Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 27 January 2016

[font size=3]STOCK MARKET WATCH, Wednesday, 27 January 2016[font color=black][/font]

SMW for 26 January 2016

AT THE CLOSING BELL ON 26 January 2016

[center][font color=green]

Dow Jones 16,167.23 +282.01 (1.78%)

S&P 500 1,903.63 +26.55 (1.41%)

Nasdaq 4,567.67 +49.18 (1.09%)

[font color=green]10 Year 1.98% -0.01 (-0.50%)

30 Year 2.75% -0.01 (-0.36%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)We haven't got a lick of snow. Snyder is still in the governor's office. It's as if Groundhog Day already started.

Fuddnik

(8,846 posts)Picked up someone at the airport, and Tampa Bay was as smooth as a sheet of glass.

But, rain moving in tonight, but still warm.

Proserpina

(2,352 posts)and move somewhere warmer than Massachusetts. The problem is, where?

I don't think she likes Florida. I know she doesn't like Michigan (and it's not much warmer here, but the growing season is at least a month longer).

The South and Southwest are too full of Southerners....

Maybe Hawaii. She likes Hawaii.

Warpy

(111,245 posts)NM is part of the southwest and it won't make her break out in a rash from exposure to too many southerners. I moved here when I got too old for Boston winters and it's been an OK fit. If she can tolerate the altitude, it might be a good fit for her, parts of the state get mild winters and hot summers. Best of all, no humidity and no bugs.

Tucson was second on my list of places to go, an island of blue in a red, red state. Parts of it are drop dead gorgeous.

Proserpina

(2,352 posts)It makes their damaged nervous systems even more dysfunctional.

Warpy

(111,245 posts)More rain than snow and the shore doesn't get nearly as hot as the interior can.

Proserpina

(2,352 posts)not my problem, I suppose. Not yet, anyway.

Warpy

(111,245 posts)Levels in water are barely above normal background and it's too damned cold to swim in, anyway.

Proserpina

(2,352 posts)President Barack Obama will offer a package of ideas to stimulate more workplace access to retirement savings when he unveils his fiscal year 2017 budget on Feb. 9, top administration officials said Monday.

“We have to promote new retirement security opportunities and test new models,” National Economic Council Director Jeff Zients said during a press briefing call with Secretary of Labor Thomas Perez. Mr. Zients called the package “an opportunity to update our social contract.”

The proposal will include requiring every employer not currently offering a retirement savings program to set up an auto-enrollment individual retirement account for workers, and tripling the startup credit that employers receive for offering a retirement plan.

The budget package also will propose a $100 million grant pilot program to determine how best to reach self-employed or those with stop-and-start work patterns, as well as a pilot program to encourage states to develop their own private-sector programs to increase access...

***************************************************************

We have such a program. It's called Social Security. Yes, I know all that cant about it was supposed to be one leg of a 3-legged stool: pension from employer, personal savings, and social security.

Well guess what! The employers sawed off the first two legs. They stole the private pension money (or never deposited it) and cut wages so low that people can't pay bills, let alone save.

So, let's do it right. Let's make social security live up to its name. Fund it adequately, share it equally, give the elderly some purchasing power and universal single payer health coverage as opposed to the Medicare/Medicaid patchwork, and see what happens.

Let's take Wall Street out of the pension business, since they have done such a lousy job at it anyway.

Proserpina

(2,352 posts)Why do the Wall Street billionaires hate Bernie? Paul Krugman, unintentionally, provided the key in his most recent attack on Bernie.

http://www.nakedcapitalism.com/2016/01/bill-black-wall-street-declares-war-against-bernie-sanders.html

...Why do the Wall Street billionaires hate Bernie? Paul Krugman, unintentionally, provided the key in his most recent attack on Bernie. Krugman claimed that the key to what he claimed was President Obama’s success was not “breaking” “Wall Street’s power” over our economy and democracy. To Krugman and Hillary’s horror, however, Democratic voters, like the median U.S. voter, understand that breaking the paramount power of the Wall Street billionaires over our economy and its political power that has caused us to descend into crony capitalism is essential to take back our Nation.

Political scientists’ research has revealed the crippling grip on power that the Wall Street billionaires have in practice and the fact that the wealthy have, on key public policies, strikingly different views than do the America people. In particular, the 1% are exceptionally hostile to Social Security and anything that protects the weak from predation by the wealthy. They are also stunningly unconcerned about problems such as global climate change while they are paranoid about debt, deficits, and inflation even during the depths of the Great Recession. The domination of the plutocrats of our economy and the shards of our democracy has led to decades of terrible policies designed to ensure that financial regulation will fail. These policies have crushed the middle class and abused the poor.

*************************************************************

You don’t have to watch the polls to know how well Bernie is doing. Just listen to the intensity of the billionaires’ bleating about Bernie.

Proserpina

(2,352 posts)Mark Twain

Read more at http://www.brainyquote.com/quotes/quotes/m/marktwain103535.html#urCwjEI0UdLvlrDc.99

http://www.bloomberg.com/news/articles/2016-01-25/draghi-says-ecb-credibility-at-stake-in-hitting-inflation-goal

Mario Draghi hit back at critics of his policies, saying the European Central Bank must fulfill its inflation mandate in order to maintain its credibility.

“Meeting our objective is about credibility,” the ECB president said in a speech near Frankfurt on Monday. “If a central bank sets an objective, it can’t just move the goalposts when it misses it.”

ECB policy makers have less than seven weeks until a March 10 meeting when they’ll decide whether their 1.5 trillion-euro ($1.6 trillion) bond-purchase plan and negative interest rates are enough to meet their inflation goal of just under 2 percent. With slumping oil costs weighing on consumer prices that are already close to stagnating, Draghi is trying to convince investors that the central bank remains willing to act if needed.

“With inflation already low for some time, we saw a danger that a continued period of low inflation –- even if oil-driven -– might destabilize inflation expectations and become persistent,” Draghi said referring to the ECB stimulus package announced in December 2015. “That risk was heightened by the fact that ‘core’ inflation, which strips out energy and food, was also low. Core inflation is not our objective, but it tends to lead headline inflation over the medium-term.”

what a maroon!

Exactly what he's being paid to do. Destroy the European social welfare state.

Proserpina

(2,352 posts)When you hear an orthodox economist, particularly one who was early to warn of the dangers of real estate bubbles around the world, speaking of a debt jubilee as the best of bad option, you know a crunch is coming. Here is the key quote from William White, former chief economist of the Bank of International Settlements, in an exclusive interview with Ambrose Evans-Pritchard of the Telegraph:

The only question is whether we are able to look reality in the eye and face what is coming in an orderly fashion, or whether it will be disorderly. Debt jubilees have been going on for 5,000 years, as far back as the Sumerians.

White gives a dire set of underlying causes, and one of them is what economists would call a lack of policy space, which in layspeak means “no remedies available to treat the disease.” Yet even though White is almost certainly correct as to the endgame, which is that many people who hold financial assets will find that they are worth a lot less than they believe, one of the reasons is that even people like White, as he exhibits in this interview, subscribe to economic beliefs that are part of the problem. In other words, there are treatments that would work, even now, but mainstream economist reject them and thus look as if they will have to relearn the lessons of the Great Depression.

Mind you, White is largely correct, most of all in his pointing out that debts need to be written down, and if they aren’t in a formal manner, they will be forcibly written down, via default. But where he errs is in deeming debt always and ever bad, and in further not acknowledging (or recognizing) that for a fiat currency issuer like the United States, using debt to finance government spending is a political requirement, not an economic one. The federal government could simply deficit spend, but our funding procedures are a holdover from the gold standard era. Thus some of the lack of policy space he complains about is due to self-imposed constraints, like the perverse and self-destructive fear of running deficits in economies that are tipping into deflation and have plenty of underutilized resources...

more

Proserpina

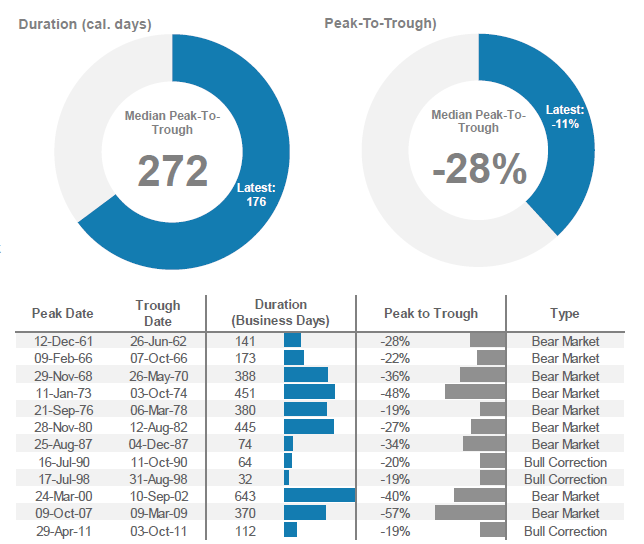

(2,352 posts)http://www.bloomberg.com/news/articles/2016-01-26/morgan-stanley-analyzed-43-bear-markets-and-here-s-what-it-found

Will history repeat itself?

U.S. stocks may be looking a bit better after one of the worst starts to the year on record, but a number of markets, especially the emerging kind, have already entered or come within points of a bear market.

Investors seeking clues as to the future direction of global equities might turn to history as their guide; Morgan Stanley analysts led by Andrew Sheets certainly have. They've crunched the numbers on more than 40 bear markets thoughout history, defined as a more than 20 percent peak to trough decline.

Here's what they found.

How long will the downturn last and how far could it go?

On average, large sell-offs last about 190 business days and investors might expect a 30 percent pullback in that time frame based on previous history, Morgan Stanley says. For the S&P 500, the bear market cycle usually takes a bit longer. Sheets and Co. concluded that for the U.S. index the median bear market lasts for about 272 days and declines were roughly 28 percent, or slightly less than the worldwide average.

more

Proserpina

(2,352 posts)Proserpina

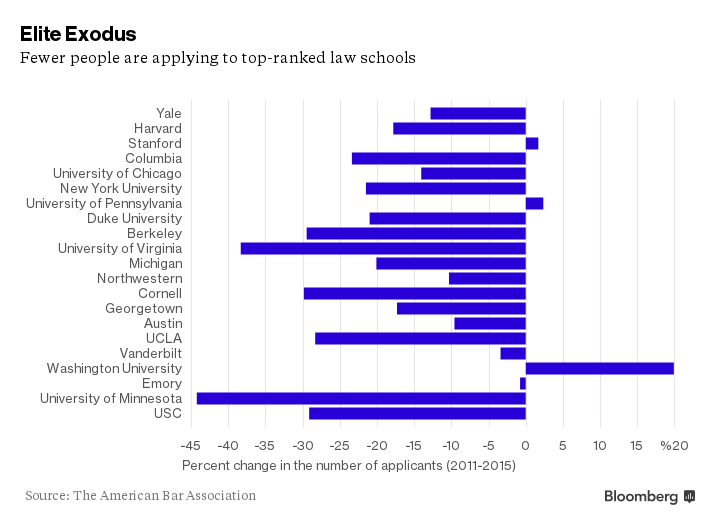

(2,352 posts)http://www.bloomberg.com/news/articles/2016-01-26/the-best-law-schools-are-attracting-fewer-students

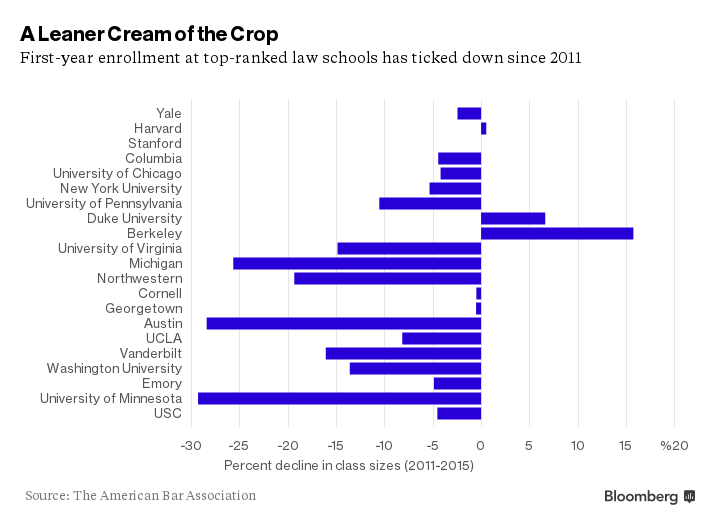

In 2010, Sarah Zearfoss, director of admissions at the University of Michigan's law school, got a tip from an employee that she simply could not ignore. It was just two years after the housing crisis, and Zearfoss and her staff were concerned about the increasingly bleak job market for new lawyers. The advice, she thought, might help: Shrink the school.

“The single best thing we could do to help our students is to make the class size smaller,” Zearfoss said.

She began to set the plan in motion. Since 2011, Michigan Law, considered one of the country's top law schools, has cut its first-year class by 26 percent. The number of applicants to the school fell 20 percent over that period, according to data from the American Bar Association.

Michigan Law is not the only elite law school to experience such a stark contraction. As applications plunge, especially from the very best students, a growing number of highly regarded law schools are slashing class sizes. The crisis in legal education, once confined to the lower tier (schools ranked below 50 by U.S. News and World Report), has hit the upper echelon...

Since 2011, the number of applicants to law schools ranked in the top 20 by U.S. News has dropped by a median 18 percent, data from the American Bar Association show. Yale Law School saw its applicant count dip by 13 percent. Harvard Law School experienced an 18 percent drop. As applications have dwindled, some of the most exclusive schools have opened their doors a little wider: Top-tier schools admitted a median 7 percent more people in 2015 than they did in 2011. Part of the reason schools send out more offers is that they expect that prospective students, who are in high demand, will be more likely to turn them down than they once were. Those measures only go so far. The majority of elite campuses, unwilling to seriously dilute their student bodies, still had to downsize. Class sizes declined by a median of 5 percent at the top 20 schools over the last five years, ABA data shows.

The most urgent challenge facing the top schools is that applications from students with the highest test scores have declined. In 2010, 12,177 people with the highest scores on the LSAT (165 and above, the highest possible score being 180) applied to law school. By 2015, only 6,667 people with those scores applied, according to figures provided by Jerome Organ, a law professor who analyzes law school admissions data.

more

Proserpina

(2,352 posts)The Wall Street Journal ran an op-ed recently by Andrew Biggs entitled “New Evidence on the Phony Retirement Crisis.” The thrust of Biggs’ argument is that the average guy gets a pretty high benefit from Social Security; couple those benefits with 401(k) saving and he will be fine in retirement. So where’s the crisis?

Too many women are not "coupled" and have no 401(k) savings, you moron!

The description of benefit generosity is couched in terms of replacement rates -- benefits as a percentage of pre-retirement earnings. The Social Security actuaries report a replacement rate of 39 percent for the typical worker retiring at 65 today. Biggs, who has done numerous studies of his own producing extraordinarily high replacement rates, this time reports a number from the Congressional Budget Office (CBO). According to the CBO, a typical middle-income worker retiring today would be eligible for a benefit equal to about 59 percent of late-life earnings. (I simply averaged the CBO replacement rates for workers born in the 1940s with those born in the 1960s). The calculations are based on different approaches. The actuaries relate the benefits for a hypothetical worker who consistently earned roughly the average wage to wage-indexed career earnings. The CBO relates the benefits to the last five years of substantial earnings indexed for prices...The Social Security actuaries undertook a study that incorporated both approaches. They took a random sample of 200,000 workers claiming benefits in 2011 and calculated replacement rates using an array of replacement rate definitions. The average retirement age for this group was 63.75. At the mean, the replacement rate for this group was 38.8 percent using wage-indexed career earnings and 39.7 percent using the last five years of significant earnings indexed by prices...

So, we jigger public benefits to maintain class? Is that so?

The point is that, when dealing with actual workers, the two approaches provide the same picture. So, the high CBO numbers cannot be explained by methodology alone. Their underlying assumptions must differ from the experience of actual individuals.

Perhaps a simpler way to think about the generosity of Social Security benefits is to look at dollar amounts paid. The most recent published data show that the average benefit for a newly retired worker in 2014 was $1,363 or $16,356 a year. Since this number reflects people retiring before 65, say the average benefit at 65 was $17,000 a year. If the CBO is right, the average worker would have earned $28,810 ($17,000/0.59) before retirement. If SSA is right, the average worker would have earned $43,590 ($17,000/0.39) before retirement. According to the Current Population Survey, typical earnings for all workers ages 55-65 were $42,000 and for full-time workers $48,000. It is very hard to believe that the recent CBO replacement rate number is a good representation of reality.

The replacement rate debate has now been going on for several years. It is part of a concerted effort to show the Social Security program is too generous and too expensive and needs to be cut. My sense is that the correct replacement rate is close to 40 percent. If the replacement rate game is too arcane, just remember that the average benefit is $17,000.

Better start figuring out a 100% replacement rate...or at least 60%. People are being starved of wages and savings and pensions.