Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 28 January 2014

[font size=3]STOCK MARKET WATCH, Tuesday, 28 January 2014[font color=black][/font]

SMW for 27 January 2014

AT THE CLOSING BELL ON 27 January 2014

[center][font color=red]

Dow Jones 15,837.88 -41.23 (-0.26%)

S&P 500 1,781.56 -8.73 (-0.49%)

Nasdaq 4,083.61 -44.56 (-1.08%)

[font color=black]10 Year 2.75% 0.00 (0.00%)

[font color=red]30 Year 3.67% +0.02 (0.55%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)with its massive computer power, it could become self-sustaining.

So instead the govt goes after Silk Road, and now this other fellow, on the theory that buying illegal drugs enables bitcoin seizures....

whatever.

Demeter

(85,373 posts)FED IS MEETING AGAIN? WHAT GIVES? AND IT DOESN'T LOOK LIKE GOLD RAN OUT OF GAS FROM HERE

http://www.marketwatch.com/story/gold-extends-losses-ahead-of-fed-meeting-2014-01-28?siteid=YAHOOB

Gold futures drifted lower on Tuesday, with buyers shrugging off a disappointing report from Apple Inc. to ease back into the equity markets ahead of this week’s Fed meeting and as earnings season cranks up... Gold on Monday finally ran out of gas, logging its first decline in three sessions, but still managed to finish above the day’s lows thanks to a still-struggling U.S. stock market.

Standard Bank’s Walter de Wet said long and short speculative positions in gold have remained mostly unchanged, which suggests a big part of the recent gains came from physical demand. That, however, could change over the next month, he warned.

“The strong physical demand we are currently witnessing from Asia could ease in February, which could see gold push lower again,” de Wet said. “We view gold as a sell into rallies in February.”

Demeter

(85,373 posts)SHADES OF LEHMANN BROS.!

http://www.nakedcapitalism.com/2014/01/china-credit-worries-rise-large-shadow-banking-default-looms.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

Over the last few years, the foreigners who’ve been concerned about China’s growth model, with its extreme dependence on investment and exports and increased use of borrowings, have looked like worrywarts. But it’s getting harder and harder for the officialdom to keep navigating the hairpin turns.

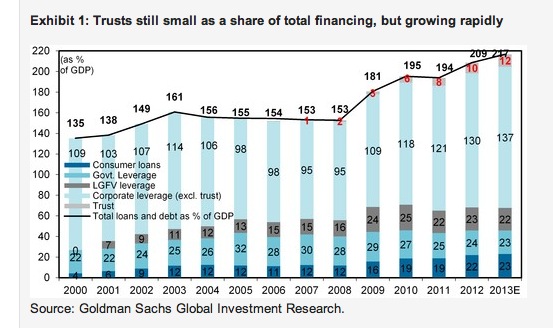

The government does have the luxury of a known drop-dead date to decide what to do about an imminent large default in its shadow banking system. We’ve written off and on about how important it has become to providing new loans in the last year, rising from 20% to 30% of the total (and experts think it’s really more like 50%), and lending has in recent years been the driver of growth, but each yuan of new borrowing now produces 1/4 the amount of GDP increase that it did five years ago.

One bit of good fortune for the officialdom is that its first major test of the shadow banking system is known in advance, giving them time to decide what to do and take any needed precautionary measures. China Credit Trust Co. has told investors it may not make a January 31 principal repayment on a 3 billion remnimbi trust product. Various financial sites, including this blog, have taken note of the concerns about default in China’s so-called wealth management products, an important source of funding for provincial real estate projects. WMP are somewhat cleaned-up cousins of structured investment vehicles. Both funded short and lent long in supposed off balance sheet vehicles. But the maturity mismatch is less with wealth management products, and the authorities apparently believe that investors will not be able to pressure banks into supporting these investments.

The China Credit Trust product isn’t considered to be a WMP; it’s a different structure, a trust, which is sold to particularly well-heeled investors. And the maturity mismatch is even lower than for a WMP, in theory reducing the market risk even further. A Goldman report, excerpted at MacroBusiness, explains:

A trust is essentially a private placement of debt. Investors in the trust must meet certain wealth requirements (several million RMB in assets would not be unusual, so the investors are either high net worth individuals or corporates) and investments have a minimum size (e.g. RMB 1mn)…Trusts invest in a variety of sectors, including various industrial and commercial enterprises, local government infrastructure projects (via LGFVs), and real estate…

A trust is not to be confused with a “wealth management product” (WMP). WMPs are available to a broader group of individuals, with much smaller minimum investments…Funds from WMPs may be invested in a range of products including corporate bonds, trust loans, interbank assets, securitized loans, and discounted bills—so WMPs are best thought of as a “money market fund” or pool for other financial products.

The real problem is that trusts aren’t that large in terms of total outstandings but they’ve become important sources of new lending in recent years:

MORE

Demeter

(85,373 posts)Bitcoin enthusiasts like to present it as a “power to the people” form of money, stressing its apparent lack of ownership (the “Napster for finance“). They stress the lack of need for a “trusted party” like a bank or broker to verify that a payment has been made. And many clearly relish the idea of launching a currency outside the control of central banks (plus this beats Cryptonomicon in geekery).

If you believe the hype, you’ve been had. As Izabella Kaminska of the Financial Times tells us, you all are really just doing free/underpaid R&D for central banks, since you are debugging and building legitimacy for one of their fond projects, making currencies digital and getting rid of cash altogether.

I had wondered about the complacency of Fed and SEC officials in Senate Banking Committee hearings on Bitcoin last year. Press reports at the time attributed it to successful lobbying. But there’s no need to fight when you understand how to become the alpha quant per Tom Lehrer:

Let no one else’s work evade your eyes,

Remember why the good lord made your eyes,

So don’t shade your eyes,

But plagiarize, plagiarize, plagiarize -

Only be sure always to call it please ‘research’.

As Kaminska explains (boldface mine):

Bitcoin has helped to de-stigmatise the concept of a cashless society by generating the perception that digital cash can be as private and anonymous as good old fashioned banknotes. It’s also provided a useful test-run of a digital system that can now be adopted universally by almost any pre-existing value system.

This is important because, in the current economic climate, the introduction of a cashless society empowers central banks greatly. A cashless society, after all, not only makes things like negative interest rates possible, it transfers absolute control of the money supply to the central bank, mostly by turning it into a universal banker that competes directly with private banks for public deposits. All digital deposits become base money.

Consequently, anyone who believes Bitcoin is a threat to fiat currency misunderstands the economic context. Above all, they fail to understand that had central banks had the means to deploy e-money earlier on, the crisis could have been much more successfully dealt with.

Among the key factors that prevented them from doing so were very probable public hostility to any attempt to ban outright cash, the difficulty of implementing and explaining such a transition to the public, the inability to test-run the system before it was deployed.

Last and not least, they would have been concerned about displacing conventional banks from their traditional deposit-taking role, and in so doing inadvertently worsening the liquidity crisis and financial panic before improving it…

Almost of all of these prohibitive factors have, however, by now been overcome:

1) Digital currency now follows in the footsteps of a “disruptive” anti-establishment digital movement perceived to be highly accommodating to the black market and all those who would ordinarily have feared an outright cash ban. This makes it exponentially easier to roll out. Bitcoin has done the bulk of the educating.

2) What was once viewed as a potentially oppressive government conspiracy to rid the public of its privacy can be communicated as being progressive and innovative as a result.

3) Banks have been given more than five years to prove their economic worth and have failed to do so. If they haven’t done so by now, they probably never will, meaning there’s unlikely to be a huge economic penalty associated with undermining them on the deposit front or in transforming them slowly into fully-funded fund managers.

4) The open-ledger system which solves the digital double-spending problem has been robustly tested. Flaws, weaknesses and bugs have been understood, accounted for, and resolved.

The balance of the article describes how the central bank digital currency would be launched, and Kazmina finds a plan developed by Miles Kimball of the University of Michigan to be thorough and viable.

Oh, and why would Bitcoin, um, central bank digital currency make it viable to implement negative interest rates? Kaminska tells us:

Either way, the key point with official e-money is that the hoarding incentives which would be generated by a negative interest rate policy can in this way be directed to private asset markets (which are not state guaranteed, and thus not safe for investors) rather than to state-guaranteed banknotes, which are guaranteed and preferable to anything negative yielding or risky (in a way that undermines the stimulative effects of negative interest rate policy).

So all these tales by Silicon Valley promoters (and remember, Marc Andressen mentioned all the money chasing Bitcoin-related ventures) of how liberating and democratic Bitcoin will be are almost certain to prove to be precisely the reverse. Hang onto your real world wallet.

Demeter

(85,373 posts)...We can use as a starting point the Congressional Budget Office's projections for GDP growth from 2008, before it recognized the damage from the collapse of the bubble. We can then compare these projections with the most recent projections from last year. If we just take the dollar losses through 2013 we get $7.6 trillion, in 2013 dollars. This is just economic losses, it does not include any effort to quantify the pain that workers or their families have suffered from being unemployed or losing their homes. This comes to roughly $25,000 for every person in the country. Alternatively, it is 190 times as much as the Republicans hoped to save from their cuts to food stamps over the next decade.

Many folks around Washington like to talk about 75 year numbers, which is the period over which we project Social Security and Medicare spending and revenue. If we assume that the economy's growth rate in years after 2018 is not affected by the collapse of the bubble, then the cumulative loss in output through 2089 as a result of the collapse of the Greenspan-Rubin bubble would be $66.3 trillion. This amount is almost seven times the size of the projected Social Security shortfall.

If we really want to have fun, we can sum the shortfall over the infinite horizon, an accounting technique that is gaining popularity among those advocating cuts to Social Security and Medicare. The loss over the infinite horizon due to the Greenspan-Rubin bubble would be over $140 trillion, or more than $400,000 for every man, woman, and child in the country.

Obviously these numbers are very speculative but the basic story is very simple. If you want to have a big political battle in Washington, start yelling about people freeloading on food stamps, but if you actually care about where the real money is, look at the massive wreckage being done by the Wall Street boys and incompetent policy makers in Washington.

Demeter

(85,373 posts)On Sept. 15, 2008, the investment bank Lehman Brothers collapsed after a long struggle to avoid bankruptcy, paralyzing the world’s financial networks and tipping the United States economy into an abyss from which it has not yet fully emerged...More than five years later, there is still no answer to perhaps the most critical question raised by the man-made disaster: How much did it all cost?

In July, three economists at the Federal Reserve Bank of Dallas, Tyler Atkinson, David Luttrell and Harvey Rosenblum, gave it a shot, at least as far as the United States economy goes. Their analysis — cautious and tentative, critically dependent on debatable assumptions — underscores how difficult it is, still, to accurately tally the costs of the most severe economic catastrophe since the Depression of the 1930s into a coherent, conclusive measure of loss.

“It is not difficult to understand why such accounting exercises are rare,” they wrote. “They require comparing a world in which no financial crisis occurred to what actually happened and what is likely to transpire.”

Most strikingly, their examination offers a panoramic view of the variety of ways in which the financial crisis diminished the nation’s standard of living. At a bare minimum the crisis cost nearly $20,000 for each American. Adding in broader impacts on workers’ well-being — an admittedly speculative exercise — could raise the price tag to as much as $120,000 for every man, woman and child in the United States. With this kind of money we could pay back the federal debt or pay for a top-notch college education for everyone. The portrait of loss, tentative as it is, suggests that even the most far-reaching measures might be justified to ensure it never happens again. But you wouldn’t know that from the current debate.

In December, the American Bankers Association sued to stop a provision of the Volcker Rule, part of the Dodd-Frank financial reform law, and intended to stop banks from engaging in risky trading on their own account. It pretty much won, convincing regulators that forcing banks to get rid of a complex debt security used by smaller institutions to raise capital would impose immediate and unnecessary costs on small community banks. Separately, the Securities and Exchange Commission has taken a legal battering at the hand of business-friendly judges arguing that the agency has not adequately assessed whether the benefits of its rules justify the costs. This has largely stopped the agency’s rule-making...Regulators creating international banking standards in Basel, Switzerland, have also faced a drumbeat of criticism from bankers who argue that proposed rules to increase the capital cushion international banks must amass to buffer against losses would slice 3.5 percent from the world’s economic output and cost 7.5 million jobs. This month, as American regulators watered down the Volcker Rule in response to the bankers’ lawsuit, regulators in Basel agreed to soften some of their capital requirements, too. Over all, almost half the rules required by the Dodd-Frank legislation have yet to be written. But the financial industry would love to slow regulation further. “Our goal is to press the pause button on the multitude of regulations and rules, to give the industry time to digest them,” said James Ballentine, executive vice president for congressional relations for the banking association. “The industry should have an opportunity to determine what is working and what is not.”

The bankers’ points are not necessarily wrong. Regulation does impose costs. Some banking rules and regulations might make loans scarcer or more expensive. Restrictions on banks’ businesses are likely to eat into their profitability. Nonetheless, the legal attack on the new regulation is disingenuous. Increasing the industry’s costs and reducing its profits is an objective of the regulation overhaul, not a bug. The goal is to ensure that banks internalize the costs of their risky business rather than have them borne by the rest of society.

“Regulatory agencies are being sued to prevent that the law be put in place because it will cause the industry that crashed the world to lose money,” said Dennis Kelleher, who heads Better Markets, a nonprofit formed after the financial crisis to press for stricter regulation of the banking sector. “But Congress made the decision of who was going to bear the costs.”

Indeed, even if financial regulation imposes broader economic costs, what matters is how they measure up against the benefit of preventing another financial disaster.

MORE

Demeter

(85,373 posts)

Demeter

(85,373 posts)Federal prosecutors are trying to thwart the easy access that predatory lenders and dubious online merchants have to Americans’ bank accounts by going after banks that fail to meet their obligations as gatekeepers to the United States financial system.

The Justice Department is weighing civil and criminal actions against dozens of banks, sending out subpoenas to more than 50 payment processors and the banks that do business with them, according to government officials.

In the new initiative, called “Operation Choke Point,” the agency is scrutinizing banks both big and small over whether they, in exchange for handsome fees, enable businesses to illegally siphon billions of dollars from consumers’ checking accounts, according to state and federal officials briefed on the investigation.

The critical role played by banks largely plays out in the shadows because they typically do not deal directly with the Internet merchants. What they do is provide banking services to third-party payment processors, financial middlemen that, in turn, handle payments for their merchant customers...

MORE SLIME AT LINK

Demeter

(85,373 posts)...The poorest children tended to have the greatest risk of psychiatric disorders, including emotional and behavioral problems. But just four years after the supplements began, Professor Costello observed marked improvements among those who moved out of poverty. The frequency of behavioral problems declined by 40 percent, nearly reaching the risk of children who had never been poor. Already well-off Cherokee children, on the other hand, showed no improvement. The supplements seemed to benefit the poorest children most dramatically.

When Professor Costello published her first study, in 2003, the field of mental health remained on the fence over whether poverty caused psychiatric problems, or psychiatric problems led to poverty. So she was surprised by the results. Even she hadn’t expected the cash to make much difference. “The expectation is that social interventions have relatively small effects,” she told me. “This one had quite large effects.”

She and her colleagues kept following the children. Minor crimes committed by Cherokee youth declined. On-time high school graduation rates improved. And by 2006, when the supplements had grown to about $9,000 yearly per member, Professor Costello could make another observation: The earlier the supplements arrived in a child’s life, the better that child’s mental health in early adulthood.

She’d started her study with three cohorts, ages 9, 11 and 13. When she caught up with them as 19- and 21-year-olds living on their own, she found that those who were youngest when the supplements began had benefited most. They were roughly one-third less likely to develop substance abuse and psychiatric problems in adulthood, compared with the oldest group of Cherokee children and with neighboring rural whites of the same age. Cherokee children in the older cohorts, who were already 14 or 16 when the supplements began, on the other hand, didn’t show any improvements relative to rural whites. The extra cash evidently came too late to alter these older teenagers’ already-established trajectories....

Demeter

(85,373 posts)DOESN'T HAVE TO BE THAT WAY, DR. KRUGMAN....SEE ABOVE

http://www.truth-out.org/opinion/item/21378-economic-opportunity-has-collapsed-so-poverty-endures

I wanted to say something about the 50th anniversary of President Lyndon Johnson's War on Poverty. By 1980 or so, according to the Center on Budget and Policy Priorities, there was widespread consensus that it had failed. But, as the C.B.P.P. also concluded in an online article earlier this month, that doesn't stand up once you do the numbers right: poverty measures that take into account government aid - aid of the kind provided by the war on poverty! - do show a significant decline since the 1960s.

...The narrative in the 1970s was that the war on poverty had failed because of social disintegration: government attempts to help the poor were outpaced by the collapse of the family, rising crime and so on. And on the right, and to some extent in the center, it was often argued that government aid was, if anything, promoting this social disintegration. Poverty was therefore a problem of values and social cohesion, not money. That was always much less true than the elite wanted to believe; as the sociologist William Julius Wilson showed long ago, the decline of urban employment opportunities actually had a lot do with the social disintegration. Still, there was something to it. But that was a long time ago. These days crime is way down, so is teenage pregnancy, and so on; society did not collapse. What collapsed instead was economic opportunity. If progress against poverty has been disappointing over the past half century, the reason is not the decline of the family, but the rise of extreme inequality.

The United States is a much richer nation now than it was in 1964, but little if any of that increased wealth has trickled down to workers in the bottom half of the income distribution. The trouble is that the American right is still living in the 1970s, or actually a Reaganite fantasy of the 1970s; its notion of an anti-poverty agenda is still all about getting those layabouts to go to work and stop living off welfare.

The reality that lower-end jobs, even if a person can get one, don't pay enough to lift people out of poverty just hasn't sunken in. And the idea of helping the poor by actually helping them remains anathema. Will it ever be possible to move this debate away from welfare queens and all that? I don't know. But for now, the key to understanding poverty arguments is that the main cause of persistent poverty is high inequality of market income - but the right can't bring itself to acknowledge that reality.

Demeter

(85,373 posts)We will be remembering Pete Seeger, folks. You can wear some flowers in your hair, so that we can show where they've all gone...

Tansy_Gold

(17,847 posts)We will celebrate a long life gloriously lived and shared with so many.

Demeter

(85,373 posts)Much as I'm sure all of Washington would like us to forget...

xchrom

(108,903 posts)India's central bank has unexpectedly raised interest rates in an attempt to rein in stubbornly high consumer prices in a crucial election year.

The Reserve Bank of India (RBI) raised the benchmark repo rate - the amount at which it charges to lend to commercial banks - to 8% from 7.75%.

Economists had expected no change after its meeting in Mumbai on Tuesday.

The RBI said that another near-term hike was unlikely if inflation eased to a more comfortable level.

xchrom

(108,903 posts)The UK economy grew by 1.9% in 2013, its strongest rate since 2007, according to the Office for National Statistics (ONS).

But growth in gross domestic product (GDP) for the fourth quarter slipped to 0.7%, down from 0.8% in the previous quarter, it said.

And economic output is still 1.3% below its 2008 first quarter level,

"We've seen growth in most parts of the economy," said Joe Grice, chief economist at the ONS.

xchrom

(108,903 posts)French unemployment has hit a record high with more than 3.3 million people now registered as out of work.

In December, 10,200 more people were listed as jobless, breaking President Francois Hollande's promise joblessness would fall by the year end.

The French unemployment rate is now 11.1%. It went up by 5.7% in 2013, and rose 0.3% in December.

In Ankara, Turkey, Mr Hollande said ahead of the release: "Stabilisation, which we have achieved, is not enough."

Demeter

(85,373 posts)This time, the Federal Reserve has created a truly global problem. A big chunk of the trillions of dollars that it pumped into the financial system over the past several years has flowed into emerging markets. But now that the Fed has decided to begin "the taper", investors see it as a sign to pull the "hot money" out of emerging markets as rapidly as possible. This is causing currencies to collapse and interest rates to soar all over the planet. Argentina, Turkey, South Africa, Ukraine, Chile, Indonesia, Venezuela, India, Brazil, Taiwan and Malaysia are just some of the emerging markets that have been hit hard so far. In fact, last week emerging market currencies experienced the biggest decline that we have seen since the financial crisis of 2008. And all of this chaos in emerging markets is seriously spooking Wall Street as well. The Dow has fallen nearly 500 points over the last two trading sessions alone. If the Federal Reserve opts to taper even more in the coming days, this currency crisis could rapidly turn into a complete and total currency collapse.

A lot of Americans have always assumed that the U.S. dollar would be the first currency to collapse when the next great financial crisis happens. But actually, right now just the opposite is happening and it is causing chaos all over the planet...What we are potentially facing is the bursting of a financial bubble on a global scale.

MORE

xchrom

(108,903 posts)Janet Yellen probably will confront a test during her tenure as Federal Reserve chairman that both of her predecessors flunked: defusing asset bubbles without doing damage to the economy.

The central bank’s easy money policies already have led to pockets of frothiness in corporate debt and emerging markets. The danger is that unwinding such speculative excesses will end up shaking the financial system and hurting growth.

Yellen is “going to be trying to do something that no one has ever done,” said Stephen Cecchetti, former economic adviser for the Bank for International Settlements, the Basel, Switzerland-based central bank for monetary authorities. She needs “to ensure that accommodative monetary policy doesn’t create significant financial stability risks,” he said in an interview.

Investors got a taste of the hazards in recent days when news of a slowdown in China’s economy, coupled with expectations of reduced stimulus from the Fed, helped trigger a rout in emerging markets that had been pumped up by easy money imported from the U.S. Emerging-market stocks dropped yesterday by the most in five months, dragging U.S. shares with them. The MSCI Emerging Markets Index has lost 7.1 percent this year.

xchrom

(108,903 posts)President Barack Obama will announce tonight in his State of the Union address that he is bypassing Congress and raising the minimum wage to $10.10 an hour for federal contractors.

Obama will issue an Executive Order for U.S. contract workers -- including janitors and construction workers -- while repeating his call to reluctant lawmakers to increase the minimum hourly wage for all employed Americans.

Lawmakers ignored Obama’s plea in last year’s address to raise the minimum wage and congressional elections coming in November won’t make reaching an agreement any easier.

“It would be challenging to move the needle on inequality in the near term even with Congress’s cooperation,” said Jared Bernstein, Vice President Joe Biden’s former chief economist. “It would be really hard to do it without.”

xchrom

(108,903 posts)Investors are embracing U.S. government bonds amid rising turmoil in the equities market, sending expectations about future volatility to a six-year low.

Implied volatility, a proxy for future swings used to price derivatives, for the iShares 20+ Year Treasury Bond ETF has dropped as much as 44 percent from a June peak. The measure reached the lowest level since October 2007 last week, according to three-month data compiled by Bloomberg on options with an exercise price near the shares. The fund has climbed 4.8 percent this year, compared with a 3.6 percent decline for the Standard & Poor’s 500 Index.

Traders are seeking safety amid growing concern about the stability of emerging-market economies and the outlook for global growth. The rally in bonds and retreat for stocks is a reversal to 2013 when the Treasury ETF (TLT), tracking U.S. debt maturing in 20 years or more, declined 16 percent while the S&P 500 advanced 30 percent to a record on Federal Reserve stimulus and improving corporate earnings.

“Investors are taking a look at the bond market, we’re starting to see that rotation,” Keith Richards, a fund manager with ValueTrend Wealth Management in Barrie, Ontario, which manages C$110 million ($99 million), said in a Jan. 23 phone interview. “They’re probably selling and taking profits on equities and buying an oversold bond class, the long bond.”

xchrom

(108,903 posts)European stocks advanced, following their largest three-day slump in seven months, as mining companies climbed and banks rebounded from a three-week low. U.S. index futures also gained, while Asian shares fell.

BHP Billiton Ltd. and Rio Tinto Group both rose more than 1.5 percent. Banco Santander SA, which generates most of its sales from Latin America, added 2.1 percent to halt an eight-day losing streak. F&C Asset Management Plc (FCAM) jumped 5.4 percent after Bank of Montreal agreed to buy the owner of the U.K.’s oldest investment fund for 708 million pounds ($1.2 billion).

The Stoxx Europe 600 Index increased 0.6 percent to 324.05 at 12:29 p.m. in London. The benchmark retreated 4.2 percent from Jan. 22 through yesterday as the Argentinian government’s decision to allow its currency to devalue triggered a rout in emerging-market currencies. Standard & Poor’s 500 Index (SPX) futures gained 0.4 percent today, while the MSCI Asia Pacific Index fell 0.4 percent for a fourth day of losses.

“We will start to see positive earnings surprises increase in Europe in the next few quarters,” said Didier Duret, who helps manage about $228 billion as chief investment officer at ABN Amro Private Banking in Amsterdam. “The correction we had in the past few days was more of a self-regulation from the market. The downturn is not a long-term trend and fundamental sentiment hasn’t changed.”

xchrom

(108,903 posts)Venture capital pioneer Tom Perkins apologized for comparing today’s treatment of wealthy Americans to the persecution of Jews in Nazi Germany, though he said he stood by his message around class warfare.

“I’d deeply apologize to you and anyone who has mistaken my reference to Kristallnacht as a sign of overt or latent anti-Semitism,” he said in an interview yesterday on Bloomberg Television. “This is not the case.”

Perkins, 82, was addressing a firestorm he had created with a letter to the editor in the Jan. 25 edition of the Wall Street Journal, in which he compared resentment of the very rich in the U.S. to a “progressive war on the American 1 percent,” akin to attacks on Jews in the 1930s. In the wake of the letter, the venture capital firm he co-founded, Kleiner Perkins Caufield & Byers, distanced itself from him, saying Perkins hadn’t been involved in the firm in years. Other venture investors including Marc Andreessen also criticized Perkins for his remarks.

Perkins told Bloomberg Television today that he made the analogy between wealthy Americans and Jews because the rich are a minority, like the Jews who made up just 1 percent of the German population before the Holocaust. He said he regretted using the word Kristallnacht, a night in 1938 when Nazis coordinated attacks against Jews, in his letter.

xchrom

(108,903 posts)Norway Finance Minister Siv Jensen said the nation’s $820 billion wealth fund should pursue the highest returns amid opposition demands that the investor place more focus on ethics and the environment.

“I believe strongly that you shouldn’t mess around with people’s pensions,” Jensen said today in an interview in Oslo. “We have an overall responsibility to have a long-term, good financial-investment profile that provides the highest possible returns at the lowest possible risk.”

Norway’s parliament is due to hold hearings today on whether the fund should exclude coal companies from its portfolio after a proposal by the Social Democrats, the biggest opposition party. The fund, built from Norway’s oil and gas revenue, already takes into account ethical rules encompassing human rights, some weapons production, the environment and tobacco when deciding on its investments.

Jensen, who took office in October, is preparing a white paper to be released in April that will provide new strategy recommendations.

xchrom

(108,903 posts)Asian stocks fell, with the regional benchmark index on course to drop for a fourth day, amid concern over the Federal Reserve’s plan to cut stimulus and as profit growth at China’s industrial companies slowed.

BHP Billiton Ltd., the world’s biggest mining company that counts China as its No. 1 market, fell 2 percent to be the biggest drag on the index as Australian markets opened after a holiday. LG Display Co. (034220) lost 3.3 percent in Seoul after customer Apple Inc. (AAPL) forecast sales that trailed analyst estimates. Komatsu Ltd., the world’s second-largest maker of construction equipment, gained 1 percent in Tokyo after bigger rival Caterpillar Inc. projected earnings that topped expectations.

The MSCI Asia Pacific Index fell 0.4 percent to 134.23 as of 9:36 p.m. in Tokyo. The regional gauge dropped yesterday by the most since June as part of a global slump sparked by weaker-than-expected data from China and a sell-off in emerging-market currencies. India unexpectedly raised interest rates today, while Fed policy makers start a two-day meeting.

“Investors can’t move much until they see the policy statement of the Federal Open Market Committee meeting on Jan. 28-29 and the market’s reaction to it,” said Toshihiko Matsuno, a strategist at SMBC Friend Securities Co., a unit of Japan’s second-largest lender. “The abrupt changes in developing markets are showing signs of settling down and the yen has stabilized. That should start buying back gradually.”

xchrom

(108,903 posts)Pressure is building on Turkish central bank Governor Erdem Basci to raise interest rates or face the prospect of the lira plunging to fresh records and government bonds extending their declines.

“Words are no longer enough, the market wants to see the central bank hiking rates,” Turker Hamzaoglu, chief emerging-markets economist at Bank of America Corp. in London, said by e-mail yesterday. “The more delayed it is, the more the central bank needs to deliver.”

It took yesterday’s announcement of an extraordinary central bank meeting with a decision promised for midnight tonight in Ankara to halt the lira’s 10-day slide, the longest run since 2001. Basci has shunned raising rates as Prime Minister Recep Tayyip Erdogan faces a corruption probe against his government and local elections on March 30.

Basci said at a press conference today that he’d called the meeting to address excessive volatility in the currency and it was time to bring interest rates into the fold. At the same time, he distinguished between temporary and permanent rate increases and defended his flexible rates policy. Basci also raised the bank’s year-end inflation estimate to 6.6 percent from 5.3 percent and said the bank would issue a statement at midnight, allowing time for monetary policy committee member Abdullah Yavas to attend upon returning from the U.S.

xchrom

(108,903 posts)December durable goods orders data are out, and the numbers aren't pretty.

Here's a quick roundup:

TOTAL ORDERS: -4.3%, 1.8% expected, previous revised down to 2.6% from 3.5%

TOTAL ORDERS EX-TRANSPORTATION: -1.6%, 0.5% expected, previous revised down to 0.1% from 1.2%

ORDERS OF NONDEFENSE CAPITAL GOODS EX-AIRCRAFT: -1.3%, 0.3% expected, previous revised down to 2.6% from 4.5%

SHIPMENTS OF NONDEFENSE CAPITAL GOODS EX-AIRCRAFT: -0.2%, 0.1% expected, previous revised down to 2.3% from 2.8%

Read more: http://www.businessinsider.com/durable-goods-orders-december-2014-1#ixzz2rhXkkbko

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Horror as banker, 39, plunges to his death from headquarters of JP Morgan in Canary Wharf

Source: Daily Mail

A banker has died after jumping 500ft from the top of JP Morgan's European headquarters in London this morning.

The man, who is believed to be 39, fell from the 33 floor skyscraper and was found on the ninth floor roof of the Canary Wharf building.

A source close to the investigation told MailOnline the man was a banker, but JP Morgan, the world's largest bank by assets, said his name and job would not be released until his family were informed...

'Traders are usually in by 7.30am, so on that basis it could be one of them.

'It was bonus week at JP Morgan last week so I hope it wasn't to do with that'.

...JP Morgan's building has been the headquarters of the bank's Europe, Middle East and Africa (EMEA) operation since July 2012.

It used to be owned by Lehman Brothers until its collapse in 2008, and the area houses the headquarters of other banking giants including HSBC and Barclays.

Read more: http://www.dailymail.co.uk/news/article-2547275/BREAKING-NEWS-Man-30s-dies-plunge-JP-Morgan-headquarters-Canary-Wharf.html

FORMER BANK EXECUTIVE FOUND HANGED AT KENSINGTON HOME

A former Deutsche Bank executive has been found dead at a house in London, it emerged today.

Former Deutsche Bank executive among 'finest minds' in field found dead

http://www.telegraph.co.uk/news/uknews/law-and-order/10601800/Former-Deutsche-Bank-executive-among-finest-minds-in-field-found-dead.html

A former Deutsche Bank executive considered to be ''among the finest minds'' in his field has been found dead.

Bill Broeksmit, 58, died at his home in Chelsea, south west London, on January 26 and his death is not being treated as suspicious.

An internal email was sent out by co-chief executive officers Anshu Jain and Juergen Fitschen to former colleagues at Deutsche Bank, paying tribute to the ''thoughtful advice and personal friendship'' he gave.

It said: ''It is our sad duty to inform you that our former colleague, Bill Broeksmit, 58, died on Sunday at his home in London.

''Bill worked at Deutsche Bank from 1996 to 2001 when he was instrumental as a founder of our investment bank. He returned to the bank in 2008, serving in various senior roles until his retirement in February 2013. He was considered by many of his peers to be among the finest minds in the fields of risk and capital management....

http://www.independent.co.uk/news/business/news/former-deutsche-bank-executive-found-dead-in-london-home-9091185.html

...Mr Broeksmit, who retired last year, joined the German lender in the 1990s and had close ties with Deutsche's co-chief executive Anshu Jain...Mr Broeksmit worked at Deutsche Bank from 1996 to 2001. He returned to the bank in 2008 where he served as head of portfolio risk optimisation until his retirement in February 2013...In 2012, he was considered for the role of head of risk officer but his nomination was blocked by German regulators citing his lack of experience manage a large number of employees.

http://www.dailymail.co.uk/news/article-2547343/Former-executive-Deutsche-Bank-hanged-Kensington-home.html?ITO=1490&ns_mchannel=rss&ns_campaign=1490

...Mr Broeksmit worked in investment banking - specifically risk and securities - and lived on exclusive Evelyn Gardens in South Kensington, which has an average property value of £1.9million... Mr Broeksmit was also employed by Merrill Lynch for a period...

Demeter

(85,373 posts)pump up that bubble, until all Jamie's friends get out...

Eugene

(61,807 posts)Source: Reuters

BY KAREN FREIFELD

NEW YORK Tue Jan 28, 2014 1:07pm EST

(Reuters) - New York will propose regulating virtual currency firms that operate in the state this year and may require them to obtain a "BitLicense," state banking regulator Benjamin Lawsky said on Tuesday.

The regulations would be aimed at preventing misconduct such as money laundering without derailing a fledgling technology, said Lawsky, the state's superintendent of financial services.

Lawsky was speaking at the start of two days of hearings on online currencies organized by his agency, the New York Department of Financial Services.

Separately on Tuesday, the Bitcoin Foundation, an advocacy group which promotes adoption of the bitcoin digital currency, said one of its executives, Charlie Shrem, had resigned a day after U.S. prosecutors charged him with conspiring to commit money laundering.

[font size=1]-snip-[/font]

Read more: http://www.reuters.com/article/2014/01/28/us-usa-bitcoin-newyork-idUSBREA0R1DA20140128

Demeter

(85,373 posts)defeats the whole purpose of the digital currency, no?