Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 12 January 2016

[font size=3]STOCK MARKET WATCH, Tuesday, 12 January 2016[font color=black][/font]

SMW for 11 January 2016

AT THE CLOSING BELL ON 11 January 2016

[center][font color=green]

Dow Jones 16,398.57 +52.12 (0.32%)

S&P 500 1,923.67 +1.64 (0.09%)

[font color=red]Nasdaq 4,637.99 -5.64 (-0.12%)

[font color=red]10 Year 2.17% +0.01 (0.46%)

30 Year 2.97% +0.01 (0.34%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

13 replies, 1710 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (12)

ReplyReply to this post

13 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

STOCK MARKET WATCH -- Tuesday, 12 January 2016 (Original Post)

Tansy_Gold

Jan 2016

OP

Fuddnik

(8,846 posts)1. An elephant weatherman.

Proserpina

(2,352 posts)2. China Not Facing 'Cataclysmic' Economic Slow Down, Says Stiglitz

no. that's for the rest of us, in the West

http://www.bloomberg.com/news/articles/2016-01-11/china-not-facing-cataclysmic-economic-slow-down-says-stiglitz

China isn’t facing a "cataclysmic" economic slowdown and last week’s market turmoil was more about badly designed stock market circuit breakers, said Nobel-prize-winning economist Joseph Stiglitz.

The circuit breakers, which caused local exchanges to close early on two days last week after stocks plunged to a 7 percent limit, weren’t as well designed as they could be, Stiglitz, a professor at Columbia University in New York, said in a Bloomberg Television interview in Shanghai.

The market closures and lower daily fixing rates for the nation’s currency against the dollar roiled global markets, heightening anxiety that it could presage a deeper slump with growth already at a 25-year low in 2015. The Shanghai Composite Index slid again Monday, pushing its decline in 2016 to 15 percent.

"There’s always been a gap between what’s happening in the real economy and financial markets," said Stiglitz. "What’s happening in China is a slowdown by all accounts. It’s a slow process of slowing down. But it’s not a cataclysmic" slowdown.

more

http://www.bloomberg.com/news/articles/2016-01-11/china-not-facing-cataclysmic-economic-slow-down-says-stiglitz

China isn’t facing a "cataclysmic" economic slowdown and last week’s market turmoil was more about badly designed stock market circuit breakers, said Nobel-prize-winning economist Joseph Stiglitz.

The circuit breakers, which caused local exchanges to close early on two days last week after stocks plunged to a 7 percent limit, weren’t as well designed as they could be, Stiglitz, a professor at Columbia University in New York, said in a Bloomberg Television interview in Shanghai.

The market closures and lower daily fixing rates for the nation’s currency against the dollar roiled global markets, heightening anxiety that it could presage a deeper slump with growth already at a 25-year low in 2015. The Shanghai Composite Index slid again Monday, pushing its decline in 2016 to 15 percent.

"There’s always been a gap between what’s happening in the real economy and financial markets," said Stiglitz. "What’s happening in China is a slowdown by all accounts. It’s a slow process of slowing down. But it’s not a cataclysmic" slowdown.

more

MattSh

(3,714 posts)3. But when the US economy falls into the shitter...

someone must be blamed. The media is getting the US ready to blame China.

Because no one in the USA can do wrong, don't ya know?

Proserpina

(2,352 posts)4. EU accuses Belgium of granting illegal tax breaks

You don't have to be big to be corrupt...the bigness helps to conceal the corruptness

http://www.dw.com/en/eu-accuses-belgium-of-granting-illegal-tax-breaks/a-18971323

Investigations by the European Union's competition watchdog have revealed Belgium has been granting illegal tax breaks to some companies for over a decade. The EU executive now wants Brussels to recover those benefits. The European Commission on Monday ordered Belgium to recover some 700 million euros ($760 million) in illegal tax breaks from 35 multinational companies.

EU Competition Commissioner Margrethe Vestager said the tax advantage had only been given to a few select firms which distorted competition by putting smaller, non-multinational companies "on an unequal footing."

The EU executive found that Belgian firms and stand-alone companies had not been able to benefit from a Belgium tax break scheme in place since 2005.

Investigations against Belgium were launched in February of last year and were part of a wider European and global crackdown on corporate tax avoidance. Such schemes reduce companies' tax liability by deducting excess profits - accrued as a result of belonging to a multinational group - from their taxable profits...

more

http://www.dw.com/en/eu-accuses-belgium-of-granting-illegal-tax-breaks/a-18971323

Investigations by the European Union's competition watchdog have revealed Belgium has been granting illegal tax breaks to some companies for over a decade. The EU executive now wants Brussels to recover those benefits. The European Commission on Monday ordered Belgium to recover some 700 million euros ($760 million) in illegal tax breaks from 35 multinational companies.

EU Competition Commissioner Margrethe Vestager said the tax advantage had only been given to a few select firms which distorted competition by putting smaller, non-multinational companies "on an unequal footing."

The EU executive found that Belgian firms and stand-alone companies had not been able to benefit from a Belgium tax break scheme in place since 2005.

Investigations against Belgium were launched in February of last year and were part of a wider European and global crackdown on corporate tax avoidance. Such schemes reduce companies' tax liability by deducting excess profits - accrued as a result of belonging to a multinational group - from their taxable profits...

more

Proserpina

(2,352 posts)5. Why the U.S. economy could keep growing until 2020

Cocaine delusions in the corner office?

http://money.cnn.com/2016/01/11/investing/longest-economic-recovery-ever/

It's a scary time for the global economy. All of a sudden the doom-and-gloom crowd has lots to crow about: China is suffering a scary slowdown, Latin America is imploding and geopolitical threats are on the rise. And the U.S. stock market is off to its worst start to a year. Ever. Yet the optimists at Morgan Stanley believe the American economy will not only withstand this global turmoil, it may keep growing until at least 2020. That would make the much-criticized recovery from the Great Recession the longest U.S. expansion in the post-war period. Last week during the market mayhem Morgan Stanley reiterated its 2020 call, pointing to evidence that suggests the U.S. economic expansion isn't ready to call it quits just yet. Here's a recap of why the economy could just keep chugging along:

1.) Fundamentals are looking solid: The latest economic reports suggest the American economy continues to look like the best house in a bad neighborhood.

2.) Fewer Americans are drowning in debt: Consumers have been hard at work repairing their balance sheets. Morgan Stanley notes that the amount of debt relative disposable income has come down a lot. It currently stands at about 106%, down from 135% in 2008. The ratio of payments to after-tax income has slipped near the lowest levels of the past three decades. In another sign of improved finances, the percentage of loan balances that are over 90 days delinquent recently fell below 4% for the first time since the recession ended.

3.) Corporate America isn't overly exuberant: Morgan Stanley sees little evidence that CEOs have overextended themselves into a situation that will create a bubble. If anything, big companies are still reluctant to splurge on big items that drive growth. For instance, capital spending declined in key sectors like energy, materials, telecom and consumer staples during the third quarter...Big companies have also dramatically improved their balance sheets. S&P 500 companies have a very manageable $100 billion of loans coming due this year and just $300 billion in 2017, Morgan Stanley says. Nonfinancial companies in the S&P 1500 are also sitting on an incredible $1.7 trillion in cash.

... Of course, there's no guarantee the U.S. economy will keep growing for the next four months, let alone the next four years. The Atlanta Federal Reserve's GDPNow forecasting model thinks growth in the fourth quarter of last year slowed to an anemic pace of just 0.8%. Other Wall Street firms are more pessimistic than Morgan Stanley. Even before chaos erupted in China, Citigroup warned last month there is a 65% of a U.S. recession in 2016. In the longer term, the American economy is susceptible to unforeseen shocks. After all, few in 2006 thought the U.S. was about to enter its worst recession since the Great Depression.

Maybe this bank is feeling the Bern...if Bernie can pull a major infrastructure bill out of the next Congress, it could happen. That would be the FDR trick.

http://money.cnn.com/2016/01/11/investing/longest-economic-recovery-ever/

It's a scary time for the global economy. All of a sudden the doom-and-gloom crowd has lots to crow about: China is suffering a scary slowdown, Latin America is imploding and geopolitical threats are on the rise. And the U.S. stock market is off to its worst start to a year. Ever. Yet the optimists at Morgan Stanley believe the American economy will not only withstand this global turmoil, it may keep growing until at least 2020. That would make the much-criticized recovery from the Great Recession the longest U.S. expansion in the post-war period. Last week during the market mayhem Morgan Stanley reiterated its 2020 call, pointing to evidence that suggests the U.S. economic expansion isn't ready to call it quits just yet. Here's a recap of why the economy could just keep chugging along:

1.) Fundamentals are looking solid: The latest economic reports suggest the American economy continues to look like the best house in a bad neighborhood.

2.) Fewer Americans are drowning in debt: Consumers have been hard at work repairing their balance sheets. Morgan Stanley notes that the amount of debt relative disposable income has come down a lot. It currently stands at about 106%, down from 135% in 2008. The ratio of payments to after-tax income has slipped near the lowest levels of the past three decades. In another sign of improved finances, the percentage of loan balances that are over 90 days delinquent recently fell below 4% for the first time since the recession ended.

3.) Corporate America isn't overly exuberant: Morgan Stanley sees little evidence that CEOs have overextended themselves into a situation that will create a bubble. If anything, big companies are still reluctant to splurge on big items that drive growth. For instance, capital spending declined in key sectors like energy, materials, telecom and consumer staples during the third quarter...Big companies have also dramatically improved their balance sheets. S&P 500 companies have a very manageable $100 billion of loans coming due this year and just $300 billion in 2017, Morgan Stanley says. Nonfinancial companies in the S&P 1500 are also sitting on an incredible $1.7 trillion in cash.

... Of course, there's no guarantee the U.S. economy will keep growing for the next four months, let alone the next four years. The Atlanta Federal Reserve's GDPNow forecasting model thinks growth in the fourth quarter of last year slowed to an anemic pace of just 0.8%. Other Wall Street firms are more pessimistic than Morgan Stanley. Even before chaos erupted in China, Citigroup warned last month there is a 65% of a U.S. recession in 2016. In the longer term, the American economy is susceptible to unforeseen shocks. After all, few in 2006 thought the U.S. was about to enter its worst recession since the Great Depression.

Maybe this bank is feeling the Bern...if Bernie can pull a major infrastructure bill out of the next Congress, it could happen. That would be the FDR trick.

Proserpina

(2,352 posts)6. Global regulators agree two-tier leverage ratio for banks

http://www.reuters.com/article/us-basel-banks-markets-idUSKCN0UP1QU20160111

The world's top 30 banks face a higher minimum requirement for their broadest measure of capital, global regulators said on Monday as they flagged a two-tier leverage ratio regime for the first time. The leverage ratio refers to the amount of capital to a bank's non-risk weighted assets, and was set at a preliminary level of 3 percent in the aftermath of the 2007-09 financial crisis. It is meant to act as a "backstop" to a bank's core capital ratios which are based on the riskiness of assets.

The Group of Central Bank Governors and Heads of Supervision (GHOS) said it agreed on Sunday that the permanent level should remain at 3 percent for the bulk of lenders across the world in an announcement that will give the sector much welcomed clarity. GHOS, however, said it discussed "additional requirements" for the world's 30 "globally systemic banks" which include Goldman Sachs, HSBC, Deutsche Bank and BNP Paribas .

The regulators have yet to decide what form the extra requirements should take, such as a flat surcharge or a graduated increase, depending on how big a bank is. The United States, Switzerland and Britain already expect their biggest banks to have a leverage ratio of 4 to 6 percent, well above the current Basel minimum. GHOS also signed off on new rules from 2019 that will make it harder for banks to exploit different capital requirements for their main banking and trading arms.

It said it would publish the package, known as the fundamental review of the trading book, later this week. It is expected to scale back capital charges from what was originally proposed after banks said they would make trading uneconomic...

So, the Big Bankers are haunted by a GHOS....wonder if it's Jacob Marley, or Herbert Hoover.

The world's top 30 banks face a higher minimum requirement for their broadest measure of capital, global regulators said on Monday as they flagged a two-tier leverage ratio regime for the first time. The leverage ratio refers to the amount of capital to a bank's non-risk weighted assets, and was set at a preliminary level of 3 percent in the aftermath of the 2007-09 financial crisis. It is meant to act as a "backstop" to a bank's core capital ratios which are based on the riskiness of assets.

The Group of Central Bank Governors and Heads of Supervision (GHOS) said it agreed on Sunday that the permanent level should remain at 3 percent for the bulk of lenders across the world in an announcement that will give the sector much welcomed clarity. GHOS, however, said it discussed "additional requirements" for the world's 30 "globally systemic banks" which include Goldman Sachs, HSBC, Deutsche Bank and BNP Paribas .

"The GHOS will finalize the calibration in 2016 to allow sufficient time for the leverage ratio to be implemented... by 1 January 2018," it said in a statement.

The regulators have yet to decide what form the extra requirements should take, such as a flat surcharge or a graduated increase, depending on how big a bank is. The United States, Switzerland and Britain already expect their biggest banks to have a leverage ratio of 4 to 6 percent, well above the current Basel minimum. GHOS also signed off on new rules from 2019 that will make it harder for banks to exploit different capital requirements for their main banking and trading arms.

It said it would publish the package, known as the fundamental review of the trading book, later this week. It is expected to scale back capital charges from what was originally proposed after banks said they would make trading uneconomic...

So, the Big Bankers are haunted by a GHOS....wonder if it's Jacob Marley, or Herbert Hoover.

Proserpina

(2,352 posts)7. Bankers charged in euro rate-rigging case

http://www.dw.com/en/bankers-charged-in-euro-rate-rigging-case/a-18972617

Nearly a dozen former top bankers have been charged with colluding to rig a key euro benchmark borrowing rate. But almost half the defendants didn't appear in court. A group of former bankers on Monday became the first to be formally charged with manipulating the Euro Interbank Offered Rate (Euribor) - a daily reference rate compiled from estimates that Eurozone banks give of their cost of borrowing. The case involves former employees of Deutsche Bank, Barclays and Societe Generale, and includes former middle managers, traders and rate submitters of six nationalities.

However, nearly half of the defendants were no-shows in the London court, with just six of the total 11 suspects appearing for the preliminary hearing. A first hearing was scheduled for Wednesday. Lawyers for the absentees, four of them German and one French, cited different reasons for their clients' nonattendance, including ongoing investigations in Germany.

The six who did appear - Christian Bittar, Colin Bermingham, Philippe Moryoussef, Sisse Bohart, Achim Kraemer and Carlo Palombo - were released on conditional bail. Bittar, a Singapore-based star trader who was once one of Deutsche Bank's most profitable money markets managers, was set a bail of 1 million British pounds (1.34 million euros, $1.45 million). None of the others was ordered to pay more than 150,000.

The case is the latest legal effort to hold accountable dozens of bankers involved in a global rate-fixing scheme, which also involved the Euribor's British counterpart, the London Interbank Offered Rate (Libor). The benchmark rates are used to set terms for $450 trillion (414 trillion euros) in securities worldwide. Global investigations into the money-making scheme, which was first revealed in the wake of the 2008 financial crisis, have so far culminated in banks and brokerages paying some $9 billion in regulatory settlements, and more than 30 individuals being charged.

Nearly a dozen former top bankers have been charged with colluding to rig a key euro benchmark borrowing rate. But almost half the defendants didn't appear in court. A group of former bankers on Monday became the first to be formally charged with manipulating the Euro Interbank Offered Rate (Euribor) - a daily reference rate compiled from estimates that Eurozone banks give of their cost of borrowing. The case involves former employees of Deutsche Bank, Barclays and Societe Generale, and includes former middle managers, traders and rate submitters of six nationalities.

However, nearly half of the defendants were no-shows in the London court, with just six of the total 11 suspects appearing for the preliminary hearing. A first hearing was scheduled for Wednesday. Lawyers for the absentees, four of them German and one French, cited different reasons for their clients' nonattendance, including ongoing investigations in Germany.

The six who did appear - Christian Bittar, Colin Bermingham, Philippe Moryoussef, Sisse Bohart, Achim Kraemer and Carlo Palombo - were released on conditional bail. Bittar, a Singapore-based star trader who was once one of Deutsche Bank's most profitable money markets managers, was set a bail of 1 million British pounds (1.34 million euros, $1.45 million). None of the others was ordered to pay more than 150,000.

The case is the latest legal effort to hold accountable dozens of bankers involved in a global rate-fixing scheme, which also involved the Euribor's British counterpart, the London Interbank Offered Rate (Libor). The benchmark rates are used to set terms for $450 trillion (414 trillion euros) in securities worldwide. Global investigations into the money-making scheme, which was first revealed in the wake of the 2008 financial crisis, have so far culminated in banks and brokerages paying some $9 billion in regulatory settlements, and more than 30 individuals being charged.

Proserpina

(2,352 posts)8. Shipping Said to Have Ceased… Is the Worldwide Economy Grinding to a Halt?

https://www.dollarvigilante.com/blog/2016/01/11/shipping-said-to-have-ceased-is-the-worldwide-economy-grinding-to-a-halt.html

Last week, I received news from a contact who is friends with one of the biggest billionaire shipping families in the world. He told me they had no ships at sea right now, because operating them meant running at a loss.

This weekend, reports are circulating saying much the same thing: The North Atlantic has little or no cargo ships traveling in its waters. Instead, they are anchored. Unmoving. Empty.

You can see one such report here. According to it,

Commerce between Europe and North America has literally come to a halt. For the first time in known history, not one cargo ship is in-transit in the North Atlantic between Europe and North America. All of them (hundreds) are either anchored offshore or in-port. NOTHING is moving.

This has never happened before. It is a horrific economic sign; proof that commerce is literally stopped.

This has never happened before. It is a horrific economic sign; proof that commerce is literally stopped.

We checked VesselFinder.com and it appears to show no ships in transit anywhere in the world. We aren’t experts on shipping, however, so if you have a better site or source to track this apparent phenomenon, please let us know.

We also checked MarineTraffic.com, and it seemed to show the same thing. Not a ship in transit…

If true, this would be catastrophic for world trade. Even if it’s not true, shipping is still nearly dead in the water according to other indices. The Baltic Dry Index, an assessment of the price of moving major raw materials by sea, was already at record all-time lows a month ago. In the last month it has dropped even more, especially in the last week. Factories aren’t buying and retailers aren’t stocking. The ratio of inventory to sales in the US is an indicator of this. The last time that ratio was this high was during the “great recession” in 2008.

Hey, Ms. Yellen, what recovery? The economy is taking on water at a rapid rate.

graphs and analysis at link

Proserpina

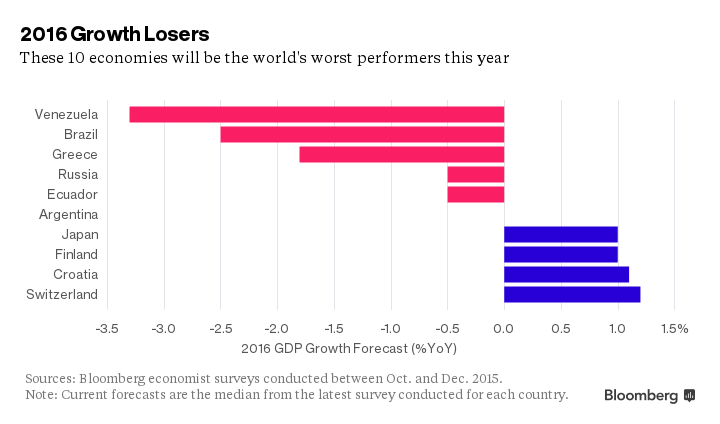

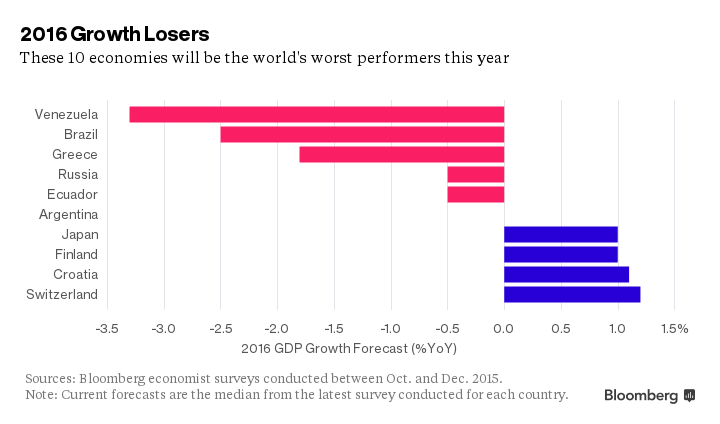

(2,352 posts)9. Meet 2016's Worst Economic Performers

http://www.bloomberg.com/news/articles/2016-01-11/meet-2016-s-worst-economic-performers-flirting-with-disaster

For the world's worst-performing economies, no good will come from New Year's resolutions to do better. For many, 2016 will only bring more disappointment, say economists surveyed by Bloomberg.

Oil-rich Venezuela will contract by 3.3 percent this year, the worst forecast of any of the 93 countries in our analysis, followed by junk-rated Brazil, debt-laden Greece and commodities-ravaged Russia.

Below are the bottom 10:

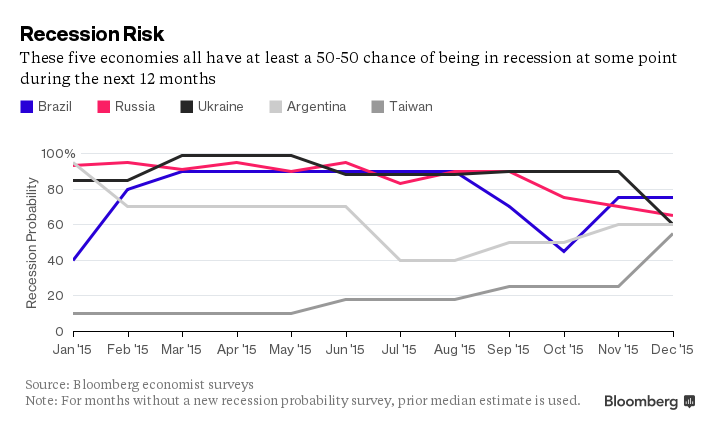

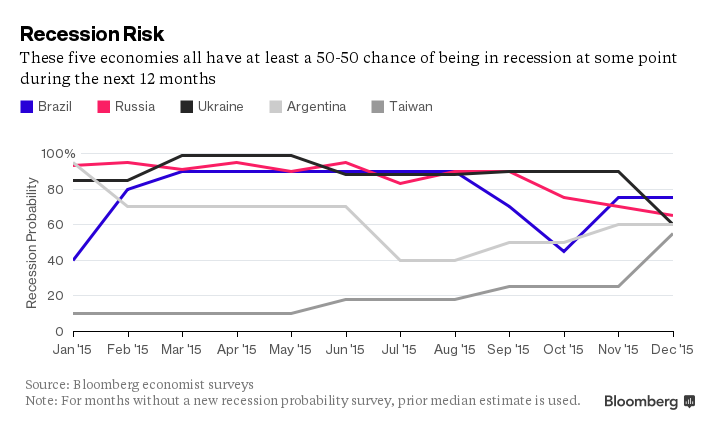

The Recession Club

The club no one wants to join has some surprises. Among the nations with a 50-50 chance of two quarters of contraction is Taiwan. Its annual growth rate slow dramatically from 4 percent in the first quarter of 2015 to minus 0.6 percent in the third quarter due to a slowdown in exports to China.

Even with expected growth this year of 1.2 percent, Ukraine, one of last year's worst performers, is still at risk. Economists rate its chance of recession over the next 12 months at 60 percent, the third-highest tied with Argentina.

more losers at link

For the world's worst-performing economies, no good will come from New Year's resolutions to do better. For many, 2016 will only bring more disappointment, say economists surveyed by Bloomberg.

Oil-rich Venezuela will contract by 3.3 percent this year, the worst forecast of any of the 93 countries in our analysis, followed by junk-rated Brazil, debt-laden Greece and commodities-ravaged Russia.

Below are the bottom 10:

The Recession Club

The club no one wants to join has some surprises. Among the nations with a 50-50 chance of two quarters of contraction is Taiwan. Its annual growth rate slow dramatically from 4 percent in the first quarter of 2015 to minus 0.6 percent in the third quarter due to a slowdown in exports to China.

Even with expected growth this year of 1.2 percent, Ukraine, one of last year's worst performers, is still at risk. Economists rate its chance of recession over the next 12 months at 60 percent, the third-highest tied with Argentina.

more losers at link

Proserpina

(2,352 posts)10. Stocks May Fall More - Then It'll Be Time to Buy, Goldman Says

But how much more?

http://www.bloomberg.com/news/articles/2016-01-12/stocks-may-fall-more-then-it-ll-be-time-to-buy-goldman-says

The China-led rout that is sending shock waves through global markets may get worse, and if it does, that’s when investors should turn back to equities, says Goldman Sachs Group Inc.’s Christian Mueller-Glissmann.

The stock strategist who works on portfolio strategy is neutral on global stocks -- and has been since August -- but he says any further drops would create opportunities to invest. He prefers European shares because they’re cheaper than U.S. ones, and the region’s companies have bright earnings-growth prospects, according to him...more

just remember, everything Goldman says in public is a lie...

http://www.bloomberg.com/news/articles/2016-01-12/stocks-may-fall-more-then-it-ll-be-time-to-buy-goldman-says

The China-led rout that is sending shock waves through global markets may get worse, and if it does, that’s when investors should turn back to equities, says Goldman Sachs Group Inc.’s Christian Mueller-Glissmann.

The stock strategist who works on portfolio strategy is neutral on global stocks -- and has been since August -- but he says any further drops would create opportunities to invest. He prefers European shares because they’re cheaper than U.S. ones, and the region’s companies have bright earnings-growth prospects, according to him...more

just remember, everything Goldman says in public is a lie...

Proserpina

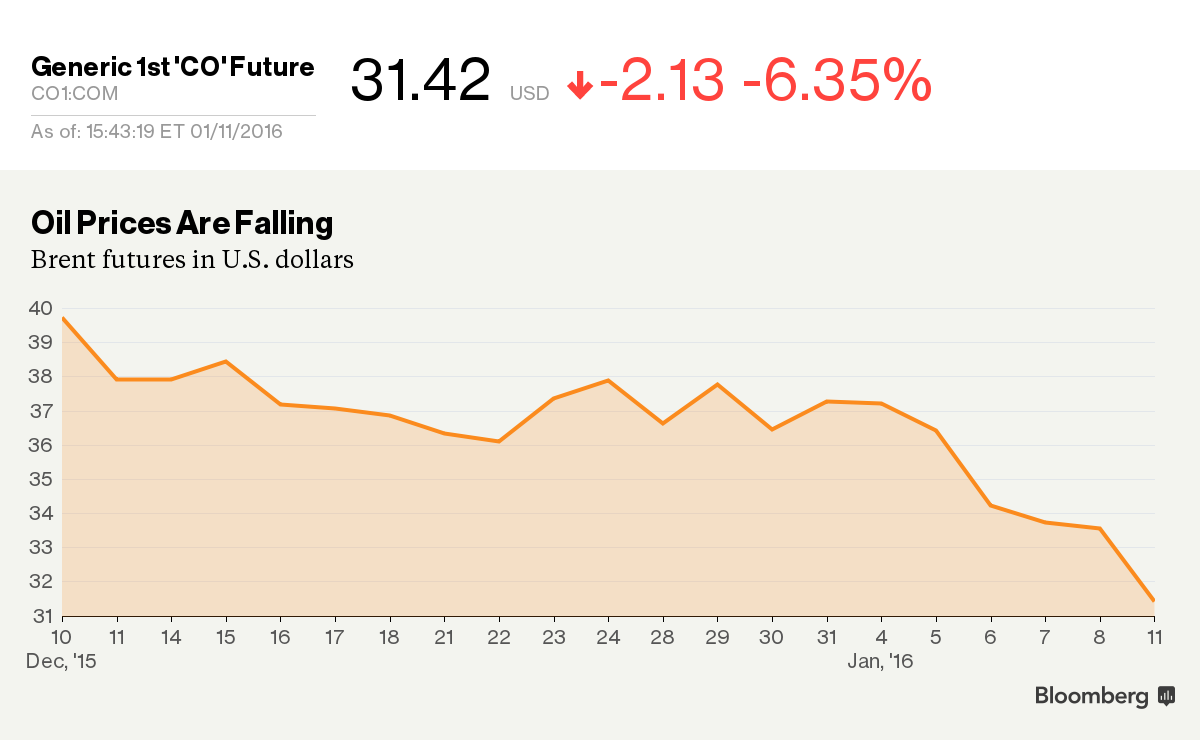

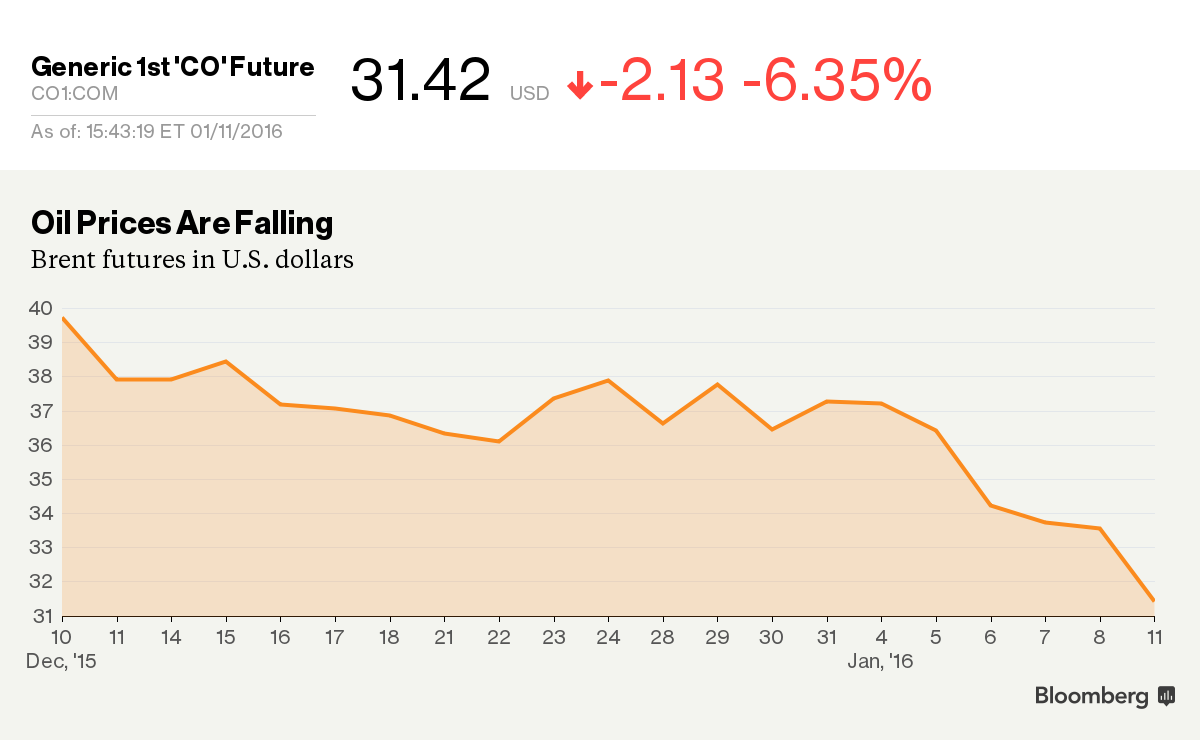

(2,352 posts)11. Monday Was a Wild Day for the Oil Market

http://www.bloomberg.com/news/articles/2016-01-11/today-was-a-wild-day-for-the-oil-market

Crude oil was getting slammed on Monday, with front-month contracts for Brent and West Texas Intermediate each down more than 6 percent at their lows for the day.

Meanwhile, Western Canadian Select, a heavier blend of crude, is trading at $16.32 per barrel.

A supply response to lower prices continues to be slow in coming, and there are signs that demand growth from China is poised to moderate in the year ahead, according to Barclays analysts.

The drop in oil prices has been accompanied by a fresh round of bearish commentary, with Morgan Stanley calling for prices to fall as low as $20 per barrel while Guggenheim sees crude reaching $25 per barrel...

more

Crude oil was getting slammed on Monday, with front-month contracts for Brent and West Texas Intermediate each down more than 6 percent at their lows for the day.

Meanwhile, Western Canadian Select, a heavier blend of crude, is trading at $16.32 per barrel.

A supply response to lower prices continues to be slow in coming, and there are signs that demand growth from China is poised to moderate in the year ahead, according to Barclays analysts.

The drop in oil prices has been accompanied by a fresh round of bearish commentary, with Morgan Stanley calling for prices to fall as low as $20 per barrel while Guggenheim sees crude reaching $25 per barrel...

more

Proserpina

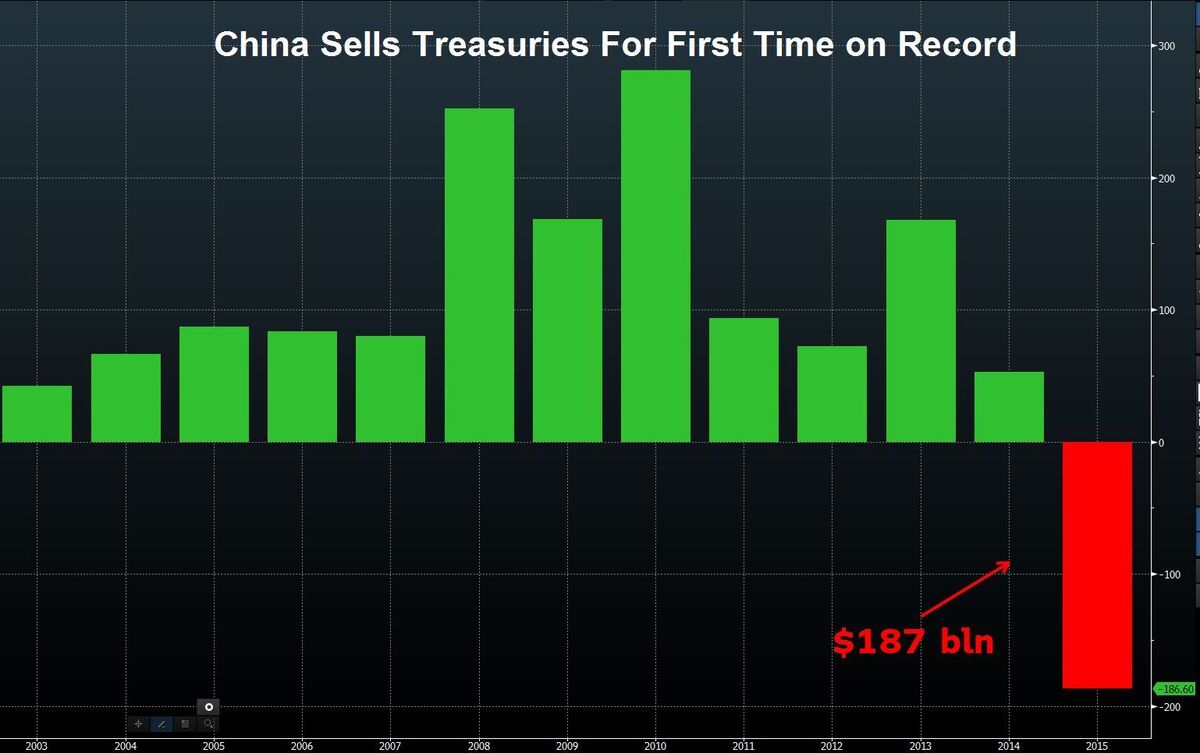

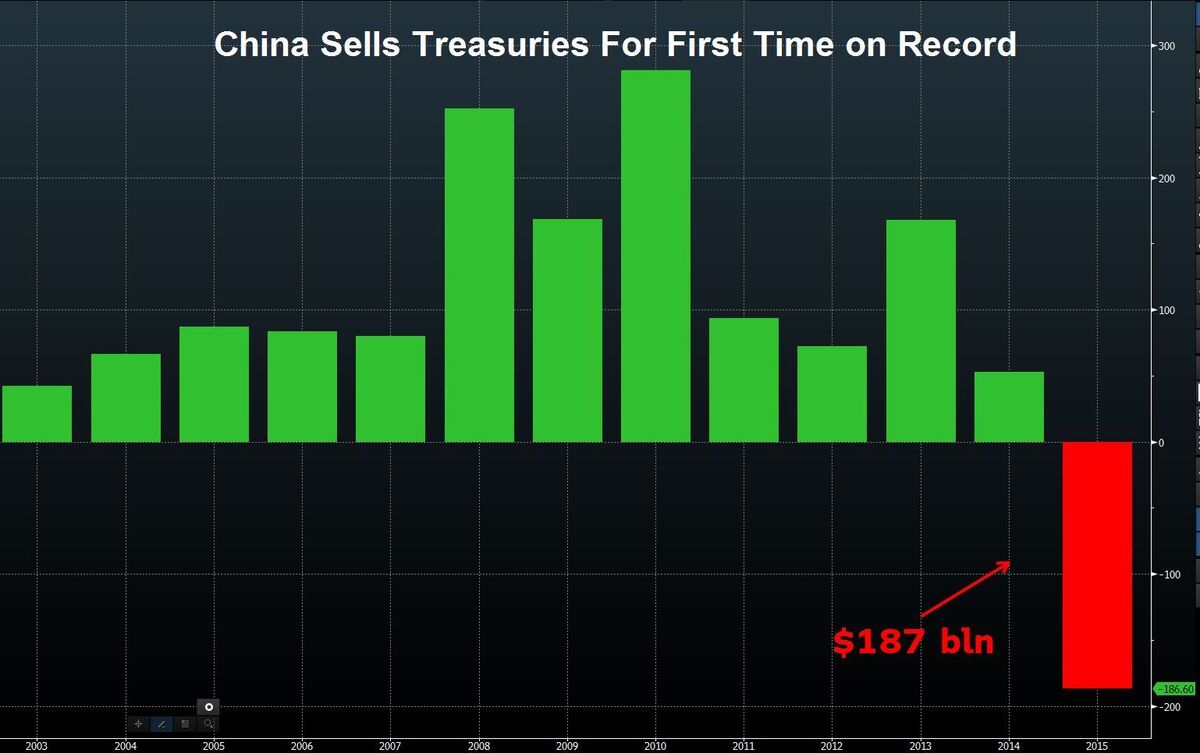

(2,352 posts)12. As China Dumps Treasuries, World Sees No Better Place for Refuge

We need an aphorism about people living in paper houses

http://www.bloomberg.com/news/articles/2016-01-10/china-retreat-from-u-s-bonds-prompts-shrugs-where-fear-reigned

It might be easy to conclude China’s unprecedented retreat from Treasuries is bad news for America.

After all, as the biggest overseas creditor to the U.S., China has bankrolled hundreds of billions of dollars in deficit spending, particularly since the financial crisis. And that voracious appetite for Treasuries in recent years has been key in keeping America’s funding costs in check, even as the market for U.S. government debt ballooned to a record $13.2 trillion.

Yet for many debt investors, there’s little reason for alarm.

While there’s no denying that China’s selling may dent demand for Treasuries in the near term, the fact the nation is raising hundreds of billions of dollars to support its flagging economy and stem capital flight is raising deeper questions about whether global growth itself is at risk. That’s likely to bolster the haven appeal of U.S. debt over the long haul, State Street Corp. and BlackRock Inc. say. Any let up in Chinese demand is being met with record buying by domestic mutual funds, which has helped to contain U.S. borrowing costs...

more

http://www.bloomberg.com/news/articles/2016-01-10/china-retreat-from-u-s-bonds-prompts-shrugs-where-fear-reigned

It might be easy to conclude China’s unprecedented retreat from Treasuries is bad news for America.

After all, as the biggest overseas creditor to the U.S., China has bankrolled hundreds of billions of dollars in deficit spending, particularly since the financial crisis. And that voracious appetite for Treasuries in recent years has been key in keeping America’s funding costs in check, even as the market for U.S. government debt ballooned to a record $13.2 trillion.

Yet for many debt investors, there’s little reason for alarm.

While there’s no denying that China’s selling may dent demand for Treasuries in the near term, the fact the nation is raising hundreds of billions of dollars to support its flagging economy and stem capital flight is raising deeper questions about whether global growth itself is at risk. That’s likely to bolster the haven appeal of U.S. debt over the long haul, State Street Corp. and BlackRock Inc. say. Any let up in Chinese demand is being met with record buying by domestic mutual funds, which has helped to contain U.S. borrowing costs...

more

Proserpina

(2,352 posts)13. The Crop Surplus is Bad News for America's Farms

http://www.bloomberg.com/news/articles/2016-01-12/farm-boom-fizzles-as-u-s-crop-surplus-expands-financial-strain

The American farm boom is all but over.

Farmland values are down from all-time highs. Global surpluses left corn and soybean prices below the cost of production. And the amount of agricultural debt relative to income ballooned to the highest in three decades, just as the Federal Reserve has begun raising interest rates for the first time since 2006.

While many growers remain profitable, the global commodity slump is increasing pressure on a Midwest economy that was largely shielded from the worst of the financial crisis by high crop prices and land values. Last year, farm income was the lowest since 2002. This year’s agriculture-trade surplus in the U.S. -- the world’s top exporter -- will be the smallest in a decade. At the same time, sales are dropping for the likes of tractor-maker Deere & Co. and seed supplier Monsanto Co.

With the prices of corn and soybeans, the nation’s biggest crops, down by more than half from records in 2012, net farm income probably tumbled in 2015 to a 13-year low of $55.9 billion, down 55 percent from a record $123.3 billion in 2013, the U.S. Department of Agriculture estimates. Debt is 6.6 times larger than net income, up from 3.8 a year earlier, and the ratio is the highest since 1984, when farm foreclosures were the highest since the Great Depression, government data show.

As surpluses keep prices low, demand for American farm exports is dropping as other countries boost output and the strong dollar makes competing supplies from Brazil to Ukraine cheaper for importers. With U.S. exports at a six-year low and imports up, the nation’s trade balance in agriculture will slump to $9.5 billion in 2016, down 78 percent from a record $43.1 billion in 2014, when shipments were the biggest ever, USDA data show.

more

The American farm boom is all but over.

Farmland values are down from all-time highs. Global surpluses left corn and soybean prices below the cost of production. And the amount of agricultural debt relative to income ballooned to the highest in three decades, just as the Federal Reserve has begun raising interest rates for the first time since 2006.

While many growers remain profitable, the global commodity slump is increasing pressure on a Midwest economy that was largely shielded from the worst of the financial crisis by high crop prices and land values. Last year, farm income was the lowest since 2002. This year’s agriculture-trade surplus in the U.S. -- the world’s top exporter -- will be the smallest in a decade. At the same time, sales are dropping for the likes of tractor-maker Deere & Co. and seed supplier Monsanto Co.

“The farm economy had a near-perfect five or six years,” built upon record U.S. demand for corn-based ethanol in fuel, surging food purchases in Asia and near-zero-percent interest rates that helped spur land investment, said Brent Gloy, an agricultural economist at Purdue University in West Lafayette, Indiana. With the oil slump eroding ethanol margins and a strong dollar eroding U.S. exports, the Fed’s decision last month to start raising borrowing costs “means there’s nothing left of the boom,” Gloy said.

With the prices of corn and soybeans, the nation’s biggest crops, down by more than half from records in 2012, net farm income probably tumbled in 2015 to a 13-year low of $55.9 billion, down 55 percent from a record $123.3 billion in 2013, the U.S. Department of Agriculture estimates. Debt is 6.6 times larger than net income, up from 3.8 a year earlier, and the ratio is the highest since 1984, when farm foreclosures were the highest since the Great Depression, government data show.

As surpluses keep prices low, demand for American farm exports is dropping as other countries boost output and the strong dollar makes competing supplies from Brazil to Ukraine cheaper for importers. With U.S. exports at a six-year low and imports up, the nation’s trade balance in agriculture will slump to $9.5 billion in 2016, down 78 percent from a record $43.1 billion in 2014, when shipments were the biggest ever, USDA data show.

more