Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 6 January 2016

[font size=3]STOCK MARKET WATCH, Wednesday, 6 January 2016[font color=black][/font]

SMW for 5 January 2016

AT THE CLOSING BELL ON 5 January 2016

[center][font color=green]

Dow Jones 17,158.66 +9.72 (0.06%)

S&P 500 2,016.71 +4.05 (0.20%)

[font color=red]Nasdaq 4,891.43 -11.66 (-0.24%)

[font color=red]10 Year 2.25% +0.01 (0.45%)

30 Year 3.01% +0.02 (0.67%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)Much more practical, useful, and consumer-oriented.

It leads right into my first post of the thread....

Proserpina

(2,352 posts)http://www.nakedcapitalism.com/2014/10/public-citizen-top-ten-pernicious-investor-state-dispute-settlement-lawsuits.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

By Lambert Strether of Corrente.

I was going to say “crazypants” instead of “pernicious,” but if there’s one thing the now rapidly collapsing neo-liberal era of dominance teaches us, it’s that what starts out as crazy turns into conventional wisdom in near-real time (see under Overton Window).

So “pernicious” it is, then. The basic theme in all these suits is that the Investor-State Dispute Settlement (ISDS) mechanism is a method of destroying state sovereignty in favor of rule by an international investor class who own the major corporations, and in conseqence seeks to prevent the state from protecting its own citizens. (For background, see “The TPP, if Passed, Spells the End of Popular Sovereignty for The United States.”).

Most dull normals like me, when reading about these ISDS cases, will probably react like this: “Wait. Can they really do that?” Well, they certainly think they can, otherwise they wouldn’t be expending massive efforts in setting up and rigging this international legal system, and they wouldn’t be bringing lawsuits in its so-called tribunals. (See this post by Golem XIV for a plausible first cut summary of the playbook that structures this effort; see item 7.) And if the Trans-Pacific Partnership (TPP) and the lesser-down but equally

The Top Ten examples are taken from Public Citzen’s new report, “Myths and Omissions: Unpacking Obama Administration Defenses of Investor-State Corporate Privileges” PDF. I’m not focusing on the Obama administration’s defenses because anybody who’s been paying attention knows they’ll be bullshit anyhow; I think propagating the

a list of lawsuits follows

Proserpina

(2,352 posts)Arlington Heights, OH — For years, locals knew that the stretch of road running through the village of Arlington Heights was notorious for police officers separating motorists from their money. Neighboring officials even went so far as to label the town a “speed trap.” In spite of being the smallest community in the county, the village of Arlington Heights had the busiest court in the region and even the state – thanks to the Arlington Heights police department and their disreputable speed trap.

According to a 2007 report from the Enquirer, the overwhelming majority of cases (93%) that pass through court in Arlington Heights, are for traffic fines alone. Despite issuing and collecting a record number of traffic fines, the money from those fines never found its way to the village bank account. The clerk of courts and the deputy clerk of courts, with the help of the ticket writing cops, enriched themselves to the tune of $260,000 before they were finally caught in October.

Even though he was met with backlash from the Arlington Heights Police department, Hamilton County Prosecutor Joe Deters, who called for the dissolution of the village in 2012, said that referring to the village as a “speed trap” is appropriate.

“Basically, they were setting up speed traps on I-75 to fund the municipal workings of that village – which they then stole,” he said. “I can’t quite put my finger on it, but there’s something off about a village that’s maybe a mile long setting up speed traps to raise money that then is used to fund a bunch of public employees. It just rubs me the wrong way.”

What Deters is describing is the basic function of every police department across the country. Everyone from the street cops to the mayor depends on drivers being extorted for traffic violations. It’s what pays their salaries. Luckily for all the residents of Hamilton County, on Friday, the Arlington Heights police department was disbanded as a result of their years of revenue collection for criminals. With the revenue collection arm now disolved, the Hamilton County Sheriff’s Office will begin patrolling the tiny village.

“You get to a point where it just doesn’t make sense anymore,” Deters said. “I think they’ve taken a hard look at what they’re doing out there, and if they’re letting the sheriff do it now, they made the right call.”

One hopes the sheriff is a little more honest, or at least, cheaper

Proserpina

(2,352 posts)We are in the time of year when most sensible animals living in northerly climates are hibernating in burrows and hollow tree trunks, while the somewhat less sensible pundits make their predictions for the coming year. My prediction is always the same—things will go on more or less same as before, until something major breaks, while the probability of something major breaking goes up with each passing year. I have called this event “collapse,” and have predicted, year after year, that it will eventually happen. And so, instead of repeating this less than useful prediction, this year I will instead provide a prescription...Not too many people, I expect, will want to follow my prescription; not too many of my family members, or friends, or acquaintances, or you who are reading this. And that's fine because, as I have learned over and over again, there is no strength in numbers. Quite the opposite: the probability of any given trick working is in inverse proportion to the number of times it is tried, or the number of people who try it. And so, if you are reading along and think “I can't possibly do this because of (insert lame excuse)!” then—good! Fine with me. Fewer people equals more oxygen. And that applies to the few people who will actually bother to read this. Lots more people will not want to read this, because—what collapse? Gasoline prices are low, Obama has shut down most of the wars, the economy is strong enough for the Fed to have started hiking rates, and once Bernie Trump gets into the White House, everything else will be set right too. To the people who think that, someone like me, who predicted collapse a while back, was clearly wrong, and needs to be psychoanalyzed, not followed. Again, fine with me, so long and thanks for all the bullshit. The reasons it's all bullshit are as follows:

• Gasoline prices are low because high oil prices crashed the economy. In turn, low oil prices are destroying the North American oil patch, which was only showing new signs of life thanks to fracking and tar sands, which are expensive to produce and only make sense when oil prices are high. Rest assured, prices will go back up, and then back down, until, in the end, oil comes to be regarded as useless toxic waste. A year ago I described exactly this scenario.

• The wars are over because all of them pretty much ended in defeat for the US. None of them achieved any of their stated objectives. Now, some of you will jump up and try to comment that the stated objectives were not the real objectives, which were to sow chaos and destruction for the sheer hell of it while enriching defense contractors. That's fine too, because such “real” objectives are consistent with imperial collapse: empire wants to steal a precious vase; empire smashes it instead; success! Moreover, whatever the objectives, they don't matter any more, because now they can't be achieved no matter what. The new Russian/Chinese/Indian/Syrian ordnance, such as the S-300/400/500 air and space defense systems, the Kalibr long-range supersonic cruise missile, along with various electronic warfare systems such as Khibiny, has rendered most US forces obsolete. You can say that defeat is victory but, as I explained two years ago, it isn't. Cancel Red Alert and set course for nearest dry dock.

• The Fed is pretending to hike rates to avoid the impression that it has lost control. This is not the only sort of pretense being attempted in the financial arena; there are plenty of others. The US economy isn't growing, and if you subtract out the effect of runaway debt (which will never be repaid no matter what scenario you consider as likely) then it's actually shrinking. More accurately, it can be said that it is sucking in whatever it can in order to avoid collapsing. It is a black hole, as I described half a year ago.

• As far as the “Bernie Trump will save us” theme, it is well understood by now that the US is no longer a democracy. (Maybe it was one once upon a time, maybe not; it doesn't matter.) Consider the matter settled. Anyone who thinks that it is still possible to effect positive change in the US by voting is a conspiracy theorist of the most miserable, deluded kind.

* * *

There are some general properties of collapses to keep in mind:

1. All things that must collapse eventually do. All empires collapse—no exceptions. All buildings collapse—unless they are demolished first. All Ponzi schemes—such as the current financial system, based on runaway debt—collapse when you least expect them to. Seeing as collapses aren't optional, it makes sense to get used to the idea of them happening, and to learn how make the best of them. Some people consider this and are filled with grief. As I pointed out before, collapse is the worst possible time to suffer a nervous breakdown, so please get your blubbering over with ahead of time.

2. Some collapses are actually good for you. Some really important things could be saved provided whatever less important thing that would cause them to collapse collapses first. For instance, if industrial civilization were to collapse soonish, this would avoid ecosystem collapse, leaving whatever survivors would be left with breathable air and a survivable climate. And if the gigantic bubble in human population, which grew apace with the burning of fossil fuels, were to pop before turning the planet into a giant smoldering trash heap, then the few survivors would have a reasonable chance of making it.

3. Bigger collapses are nastier than smaller ones. For example, if you had lots of local banks and credit unions making loans to people who then couldn't repay them, then some large number of these banks and credit unions would collapse, insured depositors would be repaid, bad debts would be written off, and the entire system would eventually recover. But, if you have a handful of gigantic banks and financial institutions holding most of the bad debts, and they fail all at once, then that brings down the entire system. And if you bail them out, then the entire system ends up on life support for the rest of its life, because nobody has any incentive to stop generating bad loans, since now everyone expects to be bailed out again and again.

4. Frequent collapses are better than infrequent ones. This is because unless things—be they populations, Ponzi schemes, economies, cities or empires—collapse on a regular basis, they tend to get too big. And when they get too big, their collapse (which is inevitable, see Point 1 above) becomes bigger, making them worse (see Point 3 above). Plus, frequent collapses of the nonfatal kind can be actually good for you (see Point 2).

For example:

• If the electric grid collapses now and again, then you will eventually learn that you need to get yourself a 12V system, a generator, some solar panels, a wind generator, and install LED lights.

• If water pressure goes down to zero periodically, then you will learn that you need to put in some cisterns, a filtration system, a demand pump, and collect water off the rooftop.

• If garbage collection stops for periods of time, then you will learn to incinerate and to compost, and will try to minimize the amount of nonbiodegradable trash you generate.

• If paid work disappears for periods of time, then you will learn that you need to keep a few months' worth of savings around to ride out these periods.

• If stores run out of food on a semi-regular basis, then you will learn that you need to grow your own food, put a chicken coop in the back yard and figure out how many lazy beds of potatoes you need.

• If banks periodically confiscate all your money (that's called a “bail-in,” and it's actually been made legal not too long ago), then you will learn to keep an absolute minimum of money in the banks, and figure out other, more reliable forms in which to store your savings.

• If you were to periodically find yourself cut off from the medical system, then you would find out ways of staying healthy and of treating yourself.

• If you periodically found it impossible to buy gasoline, you would learn that you can't rely on your car, and would instead bicycle, or walk, or take public transportation.

• If your country's government periodically turned fascist and started detaining, torturing and killing people indiscriminately, then you'd learn that you need to get yourself a second passport, and practice getting out of the country in a hurry.

These are all examples of small, frequent collapses that are good for you. But that's not what everyone seems to be aiming for, now, is it? What everyone seems to be aiming for is preventing any and all of these small, frequent, nonfatal collapses. However, such efforts are in direct contradiction with Point 1: “All things that must collapse eventually do.” Instead of preventing collapse, such tactics guarantee a single, huge, catastrophic collapse that can very well turn out to be fatal for huge masses of people. But that's OK: see Point 2: if “the gigantic bubble in human population... pops before turning the planet into a giant smoldering trash heap, then the few survivors will have a reasonable chance of making it.”

And so, what if you aspire to being one of these few survivors who might stand a reasonable chance of making it? My prescription is simple: Collapse Early and Often.

Dmitry Orlov is a Russian-American engineer and a writer on subjects related to "potential economic, ecological and political decline and collapse in the United States," something he has called “permanent crisis”. http://cluborlov.blogspot.com

Proserpina

(2,352 posts)By the time it reached the high of 29F on Tuesday, I was out "cold" with exhaustion from being out in the cold.

Gas went up 9 cents, too, adding insult to the injury of wearing enough lbs. to stay unfrozen while pumping gas.

Not to worry, though. We'll be up to freezing by Friday. Might even hit 40F for a few minutes on Saturday. Then it's back to the teens for a week, minimum. Such is life in a temperate zone.

PS: The snow has sublimated in the sunshine.

Proserpina

(2,352 posts)What would have happened if the federal government had saved Lehman Brothers back in September 2008? Could the Great Recession have been avoided? ... The Fed may well have been able to prevent the Lehman bankruptcy had it wanted to do so—and thus avoided the catastrophic results... There is no question the decision about Lehman had far-reaching effects. Lehman’s bankruptcy on September 15 precipitated a collapse in the nation’s credit markets, leading to the greatest economic crisis since the Great Depression. In view of the government’s other big bailouts that year—Bear Stearns back in March 2008, the housing agencies Fannie Mae and Freddie Mac just days before the Lehman decision, the insurance giant AIG days later, and the $700 billion TARP program launched that October—the refusal to save the investment bank seems in retrospect highly irrational. At the time, Fed Chairman Ben Bernanke defended the decision by claiming the Fed didn’t have the authority to save the bank. But The New York Times now tells us that some bankers within the New York Fed had contended there was indeed a legal right to save the bank and that it was as solvent as some of the other bailed out companies. Their assessment just didn’t get passed up to the highest circles, they now say. Really?

There’s little doubt that saving Lehman would have mitigated the credit collapse, and the ensuing Great Recession would have been less punishing. Millions of people lost jobs and houses, stocks collapsed. Europe has still not recovered from the blow. Yet passing judgment is complicated for a number of reasons. Back in mid-2008, the Wall Street community was becoming skeptical of bailouts, and then-Treasury Secretary Henry Paulson later said he was tired of being accused of too readily saving these companies. One school of thought on the street, and among economists, is to let the chips fall where they may; it was time to teach those who take big risks a lesson. It also seemed, at least momentarily, that the economy was getting stronger in the summer of 2008. The Washington decision-makers thought it only logical that the bankers were smart enough, after the go-around with Bear Stearns, to prepare themselves for a possible catastrophe by reducing risky exposure. Faith in the rationality of market participants is a cornerstone, of course, of the Invisible Hand used so often to justify laissez-faire government. The policymakers were wrong. Wall Street wasn’t ready at all.

We should keep in mind, however, that some kind of recession was likely no matter what happened to Lehman. The bubble in home prices was beginning to burst by 2007, and mortgage securities were losing value, which is what brought on Lehman’s troubles in the first place. And a Lehman rescue might well have had other damaging consequences about which we can only speculate. Without the financial and economic punishment, the nation would certainly have not passed the Dodd-Frank financial reforms. Nor would there have been enormous pressure on other federal agencies, including the Securities and Exchange Commission and the Commodities Futures Trading Commission, which as a result have become more vigilant. By sending a signal that even big Wall Street risk takers would not have to face the consequences if things went south, saving Lehman in 2008 could have further reinforced the cavalier attitude that Wall Street had had for years—one that helped lead the big investment houses toward ever-riskier financial markets. Consider, for example, the rescue of Long-Term Capital Management back in 1998, which was engineered by Alan Greenspan’s Fed. The possible failure of the giant hedge fund struck fear into the hearts of financiers, not least the Fed chairman himself. But then the government intervened—and what happened? The rescue succeeded and Wall Street returned to more or less the same practices that led to the LCTM debacle to begin with. Greenspan did nothing about tightening regulations so that firms like LTCM couldn’t borrow the towering sums they did. The Clinton administration was just as remiss in not pushing for banking reform. With Greenspan’s support, it refused to allow agencies to regulate derivatives, the highly leveraged securities based on other securities that would later be at the heart of the 2008 collapse. A mindless high-technology stock market boom got underway, based on aggressive Wall Street banking tactics and high monopolistic fees for doing deals.

Ending the last of the Glass-Steagall restrictions—the 1933 legislation that had separated commercial banking from securities trading and insurance—the Clinton administration allowed Sandy Weill’s Traveler’s Insurance to merge with Citicorp, to create the giant Citigroup. With its mammoth size, the new entity felt it could take on loads of risk, such as making huge loans to questionable high-technology giants like Enron and WorldCom, both of which soon went bankrupt. Then, later in the 2000s, it wrote all manner of securities on subprime mortgage debt, holding quite a bit on its own books. Other financial institutions were doing the same. No one was restricting them. Regulators had lots of tools to dampen speculation. They could have raised capital requirements, established maximum debt levels for financial firms, and even prohibited some kinds of securities. They surely could have regulated derivatives, in particular forcing their trading and pricing out in the open. Even in conservative economics, the principle that prices should be transparent is held as central. Economists didn’t seem to make much of a stink, either...

...What the Lehman story ultimately makes clear is the extent to which the ideologically-driven, laissez-faire approach of the government toward banking regulation was itself a culprit in the crisis. The lax enforcement of Dodd-Frank is already worrying evidence that the painful losses of 2008 are being forgotten. The nation needs regulators who fully understand that financial markets need vigilant supervision—whether or not there is an imminent threat of bank failure.

hmm...not a word about the fraud that underlay the entire debacle

Proserpina

(2,352 posts)Forget the ever-diminishing middle class, banksters have found a new target – prisoners. According to the Center For Public Integrity, prison bankers are collecting tens of millions of dollars in fees each year from inmate’s families for providing basic financial services. It turns out desperate family members trying to get money to imprisoned loved ones are very compliant customers.

Private banking companies are now getting prison contracts to handle financial deposits for inmates and are charging depositors ruinous fees. In order to process fund transfers from family members to inmates the banks often charge 35-45%. Families that need to get cash to inmates quickly have no choice but to pay.

Inmates need money for basic necessities including food, electricity and toilet paper in some states. Given that inmates are often paid well below minimum wage for their prison jobs they need that money from their families. These fees not only hurt the inmates by getting less funds but put strain on families, especially poor families who have already lost the income that may have come if the imprisoned family member was working.

Inmates earn as little as 12 cents per hour in many places, wages that have not increased for decades. The prices they pay for goods to meet their basic needs continue to increase. By erecting a virtual tollbooth at the prison gate, JPay has become a critical financial conduit for an opaque constellation of vendors that profit from millions of poor families with incarcerated loved ones.

As if the US prison system was not doing enough to cause cycles of poverty now they are helping exploit the families of the incarcerated. Then again, it might ensure future customers. Think of what those desperate family members might have to do to get enough money to pay the fees.

Just when you thought the prison-industrial complex could not get any more depraved and despicable a new way to ruin people’s lives is brought to fruition by the forces of savage capitalism.

Proserpina

(2,352 posts)President Barack Obama said today that the middle class is squeezed by stagnant wages, slow job growth and ever-higher college tuition. A new report shows that more and more U.S. workers are getting squeezed in another way: pushed into inadequate retirement plans by the country's largest employers. Worse, their employers acknowledge as much.

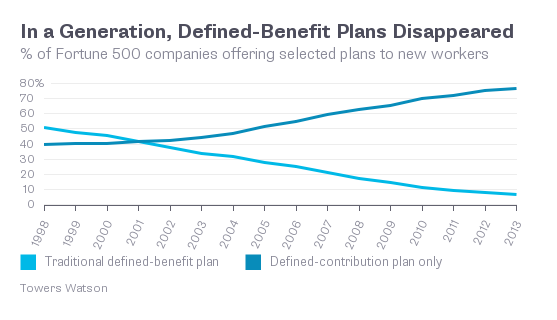

A survey last month from Towers Watson, the employee benefit consultant, shows just how rapidly the defined-benefit plan -- the traditional pension that guarantees workers an annual income after they retire -- has moved from the norm at Fortune 500 companies to all but extinct. In 1998, just more than half offered new hires a defined-benefit plan; by 2013, that had fallen to just 7 percent.

That trend continues: According to Towers Watson, at least three of the 34 Fortune 500 companies that offered defined-benefit plans to new hires last year won't do so this year.

Taking their place are defined-contribution plans, the 401(k)s and other such plans in which employers put money into an investment account in the worker's name. In theory, employees can still save enough for retirement -- if they put enough away, invest it wisely and engage in reasonable planning. But that's not what usually happens -- and according to another Towers Watson survey of large employers, they know it.

In 2012, Towers Watson asked 371 companies about their retirement plans, and how well their employees understood and made smart use of those plans. The answer, in most cases, was that they don't.

more

Proserpina

(2,352 posts)so, here's the very song for it:

In these changeable, confusing times, a little tradition goes a long way.

Proserpina

(2,352 posts)The Wall Street Journal asks “who lost the Saudis?”:

Rather than asking “who lost” Saudi Arabia, here’s a better question: why should we want to “keep” them? Perhaps at one time the benefits of having the Saudis as a client outweighed the costs, but those days are long gone. Saudi Arabia is not only a useless and reckless client, but it is increasingly a liability. As we can see from its campaign in Yemen and its destructive meddling in Syria, it is also something of a regional menace. Saudi Arabia inculcates jihadism among Muslims in many countries, supports destabilizing policies throughout the region, wages a pitiless and stupid war against its poorer neighbor, and on top of all that it is an especially abusive despotism. The connection with the Saudis has cost the U.S. an extraordinary amount, especially over the last quarter-century, and it has gained us virtually nothing.

The U.S. hasn’t “lost” the Saudis, and it has been going out of its way over the last year not to, but it wouldn’t be such a bad thing for the U.S. if we did. The Obama administration’s failure here isn’t that they’ve alienated Riyadh, but that they’ve bent over backwards for the last several years to placate them and indulge them. The war on Yemen is the most obvious and appalling example of this, but it is representative of the extent to which the U.S. supports and covers for a client regime that provides the U.S. nothing but headaches and problems.

Proserpina

(2,352 posts)To explain the allure the United States has to Saudi Arabia, one must first understand the situation properly. I begin with the year “1973”. That’s when President Nixon asked King Faisal of Saudi Arabia to accept only US dollars as payment for oil and to invest any excess profits in US Treasury bonds, notes, and bills. In exchange, Nixon pledged to protect Saudi Arabian oil fields from the Soviet Union and other interested nations, such as Iran and Iraq. Ever wonder why the United States appears to turn a blinds eye when the Saudis act up? It was the start of something great for the US, even if the outcome was as artificial as the US real-estate bubble and yet constitutes the foundation for the valuation of the US dollar. Think about it, when Saddam Hussein was captured he had a large amount of currency with him, want to guess the country of origins…. That’s it good old U.S. dollars.

By 1975, all of the members of OPEC agreed to sell their oil only in US dollars. Every oil-importing nation in the world started saving its surplus in US dollars so as to be able to buy oil; with such high demand for dollars the currency strengthened. On top of that, many oil-exporting nations like Saudi Arabia spent their US dollar surpluses on Treasury securities, providing a new, deep pool of lenders to support US government spending.

The “petrodollar” system was a brilliant political and economic move. It forced the world’s oil money to flow through the US Federal Reserve, creating ever-growing international demand for both US dollars and US debt, while essentially letting the US pretty much own the world’s oil for free, since oil’s value is denominated in a currency that America controls and prints. The petrodollar system spread beyond oil: the majority of international trade is done in US dollars. That means that from Russia to China, Brazil to South Korea, every country aims to maximize the US-dollar surplus garnered from its export trade to buy oil. Want to see where the next war is, just look at which countries are seeking to move away from the petrodollar. I’ll give you a hint, Libya, Syria, Russia, Venezuela and a few others have spoken of it.

Proserpina

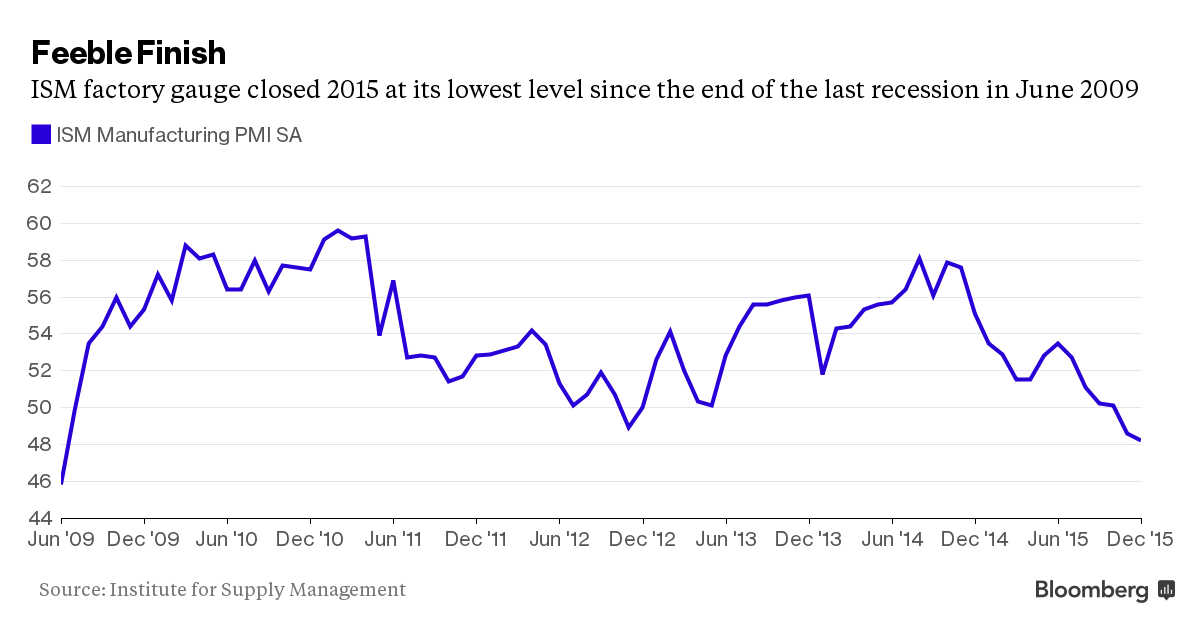

(2,352 posts)Manufacturing in the U.S. contracted in December at the fastest pace in more than six years as factories, hobbled by sluggish global growth, cut staff at the end of 2015.

The Institute for Supply Management’s index declined to 48.2, the weakest since June 2009, from 48.6 a month earlier, the Tempe, Arizona-based group’s report showed Monday. Readings lower than 50 indicate contraction. The median forecast in a Bloomberg survey of 72 economists was 49.

Struggling overseas demand and declines in commodity prices that are hurting investment in energy and agriculture continue to limit orders for American manufacturers. At the same time, robust domestic growth buoyed by labor-market momentum and burgeoning wage gains are supporting consumers’ spending power and preventing U.S. factory activity from slowing even more..

Global Weakness

Factories globally ended the year on a weak note, contributing to a selloff in stocks worldwide on Monday...

Exports, Imports

The measure of export orders showed foreign demand surprisingly climbed in December for the first time in eight months, signaling the worst may be over. The index rose to 51 from 47.5 in November. Conversely, imports dropped at the fastest pace in more than nine years...

Inventory Cutbacks

The ISM report also showed gauges of factory inventories contracted at a slower pace in December, rising to 43.5 from 43 in November. Manufacturers also said their customers still held too much in stockpiles...

Proserpina

(2,352 posts)Once the playground of the rich and famously wild, a magnificent ocean-to-harborfront estate on Paradise Island in the Bahamas is set to hit the auction block on Jan. 14. Known as Kilkee House, with a storied history as titillating as a Jackie Collins novel, its past owners include a dashing playboy who was heir to the A&P fortune and, later, the esteemed Irish actor Sir Richard Harris. Starting bid: $10 million.

The 11,000-square-foot, four-bedroom home was built more than 70 years ago by Huntington Hartford II, a handsome sophisticate better known for his attention to stunning women than for business. Rarely seen without a beauty on his arm (unless there was one on each), Hartford was a visionary who dreamed of transforming a spit of land a short boat ride away from bustling Nassau into a hideaway for the wealthy who wanted nothing more than sunshine and privacy in cold winter months.

In 1962 he built the Ocean Club (now called One & Only Ocean Club) largely as a place for his polo-playing buddies to stay. (Four-bedroom villas now go for upwards of $11,000 a night.) And he persuaded the government to let him change the name from Hog Island to Paradise Island. It’s a move considered as astute in Bahamian history as one by a former tourism chief who boldly pegged the Bahamian dollar to the greenback when the country gained independence from the U.K. in 1973, thus aligning itself with the growing tourist market from the U.S.

Today the island may be more well-known for the mass-market Atlantis resort, which has metastasized just over a bridge in the middle, and its exclusive enclave of A-list of sports and entertainment celebs situated around a golf course on the eastern end. But when Hartford built the stately colonial-style beach house, Paradise was little more than 3 ½ miles of overgrown bush with a north-facing beach on the ocean side and a harbor on the other. The best thing that could be said for it was that it acted as a natural barrier, protecting the city of Nassau, which by that time was the capital of the Bahamas and enjoying its own heyday of long-staying visitors, who arrived with steamer trunks for the winter and wined and dined with abandon.

more drool at link

Hotler

(11,420 posts)A Bailout for Volkswagen? Congress Wants to Do Something Absolutely Crazy

The combination of regulatory oversight and class-action litigation can keep companies in line. But a bill in Congress consisting of a little more than 100 words would not only prevent Kaplan from seeking justice but also cripple virtually all class-action lawsuits against corporations. It’s known as the “Fairness in Class Action Litigation Act,” but lawyers and advocates call it the “VW Bailout Bill.”

The bill, which will get a vote on the House floor in the first week of January, follows a series of steps by the judiciary to block the courthouse door on behalf of corporations. “There's no question the Supreme Court has ben moving in that direction to limit access to courts,” said Joanne Doroshow, executive director of the Center for Justice and Democracy. “But Congress has never done something like this, trying to step in and wipe out class-actions.”

http://www.thefiscaltimes.com/Columns/2016/01/04/Bailout-Volkswagen-Congress-Wants-Do-Something-Absolutely-Crazy

![]()

![]()

The fuckers in the take over in Oregon and those fuckers in Washington need an ass kicking

Fuddnik

(8,846 posts)Dow off almost 300 with an hour left.

Proserpina

(2,352 posts)and Nate Silver will have to eat his predictions...because his predictions didn't take into account a little black swan on the event horizon, coming closer all the time.

Let the economy tank, and nobody will be voting for Hillary. Nobody.

jakeXT

(10,575 posts)WASHINGTON (AP) — Monsanto said Wednesday it will eliminate another 1,000 jobs as it expands a cost-cutting plan designed to deal with falling sales of biotech-corn seeds and other financial headwinds.

The additional layoffs will bring the agriculture giant's total planned cuts to 3,600 jobs over the next two years, or about 16 percent of its global workforce. In October the company first announced the restructuring plan, intended to streamline its sales, R&D and other operations.

The St. Louis-based company says the restructuring will cost between $1.1 billion and $1.2 billion to implement, up from previous estimates of $850 million to $900 million. By the end of fiscal 2018, the company expects the changes to generate annual savings of $500 million.

Its shares fell more than 2 percent in afternoon trading Wednesday.

http://www.usnews.com/news/business/articles/2016-01-06/monsanto-swings-to-1q-loss-amid-lower-seed-sales