Economy

Related: About this forumWeekend Economists: If I were a Rickman January 22-24, 2016

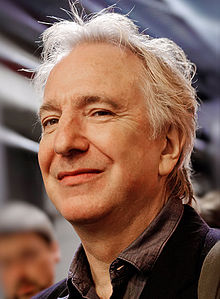

What can one say about Alan Rickman? He was an actor for all seasons: Comedy, Tragedy, Horror, Thriller...villain, hero, sidekick or heart-throb....he did them all with wit and skill and humor.

Alan Sidney Patrick Rickman (21 February 1946 – 14 January 2016) was an English actor and director, known for playing a variety of roles on stage and screen, often as a complex antagonist. Rickman trained at the Royal Academy of Dramatic Art in London, and was a member of the Royal Shakespeare Company, performing in modern and classical theatre productions. His first big television part came in 1982, but his big break was as the Vicomte de Valmont in the stage production of Les Liaisons Dangereuses in 1985, for which he was nominated for a Tony Award. Rickman gained wider notice for his film performances as Hans Gruber in Die Hard and Severus Snape in the Harry Potter film series.

Rickman's other film roles included the Sheriff of Nottingham in Robin Hood: Prince of Thieves, for which he received the BAFTA Award for Best Actor in a Supporting Role, Jamie in Truly, Madly, Deeply, Colonel Brandon in Ang Lee's Sense and Sensibility, the title character in Rasputin: Dark Servant of Destiny, which won him a Golden Globe, an Emmy and a Screen Actors Guild Award, Harry in Love Actually, P. L. O'Hara in An Awfully Big Adventure, Alexander Dane in Galaxy Quest and Judge Turpin in the film adaptation of Stephen Sondheim's musical of Sweeney Todd: The Demon Barber of Fleet Street.

Rickman died of pancreatic cancer on 14 January 2016 at the age of 69. His final film role, is as the voice of Absolem in Alice Through the Looking Glass, which will be released in May 2016

https://en.wikipedia.org/wiki/Alan_Rickman

I apologise...I started this in the Bernie Sanders group by accident...I will be moving it over and deleting from there....I was really tired! The city inspector failed my new furnace, so the heating guy had to come twiddle with it....it took hours. he's not 100% sure yet, so I await a final decision on Monday. Still, it's nice to have a furnace that works, and doesn't roar like a 747 at takeoff.

Proserpina

(2,352 posts)Rickman was born in Acton, London, to a working-class family, the son of Margaret Doreen Rose (Bartlett), a housewife, and Bernard Rickman, a factory worker. His ancestry was English, Irish and Welsh; his father was Catholic and his mother a Methodist. His family included an older brother, David (b. 1944), a graphic designer; a younger brother, Michael (b. 1947), a tennis coach; and a younger sister, Sheila (b. 1950). Rickman attended Derwentwater Primary School in Acton, a school that followed the Montessori method of education.

When he was eight years old, Rickman's father died, leaving his mother to raise him and his three siblings mostly alone. She married again, but divorced his stepfather after three years. "There was one love in her life", Rickman later said of her.

He excelled at calligraphy and watercolour painting. He attended Derwentwater Junior School, and then Latymer Upper School in London through the Direct Grant system, where he became involved in drama. After leaving Latymer, he attended Chelsea College of Art and Design and then the Royal College of Art. This education allowed him to work as a graphic designer for the Notting Hill Herald, which Rickman considered a more stable occupation than acting. "Drama school wasn't considered the sensible thing to do at 18".

After graduation, Rickman and several friends opened a graphic design studio called Graphiti, but after three years of successful business, he decided that if he was going to pursue acting professionally, it was now or never. He wrote to request an audition with the Royal Academy of Dramatic Art (RADA), which he attended from 1972 until 1974. While there, he studied Shakespeare and supported himself by working as a dresser for Sir Nigel Hawthorne and Sir Ralph Richardson.

Proserpina

(2,352 posts)After graduating from RADA, Rickman worked extensively with British repertory and experimental theatre groups in productions including Chekhov's The Seagull and Snoo Wilson's The Grass Widow at the Royal Court Theatre, and appeared three times at the Edinburgh International Festival. In 1978, he performed with the Court Drama Group, gaining parts in Romeo and Juliet and A View from the Bridge, among other plays. While working with the Royal Shakespeare Company (RSC) he was cast in As You Like It. He appeared in the BBC's adaptation of Trollope's first two Barchester novels known as The Barchester Chronicles (1982), as the Reverend Obadiah Slope.

He was given the male lead, the Vicomte de Valmont, in the 1985 Royal Shakespeare Company production of Christopher Hampton's adaptation of Les Liaisons Dangereuses, directed by Howard Davies. After the RSC production transferred to Broadway in 1987, Rickman received both a Tony Award nomination and a Drama Desk Award nomination for his performance.

Rickman's career was filled with a wide variety of roles. He played romantic leads like Colonel Brandon in Sense and Sensibility (1995) and Jamie in Truly, Madly, Deeply (1991); numerous villains in Hollywood big-budget films, like German terrorist Hans Gruber in Die Hard (1988) and the Sheriff of Nottingham in Robin Hood: Prince of Thieves (1991); and the occasional television role such as the "mad monk" Rasputin in the HBO biopic Rasputin: Dark Servant of Destiny (1996), for which he won a Golden Globe and an Emmy.

His role as Hans Gruber in Die Hard earned him a spot on the AFI's 100 Years...100 Heroes & Villains list as the 46th best villain in film history, though he revealed he almost did not take the role as he did not think Die Hard was the kind of film he wanted to make. His performance as the Sheriff of Nottingham in Robin Hood: Prince of Thieves also earned him praise as one of the best actors to portray a villain in films.

Rickman took issue with being typecast as a villain, even though he was known for playing "unsympathetic characters". His portrayal of Severus Snape, the potions master in the Harry Potter series (2001–11), was dark, but the character's motivations were not clear early on. During his career Rickman played comedic roles, including as Sir Alexander Dane/Dr. Lazarus in the science fiction parody Galaxy Quest (1999), portraying the angel Metatron, the voice of God, in Dogma (also 1999), appearing as Emma Thompson's foolish husband Harry in the British Christmas-themed romantic comedy Love Actually (2003), providing the voice of Marvin the Paranoid Android in The Hitchhiker's Guide to the Galaxy (2005) and the egotistical, Nobel Prize-winning father in Nobel Son (2007).

Rickman was nominated for an Emmy for his work as Dr. Alfred Blalock in HBO's Something the Lord Made (2004). He also starred in the independent film Snow Cake (2006) with Sigourney Weaver and Carrie-Anne Moss, which had its debut at the Berlin International Film Festival, and Perfume: The Story of a Murderer (also 2006), directed by Tom Tykwer. Rickman appeared as the evil Judge Turpin in the critically acclaimed Tim Burton film Sweeney Todd: The Demon Barber of Fleet Street (2007) alongside Harry Potter co-stars Helena Bonham Carter and Timothy Spall. Rickman provided the voice of Absolem the Caterpillar in Burton's film Alice in Wonderland (2010).

He performed onstage in Noël Coward's romantic comedy Private Lives, which transferred to Broadway after its successful run in London at the Albery Theatre and ended in September 2002; he reunited with his Les Liaisons Dangereuses co-star Lindsay Duncan and director Howard Davies in the Tony Award-winning production. His previous stage performance was in Antony and Cleopatra in 1998 as Mark Antony with Helen Mirren as Cleopatra, in the Royal National Theatre's production at the Olivier Theatre in London, which ran from 20 October to 3 December 1998. Rickman appeared in Victoria Wood with All The Trimmings (2000), a Christmas special with Victoria Wood, playing an aged colonel in the battle of Waterloo who is forced to break off his engagement to Honeysuckle Weeks' character.

Rickman also directed The Winter Guest at London's Almeida Theatre in 1995 and the film version of the same play, released in 1997, starring Emma Thompson and her real-life mother Phyllida Law. With Katharine Viner he compiled the play My Name Is Rachel Corrie, and directed the premiere production at the Royal Court Theatre, which opened in April 2005. He won the Theatre Goers' Choice Awards for Best Director. Rickman befriended the Corrie family and earned their trust, and the show was warmly received in London in 2005. But the next year, its original New York production was "postponed" over the possibility of boycotts and protests from those who saw it as "anti-Israeli agit-prop". Rickman denounced "censorship born out of fear". Tony Kushner, Harold Pinter and Vanessa Redgrave, among others, criticised the decision to indefinitely delay the show. The one-woman play was put on later that year at another theatre to mixed reviews, and has since been staged at venues around the world.

In 2009, Rickman was awarded the James Joyce Award by University College Dublin's Literary and Historical Society. In October and November 2010, Rickman starred in the eponymous role in Henrik Ibsen's John Gabriel Borkman at the Abbey Theatre, Dublin alongside Lindsay Duncan and Fiona Shaw. The Irish Independent called Rickman's performance breathtaking.

Rickman again appeared as Severus Snape in the final instalment in the Harry Potter series, Harry Potter and the Deathly Hallows – Part 2 (2011). Throughout the series, his portrayal of Snape garnered widespread critical acclaim. Kenneth Turan of the Los Angeles Times said Rickman "as always, makes the most lasting impression," while Peter Travers of Rolling Stone magazine called Rickman "sublime at giving us a glimpse at last into the secret nurturing heart that ... Snape masks with a sneer."

Media coverage characterised Rickman's performance as worthy of nomination for an Academy Award for Best Supporting Actor. His first award nominations for his role as Snape came at the 2011 Alliance of Women Film Journalists Awards, 2011 Saturn Awards, 2011 Scream Awards and 2011 St. Louis Gateway Film Critics Association Awards in the Best Supporting Actor category.

On 21 November 2011, Rickman opened in Seminar, a new play by Theresa Rebeck, at the John Golden Theatre on Broadway. Rickman, who left the production on 1 April, won the Broadway.com Audience Choice Award for Favorite Actor in a Play and was nominated for a Drama League Award.

Rickman starred with Colin Firth and Cameron Diaz in Gambit (2012) by Michael Hoffman, a remake of the 1966 film. In 2013, he played Hilly Kristal, the founder of the East Village punk-rock club CBGB, in the CBGB film with Rupert Grint.

Proserpina

(2,352 posts)

Proserpina

(2,352 posts)Proserpina

(2,352 posts)Rickman was chosen by Empire as one of the 100 Sexiest Stars in film history (No. 34) in 1995 and ranked No. 59 in Empire's "The Top 100 Movie Stars of All Time" list in October 1997. In 2009 and 2010 Rickman ranked once again as one of the 100 Sexiest Stars by Empire, both times placing No. 8 out of the 50 actors chosen. Rickman was elected to the Council of the Royal Academy of Dramatic Art (RADA) in 1993; he was subsequently RADA's Vice-Chairman and a member of its Artistic Advisory and Training committees and Development Board.

He was voted No. 19 in Empire magazine's Greatest Living Movie Stars over the age of 50 and was twice nominated for Broadway's Tony Award as Best Actor (Play): in 1987 for Les Liaisons Dangereuses, and in 2002 for a revival of Noël Coward's Private Lives. The Guardian named Rickman as an "honourable mention" in a list of the best actors never to have received an Academy Award nomination.

Two researchers, a linguist and a sound engineer, found "the perfect male voice" to be a combination of Rickman's and Jeremy Irons's voices based on a sample of 50 voices.

Rickman featured in several musical works, including a song composed by Adam Leonard entitled "Not Alan Rickman". The actor played a "Master of Ceremonies" part, announcing the various instruments in Mike Oldfield's Tubular Bells II (1992) on the track "The Bell". Rickman was one of the many artists who recited Shakespearian sonnets on the album When Love Speaks (2002), and is also featured prominently in a music video by Texas entitled "In Demand", which premiered on Europe MTV in August 2000.

Proserpina

(2,352 posts)In 1965, at the age of 19, Rickman met 18-year-old Rima Horton, who became his first girlfriend and would later be a Labour Party councillor on the Kensington and Chelsea London Borough Council (1986–2006) and an economics lecturer at the nearby Kingston University. They lived together from 1977 until his death. In 2015, Rickman confirmed that they had married in a private ceremony in New York City in 2012.

He was an active patron of the research foundation Saving Faces; and honorary president of the International Performers' Aid Trust, a charity that works to fight poverty amongst performing artists all over the world. When discussing politics, Rickman said he "was born a card-carrying member of the Labour Party".

Rickman was the godfather of fellow actor Tom Burke.

In August 2015, Rickman suffered a minor stroke, which led to the diagnosis of pancreatic cancer. He concealed the fact that he was terminally ill from all but his closest confidants. On 14 January 2016, Rickman died in a London hospital, surrounded by friends and relatives. Soon after, his fans created a memorial underneath the "Platform 9¾" sign at London King's Cross railway station.

Tributes from Rickman's co-stars and contemporaries appeared on social media following the announcement; since his cancer was not publicly known, some—like Ralph Fiennes, who "cannot believe he is gone", and Jason Isaacs, who was "sidestepped by the awful news"—expressed their surprise. Harry Potter creator J. K. Rowling called Rickman "a magnificent actor and a wonderful man". Emma Watson wrote, "I feel so lucky to have worked and spent time with such a special man and actor. I'll really miss our conversations". Daniel Radcliffe appreciated his loyalty and support. "I'm pretty sure he came and saw everything I ever did on stage both in London and New York. He didn't have to do that". Evanna Lynch said it was scary to bump into Rickman in character as Snape, but "he was so kind and generous in the moments he wasn't Snaping about". Rupert Grint said, "even though he has gone I will always hear his voice".

Kate Winslet, who gave a tearful tribute at the London Film Critics' Circle Awards, remembered Rickman as warm and generous. "And that voice! Oh, that voice." Dame Helen Mirren said his voice "could suggest honey or a hidden stiletto blade." Emma Thompson remembered "the intransigence which made him the great artist he was—his ineffable and cynical wit, the clarity with which he saw most things, including me ... I learned a lot from him." Colin Firth told The Hollywood Reporter that, as an actor, Rickman had been a mentor. John McTiernan, director of Die Hard, said Rickman was the antithesis of the villainous roles for which he was most famous on screen. Sir Ian McKellen wrote, "behind Rickman's mournful face, which was just as beautiful when wracked with mirth, there was a super-active spirit, questing and achieving, a super-hero, unassuming but deadly effective."

Proserpina

(2,352 posts)Year Title Role Notes

1978 Romeo and Juliet Tybalt BBC Television Shakespeare

1980 Thérèse Raquin Vidal BBC serial

1980 Shelley Clive Episode No. 1.7

1982 Busted Simon BBC TV film

1982 Smiley's People Mr Brownlow Episode No. 1.2

1982 The Barchester Chronicles The Revd Obadiah Slope BBC serial

1985 Summer Season Croop BBC TV series

1985 Girls on Top Dimitri / Voice of RADA CIT TV series

1988 Die Hard Hans Gruber

1989 Revolutionary Witness Jacques Roux BBC TV short

1989 The January Man Ed, the painter

1989 Screenplay Israel Yates BBC TV series

1990 Quigley Down Under Elliot Marston

1991 Truly, Madly, Deeply Jamie

1991 Robin Hood: Prince of Thieves Sheriff of Nottingham

1991 Close My Eyes Sinclair Bryant

1991 Closet Land The Interrogator

1992 Bob Roberts Lukas Hart III

1993 Fallen Angels Dwight Billings TV series

1994 Mesmer Franz Mesmer

1995 An Awfully Big Adventure P.L. O'Hara

1995 Sense and Sensibility Colonel Brandon

1996 Rasputin: Dark Servant of Destiny Grigori Rasputin

1996 Michael Collins Éamon de Valera

1996 Castle Ghosts of Ireland Tyde Documentary

1997 The Winter Guest Man in street (uncredited) Also director and co-writer

1998 Judas Kiss Detective David Friedman

1998 Dark Harbor David Weinberg

1999 Dogma The Metatron

1999 Galaxy Quest Alexander Dane/Dr Lazarus

2000 Help! I'm a Fish Joe (voice)

2001 Play Man

2001 Blow Dry Phil Allen

2001 Land of the Mammoth Cro Magnon hunter Documentary

2001 The Search for John Gissing John Gissing

2001 Harry Potter and the Philosopher's Stone Severus Snape Also released as Harry Potter and the Sorcerer's Stone

2002 Harry Potter and the Chamber of Secrets Severus Snape

2002 King of the Hill King Philip (voice) Episode: "Joust Like a Woman"

2003 Love Actually Harry

2004 Something the Lord Made Dr Alfred Blalock

2004 Harry Potter and the Prisoner of Azkaban Severus Snape

2005 Harry Potter and the Goblet of Fire Severus Snape

2005 The Hitchhiker's Guide to the Galaxy Marvin the Paranoid Android (voice)

2006 Perfume: The Story of a Murderer Antoine Richis

2006 Snow Cake Alex Hughes

2007 Nobel Son Eli Michaelson

2007 Harry Potter and the Order of the Phoenix Severus Snape

2007 Sweeney Todd: The Demon Barber of Fleet Street Judge Turpin

2008 Bottle Shock Steven Spurrier

2009 Harry Potter and the Half-Blood Prince Severus Snape

2010 Alice in Wonderland Absolem the Caterpillar (voice)

2010 Harry Potter and the Deathly Hallows – Part 1 Severus Snape

2010 The Wildest Dream Noel Odell (voice) National Geographic documentary

2010 The Song of Lunch He BBC Drama Production

2011 Harry Potter and the Deathly Hallows – Part 2 Severus Snape

2011 The Boy in the Bubble Narrator Animated short film

2011 Back at the Barnyard General Alien Episode: "Aliens"

2012 Gambit Lord Shahbandar

2013 The Butler Ronald Reagan

2013 A Promise Karl Hoffmeister

2013 CBGB Hilly Kristal

2013 Dust Todd

2015 A Little Chaos King Louis XIV Also director and co-writer

2015 Eye in the Sky Lieutenant General Frank Benson Theatrical release: 8 April 2016

2016 Alice Through the Looking Glass Absolem the Caterpillar (voice) Theatrical release: 27 May 2016 (posthumous)

Proserpina

(2,352 posts)http://www.militarytimes.com/story/military/2016/01/21/us-troops-take-over-airbase-syria-local-reports-say/79115490/

U.S. special operations troops have reportedly taken over an airfield in northeastern Syria, potentially clearing the way to flow more American military support to friendly militias fighting the Islamic State group.

A small team of U.S. troops is setting up a base camp at Rmeilan Air Base in the Syrian Kurdish region near Syria's Iraqi and Turkish borders, according to local reports.

American helicopters operated at the base over the past couple of weeks as local workers expanded the runway, according to the Syrian Observatory for Human Rights.

The airfield was until recently under control of the Syrian Kurdish forces, known as the YPG, but was turned over to the U.S. to help expand American support for the Syrian Democratic Forces, which is the loose-knit coalition of American-backed militants fighting the Islamic State group.

"Under a deal with the YPG, the U.S. was given control of the airport. The purpose of this deal is to back up the SDF, by providing weapons and an air base for U.S. warplanes," an SDF spokesperson, Taj Kordsh, told Al-Jazeera, the Qatar-based international news network, in a report published Wednesday.

boots on the ground, folks

Proserpina

(2,352 posts)http://www.informationclearinghouse.info/article44017.htm

A British governmental inquiry has concluded that Russian President Putin “probably approved” the killing of Alexander Litvinenko by polonium poisoning. http://www.informationclearinghouse.info/article44002.htm

As no evidence is provided for the surmise, we can conclude that this report on an unresolved event that happened a decade ago is part of the lies being used by the West to demonize Putin, just as the lies about MH-17 and “the Russian invasion of Ukraine.”...Litvinenko’s brother and father say that they “are sure that the Russian authorities are not involved. It’s all a set-up to put pressure on the Russian government.” Maksim Litvinenko dismisses the British report as a smear on Putin.

And that is what it is.

“Our” government not only lies to us about the economy and the wars, it also lies about literally everything. For example, do you remember the Rwanda genocide? The story we were told is the exact opposite of the truth. Today the perpetrator of the genocide, Paul Kagame, is the President of Rwanda. Western governments and media have covered up his crimes and praise him as a great humanitarian who has healed Rwanda and is totally supported by the people. The truth is that Kagame has proved himself a worse totalitarian that Hitler, Stalin, and Poll Pot combined. He has turned Rwanda into a fear-ridden psychological prison. Anjan Sundaram, a journalist who ran a journalism training school in Rwanda, describes in detail Kagame’s destruction of all truth and all independent thought in Rwanda. In his just published book by Doubleday, Bad News: Last Journalists In A Dictatorship, Sundaram gives the gruesome details of how Rwandans, with the complicity of the West, have been brought more psychologically under control than Winston Smith in George Orwell’s 1984. Kagame used murder, fear, and bribes and purges of his own supporters in order to eliminate all expression of independent thought in Rwanda. Indeed, in Rwanda the individual has disappeared. People have been merged into the state. Sundaram reports his conversation with a Rwandan who is being reconstructed along the lines of Winston Smith. This person tells Sundaram: “In this kind of country we don’t know where the state ends and where we begin. And if I don’t know where I begin I’m worth nothing. I don’t have any rights. We are not individuals, we are agents of the state.”

None of the totalitarianisms that the West ranted against during the 20th century ever got this far. There was resistance everywhere. Hitler’s own top generals plotted against him. In the Soviet Union and Mao’s China, there were dissidents, including highly placed members of the Communist Party. But in Rwanda even the concept of opposition has been erased. Reading Bad News brings to mind parallels to the US. In Rwanda sentences result not from law but from “the word of authority. Simple words had attained such power.” This reminds us of simple words from the US president that result in indefinite detention and assassination of US citizens without trials and conviction. The subservience of Western journalism has been obtained by the state similar to the suppression of independent journalism in Rwanda. Bribes are used, both monetary and access. Fear of being fired and rendered unemployable as a journalist is used. Occasionally, perhaps even murder is used as in the unresolved case of the US journalist whose car suddenly accelerated and crashed at high speed. Other American journalists have been threatened with prison sentences.

The disturbing fact that the Anglo-Zionist Empire has supported Kagame, a genocidist who “has killed more than five times as many people as Idi Amin,” is perhps an indication of what the Anglo-Zionist Empire has in mind for the rest of us.

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts' latest books are The Failure of Laissez Faire Capitalism and Economic Dissolution of the West, How America Was Lost, and The Neoconservative Threat to World Order.

Proserpina

(2,352 posts)http://sputniknews.com/columnists/20160121/1033486596/secret-behind-next-global-crash.html

The World Economic Forum in Davos is submerged by a tsunami of denials, and even non-denial denials, stating there won’t be a follow-up to the Crash of 2008. Yet there will be. And the stage is already set for it.

Selected Persian Gulf traders, and that includes Westerners working in the Gulf confirm that Saudi Arabia is unloading at least $1 trillion in securities and crashing global markets under orders from the Masters of the Universe – those above the lame presidency of Barack Obama. Those were the days when the House of Saud would as much as flirt with such an idea to have all their assets frozen. Yet now they are acting under orders. And more is to come; according to crack Persian Gulf traders Saudi Western security investments may amount to as much as $8 trillion, and Abu Dhabi’s as $4 trillion. In Abu Dhabi everything was broken into compartments, so no one could figure it out, except brokers and traders who would know each supervisor of a compartment of investments. And for the House of Saud, predictably, denial is an iron rule.

This massive securities dump has been occasionally (noted in) corporate media, http://www.bloomberg.com/news/articles/2015-09-28/saudi-arabia-has-withdrawn-billions-from-markets-estimates-show

but the figures are grossly underestimated. The full information simply won’t filter because the Masters of the Universe have vetoed it. There has been a huge increase in the Saudi and Abu Dhabi dump since the start of 2016. A Persian Gulf source says the Saudi strategy “will demolish the markets.” Another referred to a case of “maggots eating the carcass in the dark”; one just had to look at the rout in Wall Street, across Europe and in Hong Kong and Tokyo on Wednesday.

So it’s already happening. And a crucial subplot may be, in the short to medium term, no less than the collapse of the eurozone.

The Crash of 2016?

So a case could be made of a panicked House of Saud being instrumentalized to crash a great deal of the global economy. Cui bono? Moscow and Tehran are very much on (target for) it. The logic behind crashing markets, creating a recession and a depression – from the point of view of the Masters of the Universe above the lame duck President of the United States — is to engineer a major slow down, cripple buying patterns, decrease oil and natural gas consumption, and point Russia on a road to ruin. Besides, the ultra low oil price also translates into a sort of ersatz sanction on Iran.

Still, Iranian oil about to reach the market will be around an extra 500,000 barrels a day by mid-year, plus a surplus stored in tankers in the Persian Gulf. This oil can and will be absorbed, as demand is rising (in the US, for instance, by 1.9 million barrels a day in 2015) while supply is falling. Surging demand and falling production will reverse the oil crash by July. Moreover, China’s oil imports recently surged 9.3% at 7.85 million barrels a day, discrediting the hegemonic narrative of a collapse of China's economy – or of China being responsible for the current market blues. So, as I outlined here, oil should turn around soon. Goldman Sachs concurs. That gives the Masters of the Universe a short window of opportunity enabling the Saudis to dump massive amounts of securities in the markets.

The House of Saud may need the money badly, considering their budget on red alert. But dumping their securities is also clearly self-destructive. They simply cannot sell $8 trillion. The House of Saud is actually destroying the balance of their wealth. As much as Western hagiography tries to paint Riyadh as a responsible player, the fact is scores of Saudi princes are horrified at the destruction of the wealth of the kingdom through this slow motion harakiri.

Would there be a Plan B? Yes. Warrior prince Mohammed bin Sultan – who’s actually running the show in Riyadh – should be on the first flight to Moscow to engineer a common strategy. Yet that won’t happen. And as far as China – Saudi Arabia’s top oil importer — is concerned, Xi Jinping has just been to Riyadh; Aramco and Sinopec signed a strategic partnership; but the strategic partnership that really matters, considering the future of One Belt, One Road, is actually Beijing-Tehran. The massive Saudi dumping of securities ties in with the Saudi oil price war. In the current, extremely volatile situation oil is down, stocks are down and oil stocks are down. Still the House of Saud has not understood that the Masters of the Universe are getting them to destroy themselves many times over, including flooding the oil market with their shut-in capacity. And all that to fatally wound Russia, Iran and… Saudi Arabia itself.

Only a Pawn in Their Game

Meanwhile, Riyadh is rife with rumors there will be a coup against King Salman – virtually demented and confined to a room in his palace in Riyadh. There are two possible scenarios in play:

1) King Salman, 80, abdicates in favor of his son, notorious arrogant/ignorant troublemaker Warrior Prince Mohammed bin Salman, 30, currently deputy crown prince and defense minister and the second in the line of succession but de facto running the show in Riyadh. This could happen anytime soon. As an extra bonus, current Oil Minister Ali al-Naimi, not a royal, would be replaced by Abdulaziz bin Salman, another son of the king.

2) A palace coup. Salman – and his troublemaker son – are out of the picture, replaced by Ahmed bin Abdulaziz (who was a previous Minister of the Interior), or Prince Mohammed bin Nayef (the current Minister of the Interior and Crown Prince.)

Whatever scenario prevails, the British MI6 is intimately aware of the whole pantomime. And the German BND might be. Everyone remembers the BND memo at the end of 2015 that depicted Deputy Crown Prince Mohammed bin Salman as a “political gambler” who is destabilizing the Arab world through proxy wars in Yemen and Syria. Saudi sources — for obvious reasons insisting on anonymity — stress that as much as 80% of the House of Saud favors a coup. Yet the question is whether a House reshuffle would change their slow motion hara-kiri. The categorical imperative remains; the Masters of the Universe are ready to bring the whole world down in a major recession basically to strangle Russia. The House of Saud is just a pawn in this vicious game.

Proserpina

(2,352 posts)Saudi Arabia has withdrawn as much as $70 billion from global asset managers as OPEC’s largest oil producer seeks to plug its budget deficit, according to financial services market intelligence company Insight Discovery.

"Fund managers we’ve spoken to estimate SAMA has pulled out between $50 billion to $70 billion from global asset managers over the past six months," Nigel Sillitoe, chief executive officer of the Dubai-based firm, said by telephone Monday. "Saudi Arabia is withdrawing funds because it’s trying to cut its widening deficit and it’s financing the war in Yemen," he said, declining to name the fund managers.

Saudi Arabia is seeking to halt the erosion of its finances after oil prices halved in the past year. The Saudi Arabian Monetary Authority’s reserves held in foreign securities have fallen about 10 percent from a peak of $737 billion in August 2014, to $661 billion in July, according to central bank data. The government is accelerating bond sales to help sustain spending.

"Foreign-exchange reserve depletion, rather than accumulation, is the new reality for Saudi Arabia," Jason Tuvey, Middle East economist at Capital Economics, said in an e-mailed note Monday. "None of this should come as much surprise," given the current-account deficit and risk of capital flight, he said.

Saudi Arabia’s attempts to bolster its fiscal position contrast with smaller and less-populated nations in the Arabian peninsular such as Qatar. The world’s richest nation on a per capita basis plans to channel about $35 billion of investment into the U.S. over the next five years as it seeks to move away from European deals. That’s on top of plans to set up a $10 billion investment venture with China’s Citic Group.

With income from oil accounting for about 80 percent of revenue, Saudi Arabia’s budget deficit may widen to 20 percent of gross domestic product this year, according to the International Monetary Fund. SAMA plans to raise between 90 billion riyals ($24 billion) and 100 billion riyals in bonds before the end of the year as it seeks to diversify its $752 billion economy, people familiar with the matter said in August...

westerebus

(2,976 posts)Saudi's major competitor is Russia in the oil market, Iran has been a non factor for decades.

Sponsors of the great Jihad, had Russia (USSR at the time) as priority one in the Af-Pak war for a decade under the Carter-Reagan enemy of my enemy plan.

Number one arms supplier to Iran, Russia during the Iraq-Iran war. Intended to end Iran as a major player in the Middle East.

Having expanded the jihadist networks, The Caucasian Wars on Russia's borders enter the heartland of Russia.

The same KGB/FSB intelligence agencies are actively open in the Russian leadership.

US intervention into the Gulf opposing Iran goes no where. Sanctions on Iran tighten.

The Iraqi army invades Kuwait and its army is crushed. UN sanctions on oil sales and arms embargo. Saudi confirmed in its plan going forward.

9-11. US Saudi pretext in place to demilitarize Iraq.

Mission accomplished.

Russia draws the line in Ukraine. Sanctions by the US and needed investment into Russian economy leaves. The Ruble collapses.

Saudi pumps the market full with oil and depresses the price for producers world wide, before Iran signs on to accords to end its nuclear program.

Syria is in a no win war. The one Arab state most important in the US Israeli Saudi relationship is intact. Egypt.

Why is anyone surprised?

Controlled deceleration. Deflation. Under performance in world wide GDP. Migration by conflict.

Shift from fossil fuels. Climate change. Depletion of potable water resulting in forced migration. Expanding population rates in arid lands.

Little Johnny can't read, can he?

One more Virgina class nuclear submarine will make us all safer.

Hotler

(11,416 posts)to buy some oil stocks and sell them when the bounce in or around July happens. Make some quick money and get out.

Not a bad idea...

Don't risk what you can't afford to lose though.

Proserpina

(2,352 posts)http://www.counterpunch.org/2016/01/22/could-this-be-the-big-one/

Everyone take a deep breath. This isn’t 2007 again. The banks aren’t loaded with $10 trillion in “toxic” mortgage-backed securities, the housing market hasn’t fallen off a cliff wiping out $8 trillion in home equity, and the world is not on the brink of another excruciating financial meltdown. The reason the markets have been gyrating so furiously for the last couple weeks is because stocks are vastly overpriced, corporate earnings are shrinking, and the Fed is threatening to take away the punch bowl. And to top it all off, a sizable number of investors have more skin in the game than they can afford, so they had to dump shares pronto to rebalance their portfolios.

What does that mean?

It means that a lot of investors are in debt up to their eyeballs, so when the market tumbles they have to sell whatever they can to stay in the game. It’s called a “margin call” and on Wednesday we saw a real doozy. Investors dumped everything but the kitchen sink in a frenzied firesale that sent the Dow Jones bunge-jumping 565-points before clawing its way back to a 249-point loss. The reason we know it was a margin call as opposed to a panic selloff is because there was no noticeable rotation into US Treasuries. Typically, when investors think the world is coming to an end, they ditch their stocks and make the so called “flight to safety” into US debt. That didn’t happen this time. Benchmark 10-year Treasuries barely budged during the trading day, although they did stay under 2 percent which suggests that bondholders think the US economy is going to remain in the toilet for the foreseeable future. But that’s another story altogether. The fact is, investors aren’t “rotating”, they’re “liquidating” because they’ve hawked everything but the family farm and they need to sell something fast to cover their bets. Now if they thought that stocks were going to rebound sometime soon, then they’d try to hang on a bit longer. But the fact that the Fed has stayed on the sidelines not uttering a peep of encouragement has everyone pretty nervous, which is why they’re getting out now while they still can.

Capisce? Here’s how CNBC’s Rick Santelli summed it up on Wednesday afternoon:

In other words, investors are starting to believe the Fed will continue its rate-hike cycle which will put more downward pressure on stocks, so they’re calling it quits now...Santelli makes a good point about “normalization” too, which means the Fed is going to attempt to lift rates to their normal range of 4 percent. No one expects that to happen mainly because the wailing and gnashing of teeth on Wall Street would be too much to bear. Besides, the Fed just spent the last seven years inflating stock prices with its zero rates and QE. It’s certainly not going to burst that bubble now by raising rates and sending equities into freefall. Even so, many investors think the Fed could continue to jack-up rates incrementally to 1 percent or higher. And while that’s still below the current rate of inflation, the shifting perception of “easy money” to “tightening” makes a huge difference in investors expectations. And as every economist knows, expectations shape investment decisions. No one is going to load up on stocks if they think things are going to get worse. That’s the long-and-short of it.

So is the recent extreme volatility a precursor to “The Big One”? Probably not, but that doesn’t mean that stocks won’t drift lower. They probably will, after all, conditions have changed dramatically. We had been in an environment where hefty profits, low rates and ample liquidity were more-or-less guaranteed. That’s not the case anymore. Stocks are no longer priced for perfection, in fact, valuations are gradually dipping to a point where they reflect underlying fundamentals. Also, for whatever reason, the Fed seems eager to convince people that the hikes are going to persist. So here’s the question: If you take away the punch bowl at the same time that earnings are start to tank, what happens? Stocks fall, that’s what. The only question is “how far”? And since the S&P has more than tripled since it hit its lowest level in March 2009, the bottom could be a long way off, which is why investors are taking more chips off the table. It’s also worth noting that one of the main drivers of stock prices has been AWOL lately. We’re talking about stock buybacks, that is, when corporate bosses repurchase their own company’s shares to reward shareholders while boosting their “windfall” executive compensation. Here’s the scoop from FT Alphaville:

“One reason for the recent poor market performance is that corporate buybacks are precluded during the month before earnings are released. Any destabilizing macro news that occurs during the blackout window amplifies volatility because the largest source of demand for shares is absent.”

Share buybacks in the US are on pace for their biggest year since 2007, he adds, estimating $561bn for full-year 2015 (net of share issuance) and a decline to $400bn in full-year 2016.”

“Share buybacks, the markets miss you“, FT Alphaville

By some estimates, buybacks represent 20 percent of all share purchases, so obviously the current drought has contributed to the recent equities-plunge. All the same, G-Sax Kostin expects a robust rebound in 2016 to $400 billion. As long as cash is priced below the rate of inflation, corporations will continue to borrow as much as they can to ramp their own stock prices and rake in more dough. Greed trumps prudent investment decision-making every time.

As for the trouble in China: While it’s true that China’s woes could have been the trigger for the current ructions on Wall Street, it’s certainly not the cause which is the Fed’s failed monetary policy. Besides, the whole China thing is vastly overdone. As Ed Lazear told CNBC on Wednesday:

“A major recession in China that lasted ten years would cost would costs the US 2 % points in GDP. So you’re not going to get a market fall like we’re observing right now based on that.”

Economist Dean Baker basically agrees with Lazear and says:

(“Wall Street Rocks!“, Dean Baker, Smirking Chimp)

As for the plunging oil prices, there’s not much there either. Yes, quite a few high-paying oil sector jobs have been lost, capital investment has completely dried up, and many of the domestic suppliers are probably going to default on their debts sometime in the next six months or so. But are these defaults a significant risk to Wall Street in the same way that trillions of dollars in worthless Mortgage-Backed Securities (MBS) and CDOs were in 2007-2008? Heck, no. Not even close. There’s going to be a fair amount of blood on the street by the time this all shakes out, but the financial system will muddle through without collapsing, that’s for sure. The real danger is that falling oil prices signal a buildup of deflationary pressures in the economy that isn’t being countered with additional fiscal stimulus. That’s the real problem because it means slower growth, fewer jobs, flatter wages, falling incomes, more strain on social services and a more generalized stagnant, crappy economy. But as we’ve said before, Obama and the Republican-led Congress have done everything in their power to keep things just the way they are by slashing government spending to make sure the economy stays weak as possible, so inflation is suppressed, the Fed isn’t forced to raise rates, and the cheap money continues to flow to Wall Street. That’s the whole scam in a nutshell: Starve the workersbees while providing more welfare to the slobs at the big investment banks and brokerage houses. It’s a system that policymakers have nearly perfected as a new Oxfam report shows. According to Oxfam: “the 62 richest billionaires now own as much wealth as the poorer half of the world’s population.” (Guardian)

Wealth like that, “ain’t no accident”, brother. It’s the policy.

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

Hotler

(11,416 posts)"That’s the whole scam in a nutshell: Starve the workersbees while providing more welfare to the slobs at the big investment banks and brokerage houses. It’s a system that policymakers have nearly perfected as a new Oxfam report shows. According to Oxfam: “the 62 richest billionaires now own as much wealth as the poorer half of the world’s population.” (Guardian) "

"But as we’ve said before, Obama and the Republican-led Congress have done everything in their power to keep things just the way they are..."

Wealth like that, “ain’t no accident”, brother. It’s the policy.

Proserpina

(2,352 posts)http://www.ibtimes.co.uk/societe-generale-seconds-rbs-doomsday-prophecy-predicts-collapse-eurozone-1537621

Albert Edwards, a strategist at Société Générale bank, has warned of an impending global financial crisis similar to the one that occurred in 2008-09. This time, he said, it could lead to the collapse of the eurozone. The warning follows a recent note issued by analysts at Royal Bank of Scotland (RBS) to investors to "sell everything" ahead of an imminent stock market crash. It also comes at a time when global markets see a short period of relief from the bearish trend that commenced since the New Year.

At an investment conference in London, Edwards said: "Developments in the global economy will push the US back into recession. The financial crisis will reawaken. It will be every bit as bad as in 2008-09 and it will turn very ugly indeed. Can it get any worse? Of course it can." He explained that while value of currencies in emerging markets was on the decline, the appreciation of the US dollar was crushing the corporate sector and that the credit expansion in the country was not for real economic activity, but was borrowings to finance share buybacks.

Edwards stressed that the US economy was in far worse shape than what the US Federal Reserve had realised and that America's central bank had failed to learn the lessons of the housing bubble that led to the financial crisis and slump in 2008-09. "They didn't understand the system then and they don't understand how they are screwing up again. Deflation is upon us and the central banks can't see it," he said. The Société Générale strategist compared US with Japan and said that the dollar had risen by as much as the Japanese yen in the 1990s – a move which had then put Japan into deflation and caused solvency problems for banks in the Asian country, according to The Guardian.

Regarding the euro, he said that efforts by the European Central Bank to push for growth and lower the euro would not matter in the event of a fresh downturn. "If the global economy goes back into recession, it is curtains for the eurozone," he said. Rising unemployment that would be associated with another recession would not be accepted by countries such as France, Spain and Italy. "What a disaster the euro has been: it is a doomsday machine in favour of the German economy," Edwards claimed. He also said that the declining demand for credit in China was another sign of the crisis to come. "That happens when people lose confidence that policymakers know what they are doing. This is what is going to happen in Europe and the US."

Proserpina

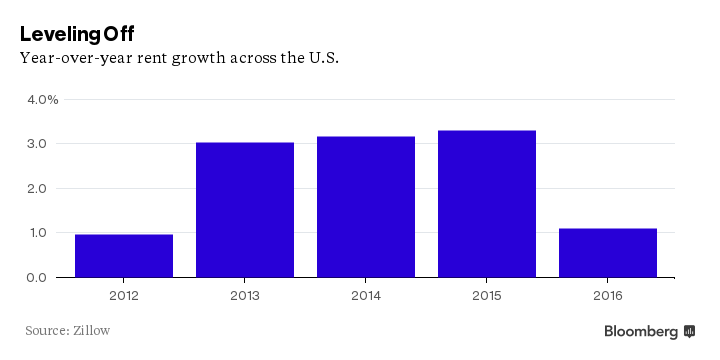

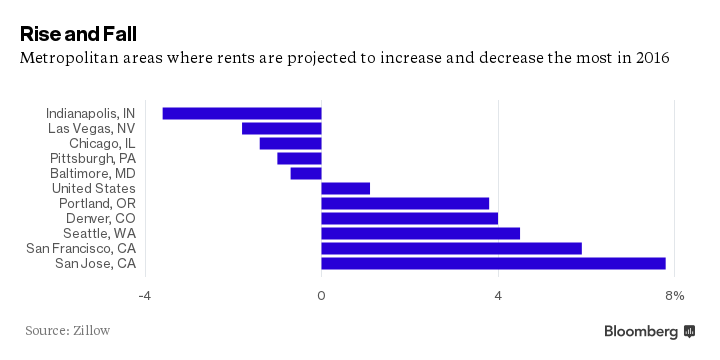

(2,352 posts)After a three-year period of rapid growth, rents are likely to flatten in 2016, according to a new report. By December, year-over-year rent increases will have slowed to 1.1 percent across the U.S., according to projections published on Friday by Zillow. That follows a three-year period during which rents grew more than 3 percent each year.

Rent growth is probably easing now because construction of new apartments—which lagged considerably during the last recession—is catching up with pent-up demand. Apartment vacancies increased in the last two quarters of 2015, the first time since 2009 that vacancies went up for consecutive three-month periods.

While rent growth is slowing nationwide, not all markets will get significant relief. Zillow expects rents to drop in a number of Midwestern cities, which are generally more affordable for renters and buyers than the costly coasts. But rents in West Coast cities such as San Francisco, Seattle, and Portland, Ore., are likely to outpace the national trend. In San Jose, Zillow expects rents to increase 8 percent, the heftiest hike in the U.S. That’s hard news for apartment hunters, but an improvement from 2014, when rents in San Jose increased 18 percent.

Proserpina

(2,352 posts)Sumner Redstone was ordered by a judge to undergo a one-hour mental examination amid mounting calls by investors for his removal as chairman of Viacom Inc. after his former girlfriend and caretaker alleged that he’s incapacitated.

A Los Angeles probate judge on Friday approved a short evaluation of Redstone, 92, by a geriatric psychiatrist and denied a request by lawyers representing the ex-girlfriend, Manuela Herzer, to question the media billionaire under oath.

“A more informal conversation” between Redstone and a physician will be more productive than an adversarial deposition and will provide more useful testimony to determine whether Herzer’s case can proceed, Judge David Cowan said in a tentative decision ahead of Friday’s hearing.

“We are gratified that Judge Cowan struck an equitable balance that assures our client has a fair opportunity to prove that her beloved Sumner was not competent when the attorneys had him remove her as his health caregiver,” Herzer’s lawyer, Pierce O’Donnell, said in a statement.

The case by Herzer has turned a public spotlight on the health of the man who controls CBS Corp. and Viacom and serves as chairman of both, and has led at least one major investor to demand details about his condition while other shareholders have called for him to resign or be removed.

Herzer, who was ordered out of Redstone’s house in October, was replaced as the agent on his advance health-care directive by longtime friend and Viacom Chief Executive Officer Philippe Dauman. Lawyers for Redstone have called Herzer’s petition a “farce” and said her true concern is her share of Redstone’s estate rather than his well-being.

“We are gratified that the court continues to reject Ms. Herzer’s increasingly desperate and disingenuous attempts to depose Mr. Redstone,” Gabrielle Vidal, Redstone’s lawyer, said in a statement.

Proserpina

(2,352 posts)Wall Street’s top leaders are getting smaller pay packages after shares of their companies slumped last year.

Goldman Sachs Group Inc. cut Chief Executive Officer Lloyd C. Blankfein’s awards 4.2 percent to $23 million after the bank’s shares fell 7 percent and profit tumbled 28 percent in 2015. Morgan Stanley lowered CEO James Gorman’s pay by 6.7 percent to $21 million after the firm missed financial targets and the stock sank 18 percent, the worst performance among the six biggest banks.

Blankfein, who became CEO in 2006, received restricted shares valued at $14.7 million, half of it tied to future performance, the New York-based company said Friday in a filing. He got about $6.3 million in a cash bonus, a person with knowledge of the payout said. The 61-year-old CEO received a $2 million annual salary and a long-term incentive award that will be disclosed later in the year.

Gorman’s pay includes $4.64 million of stock and $1.5 million in salary. The New York-based firm will report other details about the CEO’s pay later this year. He unveiled a $1 billion cost-cutting initiative and new leadership of a scaled-back bond-trading unit this month in an attempt to improve returns and placate shareholders. Last year’s share decline was the second-worst performance under Gorman, who became CEO in 2010. Separately, Morgan Stanley disclosed that Gregory Fleming, who managed the firm’s brokerage until Colm Kelleher was promoted to president this month, will remain an employee until July 6. The company said in a filing that the deferred stock and cash awards of his bonus will vest when he leaves. Fleming also gets access to office space until he departs, and keeps his physician under the company’s executive-health plan until year-end...

Hotler

(11,416 posts)he was doing God's work?? Hey Lloyd, if you stand on a ladder when you pray you'll be closer to God.

MattSh

(3,714 posts)Proserpina

(2,352 posts)Volatility in financial markets since the Federal Reserve last month announced its first interest-rate increase in nearly a decade is having the same effect as four additional quarter-point hikes, according to Morgan Stanley.

"Financial conditions have tightened materially -- by our estimation the economic equivalent of four rate hikes," analysts led by New York-based Morgan Stanley Chief U.S. Economist Ellen Zentner said in a note to clients on Thursday.

Since U.S. central bankers met in December, volatility has increased in global financial markets. The Standard & Poor’s 500 index has fallen about 9 percent, while crude oil prices have dropped 11 percent.

Forecasts released after the Federal Open Market Committee’s Dec. 15-16 meeting showed the median policy makers’ projection for four additional rate increases in 2016, based on their estimates for growth, inflation and unemployment. The FOMC next meets Jan. 26-27.

The median projection for growth in gross domestic product this year was 2.4 percent, while core inflation, measured by the price index of personal consumption expenditures, excluding food and energy, was expected to reach 1.6 percent and the unemployment rate was seen declining to 4.7 percent.

“The writing will be on the wall for many of the forecasts Fed participants had turned in at the December meeting -- forecasts that seem increasingly implausible to achieve,” the Morgan Stanley economists said.

By their estimates, market movements since the FOMC voted Dec. 16 to increase its benchmark federal funds rate by a quarter percentage point will knock 0.2 percentage point off GDP growth this year and 0.3 percentage point next year, and reduce core inflation by 0.1 percentage point in 2016 and 0.15 percentage point in 2017.

Morgan Stanley predicts the FOMC will opt to leave rates unchanged next week and may keep policy on hold at the committee’s March 15-16 meeting as well. “The bar for an additional hike in March seems insurmountable now,” the economists said.

Proserpina

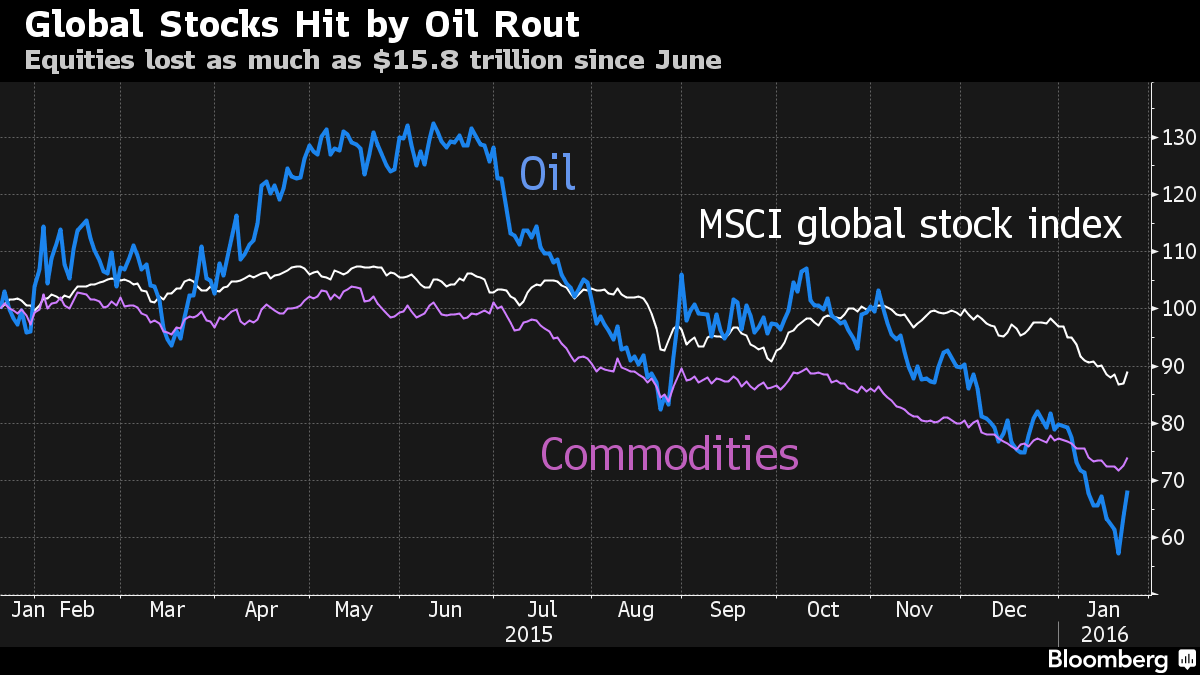

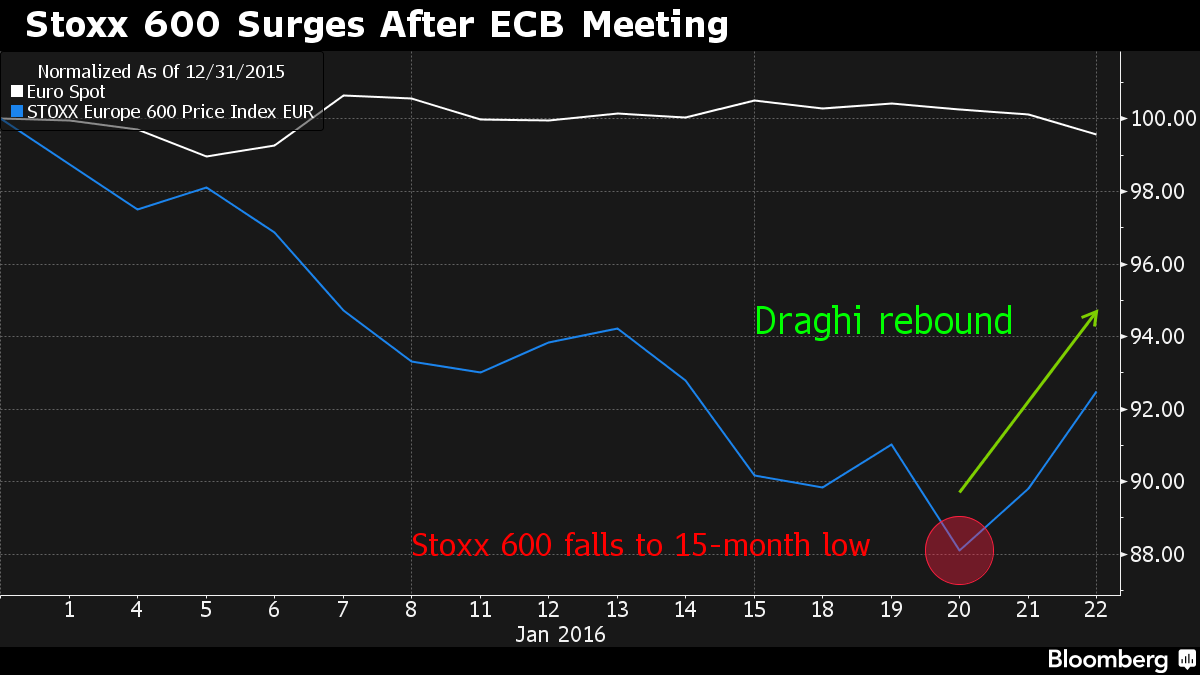

(2,352 posts)Fear and then relief gripped the markets this week, testing investors’ nerves. The problems were not particularly new -- concerns about a China-led global slowdown, collapsing oil prices and the end of Federal Reserve support had been rattling traders for months, leading to a plunge in equities back in August. The same issues reached a crescendo again by Wednesday before a rebound on central-bank optimism.

Here’s a breakdown:

The slower pace of growth in China’s economy puts into question the outlook for demand from the world’s biggest consumer of commodities. A supply glut that torpedoed the price of oil made things worse, wreaking havoc on markets and especially the metals, mining and energy industries. Global stocks in the MSCI All-Country World Index mirrored the collapse.

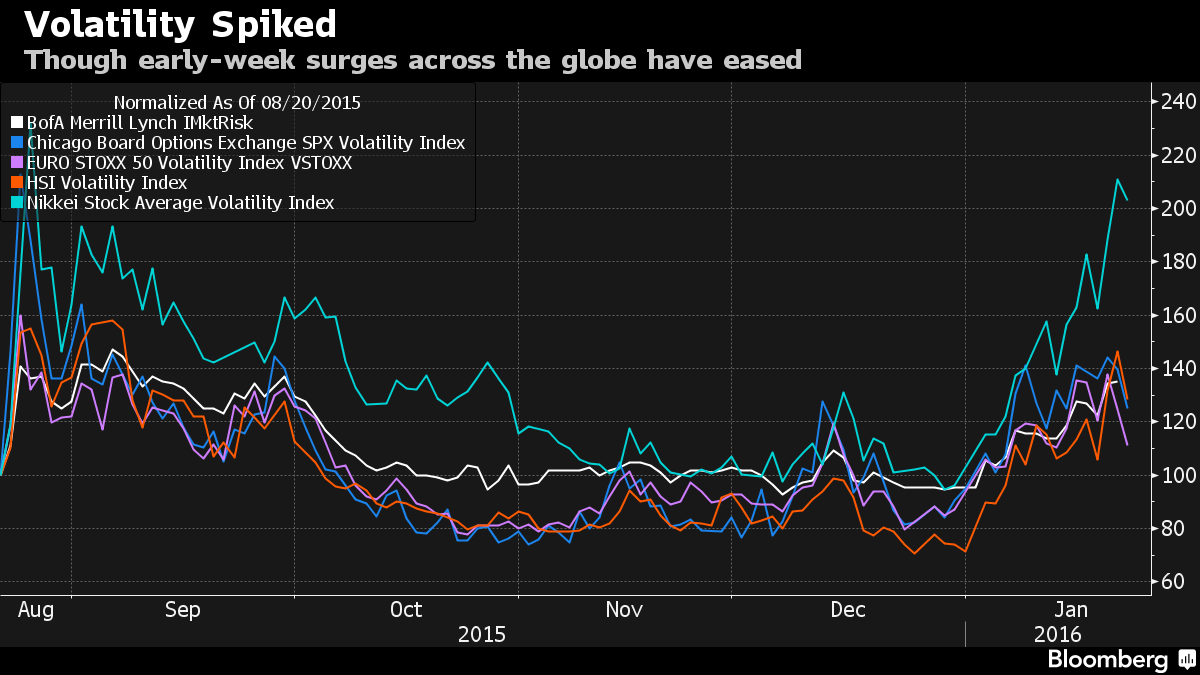

Volatility also jumped, a sign market jitters were entrenched across the board among all asset classes. A relief rally eased concerns later in the week, with the VIX (dark blue line in chart above), also dubbed the fear index, falling from a September high.

Things started looking better by Thursday, when European Central Bank President Mario Draghi floated the prospect of more economic stimulus as early as March. Investors cheered the comments, sending the Stoxx Europe 600 Index to its biggest two-day surge since 2011...

Proserpina

(2,352 posts)ECB President Mario Draghi attempted to talk the Euro lower and the market higher today in a lengthy one hour press conference following his decision to not change interest rates.

Markets are now closed, so let's put a spotlight on the results (or lack thereof) of Draghi's verbal intervention.

Read more at http://globaleconomicanalysis.blogspot.com/2016/01/draghi-rally-fizzles-in-less-than-one.html#JAmB5EMAUOEZmR7v.99

Proserpina

(2,352 posts)Oil rallied, capping the biggest two-day advance in more than seven years after a slump to a 12-year low prompted some investors to buy back record bearish bets.

Front-month futures jumped 21 percent after the February contract expired Wednesday at $26.55 a barrel, the lowest settlement since 2003. Speculators this month amassed the biggest-ever short position in U.S. crude amid concern that turmoil in China’s markets would curb fuel demand at a time when fresh exports from Iran exacerbate a global glut. Pierre Andurand, the founder of the $615 million Andurand Capital Management who correctly predicted the slump in oil prices, said the commodity will end the year higher.

"Oil is going to rally into the spring," said James Cordier, founder of Optionsellers.com in Tampa, Florida. "It’s a short-covering rally, but we do think it has legs to continue."

more

video interview of Roubini at link...worth watching!

antigop

(12,778 posts)Proserpina

(2,352 posts)Is that truly LLoyd Webber narrating?

antigop

(12,778 posts)Proserpina

(2,352 posts)Proserpina

(2,352 posts)He had the tremendous ego that an actor needs, of course, and evidently not too many weaknesses. Would all actors had half his characteristics! Take for example, Johnny Depp....well, I guess he has the ego...

Proserpina

(2,352 posts)Credit Suisse has identified the stocks most commonly held by funds — and recommends selling a lot of them...An unfortunate byproduct of the 8.5% decline in the S&P 500 Index SPX, +2.03% this year is that mutual fund managers are forced to sell popular holdings as customers pull money from their funds.

And that can punish stocks indiscriminately, even ones that are widely owned and beloved by individual investors.

Credit Suisse, in a new report, has done interesting research about popular stocks owned by mutual funds and ETFs that might be best to sell in the interest of protection and diversification.

“We tend to be wary of owning too many darlings, given less opportunity for differentiation,” said Lori Calvasina, chief U.S. equity strategist, in a report Wednesday.

see link for list

Proserpina

(2,352 posts)U.S. stocks posted their first weekly gain of the new year Friday as oil futures rebounded for a second day and hints of potential central-bank stimulus in Europe and Japan helped comfort nervous investors...

so, the oil shorts had to be covered on Weds., which raised the futures for oil, which raised the stock market....and nothing else has changed! Isn't Capitalism marvelous!

Proserpina

(2,352 posts)After getting off to the worst start to a new calendar year in history, U.S. stocks on Friday finally posted the first winning week of 2016. So did stocks bottom or is this just a bounce within a bigger pullback that could yet turn into a full-blown bear market?

For the average, long-term investor, the best advice during times of market turmoil is to remain calm and stick to a long-term investing plan. Calling a bottom—or a top—is a challenge even for professional investors. With that in mind, here’s a look at what analysts and traders are watching:

The Wednesday low

It’s “abundantly clear” that Wednesday’s sharp selloff, which saw the S&P 500 SPX, +2.03% fall to its lowest intraday level since February 2014 at 1,812.29, marked a temporary low, said Adam Sarhan, chief executive of Sarhan Capital. But he suspects that despite the subsequent rebound, which may have substantially further to run, the bears are still in control of the market.

Rallies in bear markets tend to be quite strong, fueled by short covering and investors who rush in an effort to “buy the dip,” said Sarhan, who expects stocks to fall into a full-fledged bear market. Getting to the ultimate bottom is going to take “a lot more time” and price deterioration, he said, noting that genuine bear markets tend to last from 18 to 36 months. In other words, don’t look for a bottom soon as the major indexes have yet to retreat 20% from their highs, which is the widely accepted definition of a bear market. A fall below 1,704.66 would put the S&P 500 in bear territory, while the Dow Jones Industrial Average DJIA, +1.33% would need to fall through 14,649.91.

more

Proserpina

(2,352 posts)Ukraine may still reach an agreement with Russia on $3 billion of debt it defaulted on last month as talks mediated by Germany continue, Finance Minister Natalie Jaresko said.

Officials from the two sides’ finance ministries may meet “in the near future” after their lawyers negotiated last month, Jaresko said Saturday in an interview in Davos. The next round may be among lower-level representatives if scheduling conflicts prevent the ministers from attending, she said.

“I think it’s still very possible to reach a consensual agreement out of court with Russia,” Jaresko said. “We have dialog, the dialog exists on different levels.” She urged Russian to “join the group of international creditors and come through with restructuring.”

The $3 billion bond -- which Russia bought in 2013 as part of an abortive bail-out for Ukraine’s former leader just months before he was toppled -- has become a thorny issue in the two former Soviet neighbors’ frayed relationship. The Kremlin held the debt out of an $18 billion restructuring deal Jaresko negotiated with creditors last year, setting the sides on course for a court a battle....

anybody believe this? it sounds like pleading for mercy, to me

Proserpina

(2,352 posts)Have the global financial markets lost their collective mind?

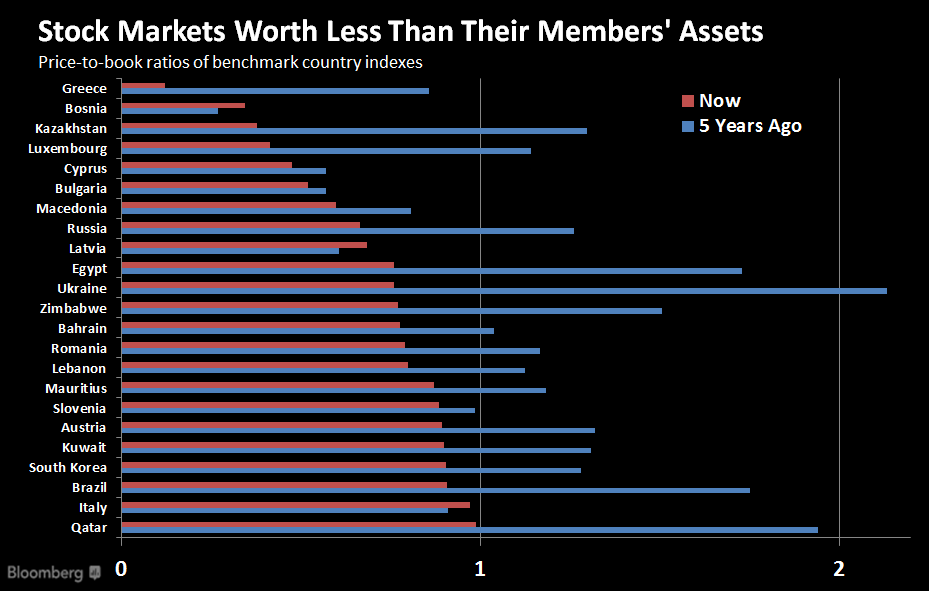

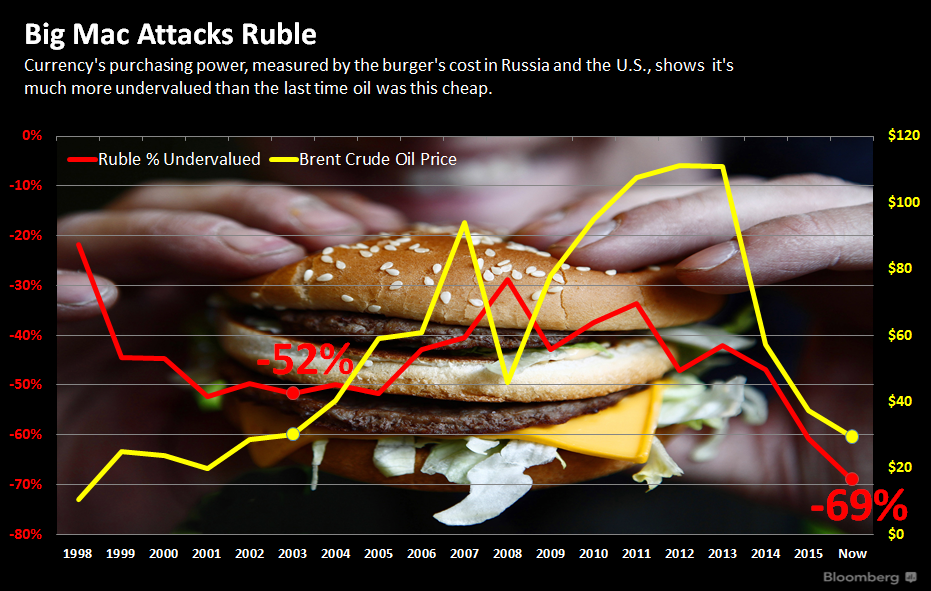

This week saw the value of Hong Kong’s benchmark stock market briefly dip below how much its member companies’ assets are worth. Foreign exchange traders are punishing currencies even in countries with improving economies, and Russia’s ruble has fallen so far that it’s a third more undervalued than the last time the country’s oil was as cheap as now.

And that’s not all, as shown by the below five charts.

While Hong Kong’s Hang Seng Index recovered enough to be worth about the same as its members’ assets, the price-to-book ratios of about two dozen other country benchmarks are now below that threshold, compared with 15 five years ago.

Russia’s currency has taken one of the world’s biggest beatings so far this year. By one crude-but-fun measure, the ruble is almost always considered undervalued, but now it’s worse than usual...Big Mac Purchasing Power Parity is based on a survey by The Economist that determines what a country’s exchange rate would have to be for the premier burger from McDonald’s there to cost the same as in the U.S. The measure gives an impression of how overvalued or undervalued a currency is.

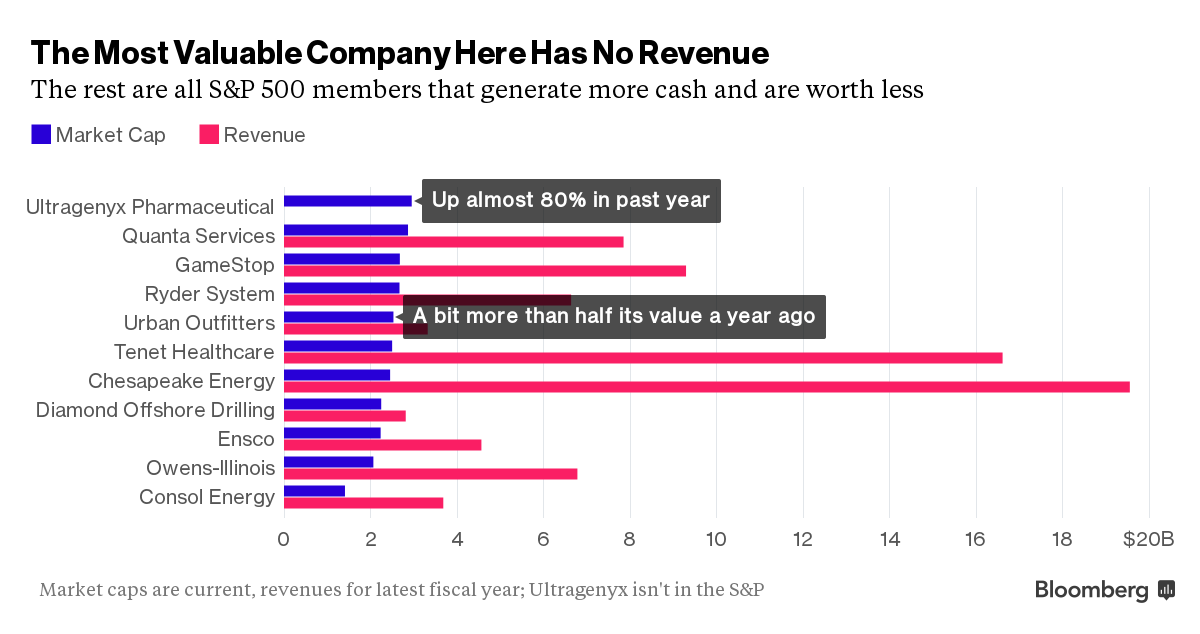

U.S. stocks haven’t been immune to this month’s worldwide drubbing. Even with this week’s recovery in the Standard & Poor’s 500 Index, the fall since the year started ranks as one of the worst three weeks in recent decades. The result: Some members are worth less than businesses with no revenue, for example Ultragenyx Pharmaceutical Inc., one of the largest such companies in the Nasdaq Composite Index.

They lost their QE free money, is all...when they lose the will to live, then we are in trouble!

Proserpina

(2,352 posts)By Pam Martens and Russ Martens: January 19, 2016

http://wallstreetonparade.com/2016/01/big-bank-stocks-have-been-crushed-heres-why/

The conventional wisdom was that the Fed’s rate hike on December 16 of last year was going to help big bank stocks by boosting their ability to charge heftier interest rates on loans. That theory has pretty much been relegated to the dust bin of financial fairy tales along with the Fed’s prediction that the slump in oil prices would be “transitory.” Bank stocks have been cratering like it’s early 2008 all over again and oil prices can’t find a floor, having broken through $60, $50, $40 and now $30 a barrel over the past 12 months. On top of the oil rout, which may spell corporate credit downgrades, bankruptcies, higher loan loss reserves – none of which are good for bank stocks – there are other bank risks not on the public’s radar screen.

Among big U.S. bank stocks, Citigroup has taken the worst drubbing. Even after reporting what were perceived to be fairly good earnings last Friday, its share price fell by 6.41 percent by the close of trading. That brings its stock losses to 30 percent from its July 2015 high. That’s not the sort of behavior one wants to see from one of the country’s largest banks and a stock that lost 60 percent of its market value in one week in 2008 (the week of November 17) and proceeded to receive the largest taxpayer bailout in U.S. history. The Wall Street Journal expressed this theory on Citigroup’s travails last Friday:

The minute U.S. corporate media tells you that “the selloff isn’t about worries of banks blowing up,” you know the worries are about banks blowing up.

There’s three major elements tied to the worry about U.S. mega banks – derivatives, interconnectedness and what investors can’t see until the bank blows up. Even though Morgan Stanley has much smaller foreign exposure than Citigroup according to the Office of Financial Research, its stock has lost 37 percent since its July high, 7 percent more than Citigroup. Goldman Sachs has lost 29 percent in market value since June; Bank of America is off 22 percent from July and JPMorgan is down by 19 percent in the same period. What these five mega Wall Street banks have in common, according to a February 2015 report from the Office of Financial Research (OFR), a unit of the U.S. Treasury Department, is mega intrafinancial system assets and liabilities – in other words, they’re on the hook to each other. The data used by the OFR was as of December 31, 2013. (Wells Fargo, which is a huge bank but not as interconnected, is down just 17 percent since its July 12-month high.)

The OFR report notes the following about the connectivity problem on Wall Street:

Given that the U.S. financial system experienced the largest collapse since the Great Depression just seven years ago; that both the debt of the U.S. government and the Federal Reserve has exploded as a result; and that regulators have repeatedly assured the public that they’ve gotten the risky situation at the big banks under control – we should not be currently witnessing bank stocks melting away like the Wicked Witch of the West. Unless, of course, as Senator Bernie Sanders and the chart below suggest, they actually are the Wicked Witches of the West.

Banks’ Systemic Importance Indicators: Study by the Office of Financial Research, U.S. Treasury Department

Proserpina

(2,352 posts)

Proserpina

(2,352 posts)Proserpina

(2,352 posts)https://www.fordfoundation.org/ideas/equals-change-blog/posts/three-business-leaders-on-how-capitalism-and-the-1-can-help-fight-inequality/

Paul Polman, CEO of Unilever

Paul Polman says that inequality is the biggest obstacle we face to creating a sustainable and equitable future. “If you belong to this lucky two percent of the population that frankly can do what they want,” he says, “you have to put yourself to the service of the other 98 percent.” To address inequality and create shared prosperity, he emphasizes the need to make systems and institutions worthy of people’s trust.

Rajiv Joshi, Managing Director of the B Team

Rajiv Joshi makes a business case for tackling inequality: With 3.5 billion people currently unable to participate in the economy, addressing inequality represents “the biggest economic opportunity of our generation.” By sharing value more fairly, he says, we will enable millions of people to realize their full potential.

Martin Whittaker, CEO of JUST Capital

Martin Whittaker argues that capitalism and justice are not at odds with each other—it’s just that we’ve lost sight of the deep sense of justice embedded in early ideas about how capitalist markets should function. “We’re so focused on the invisible hand of the market, we’d forgotten about this idea of justice and the moral dimension of markets,” he says.

videos of each speaking at link

Proserpina

(2,352 posts)As income inequality and healthcare costs rise in the United States and as an economic slowdown may be on the horizon, one of the world’s richest men expressed surprise that U.S. voters seem so angry in advance of the 2016 presidential election. Speaking at a gathering of corporate and government leaders in Switzerland, Blackstone CEO Steve Schwarzman told Bloomberg Television that he is bewildered about why Americans seem so discontented.

“I find the whole thing astonishing and what’s remarkable is the amount of anger whether it’s on the Republican side or the Democratic side,” the Wall Street mogul said at the World Economic Forum in Davos. “Bernie Sanders, to me, is almost more stunning than some of what’s going on in the Republican side. How is that happening, why is that happening?”

On the eve of the conference, the nonprofit group Oxfam released a report showing that the richest 62 people on the planet now own more wealth than half the world’s population. In the United States, recent data from Pew Research shows the average American’s median household worth has stagnated, as the median household worth of upper-class Americans increased 7 percent. Schwarzman, though, expressed surprise that people are enraged.

“What is the vein that is being tapped into across parties, that has made people so unhappy?” he said, telling Bloomberg’s anchor, Erik Schatzker, “That is something you should spend some time on.”

more

Hotler

(11,416 posts)and is getting some great responses. I think more and more people are starting to wake up. Besides thinking that voting out repugs and 3rd way Dems a good old fashioned French style revolt may be in order.

Proserpina

(2,352 posts)Proserpina

(2,352 posts)Proserpina

(2,352 posts)http://www.reuters.com/article/us-davos-meeting-markets-idUSKCN0UY2A9

...Veteran British businessman Roger Carr, who is chairman of British defense group BAE Systems, said the future was not looking bright.

"This time last year in Davos there was a very different environment, it was quite benign. The issue was the haves and the have nots, it wasn't: 'are we all going to have less?'."

"It is very pessimistic at the moment," he told Reuters...

Proserpina

(2,352 posts)why indeed....the comments are better than the article

westerebus

(2,976 posts)This is two fold. One, buy backs to keep share price moving upward, or at least not hitting the deck with a thud. Or should the economy go belly up, buy themselves back on the cheap. That's a combined reason.

The second, is not to be caught in a liquidity trap as engineered by the major player's Goldman JPM et al and the vulture's looking for a quick score.

They are all playing defense largely because they don't want to give back what the FED has given them for free. Conversely, they think the FED has no more ammunition without raising interest rates.

The FED has two choices, after the election cycle, shocking I know: one, slowly raising rates and drive up inflation, or start cleaning up their balance sheet.

There's this item called the Social Security Trust Fund that needs funding. What should the FED do? Where's the Congress? The next POTUS?

Proserpina

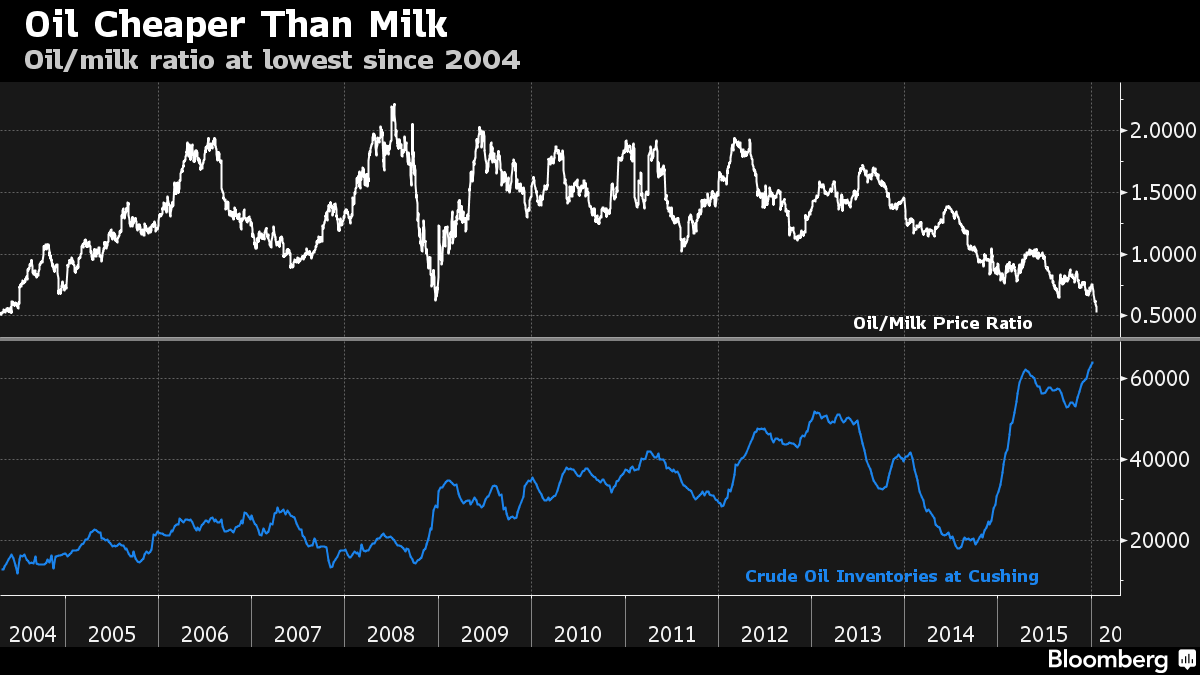

(2,352 posts)Crude oil is at a 12-year low and that means it’s even cheaper than milk.

The price of one gallon of West Texas Intermediate crude is equivalent to about half a gallon of Class III milk, the benchmark traded on the Chicago futures market. That’s the lowest ratio since 2004.

Proserpina

(2,352 posts)Goldman Sachs, the powerful investment bank that has become a symbol of Wall Street influence among Democrats and Republicans alike, is on track to be one of biggest contributors in the presidential race again this year, with $794,609 chipped in so far.

But its allegiances are spread across the political map — consistent with the firm’s long history of cultivating influence no matter which candidate or party is in office.

Story Continued Below

Goldman Sachs employees are the top contributors to the Republican campaigns of Jeb Bush and Marco Rubio, according to an analysis of federal campaign finance records the Center for Responsive Politics conducted for POLITICO. They’ve given $483,500 to the campaign and super PAC supporting Bush and $79,600 to Rubio’s campaign and allied super PAC, the analysis shows.

Republican Ted Cruz’s wife is a Goldman Sachs executive whose colleagues have begun to step up with donations since she took a leave of absence to campaign and raise money for her husband. He’s taken in $43,575 from the company in total during his campaign.

Read more: http://www.politico.com/story/2016/01/goldman-sachs-contributions-2016-election-217962#ixzz3y5qooGtC

Proserpina

(2,352 posts)Proserpina

(2,352 posts)More than originally estimated.

UnitedHealth Group warned nearly two months ago that new customers from the Affordable Care Act exchanges would hurt the insurer’s bottom line, but it looks like it misestimated by how much as enrollments exceeded expectations.

UnitedHealth, the U.S.’s largest insurer, says it will incur as much as $100 million more in losses associated with 2016 ACA plans than previously forecast. That brings total ACA plan loss projections for its new fiscal year to more than $500 million, up from previous estimates of $400 million to $425 million.

The company said it would reconsider its participation in the government-mandated exchanges, according to statements made during UnitedHealth’s earnings Tuesday.

“By mid-2016 we will determine to what extent, if any, we will continue to offer products in the exchange market in 2017,” said Dave Wichmann, president and CFO of UnitedHealth.

UnitedHealth reported losses of $720 million last year related to exchange enrollees, including $245 million for advance recognition of 2016 losses that aren’t included in the total estimated losses for this year. That means that UnitedHealth is expected to lose up to $745 million due to its 2016 ACA enrollees...

Proserpina

(2,352 posts)Their net worth has more than doubled since the president was elected. Charles and David Koch, the billionaire brothers who have spent hundreds of millions of dollars building a conservative network to oppose Democrats, have actually done very well for themselves since President Barack Obama took office.

The Koch brothers, who believe strongly in a market-based libertarian philosophy, each had a net worth of $19 billion in 2008, the year Obama was elected to office, according to Forbes. The fortune dipped slightly in 2009 to $16 billion amid a financial crisis that was caused, in part, by the kind of limited government oversight they believe in. But the Kochs have rebounded nicely. According to Forbes, the brothers are now worth $41 billion each, meaning their fortune has more than doubled under Obama.

The president called out the billionaires in August for backing efforts to block renewable energy standards. The Koch brothers have lobbied for tax breaks that favor their energy interests and funded efforts to repeal renewable energy standards at the state level.

The vast and shadowy network of the Kochs' political groups now includes its own intelligence operation. They spent around $400 million on the 2012 campaign and pledged to spend an unprecedented almost $900 million on the 2016 election.

Fuddnik

(8,846 posts)That's the only reason I can figure he's so pro Hillary. Otherwise, he's a pretty nice guy.

Proserpina

(2,352 posts)Fuddnik

(8,846 posts)I just had a cup of coffee. That usually can help me sleep.

Proserpina

(2,352 posts)Angela Merkel was missing from Davos this year, but the German leader's optimistic mantra "we can do this" echoed through the snowy resort in the Swiss Alps. China's economic slowdown? Manageable. Plunging financial markets? Temporary. And Europe's refugee crisis? A big challenge, but one which will ultimately push the bloc's members closer together, audiences were told over and over again. Beneath the veneer of can-do optimism at the World Economic Forum, however, was a creeping concern that the politicians, diplomats and central bankers who flock each year to this gathering of the global elite are at the mercy of geopolitical and economic forces beyond their control.

At the top of the lengthy list of worries was Europe, whose policymakers remain deeply divided in their approach to the refugee crisis at a time when the bloc faces a host of other threats, from Islamic extremism and the rise of far-right populists, to a possible British exit from the European Union.

"You've had deadly crises in Europe from day one and we've overcome them. However we always had one crisis at a time. Today we have about five, from Brexit to ISIS and everything in between," said Josef Joffe, the publisher-editor of German weekly Die Zeit.

"In the past we had leadership. Today we are facing overwhelming demands on leadership and we are delivering less of it," he added.

Amid the reassuring messages on the refugee crisis, came stark warnings from people like IMF chief Christine Lagarde that Europe faced a "make or break" moment. Dutch Prime Minister Mark Rutte and his Swedish counterpart Stefan Lofven gave the bloc 6-8 weeks to get its act together. And frustration boiled over after Austria became the latest country in Europe's Schengen passport-free travel zone to unveil unilateral steps at the border to stem the tide.

"There is no way you can cope with such a massive flow of people just by closing the borders," said the EU's top diplomat Frederica Mogherini. "What do you do? You close the border and it's your neighbor's problem, who closes the border, and it's the other neighbor's problem?"

On the economic front, there was also a growing sense of policymaker impotence. Last January, in a bold sign of policy activism, the European Central Bank unveiled its hotly anticipated stimulus, or quantitative easing (QE), program in a bid to kick-start growth and inflation in a euro zone still reeling from financial turmoil and breakup fears...A year later, despite Mario Draghi's assertion that the bank still has "plenty of instruments" at its disposal, the consensus in Davos was that it has now used up all its monetary ammunition and that politicians have failed to use the time the ECB bought them to implement economic reforms at home. Meanwhile growth remains subdued and inflation close to zero.

"We understand that there may be no limit to what the ECB is willing to do but there's a very clear limit to what the ECB can and will achieve," chairman of Swiss bank UBS and former Bundesbank chief Axel Weber said after Draghi signaled yet more monetary easing.