Economy

Related: About this forumWeekend Economists Dashing Through the Frost December 25-27, 2015

Well, the Winter Solstice came Tuesday, the shortest day and longest night of the year. It wasn't too bad, though, since the actual Winter is delayed by El Niño, the cyclical weather pattern set up by the waters of the Pacific Ocean.

Snow isn't expected to cover the Eastern half of the nation much before mid-January (aside from a Saturday in November which will go unmentioned). The cycle has peaked already, according to Weather Underground:

The well-advertised holiday warm wave continues to astound, with “instant” record highs set overnight in many locations from the Great Lakes to the Northeast.

Readings at midday Friday were already into the 70s Fahrenheit from southeast New York to the Gulf Coast, with widespread 80s across Florida. Some of the daily record highs along and near the East Coast on Thursday will be 10°F or more beyond the warmest Christmas Eve in more than a century of recordkeeping.

Breaking a longstanding daily record by more than 10°F is noteworthy in itself, and the intense zone of high pressure off the southeast U.S. coast is uncannily similar to the Bermuda highs common in midsummer!

Given the intense interest in holiday weather and the many family gatherings under way, we can expect this bizarre weekend to spur countless dinner-table conversations about climate change and “global weirding.”

A warm wave like this doesn’t “prove” climate change; it is one manifestation of the weather that results from natural variations such as El Niño playing out in a global atmosphere that is being warmed, moistened, and shifted by ever-increasing amounts of greenhouse gases.

Like the spectacular warm wave of March 2012, which brought 90°F readings to Michigan, the tropical Christmas Eve 2015 could serve as an excellent candidate for attribution research--the attempt to unravel how much long-term climate change raises the odds of a particular weather event. http://www.wunderground.com/blog/JeffMasters/tornadoes-rake-mississippi-delta-more-storminess-ahead

El Niño Has Matured and Will Rank Among Top 3 Strongest, NOAA Says

http://www.wunderground.com/news/strong-el-nino-december-2015

records only go back to 1950

Wednesday's storm brought Michigan its first December tornado ever recorded: about 13 miles east from my house. As long as they keep missing Ann Arbor by that much, I'm happy.

And as for the Western half of the country, the inhabitants will welcome every flake with open arms, as the Rockies must rebuild the snow reservoir (or all those ditzy Californians will start invading the Midwest) which keeps 30 million Californians alive, plus all the Arizonians and Utahns and such.

But weather aside, today's theme is Frost, Robert Frost. The American poet is known for his depictions of rural New England life, including snow...

Stopping by Woods on a Snowy Evening

By Robert Frost

Whose woods these are I think I know.

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound’s the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Robert Frost, “Stopping by Woods on a Snowy Evening” from The Poetry of Robert Frost, edited by Edward Connery Lathem. Copyright 1923, © 1969 by Henry Holt and Company, Inc., renewed 1951, by Robert Frost. Reprinted with the permission of Henry Holt and Company, LLC.

Proserpina

(2,352 posts)there may not be much economic news to be dug up for your perusement. On the other hand, there's lots of art about snow....

Mom wanted to get a Failed Bank report in, so here it is:

There were 2 bank failures on October 2nd, the first since July.

The seven branches of The Bank of Georgia will reopen as branches of Fidelity Bank during their normal business hours...

As of June 30, 2015, The Bank of Georgia had approximately $294.2 million in total assets and $280.7 million in total deposits. Fidelity Bank will pay the FDIC a premium of 3.05 percent to assume all of the deposits of The Bank of Georgia. In addition to assuming all of the deposits of the failed bank, Fidelity Bank agreed to purchase approximately $255.3 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $23.2 million.

The Bank of Georgia is the seventh FDIC-insured institution to fail in the nation this year, and the second in Georgia. The last FDIC-insured institution closed in the state was Capitol City Bank and Trust Company, Atlanta, on February 13, 2015.

Hometown National Bank, Longview, Washington, was closed 10/2/15 by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Twin City Bank, Longview, Washington, to assume all of the deposits of Hometown National Bank.

The sole branch of Hometown National Bank will reopen as a branch of Twin City Bank during its normal business hours...

As of June 30, 2015, Hometown National Bank had approximately $4.9 million in total assets and $4.7 million in total deposits. In addition to assuming all of the deposits of the failed bank, Twin City Bank agreed to purchase approximately $3.8 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $1.6 million...

Hometown National Bank is the eighth FDIC-insured institution to fail in the nation this year, and the first in Washington. The last FDIC-insured institution closed in the state was Westside Community Bank, University Place, on January 11, 2013.

Proserpina

(2,352 posts)His work was initially published in England before it was published in America. He is highly regarded for his realistic depictions of rural life and his command of American colloquial speech.

His work frequently employed settings from rural life in New England in the early twentieth century, using them to examine complex social and philosophical themes. One of the most popular and critically respected American poets of the twentieth century, Frost was honored frequently during his lifetime, receiving four Pulitzer Prizes for Poetry. He became one of America's rare "public literary figures, almost an artistic institution."

He was awarded the Congressional Gold Medal in 1960 for his poetical works.

On July 22, 1961, Frost was named Poet laureate of Vermont.

Robert Frost was born in San Francisco, California, to journalist William Prescott Frost, Jr., and Isabelle Moodie. His mother was a Scottish immigrant, and his father descended from Nicholas Frost of Tiverton, Devon, England, who had sailed to New Hampshire in 1634 on the Wolfrana.

Frost's father was a teacher and later an editor of the San Francisco Evening Bulletin (which later merged with The San Francisco Examiner), and an unsuccessful candidate for city tax collector. After his death on May 5, 1885, the family moved across the country to Lawrence, Massachusetts, under the patronage of (Robert's grandfather) William Frost, Sr., who was an overseer at a New England mill. Frost graduated from Lawrence High School in 1892. Frost's mother joined the Swedenborgian church and had him baptized in it, but he left it as an adult.

Although known for his later association with rural life, Frost grew up in the city, and he published his first poem in his high school's magazine. He attended Dartmouth College for two months, long enough to be accepted into the Theta Delta Chi fraternity. Frost returned home to teach and to work at various jobs, including helping his mother teach her class of unruly boys, delivering newspapers, and working in a factory maintaining carbon arc lamps. He did not enjoy these jobs, feeling his true calling was poetry.

Adult years

In 1894 he sold his first poem, "My Butterfly. An Elegy" (published in the November 8, 1894, edition of the New York Independent) for $15 ($410 today). Proud of his accomplishment, he proposed marriage to Elinor Miriam White, but she demurred, wanting to finish college (at St. Lawrence University) before they married. Frost then went on an excursion to the Great Dismal Swamp in Virginia and asked Elinor again upon his return. Having graduated, she agreed, and they were married at Lawrence, Massachusetts on December 19, 1895.

Frost attended Harvard University from 1897 to 1899, but he left voluntarily due to illness.

Shortly before his death, Frost's grandfather purchased a farm for Robert and Elinor in Derry, New Hampshire; Frost worked the farm for nine years while writing early in the mornings and producing many of the poems that would later become famous. Ultimately his farming proved unsuccessful and he returned to the field of education as an English teacher at New Hampshire's Pinkerton Academy from 1906 to 1911, then at the New Hampshire Normal School (now Plymouth State University) in Plymouth, New Hampshire.

In 1912 Frost sailed with his family to Great Britain, settling first in Beaconsfield, a small town outside London. His first book of poetry, A Boy's Will, was published the next year.

In England he made some important acquaintances, including Edward Thomas (a member of the group known as the Dymock poets and Frost's inspiration for "The Road Not Taken"

Frost met or befriended many contemporary poets in England, especially after his first two poetry volumes were published in London in 1913 (A Boy's Will) and 1914 (North of Boston).

The Robert Frost Farm in Derry, New Hampshire, where he wrote many of his poems, including "Tree at My Window" and "Mending Wall."

In 1915, during World War I, Frost returned to America, where Holt's American edition of A Boy's Will had recently been published, and bought a farm in Franconia, New Hampshire, where he launched a career of writing, teaching, and lecturing. This family homestead served as the Frosts' summer home until 1938. It is maintained today as The Frost Place, a museum and poetry conference site. During the years 1916–20, 1923–24, and 1927–1938, Frost taught English at Amherst College in Massachusetts, notably encouraging his students to account for the myriad sounds and intonations of the spoken English language in their writing. He called his colloquial approach to language "the sound of sense."

In 1924, he won the first of four Pulitzer Prizes for the book New Hampshire: A Poem with Notes and Grace Notes. He would win additional Pulitzers for Collected Poems in 1931, A Further Range in 1937, and A Witness Tree in 1943.

For forty-two years — from 1921 to 1963 — Frost spent almost every summer and fall teaching at the Bread Loaf School of English of Middlebury College, at its mountain campus at Ripton, Vermont. He is credited as a major influence upon the development of the school and its writing programs. The college now owns and maintains his former Ripton farmstead as a national historic site near the Bread Loaf campus.

In 1921 Frost accepted a fellowship teaching post at the University of Michigan, Ann Arbor, where he resided until 1927 when he returned to teach at Amherst. While teaching at the University of Michigan, he was awarded a lifetime appointment at the University as a Fellow in Letters. The Robert Frost Ann Arbor home was purchased by The Henry Ford Museum in Dearborn, Michigan and relocated to the museum's Greenfield Village site for public tours.

In 1940 he bought a 5-acre (2.0 ha) plot in South Miami, Florida, naming it Pencil Pines; he spent his winters there for the rest of his life. His properties also included a house on Brewster Street in Cambridge, Massachusetts, that today belongs to the National Historic Register.

Harvard's 1965 alumni directory indicates Frost received an honorary degree there. Although he never graduated from college, Frost received over 40 honorary degrees, including ones from Princeton, Oxford and Cambridge universities, and was the only person to receive two honorary degrees from Dartmouth College. During his lifetime, the Robert Frost Middle School in Fairfax, Virginia, the Robert L. Frost School in Lawrence, Massachusetts, and the main library of Amherst College were named after him.

In 1960, Frost was awarded a United States Congressional Gold Medal, "In recognition of his poetry, which has enriched the culture of the United States and the philosophy of the world," which was finally bestowed by President Kennedy in March 1962. Also in 1962, he was awarded the Edward MacDowell Medal for outstanding contribution to the arts by the MacDowell Colony.

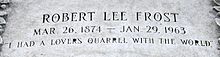

Frost was 86 when he read his well-known poem "The Gift Outright" at the inauguration of President John F. Kennedy on January 20, 1961. He died in Boston two years later, on January 29, 1963, of complications from prostate surgery. He was buried at the Old Bennington Cemetery in Bennington, Vermont. His epitaph quotes the last line from his poem, "The Lesson for Today (1942): "I had a lover's quarrel with the world."

"I had a lover's quarrel with the world." The epitaph engraved on his tomb is an excerpt from his poem "The Lesson for Today."

One of the original collections of Frost materials, to which he himself contributed, is found in the Special Collections department of the Jones Library in Amherst, Massachusetts. The collection consists of approximately twelve thousand items, including original manuscript poems and letters, correspondence and photographs, as well as audio and visual recordings.

The Archives and Special Collections at Amherst College holds a small collection of his papers.

The University of Michigan Library holds the Robert Frost Family Collection of manuscripts, photographs, printed items, and artwork.

The most significant collection of Frost's working manuscripts is held by Dartmouth.

Proserpina

(2,352 posts)A choral arrangement (one of many, most likely) I can't find the composer...found it! Randall Thompson, a wonderful composer for choirs!

Proserpina

(2,352 posts)Robert Frost's personal life was plagued with grief and loss.

In 1885 when Frost was 11, his father died of tuberculosis, leaving the family with just eight dollars.

Frost's mother died of cancer in 1900.

In 1920, Frost had to commit his younger sister Jeanie to a mental hospital, where she died nine years later. Mental illness apparently ran in Frost's family, as both he and his mother suffered from depression, and his daughter Irma was committed to a mental hospital in 1947.

Frost's wife, Elinor, also experienced bouts of depression.

Elinor and Robert Frost had six children: son Elliot (1896–1904, died of cholera); daughter Lesley Frost Ballantine (1899–1983); son Carol (1902–1940, committed suicide); daughter Irma (1903–1967); daughter Marjorie (1905–1934, died as a result of puerperal fever after childbirth); and daughter Elinor Bettina (died just three days after her birth in 1907). Only Lesley and Irma outlived their father. Frost's wife, who had heart problems throughout her life, developed breast cancer in 1937, and died of heart failure in 1938.

His Work--Style and critical response

The poet/critic Randall Jarrell often praised Frost's poetry and wrote, "Robert Frost, along with Stevens and Eliot, seems to me the greatest of the American poets of this century. Frost's virtues are extraordinary. No other living poet has written so well about the actions of ordinary men; his wonderful dramatic monologues or dramatic scenes come out of a knowledge of people that few poets have had, and they are written in a verse that uses, sometimes with absolute mastery, the rhythms of actual speech." He also praised "Frost's seriousness and honesty," stating that Frost was particularly skilled at representing a wide range of human experience in his poems.

Jarrell's notable and influential essays on Frost include the essays "Robert Frost's 'Home Burial'" (1962), which consisted of an extended close reading of that particular poem, and "To The Laodiceans" (1952) in which Jarrell defended Frost against critics who had accused Frost of being too "traditional" and out of touch with Modern or Modernist poetry.

In Frost's defense, Jarrell wrote "the regular ways of looking at Frost's poetry are grotesque simplifications, distortions, falsifications—coming to know his poetry well ought to be enough, in itself, to dispel any of them, and to make plain the necessity of finding some other way of talking about his work." And Jarrell's close readings of poems like "Neither Out Too Far Nor In Too Deep" led readers and critics to perceive more of the complexities in Frost's poetry.

In an introduction to Jarrell's book of essays, Brad Leithauser notes that, "the 'other' Frost that Jarrell discerned behind the genial, homespun New England rustic—the 'dark' Frost who was desperate, frightened, and brave—has become the Frost we've all learned to recognize, and the little-known poems Jarrell singled out as central to the Frost canon are now to be found in most anthologies."

Jarrell lists a selection of the Frost poems he considers the most masterful, including "The Witch of Coös," "Home Burial," "A Servant to Servants," "Directive," "Neither Out Too Far Nor In Too Deep," "Provide, Provide," "Acquainted with the Night," "After Apple Picking," "Mending Wall," "The Most of It," "An Old Man's Winter Night," "To Earthward," "Stopping by Woods on a Snowy Evening," "Spring Pools," "The Lovely Shall Be Choosers," "Design," [and] "Desert Places."

In 2003, the critic Charles McGrath noted that critical views on Frost's poetry have changed over the years (as has his public image). In an article called "The Vicissitudes of Literary Reputation," McGrath wrote, "Robert Frost ... at the time of his death in 1963 was generally considered to be a New England folkie ... In 1977, the third volume of Lawrance Thompson's biography suggested that Frost was a much nastier piece of work than anyone had imagined; a few years later, thanks to the reappraisal of critics like William H. Pritchard and Harold Bloom and of younger poets like Joseph Brodsky, he bounced back again, this time as a bleak and unforgiving modernist."

In The Norton Anthology of Modern Poetry, editors Richard Ellmann and Robert O'Clair compared and contrasted Frost's unique style to the work of the poet Edwin Arlington Robinson since they both frequently used New England settings for their poems. However, they state that Frost's poetry was "less (consciously) literary" and that this was possibly due to the influence of English and Irish writers like Thomas Hardy and W.B. Yeats. They note that Frost's poems "show a successful striving for utter colloquialism" and always try to remain down to earth, while at the same time using traditional forms despite the trend of American poetry towards free verse which Frost famously said was "'like playing tennis without a net.'"

In providing an overview of Frost's style, the Poetry Foundation makes the same point, placing Frost's work "at the crossroads of nineteenth-century American poetry (with regard to his use of traditional forms) and modernism (with his use of idiomatic language and ordinary, every day subject matter)." They also note that Frost believed that "the self-imposed restrictions of meter in form" was more helpful than harmful because he could focus on the content of his poems instead of concerning himself with creating "innovative" new verse forms.

An earlier 1963 study by the poet James Radcliffe Squires spoke to the distinction of Frost as a poet whose verse soars more for the difficulty and skill by which he attains his final visions, than for the philosophical purity of the visions themselves. "'He has written at a time when the choice for the poet seemed to lie among the forms of despair: Science, solipsism, or the religion of the past century…Frost has refused all of these and in the refusal has long seemed less dramatically committed than others…But no, he must be seen as dramatically uncommitted to the single solution…Insofar as Frost allows to both fact and intuition a bright kingdom, he speaks for many of us. Insofar as he speaks through an amalgam of senses and sure experience so that his poetry seems a nostalgic memory with overtones touching some conceivable future, he speaks better than most of us. That is to say, as a poet must."'

Themes

In Contemporary Literary Criticism, the editors state that "Frost's best work explores fundamental questions of existence, depicting with chilling starkness the loneliness of the individual in an indifferent universe." The critic T. K. Whipple focused in on this bleakness in Frost's work, stating that "in much of his work, particularly in North of Boston, his harshest book, he emphasizes the dark background of life in rural New England, with its degeneration often sinking into total madness."

In sharp contrast, the founding publisher and editor of Poetry, Harriet Monroe, emphasized the folksy New England persona and characters in Frost's work, writing that "perhaps no other poet in our history has put the best of the Yankee spirit into a book so completely." She notes his frequent use of rural settings and farm life, and she likes that in these poems, Frost is most interested in "showing the human reaction to nature's processes." She also notes that while Frost's narrative, character-based poems are often satirical, Frost always has a "sympathetic humor" towards his subjects.

Proserpina

(2,352 posts)Retirement, contrary to popular opinion, is not the time in which your satisfaction with life declines and your health deteriorates. Instead, it’s the exact opposite: Retirement is likely to improve your overall happiness and health, according to a working paper published by the National Bureau of Economic Research this year.

And that improvement happens immediately, according to the authors of the paper, Aspen Gorry and Devon Gorry, both professors at Utah State University, and Sita Slavov, a professor at George Mason University.

But is it so obvious that retiring is better than working, and that you start to feel happier and healthier as soon as you retire?

more

Proserpina

(2,352 posts)The final week of the year will be 2015's make or break time for stocks and should also offer some important clues about the new year.

The S&P 500 is just barely positive for the year, up just 0.1 percent since Jan. 1. It pulled back slightly Thursday, after a surge that drove it up 2.8 percent to 2,060 in the short trading week. The Dow, down 1.5 percent year-to-date, ended Thursday at 17,552 with a 2.5 percent gain for the week. The Nasdaq is the standout, up 6.6 percent year-to-date.

So the closing week in a dramatic year for stocks will decide the whole year's performance for the major indexes. Down-to-the wire isn't unprecedented. Remember in 2011, when the S&P 500 closed at 1257.60, flat but lower than 2010's closing value by less than a tenth of a point.

The final week of the year will be 2015's make or break time for stocks and should also offer some important clues about the new year.

The S&P 500 is just barely positive for the year, up just 0.1 percent since Jan. 1. It pulled back slightly Thursday, after a surge that drove it up 2.8 percent to 2,060 in the short trading week. The Dow, down 1.5 percent year-to-date, ended Thursday at 17,552 with a 2.5 percent gain for the week. The Nasdaq is the standout, up 6.6 percent year-to-date.

So the closing week in a dramatic year for stocks will decide the whole year's performance for the major indexes. Down-to-the wire isn't unprecedented. Remember in 2011, when the S&P 500 closed at 1257.60, flat but lower than 2010's closing value by less than a tenth of a point....

that's what happens when QE ends. Now, with interest rates rising, expect the market to sink like a souffle...

Proserpina

(2,352 posts)There are plenty of reasons to be optimistic about the American economy. Unemployment is relatively low, the Federal Reserve feels good enough about things to raise interest rates, and gas is cheap. That’s not to say there still isn’t a lot of uncertainty out there – the labor force participation rate is still giving analysts reason to worry, and the advent of large-scale automation is still something a lot of people aren’t accounting for, though it’s all but a certainty at this point.

Depending on how you look at it, you could really choose to feel good or bad about things; it’s all about perspective.

But one piece of good news from recent jobs reports is that some older workers, who had been having a lot of trouble finding their way back into the workforce following the great recession, are finally finding jobs. While that’s good news on the surface, there is an ugly underside to it that can’t be discounted.

A post from Zero Hedge was the first to point this out – and it was subsequently covered by others like the Huffington Post – but there seems to be an interesting current in the labor market: older workers are finding jobs, and younger workers are losing them. You can click over and check out the charts Zero Hedge has supplied to see the evidence for yourself, but it seems rather clear the labor force participation rate for younger workers has been on the decline while the opposite has been true for older demographics.

The real question here is this: why? After all, it seems that we should be seeing older workers drop out of the labor force in higher numbers, due to retirement or simple structural or frictional forces, while younger workers replace them. The reason is surprisingly simple, and a little disheartening.

The short and sweet of it is this: older workers don’t have any leverage. That means they will work for less, and won’t ask for a raise...

Proserpina

(2,352 posts)I'll be getting to see it this holiday, I hope.

Proserpina

(2,352 posts)AMERICA’S equity markets are broken. Individuals and institutions make transactions in rigged markets favoring short-term players. The root cause of the problem is that stocks trade on numerous venues, including 11 traditional exchanges and dozens of so-called dark pools that allow buyers and sellers to work out of the public eye. This market fragmentation allows high-frequency traders and exchanges to profit at the expense of long-term investors.

Individual investors, trading through brokers like Charles Schwab, E-Trade and TD Ameritrade, suffer first as the brokers profit by hundreds of millions of dollars from selling their retail orders to high-frequency traders and again as those traders take advantage of the orders they bought.

Market depth, critically important to investors who trade large blocks of securities, also suffers in the world of high-frequency traders. Startling evidence for the lack of robustness in today’s market comes from a 2013 Securities and Exchange Commission report that found order cancellation rates as high as 95 to 97 percent, a result of high-frequency traders’ playing their cat and mouse game. Market depth is an illusion that fades in the face of real buying and selling.

Securities markets work best as a central clearinghouse where all buyers and sellers of stocks come together. Not so long ago, when the New York Stock Exchange and the Nasdaq operated as virtual monopolies, American equity markets were the envy of the world. Until 2000, Nasdaq was wholly owned by a nonprofit corporation; the New York Stock Exchange was nonprofit until 2006. To ensure that they would operate in the public interest, they were treated much like public utilities...

more

Authors: Jonathan Macey is a professor of law and David Swensen is the chief investment officer at Yale.

Hotler

(11,396 posts)Nice touch....![]()

Proserpina

(2,352 posts)Just trying to maintain a family tradition for the holiday season and all...

Hotler

(11,396 posts)Gun shop owners across the U.S. have reported a marked increase in interest in their products over the holidays. In November, the FBI ran more than 2.2 million gun background checks, a 24 percent increase from last year. Gun background checks hit a new record on Black Friday, when 185,345 were processed by the FBI.

http://www.msn.com/en-us/money/markets/guns-top-christmas-wish-lists-and-the-industry-seems-to-be-booming/ar-BBnSGtX?li=BBnb7Kv

"In November, the FBI ran more than 2.2 million gun background checks" What the hell!

1. That's a shit load of guns on the streets.

2. I wonder how many are buying guns with long term credit card debt?

Credit debt bubble stretching tighter and tighter. People are getting more crazy by the day.

Mom keeps babbling about Iceland and Russia...

Fuddnik

(8,846 posts)Hotler

(11,396 posts)antigop

(12,778 posts)Silence descends amid shocked intakes of breath. One of the hosts, red-faced, declares, "What an awful thing to do." He explains sternly, "We are family and friends. We love one another and do kind things to express that love. Demanding money offends and undermines what brought us together. What do they teach in that overpriced college?"

This holiday host denounces the market as an enemy of love and solidarity. Might he eventually extend his critique of the market's effects inside the home to include what markets do outside too? Modern societies mostly ban markets as mechanisms for distributing sexual services, organs for transplants and so on. Long ago, Plato and Aristotle criticized markets for polarizing rich versus middle and poor, breeding envy and thereby undermining the social cohesion that sustains community. Might people recognize that ancient Greek wisdom again?

Proserpina

(2,352 posts)It's a whole bunch of them with too much power and too much of Other People's Money, like Shkreli...

Proserpina

(2,352 posts)Something there is that doesn't love a wall,

That sends the frozen-ground-swell under it,

And spills the upper boulders in the sun;

And makes gaps even two can pass abreast.

The work of hunters is another thing:

I have come after them and made repair

Where they have left not one stone on a stone,

But they would have the rabbit out of hiding,

To please the yelping dogs. The gaps I mean,

No one has seen them made or heard them made,

But at spring mending-time we find them there.

I let my neighbour know beyond the hill;

And on a day we meet to walk the line

And set the wall between us once again.

We keep the wall between us as we go.

To each the boulders that have fallen to each.

And some are loaves and some so nearly balls

We have to use a spell to make them balance:

"Stay where you are until our backs are turned!"

We wear our fingers rough with handling them.

Oh, just another kind of out-door game,

One on a side. It comes to little more:

There where it is we do not need the wall:

He is all pine and I am apple orchard.

My apple trees will never get across

And eat the cones under his pines, I tell him.

He only says, "Good fences make good neighbours."

Spring is the mischief in me, and I wonder

If I could put a notion in his head:

"Why do they make good neighbours? Isn't it

Where there are cows? But here there are no cows.

Before I built a wall I'd ask to know

What I was walling in or walling out,

And to whom I was like to give offence.

Something there is that doesn't love a wall,

That wants it down." I could say "Elves" to him,

But it's not elves exactly, and I'd rather

He said it for himself. I see him there

Bringing a stone grasped firmly by the top

In each hand, like an old-stone savage armed.

He moves in darkness as it seems to me,

Not of woods only and the shade of trees.

He will not go behind his father's saying,

And he likes having thought of it so well

He says again, "Good fences make good neighbours."

Proserpina

(2,352 posts)Left over from the Ice Age, boulders of all sizes cover New England, and every Spring uncovers new ones. Building walls with them is the only sensible thing to do, just to get them out of the way. There isn't much fertile soil in New England...it got pushed down into New York and points further south. New England rocks are mostly granite, too, unlike Michigan rocks, which are lovely with agates, fossils from the inland sea, basalt, jasper, and other volcanic and sedimentary debris. It's a hard place to make a living with farming...that's why the colonists pushed west into the Northwest Territory.

Proserpina

(2,352 posts)The wall in the poem ‘Mending Wall’ represents two view points of two different persons, one by the speaker and the other by his neighbour. Not only does the wall act as a divider in separating the properties, but also acts as a barrier to friendship, communication. From the narrator’s view, barriers lead to alienation and emotional isolation and loneliness. The narrator cannot help but notice that the natural world seems to dislike the existence of a wall as much as he does and therefore, mysterious gaps appear from nowhere and boulders fall for no reason. The poem portrays the lack of friendship between two neighbours, they know each other but they are not friends. There exists a communication gap between them; they meet each other only on appointed days to fix the wall separating their properties.

Thus, the poem is a sad reflection on today’s society, where man-made barriers exist between men, groups, nations based on discrimination of race, caste, creed, gender and religion.

On the other hand, the neighbour has different opinions. He believes that ‘Good fences make good neighbours.’ He considers walls as necessary to create physical barriers and for mending relations. According the poet’s neighbour, physical barriers set limits and affirm the rights of each and every individual. Walls also stand for building goodwill and trust.

The ‘wall’ is also an example of metaphor in the poem, Mending Wall.

The ‘wall’ in the poem is a metaphor for two kinds of barriers- physical and mental.

*Something there is that doesn’t love a wall

*And set the wall between us once again

*We keep the wall between as we go.

The fence symbolizes national, racial, religious, political and economic conflicts and discrimination which separate man from man and hinders the ways of understanding and cultivating relationships.

The dispute between the two neighbours symbolizes the clash between tradition and modernity. The young generation wants to demolish the old tradition and replace it with modernity while the old wants to cling on to the existing tradition and beliefs.

In “Mending Wall”, Frost has taken an ordinary incident of constructing or mending a wall between his and his neighbor’s garden and has turned it into a meditation on the division between human beings...

Proserpina

(2,352 posts)but part of NE culture is the knowledge that one man's freedom ends where the other man's nose (or wall) begins....it's part of the New England reserve, something that is missing in other parts of the nation, where people get in your face and proselytize...another term for it would be "ego boundaries".

The Ego, Superego and Id

The ego has been defined as the "

Whereas Sigmund Freud developed the concept of the ego as a separate entity from the superego and id, Paul Federn, an associate of Sigmund Freud, and one-time director of the Viennese Psychoanalytic Society has been credited with developing the concept of ego boundaries. An ego boundary is the distinction between self and others, as well as the distinction between the real and unreal...

https://suite.io/gina-barrett-putt/3xpw21e

In some psychoses the person does not have an ego boundary and cannot differentiate his or her personal perceptions and feelings from those of other people...

http://www.huffingtonpost.com/richard-koch/the-8020-view-of-ego-boun_b_5981502.html

Proserpina

(2,352 posts)A really good poem, IMO, has multiple applications.

Proserpina

(2,352 posts)http://www.nytimes.com/2015/12/23/opinion/bernie-sanders-to-rein-in-wall-street-fix-the-fed.html

To rein in Wall Street, we should begin by reforming the Federal Reserve, which oversees financial institutions and which uses monetary policy to maintain price stability and full employment. Unfortunately, an institution that was created to serve all Americans has been hijacked by the very bankers it regulates.

The recent decision by the Fed to raise interest rates is the latest example of the rigged economic system. Big bankers and their supporters in Congress have been telling us for years that runaway inflation is just around the corner. They have been dead wrong each time. Raising interest rates now is a disaster for small business owners who need loans to hire more workers and Americans who need more jobs and higher wages. As a rule, the Fed should not raise interest rates until unemployment is lower than 4 percent. Raising rates must be done only as a last resort — not to fight phantom inflation.

What went wrong at the Fed? The chief executives of some of the largest banks in America are allowed to serve on its boards. During the Wall Street crisis of 2007, Jamie Dimon, the chief executive and chairman of JPMorgan Chase, served on the New York Fed’s board of directors while his bank received more than $390 billion in financial assistance from the Fed. Next year, four of the 12 presidents at the regional Federal Reserve Banks will be former executives from one firm: Goldman Sachs...

A national bank, similar to the Bank of North Dakota, would be a sensible alternative. Iceland is doing it, I believe I read...

That was the same time US Treasury Secretary Henry Paulson, who deliberately triggered the Lehman crisis, categorically refused nationalizing the criminal Wall Street banks, contemptuously stating, “Nationalization is socialism; we don’t do that here.” It was a lie at best as Paulson, with carte blanche control over an unprecedented $700 billion Troubled Asset Recovery Fund, bailed out AIG, Goldman Sachs and his old buddies on Wall Street with “socialized” losses dumped on American taxpayers.

Unlike Greece or Ireland or other EU countries or the USA, the Iceland Parliament and government refused to give unlimited state guarantee to save the private banks.

They nationalized them instead, creating a “Good bank-Bad bank” model loosely based on the successful Swedish 1992 experience with Securum. All domestic assets of the three banks were placed in new publicly-owned domestic versions of the banks. All foreign liabilities of the banks, which had expanded with subsidiaries in the UK and Netherlands, went into receivership and liquidation. British and Dutch bank counterparties and governments shrieked howls of protest, threatening Iceland with being blackballed and forever cut off from further credit by the world. The government also imposed currency controls.

The Parliament established an Office of Special Prosecution to investigate allegations of criminal fraud by government and bankers. People responsible went to prison. Baldur Guðlaugsson, Permanent Secretary of the Ministry of Finance went to prison for insider trading; the president of Glitnir bank went to prison for tax fraud; the president of Kaupthing Bank got 5 ½ years prison; former Prime Minister Geir H. Haarde was indicted.

Iceland decided to go it alone and focus on rebuilding her devastated real economy. The results are quite opposite the results in the EU where the brutal IMF and ECB and EU austerity policies have turned a banking crisis into a major economic crisis across the EU.

By March 2015, according to the IMF itself, “Overall, macroeconomic conditions in Iceland are now at their best since the 2008-9 crisis. Iceland has been one of the top economic performers in Europe over the past several years in terms of economic growth and has one of the lowest unemployment rates… Iceland’s strong balance of payments has allowed it to repay early all of its Nordic loans and much of its IMF loans while maintaining adequate foreign exchange reserves.” The report added, “This year, Iceland will become the first 2008-10 crisis country in Europe to surpass its pre-crisis peak of economic output.”

Revolution in banking next?

The most dramatic and heartwarming development from the Iceland financial crisis however is the Prime Minister’s proposal to revolutionize the country’s money creation process. The first country in the present world to consider such bold action, Prime Minister Sigmundur Davíð Gunnlaugsson commissioned a major report, on reform of the monetary system to prevent future crises. The report, issued by Progressive Party parliamentarian and chair of the parliament’s Committee for Economic Affairs and Trade, Frosti Sigurjónsson, examined the very taboo subject of how private commercial banks are able to create money “out of thin air.”

The report considers the extent to which Iceland’s history of economic instability has been driven by the ability of banks to ‘create money’ in the process of lending.

They went to the Holy of Holies of the secrets of banking since the Bank of Amsterdam first introduced systematic fraud into credit lending in the late 1700’s before it went bankrupt—fractional reserve banking. That simply means a bank lends many times over its deposit or equity base. If there is a crisis of confidence and depositor bank runs, under fractional reserve banking, the bank goes under.

The Frosti report concluded its examination of the link between Iceland bank lending up to September 2008 and the severity of the crisis. Their conclusion was that, “the fractional reserve system may have been a long term contributing factor to various monetary problems in Iceland, including: hyperinflation in the 1980s, chronic inflation, devaluations of the Icelandic Krona, high interest rates, the government foregoes income from money creation, and growing debt of private and public sectors.” That’s a strong indictment and accurate.

It described the stages of every bank crisis since at least 1790 when the Bank of Amsterdam went bankrupt after a run: “A bank’s stock of cash and Central Bank reserves (both assets of the bank) is small compared to total deposits (the banks’ liability). A rumor that a bank may be in difficulty can therefore cause customers to withdraw their deposits in panic (a bank run). A bank run forces the bank to sell assets quickly to fund payouts to depositors. Such a sudden increase in the supply of assets can lead to a fall in market prices, putting other banks into trouble, and the whole banking system may follow.”

Sovereign Money System

The report to the Prime Minister concludes that a revolutionary change in control of credit is needed to control the greed and voracity of the private banks. They call for something known as a Sovereign Money System. As they note, “In a Sovereign Money system, only the central bank, owned by the state, may create money as coin, notes or electronic money. Private commercial banks would be prevented from creating money.”

The report further notes a major positive gain from implementing the Sovereign Money System. The private banks would not make huge profits by buying and selling Government debt at taxpayers’ expense as the government must pay private bondholders interest on that debt: “By delegating the creation of money to private commercial banks, the Central Bank of Iceland, and thereby the state, foregoes considerable income that it would otherwise earn from creating new money to accommodate economic growth.”

They describe how it would function: “In a Sovereign Money system, private banks do not create money. Instead this power is in the hands of the Central Bank, which is tasked with working in the interest of the economy and society as a whole. In the Sovereign Money system, all money, whether physical or electronic, is created by the Central Bank. Although commercial banks will no longer create money, they will continue to administer payments services for customers and will make loans by acting as intermediaries between savers and borrowers.”

And a critical provision: “The payments service will consist of Transaction Accounts held by individuals and businesses. The funds in Transaction Accounts will be electronic sovereign money created by the Central Bank. Transaction Accounts are risk free, as they are kept at the Central Bank, and interest-free as they are not available to the bank to invest. The Central Bank will be exclusively responsible for creating the money necessary to support economic growth. Instead of relying on interest rates to influence money creation by banks, the Central Bank can change the money supply directly. Decisions on money creation will be taken by a committee that is independent of government and transparent in its decision-making, as is the current monetary policy committee.”

That very system was proposed by Chicago economist Irving Fisher and others during the 1930S Great Depression in the USA. The lobby of the bankers managed to kill it.

First appeared: http://journal-neo.org/2015/04/21/iceland-s-economic-revolution/

Proserpina

(2,352 posts)April 8, 2015

The author is a Reuters Breakingviews columnist. The opinions expressed are his own.

Radical bank reform is mostly endorsed by academics, commentators and crackpots. So it is certainly worth taking note when a senior person in a real government calls for a top-to-bottom makeover of banks and the monetary system...Admittedly, the suggestion doesn’t come from the U.S. Federal Reserve or President Obama. It comes from tiny Iceland, population 330,000. Still, Frosti Sigurjonsson is chairman of the Economic Affairs and Trade Committee of the nation’s parliament and the prime minister commissioned his report, “Monetary Reform, A better monetary system for Iceland.”

Besides, Iceland is a poster child for the current system’s weaknesses. Before the financial crisis, its banks turned the nation into a giant and seemingly successful global hedge fund. GDP, expressed in dollars, rose 150 percent between 2001 and 2007. Then it all went wrong. The banks all collapsed, bringing the currency and GDP down with them. In dollars, GDP is still about 20 percent below the peak.

“Monetary Reform” offers a better way. It is clear, relatively short (93 pages, not counting the summary in Icelandic) and persuasive. Sigurjonsson proposes a version of the Sovereign Money model of banking. Basically, this is the way a clever 12-year old would design a banking system.

Right now, adult intelligence is needed to understand what experts call fractional reserve banking. Although the government issues coins and notes, most new money is actually created through bank loans. The proceeds of each new loan are deposited in a bank, but no old deposits are destroyed, so the total funds which customers can spend increases. The intelligent child trying to understand all this will feel something is wrong. Surely, she will say, all money should simply be created directly by the government. A sovereign money system satisfies the child’s reasonable requirement. It works like this. Banks manage transaction accounts, which are effectively electronic forms of bank notes. Like a $20 bill, a transaction account balance is a claim on the economy which is registered with the national monetary authority. The bank is only a custodian, keeping track of the balances and executing transactions. Losses are impossible.

There is also some grown-up banking, known as investment accounts. The name explains the purpose – the bank invests the money in these accounts in economically helpful ways. Withdrawals from investment accounts are limited and final value is not strictly guaranteed. Although Sigurjonsson does not mention the possibility, investments would not have to take the form of bank loans. The accounts could also be designed to buy bonds and shares.

What is crucial is that the two types of account are kept strictly separate. Money is either kept for transactions or reserved for investments. This sovereign money arrangement is a big improvement over the current banking system. It totally eliminates one of its big risks: losses and runs on current accounts. The money in transaction accounts is as sound as the central bank itself. Sovereign money’s investment accounts also sharply reduce the current arrangement’s other great danger – of financial panics. These usually start when new money is no longer available to prop up prices. The pain is amplified as highly leveraged investors become insolvent. With sovereign money, the supply of funds is strictly limited in the first place, so investors cannot easily build up leverage. Bubbles will be smaller and less common.

Money creation is not always harmful. On the contrary, the supply of money should generally increase at roughly the same pace as output. Since banks do not create money in a sovereign money system, someone else must. Sigurjonsson proposes dividing the responsibility between a technical decision on quantity and a political decision on allocation...The central bank does the legwork. Much as now, it would base its decision on the optimal money supply on employment, output, inflation and the state of the financial system. Unlike now, it would not use policy interest rates to prod banks or quantitative easing to push money into them. Instead, the legislature would decide what form of distribution is most just and advantageous. Its choices include additional government spending, a citizens’ bonus and loans to banks and other intermediaries with strict instructions to fund businesses.

The clever child may not notice some important issues Sigurjonsson glosses over, for example foreign currency inflows and shadow banking. But children do know about greed, so even a 12-year can identify the largest flaw: sovereign money will be at risk as long as too many people want to make too much easy money from investments. Still, the Sigurjonsson plan is a plausible blueprint for better banking and Iceland is a good place to start. The population may be embittered enough to try something new and the established global powers of banking would probably tolerate an experiment in this miniature economy. But they might regret it. The bankers’ lucrative money-creating power could be threatened by a monetary revolution which started in Reykjavík.

Proserpina

(2,352 posts)Democratic presidential contender Bernie Sanders warned on Wednesday that if he wins the White House he will “fix” the Federal Reserve by throwing bankers off its boards and increasing transparency and regulation as a way of reining in Wall Street.

Sanders criticized the pivotal decision by America’s central bank a week ago to raise interest rates for the first time in almost a decade.

He declared that the move was “the latest example of the rigged economic system”, in an opinion article for the New York Times on Wednesday.

“Wall Street is still out of control,” he said in the article.

He pointed out that most of the country’s leading financial institutions are larger now than they were during the 2008 economic catastrophe when some had to be bailed out by the government, in order to prevent global financial meltdown, because they were deemed “too big to fail”.

“If any were to fail again, taxpayers could be on the hook for another bailout, perhaps a larger one this time,” he said.

more

Proserpina

(2,352 posts)"We have to nationalize the banks. We have to get rid of the government. We need to have access to the internet seen as a human right. We need to have a new Constitution," said Birgitta Jonsdottir, founder of the Icelandic Pirate Party. Jonsdottir, a lifelong political activist and recently re-elected member of Icelandic parliament was describing the four central demands of the new political revolution sweeping Iceland since the financial collapse. "We can create power and be the government and be the media. If Iceland can do it, you can do it."

The struggle in Iceland is ongoing, but the nation's people have achieved monumental results in a relatively short amount of time due to the nature of their movement building. They managed to arrest and jail the bankers who wrecked the economy. When the government privatized public banking institutions to their friends, essentially for free, and made the people pay for their bailouts, the people threw them out of office and refused to give the banks their money. And since Iceland only recently achieved independence from Denmark in 1944, their boilerplate constitution had never been updated. The movement in Iceland successfully used direct democracy to crowdsource a new constitution via Facebook and Twitter, and that crowdsourced constitution was widely supported by the people as the official model for a new constitution.

While Iceland's politicians have since ignored the will of the people, a budding new political force in Iceland is building a movement in parliament to change that. We can learn from Iceland and accomplish similar goals here.

1. Strive For Unity

2. Turn a Few Central Demands into Goals

3. Be the Banks

4. Be the Government

5. Crowdsource a New Constitution

details at link

Proserpina

(2,352 posts)DemReadingDU

(16,000 posts)Merry Christmas

Proserpina

(2,352 posts)Today they look a little crumpled with cold (38F), although there's no frost. Mom's snowdrops are breaking through...

Proserpina

(2,352 posts)love from Demeter, Proserpina, the Kid, the grand-dog, 3 cats and the guest dog!

Proserpina

(2,352 posts)Dec 23 Greece's Prime Alexis Tsipras said on Wednesday his leftist-led coalition government had handed a USB stick with data on thousands of suspect banking transactions to a prosecutor, and said tax evaders would have one last chance to own up.

At the last cabinet meeting of 2015, Tsipras said the government's secretary general met last week with Herve Falciani, a former HSBC employee who leaked information on clients and their tax situation. Falciani was sentenced to five years in prison for espionage by a Paris court in November. A court official said the secretary obtained from Falciani new data which may help an investigation into a list of more than 2,000 names of potential tax evaders, known in Greece as 'the Lagarde list'.

"These initiatives will continue and there will be a barrage of developments because this is a government that has the political will," Tsipras told ministers.

Widespread tax evasion was largely blamed for Greece's financial woes and its debt crisis. The government has promised to crack down on tax dodgers and also wants to use the proceeds to help ease the plight of the poor. But after five years of austerity, Greeks are angry with politicians over their failure to stop the tax cheats and corruption. The investigation of the Lagarde-list has not produced significant results. To convince Greeks that their sacrifices are paying off, the government will support judicial authorities "ethically, politically and materially", a spokeswoman for the government said separately.

Last week, Greek financial prosecutors raided a UBS office in Athens, seizing records as part of an investigation into possible tax evasion by holders of large bank deposits abroad. Tsipras also told Wednesday's cabinet meeting that Athens would table a bill in January giving tax evaders a last chance to voluntarily disclose money they transferred abroad that has not been taxed.

"We will give them a last chance to present the money and pay their share to the Greek state, without facing the consequences which sooner or later they would face, if they don't do so," Tsipras said.

Proserpina

(2,352 posts)The season of Christmas is upon us. You can feel it everywhere, from the holiday decorations, to the television specials, to the waning interest in workplace productivity. Oh, yeah, and Target is back in the news for losing people's personal information again.

This of course reminds shoppers everywhere of that time Target was the victim of a hack that resulted in the exposure of millions of customers' credit card information. That breach was so bad, and the news of it so well circulated, that Target set up a website page dedicated to telling customers all about it, assuring them not only that they wouldn't be responsible for any charges on those credit cards, but also assuring customers that the company was, like, super dedicated to security moving forward.

The vulnerability of the Target app, however, isn't something that could be prevented by a chip. It would have required something as technologically advanced as basic authentication, according to Avast, which published the vulnerability.

To our surprise, we discovered that the Target app’s Application Program Interface (API) is easily accessible over the Internet. An API is a set of conditions where if you ask a question it sends the answer. Also, the Target API does not require any authentication. The only thing you need in order to parse all of the data automatically is to figure out how the user ID is generated. Once you have that figured out, all the data is served to you on a silver platter in a JSON file.

So much for all that dedication to security. Merry Christmas, Target shoppers!

Proserpina

(2,352 posts)https://www.techdirt.com/articles/20151217/09253033112/tpp-ratification-process-grinding-to-halt-as-canada-launches-widespread-consultations-deal.shtml

As we noted recently, the arrival of a new government in Canada has meant that the corporate sovereignty provisions in CETA, the Comprehensive Economic and Trade Agreement between Canada and the EU, might be re-examined, even if they are unlikely to be dropped completely. The other major trade deal involving Canada, TPP, is much more complex, since there are 11 other nations to consider. Although that limits the Candian government's scope for changing course, it appears that it is nonetheless taking a radically different approach compared to its predecessor. Where Stephen Harper's government was unwilling to involve the public in any way, Justin Trudeau's team seems willing at least to ask for their views:

As that paragraph from an article in The Globe and Mail makes clear, the Canadian government is still keen on TPP, and aims to pass it, but it does seem that the process is going to take far longer than originally envisaged. According to The Globe and Mail, Canada aims to sign soon, but not ratify it -- the final part of the process. That's in part because it's not at all clear when the US will get around to its own ratification. Doubts about the US timetable have increased after The Washington Post published the following:

McConnell, who previously supported efforts to enhance Obama's trade negotiating powers, signaled that he was undecided on how he would vote on the deal, but he was clear that the Trans-Pacific Partnership (TPP) would be defeated if it were sent to Capitol Hill next spring or summer, as the administration was planning to do.

That uncertainty is unnerving other TPP nations, as The Globe and Mail notes:

One consequence of the other TPP parties not ratifying the agreement quickly is that it makes it even harder to pass the agreement in the US -- a classic vicious circle:

That's clearly not going to happen anytime soon in Canada, as the government there makes good on its promise to consult the public on the deal. TPP may be done, but it's by no means dusted.

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-24/oil-bankruptcies-reach-highest-quarterly-level-since-recession

Bankruptcies among oil and gas companies have reached quarterly levels last seen in the Great Recession, according to the Federal Reserve Bank of Dallas.

At least nine U.S. oil and gas companies that accounted for more than $2 billion in debt have filed for bankruptcy in the fourth quarter, the bank said Wednesday in its energy economic update for the final three months of the year.

"Lower oil prices have taken a significant financial toll on U.S. oil and gas producers, in part because many face higher costs of production than their international counterparts do," according to the note written by Navi Dhaliwal, a research assistant, and Martin Stuermer, a research economist. "If bankruptcies continue at this rate, more may follow in 2016."

Since peaking in October 2014, U.S. oil and gas employment has fallen by 70,000 jobs, the analysts wrote in the report.

Proserpina

(2,352 posts)Back in June, this website first "solved" the "mystery" behind America's missing inflation, when we showed that a record number of US renters are unable to afford housing, suggesting that record amounts of "disposable income" were being diverted for use as a shelter "tax" instead of being spent on true discretionary goods and services, leading (together with the Obamacare tax) to the broad and distressing decline in not only traditional retail sales and moribund consumer spending, and the "secular" economic slowdown observed over the past several years.

We followed this in September with another expose titled "The Mystery Of The "Missing Inflation" Solved, And Why The US Housing Crisis Is About To Get Much Worse" explaining why the Fed is about to make a historic mistake and unleash an even more acute housing crisis if it hikes into an economy where the only core inflationary "impulse" if that from rent inflation, at a time when median real household incomes have tumbled to levels last seen in 1989.

As we explained in July, one major problem is that the Fed's measures of inflation are wrong, if not with malicious intent, then purely due to definitional purposes. But a bigger problem for the the Fed's measures of how the overall economy is doing (and/or overheating) is that the Fed telling the vast majority of Americans that inflation is negligible, leads to riotous laughter.

The reason for this is a simple, if dramatic, one: the U.S. transformation from a homeownership society, to one of renters.

In fact, the only age group that has seen an increase in homeownership in the "New Normal" are those aged 65 and over!

much more

...a 10 year old without a formal economic education can understand that when one pays the bulk of one's disposable income on the two core essentials, housing and health - whose prices keep soaring with every passing day - there is virtually no money left for everything else. No wonder then that the Fed will not grasp any of this before it is far too late.

And the biggest irony: for the Fed these two largest economic "taxes" which force "spending" and which push up "inflation" are precisely the catalysts that served as the basis for the Fed's decision to hike rates in a desperate attempt to give the impression that the US economy is recovering, when in reality the Fed has been looking at the economy's fundamental deterioration in the face, and reached the absolutely wrong conclusion, convincing itself it now has the "green light" to proceed with a rate hike!

Proserpina

(2,352 posts)http://www.zerohedge.com/news/2015-12-24/during-next-crisis-central-banking-itself-will-fail

For six years, the world has operated under a complete delusion that Central Banks somehow fixed the 2008 Crisis. All of the arguments claiming this defied common sense. A 5th grader would tell you that you cannot solve a debt problem by issuing more debt. If the below chart was a problem BEFORE 2008… there is no way that things are better now. After all, we’ve just added another $10 trillion in debt to the US system. Similarly, anyone with a functioning brain could tell you that a bunch of academics with no real-world experience, none of whom have ever started a business or created a single job can’t “save” the economy.

However, there is an AWFUL lot of money at stake in believing these lies. So the media and the banks and the politicians were happy to promote them. Indeed, one could very easily argue that nearly all of the wealth and power held by those at the top of the economy stem from this fiction. So it’s little surprise that no one would admit the facts: that the Fed and other Central Banks not only don’t have a clue how to fix the problem, but that they actually have almost no incentive to do so. So here are the facts:

1) The REAL problem for the financial system is the bond bubble. In 2008 when the crisis hit it was $80 trillion. It has since grown to over $100 trillion.

2) The derivatives market that uses this bond bubble as collateral is over $555 trillion in size.

3) Many of the large multinational corporations, sovereign governments, and even municipalities have used derivatives to fake earnings and hide debt. NO ONE knows to what degree this has been the case, but given that 20% of corporate CFOs have admitted to faking earnings in the past, it’s likely a significant amount.

4) Corporations today are more leveraged than they were in 2007. As Stanley Druckenmiller noted recently, in 2007 corporate bonds were $3.5 trillion… today they are $7 trillion: an amount equal to nearly 50% of US GDP.

5) The Central Banks are now all leveraged at levels greater than or equal to where Lehman Brothers was when it imploded. The Fed is leveraged at 78 to 1. The ECB is leveraged at over 26 to 1. Lehman Brothers was leveraged at 30 to 1.

6) The Central Banks have no idea how to exit their strategies. Fed minutes released from 2009 show Janet Yellen was worried about how to exit when the Fed’s balance sheet was $1.3 trillion (back in 2009). Today it’s over $4.5 trillion.

We are heading for a crisis that will be exponentially worse than 2008. The global Central Banks have literally bet the financial system that their theories will work. They haven’t. All they’ve done is set the stage for an even worse crisis in which entire countries will go bankrupt. The situation is clear: the 2008 Crisis was the warm up. The next Crisis will be THE REAL Crisis. The Crisis in which Central Banking itself will fail.

Proserpina

(2,352 posts)Two roads diverged in a yellow wood,

And sorry I could not travel both

And be one traveler, long I stood

And looked down one as far as I could

To where it bent in the undergrowth;

Then took the other, as just as fair,

And having perhaps the better claim,

Because it was grassy and wanted wear;

Though as for that the passing there

Had worn them really about the same,

And both that morning equally lay

In leaves no step had trodden black.

Oh, I kept the first for another day!

Yet knowing how way leads on to way,

I doubted if I should ever come back.

I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I—

I took the one less traveled by,

And that has made all the difference.

Proserpina

(2,352 posts)but when I look at the choices I've made, so far in my life, it seems that they were all equally bad, and it didn't matter which way I went, because I wasn't going to get anywhere near where I wanted to be. Maybe that's the fate of Millennials...maybe it's the Fate of women. Maybe this will change in the future, maybe it is the future henceforth.

Maybe it's the sign of a true avocation, that Robert Frost was satisfied with the choices he got.

Poetry is supposed to make one think. It doesn't promise happy thoughts, though.

bread_and_roses

(6,335 posts)Proserpina

(2,352 posts)Last edited Fri Dec 25, 2015, 02:24 PM - Edit history (1)

Frost in 1913.

A young man hiking through a forest is abruptly confronted with a fork in the path. He pauses, his hands in his pockets, and looks back and forth between his options. As he hesitates, images from possible futures flicker past: the young man wading into the ocean, hitchhiking, riding a bus, kissing a beautiful woman, working, laughing, eating, running, weeping. The series resolves at last into a view of a different young man, with his thumb out on the side of a road. As a car slows to pick him up, we realize the driver is the original man from the crossroads, only now he’s accompanied by a lovely woman and a child. The man smiles slightly, as if confident in the life he’s chosen and happy to lend that confidence to a fellow traveler. As the car pulls away and the screen is lit with gold—for it’s a commercial we’ve been watching—the emblem of the Ford Motor Company briefly appears.

The advertisement I’ve just described ran in New Zealand in 2008. And it is, in most respects, a normal piece of smartly assembled and quietly manipulative product promotion. But there is one very unusual aspect to this commercial. Here is what is read by a voice-over artist, in the distinctive vowels of New Zealand, as the young man ponders his choice:

Two roads diverged in a yellow wood,

And sorry I could not travel both

And be one traveler, long I stood

And looked down one as far as I could

To where it bent in the undergrowth;

Then took the other, as just as fair,

And having perhaps the better claim,

Because it was grassy and wanted wear;

Though as for that the passing there

Had worn them really about the same,

And both that morning equally lay

In leaves no step had trodden black.

Oh, I kept the first for another day!

Yet knowing how way leads on to way,

I doubted if I should ever come back.

I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I—

I took the one less traveled by,

And that has made all the difference.

It is, of course, “The Road Not Taken” by Robert Frost. In the commercial, this fact is never announced; the audience is expected to recognize the poem unaided. For any mass audience to recognize any poem is (to put it mildly) unusual. For an audience of car buyers in New Zealand to recognize a hundred-year-old poem from a country eight thousand miles away is something else entirely.

But this isn’t just any poem. It’s “The Road Not Taken,” and it plays a unique role not simply in American literature, but in American culture —and in world culture as well. Its signature phrases have become so ubiquitous, so much a part of everything from coffee mugs to refrigerator magnets to graduation speeches, that it’s almost possible to forget the poem is actually a poem. In addition to the Ford commercial, “The Road Not Taken” has been used in advertisements for Mentos, Nicorette, the multibillion-dollar insurance company AIG, and the job-search Web site Monster.com, which deployed the poem during Super Bowl XXXIV to great success. Its lines have been borrowed by musical performers including (among many others) Bruce Hornsby, Melissa Etheridge, George Strait, and Talib Kweli, and it’s provided episode titles for more than a dozen television series, including Taxi, The Twilight Zone, and Battlestar Galactica, as well as lending its name to at least one video game, Spry Fox’s Road Not Taken (“a rogue-like puzzle game about surviving life’s surprises”). As one might expect, the influence of “The Road Not Taken” is even greater on journalists and authors. Over the past thirty-five years alone, language from Frost’s poem has appeared in nearly two thousand news stories worldwide, which yields a rate of more than once a week. In addition, “The Road Not Taken” appears as a title, subtitle, or chapter heading in more than four hundred books by authors other than Robert Frost, on subjects ranging from political theory to the impending zombie apocalypse. At least one of these was a massive international best seller: M. Scott Peck’s self-help book The Road Less Traveled: A New Psychology of Love, Traditional Values and Spiritual Growth, which was originally published in 1978 and has sold more than seven million copies in the United States and Canada.

Proserpina

(2,352 posts)Given the pervasiveness of Frost’s lines, it should come as no surprise that the popularity of “The Road Not Taken” appears to exceed that of every other major twentieth-century American poem, including those often considered more central to the modern (and modernist) era. Admittedly, the popularity of poetry is difficult to judge. Poems that are attractive to educators may not be popular with readers, so the appearance of a given poem in anthologies and on syllabi doesn’t necessarily reveal much. And book sales indicate more about the popularity of a particular poet than of any individual poem. But there are at least two reasons to think that “The Road Not Taken” is the most widely read and recalled American poem of the past century (and perhaps the adjective “American” could be discarded). The first is the Favorite Poem Project, which was devised by former poet laureate Robert Pinsky. Pinsky used his public role to ask Americans to submit their favorite poem in various forms; the clear favorite among more than eighteen thousand entries was “The Road Not Taken.” The second, more persuasive reason comes from Google. Until it was discontinued in late 2012, a tool called Google Insights for Search allowed anyone to see how frequently certain expressions were being searched by users worldwide over time and to compare expressions to one another. Google normalized the data to account for regional differences in population, converted it to a scale of one to one hundred, and displayed the results so that the relative differences in search volume would be obvious. Here is the result that Google provided when “The Road Not Taken” and “Frost” were compared with several of the best-known modern poems and their authors, all of which are often taught alongside Frost’s work in college courses on American poetry of the first half of the twentieth century:

The results here are even more impressive when you consider that “The Road Not Taken” is routinely misidentified as “The Road Less Traveled,” thereby reducing the search volume under the poem’s actual title. (For instance, a search for “Frost’s poem the road less traveled” produces more than two hundred thousand results, none of which would have been counted above.) Frost once claimed his goal as a poet was “to lodge a few poems where they will be hard to get rid of ”; with “The Road Not Taken,” he appears to have lodged his lines in granite. On a word-for-word basis, it may be the most popular piece of literature ever written by an American.

****

And almost everyone gets it wrong. This is the most remarkable thing about “The Road Not Taken”—not its immense popularity (which is remarkable enough), but the fact that it is popular for what seem to be the wrong reasons. It’s worth pausing here to underscore a truth so obvious that it is often taken for granted: Most widely celebrated artistic projects are known for being essentially what they purport to be. When we play “White Christmas” in December, we correctly assume that it’s a song about memory and longing centered around the image of snow falling at Christmas. When we read Joyce’s Ulysses, we correctly assume that it’s a complex story about a journey around Dublin as filtered through many voices and styles. A cultural offering may be simple or complex, cooked or raw, but its audience nearly always knows what kind of dish is being served.

Frost’s poem turns this expectation on its head. Most readers consider “The Road Not Taken” to be a paean to triumphant self-assertion (“I took the one less traveled by”), but the literal meaning of the poem’s own lines seems completely at odds with this interpretation. The poem’s speaker tells us he “shall be telling,” at some point in the future, of how he took the road less traveled by, yet he has already admitted that the two paths “equally lay / In leaves” and “the passing there / Had worn them really about the same.” So the road he will later call less traveled is actually the road equally traveled. The two roads are interchangeable.

Proserpina

(2,352 posts)According to this reading, then, the speaker will be claiming “ages and ages hence” that his decision made “all the difference” only because this is the kind of claim we make when we want to comfort or blame ourselves by assuming that our current position is the product of our own choices (as opposed to what was chosen for us or allotted to us by chance). The poem isn’t a salute to can-do individualism; it’s a commentary on the self-deception we practice when constructing the story of our own lives. “The Road Not Taken” may be, as the critic Frank Lentricchia memorably put it, “the best example in all of American poetry of a wolf in sheep’s clothing.” But we could go further: It may be the best example in all of American culture of a wolf in sheep’s clothing. In this it strongly resembles its creator. Frost is the only major literary figure in American history with two distinct audiences, one of which regularly assumes that the other has been deceived.