Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 23 October 2015

[font size=3]STOCK MARKET WATCH, Friday, 23 October 2015[font color=black][/font]

SMW for 22 October 2015

AT THE CLOSING BELL ON 22 October 2015

[center][font color=green]

Dow Jones 17,489.16 +320.55 (1.87%)

S&P 500 2,052.51 +33.57 (1.66%)

Nasdaq 4,920.05 +79.93 (1.65%)

[font color=green]10 Year 2.02% -0.01 (-0.49%)

30 Year 2.86% -0.03 (-1.04%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)He really doesn't see the intrinsic value of every and any human being.

Demeter

(85,373 posts)"Laissez les bons temps rouler!"

http://www.marketwatch.com/story/us-stocks-may-break-losing-run-with-mcdonalds-caterpillar-in-focus-2015-10-22?siteid=YAHOOB

U.S. stocks ended sharply higher Thursday, rallying on economic data, better-than-expected earnings and dovish comments from European Central Bank President Mario Draghi.

The ECB central banker said Europe may expand stimulus measures in the face of sluggish global growth. Those remarks were enough to help the Dow Jones Industrial Average register its best point and percentage gain since Sept. 8.

After Draghi said the door is open to more quantitative easing as early as December, the euro EURUSD, -0.0810% moved below $1.12 in early morning trade, and consequently boosted the dollar.

Randy Frederick, managing director of trading and derivatives at Schwab Center for Financial Research, said the market’s rally may be fueled by the idea that the Federal Reserve may be forced to keep rates lower for longer as central bankers around the world adopt a more dovish stance...

NOBODY IS GOING TO TAKE THE PUNCH BOWL AWAY....EVER. THE ADDICTS ARE IN CHARGE.

Warpy

(111,230 posts)but the Fed seems to feel compelled to do something to keep the 1% cash flow positive.

I just know I don't have nearly as much as I do on paper. Everybody else should know that, too. Corporations are buying their own stock since borrowed money is so cheap, inflating it to fatten the top executives.

The rest of us are just screwed when the bubble pops, as usual.

Punx

(446 posts)Companies are wasting money from layoffs on share buybacks

Of course they are only looking at if from an investor's point of view. The laid off employees...meh

Demeter

(85,373 posts)AND AS FOR THE CLOWNS IN DC...THE KEYSTONE KOPS OF ECONOMICS

http://www.marketwatch.com/story/heres-what-another-debt-ceiling-showdown-means-for-interest-rates-2015-10-22?siteid=YAHOOB

The U.S. Treasury Department’s decision Thursday to postpone an auction of two-year Treasury notes fueled investor speculation about the effects of a debt-limit showdown on the debt market. As the Treasury runs out of accounting options to make payments on Nov. 3—the so-called drop-dead date—the part of the market under most stress is the U.S. government’s short-term debt, particularly one-to-three-month Treasury bills.

“The most likely outcome in case the Treasury runs out of cash would be a delayed payment policy. The Treasury would likely implement this by extending the maturity and date of coupon payment of the securities one day at a time,” wrote analysts at Bank of America in a note last week.

In other words, as the clock ticks toward a deadline for Congress to raise the debt ceiling, the Treasury is getting closer to a so-called technical default, a failure to uphold some aspect of a loan term. That in turn could lead to a spike in short-term yields, as yields reflect default risk and tend to rise when the borrower is in some type of financial trouble. Yields rise as bond prices fall.

In the past, very short-term Treasury yields have increased when the U.S. government flirted with a potential disruption by waiting until the last minute to approve a debt-limit increase. As the following chart shows, as the drop-dead date approached, yields jumped but then quickly fell back once the situation was resolved.

?uuid=33d44d44-78f7-11e5-8a8e-0015c588e0f6

?uuid=33d44d44-78f7-11e5-8a8e-0015c588e0f6

The decision to eliminate the two-year auction on Thursday was basically a pre-emptive accounting decision, aimed at keeping the government’s debt from increasing while Congress works on a compromise, analysts said...

MORE ANGST AT LINK

Demeter

(85,373 posts)Manhattan's top federal prosecutor abandoned a high-profile insider trading case against Michael Steinberg, formerly a top portfolio manager at SAC Capital Advisors, and six others on Thursday, saying the case was no longer consistent with the law. U.S. Attorney Preet Bharara in a statement said his decision was based on a December ruling from a federal appeals court that more narrowly defined what constitutes insider trading. The U.S. Supreme Court this month declined to review that decision.

Steinberg had been sentenced to 3-1/2 years in prison after his 2013 conviction at trial, and his defense lawyer welcomed the decision to drop charges.

"Michael Steinberg did not commit any crime and is an innocent man. We hope that his vindication will receive as much attention as his wrongful prosecution," Barry Berke, his lawyer, said in a statement.

Last year, the 2nd U.S. Circuit Court of Appeals curtailed prosecutors' ability to pursue insider-trading cases. The appeals court threw out the 2012 convictions of hedge fund managers Todd Newman and Anthony Chiasson, who like Steinberg were convicted for trading on inside information about Dell Inc and Nvidia Corp, saying the government had over-reached.

"These prosecutions were all undertaken in good faith reliance on what this office and others, including able defense counsel for all those who pled guilty, understood to be the well-settled law before Newman," Bharara said.

SAC Capital last year rebranded itself Point72 Asset Management as it shifted toward being a family office managing the fortune of SAC founder Steven A. Cohen. Prosecutors never charged Cohen with a crime.

Bharara also said it "would not be in the interests of justice" to insist on maintaining the convictions of six cooperating witnesses, even though they pleaded guilty as part of the same alleged scheme. The six cooperators were Spyridon Adondakis, Sandeep Goyal, Jon Horvath, Danny Kuo, Hyung Lim and Jesse Tortora...Kuo's lawyer Roland Riopelle said Bharara's office "chose to do the right thing, even if doing so was not the politically easy thing to do. With this matter behind him, Mr. Kuo looks forward to getting on with the rest of his life."

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Author Paul Theroux caused controversy with his indictment of corporate executives who abandon American communities for cheaper labor...Theroux described large regions of the south as the equivalent of deserts, without access to hospitals, decent schools, economic opportunities, or even basic financial services and nutrition. The illiteracy rate in Lee County, Arkansas, he said, was 25 percent, an astonishing number for the developed world. And these poor southerners have not cultivated subsistence skills, he said, to the extent of those in African villages, who through the centuries have managed to make their lives more viable. Lots of the people Theroux profiled in Deep South “talked about how they used to eat squirrel stew, or smother-fried squirrel. But they’re not doing it anymore.”

That we hear so little about this from a media holed up in coastal enclaves is an indictment of our collective blind spots. Theroux compared it to Mrs. Jellyby in Charles Dickens’s Bleak House, running a chaotic home with numerous kids in various states of dishevelment and hunger, but always thinking about educating the natives of Borrioboola-Gha, on the left bank of the Niger River, something Dickens calls “Telescopic Philanthropy.”

That viewpoint, while well-intended, does lead to neglect. “I met John Coors, from the Coors family, he’s now in high tech,” Theroux said. “He told me that he sent a team of dentists to Kenya. I told him there are two dental schools in Nairobi making lots of dentists. I asked why not send dentists to Mississippi? He said there are provisions for people there.”

This is the heart of the dispute. You can argue that the global poor face a far more brutal existence than their counterparts in America. But the provisions to deal with the recognized losers from globalization largely have not been delivered here, particularly in the Deep South...

Demeter

(85,373 posts)Raykovich, Iceland – In stark contrast to the record low number of prosecutions of CEO’s and high-level financial executives in the U.S., Iceland has just sentenced 26 bankers to a combined 74 years in prison.

The majority of those convicted have been sentenced to prison terms of two to five years. The maximum penalty in Iceland for financial crimes is six years, although hearings are currently underway to consider extending the maximum beyond six years.

The prosecutions are the result of Iceland’s banksters manipulating the Icelandic financial markets after Iceland deregulated their finance sector in 2001. Eventually, an accumulation of foreign debt resulted in a meltdown of the entire banking sector in 2008.

According to Iceland Magazine:

Massive debts were incurred in the name of the Icelandic public, to allow the country to continue to function, which are still being repaid to the IMF and other nations eight years later by the citizens of Iceland. In contrast to the U.S., Iceland has chosen to hold the criminals that manipulated their financial system accountable under the law. In the U.S., not a single banking executive was charged with crimes related to the 2008 financial crisis, even though the U.S. itself precipitated the crisis. Icelandic President, Olafur Ragnar Grimmson summed it up best in his response when asked how his country recovered from the global financial crisis.

“We were wise enough not to follow the traditional prevailing orthodoxies of the Western financial world in the last 30 years. We introduced currency controls, we let the banks fail, we provided support for the people and didn’t introduce austerity measures like you’re seeing in Europe.”

While Iceland has prosecuted those that caused their financial crisis, America has done the opposite...MORE

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)The price of oil has seemingly stabilized near $50, raising the possibility that this is the new equilibrium or market-clearing price. At several points in the past year, prices seemed to be moving up or down, only to revert towards this new mean. To some degree, this implies that traders think that $50 is the sweet spot, and any deviation will bring in either buyers or sellers. Of course, at the same time there are those arguing prices might go to $20 when Iran starts exporting, or recover to $100 with the expected drop in shale oil production. And there are those who don’t make predictions but just laugh at those of us who do.

The reality is that prices could do all of the above, depending on geopolitical developments more than anything else. In particular, the potential for a supply disruption in December following elections in Venezuela would send prices scurrying upwards. More Middle Eastern violence, especially on or close to the Arabian peninsula, would increase the security premium on oil, although a new intifada seems unlikely to have an impact (unlike the last one, which elevated prices for a time).

But why $50? Why not $40 or $60? At the risk of being repetitive, it is as Keynes figured out a century ago, that the economics don’t determine the price, traders’ views of the economics do, especially in the short term. And arguably, there is a perception that a price too much below $50 would not be sustainable for any length of time, and a price too much above $50 would also be unsustainable. However, the mechanisms that would generate this in the market are different.

For low prices, there are only two routes for recovery (ignoring trader psychology). First, OPEC and/or non-OPEC producers decide to cut production. Second, oil production declines sharply because of low prices. The first is quite possible, but not until prices get well below $50, while the latter is more problematical: it requires oil production to decline due to non-investment, which means the change will be notably lagged. Operating costs in oil fields are typically a fraction of the total, and only the most marginal of wells is likely to be shut down in a price collapse...

MORE

DemReadingDU

(16,000 posts)10/23/15 Why Is It So Hard To Save?

U.K. Shows It Doesn't Have To Be

At an outdoor market in London, Garfield Bloomfield, 30, who sells vegetables, offers an amused smile when asked if he's saving for retirement yet.

"My wife is not working at the moment because she decided to go back to school, and I got kids to take care of," he says. "I would like to save for the future, obviously, but at the moment I'm just working to get by, really."

Many people in the U.S. of course feel this way, too: I can't afford to save. I have student loans. I just don't make enough money. And these are very real problems. Wages have been stagnant for decades — especially in recent years since the recession.

But if you take someone like Bloomfield and enroll him automatically in a retirement savings plan — he doesn't do anything at all; pretax money just starts coming out of his paycheck — odds are overwhelming he'll keep saving even though he thinks he can't afford it.

That's exactly what's happening in England. Bloomfield's employer will soon be required to enroll him — unless he opts out — but it hasn't rolled out to all employers. The law is being phased in right now.

"We still have a ways to go, but we've got 5 million people saving," says Charlotte Clark, the top government official for retirement savings in the U.K.

And even though people can opt out if they want, they're not. "We're seeing over 90 percent of people sticking with it," Clark says. "That's 9 out of 10 people are deciding this is the right thing for them."

She says an even higher percentage of lower-income workers stick with it. It's made very clear to them that if they opt out they're losing free money from their employer, she says.

Read how it works...

http://www.npr.org/2015/10/23/445337261/why-is-it-so-hard-to-save-u-k-shows-it-doesnt-have-to-be

more from NPR series: Your Money And Your Life

http://www.npr.org/series/448706447/your-money-and-your-life

and see Monday's SMW for additional retirement savings topics

http://www.democraticunderground.com/111672771

and Tuesday

http://www.democraticunderground.com/111672790

and Wednesday

http://www.democraticunderground.com/111672815

and Thursday

http://www.democraticunderground.com/111672857

Watch the excellent PBS Frontline program

4/23/13 The Retirement Gamble, appx 54 minutes

http://www.pbs.org/wgbh/pages/frontline/retirement-gamble/

or browse thru the transcript

http://www.pbs.org/wgbh/pages/frontline/business-economy-financial-crisis/retirement-gamble/transcript-43/

snot

(10,518 posts)I saved; but I lived/worked in a time when it was possible to get an education w/o massive debt, and when one could live comfortably on the income from even a modest job, and still have something left to save.

Demeter

(85,373 posts)http://www.correntewire.com/the_platinum_coin_returns

Upon my oath, I didn’t intend to bring back the coin proposal until much later in the renewed process of Republican hostage-taking over the debt ceiling. After all, there’s not much chance that the President would ever use the platinum coin option, because his budget policy direction, of getting ever closer to a budget surplus, is best served by a “forced” compromise with the Republicans, that results in another few hundred billion in spending cuts for 2016, while allowing him to place the blame on them for that outcome. Using the platinum coin option would not have that result, because it would deliver a clear victory to him.

Of course, he doesn’t want a default due to Republican brinksmanship either, so if the Republicans do drag everyone too close to the cliff, then he may decide to take some extraordinary measures and the coin is one that is available, so it’s conceivable that he might choose this undoubtedly, from his point of view, distasteful option. It is for this reason, I suppose, that the Brookings Institution is warning him off the coin to weight his choice towards some more conventional approach.

The Brookings Warning

The warning was delivered in the form of http://www.brookings.edu/~/media/research/files/papers/2015/10/21-minimizing-debt-ceiling-crises-wallach/debt_ceiling.pdf a paper by Philip A. Wallach, in which after devoting a good deal of attention to the historical and current political context of the coming probable crisis over the Treasury breaching the debt ceiling law he asserts the “enormity of the threat posed by a failed debt ceiling negotiation.” But nevertheless he also asserts that any of the solutions proposed by those advocating for a way around such a crisis would not work because:

This is not really an argument, but a conjecture, and one that is a matter of opinion, certainly not backed by any empirical evidence, and not blindingly obvious to many people, including myself...

NOWHERE IN THAT DO I HEAR EVEN A PASSING THOUGHT TO THE PEOPLE

Demeter

(85,373 posts)“Free Trade,” the banner of Globalization, has not only wrecked the world’s economy, it has left Western Democracy in shambles. Europe edges ever closer to deflation. The Fed dare not increase interest rates, now poised at barely above zero. As China’s stock market threatened collapse, China poured billions to prop it up. It’s export machine is collapsing. Not once, but twice, it recently manipulated its currency to makes its goods cheaper on the world market. What is happening?

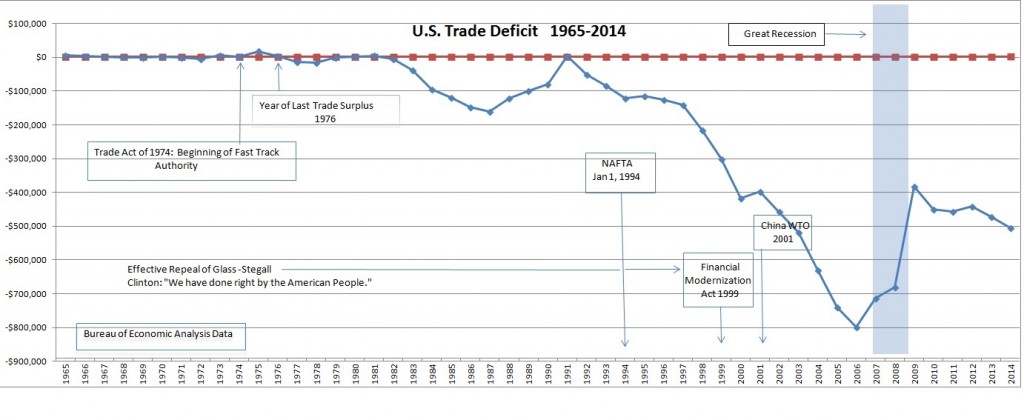

The following two graphs tell most of the story. First, an overview of Free Trade:

Capital fled from developed countries to undeveloped countries with slave-cheap labor, countries with no environmental standards, countries with no support for collective bargaining. Corporations, like Apple, set up shop in China and other undeveloped countries. Some, like China, manipulated its currency to make exported goods to the West even cheaper. Some, like China, gave preferential tax treatment to Western firm over indigenous firms. Economists cheered as corporate efficiency unsurprisingly rose. U.S. citizens became mere consumers.

Thanks to Bill Clinton and the Financial Modernization Act, banks, now unconstrained, could peddle rigged financial services, offer insurance on its own investment products–in short, banks were free to play with everyone’s money–and simply too big to fail. Credit was easy and breezy. If nasty Arabs bombed the Trade Center, why the solution was simple: Go to the shopping mall–and buy. That remarkable piece of advice is just what freedom has been all about.

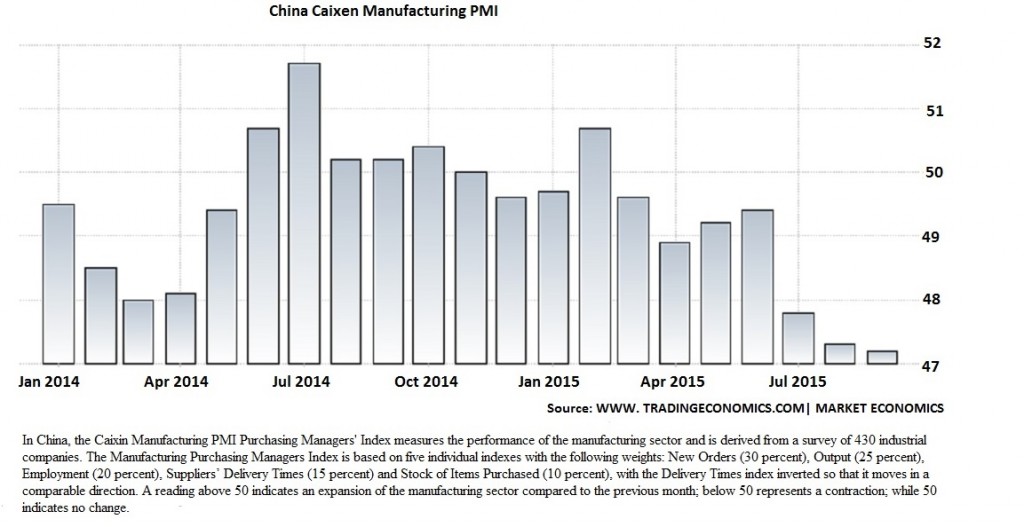

Next: China’s export machine sputters:

China’s problem is that there are not enough orders to keep the export machine going. There comes a time when industrialized nations simply run out of cash–I mean the little people run out of cash. CEOs and those just below them–along with slick Wall Street gauchos–made bundles on Free Trade, corporate capital that could set up shop in any impoverished nation in the world.. No worries about labor–dirt cheap–or environmental regulations–just bring your gas masks. At some point the Western consumer well was bound to run dry. Credit was exhausted; the little guy could not buy anymore. Free trade was on its last legs. So what did China do then? As its markets crashed, it tried to revive its export model, a model based on foreign firms exporting cheap goods to the West. China lowered its exchange rates, not once but twice. Then China tried to rescue the markets with cash infusion of billions. Still its market continued to crash. Manufacturing plants had closed–thousands of them. Free Trade and Globalization had run its course...Of course now we have the mother of all Free Trade deals –the Trans-Pacific Partnership (TPP)– carefully wrapped in a black box so that none of us can see what finally is in store for us. Nothing is ever “Free”–even trade. I suspect that China is becoming a bit too noxious and poisonous. It simply has to deal with its massive environmental problems. Time to move the game to less despoiled and maybe more impoverished countries. Meanwhile, newscasters are always careful to tout TPP.

MORE

Demeter

(85,373 posts)The U.S. request to extradite London-based trader Navinder Sarao, accused of helping to spark the 2010 Wall Street "flash crash", is "false and misleading" because it misrepresented the way markets work, his lawyer said on Thursday.

Sarao is wanted by U.S. authorities after being charged with 22 criminal counts including wire fraud, commodities fraud, commodity price manipulation and attempted price manipulation.

The 36-year-old, who lives and worked at his parents' modest home near London's Heathrow airport, is accused of using an automated trading program to "spoof" markets by generating large sell orders that pushed down prices.

He then canceled those trades and bought contracts at lower prices, prosecutors say. The flash crash saw the Dow Jones Industrial Average briefly plunge more than 1,000 points, temporarily wiping out nearly $1 trillion in market value.

Sarao's team are looking to block extradition on the grounds that the U.S. charges would not be offences under English law, and if they are, that he should be tried in Britain...

MORE

Demeter

(85,373 posts)A federal judge, disgusted by cushy deals that allow lawbreaking corporate bosses to avoid jail time, used a ruling in a little-known corruption case to tear into Department of Justice prosecutors this week.

In an 84-page opinion Wednesday approving a deferred prosecution agreement for ex-Army contractors indicted in a bribery and kickback scheme, U.S. District Judge Emmet Sullivan, of the District of Columbia, slammed federal prosecutors for striking a similar deal with General Motors last month.

Faulty ignition switches in GM vehicles killed at least 169 people. The company, accused of concealing the defect from regulators and lying about it to customers, agreed to pay a $900 million fine as part of a deferred prosecution settlement. No individual GM executive or employee has been prosecuted.

In his opinion in the case of the former Army contractors, Sullivan called the Justice Department's deal with GM "a shocking example of potentially culpable individuals not being criminally charged."

MORE

Demeter

(85,373 posts)Sens. Elizabeth Warren (D-Mass.) and Bernie Sanders (I-Vt.) called on the federal government Thursday to curb the ongoing humanitarian crisis in Puerto Rico by cracking down on vulture fund investors.

"Wall Street should not be believing that they can get blood from a stone," Sanders said. "When people are suffering and hurting, you cannot continue to squeeze them."

WATCH Sanders' and Warren's comments in the video AT LINK.

Puerto Rico has been ravaged by a decade-long recession that Sanders said has driven the childhood poverty rate to 56 percent and destroyed 20 percent of the islands jobs. Wall Street vulture funds, meanwhile, bought up huge amounts of Puerto Rican debt and have been pushing the territory's government into crippling austerity measures to meet payments. Vulture funds buy up debt at a discount when it looks like a country will have trouble paying it off, because risky bonds pay high interest rates.

"They want Puerto Rico to raise taxes, cut health care, fire teachers, cut pensions, sell off $4 billion worth of government buildings, privatize public ports, close neighborhood schools and cut support for the University of Puerto Rico, all so these vulture funds can squeeze out more profit," Warren noted.

Despite Puerto Rico's financial crunch, the federal government has resisted cutting the island any slack on its debt, even as it has driven the island economy to ruin. The Treasury Department wants Congress to pass a law giving Puerto Rico the power to wipe out some of its debt in bankruptcy, but the prospects for that proposal are slim in an era of legislative gridlock. At the hearing, Warren laid into the Treasury Department's top negotiator on the Puerto Rico crisis, Antonio Weiss for punting the mess to Congress instead of forcing the vulture funds to cut a deal.

"Treasury needs to step up and show more leadership here," Warren said. "When the banks were in trouble, Treasury did a lot more than just bail them out. Treasury stretched the limits of its authority to make sure that the banks stayed afloat. It helped broker deals between banks. It applied pressure to get parties to accept deals they may not have liked very much."

"Now the people of Puerto Rico are calling. They understand there is no bailout on the table for them and they are not asking for one. After all, they aren't a giant bank. But they are asking the administration to do what they can do what it can to help broker deals to stand up to the vulture funds," Warren added.

MORE

Hotler

(11,412 posts)I have said before that I will not vote for Hillary even if she is our only choice. With that being said I watched a bit of the Benghazi hearing yesterday after work and was appalled with the shittiness of the repugs towards her. I caught myself yelling at the TV for Hillary to stand up and tell all of them to go fuck themselves flip them the middle finger and walk out. When will Democrats stop playing nice with those shit stains. I found myself wishing that Bill and Hillary have a couple of goons on their team and send them around to follow Trey Gowdy and a few of the others and when no one is around kick the shit out of them.

DemReadingDU

(16,000 posts)and came to the same conclusion.

For what it's worth, I never voted for Bill.

Ross Perot in 1992. I loved Perot's economic charts, and he talked about that giant sucking sound of jobs to the low-wage countries.

I'm no fan of Hilary, but the crap they were pulling was complete bs. I guess no surprise there. And Biden would have us work with these people. He's either naive or a fool. Let me tell you, you don't work with Psychopaths! Do so and you will regret it every time. All you can do is stand up to them, and threaten them. Nothing else will work.

p.s. I voted for Perot in '92. And he was absolutely correct about NAFTA. I've only voted for two Presidential winners in the last 30 years. Reagan in '84 (Hey when I was young and foolish, I was young and foolish), and Obama in 2008. Another 4 years of the current regime at the time was intolerable. Boy has he been a disappointment though on economics just for starters.

Hotler

(11,412 posts)Glad to be here. Lurked for years, but couldn't keep my mouth shut when it came to TPP.