Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 5 January 2015

[font size=3]STOCK MARKET WATCH, Monday, 5 January 2015[font color=black][/font]

SMW for 2 January 2015

AT THE CLOSING BELL ON 2 January 2015

[center][font color=green]

Dow Jones 17,832.99 +9.92 (0.06%)

[font color=red]S&P 500 2,058.20 -0.70 (-0.03%)

Nasdaq 4,726.81 -9.24 (-0.20%)

[font color=green]10 Year 2.11% -0.07 (-3.21%)

30 Year 2.69% -0.07 (-2.54%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)but $20/hour is what it should be. Still a lot of work to be done.

tclambert

(11,085 posts)Peg it to the minimum, 100x the minimum, for instance. If $10 per hour minimum, $1,000 per hour maximum, and you have to work the hours to make the money. No showing up once a week for a meeting and pretending you worked 40 hours.

I know, Demeter, they'll try to cheat with bonuses and stock options and profit-sharing. No, wait, not profit-sharing. They want those bonuses even if they drive the company into bankruptcy. Corporate bankruptcy these days means workers lose their pensions, but executives get hefty bonuses.

Demeter

(85,373 posts)Lambert, a maximum would mean those thieves acquiring $1 million or more per hour will have to take a massive ego blow....

tclambert

(11,085 posts)Demeter

(85,373 posts)okay everybody, groan real loud

Demeter

(85,373 posts)With Republican majorities taking over both the House and Senate, it's instructive to look back to 2006, when the Democrats upended a dozen years of GOP legislative dominance—the era of Newt Gingrich, Dick Armey, and a “Republican Revolution” that many believed would last forever. One of the catastrophes that brought down the curtain on that period was, of course, the failure of the Bush administration's wars in Iraq and Afghanistan. Another, perhaps less well remembered, was Bush's clumsy attempt to sell Congress and the public on a plan to privatize Social Security. Politicians do, sometimes, learn from their mistakes, and since then, the Republicans have avoided direct attacks on the country's biggest, most vital, and most popular social program. Instead, they've proceeded indirectly: encouraging center-right Democrats to join them in “reforming” Social Security, and pushing an assortment of policies that chip away at the program rather than directly cutting or eroding benefits. Social Security is nowhere near the top of Washington's agenda as the 114th Congress is seated. But the November election could prove to be a turning point nevertheless. Here are the top five reasons why:

1. The Democratic center-right is not dead yet: Business-friendly Democrats were some of the biggest losers in November. They are also the Democrats most eager to prove their devotion to bipartisanship by working with Republicans to cut Social Security. Seemingly, their loss was a backhanded victory for pro-Social Security progressives, many of whom kept their seats in part by defending the program. But not so fast! Sen. Mark Warner of Virginia, perhaps the highest profile member of the Democratic center-right, who barely squeaked through to reelection in November, was named to a leadership position later that month. That counterbalances the creation of a new post to be filled by progressive champion, Sen. Elizabeth Warren of Massachusetts...Meanwhile, Gina Raimondo, the Rhode Island state treasurer and Wall Street booster who fought to slash public employees' pensions, has become a new media darling after being elected governor. Raimondo's policies “provided a template for how politicians in Washington could try to rein in Social Security and Medicare spending, if they wished,” New York Times columnist Frank Bruni wrote, dubbing Raimondo “a Democrat to watch in 2015.”

2. President Obama is still president: The Obama administration has put Social Security on the table repeatedly in its budget negotiations with congressional Republicans. The president said nothing as he campaigned for Democrats last year to suggest his views have changed. In 2015, the top item on his economic agenda will be to push a secretive trade treaty, the Trans-Pacific Partnership, through Congress. He has made clear that he will defy his own party's lawmakers to do so. Deals like the TPP have led to lost jobs and stagnating incomes for American workers. Wage stagnation has been the biggest factor in slowing the growth of Social Security's trust fund over the better part of the past three decades. The president's failure to grasp the direct link between workers' wages and Social Security's fiscal health ups the odds that he will press a deal that aggravates this trend.

3. Paul Ryan is more powerful than ever: In the new Congress, the Republican from Wisconsin will chair the House Ways and Means Committee. This makes him an even bigger force on Social Security policy than he was as Budget Committee chair, when he repeatedly called for hobbling the program. The new Congress will likely have to make adjustments to keep one portion of Social Security, the Disability Insurance (DI) trust fund, from running short in the next two years. With Ryan heading up their response, the Republicans are more likely to insist on drastic changes to the entire program rather than going the less harmful route of shifting assets from the DI fund's counterpart, the Old Age and Survivors' trust fund.

4. Rightward shift at the CBO: The Congressional Budget Office is the Hill's numbers cruncher on the economic and budgetary impact of present and proposed policy. The incoming Republican leadership have made clear they will replace director Doug Elmendorff, a centrist, with someone more to their ideological liking. A rightward shift at CBO couldn't come at a worse time for Social Security. Conservative policy analysts have been working to convince Congress and the public that there is no retirement crisis in America. In 2014, they persuaded the Social Security trustees to eliminate replacement-rate information from the trustees' annual report—data that have consistently shown Social Security only replaces about 40 percent of pre-retirement income, one of the lowest rates in the developed world. The CBO also issues a respected set of projections for Social Security, and its estimated replacement rate is only slightly more optimistic. With a new director under the thumb of the House majority, those estimates could be radically revised or else eliminated from the CBO's report.

5. Blocking police reform: What do the deaths of Michael Brown and Eric Garner and the nationwide protests against racially biased policing have to do with Social Security? It's almost axiomatic that programs like Social Security, based in mutual aid and a strong feeling of community solidarity, work best in societies with minimal social-cultural divisions. The beginnings of the long political war against Social Security roughly coincided with the 1970s backlash against the Civil Rights movement. In November, the House Republican leadership blocked a bipartisan bill to curb transfers of military weapons and equipment to local police—one of the flashpoints of the crisis between police and the African American community. The new Congress may well consider more measures that intensify the anti-Ferguson, law-and-order reaction. That would only deepen a racial divide that undermines support for broad-based programs like Social Security. Disturbing as these circumstances are, there are countervailing forces. A study last year by the National Academy of Social Insurance found that Americans remain tightly attached to Social Security: 85 percent said the program's benefits are more important to them now than ever, and 72 percent said Congress should consider increasing future benefits. Four bills to enhance benefits were introduced in the 113th Congress; the NASI survey findings suggest their sponsors should intensify efforts to pass them. Doing so is not only essential to maintaining old-age standards of living, but would be an effective counterpunch against lawmakers who prefer to see benefits reduced. Additional leverage could be gained by tying Social Security improvements to the reauthorization of the Older Americans Act and full funding of the important services it provides.

Countervailing Forces

But the most promising development for defenders of Social Security may be the powerful grassroots movement in favor of a higher minimum wage. In 21 states in 2015, including four that proved to be Republican strongholds in November—Alaska, Arkansas, Nebraska, and South Dakota—the minimum wage will increase this year. By 2016, 29 states will have a higher minimum wage than the federal government sets, according to the Economic Policy Institute. Higher wages mean higher payroll tax revenues, bolstering Social Security's finances and giving workers more leeway to save money that can supplement their Social Security retirement benefits. Immigration reform, building on Obama's executive order allowing some 5 million undocumented immigrant workers to apply for work permits—and Social Security numbers—could help as well by bringing them into the higher paying, mainstream workforce.

Another force mitigating against Social Security cuts, perversely, could be the recent, and very troubling, moves against public- and private-sector pension plans. Raimondo's success at cutting Rhode Island's retirement benefits—if they survive a court challenge—will make public employees more dependent on Social Security, not less. And Congress' recently passed “cromnibus” spending bill makes it easier for sponsors of multiemployer plans to cut benefits—even for current retirees who were counting on them. How likely is it that the 10 million-plus unionized workers covered by these plans will stand by for measures that reduce their Social Security?

Increasingly beleaguered, American households need Social Security to do more for them. But this enormous, and enormously vital program, is intimately entwined with every aspect of their working lives. Public and private pensions, international trade deals, race relations, the minutiae of Washington fiscal policy—in 2015, Social Security's defenders will have to keep an eye on all of these balls if they want to preserve and enhance it for the future.

Demeter

(85,373 posts)We’ve made progress this year — raising the minimum wage in dozens of states and cities, providing equal marriage rights in a majority of states, limiting carbon emissions. But there’s far more to do.

The economy looks like it’s improving but most Americans are still stuck in recession, and almost all the economic gains are still going to the top. The only way we can have an economy that works for the many, not the few, is to get big money out of politics — so the rules of the economic game aren’t biased in favor of big corporations, Wall Street, and the rich. And to get more people fighting for equal opportunity and shared prosperity.

But many Americans have become so cynical about politics they no longer even bother to vote. Turnout in the 2014 midterm elections was the lowest in decades. This is exactly what the moneyed interests want. If we give up on politics we give up on democracy, and they can take over all of it.

Never underestimate what we can, and will, accomplish together. Organizing. Mobilizing. Energizing. Making a ruckus.

Here’s to your and yours for a great 2015.

Demeter

(85,373 posts)Senate Republicans should resist the temptation to erode Federal Reserve independence after victory in mid-term elections, Dallas Fed President Richard Fisher said.

“Think about this: Here’s a Congress that can’t even get its own budget together. Do you want them running the central bank?” Fisher, a former deputy U.S. trade representative under President Bill Clinton, said today in an interview on Bloomberg Television.

Republicans who already run the House won command of the Senate yesterday and will take charge of the Senate Banking Committee, which oversees the U.S. central bank, when the next Congress convenes in January. Lawmakers have sponsored several bills that propose changes in the way the Fed conducts monetary policy and would subject the institution to greater congressional scrutiny.

“Take it to the extreme: We would end up playing to the cameras, which is what Congress does, and it would be a disaster,” if Congress decided to audit Fed decisions, said Fisher, a former Democratic candidate for the Senate.

With Republicans in control of Congress, their bills have a better prospect of being advanced, although there is little likelihood measures that impede Fed independence would become law. President Barack Obama, a Democrat, has veto power over any legislative proposal that reaches his desk.

Richmond Fed President Jeffrey Lacker today had a similar message as Fisher’s on the importance of central bank independence.

Opposing Audits

“I’m against compromising that, with bills that would give individual congressmen the right to audit last week’s FOMC meeting,” he said in response to an audience question after a speech in Washington.

The policy-setting Federal Open Market Committee on Oct. 29 decided to end a campaign of bond purchases and pledged to hold interest rates low for a “considerable time.”

Lawmakers claim the Fed overstepped its power by bailing out Wall Street during the 2008-2009 financial crisis, and for quadrupling its balance sheet, to $4.5 trillion, through asset purchases aimed at holding down borrowing costs.

“We work for the American people. We are given our license by the Congress of the United States. I hope they will be responsible in terms of limiting the amount they wish to interfere with our independence,” Fisher said.

“I really think its dangerous to tamper with an institution. Yes, we could be updated and tweaked, but we’ve lasted 100 years, and on balance, I think we’ve done a very good job,” he said.

THERE YOU HAVE IT, BOYS AND GIRLS. THE GAUNTLET HAS BEEN THROWN DOWN.

Demeter

(85,373 posts)...Fissures are erupting between party leaders and the rank and file over whether to first advance the most ambitious goals -- dismantling Obamacare and rolling back environmental rules -- or focus on issues less likely to face a veto from President Barack Obama.

Those close to House leaders are signaling their priority will be more pragmatic initiatives over partisan fights, to show the party is capable of governing. These include repealing a medical-device tax enacted to help pay for Obamacare and granting Obama greater trade-negotiating authority. TPP! TIPP! NO! NO!

“There’ll be plenty of people who will argue: Let’s keep pushing the president,” said Oklahoma Representative Tom Cole, an ally of House Speaker John Boehner. “That’s a mistake. Before the American people will trust you with the presidency you have to prove you can run Congress.”

Representative Tim Huelskamp, a lawmaker from Kansas aligned with the Republicans’ limited-government Tea Party wing, disagrees.

“No more excuses,” Huelskamp said in an interview. “We start with what most Republicans were talking about in their campaigns,” he said, citing the need for a more vigorous attempt to repeal Obama’s health-care law.

The new Republican-led Congress that bolstered its numbers in both the House and Senate has a six-month time frame starting in January before the 2016 presidential and congressional election campaigns take off. It will have numerous must-do items, such as raising the debt ceiling and passing a highway-funding bill.

That limited period will force leaders to set priorities between more partisan battles over Obamacare and spending cuts to popular entitlement programs, and the less-bold initiatives.

“I want to first look for areas we can agree on,” Senator Mitch McConnell of Kentucky, who’s in line to become majority leader in January, said during a press conference today in Louisville.

McConnell said he spoke with Obama, Senate Majority Leader Harry Reid and Senator Ted Cruz, a Tea Party favorite, about ways they could work together. In a news conference today, Obama cited infrastructure programs, a revamp of the tax code and trade as areas of compromise. Voters “want me to push hard to close some of these divisions, break through some of the gridlock and get stuff done,” Obama said. ...

THEY ARE ALL DELUSIONAL...THE BEST WE CAN HOPE FOR IS A STALEMATE, OR ANOTHER ECONOMIC TSUNAMI.

Demeter

(85,373 posts)A Texas man who ran a firm that claimed to make virtual currency-based investments was accused of masterminding a $4.5 million Ponzi scheme in what U.S. prosecutors said was a first-of-its-kind case tied to bitcoins. Trendon Shavers, founder of Bitcoin Savings and Trust, raised at least 764,000 bitcoins by promising investors a return of as much as 3,641 percent, prosecutors said. Instead, he used bitcoins from new investors to cover payments owed to earlier clients, while also tapping into the currency to pay for his own Las Vegas gambling and spa treatments, they said. At the peak of his scheme in 2011 and 2012, Shavers held about 7 percent of all bitcoins in circulation, they said.

“Shavers managed to combine financial and cyber-fraud into a bitcoin Ponzi scheme that offered absurdly high interest payments and ultimately cheated his investors,” U.S. Attorney Preet Bharara in Manhattan said in a statement today.

...Shavers, 32, was arrested today at his home in McKinney, Texas, by Federal Bureau of Investigation agents. He’s charged with securities fraud and wire fraud, which carry maximum prison sentences of 20 years. He’s scheduled to appear in federal court in Sherman, Texas.

In September, Shavers and Bitcoin Savings were fined $40.6 million in a civil suit by the U.S. Securities and Exchange Commission. The case was the first to determine whether the SEC had authority to regulate transactions in virtual currency. According to prosecutors, Shavers, using the name “pirateat40,” solicited investments in his company on Bitcoin Forum, an online site, by offering weekly interest of as much as 7 percent. Those lending the firm bitcoins were told they could withdraw the investments at any time, prosecutors said. Shavers told investors their bitcoins would be used to support a market-arbitrage strategy that included lending them, trading them on online exchanges and selling them locally in private transactions, according to the U.S.

MORE

Demeter

(85,373 posts)ˈôˌtärkē/

noun

noun: autarky; noun: autarchy

economic independence or self-sufficiency.

a country, state, or society that is economically independent.

What Obamaism as foreign policy is forcing Russia and other nations into...the silver lining to the cloud...destroying globalism and Western hegemony.

It's going to be an interesting few years.

http://www.nakedcapitalism.com/2014/11/return-trade-cold-war.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

Demeter

(85,373 posts)A quarter of a century ago, the Iron Curtain and Berlin Wall were demolished. This was one of the most visible consequences of the fall of communism. In the decades before 1989 political conflict had shaped the world trade pattern. Against the background of political tensions in the Ukraine, this column investigates the vulnerability of the world trade system.

Sanctions and counter sanctions currently taint trade developments between Russia and the EU and US (van Bergeijk 2014). This evokes memories of the Cold War that had a very substantial impact on East West trade in the 1950s and up to the 1990s. The East’s Council for Mutual Economical Assistance (COMECON) was created in response to US and UK economic sanctions against the Soviet Union and comprised the Soviet Union and the then satellite states Bulgaria, Czechoslovakia, Hungary, Poland and Romania. During the Cold War, trade at the European continent was substantially distorted both by the COMECON’s reliance on self-sufficiency, by the difficulties imposed by the East’s lack of hard and convertible currency and by the West imposing embargoes especially on dual use goods, technologically advanced goods and food. The impact of political frictions on openness (defined as world exports to Gross Planet Product (GPP) was substantial and for the year 1985 has been estimated 3.5% of GPP (van Bergeijk en Oldersma 1990; see also Wolf and Nitsch 2009 on trade between former East and West Germany). We know from observation that Détente led to an enormous surge in intra-European, and indeed global, trade (Afmann and Maurel 2010). Will increasing tensions with Russia now lead to contraction?

Potential Impact

Of course the findings for the 1990s cannot be used directly to infer what the impact of a new superpower conflict would mean. After the fall of the Iron Curtain and Berlin Wall, Germany united, formerly planned Central European countries became EU member states and many countries, in particular China, became important players in the world trade system offering alternative supply and export markets. Still the potential impact of the Crimean crisis and the chilling of relation between Russia and the West are substantial. A recent study by the CPB Netherlands Bureau for Economic Analysis (Veenendaal 2014), for example, reports short-term decreases of industrial production due to increased political uncertainty of about half a percentage point for the major EU countries and North America. New walls in Europe – even invisible walls – are still much more difficult to conceive than before 1961 when the Berlin Wall was erected, but at the same time one is aware that it is in the present geopolitical context that a political conflict could recreate significant look-alikes in the form of a Cold War trade scenario. This column illustrates the economic costs that would follow in such a scenario.

Political Trade Resistance

In order to estimate the potential impact of the return of a cold trade war, I perform a thought experiment, so to say re-introducing the visible and invisible walls between East and West in a gravity simulation model for the world trade system in 2008 (van Bergeijk 2012). The first step is to estimate the gravity model, in particular the political trade resistance, for the year 1988 when the political tensions between East and West were still very strong. Based on the gravity parameter estimates, for political trade resistance in 1988, I simulate a world trade patter with and without political trade resistance using 2008 population and GDP data and taking account of the breaking up of a number of former Communist countries, shifts in capital cities in Nigeria and Germany and the German unification. According to this simulation, a hypothetical re-erection of the Iron Curtain (on the borders of the Russian Federation) would reduce trade openness by about 1.5% of GPP (Figure 1).

Figure 1. Estimated Iron Curtain impact on trade openness (percent of GDP) in 1988 and 2008

Demeter

(85,373 posts)

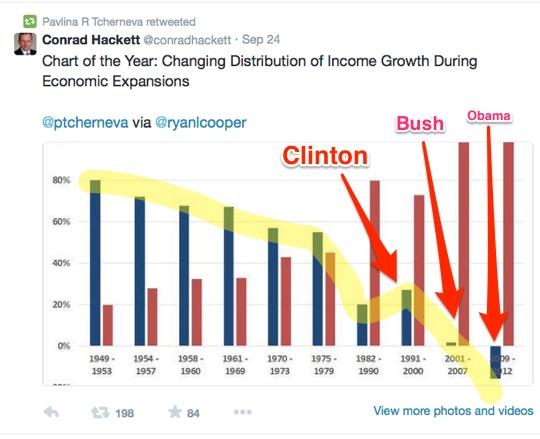

LEGEND: The blue bars are the bottom 90% of the population by income; the red bars are the top 10%.

The bottom line is that in the Bush “recovery,” nearly all the gains were creamed off by the top 10%; and in the Obama “recovery,” the bottom 90% actually lost ground. That’s “the wrong track” you keep hearing about.

In essence, voters (IN NOVEMBER'S MIDTERM ELECTIONS) are voting against Figure 1, and against Obama, and the DINOs, because Figure 1 happened on their watch.

...Summarizing, the massacre was a protest vote...

Obama and the DINOs Lost Because They Fought For What They Believed In

The Stone Kettle (before veering off into “Support the President” riffing) points out the seeming contradiction between voters choosing left policy prescriptions like a higher minimum wage and marijuana legalization and then massacring Democrats:

(There are some who believe that the DCCC’s Steve Israel sabotages non-DINOs deliberately, rather than through fecklessness. I’m not sure.)

The Irony is staggering. Last night Alaskans voted to raise the minimum wage, impose a restrictive law on mining, and legalize pot – and then they voted for the conservative big business Republican. And you’ve got ask yourself, in a state that just legalized weed, that dealt a blow to business and stood up for the little guy and the environment, how in the hell could the Democrat lose?

In reality, there is no contradiction, and there is no irony. I invite you to consider Figure 1 not as part of the “climate,” or as an outcome left under a cabbage leaf by elves, but as a policy goal successfully achieved; the bailouts were the largest upward transfer of wealth in world history; what other than Figure 1 would be the result? That Democrats worked hard to achieve their goals, and paid at the polls for standing up for principle, as they conceived of principle, is the irony. Arun Gupta writes for Telesur:

Which they have!

SMASHING ELECTION ANALYSIS: Midterms 2014: The Red Wedding for Democrats

Demeter

(85,373 posts)Don’t assume Hillary Clinton will put things right in 2016. The voters who backed Obama could be gone for good...This wasn’t supposed to happen. In American politics, so the pundits had increasingly agreed, it was the Democrats and not the Republicans who would be the dominant party of the 21st century. With the US population becoming ever more ethnically diverse, the backward-looking Republican appeal to family, church and flag would dwindle while the pragmatic Democratic openness to changing times would make them masters of the new century.

This week, however, US voters turned back the clock. When the dust from the 2014 midterm elections settles, both houses of Congress will again be under Republican control, just as they were under Bill Clinton in the 1990s and under George W Bush in the early 2000s. In the House of Representatives, the already dominant Republicans notched up one of their largest majorities since the jazz age. In the Senate, they regained the control they lost when Barack Obama was first elected in 2008.

This isn’t the new politics the experts predicted. It looks a lot more like a decisive return to the recent old.

The context goes some way to explain what happened this week.

- In the Senate, where there is a six-year electoral cycle, Democrats elected on Obama’s coat-tails in the big Democratic year of 2008 faced re-election in 2014 in a less favourable political climate. Losses were always likely. They duly took place in bellwether states such as Colorado, Iowa and North Carolina as well as in safer Republican bets such as Montana, South Dakota and West Virginia. The obvious conclusion is that post-Ronald Reagan normality has reasserted itself.

- That is also true in the House, with its two-year cycle. There, in contrast to the unchanging boundaries of the Senate, congressional districting continues to be loaded in favour of the Republicans. In 2012, the Republicans won 54% of the seats to give them a strong majority, even though the Democrats took 51% of the popular vote. That’s unlikely to have been repeated this time, but the boundary bonus is still real, designed to consolidate any Republican advantage. Again, 2014 looks more like a return to recent House election results than an aberration.

- State governorships are not often on foreign observers’ radar. Yet governors probably matter more than senators in American politics. The Republican governors who were up for election this year were those who were elected four years ago, a strong Republican year. This year, however, they did markedly better than in 2010, winning in states such as Illinois, Maryland and Massachusetts that had remained Democratic four years ago.

- It is a standard assumption that the president’s party almost always does badly in midterm elections. This year’s have been typical of that. But they also repeated the pattern of the 2010 midterms, when a smaller and differently composed section of the electorate turned out to vote than in the presidential elections of 2008 and 2012, which Obama won. The electorate in those presidential contests was a bit more racially diverse and younger than the whiter and older voters who turned out this week and in the 2010 midterms. But it does not follow that the larger, more diverse and younger electorate will come out to vote again in 2016, with more favourable results for the Democrats.

- Then there’s the money. The amounts remain eye-watering. Over $500m was spent in the House races this year, mainly on TV ads, even though only about 30 of the 435 contests were, even generously, described as competitive – another consequence of congressional redistricting. This year has also seen the scale of officially undisclosed donations rising sharply after the supreme court’s decision that such donations constitute freedom of speech. A study of key 2014 Senate contests in which Republicans triumphed this week confirms that these multimillion-dollar donations go disproportionately to Republicans.

All of these things had a bearing on this week’s massacre of the Democrats. But they do not fully explain it. There is no getting away from the fact that Obama was at least part of the Democrats’ problem on Tuesday. Some of that, without question, is about race. The Republicans are the white people’s party. This week, 60% of white people – and 64% of white men – voted Republican. But race was far from the only issue motivating the voters. Two-thirds of all voters told the exit poll on Tuesday that “things in this country are seriously off on the wrong track”, while a third – overwhelmingly Republicans – said one reason they had voted was to express opposition to Obama.

MORE

I WOULD TAKE ISSUE WITH THE NOTION THAT THE NATION IS RETURNING TO ANYTHING OR ANY PART OF THE REAGAN ERA. BUT THE REST OF IT RINGS TRUE.

Demeter

(85,373 posts)xchrom

(108,903 posts)1. German deputy chancellor Sigmar Gabriel warned on Monday that imposing additional sanctions on Russia might plunge the country into further chaos.

2. Oil prices hit new 5-and-a-half-year lows on Monday amid a supply glut and weak demand.

3. Pope Francis named 20 new cardinals on Sunday.

4. ESPN anchor Stuart Scott died on Sunday at age 49 after fighting cancer since 2007.

5. The euro hit a 9-year low against the dollar on Monday, sinking below $1.20 for the first time since June 2010.

Read more: http://www.businessinsider.com/10-most-important-things-in-the-world-jan-5-2015-1#ixzz3Nwgz24lB

xchrom

(108,903 posts)U.S. crude and Brent futures dropped to fresh 5-1/2-year lows on Monday as worries about a surplus of global supplies amid weak demand continued to drag on oil markets.

At 10.50am GMT (5.50am ET) Brent was trading at $55.23 a barrel, its the lowest values since May 2009.

Here is a chart of how it looked at 9am GMT (4am ET):

Read more: http://www.businessinsider.com/r-oil-prices-hits-fresh-five-and-a-half-year-lows-brent-below-56-2015-1#ixzz3NwhLmzcV

xchrom

(108,903 posts)Here's the scorecard:

France's CAC 40: -0.34%

Germany's DAX: -0.20%

UK's FTSE 100: -0.60%

Spain's IBEX: -0.74%

Italy's FTSE MIB: -1.05%

Asian stocks ended the day mixed: Japan's Nikkei fell 0.24%, and Hong Kong's Hang Seng closed down 0.57%, but the Shanghai Composite ended 3.58% higher.

US futures are following European stocks lower: The Dow is currently 19 points lower, and the S&P 500 is 2.5 points down.

German economic data is coming at 1 p.m. GMT, the only major release from Europe this morning. Analysts are expecting that the harmonized index of consumer prices, a major measure of inflation, will drop to just 0.2%, barely in positive territory.

That's way below the European Central Bank's 2% target, and could fall even further with oil prices staying near their lowest level in five years.

Read more: http://www.businessinsider.com/market-update-5-jan-2015-2015-1#ixzz3Nwl4x53R

xchrom

(108,903 posts)Japanese manufacturing activity showed sustained growth in December, a survey showed on Monday, suggesting domestic demand continues to recover after the economy fell into a surprise recession last year.

The final Markit/JMMA Japan Manufacturing Purchasing Managers Index (PMI) was 52.0 in December, slightly less than a preliminary reading of 52.1 and unchanged from the final reading in November.

It remained above the 50 threshold that separates contraction from expansion for the seventh consecutive month.

The output component of the PMI index was 52.5, less than a preliminary reading of 53.3 and slightly below 52.7 in November.

Read more: http://www.businessinsider.com/r-japan-december-final-manufacturing-pmi-shows-sustained-growth-good-news-for-pm-abe-boj-2015-1#ixzz3NwlebkgX

xchrom

(108,903 posts)Berlin (AFP) - German Chancellor Angela Merkel came under fire Sunday over a magazine report suggesting she would be prepared to let Greece exit the euro should a far-left party win a snap Greek election.

Der Spiegel news weekly quoted government sources as saying Berlin sees a Greek exit from the eurozone as "almost inevitable" should the radical leftist Syriza party win the vote and abandon Athens' current austerity course.

Both Merkel and her finance minister Wolfgang Schaeuble had come to consider that Greece's departure from the single-currency bloc would be "manageable", the magazine said.

The recovery underway in other formerly problem economies such as Ireland and Portugal, the establishment of a permanent eurozone bailout fund and the creation of a banking union had all bolstered Berlin's belief that the contagion from a fresh Greek crisis would be limited, it added.

Read more: http://www.businessinsider.com/afp-merkel-under-fire-over-possible-grexit-approval-2015-1#ixzz3NwmIyBtf

Demeter

(85,373 posts)German banks WILL collapse, for one thing. They've got all the loans to Greece still.

xchrom

(108,903 posts)PARIS (AP) -- France's president has raised the possibility of Greece leaving the shared euro currency, but says that's a decision for "Greece alone" to make.

Some in Europe have expressed concern that if the left-wing Syriza party wins this month's general election in Greece, the new government may renege on terms of a hugely expensive international bailout plan. That has revived questions about Greece's fitness to stay in the euro.

Francois Hollande said on France-Inter radio Monday that Greece's new leaders "will have to respect the commitments made by their country."

But he insisted that it's not up to others to say whether the result of the Greek vote means they should or shouldn't keep using the euro currency.

That, he said, "is for Greece alone to decide."

xchrom

(108,903 posts)WASHINGTON (AP) -- The incoming chairman of the Senate Commerce, Science and Transportation Committee says raising the federal fuel taxes is among the options under consideration to replenish the dwindling Highway Trust Fund.

Sen. John Thune of South Dakota says all options must be looked at to fill an enormous shortfall when the existing highway legislation expires in May.

Gas and diesel taxes haven't risen since 1993, resulting in perennial shortfalls in the fund that pays for most road projects.

Several commissions have called for raising the taxes, but Congress has been reluctant. Instead lawmakers have dipped repeatedly into the general treasury to keep the trust fund solvent.

The federal gas tax is 18.4 cents per gallon and the diesel tax is 24.4 cents per gallon.

Thune spoke on "Fox News Sunday."

xchrom

(108,903 posts)MADRID (AP) -- The number of people registered as employed in Spain has risen by 417,574 in 2014 compared with the previous year, the first annual increase since 2007 and the latest sign that the country's is recovering from its economic crisis.

The Labor Ministry said Monday that the number of people employed at the end of 2014 was 16.8 million.

The ministry said the number of people registered as jobless last year dipped by 253,627, for a total of 4.45 million. It was the second consecutive yearly drop.

Quarterly unemployment surveys - seen as more accurate by economists - showed Spain's unemployment rate was 24 percent in the third quarter, with 5.4 million people jobless.

Spain is recovering from two recessions, the last of which ended in late 2013.

xchrom

(108,903 posts)BERLIN (AP) -- A spokesman for Chancellor Angela Merkel says Germany hasn't shifted its view on Greece leaving the euro.

In a report Saturday, German weekly Der Spiegel had cited unnamed government officials indicating that Merkel and her finance minister no longer believe it would be too risky for the 19-member eurozone if Greece dropped the currency.

But deputy government spokesman Georg Streiter told The Associated Press in an emailed statement Sunday: "There is no change of course."

He also repeated Berlin's position that "the German government expects that Greece will continue to fulfill its contractual obligations toward the troika" of the EU, European Central Bank and International Monetary Fund.

Germany has warned Greece against reneging on the terms of its bailout program should the left-wing Syriza party win this month's general election.

xchrom

(108,903 posts)Warren Buffett said last year that Berkshire Hathaway Inc. (BRK/A)’s future will be about buying big businesses and expanding them over time. As he celebrates his golden anniversary running the company, investors are rallying behind the idea.

Shares of the Omaha, Nebraska-based company, which he took over in 1965, are trading close to an all-time high after climbing more than twice as much as the Standard & Poor’s 500 Index last year. They soared even as Buffett lost money on stakes in Tesco Plc and International Business Machines Corp., one of his biggest holdings.

Not too long ago, Berkshire was seen as a way to buy into the billionaire’s skill picking stocks. These days, it’s primarily a bet on his ability to make acquisitions and distribute funds among the dozens of businesses he bought over the past five decades, including electric utilities, manufacturers, retailers and one of the largest U.S. railroads.

“The market’s realizing that it’s more than just that stock portfolio,” said David Rolfe, who oversees about $10.5 billion including Berkshire shares at Wedgewood Partners Inc.

xchrom

(108,903 posts)Oil’s biggest bust since the global recession was good for a few cases of whiplash.

Just two months ago, Continental Resources Inc. (CLR), the shale driller founded by billionaire Harold Hamm, budgeted for $80-a-barrel oil and planned to spend $4.6 billion in 2015. Six weeks later, with crude down 29 percent in the interim, Continental cut its 2015 budget to $2.7 billion.

Halliburton Co. (HAL), the world’s biggest provider of fracking services to oil companies, announced Dec. 11 that it would dismiss 1,000 workers. Two months earlier, Chairman and Chief Executive Officer Dave Lesar said “our sector will be fine” if oil prices range between $80 and $100 a barrel.

xchrom

(108,903 posts)Greece’s political parties embarked on a flash campaign for elections in less than three weeks that Prime Minister Antonis Samaras said will determine the fate of the country’s membership in the euro currency area.

Samaras used a Jan. 2 speech to warn that victory for the main opposition Syriza party would cause default and Greece’s exit from the 19-member euro region, while Syriza leader Alexis Tsipras said his party would end German-led austerity. Der Spiegel magazine reported Chancellor Angela Merkel is ready to accept a Greek exit, a development Berlin sees as inevitable and manageable if Syriza wins, as polls suggest.

The high-stakes run-up to the Jan. 25 vote returns Greece to the center of European policy makers’ attention as they strive to fend off a return of the debt crisis that wracked the region from late 2009, forcing international financial support for five EU countries. While Greek 10-year bond yields rose 16 basis points to 9.41 percent today from a post-crisis low of 5.57 percent in September, the relative improvement in yields from Italy to Ireland suggests that the contagion has been contained. The benchmark ASE stock index fell 2.4 percent to 816.46 at 11:42 a.m. in Athens.

xchrom

(108,903 posts)Mario Draghi will this week get his first taste of one of the dominant challenges for the euro-area economy for 2015.

Consumer prices probably recorded the first annual decline in more than five years in December amid a slide in the cost of oil, aggravating concern at the European Central Bank that subdued inflation will become entrenched. With Italy in recession, French momentum lackluster and Germany struggling to leave a weak patch behind, policy makers are haggling over stimulus as governments drag their feet on economic reforms.

Inflation data on Jan. 7 may tip the scales in favor of large-scale sovereign-bond purchases when the ECB president leads a meeting of the Governing Council later this month. He said last week that the risk of deflation “cannot be entirely excluded,” while others led by Bundesbank President Jens Weidmann favor holding off to allow previous measures to take effect.

xchrom

(108,903 posts)Investors in Sweden’s currency are already profiting from a last-minute deal struck in the final days of 2014 to avert political upheaval.

Since Dec. 27, when Prime Minister Stefan Loefven revealed his minority coalition reached an accord with the opposition to pass his budget and call off a snap election, the krona has gained 0.6 percent against the euro. That compares with a 3.2 percent decline from Dec. 3 to Dec. 26, when Sweden still faced its first early election since 1958 after an anti-immigration party blocked Loefven’s inaugural spending plan.

According to Danske Bank A/S (DANSKE), the parliament’s ability to resolve the stalemate means krona investors now stand to see further gains in the short term.

“There has been a small a risk premium in the krona because of the political uncertainty, which could speak for a slightly stronger krona,” said Stefan Mellin, an analyst at Danske Bank in Stockholm.

DemReadingDU

(16,000 posts)1/5/15 Stiglitz Blocked From SEC Panel After Faulting High-Speed Trades

Joseph Stiglitz, the Nobel laureate economist who called for a tax on high-frequency trading, has been blocked from a government panel that will advise regulators on issues facing U.S. equity markets, according to people familiar with the matter.

Stiglitz’s rejection shows the partisan infighting that has bogged down Securities and Exchange Commission Chair Mary Jo White’s plan to set up a panel of experts to advise the agency on topics ranging from rapid-fire stock trading to dark pools.

Republican Commissioner Daniel Gallagher opposed Stiglitz’s nomination in recent weeks as White sought to complete the list of participants, according to two people who asked to not be identified because the deliberations were private. Democratic Commissioner Luis Aguilar had pushed for Stiglitz, who has said high-frequency trading isn’t good for financial markets and should be curbed, possibly through a tax.

“I think they may not have felt comfortable with somebody who was not in one way or another owned by the industry,” Stiglitz said in a phone interview.

White said Jan. 3 that she will announce the members of the advisory market-structure committee in the coming days -- six months after she first proposed the idea together with a blueprint for renewed market oversight. Each of the five commissioners -- two Democrats, two Republicans and White, an independent -- was allowed to nominate one person to the panel. The commission then had to come to agreement on the final list, which is expected to have more than 15 members.

Gallagher declined to comment on the panel, as did Gina Talamona, a spokeswoman for White.

more...

http://www.bloomberg.com/news/2015-01-05/stiglitz-blocked-from-sec-panel-after-faulting-high-speed-trades.html

Demeter

(85,373 posts)Now she's given Stiglitz cachet with the Tea Party (heh heh heh).

Trojan horse is complete and ready to position!

DemReadingDU

(16,000 posts)1/4/15 11 Predictions Of Economic Disaster In 2015 From Top Experts All Over The Globe by Michael Snyder

Will 2015 be a year of financial crashes, economic chaos and the start of the next great worldwide depression? Over the past couple of years, we have all watched as global financial bubbles have gotten larger and larger. Despite predictions that they could burst at any time, they have just continued to expand. But just like we witnessed in 2001 and 2008, all financial bubbles come to an end at some point, and when they do implode the pain can be extreme. Personally, I am entirely convinced that the financial markets are more primed for a financial collapse now than they have been at any other time since the last crisis happened nearly seven years ago. And I am certainly not alone. At this point, the warning cries have become a deafening roar as a whole host of prominent voices have stepped forward to sound the alarm. The following are 11 predictions of economic disaster in 2015 from top experts all over the globe…

#1 Bill Fleckenstein: “They are trying to make the stock market go up and drag the economy along with it. It’s not going to work. There’s going to be a big accident. When people realize that it’s all a charade, the dollar will tank, the stock market will tank, and hopefully bond markets will tank. Gold will rally in that period of time because it’s done what it’s done because people have assumed complete infallibility on the part of the central bankers.”

#2 John Ficenec: “In the US, Professor Robert Shiller’s cyclically adjusted price earnings ratio – or Shiller CAPE – for the S&P 500 is currently at 27.2, some 64pc above the historic average of 16.6. On only three occasions since 1882 has it been higher – in 1929, 2000 and 2007.”

#3 Ambrose Evans-Pritchard, one of the most respected economic journalists on the entire planet: “The eurozone will be in deflation by February, forlornly trying to ignite its damp wood by rubbing stones. Real interest rates will ratchet higher. The debt load will continue to rise at a faster pace than nominal GDP across Club Med. The region will sink deeper into a compound interest trap.”

#4 The Jerome Levy Forecasting Center, which correctly predicted the bursting of the subprime mortgage bubble in 2007: “Clearly the direction of most of the recent global economic news suggests movement toward a 2015 downturn.”

click for 7 additional predictions

http://theeconomiccollapseblog.com/archives/11-predictions-economic-disaster-2015-top-experts-globe

Demeter

(85,373 posts)They don't even have damp wood. Unfortunately, since neither stone has either flint nor steel in it, they can't even get sparks.

Demeter

(85,373 posts)My best guess is that despite the NYTimes and the entire Democratic party being in denial about this, voters really HATE Obamacare. It’s the cheap airlines special of healthcare where you have no idea what the guy sitting next to you paid for the same seat but you’re pretty sure he got a better deal than you did. Oh sure, there are always going to be a few people who scored the deal of a lifetime, but that only means that the rest of the poor slobs in economy subsidized their ticket. Meanwhile, business class is enjoying extra legroom because their employers used CliqBook to negotiate better deals. And first class doesn’t know or care about the people in steerage.

Then there is the problem of being forced to buy a ticket in economy where there is zero legroom and you could swear the airline shrank your personal space by another 25%, and there are no snacks but some grumbling flight attendant who just lost her pension is walking up and down the aisle with pony bottles of water that sell for 5 times what you would pay on Air France. Then you realize that this flight is 14 hours long and you have to pee but YOU had to buy the cheapest seat you could find so you’re crammed in to the window seat and have to climb over other people to get out. And there’s Paul Krugman sitting in a business class upgrade saying you’re ungrateful if you complain about your seat because the morbidly obese passenger whose excess girth is spilling over your armrest is finally able to afford his insulin.

Did I mention that you have to pay full price tickets for a long time before you can use your frequent flyer miles? In fact, you may never get a chance to use them

I take back that extended metaphor because some of us are not on that plane. Noooo, we’re the ones whose careers were ended by the financial catastrophe and haven’t been able to afford a ticket and can’t get a subsidy because we make too little money. So, we’re stuck there on the tarmac, paying a penalty for being deadbeats, except we’re not deadbeats. We’re just invisible to the Krugman types and the nation’s elderly who just can’t understand what horrible thing we must have done if we can’t find new jobs. Maybe the new Republicans will implement training programs for us where we will learn how to take responsibility for coming to work sober and on time every day and where we can learn useful skills like how to use a computer and the inter toobz, Oh, yes, sign me up for that! I LOVE mandatory pointless patronizing lectures that will not improve my life a jot. It’s what I live for.

Didn’t the Democrats promise they were going to fix Obamacare if only they could just pass it first? They swore up and down that they were going to revisit it and correct all the flaws as soon as they could. And how did that go? It’s not that the country doesn’t want or need better healthcare. It’s just that when Democrats had two whole years to create something better they had Obama in charge all ready to lock us into a plan that only the extravagantly expensive health care/insurance industry wanted.

And don’t even get me started on the crappy economy. I am having a very hard time believing that the economy is picking up. Now I have to worry about a bunch of nut job Republicans waving some shiny Grand Bargain object in front of Obama, who’s got the political skills of a second grader being shaken down by the class bullies that want his lunch money. Make that OUR lunch money.

It could have been different. Of course, Democrats will blame Bill Clinton. It’s what they always do. They never learn that this is just what the psychopaths who run the country want. They need Bill Clinton to be the enemy to keep the party’s attention off of what they are doing. There must be a scapegoat.

Well, I have a new governor and my congressman retained his seat, not that it will do much good seeing as here in Pittsburgh, we’re a tiny dot of blue in a sea of red. It’s sort of like being the good guys surrounded by zombies infected by a virus transmitted through their cable boxes. The closer you are to urban areas where diversity confers some protection, the less likely you are to be infected. Too bad about that whole gerrymandering thing.

{{sigh}}

We deserve better than this.

INDEED WE DO

Demeter

(85,373 posts)Ed added:

The idea of buying people under the name of wages is exactly what Samuelson means when he talks about labor as a factor of production, like coal.

By Ed Walker, who writes as masaccio at Firedoglake. You can follow him at Twitter at @MasaccioFDL, and here’s his author page at Firedoglake.

Even as more low paid workers take to the streets to demand an increase in the minimum wage, there are plenty of people ready to tell you that labor markets pay you what you are worth, so if you get $9.35 per hour for 30 random hours a week, that’s what you are worth. I hear this from lots of people who should know better, college-educated people holding well-paying jobs in the corporate world, even women who must know that on average women are paid less than men doing the same job. One reason people believe this obviously false idea must be the theory of marginal productivity of labor taught for decades in colleges and high schools. I wrote about the theory of marginal productivity as an explanation for compensation here, based on the analysis of Thomas Piketty in Capital in the Twenty-First Century. Piketty’s focus is on the enormous compensation paid to top managers, which is so obviously unrelated to marginal productivity as to make that theory laughable, and my post looks at payments to the top dogs at PIMCO as an example of the giggles.

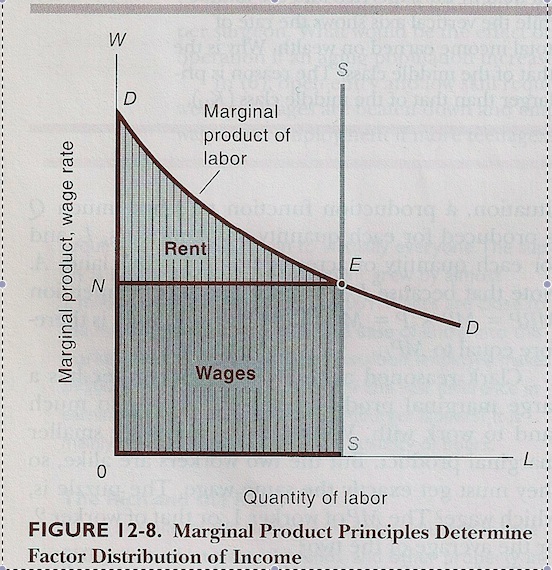

Turning to compensation for the rest of us, here’s a short refresher. I have a copy of the 2005 edition of Economics by Paul Samuelson and William Nordhaus, partly because I’m too cheap to spring for the most recent edition, $255 at Amazon, and partly because I imagine a lot of people studied introductory economics from this textbook or an even older version. Chapter 12, titled How Markets Determine Incomes, is based on the theory of marginal productivity. The authors assert that labor is a factor of production, just like land and machines and plant and electricity. Wages are determined by the marginal product of labor, just like those other factors of production. The authors define two types of demand, direct demand, which is the demand for finished products and services by direct consumers, and derived demand, which is the demand for products and services to be used in the production of other goods and services. Thus, the rental price for farmland to grow corn is derived from the consumer demand for corn.

Then they define Marginal Revenue Product as the additional revenue produced by a unit of input of something (labor, steel, electricity, cash loans) while all other things are held constant. It is equal to the marginal revenue the firm gets from the sale of the additional output, if any, created by the additional unit. Hands are waved, and the authors tell us that the firm should add inputs of all kinds to the point that the marginal revenue product of the input is less than or equal to the cost of the input. Here’s a chart, Samuelson/Nordhaus at 238.

S:N Marginal Product Graph 2

The authors explain that the rent triangle is equal to about 1/4 of wages, which “… reflects the fact that labor earnings constitute about three-quarters of national income.” Nice and simple. So then we calculate the supply and demand for the entire economy by adding up all the supply and demand curves of every firm. Then we have equilibrium at the point where the supply equals the demand. From here, it’s a short step to determining the distribution of money to wages. Samuelson and Nordhaus give us the model of John Bates Clark from 1900.

Under perfect competition, the answer is clear: Landlords will not hire a worker if the market wage exceeds that worker’s marginal product. So competition will ensure that all the workers receive a wage rate equal to the marginal product of the last worker.

But now there is a surplus of total output over the wage bill because earlier workers have higher MPs than the last worker. What happens to the excess MPs…? The rest stays with the landlords as their residual earnings, which we will later call rent. Why…? The reason is that each landlord is a participant in the competitive market for land and rents the land for its best price. 237-8, emphasis in original.

John Bates Clark was one of the important neoclassical economists. This is from a recent paper.

Samuelson and Nordhaus are teaching neoclassical economics based on Natural Law thinking a century old. Here’s how they explain themselves:

Here’s a version from Gregory Mankiw from 2006, offering some detail on what might be taught in an advanced economics class. He claims the model works well. He concedes that the data available on declining wage share is “not well understood”, but we shouldn’t be concerned, he claims.

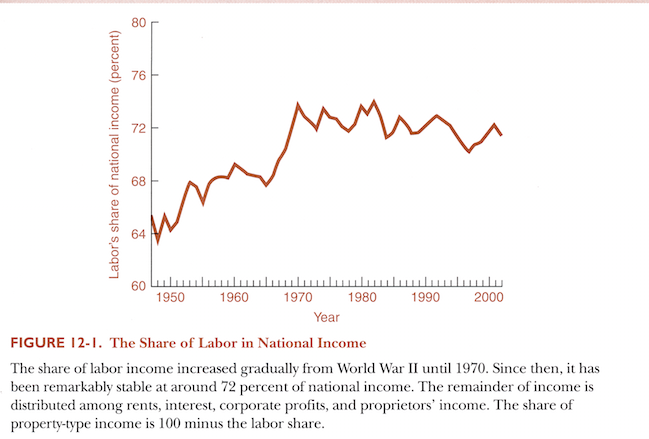

Piketty says we should look at data, so let’s. Samuelson/Nordhaus offer this chart; take a look at the caption:

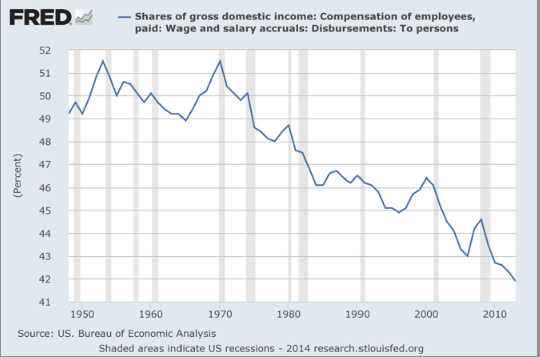

S:N Labor Share

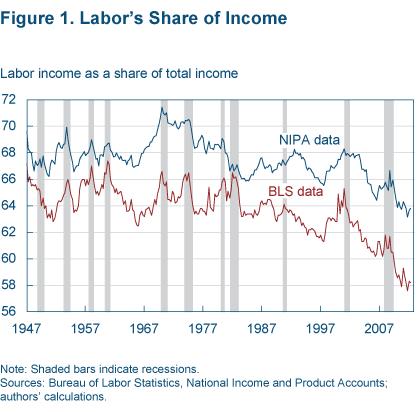

Here’s another version of that data in chart form, this one covering the period ending 2010, prepared by the Cleveland Fed.

Labor share Cleveland Fed

Here’s how that paper describes the data:

As best I can tell, the NIPA data, in blue in the second chart, is fairly close to Samuelson’s data. Many people today look at a third chart, the one from FRED:

Chart 5

The technical description of this chart is here. It differs from Samuelson’s chart in that the denominator is gross domestic income instead of national income. There may be other differences because the source of the Samuelson/Nordhaus data is the detailed NIPA tables, and what you get depends on which elements you decide to count. For yet another take, here’s Jared Bernstein, whose views are worth a read.

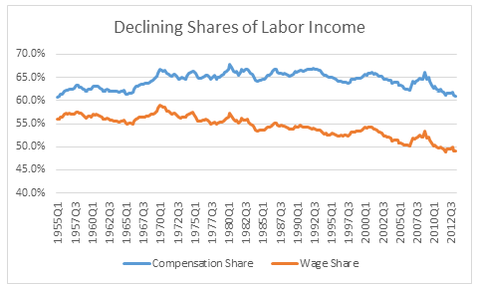

Bernstein Labor Share

By all these accounts, labor’s share of gross income is falling.

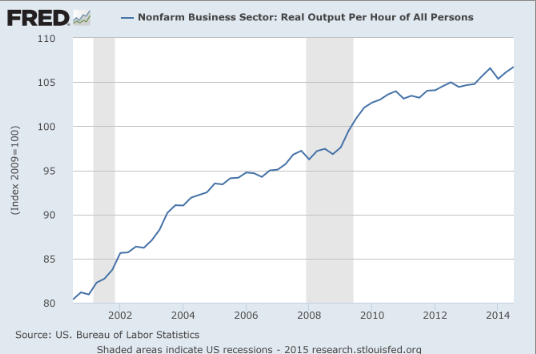

At the same time, productivity is increasing. Here’s a productivity chart from FRED.

Real Output Productivity

For the marginal productivity theory to make sense, you have to assume that labor compared to other factors of production is less productive than it was before. It’s hard to see how this could be true in an economy dominated by the service sector, as in the US. So, not surprisingly, the data doesn’t support marginal productivity as an explanation of income distribution. To see why, here’s a relatively short but detailed criticism of this armchair theory through reality checking. http://www.paecon.net/PAEReview/issue59/Moseley59.pdf

As the same writer points out, the theory is quietly being removed from most textbooks because it’s useless, except to dead-enders like Mankiw, who continues to teach it from his perch at Harvard. So if most economists think so little of it, why does it survive? Maybe it’s because the distribution it describes is supposed to arise from the operation of Natural Law. As such, it fits neatly with Invisible Hand mumbo-jumbo. Natural Law isn’t a testable or usable theory. Instead, it is a normative theory. It tells you what the writer thinks is the moral and righteous position. People who tell you marginal productivity theory is true want you to think that current distribution of income is natural and just, and that any other distribution would be unjust, unfair to someone. That’s what that Natural Law stuff means: the income you get from the labor market is what it Should Be, and if you get more, you’re taking it away from someone. Maybe that someone is another worker, but more likely, you’re stealing from the owners of the things used in production: the return to which the capital owner and the land owner are entitled by virtue of the Natural Law. Samuelson and Nordhaus teach their students that the economy as currently constructed is natural and fair.

Add to that a desire to believe that the economic system is fair, and a constant media and political drumbeat about the wonders of capitalism, and you have the perfect setting for uncritical belief in a false and stupid idea. You are worth more than the “market” says.

I REFER READERS TO THE WOLFF VIDEOS I'VE BEEN POSTING, WHERE HE STATES THAT THE INSATIABLE DEMAND FOR LABOR IN THE USA WAS FINALLY MET WHEN THE BABY BOOMERS ENTERED THE LABOR FORCE, AND SO, LABOR SWITCHED FROM A SELLER'S MARKET TO A BUYER'S MARKET....

MattSh

(3,714 posts)Demeter

(85,373 posts)Was a little worried when you didn't post on weekend...

Eugene

(61,872 posts)Source: BBC

US oil price falls below $50 on supply glut fears

The US oil price has fallen below the symbolic threshold of $50 a barrel for the first time since April 2009.

The price of Brent crude also fell on Monday, dipping more than 6% to trade at below $53 a barrel.

The price of both Brent crude and US oil, known as West Texas Intermediate crude, have now lost more than half of their value since mid-2014.

[font size=1]-snip-[/font]

Read more: http://www.bbc.com/news/business-30687669