Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 21 March 2016

[font size=3]STOCK MARKET WATCH, Monday, 21 March 2016[font color=black][/font]

SMW for 18 March 2016

AT THE CLOSING BELL ON 18 March 2016

[center][font color=green]

Dow Jones 17,602.30 +120.81 (0.69%)

S&P 500 2,049.58 +8.99 (0.44%)

Nasdaq 4,795.65 +20.66 (0.43%)

[font color=green]10 Year 11.88% -0.01 (-0.53%)

[font color=black]30 Year 2.68% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

2/25/16 Jason Keryc sentenced to 9 years in prison, 3 years supervised release and to pay back $180MM to investors he bilked in a Ponzi scheme while an acct. mgr at Agape World.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Hotler

(11,409 posts)The Day Jamie Dimon Saved the Global Stock Market From Disaster.

Global equities delivered $8.6 trillion of losses through Feb. 11 as the MSCI All-Country World Index tumbled 12 percent. Talk of a global recession and powerless central banks could be heard from Tokyo to London to New York.

And then Jamie Dimon appeared. After the close of trading that day, news broke that the chairman and chief executive officer of JPMorgan Chase & Co. spent $26.6 million to buy shares of his New York-based bank. The MSCI soared almost 5 percent in the next four days, the start of a rally that -- barring a disaster -- will put the broadest measure of worldwide equities on track this week to erase its loss for the year.

To be sure, Dimon’s move -- which came as confidence in the world’s biggest financial institutions was waning -- is far from the only reason for the rebound. Concern that China was about to embark on a massive devaluation of its currency has eased, oil prices are no longer in freefall and economic data have on average improved.

<snip>

Bridled Enthusiasm;

And yet for all the positive signals being sent by stocks, buyers aren’t storming back. In fact, going by one measure of U.S. outflows, investors just yanked more money from American equities that any time since September. Enthusiasm remains bridled as a logjam of investor concerns, from China growth to ineffective central-bank policy and weakening profits, shows no signs of dissipating.

“The question everyone should be asking is what has really changed in the last three months?” said John Canally, chief economic strategist at LPL Financial in Boston, which oversees about $460 billion. “Global concerns, while slightly less, are still there.”

Not Buying;

“I’m not buying anything; I’m sitting on my hands and waiting,” said Michael Woischneck, an equities fund manager who oversees the equivalent of $166 million at Lampe Asset Management in Dusseldorf, Germany. “I would definitely sell this rally because it’s totally central-bank driven and has nothing or very little to do with fundamentals.”

http://www.msn.com/en-us/money/markets/the-day-jamie-dimon-saved-the-global-stock-market-from-disaster/ar-BBqIhpl?li=BBnbfcN&ocid=iehp

Jamie saving the Global Markets seems to be over rated. But Cramer and others have a love affair for the man. Me not so much.

Hotler

(11,409 posts)This CEO just gave $10M in cash to his employees.

The Chicago-born CEO of a Welsh insurance company is giving £1,000 ($1,445) to each of his employees as a parting gift when he leaves his role in May.

Henry Engelhardt, the outgoing CEO of the Admiral Group (ADM-GB), and his wife announced Thursday they would part with £7 million of their own money and split it between every full-time member of staff with at least one year's service. All other staff will be given £500.

The company, mostly known for its car insurance brand in the U.K., employs 7,000 people in total with operations in countries such as Wales, England, India and Italy. A spokesperson for the company told CNBC that the gift would be paid into employee's salaries and would be taxed in the normal way.

"Saying thank you to all the Admiral staff who work so hard every day to make Admiral great is the most important thing we can do. We are making this gift in recognition of the hard work and team spirit that has underpinned Admiral's success as we've grown from a start-up with value of £0 to a FTSE 100 company with a value of £5 billion today," Engelhardt said in emailed statement on Thursday.

http://www.msn.com/en-us/money/companies/this-ceo-just-gave-dollar10m-in-cash-to-his-employees/ar-BBqC9XR?li=BBnbfcN&ocid=iehp

Well played Sir, enjoy your retirement.

Hotler

(11,409 posts)Colorado economists warn about recession, complicating spending fight. Spending cuts expected as state revenues decline.

The severe downturn in the oil and gas industry, combined with global economic pressures, led state economic analysts on Friday to caution Colorado lawmakers about the looming possibility of a recession.

The warning represented a milestone, after years of positive news as the state surged out of the Great Recession, and further complicates the ongoing battle at the Capitol concerning the $27 billion state budget.

Legislative Council economist Larson Silbaugh told lawmakers that the state's economy expanded through the first half of 2015 but slowed toward the end, a trend that continued into this year as energy prices continued to decline.

"If weakness in natural resources, manufacturing and agricultural areas of the economy reach a critical mass, we have an increasing chance of a recession," Silbaugh said.

http://www.denverpost.com/news/ci_29656856/colorado-economists-warn-about-recession-complicating-spending-fight

More at the link.

wordpix

(18,652 posts)CT that is. Rust belt is where i live

Hotler

(11,409 posts)How to Rob a Central Bank. Editorial from Bloomberg News.

As brazen heists go, it was a quiet one. Over a single weekend in February, hackers managed to extract tens of millions of dollars from Bangladesh's central bank before anyone noticed. Now the bank is in turmoil, its governor has resigned and much of the cash is missing. It's one of the biggest holdups in history -- and other central banks should be on notice.

The scheme started when intruders inserted malware into Bangladesh Bank's system in January. With information evidently gleaned from the attack, they were able to divert funds from the bank's account at the New York Fed using the SWIFT messaging system. Officials only wised up when the thieves tried to move an additional $850 million to suspect accounts, and a routing bank noticed a comical spelling error in one request. By then, some $81 million was long gone.

A few lessons from this strange tale suggest themselves.

First, central banks make fat targets. Many are under constant attack. Those in the developing world, with lots of new capital but not much digital security, are especially at risk. Bangladesh had amassed some $28 billion in foreign-currency reserves, and its central bank had alarmingly lax defenses. It was a hacker's dream.

Second, fessing up quickly is crucial. Officials at Bangladesh Bank kept quiet for more than a month, and never quite got around to informing the country's finance minister. Meanwhile, the pilfered cash made its way across the globe. Asian governments and industries, in particular, would benefit from better information-sharing about intrusions.

A more crucial lesson is that cybersecurity, though boring, is everyone's responsibility -- even the boss's. ("I am not a technical person," the now ex-governor of Bangladesh Bank said by way of explanation.) All too often, malicious hacks come down to simple human error. Making better use of encryption, access controls and strong verification systems can help, but nothing can substitute for training and vigilance.

Finally, preventing hackers from moving the money they've siphoned off requires global cooperation. The thieves in this case laundered much of the cash through casinos in the Philippines. Not coincidentally, Filipino lawmakers have exempted casinos from anti-money-laundering requirements. Tightening those restrictions would be wise. But there are still far too many places where lax laws, custom or generalized chaos provide a welcome home for dirty money. Changing those norms will only get more urgent.

All told, this puzzling episode should be a wake-up call. Next time, the miscreants won't be so flagrant, greedy or orthographically challenged. They'll have plenty of enticing targets to choose from. And they'll only have to get lucky once.

http://www.bloombergview.com/articles/2016-03-20/how-to-rob-a-central-bank

Hotler

(11,409 posts)Most of the world needs accommodative monetary policy; the U.S. increasingly doesn't.

That's a problem for central banks looking to maintain financial stability during a time in which disinflationary forces prevail in most parts of the globe, and a particular pain for the Federal Reserve, whose recent decision to stand pat on interest rates, combined with dovish rhetoric, and a subdued outlook, placed it firmly back in position as the central bank for the world.

"One interpretation of the recent moves by the European Central Bank and the Federal Reserve is that they represent coordinated attempt to ease global financial conditions while avoiding upward pressure on the U.S. dollar, especially against the Chinese renminbi," write Chief Economist Jan Hatzius and Economist Sven Jari Stehn of Goldman Sachs Group Inc, giving a nod to the so-called "Plaza Accord 2.0" theory.

In its statement last week, the Fed noted the resilience of the U.S. economy in the face of financial market turmoil stemming from the devaluation of China's currency in August by highlighting that activity had been expanding at a moderate pace despite these headwinds.

http://www.bloomberg.com/news/articles/2016-03-21/goldman-global-coordinated-easing-won-t-last-and-the-fed-will-need-to-hike-rates-four-times-in-2016

Hey we're resilient. Woohoo!

Hotler

(11,409 posts)

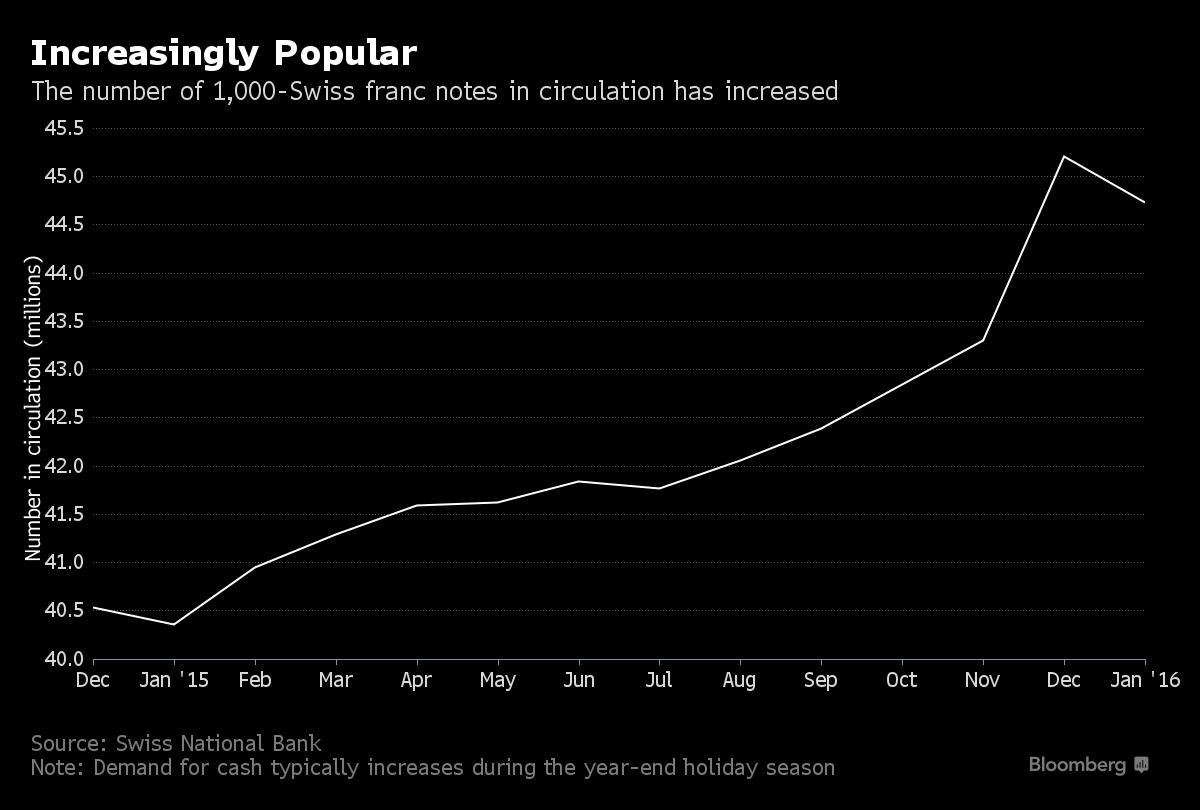

Some 44.7 million 1,000-franc notes were in circulation in January, according to Swiss National Bank data published on Monday. That’s the highest reading for the start of the year since at least 2000 and marks just a 1 percent decrease from December, when there typically is heightened demand for Switzerland’s most valuable banknote. The SNB has said it won’t drop the bill, even as questions have arisen about the longevity of the 500-euro note in the neighboring euro area.

http://www.bloomberg.com/news/articles/2016-03-21/demand-for-1-000-franc-notes-at-all-time-january-high-chart

People Europe are snatching these up as a way to hedge against negative interest rates.

Hotler

(11,409 posts)Yesterday we reported that the ECB has begun contemplating the death of the €500 EURO note, a fate which is now virtually assured for the one banknote which not only makes up 30% of the total European paper currency in circulation by value, but provides the best, most cost-efficient alternative (in terms of sheer bulk and storage costs) to Europe's tax on money known as NIRP.

That also explains why Mario Draghi is so intent on eradicating it first, then the €200 bill, then the €100 bill, and so on.

We also noted that according to a Bank of America analysis, the scrapping of the largest denominated European note "would be negative for the currency", to which we said that BofA is right, unless of course, in this global race to the bottom, first the SNB "scraps" the CHF1000 bill, and then the Federal Reserve follows suit and listens to Harvard "scholar" and former Standard Chartered CEO Peter Sands who just last week said the US should ban the $100 note as it would "deter tax evasion, financial crime, terrorism and corruption."

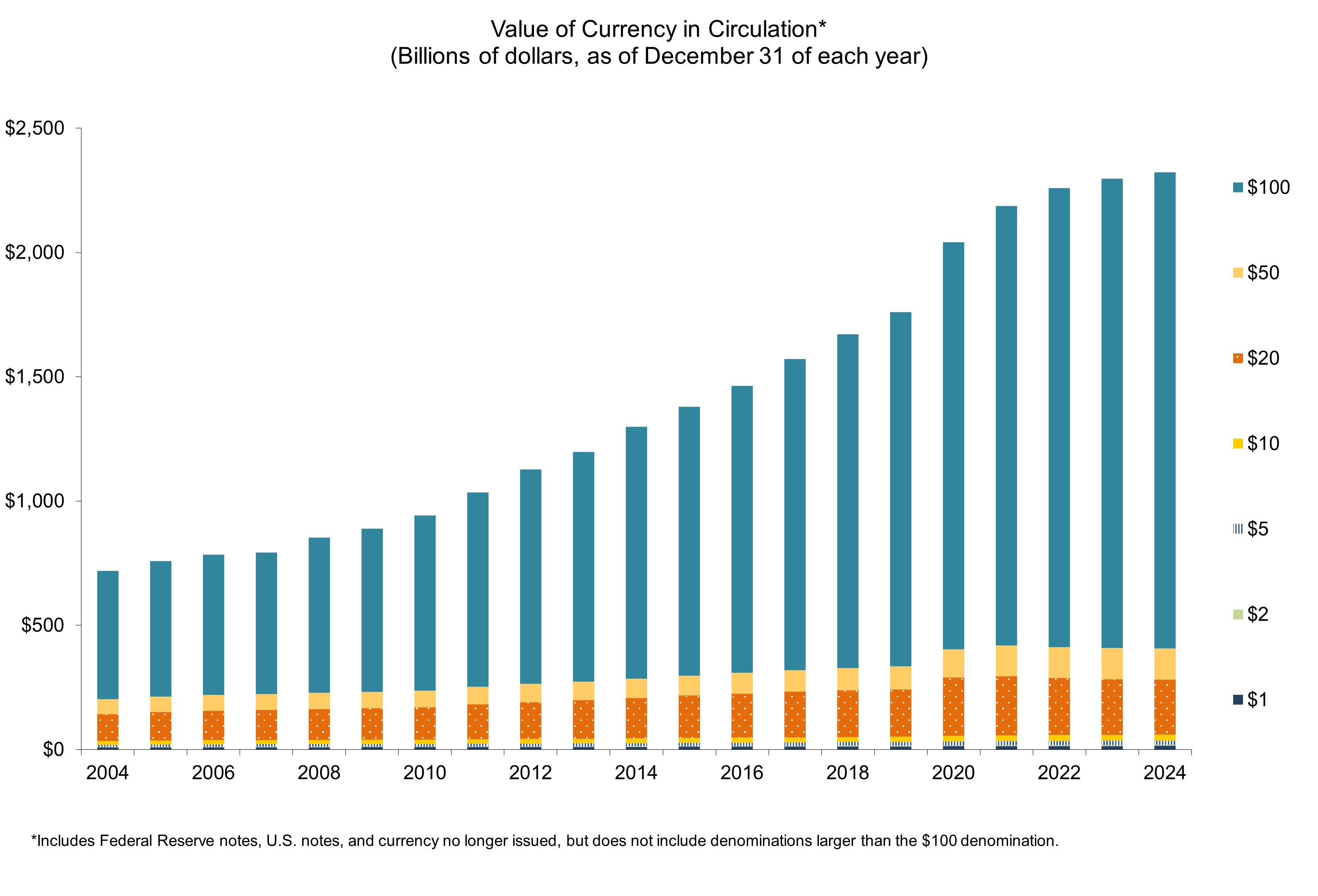

Well, not even 24 hours later, and another Harvard "scholar" and Fed chairman wannabe, Larry Summers, has just released an oped in the left-leaning Amazon Washington Post, titled "It’s time to kill the $100 bill" in which he makes it clear that the pursuit of paper money is only just starting. Not surprisingly, just like in Europe, the argument is that killing the Benjamins would somehow eradicate crime, saying that "a moratorium on printing new high denomination notes would make the world a better place."

Yes, for central bankers, as all this modest proposal will do is make it that much easier to unleash NIRP, because recall that of the $1.4 trillion in total U.S. currency in circulation, $1.1 trillion is in the form of $100 bills. Eliminate those, and suddenly there is nowhere to hide from those trillions in negative interest rate "yielding" bank deposits.

So with one regulation, the Fed - if it listens to this Harvard charlatan, and it surely will as more and more "academics" get on board with the idea to scrap paper money - could eliminate the value of 78% of all currency in circulation, which in effect would achieve practically the entire goal of destroying the one paper alternative to digital NIRP rates, in the form of paper currency.

That said, it would still leave gold as an alternative to collapsing monetary system, but by then there will surely be a redux of Executive Order 6102 banning the possession of physical gold and demanding its return to the US government.

http://www.zerohedge.com/news/2016-02-16/larry-summers-launches-war-us-paper-money-its-time-kill-100-bill

More of Larry Summer's wisdom at the link.

First they came for the $100 bill and nobody said anything...

Punx

(446 posts)Yeah, sure...if zero hedge says so...

"First they came for the $100 bill and nobody said anything... " My thoughts exactly, then the $50 bill and so on and so on....

Given the climate, especially on the right, but the left too, but do this and ban holding of gold and the government will have rebellion on their hands, and it won't be just a bunch of dumb-asses in Malhuer.

Fuddnik

(8,846 posts)Punx

(446 posts)It's hardly a liberal slam.

Some of you here may remember F4lconF16; He was working for a start-up doing delivery services in Seattle for Amazon and the workers in another start-up complained about their hours and wages and Amazon basically pulled the plug on everyone. A big "FU" to the workers. Now I may be getting my facts a bit mixed up but the gist is correct.

Fuddnik

(8,846 posts)Hotler

(11,409 posts)OTTAWA — It took only 900 years, but paper money is fading away.

As a new technology, plastic bank notes, becomes more popular around the world, people will have to get used to money that is slipperier but less grimy and harder to fold into origami cranes but more likely to survive washing machines.

The decline of one of the world’s greatest inventions gained momentum on Wednesday when Britain announced that the British pound, a reserve currency that has been printed on cotton-based paper for 300 years, will be made from plastic. Britain is the latest nation to replace paper bills — starting with the £5 and £10 notes — with plastic ones. Canada and Australia have already made the switch, as have about two dozen other countries.

Others, although not the United States, are expected to follow suit. The reason is simple enough: Plastic — or polymer, as it is called — holds up better than paper. It is also a lot harder to counterfeit.

http://www.nytimes.com/2013/12/19/business/international/britain-to-join-ranks-of-nations-using-plastic-currency.html?_r=0

Punx

(446 posts)Like cotton/paper based bills do, and less likely to rot. Will make it more likely to survive buried in your back yard. ![]()

Gungnir

(242 posts)Apparently Australian businesses had lots of trouble with the bills springing out of the cash drawer when the arm that keeps the bills in place was lifted up.

The Australian currency is pretty cool, IMHO. https://en.wikipedia.org/wiki/Banknotes_of_the_Australian_dollar

http://www.bbc.com/capital/story/20140108-where-money-is-made-of-plastic

These new notes aren’t without problems.

Nigeria, which is still a largely cash-based society, is going back to old-fashioned cotton paper cash this year. The country began testing low-denomination polymer notes in 2007. But the ink on the notes faded under the blazing sun experienced year-round in the African country — and Nigerian bus conductors and other merchants began rejecting the blurry notes.

(so add a UV protectant)

Polymer currencies also suffer from another problem: they don’t always stay folded.

“They have memory and can spring back from being flat,” said Cubaj. That was a problem in parts of Thailand, he added, where it’s traditional to fold banknotes. Other people complain that the new notes are slippery and stick together.

Gungnir

(242 posts)The research, published by the journal Appetite, provides the first evidence that people who perceive themselves as poor are more likely to eat more.

The new study, by Dr Boyka Bratanova, also suggests that people eat more calories to 'self-soothe' a sense of anxiety when they feel unequal to others.

The research provides the first experimental evidence that poverty and inequality can cause obesity through increased consumption of high calorie food, and that there are psychological mechanisms linking these economic conditions to eating behaviour.

...

"It appears that humans and animals respond similarly to harsh and scarce environments, and this response takes the form of pre-emptive increase in food consumption.

much more at link