Economy

Related: About this forumWeekend Economists: Spock Lives! March 6-8, 2015

I don't know about you, but writing today's date (I was signing checks) is weirding me out. How can it possibly be? Anyway....

?w=680

?w=680

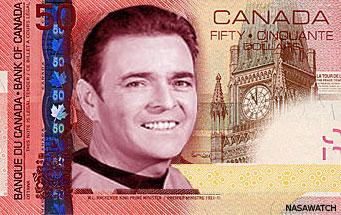

The news of beloved actor Leonard Nimoy’s passing on Friday has saddened his fans over the last few days, but we’ve got to hand it to our neighbors in the wintry north for their unique way of paying tribute: Reviving a past trend known as “Spocking,” mourning Canadians have been doodling on their $5 bills, turning the image of Prime Minister Sir Wilfrid Laurier into that of the half Vulcan, half human Star Trek character.

Trekkies in Canada are flexing their artistic muscles with variations on the Spocking theme, which works best on older, cotton cloth bills — though some have succeeded in drawing his likeness on the newer polymer currency as well.

This outburst in affection for Nimoy was prompted by a Tweet from Canadian Design Resource, urging Canadians to Spock their bills:

Canadians have been doing this since at least 2008, notes CNET, when the Facebook group “Spock Your Fives” promoted the practice.

It’s not illegal to change the bills into Spock as the denomination is still clearly visible — though PhotoShopping your own bills and trying to use them would be a big no-no — but the Bank of Canada said back in 2002 that it’s not a great idea.

“Writing on a bank note may interfere with the security features and reduces its lifespan,” the Bank of Canada said. “Markings on a note may also prevent it from being accepted in a transaction.”

Spock and I go a long way back...back to the beginning. My collection of Spockenalia is an open scandal in what little is left of my family. And while Leonard Nimoy, a gentle, thoughtful human, is gone, the persona he created will live forever: the alien among us, the commentator, critic, guest, half-breed, hybrid, brother, and the most human being we have ever known. Live long and Prosper, Admiral and Ambassador!

Demeter

(85,373 posts)AUDIO ONLY:

TO MODIFY ALDONZA'S EPITAPH FOR THE FALLEN POET:

A MAN DIED. HE SEEMED A GOOD MAN. I DID NOT KNOW HIM....

SPOCK IS NOT DEAD. BELIEVE!

Demeter

(85,373 posts)A combination of lower-class status in the military, overwork, and psychological trauma appears to be taking a mental toll on drone pilots. The US drone war across much of the Greater Middle East and parts of Africa is in crisis and not because civilians are dying or the target list for that war or the right to wage it just about anywhere on the planet are in question in Washington. Something far more basic is at stake: drone pilots are quitting in record numbers. There are roughly 1,000 such drone pilots, known in the trade as "18Xs," working for the US Air Force today. Another 180 pilots graduate annually from a training program that takes about a year to complete at Holloman and Randolph Air Force bases in, respectively, New Mexico and Texas. As it happens, in those same 12 months, about 240 trained pilots quit and the Air Force is at a loss to explain the phenomenon. (The better-known US Central Intelligence Agency drone assassination program is also flown by Air Force pilots loaned out for the covert missions.) On January 4, 2015, the Daily Beast revealed an undated internal memo to Air Force Chief of Staff General Mark Welsh from General Herbert "Hawk" Carlisle stating that pilot "outflow increases will damage the readiness and combat capability of the MQ-1/9 Predator and Reaper enterprise for years to come" and added that he was "extremely concerned." Eleven days later, the issue got top billing at a special high-level briefing on the state of the Air Force. Secretary of the Air Force Deborah Lee James joined Welsh to address the matter. "This is a force that is under significant stress—significant stress from what is an unrelenting pace of operations," she told the media.

In theory, drone pilots have a cushy life. Unlike soldiers on duty in "war zones," they can continue to live with their families here in the United States. No muddy foxholes or sandstorm-swept desert barracks under threat of enemy attack for them. Instead, these new techno-warriors commute to work like any office employees and sit in front of computer screens wielding joysticks, playing what most people would consider a glorified video game. They typically "fly" missions over Afghanistan and Iraq where they are tasked with collecting photos and video feeds, as well as watching over US soldiers on the ground. A select few are deputized to fly CIA assassination missions over Pakistan, Somalia, or Yemen where they are ordered to kill "high value targets" from the sky. In recent months, some of these pilots have also taken part in the new war in the Syrian and Iraqi borderlands, conducting deadly strikes on militants of ISIL. Each of these combat air patrols involves three to four drones, usually Hellfire-missile-armed Predators and Reapers built by southern California's General Atomics, and each takes as many as 180 staff members to fly them. In addition to pilots, there are camera operators, intelligence and communications experts, and maintenance workers. (The newer Global Hawk surveillance patrols need as many as 400 support staff.)

The Air Force is currently under orders to staff 65 of these regular "combat air patrols" around the clock as well as to support a Global Response Force on call for emergency military and humanitarian missions. For all of this, there should ideally be 1,700 trained pilots. Instead, facing an accelerating dropout rate that recently drove this figure below 1,000, the Air Force has had to press regular cargo and jet pilots as well as reservists into becoming instant drone pilots in order to keep up with the Pentagon's enormous appetite for real-time video feeds from around the world. The Air Force explains the departure of these drone pilots in the simplest of terms. They are leaving because they are overworked. The pilots themselves say that it's humiliating to be scorned by their Air Force colleagues as second-class citizens. Some have also come forward to claim that the horrors of war, seen up close on video screens, day in, day out, are inducing an unprecedented, long-distance version of post-traumatic stress syndrome (PTSD).

But is it possible that a brand-new form of war—by remote control—is also spawning a brand-new, as yet unlabeled, form of psychological strain? Some have called drone war a "coward's war" (an opinion that, according to reports from among the drone-traumatized in places like Yemen and Pakistan, is seconded by its victims). Could it be that the feeling is even shared by drone pilots themselves, that a sense of dishonor in fighting from behind a screen thousands of miles from harm's way is having an unexpected impact of a kind psychologists have never before witnessed?

WHAT IS WRONG WITH CALLING IT WHAT IT IS: GUILT! IT'S WRONG, THEY KNOW IT'S WRONG, AND ONLY A PSYCHOPATH WOULDN'T CARE ABOUT HIS REPUTATION OR HIS SOUL.....

Pratap Chatterjee is executive director of CorpWatch. He is the author of Halliburton's Army: How A Well-Connected Texas Oil Company Revolutionized the Way America Makes War and Iraq, Inc. His next book, Verax, a graphic novel about whistleblowers and mass surveillance co-authored by Khalil Bendib, will be published by Metropolitan Books in 2016.

Demeter

(85,373 posts)It’s seed time for the 2016 presidential elections, when candidates try to figure out what they stand for and will run on. One thing seems reasonably clear. The Democratic nominee for president, whoever she may be, will campaign on reviving the American middle class. As will the Republican nominee, although the Republican nominee’s solution will almost certainly be warmed-over versions of George W. Bush’s “ownership society” and Mitt Romney’s “opportunity society,” both seeking to unleash the middle class’s entrepreneurial energies by reducing taxes and regulations. That’s pretty much what we’ve heard from Republican hopefuls so far. As before, it will get us nowhere.

The Democratic nominee will just as surely call for easing the burdens on working parents through paid sick leave and paid family and medical leave, childcare, elder-care, a higher minimum wage, and perhaps also tax incentives for companies that share some of their profits with their employees. All this is fine, but it won’t accomplish what’s really needed. The big unknown is whether the Democratic nominee will also take on the moneyed interests – the large Wall Street banks, big corporations, and richest Americans – which have been responsible for the largest upward redistribution of income and wealth in modern American history...

(since the crash of 2008) the Street has been back to many of its old tricks. Its lobbyists are also busily rolling back the Dodd-Frank Act intended to prevent another crash. The Democratic candidate could condemn this, and go further, promising to resurrect the Glass-Steagall Act, once separating investment from commercial banking (until the Clinton administration joined with Republicans in repealing it in 1999). The candidate could also call for busting up Wall Street’s biggest banks and thereafter limiting their size; imposing jail sentences on top executives who break the law; cracking down on insider trading; and, for good measure, enacting a small tax on all financial transactions in order to reduce speculation.

Another part of America’s upward redistribution has come in the form of “corporate welfare,” tax breaks and subsidies benefiting particular companies and industries (oil and gas, hedge-fund and private-equity, pharmaceuticals, big agriculture) for no other reason than they have the political clout to get them. It’s also come in the guise of patents and trademarks that extend far beyond what’s necessary for adequate returns on corporate investment, resulting, for example, in drug prices that are higher in America than in any other advanced nation. It’s taken the form of monopoly power, generating outsize profits for certain companies (Monsanto, Pfizer, Comcast) along with high prices for consumers. And it’s come in the form of trade agreements that have greased the way for outsourcing American jobs abroad, thereby exerting downward pressure on American wages.

Not surprisingly, corporate profits now account for a largest percent of the total economy than they have in more than eight decades; and wages, the smallest percent in more than six. The candidate could demand an end to corporate welfare and excessive intellectual property protection, along with tougher antitrust enforcement against giant firms with unwarranted market power. And an end to trade agreements that take a big toll on wages of working-class Americans. The candidate could also propose true tax reform: higher corporate taxes, in order to finance investments in education and infrastructure; ending all deductions of executive pay in excess of $1 million; and cracking down on corporations that shift profits to countries with lower taxes. She (or he) could likewise demand higher taxes on America’s billionaires and multimillionaires, who have never been as wealthy, or taken home as high a percent of the nation’s total income and wealth, in order to finance an expanded Earned Income Tax Credit (a wage subsidy for low-income workers). Not the least, taking on the moneyed interests would necessitate limiting their future political power. Here, the candidate could promise to appoint Supreme Court justices committed to reversing Citizens United, push for public financing of elections, and demand full disclosure of all private sources of campaign funding.

THE ONLY THING ROBERT REICH FORGOT IS PUTTING AN END TO ENDLESS WAR...

Demeter

(85,373 posts)A Canadian charged for refusing to give border agents his smartphone passcode was expected Thursday to become the first to test whether border inspections can include information stored on devices. Alain Philippon, 38, risks up to a year in prison and a fine of up to Can$25,000 (US$20,000) if convicted of obstruction.

He told local media that he refused to provide the passcode because he considered information on his smartphone to be "personal." Philippon was transiting through the port city of Halifax on his way home from a Caribbean vacation on Monday when he was selected for an in-depth exam.

"Philippon refused to divulge the passcode for his cell phone, preventing border services officers from their duties," Canada Border Services Agency said in an email.

The agency insists that the Customs Act authorizes its officers to examine "all goods and conveyances including electronic devices, such as cell phones and laptops." But, according to legal experts, the issue of whether a traveler must reveal the password for an electronic device at a border crossing has not been tested in court.

"It's) one thing for them to inspect it, another thing for them to compel you to help them," Rob Currie, director of the Law and Technology Institute at Dalhousie University, told public broadcaster CBC.

Philippon is scheduled to appear in court on May 12.

Demeter

(85,373 posts)Editor's note: What do Canadians need to push back against mass government surveillance? According to Edward Snowden, it's direct access to the facts -- not facts that are relayed through newspaper or media accounts, but through original documents. Snowden, the world’s most famous whistleblower, participated in a livestream Q&A this morning, hosted by the Canadian Journalists for Free Expression, as part of the release of the Snowden Archive, Canada's first searchable database of classified documents on global surveillance programs made publicly available by Snowden. In a wide-ranging discussion, he addressed the impact of his leak on governments and the governed, and offered his thoughts on Canada's new anti-terror legislation, Bill C-51. Below is an unofficial transcript of his opening remarks (SEE LINK). Video in full above.

Demeter

(85,373 posts)The former CIA agent and NSA leaker made a public appeal for asylum in Switzerland saying that sees this country as a great political option because it has a history of neutrality...

BAD MOVE, ED! THE SWISS ARE MORE THAN WILLING TO KNIFE SOMEBODY; THEY ARE UNDER TREMENDOUS PRESSURE FROM THE NWO AND BANKSTERS...

Security Agency (NSA) leaker Edward Snowden, who has been living in Russia since mid-2013, on Friday made a public appeal for asylum in Switzerland, where he said he once worked under diplomatic cover for the Central Intelligence Agency (CIA).

"I would love to return to Switzerland, some of my favourite memories are from Geneva. It's a wonderful place," he told a Moscow-Geneva videoconference. "I do think Switzerland would be a sort of great political option because it has a history of neutrality."

US prosecutors accuse Snowden of leaking information on US National Security Agency (NSA) secret surveillance programs to mainstream media.

In 2013, he was granted a temporary asylum in Russia after spending more than a month in the transit zone of Moscow's Sheremetyevo airport.

In August 2014, as the asylum expired, Snowden received a three-year residency permit.

Demeter

(85,373 posts)At least 95 families were evicted every day in Spain in 2014, fresh statistics say as Spaniards struggle to meet mortgage payments. Home foreclosures have become a stark symbol of the 7-year economic crisis, with 2014 seeing a further rise in numbers. The number of foreclosures on all types of residences, including holiday homes, offices and farms, reached 119,442 last year, almost 10 percent higher than in 2013, according to data from the National Statistics Institute.

Foreclosure procedures on main residences rose to 34,680 families in 2014, an increase of 7.4 percent over the previous year. Andalusia, Catalonia and Valencia were the worst-affected regions.

Evictions have become a symbol of the economic crisis Spain has been struggling with since 2008. Most of them were connected to mortgages taken out during property booms in 2006 and 2007.

The situation has provoked nationwide protest....PODEMOS! MORE AT LINK

Demeter

(85,373 posts)Versatile actor, director and photographer whose career was defined by his role as Star Trek’s Mr Spock

<iframe src="https://embed.theguardian.com/embed/video/culture/video/2015/feb/28/leonard-nimoy-star-treck-mr-spock-dies-aged-83-video-report" width="560" height="315" frameborder="0" allowfullscreen></iframe>

Few actors outside soap opera become defined by a single role to the exclusion of all else in their career. But that was the case for Leonard Nimoy, who has died aged 83. He did not simply play Mr Spock, first officer of the USS Enterprise in Star Trek – he was synonymous with him, even after taking on other parts and branching out into directing and photography.

Star Trek began life on television, running for three series between 1966 and 1969, and later spawned numerous spin-offs, including a run of films of varying quality, two of which (Star Trek III: The Search for Spock, from 1984, and Star Trek IV: The Voyage Home, from 1986) Nimoy directed. “I’m very proud of having been connected with the show,” he wrote in 1975. “I felt that it dealt with morality and philosophical questions in a way that many of us would wish were part of the reality of our lives.”

In front of the camera, as the half-human, half-Vulcan Spock, he captured with delicious wit the tensions in the character. Spock’s logical, detached perspective could be infuriating to his more demonstrative colleagues; it also caused him to be amused or bewildered by the workings of humans. This could play out humorously or poignantly. He was uniquely placed, for example, to analyse coolly our emotional shortcomings: “It is curious how often you humans manage to obtain that which you do not want,” he mused in the first series. His dry rapport with the more passionate, full-blooded Captain James T Kirk (William Shatner) was a pleasure that endured long after the Star Trek brand itself showed signs of having been around the galaxy a few too many times.

Once seen, Spock was never forgotten. The hair, boot-polish black, was snipped short with a severe, straight fringe; it looked more like headgear than a haircut, more painted on than grown. An inch of forehead separated that fringe from a pair of sabre-like eyebrows that arched extravagantly upwards. These came in handy for conveying what the reserved Spock could not always express verbally. “The first thing I learned was that a raised eyebrow can be very effective,” said Nimoy.

Spock’s defining physical feature, though, was his pointed ears. The actor’s first reaction upon seeing them was: “If this doesn’t work, it could be a bad joke.” Sharply tapered but in no way pixieish, the ears somehow never undermined his gravitas. Or rather, Nimoy’s sober disposition precluded laughter. Besides, in a show suffused with messages of inclusivity and tolerance, it would never do for audiences to laugh at someone just because he came from Vulcan....

MORE

Demeter

(85,373 posts)http://tass.ru/en/economy/781349

Ukraine counts on the IMF to approve a new package of financial aid on March 11

The international reserves of the National Bank of Ukraine (NBU) dropped in February 2015 by 12.4% to $5.6 billion, the regulator reported Thursday.

"According to preliminary data, as of March 1, 2015 international reserves in Ukraine totaled $5.625 billion," the report said.

The drop in reserves "was caused by making payments by Government and the National Bank of Ukraine with redemption and service of government and government-backed debts in foreign currency ($539.1 mln), including payments into the International Monetary Fund. Besides, the level of international reserves was influenced by National Bank interventions on the sale of foreign currency at $651.3 mln, $560,4 mln of which was sold for targeted interventions. Interventions on purchase of exchange totaled $144.7 mln," the report said.

The National Bank of Ukraine also said Ukraine has enough gold and currency reserves to meet its commitments in the short-run.

"Given that Ukraine counts upon a positive decision by the International Monetary Fund (IMF) board of directors regarding extension of a new package of financial aid already on March 11, as of today the international reserves of Ukraine will suffice to meet commitments and current operations of Government and the National Bank in the short-run," the report said.

BRAVE WORDS! LOTS OF OTHER ARTICLES ON UKRAINE AT SAME SITE.

DemReadingDU

(16,000 posts)It's an excellent video that you shared last November.

Leonard Nimoy takes a trip back to Boston with his son Adam. Leonard talks about growing up in the West End before it was re-developed, selling newspapers, how he got his start in acting, and various other people who shaped his life. Appx 30 minutes.

http://vimeo.com/90940421

DemReadingDU

(16,000 posts)I must be the only person who has never seen any of the Star Trek tv shows or movies.

So post away for me to gain a Trekkie education.

I'm speechless! Have you got 4-5 years?

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)as far as I'm concerned, you can ignore The Next Generation, but the Voyager and Deep Space Nine spinoffs are good, if you are getting the habit.

Then there is the fan fiction...literally hundreds of books in print.

That will give you a basic working knowledge of the universe. Oh, I forgot the "technical journals"! (inside joke)

No matter what your interest (except for economics--there are some analyses of how economics works in the 23rd century, but they are inferred from educated guesses), there is an aspect of Star Trekdom that addresses it.

Or, you could look at Memory Alpha--the Star Trek Wikipedia

http://en.memory-alpha.org/wiki/Portal:Main

Demeter

(85,373 posts)AND IT'S RAINBOWS AND PONIES, ALL AROUND!

http://www.bloomberg.com/news/articles/2015-03-05/fed-stress-tests-show-31-largest-banks-meet-capital-targets

The Federal Reserve said all 31 big banks subjected to a stress test have sufficient capital to absorb losses during a sharp and prolonged economic downturn. It’s the first time since the central bank started stress tests in 2009 that no firm fell below any of the main capital thresholds. Goldman Sachs Group Inc. surpassed the 8 percent minimum for total risk-based capital by 0.1 percentage point, potentially restricting its room to return capital to shareholders. The annual tests, using hypothetical scenarios that are not forecasts, are the cornerstone of the Fed’s efforts to prevent a repeat of the 2008 financial crisis and to gauge the ability of banks to withstand economic turmoil.

The largest U.S.-based banks “continue to build their capital levels and to strengthen their ability to lend to households and businesses during a period marked by severe recession and financial market volatility,” the Fed said in a statement Thursday. The Fed uses the exams to prod lenders into building up capital buffers. Banks that don’t meet a second round of tests released next week may face restrictions in buying back stock and paying dividends.

This year’s results are being released as the Fed faces scrutiny from lawmakers critical of its supervision of the biggest banks. Fed Chair Janet Yellen countered the criticism, saying this week the central bank works hard to avoid the trap of “regulatory capture,” or the risk that bank examiners get too cozy with the firms they oversee.

Six Largest

Bank of America Corp. was the only bank among the six largest to improve in every capital measure from its performance in last year’s test. Wells Fargo & Co. surpassed every minimum by at least 2 percentage points. Morgan Stanley’s ratio in three capital measures fell in a severely adverse scenario to within 1 percentage point of the required minimum. Loan-loss estimates for the 31 banks totaled $490 billion under a hypothetical severely adverse scenario, down from $501 billion for the 30 banks tested last year. The losses include a $102.7 billion hit to trading. JPMorgan Chase & Co. would suffer the most from trading losses, estimated at $23.6 billion. The heaviest damage was to consumer lending, with 39 percent of projected losses from such activity as mortgages and credit cards. Goldman Sachs’s small buffer over the required minimum would appear to leave the firm with less than $1 billion in excess capital to pay out to shareholders. In 2014, the bank returned $6.52 billion in dividends and share repurchases.

Citigroup Losses

Citigroup Inc. lost the most among banks in an accounting line known as accumulated other comprehensive income, which measures losses that can erode equity, even if they aren’t immediately reflected in the firm’s net income. The New York-based bank’s losses in that category were estimated to reach $20.5 billion, or about three quarters of the industry’s total, under the severely adverse economic scenario. Under the less severe scenario, the bank’s $29.3 billion in losses accounted for about one third of the total. The Fed didn’t specify what part of Citigroup’s business fueled the loss estimate. Accounting rules require banks to record unrealized gains and losses from items such as “available-for-sale” security holdings and foreign-currency moves under that line item.

Adverse Scenario AND MORE, AT LINK

Demeter

(85,373 posts)Demeter

(85,373 posts)After a challenging year with legal issues and settlements, Bank of America Corporation BAC can now rejoice on finally unburdening itself of the multi-year $8.5 billion mortgage settlement deal after the Manhattan appellate court approved the settlement entirely in the bank’s favor yesterday. The court decision put an end to the opposition faced by the bank since 2011 on account of investors being dissatisfied with the compensation paid to them. BofA can now focus on reviving profitability by concentrating on core operations with all its major litigations settled.

Flashback

In Jun 2011, BofA had reached an agreement to pay $8.5 billion for its legacy Countrywide Financial Corp. mortgage repurchase and servicing claims. The settlement took place between 22 investors who suffered significant losses for their investments in mortgage-backed securities (MBS) that were sold by Countrywide prior to the housing market failure. BofA acquired Countrywide in 2008. The agreement basically covered most of BofA’s legacy Countrywide- issued first-lien MBS repurchase exposure. It represented 530 trusts with original principal balance of $424 billion and a total current unpaid principal balance of about $221 billion.

The group of investors, including BlackRock Inc. BLK, PIMCO, MetLife Inc. MET and the Federal Reserve, had alleged that prior to the financial crisis, Countrywide had sold securities that were tied to bad-quality loans. The loans were not even well-managed by The Bank of New York Mellon Corp. BK, which was the trustee for the MBS. Therefore, these investors sought a buyback relief in MBS that were offloaded by Countrywide.

Current Update

In Jan 2014, the settlement agreement was largely approved by New York state Judge Barbara Kapnick. However, the loan-modification claims by investors were carried forward. The present decision under a panel of five judges refuted the claims stating that BNY Mellon as a trustee did not misuse its authority over the settlement. With full approval from the court, BofA can now put the entire matter to rest and move forward without the weight of legal settlements on its financials.

Demeter

(85,373 posts)The European Central Bank has finally set a date for the launch of its massive sovereign bond-buying program aimed at providing cash to the ailing eurozone economy and lifting inflation. Following a meeting of the European Central Bank's rate-setting Governing Council in Cyprus on Thursday, ECB president Mario Draghi said the bank would start buying sovereign bonds from eurozone countries on Monday next week.

"We will on 9 March 2015 start purchasing euro-dominated public sector securities in the secondary market. We will also continue to purchase asset-backed securities and covered bonds which we started last year," Draghi told a news conference in the Cypriot capital Nikosia.

Germany's blue chip stock index, the DAX, jumped to a new high of 11,527 points after Draghi's comments. The euro fell to a fresh 11-year low against the dollar of $1.10.

In January, the central bank for the euro currency area unveiled an aggressive plan to stimulate the flagging eurozone economy that would involve printing 60 billion euros ($69.7 billion) a month from March this year until September 2016 to finance large-scale purchasing of public and private assets.

The ECB program, also known as quantitative easing, marks the most far-reaching attempt yet by the central bank to prop up the 19-member common currency bloc. In all, the bank intends to spend 1.14 trillion euros over 19 months to spur inflation and encourage lending in the real economy...MORE

Demeter

(85,373 posts)Richard Werner (economics professor at University of Southampton) is the inventor of quantitative easing (QE). Werner previously said that QE has failed to help the economy. (Former long-time Fed chair Alan Greenspan agrees. Numerous academic studies confirm this.) But Werner is now taking off the gloves …He said recently:

But the central bankers are instead choosing to act in a way which creates massive profits for the big banks, instead of stabilizing the economy. Werner blames the revolving door between central bankers and private bankers

The central banks have twisted the whole concept of easing … pretending that they’re trying to help the economy, when they’re doing something else entirely

Credit should be extended to the productive economy – businesses which create goods and services – and not to financial speculators or high levels of consumer debt. Extending credit to small businesses former creates prosperity; lending to financial speculators only leads to economic instability and soaring inequality; and when too high a percentage of lending goes to luxury consumer consumption, it’s bad for the economy

Banks create money and credit out of thin air when they make loans (background)

It’s a myth that interest rates drive the level of economic activity. The data shows that rates lag the economy

Indeed, economists also note that QE helps the rich … but hurts the little guy. QE is one of the main causes of inequality. And economists now admit that runaway inequality cripples the economy. So QE indirectly hurts the economy by fueling runaway inequality. A high-level Federal Reserve official says QE is “the greatest backdoor Wall Street bailout of all time”. And the “Godfather” of Japan’s monetary policy admits that it “is a Ponzi game”. And – as counter-intuitive as it sounds – QE actually hurts the economy and leads to deflation in the long-run.

Demeter

(85,373 posts)For six years, the world has operated under a complete delusion that Central Banks somehow fixed the 2008 Crisis.

All of the arguments claiming this defied common sense. A 5th grader would tell you that you cannot solve a debt problem by issuing more debt. Similarly, anyone with a functioning brain could tell you that a bunch of academics with no real-world experience, none of whom have ever started a business or created a single job can’t “save” the economy.

However, there is an AWFUL lot of money at stake in believing these lies. So the media and the banks and the politicians were happy to promote them. Indeed, one could very easily argue that nearly all of the wealth and power held by those at the top of the economy stem from this fiction. So it’s little surprise that no one would admit the facts: that the Fed and other Central Banks not only don’t have a clue how to fix the problem, but that they actually have almost no incentive to do so.

So here are the facts:

1) The REAL problem for the financial system is the bond bubble. In 2008 when the crisis hit it was $80 trillion. It has since grown to over $100 trillion.

2) The derivatives market that uses this bond bubble as collateral is over $555 trillion in size.

3) Many of the large multinational corporations, sovereign governments, and even municipalities have used derivatives to fake earnings and hide debt. NO ONE knows to what degree this has been the case, but given that 20% of corporate CFOs have admitted to faking earnings in the past, it’s likely a significant amount.

4) Corporations today are more leveraged than they were in 2007. As Stanley Druckenmiller noted recently, in 2007 corporate bonds were $3.5 trillion… today they are $7 trillion: an amount equal tot nearly 50% of US GDP.

5) The Central Banks are now all leveraged at levels greater than or equal to Lehman Brothers was when it imploded. The Fed is leveraged at 78 to 1. The ECB is leveraged at over 26 to 1. Lehman Brothers was leveraged at 30 to 1.

6) The Central Banks have no idea how to exit their strategies. Fed minutes released from 2009 show Janet Yellen was worried about how to exit when the Fed’s balance sheet was $1.3 trillion. Today it’s over $4.5 trillion.

We are heading for a crisis that will be exponentially worse than 2008. The global Central Banks have literally bet the financial system that their theories will work. They haven’t. All they’ve done is set the stage for an even worse crisis in which entire countries will go bankrupt.

Demeter

(85,373 posts)Below are a few documentaries that are a must watch if you haven't already seen them. If you have, watch them again.

The Untouchables

The Go Go's

Money, Power & Wall Street

China's Real Estate Bubble

Congress: Trading Stock on Inside Information

|

:

MattSh

(3,714 posts)So many times before.

McCain with the Ukraine Nazis

McCain with the Syrian rebels

McCain with the Libyan rebels

Wherever McCain shows up, trouble follows.

John McCain (C) and Boris Nemtsov (R)

MattSh

(3,714 posts)Last edited Sat Mar 7, 2015, 08:38 AM - Edit history (1)

I'll likely post this on GD later, at a time it'll have a greater impact.

Derived from this chart:

The least Russo-phobic national media is at the top of the list; the most Russo-phobic at the bottom.

How this works. If the balance between neutral articles and negative articles are equal, you are assigned a score of 1. So even here, you can't exactly call them Russo-friendly either.

Some interesting correlations here.

Arab countries: All score 1 or less. While the USA has been making enemies here for who knows how long, the Russians are making friends. It never hurts to have 1.3 billion Muslims on your side.

The countries in yellow actually have a border with Russia. Do I see some slackers there?

USA is 5 times more Russo-phobic than Canada. But of course. The USA is an exceptional country, with exceptional media, and an exceptional leader. And blessed by God. Canada? Well, they're all hosers. And this winter has frozen their brains.

The USA is 2.5 times more Russo-phobic than Ukraine. And Georgia is not very Russo-phobic at all.

Only 2 European countries that border Russia have a score > 2. The USA scores over 6.

The USA is NOT #1 again. They fall behind Germany. But at least Germans are starting to see through the BS, because the sanctions they applied on Russia are biting them hard, and the counter-sanctions by the Russians are biting too.

http://www.russia-direct.org/analysis/russia-now-monitoring-world%E2%80%99s-mass-media-bias

Demeter

(85,373 posts)The search for Truth is Never-Ending

(You forgot a link, Matt)

MattSh

(3,714 posts)but here's a link anyway, here and there too.

http://www.russia-direct.org/analysis/russia-now-monitoring-world%E2%80%99s-mass-media-bias

Demeter

(85,373 posts)Apple may consume up to 746 metric tonnes of gold per year in the production of its new luxury Apple watch, due for release in April. This equates to roughly one third of gold’s total annual global mine supply. The watch will come in three varieties - the entry level "Sports" model, the mid-tier "Apple Watch" and the upper end "Apple Watch Edition" which the company says will be made of 18k (75% pure) gold and is estimated to retail from anywhere between $4,000 and $10,000.

Apple (APPL) have ordered their manufacturing plants in Asia to produce between 5 and 6 million units. Around half of these will be the Sports model which is expected to retail for $349. Around one third of the order will be made up of the mid-range watch leaving an estimated one sixth of the order to be comprised of the gold edition. Tidbits, the independent blog discussing all things Apple have estimated that each watch will use 2 ounces of gold. While this may be an over-estimation - a watch made of 75% gold would be be quite bulky if it used a full two ounces - it is not impossible, especially if buyers were to opt for a gold bracelet with the watch. Apple's reported expectation to shift one million units of the Edition model will be a tall order. In the end it will probably come down to the price. Even at the lower end estimate of $4,000 it's hard to imagine Apple shifting one million units each month.

However, Apple's ability to generate a buzz or hype, depending on your perspective, cannot be under-estimated. While details concerning the actual function of the Watch do not suggest a "must-have" motivation for buying it - at least on technological grounds - Apple raving fans may create the massive demand the company expects. It does not have the element of indispensable usefulness that one could associate with the iPhone or iPad. The major attraction of the ‘Watch’ will be a fashionable one and be about being part of the Apple ‘tribe.’ This is not a terrain in which we would normally expect a technology company to operate in comfortably. However, Apple have recruited the former CEOs of Yves Saint Laurent and Burberry to make up for their lack of expertise. It will be interesting to see how this synergy works out. We wonder how many people would be willing to shell out for a jewelry and technology hybrid with an expected usefulness of roughly five years when the most expensive element in it is its gold content. These types of purchases are normally made with a view to it being useful and having sentimental value for a lifetime. Perhaps Apple will offer upgrades where the interior of the watch can be replaced while keeping the same gold exterior.

If the Watch Edition is to be successful it will require quite a leap in the psychology of jewelry buying. However, we would be hesitant to bet against the capabilities of the Apple marketing machine and the loyalty of Apple buyers in this regard. Should the Watch Edition retail at $4,000 it should leave Apple reasonable room to manoeuvre in the event of a spike in the price of gold. If Apple were to use a full two ounces of gold it would currently cost them roughly $2,400. Assuming other costs are not much greater than those involved in producing the Sports model which is expected to retail at $349, we can assume that Apple will have a buffer of around $1,200, to absorb a gold price spike of 50%. These figures don't include marketing costs or expected profits. The CultofMac blog speculates that Apple would need to wrest 45% of the share of luxury watches from the likes of Rolex and other high-end Swiss watches to meet its target. It is, however, likely that Apple will attract lot of customers who would not normally be in the marketplace for luxury watches.

One million units per month using 2 ounces of gold would amount to the 746 tonnes of the metal mentioned above. While Apple may not use that amount of gold per unit and may not shift its expected volume of units, what is important is that there is a major new buyer in the gold market. Where Apple goes - others may follow creating additional sources of demand. The ramifications for the gold market based on these estimates are significant. Currently, China is already buying more than 1,500 metric tonnes annually or more than 50% of global supply. Creditor nation central banks, particularly the Chinese, are diversifying their gold reserves and accumulating large amounts of bullion on an ongoing basis. Many central banks, including Germany, Austria, the Netherlands, Belgium, are repatriating their own gold reserves from the Federal Reserve and the Bank of England. Many analysts believe that this is forcing their counter-parties into the market to regain gold that should be in their possession but was dumped onto the market as part of the gold-suppression scheme.

With an enormous buyer like Apple coming into the market, supply is going to have to come from existing stocks of gold. That is to say, supply does not exist to meet this new demand...

MORE, GENERAL INFORMATION, AT LINK

Demeter

(85,373 posts)Russia has arrested two men apparently from the Caucasus on suspicion of killing the opposition leader Boris Nemtsov, the head of the secret police said on Saturday. Alexander Bortnikov, director of the FSB, successor to the KGB, told Russian TV two men named as Anzor Gubashev and Zaur Dadayev had been taken into custody, on the basis of results of the investigation so far. Russian president Vladimir Putin had been informed of the arrests, he added.

Russian media quoted sources close to the investigation as saying the detentions were based on surveillance camera footage and phone records and evidence left in a getaway car. Investigators were said still to have no information on who might have ordered the killing.

The detentions came just over a week after Nemtsov, a former deputy prime minister turned opposition leader was gunned down close to the Kremlin walls as he returned home from a restaurant late in the evening of February 27 with his 23-year-old girlfriend. He was shot four times in the back from a Makarov pistol.

MORE SPECULATION, GOSSIP AND DISSING AT LINK

MattSh

(3,714 posts)Well, not really. Just one of those subtle biases the media always needs to insert.

Demeter

(85,373 posts)There's also the scoffing of Chechen thugs being the local go-to for hired killers...which makes them ideal for a little Western assassination plot, doesn't it?

I am personally impressed that the Moscow police came up with results in a week. Could the US do so without shutting down the entire city, like they did for Boston marathon bombing? Although there are murmurs that kettling Boston was an opportunistic test of a long-developing plan for suppressing the public...

Demeter

(85,373 posts)Winston Churchill once said, “I feel lonely without a war.” He also badly missed the loss of empire. Churchill’s successor – the ‘Empire of Chaos’ – now faces the same quandary. Some wars – as in Ukraine, by proxy – are not going so well. And the loss of empire increasingly manifests itself in myriad moves by selected players aiming towards a multipolar world. So no wonder US ‘Think Tankland’ is going bonkers, releasing wacky CIA-tinted “forecasts” where Russia is bound to disintegrate, and China is turning into a communist dictatorship. So much (imperial) wishful thinking, so little time to prolong hegemony.

The acronym that all these “forecasts” dare not reveal is BRICS (Brazil, Russia, India, China, and South Africa). BRICS is worse than the plague as far as the ‘Masters of the Universe’ that really control the current - rigged - world system are concerned. True, the BRICS are facing multiple problems. Brazil at the moment is totally paralyzed; a long, complex, self-defeating process, now coupled with intimations of regime change by local ‘Empire of Chaos’ minions. It will take time, but Brazil will rebound. That leaves the “RIC” – Russia, India and China - in BRICS as the key drivers of change. For all their interlocking discrepancies, they all agree they don’t need to challenge the hegemon directly while aiming for a new multipolar order.

The BRICS New Development Bank (NDB) – a key alternative to the IMF enabling developing nations to get rid of the US dollar as a reserve currency – will be operative by the end of this year. The NDB will finance infrastructure and sustainable development projects not only in the BRICS nations but other developing nations. Forget about the Western-controlled World Bank, whose capital and lending capacity are never increased by the so-called Western “powers.” The NDB will be an open institution. BRICS nations will keep 55 percent of the voting power, and outside their domain no country will be allowed more than 7 percent of votes. But crucially, developing nations may also become partners and receive loans.

Damn those communists

A tripartite entente cordiale is also in the making. Indian Prime Minister Narendra Modi will be in China next May – and ‘Chindia’ will certainly engage in a breakthrough concerning their bitter territorial disputes. As much as Delhi has a lot to benefit from China’s massive capital investment and exports, Beijing wants to profit from India’s vast market and technology savvy. In parallel, Beijing has already volunteered economic help to Russia – if Moscow asks for it – on top of their evolving strategic partnership. The US “pivoting to Asia” – launched at the Pentagon – is all dressed up with no place to go. Bullying Southeast Asia, South Asia and, for that matter, East Asia as a whole into becoming mere ‘Empire of Chaos’ vassals – and on top of it confronting China - was always a non-starter. Not to mention believing in the fairy tale of a remilitarized Japan able to “contain” China.

A GENERAL SUMMARY OF THE STATE OF THE WORLD AND THE NATIONS ON IT, AND THE SHIFTING ALLIANCES AND MARKETS, FOLLOWS...SEE LINK

THE GERMANY SECTION IS EXTREMELY INTERESTING, AS IS THE MIDDLE EAST

Pepe Escobar is the roving correspondent for Asia Times/Hong Kong, an analyst for RT and TomDispatch, and a frequent contributor to websites and radio shows ranging from the US to East Asia.

Demeter

(85,373 posts)The labor dispute that wreaked havoc on West Coast ports and on shippers for months was tentatively settled on February 20. By then, it was too late. Cargo had been delayed for weeks. Perishable goods with sell-by dates were stuck in refrigerated containers somewhere. Companies around the country spent endless working hours to keep the supply chain from collapsing. Cargo was shipped by air at a big additional cost. Demurrage charges and other costs piled up. Manufacturers, like Honda, ran out of parts and had to cut production…. It was a fiasco shippers won’t forget. Growers in the Central Valley of California, when they want to export their produce to Asia, don’t have a choice. Shipping these goods across the country to ports on the East Coast or the Gulf or to Canada is too costly and takes too long. Other companies have the same problem. They’re captive customers of the West Coast ports. But not every company has that problem.

There is the near-term impact.

“Damage to the first quarter is done, and there’s nothing we can do about it,” Journal of Commerce economist Mario Moreno told the annual TPM Conference in Long Beach. In January, the volume of US containerized imports was down 10% from a year ago. West Coast ports, which handled about 54% of the imports last year, weighed heavily. For instance, at the Port of Los Angeles, volume plunged 28%, at the Port of Oakland 32%! And February, Moreno said, doesn’t look a lot better. It will drag down the whole year, with total US containerized imports inching up a crummy 1.7% in 2015, rather than the 6% he’d projected earlier.

Exports look even crummier. It’s not just the West-Coast port problems, but also the strong dollar and, worse, lackluster demand in Asia and Europe that are expected to drag down total US containerized exports by 4.4%, Moreno said. It would be the second year in a row of declines. Exports add to GDP. Goosing exports is how everyone in the world wants to fix their economies, in a zero-sum game. But it’ll be tough for the US. Industry analysts and port executives project it might take another two to three months to clear out the backlog. According to the JOC, “The congestion is so severe that it will tax the ability of marine terminals, longshore labor, truck drivers, and equipment providers to clear out the backlogs while attempting to handle new vessel arrivals each week.”

Then there is the long-term damage.

“Completely unnecessary and completely man-made” congestion has caused “permanent and irrevocable damage,” explained Adam Hall, senior director international logistics at Dollar General, which ranked 33rd on the 2013 JOC Top 100 Importers list. “The reason I say that is that we have figured out better ways to move our cargo that don’t involve the West Coast.” Dollar General will shift more of its Asian imports from its centers in Southern California to its centers near Savannah, Georgia. “We have a bicoastal strategy that enables us to move back and forth,” he said. Shipping from Asia via the West Coast is faster and cheaper than the southern route via the Panama Canal, but reliability is more important than speed for some cargo, Hall said. “We will not be married to any one port.” The biggest shippers – importers in the import-dependent US – such as Wal-Mart, Home Depot, and Target, use the so-called four-corner strategy with facilities at the northern and southern ports on the West Coast, the East Coast, and the Gulf. They’re not married to one port either. And the fiasco has taught even smaller companies to look for alternatives to West-Coast ports. In a JOC survey of 138 shippers, 65.4% said they would reroute cargo to avoid West Coast ports this year and in 2016. Of those, 22.7% said they’d reroute 10-30% of their cargo, 11% said they’d reroute 31-50%, and 9.5% said they’d reroute over 50%. In other words, over 20% of the shippers said they’d reroute over 31% of their cargo to avoid West Coast ports!

That’s a lot of business that will be lost.

And shippers will source some of their merchandise closer to the US, or even in the US, to avoid the eternal “cycle” of labor disputes, said Steve Wolfe, VP of global supply chain and logistics at Stanley Furniture. “Not only is it getting old, it’s more and more disruptive and raising costs to the point that bringing manufacturing back may end up being break-even, though it’s probably commodity specific,” he said in his survey response. “Our company is certainly beginning to look for alternatives as well as many of my peers in various commodity segments.” This is good news for parts of the US, including ports on the East Coast and the Gulf Coast, and for ports in Canada, and it may be good news for manufacturing if it pans out. But its bad news for West-Coast ports and the industries that have sprung up around them, and for warehouse facilities, truckers, railroads, etc. that are focused on the West Coast. It comes on top of the expansion of the Panama Canal – to be completed no later than next year – that will allow even larger vessels to squeeze through, which would bring down shipping costs of the southern route and make it more competitive with truckers and railroads in the US.

This is what happens when the two sides in a dispute hold the already struggling economy of an entire nation hostage to further their own goals. They played a sordid blame game in the media here for months. Every time an article on the port congestion appeared, it seemed to contain propaganda from one side that the propagandists at the other side fiercely denied by issuing their own propaganda. The idea was to eke out an advantage by holding a big gun to the nation’s head. But the gun backfired. It caused permanent damage to all involved, for the benefit of the same sectors in other parts of the country, in Canada, and even in Panama. And now the whole world marvels how such a convoluted, spread-out, French-like disruption of commerce by a small number of actors could happen in the US.

Demeter

(85,373 posts)Uber said it was halting operations in Anchorage on Friday until Alaska's largest city can work out details enabling the ride-share company's drivers to accept paying fares, as an Oregon city sued the firm over safety requirements. Uber drivers had been providing free rides since last fall after a Superior Court judge ruled that accepting payments would violate the city's taxi ordinance, the Alaska Dispatch News reported. An Uber Anchorage operations manager said the company halted operations because the city's efforts to draft rules for Uber drivers, such as insurance and background check requirements, have not come quick enough, despite months of negotiations. Anchorage Mayor Dan Sullivan said Uber's decision "should not be attributed to inaction by the municipality as the process has been continuous and a path forward has been established by the Assembly." Sullivan added that the Assembly members and city officials will meet with Uber on March 18 to try to work out an agreement.

Uber has been fighting with cities across the country, contending it is not a taxi service and should not be required to adhere to existing taxicab regulations.

The Oregon city of Eugene sued Uber in Lane County Circuit Court on Thursday, asking the court to stop Uber from operating until it meets what the city calls "minimum safety requirements," said Laura Hammond, Eugene's communication and policy analyst. The city and Uber have wrangled over which regulations the ride-sharing service should follow since it launched there in September. The city has also fined Uber $146,000, which Uber is appealing. At issue in Eugene are city regulations that include background checks conducted by local police, proof of insurance, and proof of a mechanical inspection that shows they can verify safety features, Hammond said.

Uber contends it already conducts its own third-party background checks and provides commercial auto insurance coverage.

Uber suspended operations in Portland in December, agreeing to give that city until April to come up with revised ride-sharing regulations. But Uber officials complain that Eugene has been more rigid, and that a city decision to add Uber to its for-hire code sets its services up for failure. "While jurisdictions across the country, including neighbors like Vancouver and Portland, work to craft regulations that ensure public safety and embrace ridesharing, Eugene city leaders decided to hide behind bureaucratic red tape," said Brooke Steger, Uber General Manager for the Pacific Northwest.

Demeter

(85,373 posts)The latest jobs report showed that unemployment fell to 5.5 percent in February and that 295,000 jobs were added to the economy. But the labor market is not as healthy as those figures might suggest. For example, the latest report shows that unemployment is still elevated for African-Americans, at 10.4 percent, and for Hispanics, at 6.6 percent, compared with 4.7 percent for white workers. In a truly strong job market, those racial gaps would be narrower because the competition for workers would drive joblessness down for minorities, who are the hardest hit in hard times.

Another sign of weakness is stagnant wage growth. In a stronger job market, competition for labor would push up wages as it pulled down unemployment. But wages have barely budged throughout the nearly six-year-old recovery. Ignoring these signs of weakness would be foolish, and yet the new report has stirred talk that the Federal Reserve will see the falling jobless rate as a sign of strength that justifies an imminent interest-rate increase. That would be a mistake, however, because raising rates in the near term would lock in high unemployment among minorities and wage stagnation.

The goal of monetary policy is to set rates low enough to foster job growth and high enough to control inflation. In the past, the Fed has indicated that an unemployment rate around 5.4 percent would be consistent with holding inflation to a target rate of 2 percent on average. Both the jobless rate and the inflation rate are getting closer to the benchmarks the Fed has set for initiating rate increases. But there are problems with those targets. The reason the Fed associates falling unemployment with rising inflation is that, theoretically, more hiring leads to higher wages that, in turn, lead to consumer demand for goods and services, pushing up prices. In practice, it has been several decades since those relationships have held — in part, because the Fed has usually been too quick to raise rates when wages have started to rise. This has led to a long-term decline in the share of income that goes to worker pay and a long-term increase in the share that goes to stockholders and executives.

The Fed should hold off until wages are growing in tandem with inflation and productivity. In the meantime, it should use its regulatory tools to ensure that low-interest-rate credit is put to productive uses and not speculative bubbles. Of course, Congress should do its part for job creation and economic growth — say, by financing infrastructure projects. Its inability to act is yet another reason the Fed has to get its response right.

Demeter

(85,373 posts)

My targets are dysfunctional and deranged females, however, so it will be more of a cat fight...I'm getting tired of it, but what can we do? Most people are not engineers, and to the extent that they aren't, professionalism is impossible.

When a person's inherent feeling of worthlessness and total lack of useful problem-solving skills runs into the opposite, there is conflict.

Demeter

(85,373 posts)There’s a familiar ring to the U.S. calls to arm Ukraine’s post-coup government. That’s because the same big-money players who stand to benefit from belligerent relations with Russia haven’t forgotten a favorite Cold War tune...President Obama has said that he won’t rule out arming Ukraine if a recent truce, which has all but evaporated, fails like its predecessor. His comments echoed the advice of a report issued a week prior by three prominent U.S. think tanks: the Brookings Institute, the Chicago Council on Global Affairs and the Atlantic Council. The report advocated sending $1 billion worth of “defensive” military assistance to Kiev’s pro-Western government. If followed, those recommendations would bring the U.S. and Russia the closest to conflict since the heyday of the Cold War. Russia has said that it would “respond asymmetrically against Washington or its allies on other fronts” if the U.S. supplies weapons to Kiev.

The powers with the most skin in the game—France, Germany, Russia and Ukraine—struck a deal on Feb. 12, which outlines the terms for a ceasefire between Kiev and the pro-Russian, breakaway provinces in eastern Ukraine. It envisages a withdrawal of heavy weaponry followed by local elections and constitutional reform by the end of 2015, granting more autonomy to the eastern regions. But not all is quiet on the eastern front. The truce appears to be headed the route of a nearly identical compromise in September, which broke down immediately afterward.

Moscow’s national security interests are clear. Washington’s are less so, unless you look at the bottom lines of defense contractors. As for those in the K Street elite pushing Uncle Sam to confront the bear, it isn’t hard to see what they have to gain. Just take a look below at the blow-by-blow history of their Beltway-bandit benefactors:

No Reds Means Seeing Red

Following the end of the Cold War, defense cuts had presented bottom-line problems for America’s military producers. The weapons dealers were told that they had to massively restructure or go bust. Luckily, carrots were offered. Norm Augustine, a former undersecretary of the Army, advised Defense Secretary William Perry to cover the costs of the industry mergers. Augustine was then the CEO of Martin Marietta — soon to become the head of Lockheed Martin, thanks to the subsidies. Augustine was also chairman of a Pentagon advisory council on arms-export policy. In that capacity, he was able to secure yet more subsidy guarantees for NATO-compatible weapons sales to former Warsaw Pact countries. But in order to buy the types of expensive weapons that would stabilize the industry’s books, those countries had to enter into an alliance with the U.S. And some members of Congress were still wary of shelling out money to expand a military alliance that had, on its face, no rationale to exist.

Enter the NATO Expansion Squad

Enter the U.S. Committee to Expand NATO. Formed in 1996, the Committee wined and dined elected officials to secure their support for NATO enlargement. Meanwhile, Lockheed buttressed its efforts by spending $1.58 million in federal contributions for the 1996 campaign cycle. The Committee’s founder and neocon chairman, Bruce Jackson, was so principled in his desire to see freedom around the globe that he didn’t even take a salary. He didn’t have to; he was a vice president at Lockheed Martin...Bruce Jackson began running a new outfit in 2002. It was called the Committee for the Liberation of Iraq. (36 F-16s are currently slated for delivery to Iraq at an estimated $3 billion.)

By Clinton’s second term, everyone was on board. Ron Asmus, a former RAND Corporation analyst and the “intellectual progenitor” of NATO expansion (who would later co-chair the Committee to Expand NATO), ended what was left of the policy debate in the State Department. He worked with Clinton’s diplomatic point man on Eastern Europe, Strobe Talbott. Poland, Hungary and the Czech Republic were all in NATO come 1999. The Baltic States would soon follow. By 2003, those initial inductees had arranged deals to buy just short of $5 billion in fighter jets from Lockheed.

Rivers of Cash

Strobe Talbott, President

• Talbott sought to bolster Brookings’ coffers with aggressive corporate fundraising. He took it from annual revenues of $32 million in 2003 to $100 million by 2013. Though always corporate-friendly, Brookings has become little more than a pay-to-play research hub under Talbott’s reign.

• Among the many corporate donors to Brookings are Boeing, General Dynamics, Raytheon, Northrup Grumman, Lockheed Martin and cyber-defense contractor Booz Allen Hamilton.

David M. Rubenstein, Co-Chairman of Board of Trustees

• Rubenstein is co-founder and co-CEO at the Carlyle Group, a massive private equity firm. Among the companies in which Carlyle has a controlling stake in is Booz Allen Hamilton — a military and intelligence IT firm that is currently active in Ukraine.

• Booz, which both sells to and operates within the U.S. military and intelligence apparatus, counts four former Carlyle executives among its directors. Ronald Sanders, a vice president at Booz, serves on the faculty of Brookings.

Atlanticists

Stephen Hadley, Director

• A former national security advisor for George W. Bush, Hadley doubles as a director for Raytheon. He was also the driving force behind the creation of the U.S. Committee on NATO, on whose board he sat, and the Committee for the Liberation of Iraq.

• Prior to joining the Bush White House, Hadley was a lawyer for Shea & Gardner, whose clients included Lockheed Martin.

James Cartwright, Director

• A retired general and former vice chair of the Joint Chiefs of Staff, James Cartwright has an active work life. He’s “an advisor to defense and intelligence contractor TASC, defense consulting firm Accenture, and Enlightenment Capital, a private equity firm with defense investments,” according to the Public Accountability Initiative. He’s also on the board of Raytheon, which earned him $124,000 in 2012.

Other notables include:

• Nicholas Burns – former diplomat and current senior counselor at The Cohen Group, which advises Lockheed Martin, among other defense companies

• James A. Baker III – Bush 41 Secretary of State and partner at law firm Baker Botts. Clients include a slew of defense companies

• Thomas R. Pickering – former senior vice president for Boeing

Chi-town Chickenhawks

Lester Crown, Chairman

• The chair of Henry Crown & Co., the investment firm that handles the fortune started by his father, Henry Crown. Henry put the “dynamic” in General Dynamics, helping to turn it into the world’s largest weapons manufacturer by the time Lester became its chairman in 1986. The defense behemoth remains the single largest source of the family’s treasure; they’re currently the 35th richest clan in America. General Dynamics produces all of the equipment types proposed for transfer to Ukraine in the think-tank report.

Ivo Daalder, President

• A co-author of the report, Daalder is a former diplomat and staffer on Clinton’s National Security Council. He later served on the Hart-Rudman Commission from 1998-2001. It was chartered by Defense Secretary William Cohen—later to become a Lockheed consultant—and tasked with outlining the major shifts in national security strategy for the 21st century. Among its commissioners was none other than Norm Augustine.

The commission concluded that the Department of Defense and intelligence community should drastically reduce their infrastructure costs by outsourcing and privatizing key functions, especially in the field of information technology.

The main beneficiaries have been America’s major defense contractors: Raytheon, Lockheed Martin, Northrup Grumman, Boeing, Booz Allen Hamilton and Lester Crown’s outfit, General Dynamics.

General Dynamics’ revenue tripled between 2000 and 2010 as it acquired at least 11 smaller firms that specialized in exactly the sort of services recommended for outsourcing. Roughly one-third of GD’s overall revenue in 2013, the same year that Daalder was appointed president of the Council by Crown, came from its Information Systems and Technology division.

So even without a Cold War Bear to fuel spending, the re-imagining of that old foe is oiling the revolving door between the government and defense contractors.

Demeter

(85,373 posts)Leonard Nimoy helped his replacement as Spock deal with the pressure of stepping into an iconic role. But Quinto remembers how a professional relationship soon developed into a close friendship

I first met Leonard Nimoy in 2007 at the Comic-Con conference in San Diego where it was announced I would be taking over the role of Spock. I was really excited to meet him and hopeful he would support me stepping into it. I never imagined how our meetings about the character would evolve into a very profound friendship...We were introduced on a crowded elevator. It was very hurried and hustled, as we were about to appear in front of a crowd of 6,000 people. When the elevator doors opened on the conference floor he looked at me, said “You have no idea what you’re in for”, and walked out. For more than 40 years, he had trodden the path that I was about to embark on.

In some ways he was grateful to be able to share this character with someone else, because it was something that he had experienced singularly for so many years. I never felt that he was trying to instruct me, to tell me how to do it. He was just there to answer whatever questions I had. He was very supportive of my take on Spock. It was the initial connection, but eventually our relationship had very little to do with Spock. It was a springboard to get to know each other on a much deeper level.

The first thing that I really took note of with Leonard was his sense of humour. He used it to disarm people. Those who had certain expectations were often surprised by how funny he was. Wise man that he was, he never took anything too seriously, yet he was a very serious man. He was able to strike a balance in his relationships with people, especially fans, which I really admired. He inspired and influenced an entire generation because of this role that people connected to. He was able to make the fans feel seen, like they really connected with him. And yet he also cultivated a kind of distance that preserved him. I took note of that as I got deeper in the world of Trek and deeper into the exposure that this character would bring.

Leonard lived his life so beautifully and with such grace. He was a very honourable person, and his life reflected that. His family reflects that. I lost my father at a very young age, and Leonard came to occupy a space in my life that was like a father figure. I had this person that I could look to with such respect. He was refined. And he cultivated a sense of dignity and respect for other people.

A MOVING STORY. MORE AT LINK

Demeter

(85,373 posts)Demeter

(85,373 posts)The United States has frozen assets of two Russian banks controlled by three billionaire friends of Russian President Vladimir Putin worth some $637 million, The Wall Street Journal reported Thursday.

"Also hit is SMP Bank, majority-owned by Arkady and Boris Rotenberg… Their bank has had at least $65 million - equal to about 2% of 2013 assets - blocked across dozens of accounts in US financial institutions, Treasury documents show," it said.

Both banks are on the list of Russian enterprises and financial institutions the US imposed economic sanctions on. The list also includes Russian state-controlled energy giant Gazprom, Gazprom Neft, Lukoil, Surgutneftegaz and Rosneft. The punitive measures are also in place against Russia’s largest lender Sberbank, the Bank of Moscow, Gazprombank, Rosselkhozbank, Vnesheconombank, VTB and a number of defense industry enterprises.

Russian officials and companies came under the first batch of Western sanctions, including visa bans and asset freezes, after Russia incorporated Crimea in mid-March 2014 after the February 2014 coup in Ukraine. Despite Moscow’s repeated statements that the Crimean referendum on secession from Ukraine was in line with the international law and the UN Charter and in conformity with the precedent set by Kosovo’s secession from Serbia in 2008, the West and Kiev have refused to recognize the legality of Crimea’s reunification with Russia. The West announced new, sectoral, restrictions against Russia in late July 2014, in particular, for what the West claimed was Moscow’s alleged involvement in protests in Ukraine’s southeast. In response, Russia imposed on August 6, 2014 a one-year ban on imports of beef, pork, poultry, fish, cheeses, fruit, vegetables and dairy products from Australia, Canada, the European Union, the United States and Norway. New large-scale punitive measures against Russia followed in September and December 2014.

Russia has constantly dismissed accusations of "annexing" Crimea claiming Crimea reunified with Russia voluntarily after a referendum. Allegations that Moscow could in any way be involved in hostilities in east Ukraine have been dismissed as well.

http://tass.ru/en/infographics/7239

Demeter

(85,373 posts)tass.ru/en/economy/781449

The president has also slashed the salaries of the prime minister, prosecutor general, head of Investigative Committee, Cabinet members and Kremlin officials...Russian President Vladimir Putin has signed a decree that reduces the salaries of the president, prime minister, prosecutor general, head of Investigative Committee, Cabinet members and Kremlin officials by 10%, the Kremlin press service reported on Friday.

The salary cut will be in effect till the end of the year, says the decree.

The reduction will also affect those with salaries based on the 2004 Presidential decree that's titled "On payment for executive power federal organization top managers" and those that fall under the 2013 decree "on the monetary remuneration of persons in public office," as well as for other people, whose salaries are mandated by a federal law.

President Putin also reduced the wages of Kremlin administration, government staff and the Chamber of Accounts by 10% as well.

The decree affecting the president, the prime minister, prosecutor general, head of Investigative Committee came into effect on March 1, while for Cabinet members and Kremlin officials the salary reduction will take effect on May 1.

Demeter

(85,373 posts)— Paul Craig Roberts, former Assistant Secretary of the US Treasury

“Don’t blame the mirror if your face is crooked.”

— Russian proverb

On February 10, 2007, Vladimir Putin delivered a speech at the 43rd Munich Security Conference that created a rift between Washington and Moscow that has only deepened over time. The Russian President’s blistering hour-long critique of US foreign policy provided a rational, point-by-point indictment of US interventions around the world and their devastating effect on global security. Putin probably didn’t realize the impact his candid observations would have on the assembly in Munich or the reaction of powerbrokers in the US who saw the presentation as a turning point in US-Russian relations. But, the fact is, Washington’s hostility towards Russia can be traced back to this particular incident, a speech in which Putin publicly committed himself to a multipolar global system, thus, repudiating the NWO pretensions of US elites. Here’s what he said:

With that one formulation, Putin rejected the United States assumed role as the world’s only superpower and steward of global security, a privileged position which Washington feels it earned by prevailing in the Cold War and which entitles the US to unilaterally intervene whenever it sees fit. Putin’s announcement ended years of bickering and deliberation among think tank analysts as to whether Russia could be integrated into the US-led system or not. Now they knew that Putin would never dance to Washington’s tune.

In the early years of his presidency, it was believed that Putin would learn to comply with western demands and accept a subordinate role in the Washington-centric system. But it hasn’t worked out that way. The speech in Munich merely underscored what many US hawks and Cold Warriors had been saying from the beginning, that Putin would not relinquish Russian sovereignty without a fight. The declaration challenging US aspirations to rule the world, left no doubt that Putin was going to be a problem that had to be dealt with by any means necessary including harsh economic sanctions, a State Department-led coup in neighboring Ukraine, a conspiracy to crash oil prices, a speculative attack of the ruble, a proxy war in the Donbass using neo-Nazis as the empire’s shock troops, and myriad false flag operations used to discredit Putin personally while driving a wedge between Moscow and its primary business partners in Europe. Now the Pentagon is planning to send 600 paratroopers to Ukraine ostensibly to “train the Ukrainian National Guard”, a serious escalation that violates the spirit of Minsk 2 and which calls for a proportionate response from the Kremlin. Bottom line: The US is using all the weapons in its arsenal to prosecute its war on Putin.

Last week’s gangland-style murder of Russian opposition leader, Boris Nemtsov, has to be considered in terms of the larger geopolitical game that is currently underway. While we may never know who perpetrated the crime, we can say with certainly that the lack of evidence hasn’t deterred the media or US politicians from using the tragedy to advance an anti-Putin agenda aimed at destabilizing the government and triggering regime change in Moscow. Putin himself suggested that the killing may have been a set-up designed to put more pressure on the Kremlin. The World Socialist Web Site summed up the political implications like this:

It is all but obvious that the Obama administration is hoping a faction will emerge within the Russian elite, backed by elements in the military and secret police, capable of staging a “palace coup” and getting rid of Putin….

The United States is not seeking to trigger a widespread popular revolt. (But) are directed entirely at convincing a section of the oligarchy and emerging capitalist class that their business interests and personal wealth depend upon US support. That is why the Obama administration has used economic sanctions targeting individuals as a means of exerting pressure on the oligarchs as well as broader sections of the entrepreneurial elite….

It is in the context of this international power struggle that one must evaluate Nemtsov’s murder. Of course, it is possible that his death was the outcome of his private dealings. But it is more likely that he was killed for political reasons. Certainly, the timing of the killing—on the eve of the opposition’s anti-Putin demonstration in Moscow—strongly indicates that the killing was a political assassination, not a private settling of accounts.” (“Murder in Moscow: Why was Boris Nemtsov assassinated?“, David North, World Socialist Web Site)

Just hours after Nemtsov was gunned down in Moscow, the western media swung into action releasing a barrage of articles suggesting Kremlin involvement without a shred of evidence to support their claims. The campaign of innuendo has steadily gained momentum as more Russia “experts” and politicians offer their opinions about who might be responsible. Naturally, none of the interviewees veer from the official storyline that someone in Putin’s charge must have carried out the attack. An article in the Washington Post is a good example of the tactics used in the latest PR campaign to discredit Putin. According to Vladimir Gel’man, Political Scientists European University at St. Petersburg and the University of Helsinki:

The article in the Washington Post is fairly typical of others published in the MSM. The coverage is invariably long on finger-pointing and insinuation and short on facts. Traditional journalistic standards of objectivity and fact-gathering have been jettisoned to advance a political agenda that reflects the objectives of ownership. The Nemtsov assassination is just the latest illustration of the abysmal state of western media...The idea that Putin’s agents would “whack” an opposition candidate just a stone’s throw from the Kremlin is far fetched to say the least. As one commenter at the Moon of Alabama blog noted: