Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 7 July 2014

[font size=3]STOCK MARKET WATCH, Monday, 7 July 2014[font color=black][/font]

SMW for 3 July 2014

AT THE CLOSING BELL ON 3 July 2014

[center][font color=green]

Dow Jones 17,068.26 +92.02 (0.54%)

S&P 500 1,985.44 +10.82 (0.55%)

Nasdaq 4,485.92 +28.19 (0.63%)

[font color=green]10 Year 2.64% -0.04 (-1.49%)

30 Year 3.47% -0.03 (-0.86%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)They got "none".

Demeter

(85,373 posts)“In the language of ‘terrorism studies,’ the human beings involved in these social movements are 'contagions,' as in vectors of disease...The goal of “terrorism studies” is “to find possible vectors of resistance, which are to be identified and eradicated, like a disease.”

The U.S. Department of Defense is immersed in studies about...people like you. The Pentagon wants to know why folks who don’t themselves engage in violence to overthrow the prevailing order become, what the military calls, “supporters of political violence.” And by that they mean, everyone who opposes U.S military policy in the world, or the repressive policies of U.S. allies and proxies, or who opposes the racially repressive U.S. criminal justice system, or who wants to push the One Percent off their economic and political pedestals so they can’t lord it over the rest of us. (I’m sure you recognize yourself somewhere in that list.)

The Pentagon calls this new field of research “terrorism studies,” which is designed to augment and inform their so-called War on Terror. Through their Minerva Research Initiative, the military has commissioned U.S. universities to help it figure out how to deal with dissatisfied and, therefore, dangerous populations all around the world, including the United States.

The Minerva Initiative was the subject of an article in The Guardian newspaper by Dr. Nafeez Ahmed, an academic who studies international security issues. The Initiative seeks to sharpen the U.S. military’s “warfighter-relevant insights” into what makes people tick, and get ticked off at power structures, in regions “of strategic importance to the U.S.” Since the U.S. is an empire seeking global hegemony, and sees the whole world as strategic, the Minerva program’s areas of interest involve – everybody on the planet.

Total War Against the Planet

So, now you know why U.S. intelligence agencies are tapping the telephones and Internet communications of virtually the entire population of the planet. They are mapping every conceivable human network, sifting through the myriad patterns of human association to find possible vectors of resistance, which are to be identified and eradicated, like a disease. American military and intelligence enlisted academics to study the dynamics of "the 2011 Egyptian revolution, the 2011 Russian elections, the 2012 Nigerian fuel subsidy crisis and the 2013 Gazi park protests in Turkey" – all with the aim of preventing similar “contagions” from spreading.

The United States military sees itself as engaged in a total war against the entirety of planet Earth: all of its people, its social movements and dynamics, are enemy territory, including the people of the United States. When American rulers say they are defending U.S. national security interests against all potential enemies, what they really mean is they are defending the prevailing capitalist order against any social movement that might oppose it, anywhere on Earth. They want to put the hole planet on lockdown, and have enlisted U.S. universities in their global fascist project.

tclambert

(11,085 posts)'Cause I know somebody who keeps talking about an impending FRSP.

Demeter

(85,373 posts)Winston S. Churchill

They don't even draw a distinction between lawful democratic redress, or process, and terrorism. This is why this effort will go down in history as a Miserable Failure in every respect.

Just like Iraq and Afghanistan and Syria and Ukraine and...

Demeter

(85,373 posts)China has permitted banks to freely set their own exchange rates for the yuan against the dollar in over-the-counter transactions -- another step toward freeing the exchange rate from government control. Banks were previously required to price the yuan/dollar rate they offered retail clients within 3 percent in either direction of the Chinese central bank's midpoint on a given day...The new rules do not apply to the yuan/dollar's main rate in the interbank market, which is subject to controls including the central bank setting a daily midpoint from which the spot rate has been allowed to fluctuate in either direction by 2 percent since March.

Under the new policy, effective immediately, banks can price OTC yuan/dollar exchange rates "in line with market supply and demand and without any restrictions", the People's Bank of China (PBOC) said in a statement published late on Wednesday. The move "is aimed at further perfecting the mechanisms to establish market-oriented exchange rate for the yuan," the central bank said in the statement. However, the wholesale market that the banks trade in must still abide by the midpoint guidance rate. Because that primary market is an enormous source of forex supply and demand, posting around $15 billion in transactions every day, it will continue to exercise a strong influence on the retail market.

The world's second-largest economy is seeking to increase the use of the yuan in global trade and investment to diminish China's dependence on the U.S. dollar, and by extension its exposure to economic policy decisions made in Washington outside of its control. Allowing the market to price the yuan against the dollar is a pre-requisite for wider liberalisation, and at the same time decreases the need for Beijing to accrue dollar reserves in the name of managing the exchange rate. The PBOC has purposefully guided the yuan to stage more two-way trading over the past couple of years, letting the yuan appreciate 2.9 percent versus the dollar in 2013, only to push it down as much as 3.4 percent this year to convince the market not to consider the currency a one-way bet on appreciation.

TESTING THE WATERS

With the first market-oriented yuan/dollar exchange rates in the OTC market, the central bank can collect data on dollar supply and demand from major state banks, traders said...The latest reform step comes ahead of bilateral economic talks between the United States and China later this month, during which U.S. officials are expected to raise their concerns about Beijing's interventions in the currency market. Critics say China artificially suppresses the value of the yuan to protect its exporters, an accusation China has always denied. U.S. Treasury Secretary Jack Lew, who will attend the Strategic & Economic Dialogue in Beijing later this month, said on Tuesday the yuan's value is a "very big issue" for the United States and that the currency needs to appreciate more.

Robert Minikin, forex strategist at Standard Chartered in Hong Kong, said he believed that Beijing is also preparing to change the way it manages the market in general, and that the freeing of the retail market could be a step in this direction....Minikin was referring to a common complaint by participants in China's forex market, namely that the central bank has used the daily midpoint fixing as a leash to control market movements instead of an indicator of consensus price....Economists have pointed out that so long as Beijing continues to set an official midpoint rate, it retains a tool for controlling the exchange rate; and so long as the interbank market is restrained by a trading band, the market is not truly in charge.

Demeter

(85,373 posts)The government said Tuesday it is considering changing banks to pay creditors holding restructured bonds from a $100 billion default in 2001, as it plans talks this week to avert a second default amid a court battle with bondholders who refused to participate in the restructurings.

The possibility of switching banks "is part of the analysis," Cabinet Chief Jorge Capitanich said in a televised press conference.

This would involve changing the paying agent for the restructured bonds to possibly Banco Nacion, the largest state bank, as the government is trying to figure out how to pay the 92.4% of bondholders who accepted 30 cents on the dollar in restructuring agreements in 2005 and 2010.

The latest payment was due Monday, and the government Friday tried to wire $539 million to the Bank of New York Mellon, the paying agent for the restructured bonds, to make a $539 million payment as part of a total of more than $1 billion due. But U.S. federal judge Thomas Griesa, who has been presiding over the holdouts case, said the payment would be "illegal" because it would violate his order to pay $1.5 billion owed to the plaintiff creditors, among them a hedge fund of American billionaire Paul Singer. These holdouts won a lengthy case based on an equal treatment clause in the bond contracts, meaning the country must pay the plaintiffs at the same time it makes its next payment to the holders of restructured bonds.

Argentina still has a 30-day grace period, until July 30 to make the payments, without being considered in default.

MORE

KILL THE VULTURE

Demeter

(85,373 posts)At a recent trade fair in Tokyo, a robot was was busy rolling rice into cylinders for sushi while fair-goers gathered around to sample the automation's "handiwork."

Manufactured by Suzumo Machinery Co. in Tokyo, the robot can produce 4,300 rolls per hour and retails for about 1.35 million yen ($13,250), excluding tax.

An employee of a supermarket operator in Kanagawa Prefecture watching the robot in action said the machine would be a big help at the store, where wages were raised 50 yen an hour the month before to attract additional much-needed part-time workers.

The robot is a sign of a recent move spreading across the nation in the construction, retailing and restaurant industries to fill the labor void with the introduction of robots and other automated equipment...

Demeter

(85,373 posts)OR AS THE BRITS WOULD SAY: DROPS A BRICK

http://www.bloomberg.com/news/2014-07-02/u-k-regulator-pressed-by-lawmakers-to-investigate-stock-rigging.html

Britain’s markets regulator should investigate whether the closing prices of stocks are being manipulated, according to lawmakers.

“This is something which is very widely spoken about among equity traders,” Conservative lawmaker Mark Garnier said at a hearing of the Treasury Committee in London today. “This is not a minor thing. This is a big deal.”

Garnier asked David Bailey, head of markets infrastructure and policy at the Financial Conduct Authority, if the regulator had brought any prosecutions against anyone for trying to manipulate closing prices. Bailey said he was unaware of any investigations into closing prices and pledged to report back to the Parliamentary committee when he had more information.

“We’re all amazed that this equity closing price hasn’t been looked at before,” Conservative party lawmaker Andrew Tyrie, the committee’s chairman, said at the hearing.

Regulators around the world are grappling with a widening list of benchmarks that have been, or are claimed to have been, manipulated by traders at banks for their own profit. The FCA is one of more than a dozen authorities investigating the $5.3 trillion-a-day currency market following allegations dealers colluded to move benchmark rates used by investors. ...

Demeter

(85,373 posts)...the debt held by American households is rising ominously. And unless our economic policies change, that debt balloon, powered by radical income inequality, is going to become the next bust. Our macro models at the Levy Economics Institute are showing that the US economy is about to face a repeat of pre-crisis-style, debt-led growth, based on increased borrowing. Falling government deficits are being replaced by rising debts on everyone else's ledgers – well, almost everyone else's. What's emerging is a new sort of speculative bubble, this time based on consumer and corporate credit.

Right now, America is wrestling a three-headed monster of weak foreign demand, tight government budgets and high income inequality, with every sign that these conditions will continue. With that trio in place, the anticipated growth isn't going to be propelled by an export bonanza, or by a government investment boom. It will have to be driven by spending. Even a limping recovery like the one we're nursing along today depends on domestic demand – consumer spending not just by the wealthy, but by everyone else.

We believe that Americans will keep consuming at the same ever-rising rates of past decades, during good times and bad. But for the vast majority, wages and wealth aren't going up, so we're anticipating that the majority of Americans – the 90% – will once again do what was done before: borrow, and then borrow more. By early 2017, with growth likely to stall even according to CBO predictions, it should be apparent that we're reliving an alarming history. Middle- and low-income households have been following a trajectory of an ever-higher ratio of debt to income. That same ratio has been decreasing for the most well-off 10%, who are continuing to see debt decline and wealth rise...To paraphrase Voltaire's words on God, even if bubbles and debt did not exist, it would be necessary to invent them. And that is exactly what we are doing.

Demeter

(85,373 posts)Fourteen years ago, the 1% got the tax breaks and regulatory rollbacks which they had repeatedly assured us would usher in an era of boundless prosperity. What was ushered in instead was the worst economic disaster since the Great Depression - an ongoing disaster that is exacerbated by the austerity-mongering neoliberal vampires who still control our economy.

Now, even the Harvard Business Review is calling out the neoliberal nonsense about "entreprenuers", pointing out that the short-term view of the financial markets values "disruptive innovation" less than "efficiency innovation" (i.e., cutting jobs).

When the man who invented the term "disruptive innovation" (Clayton Christensen) says captialism does not value his brainchild, you know that Wall St. has jumped the shark...Christensen is a good teacher. Unlike most business school writers, he actually clarifies the topic he is writing about, as opposed to burying it in jargon, like Theory Z. In the article I'm referencing, he sub-divides innovation, and thereby uncloaks for us how the business jargon has mashed true innovation together with cost-cutting. (Sorta the same way today's Democratic Party has mashed progressivism together with corporate welfare.) Christensen defines three kinds of innovation:

Efficiency innovations help companies make and sell mature, established products or services to the same customers at lower prices.

Market-creating innovations, our third category, transform complicated or costly products so radically that they create a new class of consumers, or a new market.

Then, he goes on to essentially say that one of the fundamental tenets of capitalism, a tenet that underlies the austerity mania, is no longer true:

While it’s still true that scarce resources need to be managed closely, it’s no longer true that capital is scarce. A recent Bain & Company analysis captures this point nicely, concluding that we have entered a new environment of “capital superabundance.” Bain estimates that total financial assets are today almost 10 times the value of the global output of all goods and services, and that the development of financial sectors in emerging economies will cause global capital to grow another 50% by 2020. We are awash in capital...witness the $1.6 trillion in cash on corporate balance sheets.

People have been pointing to all the unspent capital, which politically-aware people understand is just parked until the crooks can buy a tax-amnesty. (I would add the estimated $20 Trillion parked in tax havens by the super-rich over the last 30 years.) We should be shouting what Christensen says:

Therefore, austerity can be seen as a form of looting - privatization (and subsequent under- or dis-investment in public assets) and the ruthless extraction of the life savings of the middle class, as it struggles to keep its head above water....

Demeter

(85,373 posts)If you wish your smartphone had more security and privacy features, you might soon be switching phones: pre-orders for the Blackphone, codeveloped by secure communications provider Silent Circle and hardware developer Geeksphone, will hit the market before the start of July. Several thousand of the phones have already been pre-ordered, according to the Blackphone's makers, and the phone is already sold out.

Announced this past January, the Blackphone will cost $629 USD and be available on a number of service providers in the Americas and Europe. It has a number of privacy and security features, including encrypted phone calls, texts and video chats, a custom Android-based operating system and a Virtual Private Network to anonymize users' Web traffic.

The Blackphone was created to address concerns over the National Security Agency's widespread surveillance, as revealed by former NSA employee Edward Snowden. Its privacy and security features also go a long way to protecting users from cybercriminals and hackers. The phone has a 4.7-inch 720p screen, 16GB of storage, an 8-megapixel rear camera and a 5-MP front camera. Google Play Android apps are compatible with its custom Android-based operating system, PrivatOS. The encryption used on Blackphone is end-to-end, meaning that even when communicating with less secure phones, users' content will be encrypted from their own Blackphone to Silent Circle's servers. But even then Silent Circle can't read the messages sent through its servers, because the keys that "lock" the encryption reside only on individual Blackphones. This means that even if a government orders Silent Circle to disclose any or all of its records, the company will only be able to hand over encrypted and therefore unreadable data.

The Blackphone comes with three one-year subscriptions to Silent Circle's encrypted communications app that users can hand out to their friends. This is to ensure that conversations are entirely encrypted between the communicating phones. The price also includes a two-year subscription for encrypted cloud storage provider SpiderOak, and two years of the Disconnect Secure Wireless VPN mobile client.

— Jill Scharr, Tom's Guide

Email jscharr@techmedianetwork.com or follow her @JillScharr and Google+. Follow us @TomsGuide, on Facebook and on Google+.

Demeter

(85,373 posts)In a first, one player got a monopoly of Bitcoin's total computational power...For the first time in Bitcoin's five-year history, a single entity has repeatedly provided more than half of the total computational power required to mine new digital coins, in some cases for sustained periods of time. It's an event that, if it persists, signals the end of the crypto currency's decentralized structure.

Researchers from Cornell University say that on multiple occasions, a single mining pool repeatedly contributed more than 51 percent of Bitcoin's total cryptographic hashing output for spans as long as 12 hours. The contributor was GHash, which bills itself as the "#1 Crypto & Bitcoin Mining Pool." During these periods, the GHash operators had unprecedented powers that circumvented the decentralization that is often held up as a salient advantage Bitcoin has over traditional currencies. So-called 51 percenters, for instance, have the ability to spend the same coins twice, reject competing miners' transactions, or extort higher fees from people with large holdings. Even worse, a malicious player with a majority holding could wage a denial-of-service attack against the entire Bitcoin network.

Like tremblers before a major earthquake, most of GHash's 51-percent spans were relatively short. Few people paid much attention, since shortly after a miner loses the majority position, it also loses its extraordinary control. Then, on June 12, GHash produced a majority of the power for 12 hours straight, a sustained status that enables precisely the type of doomsday scenario some researchers have warned was possible...There's no evidence the anonymous operators of GHash exercised any of those abilities. Still, the mere possibility undermines a core Bitcoin tenet that it be decentralized so it can't be controlled by a single entity.

"A 51 percenter can control which Bitcoin transactions happen," wrote Ittay Eyal, a post-doctorate researcher in Cornell's Department of Computer Science, in an e-mail to Ars. "It becomes a monopoly. It can set arbitrarily high transaction fees, for example, or even extort someone to allow them to perform transactions. It could block or delay all transactions but its own. One of Bitcoin's goals was to be a free system, independent of anyone's control. With small pools, no one has this kind of control. With a 51 percenter, there is."

more

Demeter

(85,373 posts)I've taken most of my vacation free time to debug, update, and un-pop-up my sister's computer. It is only now that I can actually post anything without massive interference from all the parasites.

she even had Trojans on this baby! Sis is a chemical/paper engineer and MBA...she doesn't believe in computers, even less than I do.

I'll begin the long journey home Monday. If the Kid is willing, we may stop in Niagara and stare at the Falls.

It's been a wonderful vacation (even with the Kid in tow). I gotta make my real life more like this: regular meals and sleep at regular times....

It's been a real shock coming back to a state/region I lived in for 20+ years, and I can't remember the roads or anything....not that I wanted to, but....it's still a shock to find such big holes in the memory. Of course, a lot has changed since 1996.

Demeter

(85,373 posts)Although the Russian move to stop supplying gas to the Ukraine unless it pays upfront is an important, if expected, development, its immediate impact will be blunted by it taking place during the summer. From the Financial Times:

Analysts said an immediate energy crisis was unlikely because both Ukraine and gas buyers in Europe have built up plentiful stocks after a mild winter. Benchmark spot gas prices in Europe, which have dropped by almost 40 per cent this year, rose just 2 per cent on Monday.

Gazprom – which relies on exports to Europe for a large share of its revenues – has stressed that it will continue to deliver gas to European customers, including increasing supplies through routes that bypass Ukraine, if necessary.

Although Ukraine says it has 14 million cubic meters of gas stored, apparently enough to carry the country through December, the relationship between the two sides has become so poisoned that it’s not obvious how a deal could get done before then. And why should Russia make concessions? The FT again:

“In fact we couldn’t really discuss because Ukraine insisted only on one position,” said Alexei Miller, chief executive of Gazprom, referring to several recent rounds of negotiations aimed at resolving the deadlock.

Both sides are also suing each other, with Gazprom demanding $4.5 billion it says is past due, and Ukraine’s Naftogaz countersuing for $6 billion in alleged overcharges since 2010.

More detail from OilPrice:

During the talks in Kiev, each side clung to its negotiating position. Moscow’s has been to keep the price of gas at the original level set in a 2009 contract of $485 per 1,000 cubic meters, but at the same time to waive an export tax that would reduce the price to $385.

Kiev’s position has been that the tax waiver was simply a way for Moscow to exert leverage on its smaller neighbor because it could always restore the duty.

During a meeting in Gorki, outside Moscow, Gazprom CEO Alexei Miller told Russian Prime Minister Dmitry Medvedev, “Thanks to the unconstructive position of the Ukrainian government, today a prepayment system was introduced.”…

Ukraine’s pipeline from Russia also carries gas to EU countries, but Gazprom spokesman Sergei Kupriyanov said Ukraine was obliged not to siphon any of it for its own use. Nevertheless, Gazprom has notified the European Commission of a “possible disruption” of the gas flow if Kiev doesn’t meet this obligation.

Tim Ash, an energy analyst at Standard Bank PLC, told the Associated Press that Kiev could theoretically tap some gas meant for the EU, which wouldn’t hurt European customers now, but could make it harder for them to stockpile gas for the winter.

While a lot can happen between now and December, there’s nothing here that gives reason to think either side will budge. The Ukraine may hope that it can stick to its guns and that if it gets to the late fall and Russia has not budged, the West will provide some combination of pressure, cash, and other inducements to get Russian gas supplies restored, given that Ukraine can simply steal gas from Europe and use a humanitarian crisis as an excuse. This may prove to be optimistic thinking. And if the Ukraine pinches more than a little bit of gas bound for Europe, it’s going to become politically even more difficult for Europe to provide active support to the Ukraine.

Demeter

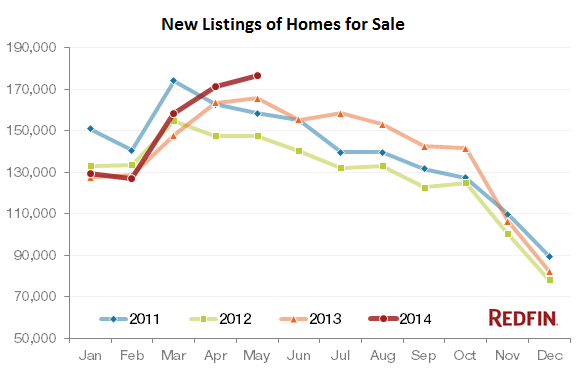

(85,373 posts)It always starts with a toxic mix. Last fall when sales that had been predicted to continue their miraculous ascent were suddenly swooning, soothsayers dealt with it by developing a whole plethora of excuses. At each new disappointment, they dragged out new excuses. But in May, the toxic mix came to a boil, and now there are no more excuses: sales plunged and inventories jumped. The housing market is buckling under its own inflated weight...And what excuses they’d come up with! Last fall, the fiscal cliff, the threat of a government shutdown, the possibility of default that was belittled by everyone supposedly made home buyers uncertain. But these issues were swept under the rug, and sales continued to drop into the winter. Polar vortices were blamed, though in California, where the weather was gorgeous, sales dropped faster than elsewhere. Then the spring buying season came around when massive pent-up demand was supposed to sweep like a tsunami over the land. But sales continued to decline. So tight inventories were blamed. There simply weren’t enough homes for sale, it went. Alas, in May, new listings rose 6.5% from a year ago to a four-year high in the 30 markets that electronic real-estate broker Redfin tracks. People were dumping their homes on the market; new listings soared 25.5% in Ventura, CA, 15.8% in West Palm Beach, and 15.4% in Baltimore. This is what it looked like for all 30 markets combined:

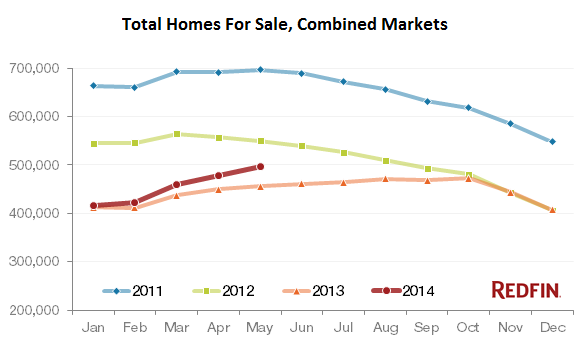

The onslaught of new listings added to the unsold inventory and pushed up the total number of homes for sale by 9.1% to the highest level since August 2012. And in this elegant manner, the final excuse of tight inventories causing the plunge in sales went up in smoke. This rise in inventory has been going on all year. Yet, as Redfin pointed out with a soupçon of irony, it was “surprising to some, given the speculation about extremely low inventory creating intense pent-up demand among buyers who have been waiting for months with low interest rates burning holes in their pockets.”

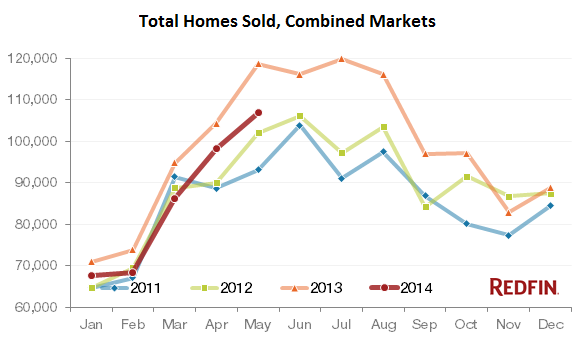

Real estate is local. During the last housing bust, some areas started to crater in early 2006, while others hung in there for a while longer. San Francisco’s bubble hit its peak in November 2007, and everyone thought that the city, being so unique, would be immune to the pandemic of housing mayhem. A month later, it cratered. So this time too, it isn’t impacting all markets equally. In 10 of the 30 markets, inventories were actually down. But in some of the hottest markets a year or two ago, inventories skyrocketed: up 14.6% in Los Angeles, 15.5% in Washington, DC, 16.2% in San Diego, 23.1% in Sacramento, 27.9% in Orange County, 30.9% in Riverside-San Bernardino, CA, and up – I’m not kidding – 33.4% in Phoenix. And this inventory isn’t selling: in the 30 markets, sales in May plunged 10% from a year ago. Now that homes are coming on the market in large numbers, buyers, faced with sky-high prices and higher mortgage rates, went on strike:

In some of the hottest markets of 2012 and 2013, sales are falling off a cliff: down 11.6% in Las Vegas, 12.2% in Chicago, 12.3% in Seattle, Orange County, and Los Angeles, down 12.5% in Washington, DC, 13.1% in Long Island, 13.5% in San Francisco, 14.6% in Sacramento, 20% in Phoenix, and down 20.8% in San Diego. These are ugly numbers. But, but, but… the median sales price still rose 8.2% in May from a year ago, though that’s down from the 14.5% increase in May 2013, and from the 20% at the peak of 2012. Redfin reported that its agents had observed “the shift away from a sellers’ market, with buyers having more power and less competition.” But apparently, “many sellers still haven’t read the memo.”

Since early 2012, Wall Street players, armed to the teeth with the nearly free and limitless money that the Fed in its infinite wisdom has made available specifically for these purposes, piled into the market, buying up hundreds of thousands of homes helter-skelter and turning them into rental properties. It switched these homes from for-sale lists to for-rent lists, where many languished unperturbed, and it drove up prices in record time. Current homeowners welcome that. But first time buyers, the natural force in the housing market, were effectively pushed aside and are now priced out of the market. Even many current homeowners who want to sell are locked into their homes as they cannot afford the next home, given higher mortgage rates and sky-high prices. At these prices, even investors can’t buy these homes and rent them out at a profit. In many areas of the country, that business model is kaput. So they pulled back too. This is how the Fed fixed the housing market. The only thing lacking in this “fixed” housing markets are willing and able buyers. So inventories are piling up, and someday sellers will “read the memo.” Then prices will be whittled down to where they make economic sense in this economy. We’ve been through this before. Only this time, it’s different: the Fed, which so eagerly took credit for having “fixed” the housing market, is going to be hard-pressed to cut interest rates further, or do anything else it isn’t already doing.

Demeter

(85,373 posts)http://www.nakedcapitalism.com/2014/06/repeated-foreclosures-time-borrower-demonstrates-failure-fix-servicing-fallacy-save-banks-costs-policy.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

It was obvious at the time of the various mortgage “settlements” that the Administration’s policy was to make only cosmetic fixes in a badly broken servicing model. And despite evidence of continuing mortgage servicing abuses, from significant errors in records to failure to implement required reforms, like ending dual tracking, the public is being subjected to Big Lies from Timothy Geithner (in his new book) and Larry Summers (in a Financial Times opinion piece) that the only approach possible to the crisis was the one that was taken, of coddling the banks and leaving the greater public bearing the costs in numerous ways, from rising inequality, a lousy job market and weak growth, to a mortgage market that is destined to remain on government life support.

The last point is not as well understood as it needs to be. The failure to make servicers clean up servicing means that there is virtually no private mortgage securitization market. Prior to the crisis, it was 40% to 60% of total mortgage originations.

Mortgages made now are overwhelmingly either government guaranteed or retained on bank balance sheets. Except for a very few deals (jumbos with very large down payments), investors, who were badly burned by servicing abuses, are not willing to be fooled again. As a result, it’s a virtual certainty that new mortgages will depend on government guarantees. The housing-industrial complex has sufficient clout to insist that the Federal government continue to absorb mortgage credit risk, since having banks retain mortgages on bank balance sheets would result in much higher interest charges, and as a result, lower housing prices. We’ll discuss shortly why the failure to force servicers to clean up their shoddy records and procedures means we won’t see a meaningful private mortgage securitization market any time soon, which means government guaranteed mortgages will continue to dominate housing finance.

MUCH MORE AT LINK

AND STILL, THEY WANT TO SHUT DOWN FREDDIE AND FANNIE? ARE THEY NUTS?

xchrom

(108,903 posts)BEIJING (AP) -- Global stock markets were mostly lower Monday as investors looked ahead to U.S. corporate earnings following last week's strong job numbers.

Oil fell below $104 per barrel as expectations of increased supply offset strong U.S. job growth.

Markets gave up some of last week's gains that followed news the United States generated a stronger-than-expected 288,000 jobs in June, a sign an economic recovery might be gaining traction.

"The market saw another piece of evidence that the U.S. economy is gathering steam while at the same time central bank rhetoric remains dovish," said Credit Agricole CIB in a report.

xchrom

(108,903 posts)BERLIN (AP) -- German industrial production declined significantly in May, a third consecutive drop that suggests slowing growth in China and tensions over Ukraine may be having an impact on Europe's biggest economy.

The Federal Statistical Office said Monday that production was down 1.8 percent compared with the previous month. In April, it slipped 0.3 percent - revised downward from the initial reading of 0.2 percent growth.

The Economy Ministry pointed to a calendar effect from holidays in May and expected weakness in construction but said "geopolitical causes" may have contributed. Data last week showed factory orders sagging in May after a strong increase in April.

ING economist Carsten Brzeski said German industrial activity remains strong and companies have well-filled order books, but "the stimulus for a further acceleration is currently missing."

Demeter

(85,373 posts)What did they THINK would happen when everyone lived in each other's pockets?

xchrom

(108,903 posts)The chief of the International Monetary Fund predicts that the global economy will improve over the next 18 months but says that growth might not be as fast as previously expected.

IMF Managing Director Christine Lagarde says that investment remains weak and that the recovery in the United States hinges on the ability of the Federal Reserve to gradually reduce stimulus measures and on political leaders agreeing on a fiscal plan.

Lagarde made the comments Sunday at a conference in France. The IMF is expected to refresh its economic forecasts this month. In April, it predicted global growth of 3.6 percent this year and 3.9 percent in 2015, up from 3 percent last year.

Growth was unexpectedly weak earlier this year but should gain momentum in the second half of 2014 and pick up more in 2015, Lagarde said. Still, she said, the recovery in advanced countries remains tepid, and developing countries won't grow as fast as had been expected.

Demeter

(85,373 posts)I think she means she will still be employed,

xchrom

(108,903 posts)WASHINGTON (AP) -- How much distance from an immoral act is enough?

That's the difficult question behind the next legal dispute over religion, birth control and the health law that is likely to be resolved by the Supreme Court.

The issue in more than four dozen lawsuits from faith-affiliated charities, colleges and hospitals that oppose some or all contraception as immoral is how far the Obama administration must go to accommodate them.

The justices on June 30 relieved businesses with religious objections of their obligation to pay for women's contraceptives among a range of preventive services the new law calls for in their health plans.

xchrom

(108,903 posts)BUENOS AIRES, Argentina (AP) -- Argentina's economy minister will meet with a court-appointed negotiator on Monday aiming to resolve a long dispute with U.S. holdout creditors, the economy ministry said on Sunday.

Economy Minister Axel Kicillof will lead Argentina's delegation to meet Daniel A. Pollack in New York. Pollack is presiding over negotiations between representatives of Argentina and U.S. bondholders aimed at resolving the conflict over $1.5 billion in debt. The holdout funds will not be part of the meeting.

Argentina needs to strike a deal before the end of the month with the holdouts if it is to avoid a default. The holdouts rejected debt swaps after Argentina's record $100 billion default in 2001-2002.

President Cristina Fernandez has long refused to negotiate with the plaintiffs led by New York billionaire Paul Singer's NML Capital Ltd., who spent more than a decade litigating for payment in full rather than agreeing to provide Argentina with debt relief.

xchrom

(108,903 posts)Fast food workers have been demonstrating and striking around the country, and some have been fired or arrested as they protested their low wages. The current minimum wage is $15,080 if earned full-time, while the average pay of top restaurant CEOs in 2013 was $10,872,390—721 times more than minimum-wage workers. These corporate CEOs earn more on the first morning of the year than a minimum-wage worker will earn over the course of a full year.

xchrom

(108,903 posts)Mark Carney was hailed as a fashion icon by the British media in his first months as governor of the Bank of England.

The cut of his dark-blue suits won praise as did his casual wear when he was photographed in shorts and a polo shirt at a music festival. Even a bag he picked up for free at an international conference was described as a killer accessory.

The Canadian is emerging as a trendsetter in monetary policy too. An increase in U.K. interest rates “could happen sooner than markets currently expect,” he announced last month.

That lurch toward the hawkish sent the pound climbing and prompted economists to revise their forecasts, with some expecting higher U.K. borrowing costs as soon as November.

xchrom

(108,903 posts)In the relative calm that is the market for U.S. Treasuries, a sense of unease over a vital cog in the financial system’s plumbing is beginning to rise.

The Federal Reserve’s bond purchases combined with demand from banks to meet tightened regulatory requirements is making it harder for traders to easily borrow and lend certain desired securities in the $1.6 trillion-a-day market for repurchase agreements. That’s causing such trades to go uncompleted at some of the highest rates since the financial crisis.

Disruptions in so-called repos, which Wall Street’s biggest banks rely on for their day-to-day financing needs, are another unintended consequence of extraordinary central-bank policies that pulled the economy out of the worst financial crisis since the Great Depression. They also belie the stability projected by bond yields at about record lows.

“You have a little bit of a perfect storm here,” said Stanley Sun, a New York-based interest-rate strategist at Nomura Holdings Inc., one of the 22 primary dealers that bid at Treasury auctions, in a telephone interview June 30.

xchrom

(108,903 posts)Gold extended a decline from a three-month high as the outlook for higher borrowing costs in the U.S. strengthened the dollar. Silver also dropped.

Gold ended a 12-year rally last year on expectations the Federal Reserve would reduce stimulus as the economy improved. International Monetary Fund Managing Director Christine Lagarde said yesterday U.S. growth is set to accelerate in the coming months even as she signaled a cut in the bank’s global forecast. The greenback reached a one-week high against the euro, while the Bloomberg Dollar Spot Index was little changed.

“No figures out today mean that prices will probably continue to meander sideways,” David Govett, head of precious metals at Marex Spectron Group in London, wrote today in a note. “We have now well-and-truly entered the summer doldrums and wouldn’t hold out a lot of hope for fireworks in the near future. I still feel that the market has done enough on the upside for the time being.”

Bullion for immediate delivery fell 0.5 percent to $1,314.38 an ounce at 10:01 a.m. in London, according to Bloomberg generic pricing. The metal climbed to $1,332.33 on July 1, the highest price since March 24, and completed a fifth week of gains last week. Gold for August delivery dropped 0.4 percent to $1,314.90 an ounce on the Comex in New York. Futures trading volumes were 19 percent lower than the average for the past 100 days for the time of day, according to data compiled by Bloomberg.

xchrom

(108,903 posts)European stocks fell, as investors assessed equity valuations following the biggest weekly rally since March. U.S. index futures also slid before the start of the earnings season, while Asian shares were little changed.

Bolsas y Mercados Espanoles SA and Deutsche Boerse AG slipped at least 2.5 percent each. Helvetia Holding AG dropped after the Swiss insurer said it will buy a majority stake in Nationale Suisse, which jumped 25 percent. TeliaSonera AB and Tele2 AB gained more than 2 percent each after the Swedish company agreed to buy Tele2 AB’s Norwegian business. PostNL NV (PNL) rallied the most since February 2012 after boosting its annual profit forecast.

The Stoxx Europe 600 Index dropped 0.3 percent to 346.89 at 10:29 a.m. in London. The equity gauge rose 1.8 percent last week as U.S. jobs data exceeded economists’ forecasts and commodity producers rallied. The index traded at 15.6 times the estimated earnings of its members on July 4, near its highest valuation since 2009. Futures on the Standard & Poor’s 500 Index slid 0.2 percent today, while the MSCI Asia Pacific Index slipped less than 0.1 percent from a six-year high.

“What we need to see now is earnings growth,” said Michael Kapler, a portfolio manager at Mittelbrandenburgische Sparkasse in Potsdam, Germany. “Companies have to really deliver this time because equities are not so cheap anymore. We might have some sort of correction in Europe if this earnings season disappoints, and there will be bigger questions concerning valuations. Figures out of the U.S. will give investors an indication of how business is doing, although expectations are already quite high for this quarter.”

xchrom

(108,903 posts)For the third straight year, rotating into defensive industries is proving to be a losing strategy in the U.S. equity market.

Chip companies led by Micron Technology Inc. and consumer shares such as Netflix Inc. are driving gains since equities bottomed on April 11, replacing soapmakers and utilities that rallied as the economy slowed. The gains reflect projections that these cyclical stocks will deliver some of the strongest earnings growth in the Standard & Poor’s 500 Index this year, based on analyst estimates compiled by Bloomberg.

The fleeting advance in defensive equities sounded a false alarm at the start of a year once again as the outlook for the U.S. economy improved. While gross domestic product contracted 2.9 percent in the first quarter, the latest data on personal spending, manufacturing and inflation have exceeded analyst forecasts. Almost $2 trillion has been added to share values since April amid gains that pushed transportation stocks, industrials and small-cap shares to records.

“We, like much of the industry, have been positioned, waiting and expecting some kind of pullback, and we got the pullback in the first quarter,” Chris Bouffard, who helps oversee $9 billion as chief investment officer at the Mutual Fund Store in Overland Park, Kansas, said July 2. “A lot of people were thinking, ‘oh, this might be the big one.’ Since then, the playbook resumed. We marched to new highs.”

xchrom

(108,903 posts)Over the weekend, I reread remarks that U.S. Federal Reserve chair Janet Yellen made last week at the International Monetary Fund and also read the transcript of her conversation with Christine Lagarde, the International Monetary Fund's managing director.

The IMF event brought together a virtual who’s who of the international economic and financial community, and in one of her most significant policy speeches to date, Yellen seized the opportunity to address head-on some of the major questions confronting modern central bankers. Many of these center around the burden of trying to restore, almost singlehandedly, economic growth, more dynamic job creation, price stability, and durable market stability.

There are seven major takeaways from Yellen's IMF speech. They collectively signal that the Fed will maintain a gradual policy approach for now. Markets, conditioned to expect strong and steadfast monetary support from the Fed, welcome that stance. But Yellen's statements also point to the need for a delicate transition from policy-induced growth to more organic economic growth. If that transition is mishandled, it would trigger renewed financial and economic instability.

First, Yellen recognizes that we could well be in a world of steady-state interest rates that, in both nominal and inflation-adjusted terms, are lower than what historical experience would suggest.

Second, such rates, as Yellen noted, can “heighten the incentives of financial market participants to reach for yield and take on risk.” Indeed, she added, “such risk-taking can go too far, thereby contributing to fragility in the financial system.”

Third, financial stability cannot be divorced from the pursuit of economic well-being, because “a smoothly operating financial system promotes the efficient allocation of saving and investment, facilitating economic growth and employment.”

xchrom

(108,903 posts)Landesbank Baden-Wuerttemberg, which has ousted Canada’s Desjardins Group as the most-accurate currency forecaster, says traders are underestimating the dollar by misjudging how quickly the U.S. will raise interest rates.

Germany’s biggest state-owned lender, which topped Bloomberg’s rankings for the four quarters ended June 30, predicts the greenback will climb more than 4 percent by year-end to $1.30 per euro, compared with a median survey estimate of $1.32. LBBW, which rose from second place in the January through March period, says the Federal Reserve may lift rates as soon as the first quarter of 2015 as the world’s largest economy recovers.

“We expect the interest-rate hike in the U.S. will be earlier than currently expected by the market,” Julian Trahorsch, who’s part of the six-strong team of forecasters responsible for LBBW’s victory, said in a July 2 phone interview from Stuttgart. “All indicators point to a very strong recovery in the U.S. and to a faltering recovery in the euro zone. In the first quarter, the Fed could already raise. This is not priced into the euro-dollar exchange rate.”

Dollar bulls received a boost last week when a Labor Department report showed U.S. job creation exceeded economists’ forecasts in June, while the unemployment rate tumbled to the lowest since 2008. Employment and inflation are the factors that Fed Chair Janet Yellen says she’ll take into account when starting to raise rates, which she pledged last month to keep near zero for a “considerable time.”

xchrom

(108,903 posts)Mario Draghi’s plan to end the euro area’s lending drought risks missing the target.

While the European Central Bank president says a program to hand as much as 1 trillion euros ($1.4 trillion) to banks has built-in incentives to spur lending to the real economy, analysts from Barclays Plc to Commerzbank AG have doubts on how well it will work. In fact, the measure allows banks to borrow cheaply from the ECB even without increasing credit supply.

Draghi has identified weak lending as an obstacle to the euro area’s recovery and is committed to reversing a slump that has eroded more than 600 billion euros in loans to companies and households since 2009. The risk is that if the latest plan fails, the currency bloc slips closer to deflation and to the need for more radical action such as quantitative easing.

“It’s not the silver bullet,” said Philippe Gudin, chief European economist at Barclays in Paris. “Every incentive for banks to lend is a good thing, but I wouldn’t say I’m reassured that credit will pick up.”

Demeter

(85,373 posts)...Usury derives from the Latin usus, meaning 'use', and referred to the charging of a fee for the use of money. Interest comes from the Latin interesse, meaning 'compensation for loss', and originated, in the Roman legal codes as the fee someone was paid if they suffered a loss as a result of a contract being broken. So a lender could charge interest to compensate for a loss, but they could not make a gain by lending....It is easier to understand this distinction with a simple example. A farmer lends a cow to their cousin for a year. In the normal course of events, the cow would give birth to a calf and the cousin would gain the benefit of the cow's milk. At the end of the loan, the farmer could expect the cow and the calf to be returned. The interest rate is 100%, but it is an interest since the farmer, if they had not lent the cow to their cousin, would have expected to end the year with a cow and a calf. Similarly, if the farmer lent out grain, they could expect to get the loan plus a premium on the basis that their cousin planted the grain, he would reap a harvest far greater than the sum lent.

Because money is 'barren', unlike land or labour it could not 'produce' anything. As a result, money can have no intrinsic value, other than its use to facilitate exchange, and so charging for the lending of money is essentially selling something that has no value. Thomas Aquinas argued that

So, usury contradicts 'natural law'. Even if you could convince the canon lawyers that you were, in fact, selling something that did exist, the theologians might argue that usury was an affront to God because, since money was barren, the usurer was charging for time, and "time was God's exclusive property''. In theory, this is all very clear, in practice there was still the question of where the dividing line between usury and interest was and almost everyone who was handling money was looking to charge as much interest as was permissible.

Around 1236, an English professor of canon (church) law, Alanus Anglicus, argued that usury did not exist if the future price of the good was uncertain in the mind of the merchant. These theories became established in the medieval legal system between 1246 and 1253 by Pope Innocent IV, a former professor of law at Bologna. Not only could a merchant adjust the 'just price' to cover their labour and expenses, but also they could also adjust the price to take into account the risk they bore, called an aleatory contract, from the Latin word alea for chance. In establishing this principle, a Catholic jurist initiated the scientific study of financial risk. Today, financial economics models interest through a force of interest, r, and so the value of a loan of X0 at time t = 0 would be repaid by an amount XT given by

This implies that the repayment amount Xt is the solution to the most basic differential equation,

that is, Xt grows at a constant rate r. This links to Piketty’s thesis that capitalism induces inequality because r, the return on money, is greater than g the growth rate of the economy. This is conventional economic theory.

I argue that at the heart of financial economics is not growth but reciprocity, so how do I account for interest?

MORE

Demeter

(85,373 posts)People like hard currency and use it every day. It is a check on centralized power. It is private and peer-to-peer. And despite or because of that, some want to get rid of it...While investigating Bitcoin, Antonis Polemitis once poked fun by imagining how the media would react to the introduction of cash. He titled his parody, "Bizarre Shadowy Paper-Based Payment System Being Rolled Out Worldwide." Cash has been dubbed "bills" among "the shadowy community of anti-banking libertarians who have been the primary users of cash to date," the article explains, and "though hard to imagine, cash operates with no consumer protection at all. If your ‘bills’ are stolen or lost, they are gone forever."

A later section of the article is titled "Perfect for Criminals":

The launch of cash has provoked a reaction from law-enforcement agencies worldwide that universally condemned the development. “Cash is a 100% anonymous and untraceable payments technology. It is like a weapon of mass destruction launched against law enforcement,” said Mike Smith, the recently confirmed FBI Director. “It is the perfect payment mechanism for criminals, drug cartels, terrorists, prostitution rings and money launderers. We don’t know how we will be able to combat such a technology and fully expect that a new generation of super-criminals will emerge, working in the shadows of a world where they can conduct their illicit affairs without leaving a trace.”

Polemitis quotes the fictional banking superintendent of New York State: "I can’t think of any reason that a law-abiding individual would want to use cash," he declared. "At a bare minimum, we believe there should be a licensing procedure for individuals or businesses that plan to use cash, a ‘Cash-License’ as it were. This license will limit ‘cash’ to trust-worthy individuals who keep detailed auditable records of all their cash transactions in order to keep New York safe from criminals.”

At the time, I laughed.

Today I worry that the parody is prescient. Kenneth Rogoff, a professor of public policy and economics at Harvard University, is as good a place to begin as any. Under the headline, "Paper money is unfit for a world of high crime and low inflation," he declares in the Financial Times that "it is time to consider whether paper currency is vestigial, or worse," in part because "phasing out currency would address the concern that a significant fraction, particularly of large-denomination notes, appears to be used to facilitate tax evasion and illegal activity."

MORE

Demeter

(85,373 posts)It's clear that there is no major upward trend. And slicing the data differently doesn't make a difference — Fox said that since homicides are on the downswing in general, the overall shape of the graph wouldn't change much if you changed the definition of a mass shooting to, say, three victims or more. There isn't even any upswing in the number of school shooting victims, at least based on the Department of Education's own official statistics (PDF).

Why, then, is there such a powerful feeling that things are getting worse? Media coverage plays a big role. It's almost hard to believe today, but there was a time in the not too distant past when people in New York might not even hear about a school shooting that happened across the country. Today, every incident immediately explodes onto the national stage and is then amplified a millionfold by social media. It's a visceral example of the availability heuristic — the easier it is for us to think of a certain type of event (whether a school shooting or a plane crash), the higher we rate its probability. But this is an illusion; just because it's easier than it ever has been to think of an example of a shooting doesn't mean these events are more likely than they were in the past.

All that said, the United States remains a very dangerous place by the standards of other developed countries (PDF), and little progress is being made on gun control, mental health, and other factors that contribute to the nation's higher-than-it-should-be homicide rate. But overall, things aren't getting worse by the year. To paraphrase Bill Clinton, trend lines are more important than headlines — or tweets or Facebook posts.

Demeter

(85,373 posts)INTERESTING WEBSITE....

The uproar over the manipulation of wait times at the Phoenix VA hospital and other VA sites has tended to overshadow the larger issue of whether U.S. veterans have sufficient, unimpeded access to care. The short answer is they don’t, due to the inherent limitations of the VA program and the fragmented nature of our current health system. Among other problems, many veterans don’t even qualify for VA care and are completely uninsured.

There are 22 million veterans in the U.S. today. They are mostly poor, and the Vietnam-era veterans are getting to an age where they need more health care.

Over the years there have been long waits for different kinds of care at the VA, even as the overall population of veterans is declining. As we now know, some VA administrators have gamed the scheduling system to make their wait times appear shorter, the result of a “pay for performance” scheme that financially rewarded managers if they kept waits to under two weeks – even if that goal was unattainable at their facilities due to doctor shortages, a rapid influx of veterans due to retirement nearby or eligibility changes, or other factors. But the longest and most onerous waits are associated with the time it takes to determine if veterans are eligible to receive care at the VA, and at what level. This determination is done precisely because the VA is not a single-payer system. It doesn't cover everyone; it's not accessible to every veteran; it is just one payer among many in our fragmented system. Currently about 2.3 million veterans and their family members are completely uninsured.

In contrast, a single-payer national health program would cover everyone and allow them to choose any provider and source of care in the U.S.

The VA has pioneered quality initiatives, delivery system changes and an electronic medical record that is far ahead of the private sector. Veterans' service organizations praise the VA, even as they complain about waits, precisely because of its high quality. But any health care program that benefits low-income individuals and families (including the VA, because today the poor are more likely to join the military) is politically vulnerable to budget cuts or calls for privatization, and is likely to suffer from more problems than a health system that benefits everyone -- rich and poor, young and old, soldiers and civilians, i.e. the entire population. Otherwise there will be pressure to underfund it.

Single-payer national health insurance, an improved Medicare for All, will offer a single tier of high-quality care to everyone. It would address wait times in an organized way, be transparent and accountable, and allocate medical resources based on need, not ability to pay.

Demeter

(85,373 posts)http://www.nakedcapitalism.com/2014/07/obama-va-robert-macdonald-procter-gamble-scandal.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

After reports of problems with access, manipulation of data about waiting times, and most recently “a corrosive culture,” the US Department of Veterans Affairs, the country’s large government run health system, has had a massive leadership overhaul. President Obama’s nominee to head the agency is now Robert A McDonald, for CEO of Procter and Gamble. The choice of a former CEO or a large corporation was called “unorthodox” by the Boston Globe, but many saw merit in a business leader running the VA. As reported by the Globe, House Speaker John Boehner said that as a “private sector” leader, Mr McDonald is the “kind of person who is capable of implementing the kind of dramatic systemic change that is badly needed and long overdue at the VA.” The Chairman of Boeing, also a member of the P&G board, hailed Mr McDonald as the person who “navigated Procter & Gamble through the difficult post-financial-crisis years, where he expanded business in developing markets and made substantial progress improving the efficiency of the company’s internal operations….” On the other hand, a column in the Washington Post suggested that expertise in “selling Tide and Pantene” might not be relevant to fixing the VA. Yet aside from a single article on the Ring of Fire web site, all news coverage and discussion so far has ignored Mr McDonald previous experience in health care leadership, but also that his relevant track record ought to raise questions about his fitness for the VA position.

Procter and Gamble and Health Care

According to Mr McDonald’s official P+G biography, after various roles in various countries, before becoming CEO,

Although not widely known as a pharmaceutical company, P&G actually had a subsidiary that made prescription drugs, which Mr McDonald sold off in 2009 (see this Wall Street Journal report.) As we noted here, its products still include over the counter pharmaceuticals (e.g., Pepto-Bismal, Metamucil, Prilosec OTC). Also, while Procter & Gamble does not make it very obvious, it has owned MDVIP, a company that employs physicians to provide concierge medical services, since 2010, although as Cincinnati.com just reported, it will soon sell this unit to private equity. So during Mr McDonald’s tenure, his company was to some extent a pharmaceutical company, and a health care provider.

The Blumsohn – Procter and Gamble – Sheffield University Case

Furthermore, on Mr McDonald’s watch as Vice Chairman of Global operations and Chief Operating Officer, there was a case involving Procter and Gamble that raised multiple concerns about the ethics of its pharmaceuticals operations. We first posted about the case in 2005. For all relevant posts, SEE LINK. In 2009 we described the case thus,

We previously summarized the case’s events

Although the research contract designated Blumsohn and Eastell as “Investigators” under whose direction the project would be carried out, Blumsohn was not given access to the original data collected by the project.

Despite numerous requests, (like this one), P&G refused access to this data repeatedly.

Blumsohn was concerned that he and Eastell could be accused of scientific fraud if they continued to make presentations and write articles and abstracts without access to the data which they were supposedly writing about.

Blumsohn became suspicious that some of the analyses done by P&G could be misleading, especially related to a graph shown to him that omitted 40% of patient data.

Blumsohn objected to P&G arranging for papers and abstracts to be written by a professional writer, but with Blumsohn listed as first author. Blumsohn was concerned that such ghost-written documents were mainly meant to convey “key messages” in support of P&G’s commercial interests.

Eastell warned Blumsohn not to aggravate P&G, because the company was providing a grant to the University which “is a good source of income.”

After repeated failed attempt to get the data, Blumsohn complained to numerous officials at Sheffield University, including Eastell, medical school Dean Tony Weetman, University Vice-Chancellor Robert Boucher, and the Head of the University’s Department of Human Resources, Ms R Valerio.

Still unable to get the data, he spoke with news reporters about his case. At this point, Sheffield suspended him, but then offered him a severance agreement if he signed a contract binding him not to make any detrimental or derogatory statements about the University and its leaders.

So the case involved suppression and manipulation of research, ghost-writing, institutional conflicts of interest, and attempts to silence a whistle blower. It provides lessons about the downsides of letting commercial firms sponsor and hence control human research designed to evaluate the products or services they sell; and of academic medicine becoming dependent on research money from such firms for such research.

Although this case occurred in the UK, it involved actions by the US based Procter and Gamble. While many of the events in the case occurred before 2004, from 2004 to 2009 it became clear that Procter and Gamble was not going to go easy on Dr Blumsohn. For example, according to Dr Blumsohn, in 2006, P&G released some scientific data relevant to the case, but not complete enough data to be meaningful. In 2007, there was still shady business going on involving scientific abstract submissions apparently made in Dr Blumsohn’s name by P&G operatives. Since Procter and Gamble never made any known attempt to apologize, explain its conduct, or ameliorate Dr Blumsohn’s plight during 2004 – 2009, as one of the most senior leaders of Procter and Gamble, seemingly with direct authority over its pharmaceutical operations in the UK during that time period, Mr McDonald ought to be held accountable for the company’s misbehavior described above. To my knowledge, though, no one at P&G, including Mr McDonald, has ever admitted responsibility or been made accountable in any way.

Summary

Since Mr McDonald recently was an executive of a company that sold prescription and non-prescription pharmaceuticals, and provided direct health care, confirmation as Veterans Affairs secretary could be regarded as a transit through the revolving door, and hence open to question. Since Mr McDonald got $15,928,015 in total compensation during his last year as CEO (2012-13) (see the company’s 2013 proxy statement), and had accumulated 2,247,593 shares of stock or equivalent by 2013, worth approximately $179 million at today’s price of $79.67, his ability to understand the needs of the often poor veterans whom the VA serves is also open to question. More importantly, while Mr McDonald held high executive positions at Procter and Gamble, the company was involved in a dodgy affair involving conflicts of interest, manipulation of research, and attempted silencing of whistle blowers. In my humble opinion, given that these events occurred directly on his watch, his fitness to run a huge health care system ought to be in question unless his responsibility for these events is disproved. The widespread huzzahs for Mr McDonald as potential VA leader based mainly on his exalted status as CEO of a big corporation show that many in the US still see corporate CEOs as aristocracy. True health care reform would hold health care leaders accountable, particularly for upholding the health care mission and putting patients’ and the public’s health ahead of revenue generation and especially personal profit.

Demeter

(85,373 posts)When inquired if Godzilla was “good or bad,” producer Shogo Tomiyama likened it to a Shinto “God of Destruction” which lacks moral agency and cannot be held to human standards of good and evil. “He totally destroys everything and then there is a rebirth; something new and fresh can begin,” he said. Despite all the hopes many of us had for the Affordable Care Act (ACA), the current system of medical insurance is a dysfunctional nightmare. I should know, because I am in the unique position of experiencing it from three perspectives simultaneously: that of a patient who uses an insurance plan, that of a small business owner who purchases insurance for a group of employees, and that of a physician who contracts with and gets paid by insurance companies.

As a patient, I am tricked by the expensive insurance plan I bought. Even though the card says “HSA 2000,” the deductible for my family is actually $4,000. After that the insurance only pays for 70 percent of covered charges when initially we were told 80 percent. When I call my insurance company to address problems, I must make sure that I have several hours of free time, so that I can stay on hold long enough to get through to the low level representative who has little power to do anything. The disclaimer “Description of covered benefits is not a guarantee of payment” makes me fearful and insecure. I am at the mercy of large, for-profit corporation that is beholden to shareholders and run by greedy CEOs who do not care about me. Having insurance means little anymore. Deductibles are high, share of costs are high, and many benefits are simply not covered. Deny, deny, deny! The company has so many devious ways of denying payment that even a sophisticated health care “consumer” can be taken by surprise. The reason for denial could be the type of treatment (no counseling for you!), or lack of a contract with a specific provider, or that your medication is non generic, or not on formulary...Deductibles can vary depending on the type of service: medical, pharmacy, durable medical, or mental health (don’t even mention dental or vision). After my insurance denied the fourth claim submitted, I realize what is going on. In the past insurances could kick you off for getting sick or refuse to accept you for having a pre-existing condition, but now they are legally obliged to accept all comers. However, they have found a new way to shed their undesirable patients: balk, deny, hassle and ignore you until you willingly transfer your diseases to another company. Ah, insurance is wonderful – just don’t get sick!

As a small business owner, I have over 25 employees, most of whom rely on me to provide insurance. Over the past decade, we dread the arrival of each new year, because the insurance plans offered previously are cancelled and replaced by more expensive plans with fewer benefits. Typically we see the price of premiums increase by 25-40 percent. The plans are so complicated we can’t even understand them, and we have three full time medical billing specialists on staff. The alphabet soup of HMOs, EPOs, PPOs, HSAs is overwhelming, the rules that regulate the deductibles, copays, share of cost, prior authorizations and formularies can be mind-boggling, and even if you understand them, remember: Descriptions of benefits are not a guarantee of payment.

As a physician, I have had no end of problems dealing with the nine different insurance companies with which we have contracts. Our office has three full-time employees whose job it is to make sure the claims we send in get paid correctly, each according to its own set of terms. It seems that any reason is good enough for an insurer to underpay or deny payment. If we don’t catch the mistakes, we lose out. I pay my staff their hourly wage as they beg, bicker and bargain so we can get reimbursed. Sometimes we call the California Medical Association to get help, and sometimes we yell at our insurance broker, but we don’t often reach out to the understaffed, overburdened Department of Insurance or the Department of Managed Health Care. I also pay my staff to overcome other hurdles and barriers the insurance industry has created like “prior authorizations” that are required before patients can get their medications, consults or procedures...When the ACA was rolled out, our office was also offered a very low reimbursement rate to see a certain insurer’s Covered California patients, so we declined the contract. However, that insurer gave patients deceptive insurance cards that looked identical to those of our contracted patients, and we were also falsely promoted as contracted providers on their website. Our office and our patients did not find out who had Covered California status and who had regular status until bills were denied, and it fell upon my staff to inform parents that their insurance had not covered their costs and that they owed us money. Dumbfounded and dismayed, families wept and raged at our medical billers. My newest employee quit because she felt she could not continue in a job that was so hurtful to young families. After sending out patient after patient in tears, she decided the bad karma invoked by performing her duties could not be justified, and she decided to move on to a happier job. When things reach a point where your employees feel like they will face eternal damnation just for doing their job then the system is broken.