of the high seas.

This brings me to look at Myanmar. Out of the prison of military dictatorship just in time to possibly become the next Asian miracle? Did the pipeline on its coast into south China provide an incentive to open up as the Pakistan pipeline might not be Taliban proof?

The end of the 1972 bear market. Take a Google if you like gold history.

The Munich massacre was a 1972 event just for perspective.

Demeter

(85,373 posts)we are truly up the creek without a paddle...to mix a few metaphors.

DemReadingDU

(16,000 posts)QE was not designed for the remaining 99%.

westerebus

(2,976 posts)For those of us who swim against the tide, knowing when to float home is a must.

Demeter

(85,373 posts)Due to competition from online retailers like Amazon and dismal holiday sales at Target, J.C. Penny, Sears, Best Buy, and other major retailers, a flood of retail store closings are on the way. Moreover, that same competition also dictates a decided shift away from large stores in large malls, to smaller facilities. All things considered, expect nothing less than a massive Tsunami of Retail Store Closings and Downsizings.

January is typically a busy month for retailers to announce store closings. According to the International Council of Shopping Centers, 44 percent of annual store closings announced since 2010 have occurred in the first quarter. But this year's closings are likely indicative of a new trend, sparked by more and more shoppers turning to the Web, experts said.

Paired with a compressed holiday shopping calendar and a spate of freezing weather across much of the U.S., online shopping contributed to a nearly 15 percent decline in foot traffic this past holiday season, according to ShopperTrak.

"Stores are making a long-term bet on technology," said Belus Capital Advisors analyst Brian Sozzi. "It simply doesn't make strategic sense to enter a new 15-year lease as consumers are likely to continue curtailing physical visits to the mall."

Sozzi said that after a profitable but below-expectations holiday season, the retail industry will face its second "tsunami of store closures across the U.S.," only a few years after what he called the "fire sale holiday season of 2008."

Steering Clear of Traditional Malls

One big shift in store closings has come from retailers shying away from indoor malls, instead favoring outlet centers, outdoor malls or stand-alone stores. Although new retail construction completions are at an all-time low, according to CB Richard Ellis, the supply of new outlet centers has picked up in recent quarters.

"There's no question that mall stores are closing quicker than open air, as far as the department stores," Birnbrey said.

Rick Caruso, founder and CEO of Caruso Affiliated, said at the recent National Retail Federation convention that without a major reinvention, traditional malls will soon go extinct, adding that he is unaware of an indoor mall being built since 2006.

"Any time you stop building a product, that's usually the best indication that the customer doesn't want it anymore," he said.

Expect Layoffs and Decreased Hours

Fewer, smaller stores requires layoffs or shorter hours. Given that job growth over the past year or more has been largely influenced by Obamacare artifacts, and that wave has played out, expect economists (but not Mish readers) to be shocked by what happens next to future headline job numbers.

Demeter

(85,373 posts)The minimum wage is 23 percent less than its peak inflation-adjusted value in 1968. This is despite productivity (how much output can be produced in an average hour of work in the economy) more than doubling in that time period. The low-wage workforce has surely contributed to this rise in economy-wide productivity, since as a group they have far more education now than they did then. For the workforce overall, 37 percent in 1968 had not completed high school (or received a GED), which was true for only 9 percent in 2012 (the latest year with comparable data). We can drill down to examine low-wage workers, which we are defining for this analysis as those earning in the bottom fifth of the wage distribution.

The figure below shows that low-wage workers have far more education now than they did back in 1968. In 1968, 48 percent of low-wage workers had a high school degree, compared to 79 percent in 2012. Correspondingly, many more low-wage workers have attended at least some college or have a college degree, which the graph identifies as ‘college experience.’ While only 16.8 percent of low-wage workers in 1968 had gone to some college or had a college degree, that group had grown to nearly half (45.7 percent) by 2012. The bottom line is that minimum wage in 2013 is far less now than it was in 1968 despite the economy’s productivity more than doubling, and low-wage workers attaining far more education.

Demeter

(85,373 posts)Stay warm, everyone. It's unbearable here, and I went absolutely nowhere today. Unfortunately, the weather will stink for AT LEAST another full week.

Demeter

(85,373 posts)(Phone rings)

Receptionist: Beegbaux Medical Clinic, can I help you?

Newly Insured: Hi. I have a new Obamacare policy and I’d like to schedule a visit.

Receptionist: Who is your insurance with?

Newly Insured: A company called Corporate Welfare Assurance Company. You’ve seen their ads on TV, “The President’s giving you CWAP so sign up”

Receptionist: Duh: don’t you read the news? This is a respectable medical clinic: we don’t take CWAP here.

Newly Insured: I pay 18% of my gross salary for quality affordable healthcare. I’ve had a strange looking growth for ten months but after scheduling an appointment under my old plan my last insurance company dropped me before I could show up.

Receptionist: All that is very interesting and I can relate – despite working in a medical office I have ACA CWAP insurance myself — but there’s nothing I can do. Bye. [Click sound]

{Cut to a montage of various receptionists for each line]

Receptionist 2: No, we don’t take the President’s CWAP.

Receptionist 3: We tried working with CWAP insurance but they kept threatening to drop us from their network if we demanded to be paid, and eventually did so. Sorry.

Receptionist 4: We’re out of network for CWAP but if you’d pay us $150 we’ll look at you.

Receptionist 5: For a regular doctor visit? Nope. Sorry. But…

Newly Insured: {Cutting her off] Trying to use CWAP is a hopeless pain in the ass.

Receptionist 5: Well, if it’s a screening colonoscopy you’re looking for you should have said so. CWAP covers those if you’re over 50 though you have to pay more if during the procedure the doctor finds anything and fixes it.

Newly Insured: I’m still pretty young and .. wait; who said anything about a colonoscopy? I just want a doctor.

Receptionist 5: Well, let me look at the menu of items covered… Are you into wine?

Newly Insured: Uh, yeah, I guess. I usually have a glass of wine with dinner.

Receptionist 5: Great! CWAP covers residential substance abuse treatment. Pack a bag, leave the bottle behind, and we’ll have you enrolled this evening.

Newly Insured: I don’t think it’s a good idea to try giving up alcohol while trying to navigate this CWAP.

Receptionist 5: Hmm. Well then how about a syphilis test? If you were a woman I could offer you tests for syphilis, chlamydia, gonorrhea, hepatitis, a urinary tract infection and HPV but you’re a man so it’s one Bad Blood test for you.

Newly Insured: Bad blood test?

Receptionist 5: That means syphilis. It’s from a list of slang terms for venereal diseases that the CDC created at this web address: http://www.cdc.gov/std/healthcomm/HPVGenPub2004ApD.pdf

Newly Insured: Wouldn’t it make more sense to test anybody willing be tested for venereal disease since curing one man or woman prevents infection from spreading?

Receptionist 5: Look – this is all philosophically interesting, and I’m trying to work with you and all, but I’m not the one who defined what this CWAP covers. My job is to sell procedures and it doesn’t sound like you want one, which they’ve told me to tell you is like totally irresponsible, but don’t waste my time. {Play sound of phone clicking down.]

Receptionist 6: Yes – we’ll take your CWAP. Our next appointment is in two months. Is that acceptable?

Newly Insured: Really!

Receptionist 6: Really what? Two months? That seems to annoy some people. Tough. Honestly we’ve lost a lot of patients lately or it’d be 3-4 months.

Newly Insured: Lost them because they obtained superior health insurance and went to high end clinics at training hospitals?

Receptionist 6: No, lost them because they died. I mean we’re not like a high-cost clinic where bankers, oil sheiks, drug dealers, and shadier types like the owners of government-hired foreclosure review consultancies can just whip out a brief case and pay cash. But there are doctors and nurses here.

Newly Insured: I wasn’t questioning: I’m just happy to hear you have an opening: I’ll take it! Who is my doctor?

Receptionist 6: Dr. Frank. He’s one of my favorites here! He used to be in a rock band then, while playing a gig on an island somewhere he caught something from a groupie and wandered into a local medical school. He loved the place and dated the Dean for awhile – Frank has great taste like that ‘cause, not to brag, but he’s dating me now, well, and a few others here but, like, whatever, they’ll go away — and, oh yeah, eventually they gave him an MD.

Newly Insured: But he is a doctor? Licensed in the US? He knows what he’s doing?

Receptionist 6: Oh yeah. He’s great. CWAP actually gave him an award for the lowest cost of care out of any doctor in the whole state. CWAP sends him all sorts of goodies. Soon he’ll be training stodgier doctors, with more boring backgrounds. Frank’s suggested a training cruise: I’m hoping he’ll bring me with.

Newly Insured: Does he have a specialty?

Receptionist 6: He convinces people with cancer to skip treatment. “Die high and happy,” that’s Frank’s motto, his contribution to modern medicine as he likes to call it. If you’re gonna’ go you may as well die a little sooner — flying on top of the world — rather than puking and bald, right? It’s not like we live forever.

Newly Insured: I guess, though if death is avoidable I’d rather put it off a few years. Anyway I suppose he’s a start. OK; we’re scheduled. I’ll see you in four months.

Receptionist 6: Wait, I forgot something…. Oh yeah, I’m supposed to tell you to remember that your visit is under the deductible so it will cost at $200 and more if tests are needed and, like, since you’re seeing Frank, and he owns the lab, tests are always needed.

Newly Insured: But that’s more than it cost for the clinic that didn’t take CWAP!

Receptionist 6: Yeah, but it counts towards your deductible so if anything is really wrong, assuming that you pay us another $6,000 of so, your CWAP will be worth something. Unless of course it takes until the end of the year to reach $6,000, then you’ll have to start counting your CWAP all over again.

Newly Insured: You know I can fly to Europe, pay a top quality doctor, and receive quite a bit of treatment all for less than $6,000, plane ticket included?

Receptionist 6: Au Revoir. Want company?

DemReadingDU

(16,000 posts)1/24/14 HSBC imposes restrictions on large cash withdrawals

Some HSBC customers have been prevented from withdrawing large amounts of cash because they could not provide evidence of why they wanted it, the BBC has learnt.

Listeners have told Radio 4's Money Box they were stopped from withdrawing amounts ranging from £5,000 to £10,000.

HSBC admitted it has not informed customers of the change in policy, which was implemented in November.

The bank says it has now changed its guidance to staff.

more...

http://www.bbc.co.uk/news/business-25861717

xchrom

(108,903 posts)Austria’s mint is running 24 hours a day to meet orders for gold coins, joining counterparts from the U.S. to the U.K. to Australia in reporting accelerating demand boosted by the bear market in bullion.

Austria’s Muenze Oesterreich AG mint hired extra employees and added a third eight-hour shift to the day in a bid to keep up with demand. Purchases of bullion coins at Australia’s Perth Mint rose 20 percent this year through Jan. 20 from a year earlier. Sales by the U.S. Mint are set for the best month since April, when the metal plunged into a bear market.

Global mints are manufacturing as fast as they can after a 28 percent drop in gold prices last year, the biggest slump since 1981, attracted buyers of physical metal. The demand gains helped bullion rally for five straight weeks, the longest streak since September 2012. That won’t be enough to stem the metal’s slump according to Morgan Stanley, while Goldman Sachs Group Inc. predicts bullion will “grind lower” over 2014.

“The long-term physical buyers see these price drops as opportunities to accumulate more assets,” said Michael Haynes, the chief executive officer of American Precious Metals Exchange, an online bullion dealer. “We have witnessed some top selling days in the past few weeks.”

xchrom

(108,903 posts)Asian currencies fell this week, led by South Korea’s won, as Chinese economic data missed estimates and a stronger U.S. recovery added to speculation the Federal Reserve will cut its stimulus further.

The Bloomberg-JPMorgan Asia Dollar Index (ADXY) dropped for a second week as reports showed U.S. December sales of existing homes capped the best year since 2006 and jobless claims held near a six-week low. Signs of a sustained economic pickup fueled bets the Fed will continue to reduce bond-buying that has spurred fund flows to emerging markets. Manufacturing in China, Asia’s biggest economy, may have contracted this month, a preliminary reading showed on Jan. 23.

“Weak data in China are strengthening demand for safety assets like the dollar,” said Hong Seok Chan, a currency analyst at Daishin Economy Research Institute in Seoul. “U.S. tapering expectations offer a continued boost for the greenback.”

The won recorded its worst week in seven months, slumping 1.9 percent from Jan. 17 to 1080.36 per dollar, data compiled by Bloomberg show. Malaysia’s ringgit slid 1.1 percent, its biggest weekly loss in a month, to 3.3334. India’s rupee dropped 1.8 percent, the most since August, to 62.6850 and Indonesia’s rupiah fell 0.7 percent to 12,180.

xchrom

(108,903 posts)The yen and the Swiss franc rallied as a selloff in emerging-market currencies deepened, stoking demand for haven assets.

The yen strengthened against all but two of 174 global peers as increased scrutiny of credit risks in China supported demand for Japanese assets. Argentina’s peso was the fourth worst global performer after a 13 percent slump yesterday as the country devalued the currency. The dollar was underpinned by speculation the Federal Reserve will continue to scale back stimulus. Turkey’s lira slid to a record and Russia’s ruble fell to a five-year low.

“We’re having a risk-off move,” Douglas Borthwick, the head of foreign exchange at Chapdelaine & Co. in New York, said in a phone interview. “Japan and Switzerland are both very interested in weakening their currency, so you’d expect that any sort of pullback in dollar-yen or dollar-Swiss would be bought into, which is why they’re seeing strength today.”

The yen rose 0.9 percent to 102.31 per dollar at 5 p.m. New York time after reaching 102, the strongest level since Dec. 6. It appreciated 1 percent to 139.98 per euro. The franc gained 0.3 percent to 89.45 centimes per dollar and added 0.4 percent to 1.2235 per euro.

xchrom

(108,903 posts)Over a three-hour lunch in Davos yesterday, Carlyle Group LP (CG) co-founder David Rubenstein told a group of investors and bankers his biggest worry: nobody appeared to be worried about anything at all.

Less than 24 hours later, the devaluation of the Argentine peso accelerated the worst selloff in emerging market stocks in five years, unnerving delegates at the World Economic Forum in Switzerland. As they shuttled from meetings to meals, losses were piling up by the minute as developing nation currencies slid with equities.

“I don’t want to look,” Daniel Loeb, billionaire founder of hedge fund Third Point LLC, said of the financial markets as he walked between meetings at the Congress center in Davos.

After recent gatherings were dominated by crises from Lehman Brothers Holdings Inc. to Greece, this year’s had begun to reflect a mood of optimism as economies and stock markets recovered. That enthusiasm waned today as the rout in emerging markets exacerbated concern that the engines of global growth since the crisis have now stalled.

Demeter

(85,373 posts)

xchrom

(108,903 posts)xchrom

(108,903 posts)(Reuters) - A full-scale flight from emerging markets accelerated on Friday, as investors sold shares in major markets and bought safe-haven assets such as U.S. Treasuries, the yen and gold.

On Wall Street, the benchmark S&P 500 stock index tumbled 2.0 percent on the day, and ended the week down 2.6 percent, its worst week since June 2012.

Concerns about slower growth in China, reduced support from U.S. monetary policy and political problems in Turkey, Argentina and Ukraine drove the selling.

The Turkish lira hit a record low as the cost of insuring against a Turkish default rose to an 18-month high. Argentina's peso fell again after the country's central bank abandoned its support of the currency.

xchrom

(108,903 posts)(Reuters) - The euro zone will assure the International Monetary Fund in coming months that it will continue to bankroll Greece, enabling the IMF to disburse its share of international aid to Athens, a senior European Union official said on Friday.

Progress in Greek reforms, undertaken by Athens in return for international financial aid, will be among the topics for talks among euro zone finance ministers, called the Eurogroup, at a meeting on Monday.

Under IMF rules, the Fund cannot disburse its part of the loans to Greece unless it is financed 12 months ahead. But according to the IMF, Athens is 4.4 billion euros short in 2014 and 6.5 billion short in 2015.

For IMF money to flow to Greece, therefore, the euro zone will have to affirm that Athens will get more money.

xchrom

(108,903 posts)(Reuters) - Pepsico, Nestle and Cisco on Friday announced major investments that together totaled more than $7 billion in Mexico, where the government has pushed through a series of economic reforms that aim to boost foreign investment and growth.

Mexico has embraced free trade policies in recent decades, and has drawn growing investment interest after President Enrique Pena Nieto made a landmark reform drive in his first year in office, pushing major telecommunications, energy, banking and tax legislation through a divided Congress.

"It is very encouraging to see the enthusiasm that has been awoken by our country due to the structural changes that are happening," Pena Nieto said at the World Economic Forum (WEF) in Davos.

Pepsico (PEP.N) said it would spend $5 billion in Mexico over five years to strengthen its food and beverage business, adding it planned to expand its production capacity by adding new manufacturing lines and expand delivery routes.

xchrom

(108,903 posts)WASHINGTON (AP) -- Debates on lowering trade barriers can turn Congress upside down for Democratic presidents promoting such legislation. Business-minded Republicans suddenly turn into allies and Democrats aligned with organized labor can become outspoken foes.

It's a reversal of the usual order of things, where a Democratic president can generally count on plenty of support from fellow Democrats in Congress along with varying levels of resistance from Republicans.

Now it is President Barack Obama's turn to experience such a role reversal. Already, he is encountering pockets of Democratic resistance, especially from those representing manufacturing states, to his efforts to win congressional approval for renewal of "fast track" negotiating authority.

Such expedited powers help speed the process for major trade agreements by restricting Congress to up-and-down votes on what's already been negotiated - with no amendments allowed.

xchrom

(108,903 posts)NEW YORK (AP) -- Platinum and palladium slumped Friday as investors fretted about the prospects for growth in emerging markets.

Both metals, which are used to make catalytic converters for autos, tend to track the outlook for growth in emerging economies such as China and Latin America. A downturn in emerging markets began Thursday following signs that manufacturing was contracting in China, a major importer of raw materials and a key driver of global economic growth.

"For platinum and palladium, more than half of the demand is (for use) in automobiles," said Howard Wen, a precious metals analyst at HSBC Securities. "So, global growth has an influence on these metals, obviously."

The price of platinum for delivery in April fell $34.60, or 2.4 percent, to $1,428.60 an ounce. Palladium for March dropped $11.10, or 1.5 percent, to $734.80 an ounce.

xchrom

(108,903 posts)NEW YORK (AP) -- The frigid winter of 2014 is setting the price of natural gas on fire.

The price in the futures market soared to $5.18 per 1,000 cubic feet Friday, up 10 percent to the highest level in three and a half years. The price of natural gas is up 29 percent in two weeks, and is 50 percent higher than last year at this time.

Record amounts of natural gas are being burned for heat and electricity. Meanwhile, it's so cold that drillers are struggling to produce enough to keep up with the high demand. So much natural gas is coming out of storage that the Energy Department says supplies have fallen 20 percent below a year ago - and that was before this latest cold spell.

"We've got record demand, record withdrawals from storage, and short-term production is threatened," says energy analyst Stephen Schork. "It's a dangerous market right now."

Natural gas and electric customers are sure to see somewhat higher rates in the coming months. But they will be insulated from sharp increases because regulators often force natural gas and electric utilities to use financial instruments and fuel-buying strategies that protect residential customers from high volatility.

xchrom

(108,903 posts)DAVOS, Switzerland (AP) -- European Central Bank president Mario Draghi laid out the hope that the ailing eurozone economic recovery will pick up steam over the coming months.

He told delegates Friday at the World Economic Forum that a stream of "solid" survey data are pointing to better times ahead for a region that's grappled with a debt crisis, recession and sky-high unemployment over the past few years. Recent surveys of purchasing managers and consumers have indicated growing buoyancy.

"The hard data are not however as uniformly good as the survey data," said Draghi, who has been widely credited for helping to douse the debt crisis fires. "In a sense, this behavior reflects very similar behavior that took place in the United States a year, a year and a half ago."

The U.S. has achieved so-called escape velocity that is bearing down on unemployment and prompted the Federal Reserve to start reducing its extraordinary monetary stimulus, which has been in place, in its various guises, for around five years.

Demeter

(85,373 posts)LOOKS LIKE IT'S STARTING EARLY, WITH THE RUN ON HKCB

http://www.telegraph.co.uk/finance/financetopics/davos/10590134/Crippled-eurozone-to-face-fresh-debt-crisis-this-year-warns-ex-ECB-strongman-Axel-Weber.html

A top panel of experts in Davos has poured cold water on claims that the European crisis is over, warning that the eurozone remains stuck in a low-growth debt trap and risks being left on the margins of the global economy by US and China.

Axel Weber, the former head of the German Bundesbank, said the underlying disorder continues to fester and region is likely to face a fresh market attack this year.

"Europe is under threat. I am still really concerned. Markets have improved but the economic situation for most countries has not improved," he said that the World Economic Forum in Davos.

Mr Weber, now chairman of UBS, said the European Central Bank's stress test for banks in November risks setting off a new sovereign debt scare, reviving the crisis in the Mediterranean countries...

EURO-BASHING AND MORE AT LINK

xchrom

(108,903 posts)The market declined significantly in the face of the unexpected drop in the Chinese Purchasing Managers Index, following closely on the heels of China’s declining GDP growth and potentially serious credit problems. According to HSBC, China faces a cash shortage in its financial system, creating a dilemma for the Chinese leadership that is focused on rebalancing the economy and reining in credit. The market’s decline was on target, as the disappointments cast doubt on the widespread consensus of recovering global growth. Without the impetus from the Chinese growth engine, the global economy cannot recover and is likely to fall into recession. This is particularly true since U.S. economic growth has still not reached “escape velocity” at a time when the Fed seems set to wind down Quantitative Easing (QE) by year-end.

While the stock market seems to have accepted the prospect of an end to QE, the rationale for the continuation of the bull market has shifted to a belief in accelerating growth in the economy and in corporate earnings, both globally and domestically. For the last few years the market was able to accept tepid growth on the grounds that QE would provide enough liquidity to move stocks ahead. But without the prospect of continuing boosts to liquidity, tepid growth is no longer enough, and, unfortunately, it looks as if that is the most we are likely to get.

Despite the belief of most strategists and economists that the U.S. economy is picking up steam, it is far from evident in the data. Examination of the evidence indicates to us that the economy is still not at a point where we can conclude that growth is now self-sustaining in the new world of Fed tapering.

Where is the so-called consumer resurgence? Year-over-year real retail sales were up 4.1% in December, compared to an increase of 5.2% in the year ended December 2012 and 6.2% in December 2011. Similarly, overall consumer spending increased 1.2% in the year ended November 2013 compared to 2.1% in the year ended November 2012. Anecdotal information from retailors does not indicate much of a pickup, if any, in December. And remember that consumer spending accounts for about 70% of GDP. These results should not be surprising, since real disposable income was up only 0.6% year-over-year in the latest reported period.

Read more: http://comstockfunds.com/default.aspx?act=newsletter.aspx&category=MarketCommentary&MenuGroup=Home&NewsLetterID=1758&startrow=1#ixzz2rPjRXgm1

xchrom

(108,903 posts)DAVOS/LONDON (Reuters) - Top emerging market policymakers moved to allay concerns about their economies on Friday after investors sold off their currencies, raising fears of a broad market rout.

The U.S. Federal Reserve's plan to gradually withdraw its stimulus has long been expected to lead to a pullout from emerging markets. But the prospect of an economic slowdown in China added to concerns on Friday that emerging markets, particularly those with large current account deficits, may struggle to support their currencies this year.

Argentina said on Friday it would relax currency controls it had long defended as essential, in a policy reversal forced by high inflation and a tumble in the peso.

Turkey's lira hit a record low despite an estimated $3 billion of intervention by its central bank the previous day. The rouble and the rand also languished at levels not seen since the 2008-2009 financial crisis.

Read more: http://www.businessinsider.com/emerging-market-leaders-on-currencies-2014-1#ixzz2rPmeeppc

xchrom

(108,903 posts)NEW YORK (Reuters) - Fund investors worldwide poured $6.6 billion into stock funds in the week ended January 22 on optimism that stocks would push higher this year, data from a Bank of America Merrill Lynch Global Research report showed on Friday.

The new demand brought inflows into stock funds so far this year to $16 billion, following a record inflow of $358 billion in 2013, according to the report, which also cited data from fund-tracking firm EPFR Global.

The inflows came even as the benchmark Standard & Poor's 500 <.SPX> stock index fell a modest 0.2 percent over the holiday-shortened week on some disappointing corporate earnings. The U.S. stock market was closed Monday for the Martin Luther King Jr. holiday.

"If you get a pullback, that's a natural time for people who have been wanting to buy to step in," said Michael Jones, chief investment officer of RiverFront Investment Group, with $4.3 billion in assets.

Read more: http://www.businessinsider.com/baml-equity-fund-flows-2014-1#ixzz2rPqkiKLG

xchrom

(108,903 posts)In an interview with the Wall Street Journal's Anupreeta Das, Warren Buffett says Dimon is not getting paid enough.

“If I owned J.P. Morgan Chase, he would be running it and he would be making more money than the directors are paying him,” he told her.

Buffett has publicly defended Dimon previously, and said he personally owns JPM shares.

Buffett added that the firm was a “huge plus to the American financial system” during the financial crisis

“If Jamie decides he wants to make more money, all he has to do is call me and I’d hire him at Berkshire,” Buffett said.

Read more: http://www.businessinsider.com/warren-buffett-on-jamie-dimons-pay-2014-1#ixzz2rPsZ02zM

Demeter

(85,373 posts)Why Warren Buffett would sully himself....

xchrom

(108,903 posts)Anyone who has ever struggled to get her landlord to fix a broken appliance can imagine how much worse it could have been if she were paying rent to a faceless hedge fund based thousands of miles away. That tenant’s nightmare may be on its way to reality for hundreds of thousands of Americans, as Wall Street firms have snapped up 200,000 family houses with the intention of renting them out.

Banks, hedge funds, and private equity firms have been amassing those real estate holdings for a few years now, but their plan for wringing profit out of the rental market is just starting to draw real scrutiny. The New York-based hedge fund Blackstone Group is now the nation’s largest landlord after purchasing over 40,000 foreclosed family homes for the purpose of renting them out.

While firms like Blackstone often farm out the day-to-day management of the rental properties to third-party companies, those intermediaries are often also based in faraway states. Some have a track record of being unresponsive to basic things like broken sewer pipes, as the Huffington Post has reported. The banks and their intermediaries may neglect basic upkeep of these properties. In that worst-case scenario for renters, local and attentive property managers and building supers will get replaced with “Wall Street-based absentee slumlords,” in David Dayen’s phrase.

On-the-ground concerns for communities and renters go beyond neglect, however. The rising influence of financial titans turned local landlords could threaten all sorts of public services. In the case of Huber Heights, OH, the hedge fund Magnetar Capital has become the largest landlord in the whole town and is using that influence to try to extract lower property tax charges from the town — a change that would undermine funding for schools and other public services for locals, but boost the bottom line of the Illinois-based financial giant. (Magnetar’s dodgy past dealings from the subprime era also underscore an unsettling dynamic to Wall Street’s entry into the rental market: the same companies that helped turn homeowners into renters through mass foreclosures are now preparing to make even more money off of the same rental demand they helped create.)

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)But as I replied last week, most Americans have other priorities and really are not paying attention. Not until there is no food and they are hungry, no income nor savings, and are desperate. Desperate people will do desperate things.

And really, how many people have even heard Magnetar? I think if I went shopping in my previous town of Huber Heights, and asked other shoppers about Magnetar owning the rentals in H.H., maybe I might find 1 or 2 who know of Magnetar and its dodgy past.

Demeter

(85,373 posts)It falls to those who know to spread the word.

DemReadingDU

(16,000 posts)It's like discussions with many Republicans, they refuse to cooperate!

xchrom

(108,903 posts)American workers’ wages are growing at just 2 percent per year, the slowest rate since at least 1965, according to a new research note from Goldman Sachs.

That means wage growth is only barely outpacing inflation, which rose by 1.5 percent last year. The research also expects the trend to continue.

Wage growth has been particularly slow in the aftermath of the recession. Real wages have declined 7 percent since 2007 and the pace of growth has been slowing down. There are currently about three job seekers for every job opening — making it risky for the employed to push their bosses too hard for pay increases — and those who do find a job are increasingly ending up in work that pays very little.

But wage stagnation is not a brand new trend. American workers have seen a “lost decade” of wage growth, with wages flat or declining for the bottom 60 percent of the workforce between 2000 and 2012. At the same time, workers’ productivity jumped 25 percent during that time. And things have been bad at the bottom of the income scale for decades: since the 1970s, the richest 20 percent of Americans have seen far more income growth than the bottom.

Demeter

(85,373 posts)before I or the temperatures drop...24F no windchilll....it's a heat wave!

See you all later, if I survive.

Hotler

(11,420 posts)Thank you. I learn more here in WEE and SMW than I do on Google. Stay warm.

Demeter

(85,373 posts)Because I get a whacky idea, and then start Googling....

My mind is filled higglety-piggelty worse than my house with all sorts of stuff that might come in handy some day....

And then I have a truly bizarre circle of friends who feed the collecting imperative...and the whacky ideas.

Hotler

(11,420 posts)We're coming up on the 40th anniversary of Blazing Saddles.

"My mind is a raging torrent, flooded with rivulets of thought, cascading into a waterfall of creative alternatives."

"Gal-darnit, Mr. Lamarr, you use your tongue purttier than a twenty-dollar whore"

One of my favorite movies. I saw that movie when it first came out, I was 19, I saw it with my mom and that was the hardest I ever heard her laugh. I sure miss my mom. Think about her makes a little misty.

Demeter

(85,373 posts)16 years, and counting

hamerfan

(1,404 posts)Great photos of the sculptures, Demeter. Thanks for them!

It's The End Of The World As We Know It by REM:

Demeter

(85,373 posts)How do you do that?

Demeter

(85,373 posts)The horrific images from the Japanese earthquake-tsunami have probably shaken everyone’s confidence. When a nation so modern — so modern that its technology is considered cutting edge — is knocked down so badly, with thousands of citizens dead and many more left in the cold dark for days, with food running short, communities isolated, and anxieties about a nuclear energy threat, the rest of us can only wonder how secure we are. The anxiety will pass. The worst of tragedies — like the 2004 Indian Ocean tsunami which killed 230,000 people and the 2008 earthquake in China which took 68,000 lives — pass into vague memory as we go about our daily lives. (The public’s amnesia for natural disasters drives emergency preparedness experts batty.) But the experience at the moment creates a sort of historical flashback to an era when it was a lot harder to feel secure, when insecurity was the norm. There was a time, a long time, from when humans appeared on earth to about the 20th century, when death was a constant companion. I don’t mean this in the sense of an existential foreboding (as in a Woody Allen movie), but in the sense of an everyday experience and threat. Death — along with serious disability and chronic pain — was all around and could strike suddenly. Most Americans today live without that constant fear.

In America of the 1700s and early 1800s, the average woman would have already buried both of her parents and four of her children by the time she had reached middle age. The diaries and letters of mothers from that era show that the experience of losing and fearing the loss of infants constantly pressed on their thoughts and emotions. It was not until after World War I that the typical mother would live to see all her children grow up. Early Americans understood the precariousness of life. Puritan ministers stressed death’s whim and the need to stay religiously prepared. Many could recite the saying, as Reverend Cotton Mather did, “If an old man has death before his face, a young man has death behind his back; the Deadly Blow may be as near to one as ’tis the other.” Similarly, a 1776 gravestone in Schenectady, New York, warned passers-by that the Angel of Death is close, so be ready for Judgement: “The soul prepared needs no delay / The summon comes the saint obeys.” Death often rode in with the plague, the First Horseman of the Apocalypse. In 1832, residents of Schenectady tracked reports of cholera in England, its arrival by ship in New York harbor, and then its advance upstate. Civic leaders mobilized citizens to clean the streets, experiment with disinfectants, reform their personal habits, and join in prayer. In the end, little helped and more than 40 died in a town of five thousand people. (Story told here SEE OP FOR LINK.) New York City suffered even more. Tens of thousands of the well-to-do fled Manhattan ahead of the disease. “The roads, in all directions, were lined with well-filled stagecoaches, livery coaches, private vehicles, and equestrians, all panic-struck, fleeing the city” and filling up farm homes for miles around. Over 3,500 largely poor, immigrant, and black New Yorkers died (proportionally it was as if over 100,000 New Yorkers died today). In some neighborhoods death arrived so quickly that bodies remained lying in the gutter. On the Illinois frontier, federal troops carried the same cholera into communities which were already beset by seasonal epidemics. Cholera lasted there into 1834. Deaths mounted so rapidly in what was then “the West” that sometimes two bodies shared a blanket for a coffin. Add to these episodic catastrophes the chronic ones such as common illnesses and infections (in 1900, about one of every 500 Americans died of tuberculosis; compare that to the rates for AIDS in 2000, when 1 of every 6,000 Americans was just diagnosed with HIV); accidents (one study found that a large proportion of Boston men in the 19th century ended their lives falling off scaffolds, getting caught in machinery, or in other accidents); wars on the frontiers; alcoholism; and everyday interpersonal violence.

Death’s retreat